Parkson Bundle

How has Parkson, a Malaysian retail giant, shaped the Southeast Asian market?

Delve into the fascinating Parkson SWOT Analysis to understand the strategic landscape! Established in 1987, Parkson, initially Parkson Grand, has become a cornerstone of the retail industry. This overview explores the journey of this iconic Malaysian business, from its humble beginnings to its current status as a leading department store operator.

This brief overview of Parkson company explores its evolution, highlighting key milestones and its significant impact on the Malaysian retail industry. From its early years in Kuala Lumpur to its expansion across Southeast Asia, Parkson's story is one of adaptation and resilience. Discover how Parkson Malaysia navigated the complexities of the department store history and the ever-changing consumer landscape to remain a prominent player.

What is the Parkson Founding Story?

The founding of Parkson Holdings Berhad marks a significant chapter in the retail industry, particularly within the context of Malaysian business history. Incorporated in August 1982 as a private limited company, the company's journey began with a vision to establish a leading department store group in Asia. This vision, spearheaded by founder William Cheng, laid the groundwork for what would become a prominent player in the region's retail landscape.

The company's official retail operations commenced in 1987 with the opening of its first department store, Parkson Grand, in Sungei Wang Plaza, Kuala Lumpur. This marked the beginning of Parkson's commitment to offering a diverse range of products, including fashion apparel, cosmetics, household goods, and accessories. This strategy, which remains a core element of its business model, was designed to cater to a wide customer base.

Parkson's early years were shaped by the economic environment of Malaysia, where a growing middle class and increasing urbanization provided fertile ground for modern retail formats. The company's expansion was further fueled by its listing on the Main Market of Bursa Malaysia Securities Berhad on October 28, 1993. This strategic move enhanced its ability to secure funding and accelerate its growth trajectory, allowing it to capitalize on the evolving consumer market.

Parkson's history reflects a series of strategic decisions and adaptations to market trends, contributing to its sustained presence in the retail sector.

- 1982: Parkson Holdings Berhad incorporated.

- 1987: First department store, Parkson Grand, opens in Kuala Lumpur.

- 1993: Listed on Bursa Malaysia Securities Berhad.

- Early Expansion: Rapid expansion across Malaysia and into other Asian markets.

The company's initial funding sources included internal capital generation and early investments, which supported its expansion. The company's ability to navigate the challenges of establishing a retail presence in a competitive market highlights its strategic foresight and operational capabilities. For a deeper understanding of the competitive environment Parkson operates in, consider reading about the Competitors Landscape of Parkson.

Parkson's success is partly attributed to its ability to adapt to changing consumer preferences and market dynamics. The company's focus on providing a wide array of products and services has enabled it to maintain a strong position in the retail industry. This strategy has been crucial in attracting and retaining a diverse customer base, contributing to its longevity and continued relevance in the market.

