OSI Systems Bundle

How Did OSI Systems Become a Global Leader?

Founded in 1987, OSI Systems SWOT Analysis has evolved from a California startup to a major player in security technology and medical devices. Its mission, driven by founder Deepak Chopra, was to develop solutions that enhance safety and health. This commitment has fueled the company's growth and impact across diverse sectors.

This brief history of OSI Systems company reveals a fascinating journey. From its early days, OSI Systems has strategically expanded, making key acquisitions and continuously innovating its product offerings. Today, the company's impressive $1.54 billion in revenue for fiscal year 2024 and a market capitalization of approximately $3.75 billion USD as of June 2025, stand as testaments to its success in the homeland security, healthcare, and aerospace industries, including its subsidiary Rapiscan Systems.

What is the OSI Systems Founding Story?

The founding of OSI Systems marks the beginning of a company that would become a significant player in security and healthcare technology. The story begins in 1987, with Deepak Chopra at the helm, who remains the Chairman and CEO to this day. The company's journey started with a vision to develop specialized electronic systems and components.

The company's headquarters are located in Hawthorne, California. While specific details about the initial funding are not readily available, the foundational idea was to address the need for advanced technology solutions, especially in sectors focused on safety and health. This initial focus set the stage for its future diversification and growth.

Initially known as 'Opto Sensors, Inc.' until May 1997, the company's early business model revolved around optoelectronic devices. These devices were crucial for converting optical signals into electronic signals, serving applications from satellites to computer peripherals.

- The company's initial focus was on the design, manufacture, and sale of optoelectronic devices.

- These early products were used in diverse applications, including satellites and laser guidance systems.

- The technology was critical for converting optical signals into electronic signals.

- This early focus laid the groundwork for the company's future vertical integration strategy.

The company's early focus on optoelectronics was a strategic move. It allowed OSI Systems to develop and supply specialized electronic components. This vertical integration strategy was key to the later establishment of its Security and Healthcare divisions. The early technological foundation was critical for future expansions. For more insights into the company's strategic approach, consider reading about the Marketing Strategy of OSI Systems.

OSI Systems SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of OSI Systems?

The early growth of OSI Systems was marked by strategic acquisitions, significantly broadening its market reach and product portfolio. A key move in 1997 was the acquisition of Rapiscan Security Systems, which expanded its presence in the security screening market. This was followed by the 2001 acquisition of Spacelabs Medical, entering the healthcare industry and diversifying its business segments. These acquisitions transformed OSI Systems company from an optoelectronics firm into a diversified organization with major operations in security and healthcare.

Throughout the 1990s and early 2000s, OSI Systems engaged in strategic expansions. In 1990, it acquired UDT Sensors, Inc., followed by Rapiscan Security Products Limited and Ferson Optics, Inc. in 1993. The company formed international partnerships, such as ECIL-Rapiscan Security Products Limited in 1994, and established manufacturing facilities like Opto Sensors (Malaysia) Sdn. Bhd. in the same year. Further acquisitions included Advanced Micro Electronics AS (1997), Osteometer MediTech A/S (1998), and the security products business of Metorex International Oy (1998).

The early 2000s saw the formation of OSI Medical, Inc. (1999) and RapiTec, Inc. (2000), and the acquisition of Spacelabs Medical in 2004, which brought patient monitoring and diagnostic cardiology systems into its offerings. In 2006, OSI Systems acquired Del Mar Reynolds, a British diagnostic cardiology company. These moves were crucial in strengthening its position in the security, healthcare, and optoelectronics markets.

These efforts significantly contributed to increased revenue and a growing global footprint. The company’s continued investment in research and development, totaling $77.7 million in 2024, compared to $72.3 million in 2023, has supported its product innovation and ability to meet evolving customer needs. Its global manufacturing and supply chain, with facilities in the U.S., Europe, and Asia, have enabled efficient production and distribution, reinforcing its market reception and competitive standing. You can learn more about the people behind the company in this article: Owners & Shareholders of OSI Systems.

The acquisition of Rapiscan Systems in 1997 was a turning point, propelling OSI Systems into the security technology sector. Similarly, the Spacelabs Medical acquisition in 2001 marked a significant entry into the medical devices market. These strategic moves not only broadened the company's product offerings but also diversified its revenue streams, making it a more resilient and multifaceted organization.

OSI Systems PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in OSI Systems history?

