Moonpig Group Bundle

How Does Moonpig Group Thrive in the E-commerce Arena?

Moonpig Group, a leading force in the online gifting sector, offers a unique blend of personalized products and seamless customer experiences. With a strong UK market presence and a remarkable 70% repeat purchase rate, this e-commerce business continues to captivate customers. In the financial year ending April 2024, Moonpig Group showcased impressive financial results, driven by strategic investments and innovation.

Operating through its Moonpig and Greetz brands, alongside Red Letter Days and Buyagift, the Moonpig Group SWOT Analysis reveals the company's strengths and opportunities. This analysis will explore the company's operating model and how it consistently achieves growth in the competitive landscape of online greeting cards and personalized gifts. Understanding the Moonpig Group SWOT Analysis and its revenue strategies is key for investors and anyone interested in the Moonpig company.

What Are the Key Operations Driving Moonpig Group’s Success?

The Moonpig Group creates value by offering a convenient online platform for online greeting cards, personalized gifts, and flowers. Their core products include a wide selection of personalized cards, with over 10,000 designs, and a curated range of gifts. This caters to a broad customer base seeking customized products for various occasions.

The company's operational processes are supported by a strong technology and data platform. This includes advanced logistics for efficient delivery, with an average delivery time of 1.5 days in key markets. The Moonpig company focuses on providing a seamless and personalized experience for its customers, differentiating it within the e-commerce business landscape.

Moonpig Group's operations are unique due to its sustained investment in AI-driven personalization tools, which have led to a 25% increase in average order value year-over-year. These tools include AI-generated 'smart text' messages, video and audio messages for cards, and enhanced recommendation algorithms leveraging customer-level data. This technological edge translates into significant customer benefits, offering a highly tailored and engaging experience that differentiates Moonpig from its competitors.

Moonpig offers a wide range of products including personalized greeting cards, flowers, and gifts. Customers can customize cards with photos and messages, and choose from a variety of gift options. The platform is designed for ease of use, allowing customers to quickly find and personalize products for any occasion.

The company uses a robust technology platform to manage its operations, including order processing, personalization, and logistics. AI-driven tools enhance the customer experience by offering tailored recommendations and personalized messages. Data analytics are used to optimize marketing efforts and improve customer engagement.

Moonpig has streamlined its supply chain to ensure timely fulfillment of orders. They have invested in fulfillment centers in the UK and the Netherlands. Strategic partnerships enhance the gifting range, providing more choices for customers.

Moonpig focuses on providing a highly personalized and engaging customer experience. AI-driven tools are used to create 'smart text' messages and enhance recommendation algorithms. This focus on personalization leads to higher customer satisfaction and increased order values.

Moonpig Group's operational success is rooted in its ability to combine a wide product range with advanced technology. This approach enables the company to offer a superior customer experience, leading to strong financial performance. For more information, consider reading the Growth Strategy of Moonpig Group.

- Focus on personalized products.

- Investment in AI and data analytics.

- Efficient supply chain and distribution.

- Strategic partnerships to expand offerings.