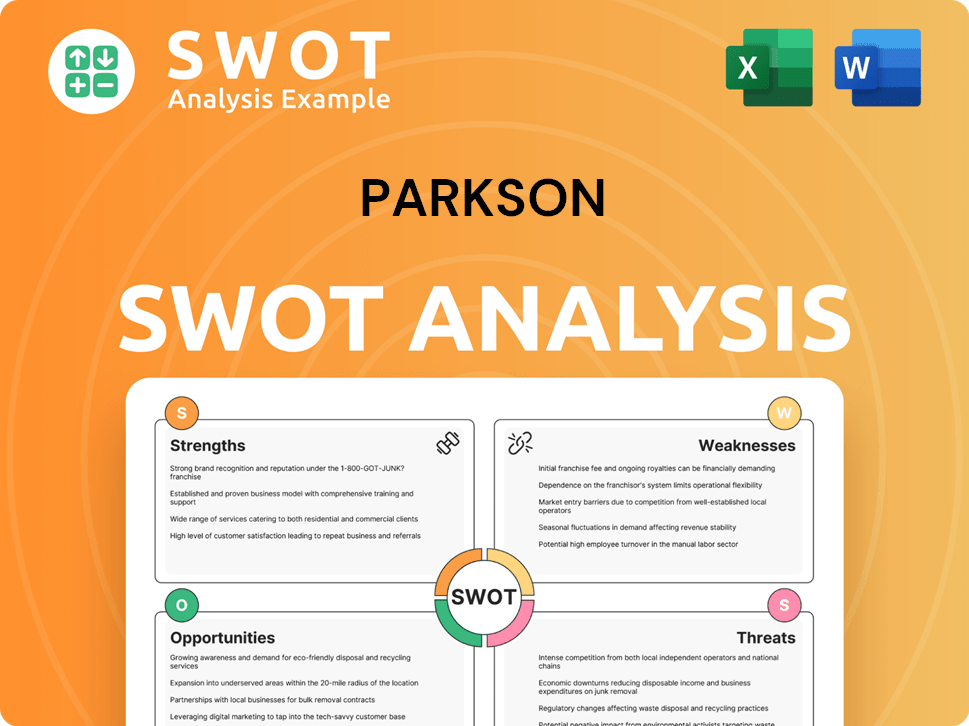

Parkson SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Parkson?

The early growth of the Parkson company, a key player in the retail industry Malaysia, was marked by a strategic expansion of its store network. This expansion was a significant factor in its early success. The company's growth included entering new markets and diversifying its business model to adapt to changing consumer demands.

Parkson's initial growth involved a steady expansion across Malaysia, averaging about two new stores per year. This aggressive strategy fueled strong same-store sales growth in the early 2010s. The company's expansion was a key milestone in its early years.

Parkson expanded its reach internationally, entering Vietnam in 2005 with a store in Ho Chi Minh City. The company further expanded, entering Indonesia in 2011 through the acquisition of the Centro department store network. This international presence marked a crucial phase in the company's development.

In 2012, Parkson Retail Asia Limited was listed on the Singapore Exchange. By 2017, the company operated 67 department stores across Malaysia (43 stores), Vietnam (9 stores), Indonesia (2 stores), and Myanmar (1 store). This extensive network highlighted the company's significant presence in Southeast Asia.

Parkson Retail Group Limited, the China retail arm, was established and launched on November 30, 2005. It grew to include a network of 60 department stores across 33 major cities in China. This expansion into China was a strategic move to capitalize on the growing consumer market.

During this period, market reception was generally positive, with consistent growth in store count and sales. Parkson's strategic shifts included diversifying its income sources and exploring various business models, such as its 'Multiple Stores in a City' and 'Model Innovation' strategies in China. For more insights into the company's strategies, consider reading about the Marketing Strategy of Parkson.

