OSI Systems Bundle

Unveiling OSI Systems: How Does This Global Powerhouse Operate?

OSI Systems, a leader in security and healthcare, plays a vital role in global commerce and public health. From airport security to medical diagnostics, its influence is undeniable. Understanding OSI Systems SWOT Analysis is crucial for anyone seeking to understand its market position.

This deep dive into the OSI Systems company will explore its core operations, diverse revenue streams, and strategic moves. We'll dissect how OSI Systems leverages its divisions to generate profit, examining its OSI Systems products, market position, and future trajectory. Whether you're interested in OSI Systems stock, or simply curious about How OSI Systems works, this analysis provides essential insights into this multifaceted company and its financial performance.

What Are the Key Operations Driving OSI Systems’s Success?

Understanding how OSI Systems company operates involves examining its core business segments and the value they provide. OSI Systems generates value through three main divisions: Security, Healthcare, and Optoelectronics and Manufacturing. Each division focuses on distinct markets, offering specialized products and services that address specific customer needs.

The company's operational approach includes sophisticated research and development, precision manufacturing, and extensive global logistics. This integrated strategy allows OSI Systems to leverage shared technologies and manufacturing efficiencies, contributing to its competitive effectiveness. A closer look at each division reveals the intricacies of How OSI Systems works.

The company's focus on innovation, quality, and customer service is central to its value proposition. The company's commitment to these principles is reflected in its financial performance and market position. For a deeper dive into the company's origins, you can explore the Brief History of OSI Systems.

The Security division, using brands like Rapiscan Systems, provides threat detection systems for airports, borders, and critical infrastructure. This division offers X-ray and gamma-ray inspection systems, baggage and parcel inspection systems, and people screening systems. The operational processes include R&D, manufacturing, and global logistics to deploy and maintain these complex systems.

The Healthcare division, primarily through the Spacelabs Healthcare brand, offers patient monitoring, anesthesia delivery, and clinical information systems. These products are essential for hospitals and healthcare providers, improving patient care and operational efficiency. Manufacturing and sourcing emphasize regulatory compliance and quality control.

This division, operating under the OSI Optoelectronics and OSI Electronics brands, designs and manufactures custom optoelectronic components and provides electronic manufacturing services (EMS). It serves aerospace, defense, medical, and industrial sectors. The division's strength lies in its technological capabilities, custom design expertise, and efficient manufacturing processes.

The company's supply chain involves a global network of suppliers and distribution channels. This ensures timely delivery and support for its diverse customer base. The integrated approach across its divisions allows OSI Systems to leverage shared technologies and manufacturing efficiencies, contributing to its competitive effectiveness.

OSI Systems excels through its diverse product offerings and integrated operational approach. The company's ability to serve multiple sectors with specialized products is a key strength. The company's financial performance reflects its operational efficiency and market positioning.

- Advanced Technology: Investment in R&D and manufacturing capabilities.

- Global Reach: Extensive supply chain and distribution networks.

- Customer Focus: Tailored solutions and high-quality production.

- Strategic Integration: Leveraging shared technologies and efficiencies.