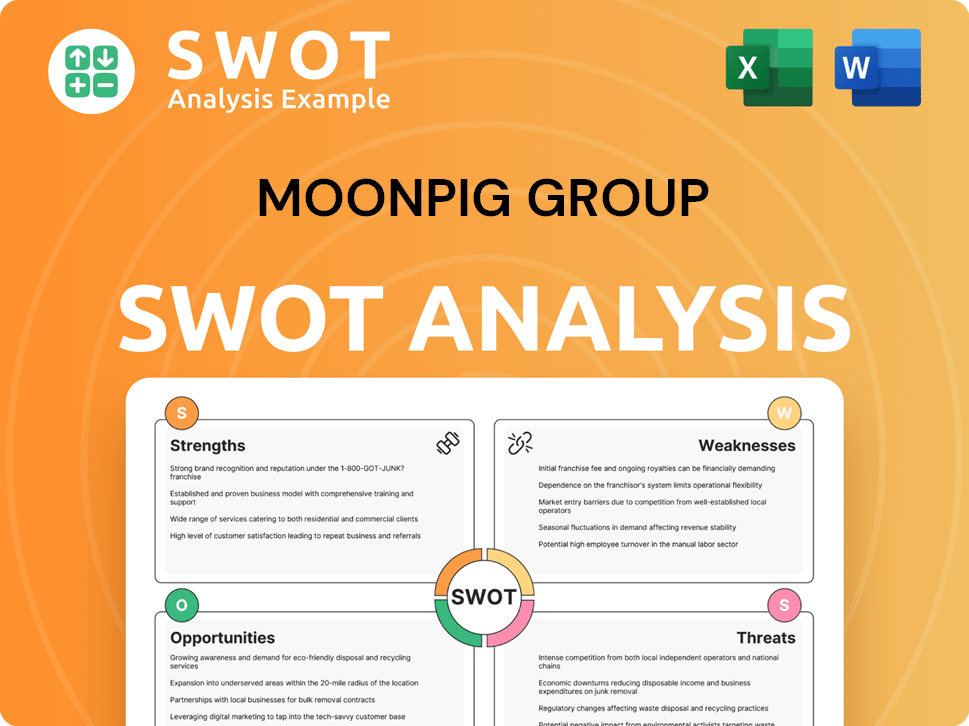

Moonpig Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Moonpig Group Make Money?

The Moonpig Group generates revenue primarily through the sale of personalized cards, gifts, and flowers. This e-commerce business model focuses on providing customers with a convenient way to send thoughtful gifts and cards. The company's success hinges on its ability to attract customers and encourage repeat purchases through a user-friendly platform and a wide selection of products.

For the financial year ending April 2023, the Moonpig company reported a total revenue of £220 million. The revenue breakdown shows the importance of personalized cards, gifts, and flowers. In the financial year ending April 2024, Moonpig Group's revenue increased to £341.1 million, marking a 6.6% year-on-year rise.

The Moonpig brand itself contributed significantly to revenue growth, with an 8.2% increase driven by increased orders and a higher average order value. This growth highlights the brand's strength and its ability to attract and retain customers in the competitive online greeting cards and personalized gifts market. The company continually adapts its strategies to meet evolving customer preferences and market trends.

The company employs a 'card-first' approach, aiming to cross-sell gifts and experiences once customers are engaged with card customization. This strategy leverages the initial card purchase to introduce additional gift options. Innovative strategies include subscription schemes like Moonpig Plus and Greetz Plus, which contribute to recurring revenue and customer loyalty. The acquisition of Red Letter Days and Buyagift brands in July 2022 expanded its offerings into gift experiences, solidifying its position as a comprehensive online gifting companion. To understand more about the company's structure, you can read about Owners & Shareholders of Moonpig Group.

- The 'card-first' approach focuses on cross-selling gifts and experiences.

- Subscription schemes like Moonpig Plus and Greetz Plus drive recurring revenue.

- The acquisition of Red Letter Days and Buyagift expanded gift experience offerings.

- Total revenue from Ireland, Australia, and the US grew by 34.3% to £8.7 million in FY24, indicating successful international expansion.

