Moonpig Group Bundle

Can Moonpig Group Continue Its E-commerce Dominance?

Moonpig Group, a leader in the online personalized gifting market, has redefined how we celebrate special occasions. From its 2000 launch, this e-commerce business has transformed the greeting card industry. Its IPO in February 2021 marked a significant milestone, reflecting strong investor confidence in its growth potential.

This analysis delves into the Moonpig Group SWOT Analysis, exploring its strategic roadmap for continued success. We'll examine Moonpig's growth strategy, including its expansion plans and innovative approaches to customer acquisition. The future prospects of Moonpig Group are promising, and we will explore its potential within the competitive landscape of personalized gifts and online greeting cards.

How Is Moonpig Group Expanding Its Reach?

The Moonpig Group is actively pursuing several expansion initiatives to drive future growth. Their strategy focuses on both geographical market penetration and product category diversification, aiming to solidify its position in the online greeting cards and personalized gifts market. This approach is crucial for sustaining the company's growth trajectory and enhancing its competitive edge in the e-commerce business landscape.

A key element of their strategy involves expanding their presence in existing markets, particularly the US. The company sees significant growth opportunities there for personalized cards and gifts. By increasing brand awareness and customer acquisition through targeted marketing campaigns and enhanced product offerings, Moonpig aims to capture a larger share of the US market.

Furthermore, Moonpig continues to explore new product categories beyond cards, gifts, and flowers. The aim is to diversify revenue streams and capture a larger share of the gifting market. This includes expanding their gifting range to offer a wider selection of items suitable for various occasions and recipient demographics, enhancing their overall market appeal.

Focusing on expanding in existing markets, especially the US, to increase brand awareness and customer acquisition. This involves targeted marketing campaigns and enhanced product offerings to drive growth. The company is leveraging its established e-commerce platform to reach a wider audience.

Exploring new product categories beyond cards, gifts, and flowers to diversify revenue streams. This includes expanding the gifting range to offer a wider selection of items suitable for various occasions and recipient demographics. This strategy aims to capture a larger share of the gifting market.

Collaborating with popular brands or artists to offer exclusive designs and products, attracting new customer segments. These partnerships broaden reach and enhance product assortment. This approach helps to increase brand appeal and customer engagement.

Investing in improving its delivery infrastructure to support increased order volumes and offer more flexible delivery options. This enhances the overall customer experience. The goal is to provide reliable and efficient service.

Moonpig’s expansion plans include a strong focus on the US market, where they see significant growth potential. They are also actively diversifying their product range to include a wider variety of gifts, aiming to increase revenue streams. Strategic partnerships and delivery infrastructure improvements are also key components of their growth strategy.

- US Market Expansion: Aggressive marketing and enhanced product offerings.

- Product Diversification: Expanding beyond cards to include a wider range of gifts.

- Strategic Partnerships: Collaborations to broaden product offerings and reach.

- Delivery Enhancements: Improving infrastructure for faster and more flexible delivery.