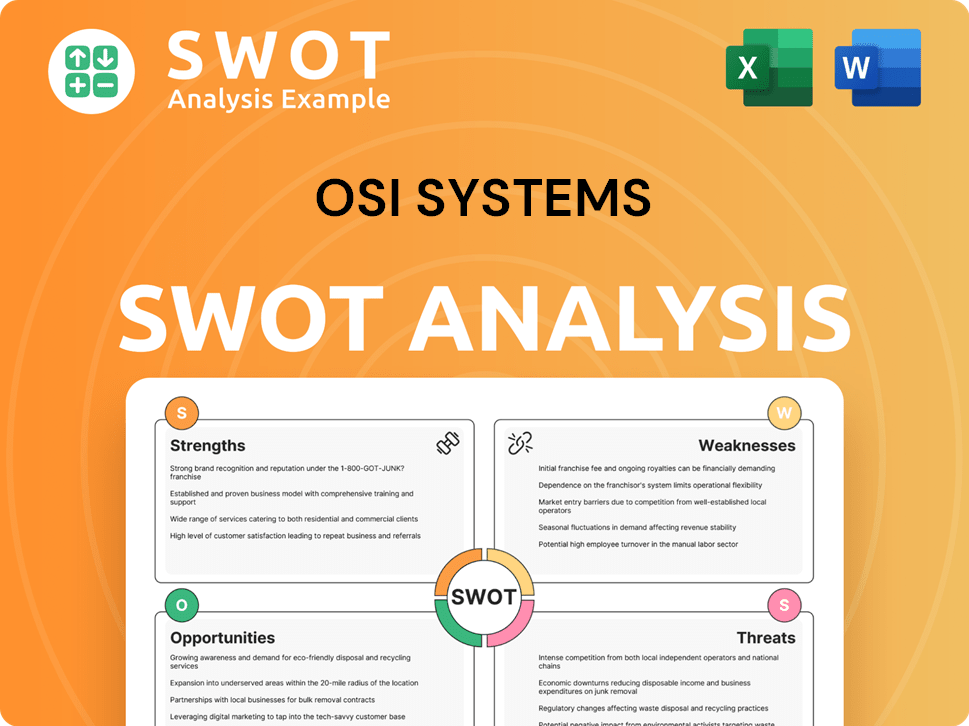

OSI Systems SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does OSI Systems Make Money?

Understanding the revenue streams and monetization strategies of the OSI Systems company is key to grasping its financial performance. The company leverages a diversified approach, primarily generating income through product sales and service contracts across its various divisions.

For the fiscal year ending June 30, 2024, OSI Systems reported total revenue of approximately $1.38 billion, showcasing its significant market presence. This revenue is derived from a mix of product sales and service offerings, each playing a crucial role in the company's financial health.

The OSI Systems company generates revenue through a combination of product sales and service contracts. This strategy allows the company to maintain a stable financial outlook by providing a mix of immediate sales and recurring revenue streams. To learn more, you can refer to the Growth Strategy of OSI Systems.

The company's revenue model is built on a dual foundation of product sales and service contracts. This approach ensures a balance between immediate revenue from product sales and a steady income stream from long-term service agreements.

- Product Sales: These include security and inspection systems, healthcare devices, and optoelectronic components. For example, the Security division's revenue in the first quarter of fiscal year 2025 was $240.2 million.

- Service Revenue: This encompasses maintenance contracts, spare parts, and technical support. Service revenue provides a recurring income stream and strengthens customer relationships. The service revenue for the Security division in the first quarter of fiscal year 2025 was $109.8 million.

- Bundled Solutions: Combining hardware, software, and services into a single package increases the average contract value.

- Tiered Pricing: Offering different levels of support and functionality allows customers to choose options that fit their needs and budget.

- Cross-Selling: Leveraging expertise across divisions, such as using optoelectronics in security and healthcare products, enhances product capabilities and market appeal.

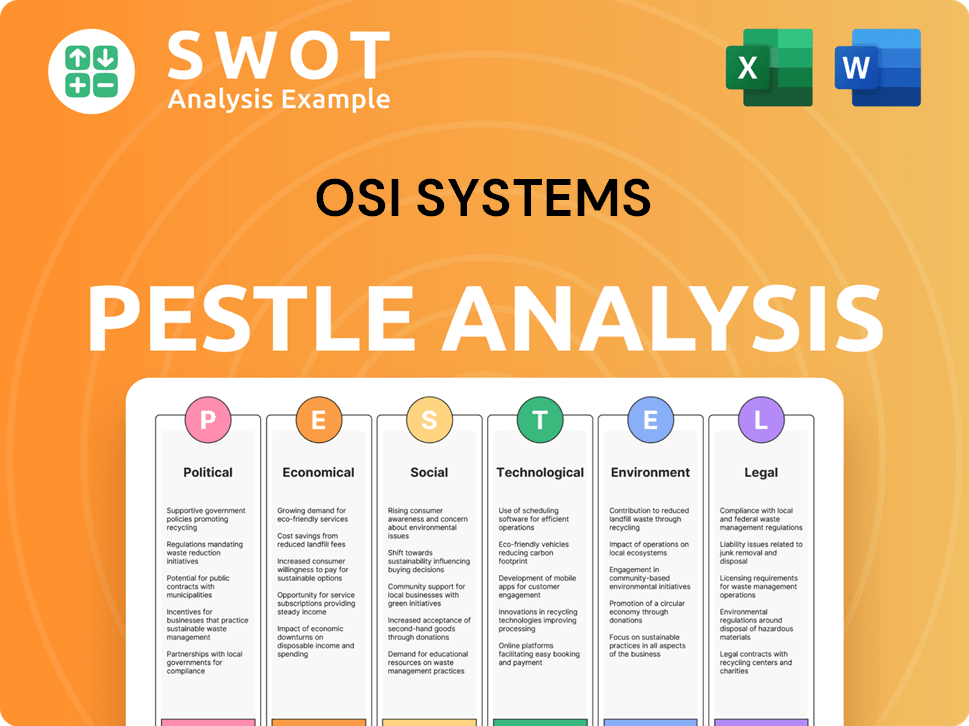

OSI Systems PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped OSI Systems’s Business Model?