The OSI Systems company has achieved significant milestones, marked by groundbreaking product launches and industry-first innovations. Since its inception, the OSI Systems history is filled with strategic moves and technological advancements, solidifying its position in the security and healthcare sectors.

| Year | Milestone |

|---|---|

| 1993 | Rapiscan Systems, a division of OSI Systems, was established and became a global leader in security inspection solutions. |

| 2016 | The acquisition of American Science and Engineering (AS&E) expanded OSI Systems' security offerings, enhancing its market position. |

| May 2025 | The Security division secured a $36 million contract for airport screening solutions in the Middle East, showcasing its continued growth. |

Innovations at OSI Systems are driven by a commitment to technological advancement across its divisions. The company's focus on research and development is evident in its extensive patent portfolio and the continuous development of new products.

Rapiscan Systems has consistently introduced cutting-edge security inspection solutions, with over 100,000 products installed in more than 170 countries. These solutions include baggage and parcel inspection, cargo and vehicle inspection, and people screening systems.

A notable innovation is the Orion® 920CT checkpoint screening system, integrated with Rapiscan® TRS™ (Tray Return System), designed for inspecting carry-on items, enhancing efficiency and security at checkpoints.

Spacelabs Healthcare develops patient monitoring, diagnostic cardiology, and anesthesia delivery systems. These innovations aim to improve patient care worldwide, reflecting a commitment to healthcare advancements.

The Optoelectronics and Manufacturing division develops specialized electronic components and manufacturing services for various sectors, including defense, aerospace, and medical imaging. This division supports the company's diverse product offerings.

OSI Systems holds a substantial intellectual property portfolio, with 127 active patents across medical imaging and security screening technologies as of January 2025. This portfolio underscores its commitment to innovation.

A recent patent granted in April 2024 details a method for estimating crop mass using X-ray scanners, showcasing their continued innovation in diverse applications. This highlights the company's ability to apply its technology in new areas.

Despite its successes, OSI Systems has navigated challenges typical of a diversified technology company. These challenges include market fluctuations, intense competition, and the complexities of integrating acquisitions.

The company faces challenges related to economic cycles and market downturns that can impact demand for its products and services. These fluctuations require strategic adaptability to maintain financial performance.

The security technology and medical devices markets are highly competitive, requiring continuous innovation and differentiation. The company must stay ahead of competitors to maintain its market share.

Integrating acquired companies, such as AS&E, presents operational and financial challenges. Successfully merging operations and cultures is crucial for realizing the full benefits of acquisitions.

The company's vertically integrated model, which helps reduce costs and enhance customer retention, is a key strength. This model allows for greater control over the supply chain and product quality.

Continued investment in research and development, with $77.7 million in expenses in 2024, demonstrates its commitment to addressing challenges through innovation and adapting to market needs. This investment is crucial for long-term growth.

OSI Systems' strategy often involves acquiring companies that are 'accretive out of the gate or very soon thereafter' and are strategic in filling technology or channel needs, or even taking out competitors. This approach helps expand the company's market presence.

To understand more about the financial aspects, consider reading this article about Revenue Streams & Business Model of OSI Systems.

OSI Systems Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for OSI Systems?

The journey of OSI Systems, from its inception to its current standing, showcases a strategic evolution through acquisitions and market expansions. Founded in 1987 as Opto Sensors, Inc., the company has grown significantly. Key milestones include early acquisitions such as UDT Sensors, Inc. in 1990, and the expansion into security with Rapiscan Security Products Limited in 1993. The acquisition of Spacelabs Medical in 2001 marked a significant move into the healthcare sector. Further acquisitions, notably American Science and Engineering (AS&E) in 2016, enhanced its security screening capabilities. Recent financial performance, including record revenues in 2024 and strong Q3 results in 2025, highlights the company's sustained growth and strategic positioning in the market.

| Year | Key Event |

|---|---|

| 1987 | Deepak Chopra founded OSI Systems, Inc. in Hawthorne, California, initially operating as Opto Sensors, Inc. |

| 1990 | OSI Systems acquired UDT Sensors, Inc. |

| 1993 | The company acquired Rapiscan Security Products Limited and Ferson Optics, Inc., expanding into security. |

| 1997 | Advanced Micro Electronics AS was acquired, and the company began operating under the name OSI Systems, Inc. |

| 2001 | OSI Systems entered the healthcare industry by acquiring Spacelabs Medical. |

| 2004 | The acquisition of Spacelabs Medical was completed. |

| 2007 | A significant contract was awarded by the U.S. Department of Homeland Security. |

| 2011 | OSI Systems acquired OSI Laser Diode Inc., a manufacturer of solid-state lasers. |

| 2016 | The company acquired American Science and Engineering (AS&E) for approximately $269 million, increasing security screening capabilities. |

| 2023 | OSI Systems was awarded $24 million in task orders for security screening solutions. |

| 2024 | OSI Systems reported record fiscal year revenues of $1.54 billion, a 20% year-over-year increase; also received multiple TSA contracts totaling over $22 million. |

| March 2025 | OSI Systems reported Q3 fiscal year 2025 revenues of $444.4 million, a 10% year-over-year increase, and raised fiscal 2025 revenue guidance to $1.69–$1.715 billion. |

| May 2025 | The Security division received a $36 million contract for airport screening solutions and a $47 million services order for security inspection systems. |