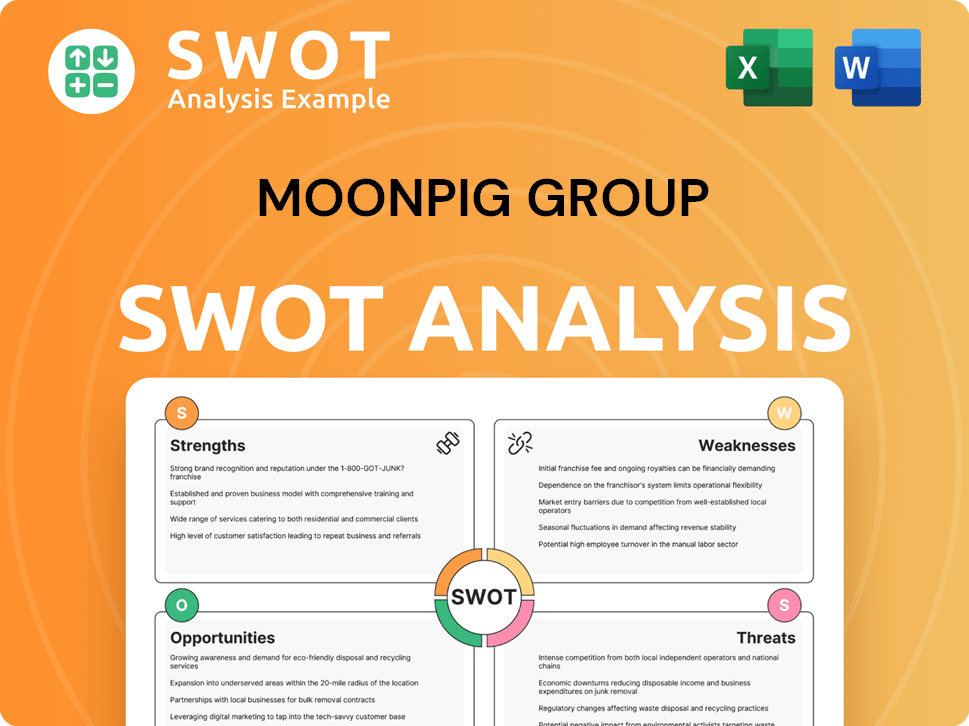

Moonpig Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Moonpig Group Invest in Innovation?

The Moonpig Group's growth strategy heavily relies on innovation and technology to enhance customer experience and operational efficiency. They consistently invest in their proprietary technology platform, focusing on personalization and e-commerce functionalities. This commitment helps them maintain a competitive edge in the online greeting cards and personalized gifts market.

A key aspect of Moonpig's strategy involves leveraging data analytics to personalize marketing efforts and product suggestions. This data-driven approach allows them to better understand customer preferences and tailor their offerings accordingly. The company's focus on digital transformation is evident in its efforts to streamline the customer journey from product discovery to checkout.

Moonpig's use of cutting-edge technologies, such as artificial intelligence (AI), is central to its innovation strategy. AI is utilized to enhance product recommendations, optimize inventory management, and improve customer service through intelligent chatbots. These advancements are crucial for driving growth within the competitive e-commerce business landscape.

Moonpig's proprietary technology platform is the backbone of its e-commerce operations. It supports personalization, order processing, and customer relationship management. Ongoing investments are made to improve this platform.

A core feature is the personalization engine, which allows customers to create unique products. This includes design tools and recommendation algorithms. This engine is constantly updated to enhance user experience.

AI is used to improve product recommendations and customer service. Intelligent chatbots and automated systems help streamline operations. AI enhances the overall shopping experience.

The mobile app is a key channel for customer engagement and sales. Continuous updates and improvements are made to the app. The app enhances accessibility and convenience.

Automation plays a vital role in production and fulfillment processes. This ensures efficient handling of high-volume orders. Automation helps maintain quality and speed.

Data analytics are used to personalize marketing and product suggestions. This data-driven approach allows for better understanding of customer preferences. Data analytics optimize marketing efforts.

The company's focus on technological advancements in personalization and e-commerce is a key driver for its future prospects. For more details on their business model, you can check out the Revenue Streams & Business Model of Moonpig Group article. Moonpig's commitment to innovation is evident in its consistent efforts to streamline the customer journey, from product discovery to checkout, utilizing data analytics to personalize marketing efforts and product suggestions. While specific financial data for 2025 is not yet available, the company's past performance indicates a strong emphasis on leveraging technology for growth and profitability.

Moonpig's innovation strategy includes several key technological initiatives aimed at enhancing its e-commerce capabilities and customer experience.

- Enhancing personalization through improved design tools and recommendation algorithms.

- Utilizing AI to optimize inventory management and improve customer service.

- Streamlining the customer journey through data-driven insights and automation.

- Continuous updates to the mobile app to enhance user experience and accessibility.