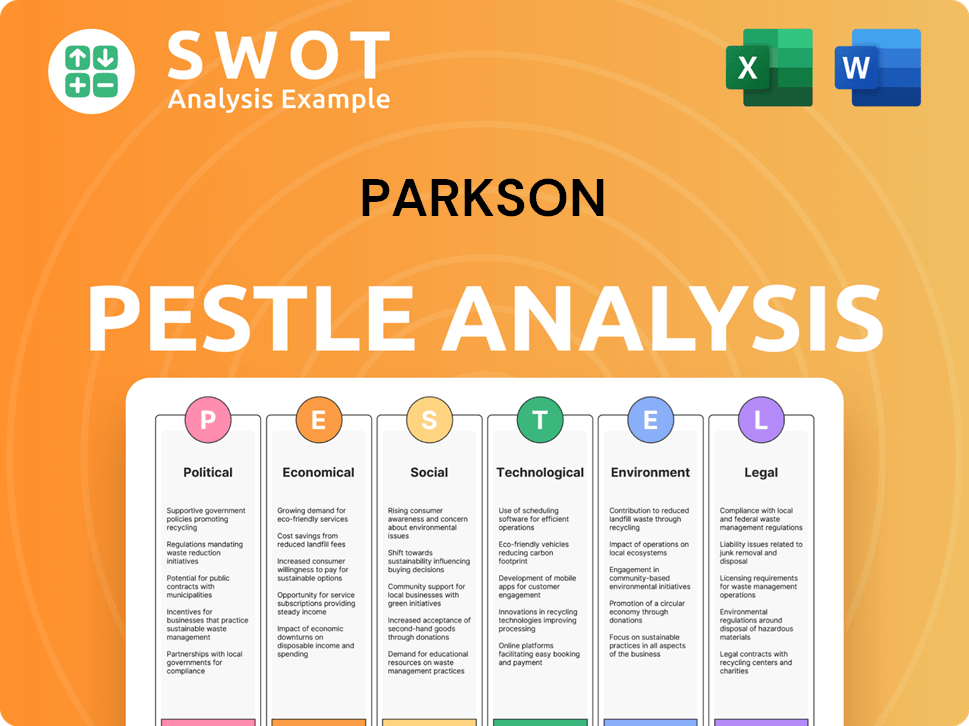

Parkson PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Parkson history?

The Parkson company has achieved several significant milestones throughout its history, notably expanding its geographical footprint across Southeast Asia and China, establishing itself as a key player in the department store history.

| Year | Milestone |

|---|---|

| Early Years | Established its presence, focusing on building a strong foundation in the retail sector. |

| Expansion Phase | Expanded its operations across Southeast Asia and China, increasing its market reach. |

| Recent Years | Continued to adapt to changing market conditions, including enhancing its offerings and managing financial performance in a competitive environment. |

A key innovation has been its continuous effort to refresh and enhance its offerings, including the introduction of lifestyle elements like food and beverage outlets within its department stores. The company has also launched private label brands and agency apparel lines of international brands to cater to a young, fashion-conscious, and contemporary market.

Incorporated food and beverage outlets and other lifestyle elements within its department stores to enhance the shopping experience. This strategy aimed to attract a broader customer base and increase dwell time.

Introduced private label brands to offer unique products and increase profit margins. These brands catered to specific customer preferences and trends, enhancing product offerings.

Launched agency apparel lines of international brands to attract a younger, fashion-conscious demographic. This strategy helped to stay relevant in a competitive market.

Regularly updated store layouts and designs to create a contemporary shopping atmosphere. This approach helped to maintain customer interest and attract new shoppers.

Developed online platforms to complement physical stores, catering to changing consumer shopping habits. This omnichannel approach helped to expand market reach.

Implemented customer loyalty programs to retain customers and encourage repeat purchases. These programs provided incentives and rewards to build customer relationships.

Parkson Malaysia, a primary market for the Parkson company, has faced challenges, including a less-than-expected retail industry growth in 2024. The company's financial results reflect these difficulties, with lower earnings and revenue reported for FY2024.

The retail industry in Malaysia experienced a slower growth rate in 2024, impacting sales. Increased costs of living and potential tariff hikes added to the economic challenges.

Department store sales growth was flat, with Parkson Malaysia experiencing flat same-store sales growth. This reflected broader industry trends and consumer behavior.

Rental and salaries continued to rise, with the minimum wage increasing in February 2025. Inflation and subsidy rationalization also contributed to higher operational costs.

Post-COVID-19 tourism, while buoyant, did not significantly boost retail merchandise sales, as younger tourists favored eco-tourism and local experiences. This shift affected sales.

Parkson Retail Asia Limited reported lower earnings of S$24.1 million for FY2024, an 18.4% year-on-year decline. Revenue also decreased by 3.1% year-on-year to S$214.8 million.

The company undertook strategic pivots, including the deconsolidation of certain Vietnamese subsidiaries. Despite the challenges, management focused on operational improvements.

