Moonpig Group Bundle

How Did Moonpig Group Revolutionize the Greeting Card Industry?

From a simple idea to a publicly traded giant, the Moonpig Group SWOT Analysis reveals a fascinating story of innovation. This e-commerce pioneer transformed how we send online greeting cards and personalized gifts. Let's explore the key moments that shaped the Moonpig company and its remarkable journey.

The Moonpig history is a testament to the power of adapting to the digital age. Founded in April 2000, the company quickly became a leader in the online greeting cards market. With a focus on personalized products and a strong e-commerce strategy, Moonpig Group has continued to expand its reach and solidify its position in the industry, showcasing impressive financial performance.

What is the Moonpig Group Founding Story?

The story of the Moonpig Group begins in April 2000 with Nick Jenkins, a former lawyer and commodity trader, at the helm. Jenkins envisioned revolutionizing the greeting card industry by merging digital printing with the internet, offering customers a more personalized experience than traditional high street options. This marked the inception of what would become a significant player in the online gifting market.

The company's name, 'Moonpig,' is derived from Jenkins' childhood nickname, adding a personal touch to the brand's identity. Initially, the business model centered on enabling individuals to personalize and send greeting cards online, a novel concept at the time. This approach allowed customers to add custom messages, photos, and designs, creating a more emotionally resonant gifting experience.

Launching during the dot-com bubble's decline, Moonpig faced early challenges. However, Jenkins secured further investment from private investors and venture capital. The rise of broadband internet and digital cameras, combined with word-of-mouth marketing, gradually boosted sales, leading to the company's first profits in 2005. Jenkins' background as a commodity trader and his MBA studies at Cranfield University shaped his pursuit of this venture, identifying a market gap for personalized products and recognizing the potential of digital printing and personalization trends.

Here are some of the key milestones in the history of the Moonpig Group, highlighting its journey from inception to its current market position. This timeline showcases the company's strategic decisions and growth trajectory.

- 2000: Moonpig.com launched by Nick Jenkins.

- 2005: The company achieves its first profits.

- 2011: Moonpig was acquired by Photobox Group.

- 2021: The company went public, with its initial public offering (IPO) on the London Stock Exchange.

- Recent Years: Moonpig has focused on expanding its product offerings and market reach, including acquisitions and international expansion.

The Moonpig history highlights a significant shift in the greeting card industry. The company's ability to adapt and innovate has been crucial to its success. The Moonpig Group has expanded beyond online greeting cards to include personalized gifts, leveraging e-commerce to reach a global audience. The Moonpig company's evolution demonstrates its resilience and strategic foresight in a competitive market.

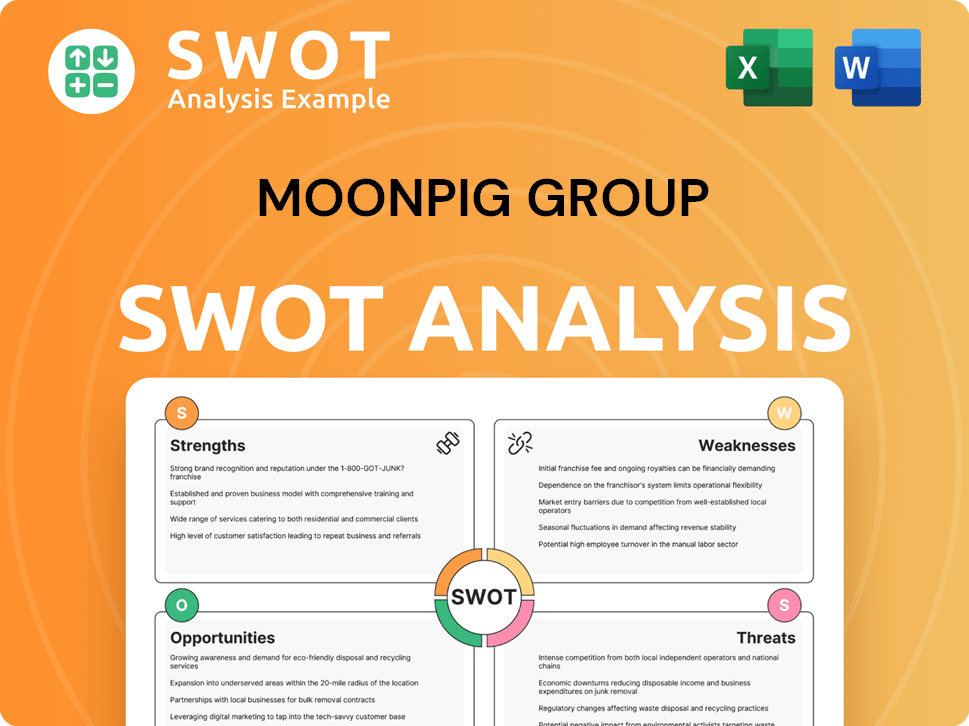

Moonpig Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Moonpig Group?