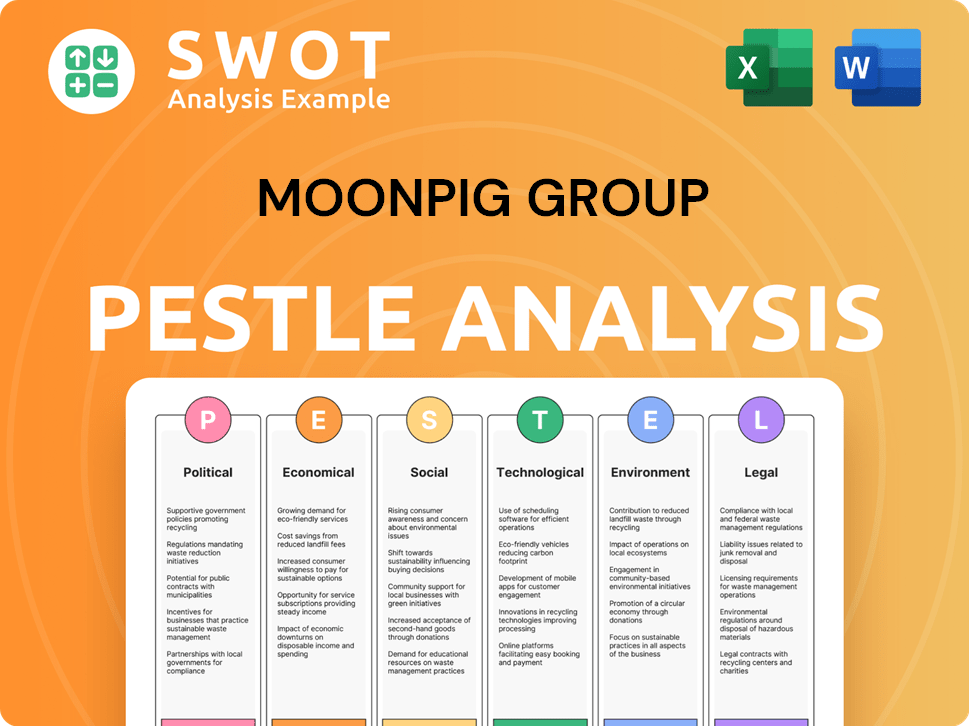

Moonpig Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Moonpig Group’s Business Model?

The journey of the Moonpig Group has been marked by strategic expansions and key financial milestones. Initially launched in April 2000 as an online greeting cards retailer in the UK, the Moonpig company quickly expanded into card-attached gifting, including flowers and various off-the-shelf presents. The acquisition of Greetz in 2018, a leading online card and gifting business in the Netherlands, was a major strategic move. The acquisition of Red Letter Days and Buyagift brands in July 2022 further solidified its position in the gifting market.

A significant financial milestone was the company's admission to trading on the London Stock Exchange's Main Market in February 2021. This event highlighted its established position within the gifting industry. The Moonpig Group has consistently invested in technology and data to address operational and market challenges. The company is on track to meet its 2025 guidance, despite ongoing macro headwinds in gifting, with strong sales performance at the Moonpig brand.

Moonpig has adapted to changing consumer preferences by developing digital gifting solutions and enhancing personalization features like AI-driven customized messages and video/audio messages. The company's ability to leverage extensive customer data for personalized recommendations and occasion reminders contributes to strong customer retention and recurring business.

Launched in April 2000 as the UK's first online card retailer.

Acquisition of Greetz in 2018, expanding into the Dutch market.

Acquisition of Red Letter Days and Buyagift in July 2022.

Admission to trading on the London Stock Exchange in February 2021.

Expansion into card-attached gifting, including flowers and gifts.

Investment in technology and data to improve operations.

Development of digital gifting solutions and enhanced personalization features.

Focus on customer retention through personalized recommendations.

Strong brand recognition in the UK market.

Technological edge through AI-driven personalization tools.

Logistical efficiency with streamlined operations and quick delivery.

Use of customer data for personalized recommendations.

89% of revenue in the year to April 2024 derived from existing customers.

On track to meet 2025 guidance despite market challenges.

Continued investment in AI technologies.

Expansion of product range and exploring new geographical markets.

Moonpig's competitive advantages include strong brand recognition, particularly in the UK, leading to high customer loyalty. The company maintains a technological edge through investments in AI-driven personalization tools. Logistical efficiency, with streamlined operations and quick delivery times, also provides a competitive edge. Moreover, the company's ability to leverage extensive customer data for personalized recommendations and occasion reminders contributes to strong customer retention and recurring business.