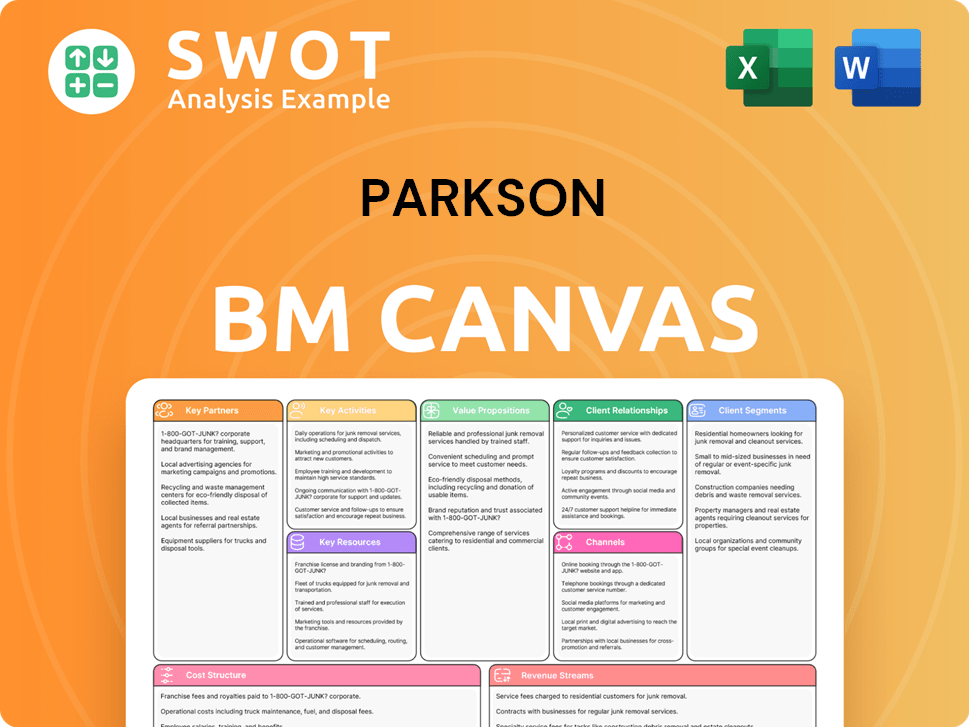

Parkson Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Parkson?

The Parkson history is a story of strategic growth and adaptation within the retail sector. The company's journey began in 1982 with the incorporation of Parkson Holdings Berhad in Malaysia, followed by the opening of its first store in 1987. Over the years, Parkson expanded its presence, listing on the Bursa Malaysia Securities Berhad in 1993 and venturing into international markets like Vietnam (2005) and Indonesia (2011). Further milestones include the listing of Parkson Retail Group Limited on the Hong Kong Stock Exchange in 2005 and Parkson Retail Asia Limited on the Singapore Exchange Securities Trading Limited (SGX-ST) in 2011. Recent financial results, such as the 8% revenue growth in 2023 for Parkson China and the S$214.8 million revenue reported by Parkson Retail Asia Limited for FY2024, highlight the company's ongoing efforts to thrive in the competitive retail industry.

| Year | Key Event |

|---|---|

| 1982 | Parkson Holdings Berhad incorporated in Malaysia. |

| 1987 | First Parkson Grand store opened in Sungei Wang Plaza, Kuala Lumpur, Malaysia. |

| 1993 | Parkson Holdings Berhad listed on Bursa Malaysia Securities Berhad. |

| 2005 | Parkson entered Vietnam; Parkson Retail Group Limited (China retail arm) listed on the Hong Kong Stock Exchange. |

| 2007 | First flagship store, Parkson Elite, opened at Pavilion KL in Malaysia. |

| 2011 | Parkson entered Indonesia through the acquisition of Centro department store network; Parkson Retail Asia Limited listed on the Singapore Exchange Securities Trading Limited (SGX-ST). |

| 2023 | Parkson China registers an 8% revenue growth to RM2,278 million. |

| 2024 | Parkson Retail Asia Limited reports S$214.8 million in revenue and S$35.4 million in profit before tax for FY2024. |

| Q1 2025 | Parkson Retail Asia posts a net profit of S$14.7 million, a 21.1% year-on-year increase, with revenue rising 8.3% to S$67.2 million. |