The early growth of Moonpig Group, a leading player in the online greeting cards and personalized gifts market, involved overcoming initial challenges in establishing a customer base and educating the public about the convenience of e-commerce. The company focused on creating a user-friendly website with intuitive tools for card personalization. A key element in its expansion was the launch of its first television advertising campaign in the UK in November 2006, which significantly boosted brand recognition.

By summer 2009, the

Geographical expansion began with entry into the Australian market in 2004. This was followed by product diversification in late 2009 with the introduction of flowers and custom mugs. In 2010, Moonpig launched its business in the United States. This expansion strategy allowed Moonpig to tap into new markets and increase its overall revenue.

A significant development in the

Throughout this period, Moonpig consistently invested in technology and data, transforming itself into a technology and data platform for gifting. The company also opened new operational facilities in Tamworth, UK, and Almere, Netherlands, to support its growing operations. This strategic focus on technology and infrastructure has been crucial for scaling its operations and maintaining its competitive edge in the online greeting cards and personalized gifts market.

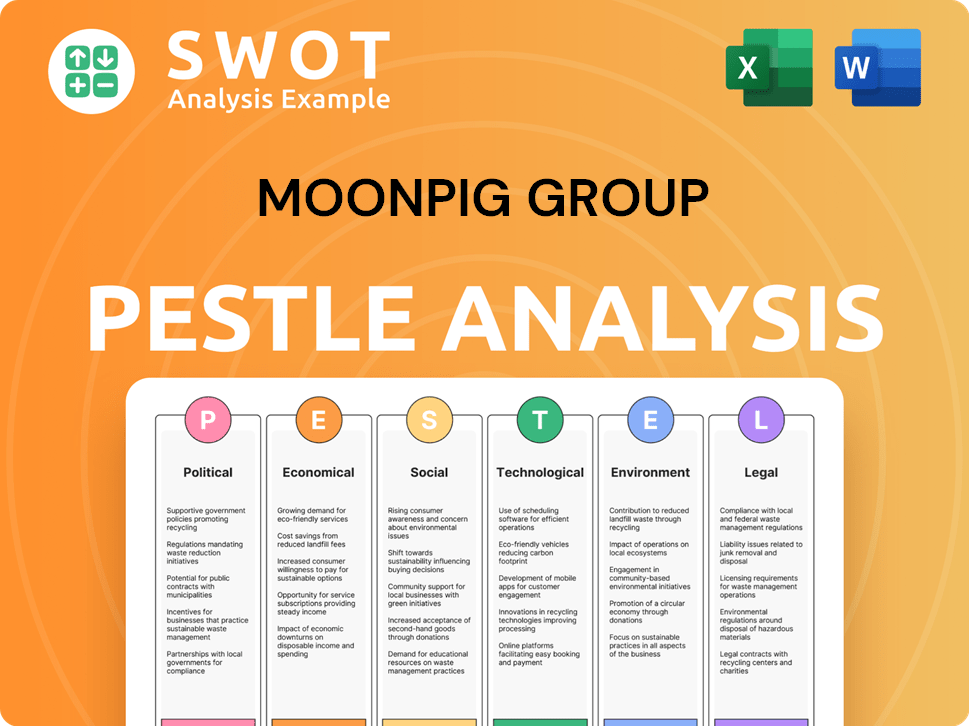

Moonpig Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Moonpig Group history?

The Moonpig Group has achieved significant milestones, evolving from a tech-enabled retailer to a data-driven gifting platform. Its journey includes strategic acquisitions, technological advancements, and expansions in the e-commerce sector, solidifying its position in the online greeting cards and personalized gifts market.

| Year | Milestone |

|---|---|

| 2000 | Founded, marking the beginning of its journey in the online greeting cards industry. |

| 2011 | Acquired by Photobox Group, expanding its reach within the online gifting market. |

| 2021 | Moonpig Group went public with an IPO. |

| 2022 | Acquired the Experiences division, including Red Letter Days and Buyagift, for £124 million. |

| October 2024 | Moonpig Plus and Greetz Plus membership subscriptions reached 750,000 members. |

Moonpig Group has consistently innovated, particularly in technology and data. This includes migrating Greetz onto a unified platform and developing AI-driven features.