- Strong brand recognition and customer loyalty.

- Technological innovation with AI-driven personalization.

- Efficient logistics and quick delivery times.

- Data-driven personalized recommendations.

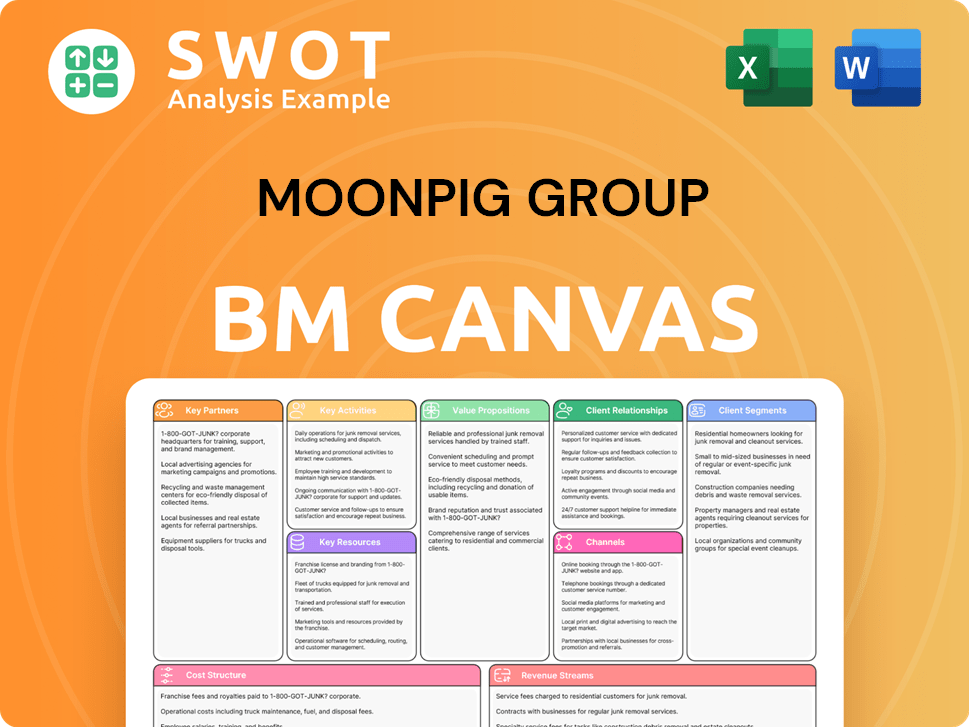

Moonpig Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Moonpig Group Positioning Itself for Continued Success?

The Moonpig Group holds a prominent position in the online greeting card and gifting market, particularly in the UK and the Netherlands. The Moonpig brand alone captured a 70% market share in the online card category in the UK during 2023. As of October 2024, the company's active customer base across Moonpig and Greetz reached 11.7 million, demonstrating strong customer loyalty and broad reach.

However, the Moonpig Group faces several challenges. Intense competition within the online greetings card market, along with regulatory changes and economic downturns, pose potential risks. Operational and strategic risks, such as dependence on third-party suppliers and the need to adapt to evolving consumer trends, also need to be managed effectively.

The Moonpig brand dominates the UK online card market with a 70% share. The company's customer base grew to 11.7 million by October 2024. Approximately 82% of its revenue comes from the UK, with the Netherlands contributing 15%.

Key risks include competition from rivals such as Funky Pigeon and Thortful. Regulatory changes and economic downturns can impact sales. Operational risks involve third-party suppliers, and strategic risks include adapting to consumer trends.

Moonpig projects FY25 revenue between £350 million and £353 million. The company aims to be the 'ultimate online gifting companion'. Expansion into European markets like Germany and France is planned.

Focus on growth through existing customers and platform enhancements. Investment in AI, such as AI-generated stickers, is ongoing. A new £60 million share buyback program is planned for FY26, reflecting confidence in strong cash flow.