Parkson Retail Asia is focused on improving its operations and financial performance. This includes enhancing product offerings, improving gross margins, and optimizing operational efficiency. The company is also actively pursuing tactical promotional activities and managing costs effectively.

The company is continuously looking for new store openings and is focused on strategic initiatives to gain greater market share. The retail industry in Southeast Asia is projected to grow at 9.8% annually through 2030. This offers significant opportunities for Parkson to expand its footprint.

Despite challenges like inflation and rising costs, Parkson's strong balance sheet and cash flow generation provide a cushion for reinvestment. This financial stability allows the company to invest in high-growth markets, such as Vietnam and Cambodia, fueling further expansion.

Parkson Retail Group in China plans to open new stores in familiar markets to capture growth opportunities. This strategic approach leverages existing market knowledge and brand recognition to capitalize on consumer demand and expand its presence.

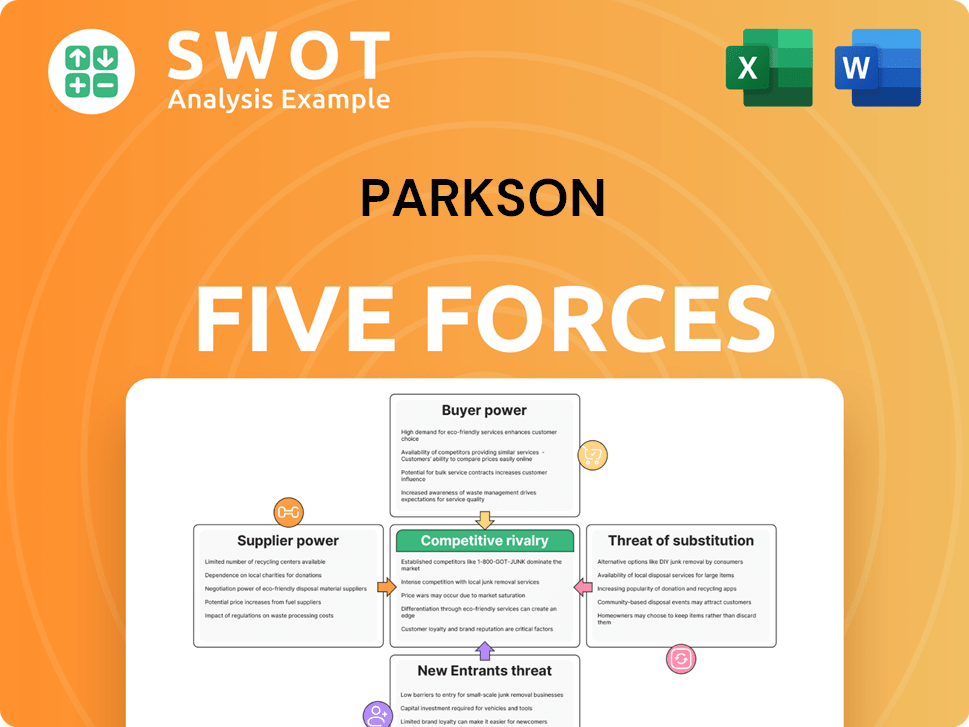

Parkson Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Parkson Company?

- What is Growth Strategy and Future Prospects of Parkson Company?

- How Does Parkson Company Work?

- What is Sales and Marketing Strategy of Parkson Company?

- What is Brief History of Parkson Company?

- Who Owns Parkson Company?

- What is Customer Demographics and Target Market of Parkson Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.