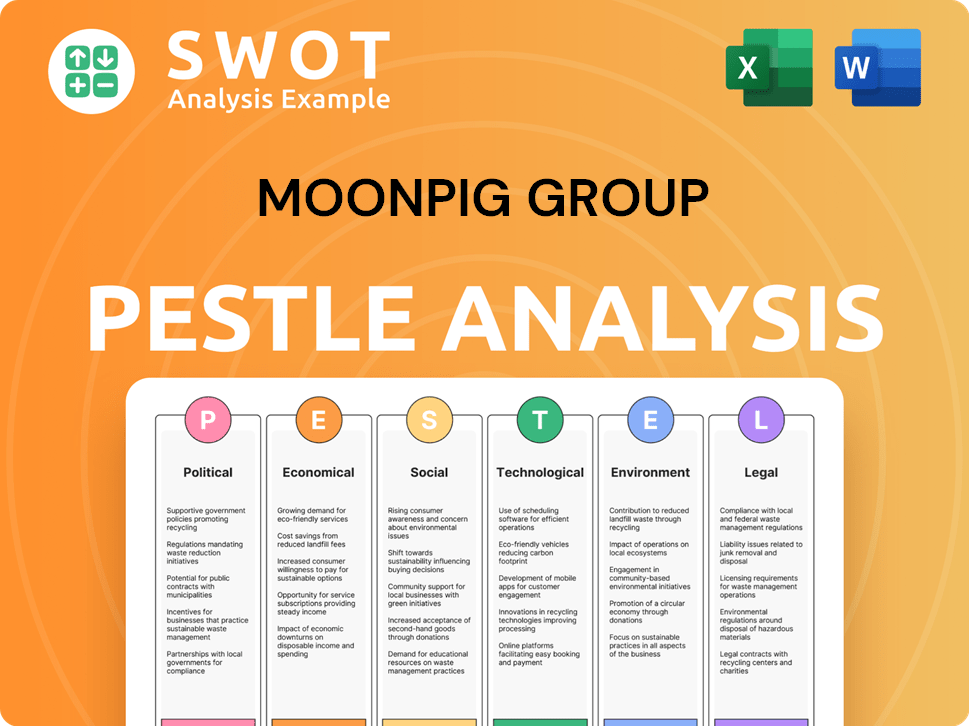

Moonpig Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Moonpig Group’s Growth Forecast?

The financial outlook for Moonpig Group centers on sustainable growth, driven by increasing order volumes and an expanding product range. For the fiscal year ending April 30, 2024, the company anticipated broadly flat year-on-year revenue, with adjusted EBITDA projected to be between £96 million and £99 million. This outlook suggests a period of consolidation after strong previous growth, emphasizing profitability and operational efficiency. Understanding the Owners & Shareholders of Moonpig Group is crucial for grasping the company's financial trajectory.

Moonpig's long-term financial goals include continued revenue growth, achieved through market share gains and diversification into higher-margin gift categories. This strategy aims to leverage the existing customer base and brand recognition to drive sales of complementary products. The company's approach reflects a commitment to adapting to market dynamics while maintaining a strong financial position.

The company's financial strategy also involves disciplined capital allocation, with investments directed towards technology enhancements, marketing initiatives, and strategic expansion. Moonpig's strong cash flow generation supports these investments without significant reliance on external funding in the near term. Analyst forecasts generally align with the company's outlook, anticipating steady growth in the personalized gifting market. This financial narrative emphasizes balancing growth with profitability to deliver consistent shareholder value.

Market analysis for 2024 indicates a steady growth trajectory for Moonpig within the online greeting cards and personalized gifts sector. The company is expected to maintain its leading position by leveraging its strong brand and customer loyalty. This includes focusing on customer acquisition strategies to expand its reach.

The revenue growth forecast for Moonpig anticipates continued expansion, driven by increased order volumes and the introduction of new product lines. This includes the expansion plans within the UK and potentially into international markets. The forecast takes into account the impact of digital marketing efforts.

The competitive landscape for Moonpig includes both established and emerging players in the e-commerce business of personalized gifts. The company's strategy involves differentiating itself through superior user experience and a wide range of personalized gift ideas. This competitive analysis also considers the impact of digital marketing.

Moonpig's expansion plans within the UK focus on increasing market share and enhancing its product offerings. This includes leveraging its strong brand recognition and customer base to drive sales. The company's strategy involves both organic growth and potential strategic partnerships.

The financial performance of Moonpig Group reflects a commitment to sustainable growth and profitability. The company's ability to generate strong cash flow supports its investments in technology and marketing. The company’s financial results for the fiscal year ending April 30, 2024, projected revenue to be broadly flat year-on-year, with adjusted EBITDA expected to be between £96 million and £99 million.