Looking ahead, Moonpig Group is focused on sustaining and expanding its profitability. The company anticipates full-year revenue for FY25 to be between £350 million and £353 million, with an adjusted EBITDA margin at the top end of its 25% to 27% guidance range. For further insights into the company's strategies, you can refer to the Marketing Strategy of Moonpig Group. Strategic initiatives include further expansion into European markets like Germany and France, which are projected to increase its total addressable market size by an estimated 25% by 2025. The company is also exploring the corporate gifting market. Moonpig's ongoing investment in AI and innovation, such as AI-generated stickers and optimized recommendation algorithms, is expected to drive future growth and deepen customer engagement. The company also plans a new £60 million share buyback program commencing in FY26, signaling confidence in its strong free cash flow generation.

The company is leveraging its existing customer base and enhancing its platform. Moonpig is investing in AI and innovation, such as AI-generated stickers. Expansion into new markets, like Germany and France, is also a key strategy.

- Focus on customer retention and repeat purchases.

- Continuous improvement of technology and data science capabilities.

- Strategic market expansion to increase market share.

- Exploration of new business opportunities, such as corporate gifting.

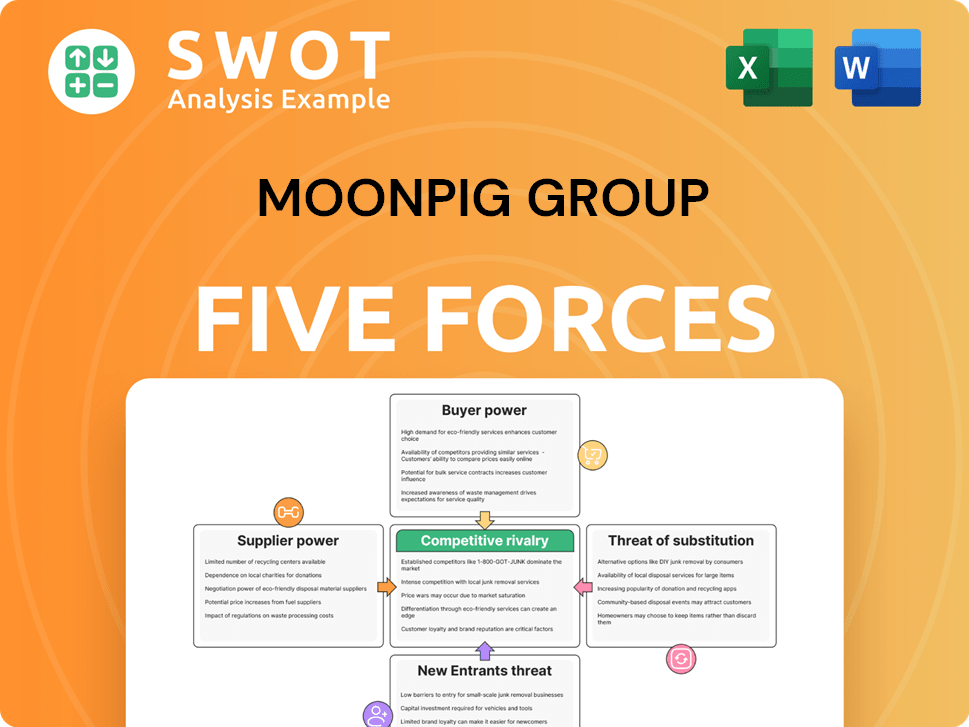

Moonpig Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Moonpig Group Company?

- What is Competitive Landscape of Moonpig Group Company?

- What is Growth Strategy and Future Prospects of Moonpig Group Company?

- What is Sales and Marketing Strategy of Moonpig Group Company?

- What is Brief History of Moonpig Group Company?

- Who Owns Moonpig Group Company?

- What is Customer Demographics and Target Market of Moonpig Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.