The company introduced AI-generated 'smart text' for greeting card messages, enhancing personalization. They also enabled the addition of personalized video and audio messages to cards, along with group card functionality.

The migration of Greetz onto a unified technology platform streamlined operations. This integration improved efficiency and customer experience across both platforms.

Launched membership subscriptions to enhance customer loyalty. By October 2024, these subscriptions had grown to 750,000 members.

Implemented AI semantic search capability to improve product discovery. This enhancement helps customers find what they need more efficiently.

Upgraded recommendation algorithms to enhance the customer experience. These improvements help customers discover relevant products and increase sales.

The company's database of customer occasion reminders grew significantly. By October 2024, it reached 96 million, aiding customer loyalty and repeat purchases.

Despite its growth, Moonpig Group has faced challenges, including macroeconomic headwinds and specific operational issues. The company has responded with strategic initiatives to address these issues.

The gifting market experienced challenges due to macroeconomic conditions. This impacted overall sales and profitability.

The Experiences division, including Red Letter Days and Buyagift, faced difficulties. A £56.7 million non-cash charge for impairment of goodwill was recorded.

In the six months to October 2024, the company reported a pre-tax loss of £33.3 million. This was primarily due to the impairment charge and other factors.

Greetz experienced a revenue decrease, impacting overall financial results. The company is working on improving its performance.

Moonpig implemented a transformation plan for the Experiences segment. This involved relocating its head office and outsourcing non-core functions.

The transformation plan resulted in over £1 million in direct cost synergies. This helped improve the company's financial efficiency.

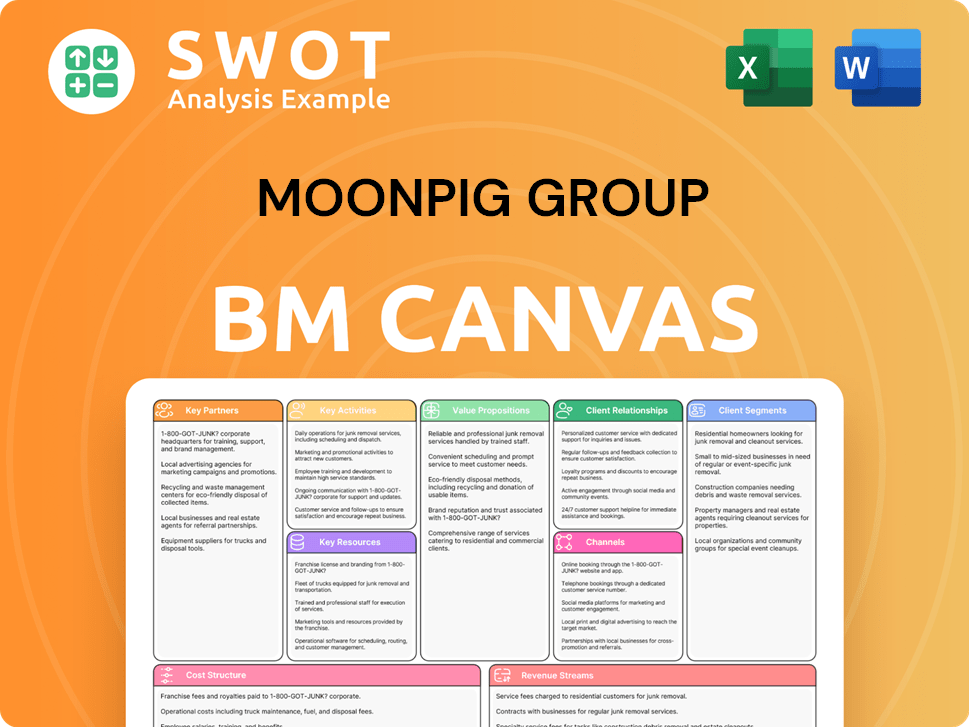

Moonpig Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Moonpig Group?