- Revenue growth driven by increased order volumes and product diversification.

- Focus on profitability and operational efficiency.

- Disciplined capital allocation for technology and marketing investments.

- Strong cash flow generation to support growth initiatives.

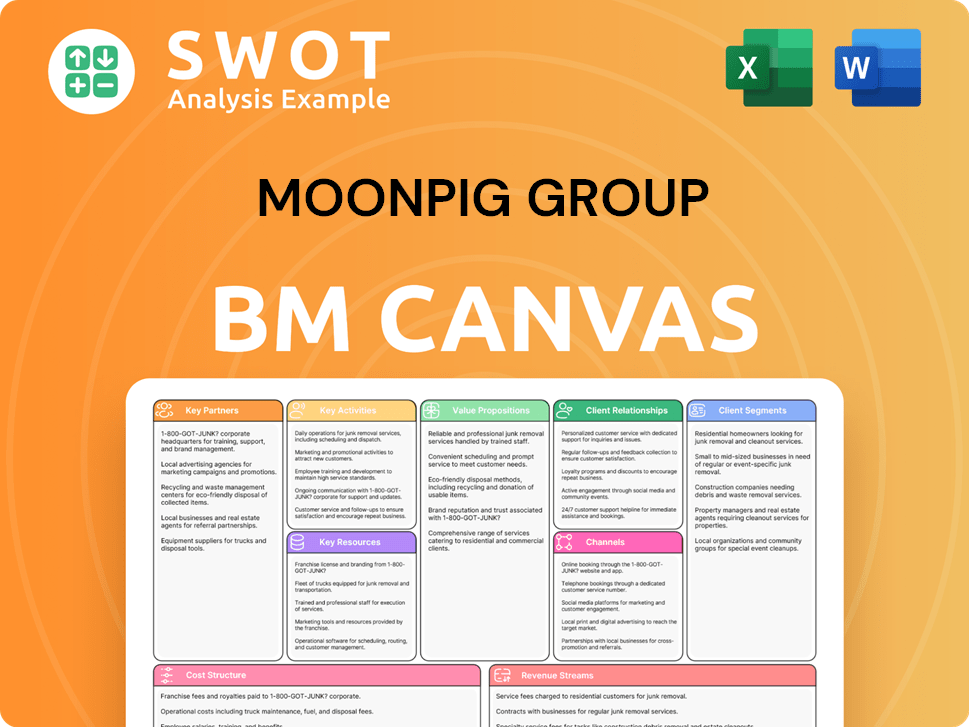

Moonpig Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Moonpig Group’s Growth?

The Moonpig Group's path to expansion isn't without its hurdles. Several risks could impact the company's growth, requiring careful management and strategic planning. Understanding these potential obstacles is crucial for assessing the Moonpig Group's future prospects.

Market competition, regulatory changes, and supply chain issues are key areas of concern. Technological advancements and evolving consumer expectations also present ongoing challenges. The ability to navigate these risks will significantly influence Moonpig Group's success.

Moonpig Group faces intense competition in the online greeting cards and personalized gifts market. Competitors include large e-commerce platforms and niche providers. This necessitates continuous innovation and differentiation to maintain market share. The company must stay ahead of the curve to succeed in this competitive landscape, as highlighted in a Brief History of Moonpig Group.

The personalized gifts and online greeting cards market is highly competitive, with numerous players vying for consumer attention. This includes both large e-commerce giants and specialized providers. To stand out, Moonpig Group must continuously innovate and differentiate its offerings.

Changes in data privacy and e-commerce regulations could pose compliance challenges. These changes may increase operational costs and require adjustments to business practices. Staying compliant is essential for maintaining customer trust and avoiding penalties.

Disruptions in the supply chain, such as raw material shortages or shipping delays, can impact product fulfillment. Given the personalized nature of its products, Moonpig Group must ensure a reliable supply chain. Efficient logistics are crucial for customer satisfaction.

Emerging technologies could shift consumer preferences and operational paradigms. Moonpig Group must invest in its technology and adapt to new trends to remain competitive. Continuous innovation is vital to avoid being disrupted by new platforms.

Consumers increasingly expect sustainable and ethically sourced products. Moonpig Group needs to adapt its sourcing and operations to meet these expectations. Maintaining a positive brand reputation requires addressing sustainability concerns.