OSI Systems is strategically positioned for continued growth, driven by its focus on high-margin service revenue. The company’s strong backlog, exceeding $1.8 billion as of March 31, 2025, ensures a robust pipeline for future revenue generation. Ajay Mehra, President and CEO, emphasizes increasing service revenue's share, aligning with the company's vertically integrated model.

Vertical integration is key to reducing costs and enhancing customer retention. OSI Systems continues to invest in research and development to enhance its product portfolios. Acquisitions remain a core strategy to fill channel or technology needs, expanding market presence. The company is focused on creating solutions for a safer and healthier world.

The company's financial performance reflects its strong market position. In 2024, OSI Systems reported record revenues of $1.54 billion. The Q3 fiscal year 2025 revenues reached $444.4 million, a 10% year-over-year increase. The company has raised its fiscal 2025 revenue guidance to $1.69–$1.715 billion.

With a market capitalization of approximately $3.75 billion USD as of June 2025, OSI Systems demonstrates a strong presence in the security technology and medical devices markets. The company's strategic acquisitions, such as AS&E and the focus on high-margin services, contribute to its competitive advantage. The company's focus on innovation and expansion positions it well for future growth.

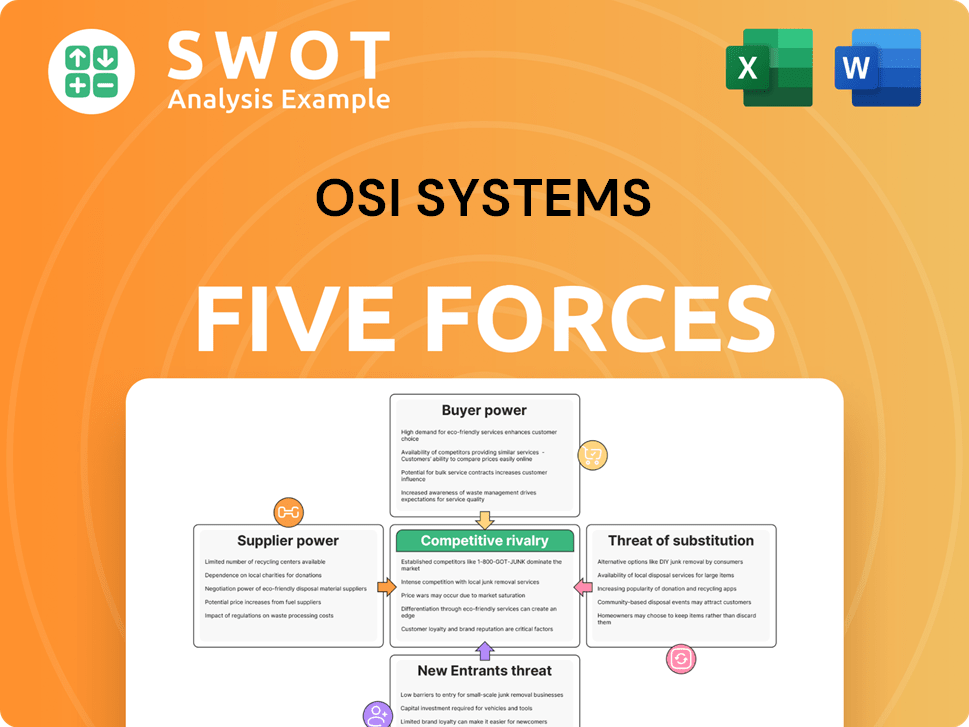

OSI Systems Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of OSI Systems Company?

- What is Growth Strategy and Future Prospects of OSI Systems Company?

- How Does OSI Systems Company Work?

- What is Sales and Marketing Strategy of OSI Systems Company?

- What is Brief History of OSI Systems Company?

- Who Owns OSI Systems Company?

- What is Customer Demographics and Target Market of OSI Systems Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.