The Growth Strategy of Moonpig Group has been marked by significant milestones, from its inception as an online greeting cards retailer to its current status as a major player in the e-commerce market for personalized gifts. The company's journey includes expansions, acquisitions, and a successful IPO, reflecting its evolution and strategic growth over the years.

| Year | Key Event |

|---|---|

| April 2000 | Moonpig.com launched, becoming the UK's first online card retailer. |

| 2004 | Expansion into the Australian market. |

| 2005 | Moonpig achieved its first profits. |

| November 2006 | The company launched its first television advertising campaign in the UK. |

| Late 2009 | Product range expanded to include flowers and custom mugs. |

| 2010 | Moonpig launched in the United States. |

| 2011 | Nick Jenkins sold Moonpig to Photobox. |

| 2016 | Photobox, including Moonpig, was acquired by private equity firms Electra and Exponent. |

| 2018 | Moonpig Group acquired Greetz, an online card and gifting business in the Netherlands. |

| 2019 | Photobox and Moonpig were split. |

| February 5, 2021 | Moonpig Group was admitted to trading on the London Stock Exchange's Main Market. |

| July 2022 | Moonpig Group acquired Experiences, which operates the Red Letter Days and Buyagift brands. |

| October 2024 | Moonpig and Greetz active customer base grew to 11.7 million, and Moonpig Plus/Greetz Plus subscriptions reached 750,000 members. |

| FY25 | Moonpig Group anticipates full-year revenue between £350 million and £353 million. |

Moonpig Group aims to become the 'ultimate gifting companion' in its core markets, focusing on data and technology. The company plans to increase its active customer base, boost order frequency, and raise the average order value. They are targeting double-digit percentage annual revenue growth.

The company is aiming for an adjusted EBITDA margin rate of approximately 25% to 27%. They are also targeting mid-teens percentage growth in adjusted earnings per share over the medium term. A new £60 million share buyback program was announced, reflecting strong cash generation.

Expansion into new geographical markets, including Ireland, Australia, and the US, is a key focus, with significant revenue growth seen in H1 FY25. Moonpig is also exploring the corporate market with 'Moonpig for Work' to send personalized cards and gifts. Ongoing investment in AI and technology is expected to drive future growth.

Moonpig benefits from the long-term structural shift to online gifting. The company's focus on personalized gifts and online greeting cards positions it well in the e-commerce sector. The company's leadership anticipates continued growth, leveraging its founding vision.

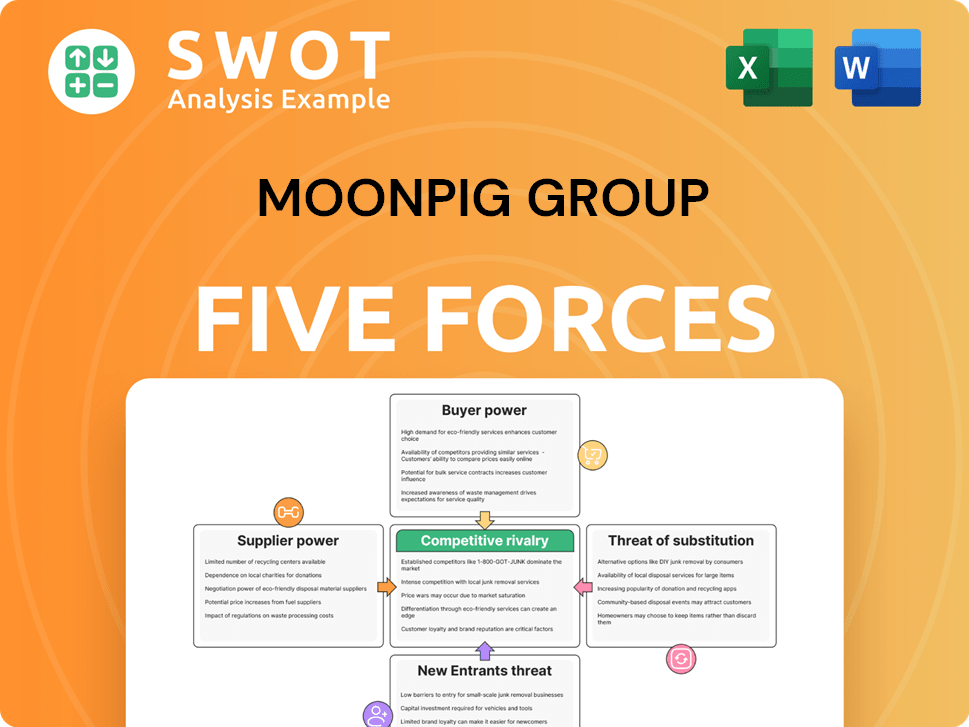

Moonpig Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Moonpig Group Company?

- What is Growth Strategy and Future Prospects of Moonpig Group Company?

- How Does Moonpig Group Company Work?

- What is Sales and Marketing Strategy of Moonpig Group Company?

- What is Brief History of Moonpig Group Company?

- Who Owns Moonpig Group Company?

- What is Customer Demographics and Target Market of Moonpig Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.