Moonpig Group mitigates these risks through investment in technology, diversified supplier networks, and agile operational frameworks. The company uses robust risk management frameworks, including scenario planning, to prepare for potential disruptions. The company has shown resilience by adapting to increased demand and logistical challenges during the COVID-19 pandemic.

A Moonpig market analysis 2024 would reveal the competitive landscape, including key players like Funky Pigeon and Etsy. These competitors offer similar products, creating a need for Moonpig to differentiate through product offerings, user experience, and marketing. The e-commerce business must continually adapt to maintain its market position.

Moonpig Group's financial performance is crucial for its Moonpig growth strategy. The company's Moonpig revenue growth forecast depends on factors like effective customer acquisition strategies and efficient operations. Moonpig profitability analysis is essential for long-term sustainability and investor confidence. As of 2024, the company continues to focus on these aspects.

Moonpig's expansion plans UK and Moonpig international market strategy are critical for future growth. These strategies include expanding product lines, improving the Moonpig user experience review, and leveraging digital marketing. Moonpig customer acquisition strategies are vital for attracting new users and increasing sales. The company's focus on new product development is ongoing.

Moonpig's sustainability initiatives are becoming increasingly important to consumers. Addressing environmental concerns and ethical sourcing is vital for maintaining brand reputation. The company's Moonpig mobile app features and Moonpig personalized gift ideas also play a role in attracting and retaining customers. These aspects directly impact Moonpig Group's financial performance.

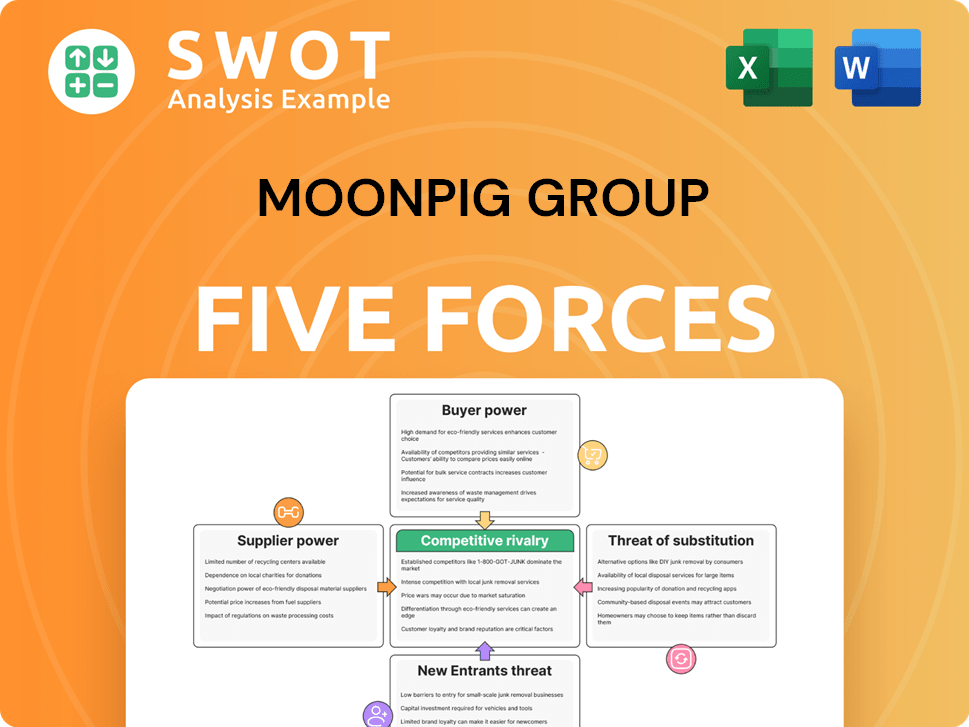

Moonpig Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Moonpig Group Company?

- What is Competitive Landscape of Moonpig Group Company?

- How Does Moonpig Group Company Work?

- What is Sales and Marketing Strategy of Moonpig Group Company?

- What is Brief History of Moonpig Group Company?

- Who Owns Moonpig Group Company?

- What is Customer Demographics and Target Market of Moonpig Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.