OSI Systems has achieved several significant milestones that have shaped its operational and financial performance. A pivotal strategic move was the acquisition of Spacelabs Healthcare in 2004, which broadened its presence in the medical device market. This strategic expansion allowed the company to diversify its revenue streams and leverage its technological expertise in new, high-growth sectors.

The company's strategic moves have been instrumental in its growth and market positioning. Recent contracts, such as the approximately $100 million order for cargo and vehicle inspection systems in March 2024, highlight its continued strength in the security market. Furthermore, the $49 million contract awarded in October 2024 underscores its solid market position and ability to secure substantial deals.

OSI Systems' competitive advantages are rooted in its strong brand reputation, technological leadership, and comprehensive product portfolio. Its expertise in advanced threat detection, medical diagnostics, and optoelectronic components provides a significant barrier to entry for competitors. The company continues to adapt to new trends, such as the increasing demand for artificial intelligence (AI) and machine learning (ML) integrated into its security systems for enhanced threat detection, and the growing need for remote patient monitoring solutions in healthcare.

The acquisition of Spacelabs Healthcare in 2004 was a significant strategic move, expanding OSI Systems' presence in the medical device market. Securing substantial contracts, such as the approximately $100 million order in March 2024 and the $49 million contract in October 2024, demonstrates its continued success in the security market.

OSI Systems has focused on expanding its market presence through acquisitions and securing large contracts. The Spacelabs Healthcare acquisition allowed for diversification into the medical device sector. The company has also optimized its inventory management and diversified its supplier base to mitigate supply chain disruptions.

OSI Systems' competitive edge stems from its brand reputation, technological leadership, and comprehensive product portfolio. Its expertise in advanced threat detection and medical diagnostics creates a significant barrier to entry. The company's global service and support infrastructure also enhance its competitive advantage.

The company has faced operational challenges, including global supply chain disruptions, particularly affecting the availability of electronic components. To address these issues, OSI Systems has focused on optimizing inventory management and diversifying its supplier base. These efforts have helped ensure timely delivery of products.

OSI Systems continues to adapt to new trends, such as the increasing demand for artificial intelligence (AI) and machine learning (ML) in its security systems. This focus on innovation ensures the company remains at the forefront of technological advancements.

- Integration of AI and ML for enhanced threat detection.

- Development of remote patient monitoring solutions.

- Continuous improvement in security and healthcare technologies.

- Maintaining a competitive advantage in dynamic markets.

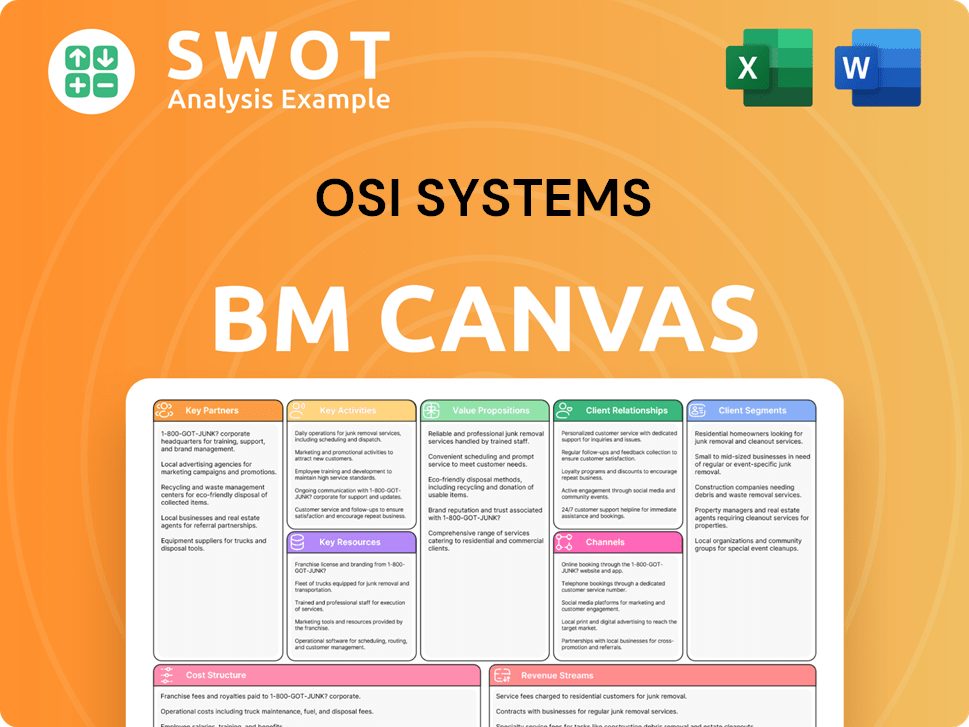

OSI Systems Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is OSI Systems Positioning Itself for Continued Success?

The OSI Systems company holds a strong market position in the security, healthcare, and optoelectronics sectors. Its divisions, including Rapiscan Systems in security and Spacelabs Healthcare, are global leaders. This market presence is supported by a broad customer base and established brand loyalty, contributing to sustained revenue and growth. For investors wondering, 'How OSI Systems works,' this overview provides crucial insights.

However, OSI Systems faces risks like regulatory changes in healthcare and security, competition, supply chain issues, and economic downturns. These factors could affect product development, market access, and profitability. Understanding these challenges is vital for evaluating OSI Systems' long-term prospects and its ability to generate consistent returns. For those considering, 'Is OSI Systems a good investment,' these risks are important to consider.

OSI Systems is a key player in security, healthcare, and optoelectronics. Rapiscan Systems leads in security, while Spacelabs Healthcare is known in patient monitoring. The optoelectronics division serves various clients with specialized manufacturing.

OSI Systems confronts regulatory changes, competition, supply chain disruptions, and economic downturns. These factors can impact product development, market share, and overall financial performance. The security and healthcare sectors are particularly sensitive to these risks.

OSI Systems aims for growth through R&D, market expansion, and service enhancements. The company is investing in advanced technologies and pursuing strategic acquisitions. OSI Systems is focused on innovation and operational efficiency.

In fiscal year 2024, OSI Systems reported revenues of approximately $1.4 billion. The security division, including Rapiscan, contributed significantly. The company’s financial results reflect its market position and strategic initiatives.

OSI Systems is focused on strategic initiatives to sustain and expand its revenue. This includes investments in research and development, particularly in AI and machine learning. The company is also expanding its market presence in emerging economies.

- Continued investment in R&D to enhance product offerings.

- Market expansion in emerging economies.

- Strengthening service offerings for recurring revenue.

- Strategic acquisitions to enhance portfolio.

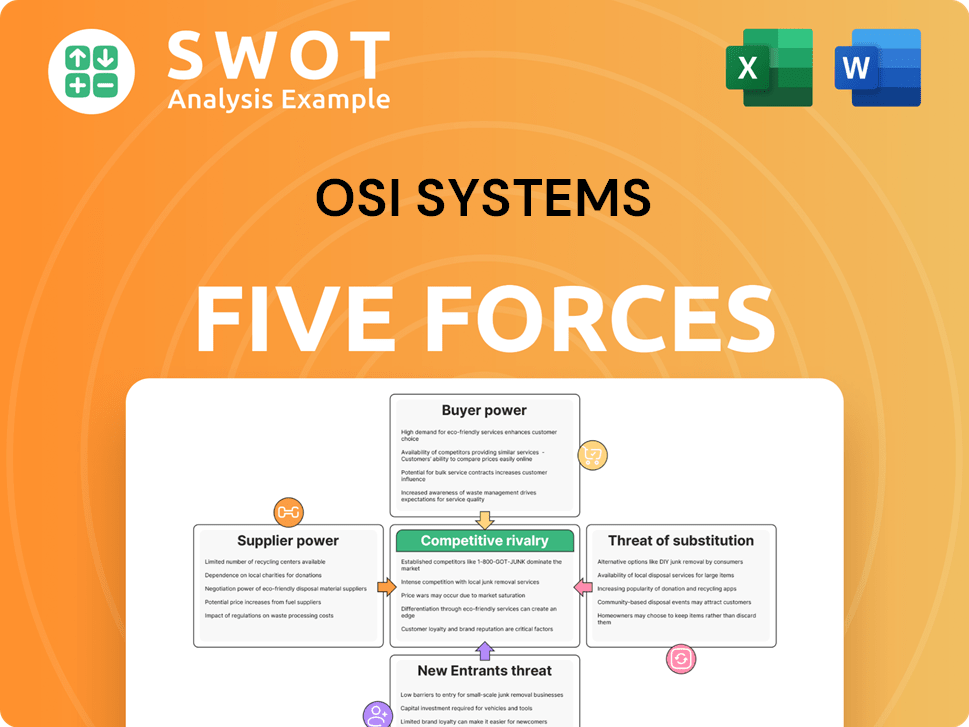

OSI Systems Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of OSI Systems Company?

- What is Competitive Landscape of OSI Systems Company?

- What is Growth Strategy and Future Prospects of OSI Systems Company?

- What is Sales and Marketing Strategy of OSI Systems Company?

- What is Brief History of OSI Systems Company?

- Who Owns OSI Systems Company?

- What is Customer Demographics and Target Market of OSI Systems Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.