Parkson Bundle

How Does Parkson Company Thrive in Southeast Asia's Retail Market?

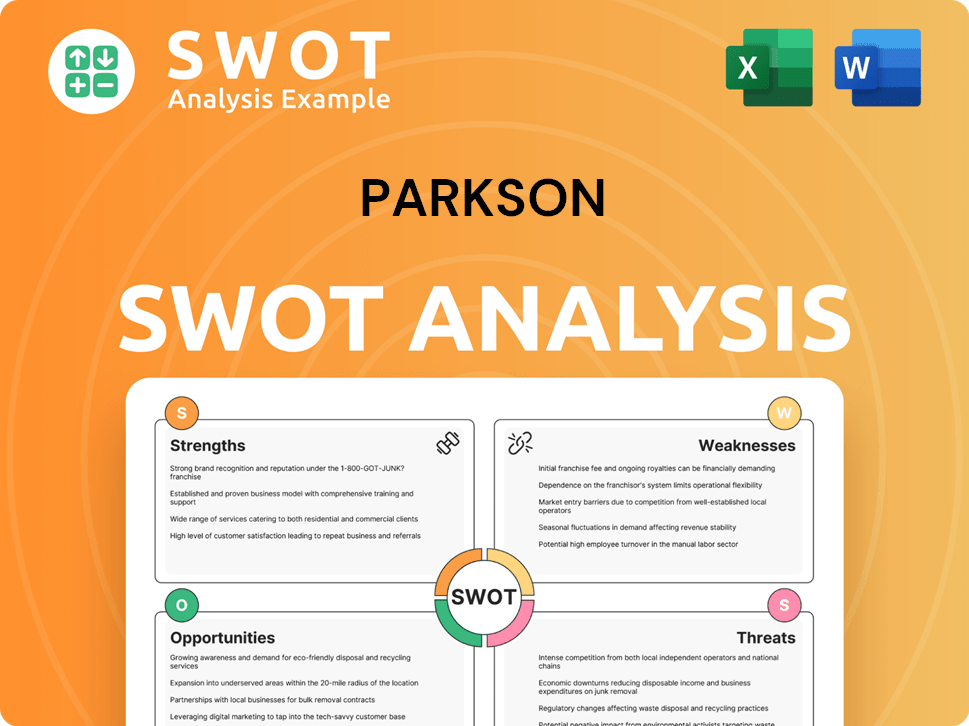

Parkson Retail Asia Limited stands as a retail giant in Southeast Asia, but how does this department store operator truly function? While specifics from 2024-2025 are still emerging, Parkson maintains a strong presence across key markets, offering a wide array of products. Understanding the Parkson SWOT Analysis is vital for anyone seeking to understand its position.

This article will explore the core of Parkson's business, including its Parkson business model, Parkson operations, and revenue generation. Investors, customers, and industry watchers alike will gain valuable insights into Parkson Company and its strategies. We'll analyze its market positioning, providing a comprehensive look at how Parkson navigates the competitive Southeast Asian retail landscape and addresses questions like "How does Parkson make money?" and "Where are Parkson department stores located?".

What Are the Key Operations Driving Parkson’s Success?

The core operations of the company, a prominent player in Southeast Asia's retail sector, revolve around its network of department stores. The company's value proposition centers on providing a diverse range of products and a convenient shopping experience for a wide customer base, spanning various income levels. The business model is designed to cater to consumers seeking a one-stop destination for both international and local brands.

The company's offerings include fashion apparel for men, women, and children, cosmetics, fragrances, household goods, and accessories. These products are strategically curated to meet the varied needs and preferences of its target demographic. The company's operations are supported by a complex interplay of sourcing, logistics, and in-store management, all aimed at delivering a seamless shopping experience.

The company's operational processes involve sourcing from numerous local and international vendors, managed through established relationships and purchasing agreements. Logistics are crucial for ensuring the timely delivery of goods to its widespread store network. The primary sales channels are physical department stores, where customer service and visual merchandising play significant roles in the shopping experience. The company's success is built on its established brand recognition and extensive physical footprint in key Southeast Asian markets.

The company offers a wide range of products, including fashion apparel, cosmetics, fragrances, household goods, and accessories. These offerings cater to a diverse customer base, providing a one-stop shopping experience. The product selection includes both international and local brands to meet varied consumer preferences.

The company's operational processes involve sourcing, logistics, and in-store management. Procurement from local and international vendors is managed through established relationships. Logistics ensure timely delivery to the store network. Customer service and visual merchandising are key in-store elements.

The company creates value through its network of department stores, offering a convenient shopping experience. It provides a diverse range of products, catering to various income segments. The company's established brand recognition and physical footprint enhance its appeal in key markets.

The company's distribution network is built around its physical store locations. These stores are strategically placed in urban centers and shopping malls. This placement maximizes accessibility for customers, enhancing the shopping experience. The company's reach is primarily focused on Southeast Asian markets.

The company's competitive advantage lies in its established brand recognition and extensive physical presence in key Southeast Asian markets. This translates into a perceived level of quality and variety that appeals to its target demographic, offering convenience, product diversity, and a consistent shopping environment. For a deeper dive into the company's strategic growth, consider reading about the Growth Strategy of Parkson.

- Extensive store network in prime locations.

- Strong brand recognition and customer loyalty.

- Diverse product offerings catering to various consumer needs.

- Efficient supply chain and logistics management.

Parkson SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Parkson Make Money?

The primary revenue stream for the company comes from direct product sales within its department stores. This includes a wide array of items such as fashion apparel, cosmetics, household goods, and accessories. The company's business model is largely centered around traditional retail practices.

The company's monetization strategies involve mark-up pricing on goods purchased from suppliers, volume-based sales, and promotional activities. The revenue mix can vary by region, influenced by local consumer preferences and the specific brand assortments available in each market. The company has likely adapted its revenue sources to reflect changing consumer trends, potentially by introducing new product categories.

The company's operations focus on traditional retail models, with revenue primarily generated through direct sales within its department stores. The company's retail offerings are diverse, aiming to capture a broad spectrum of consumer spending. For more information on the company's ownership and structure, consider reading about Owners & Shareholders of Parkson.

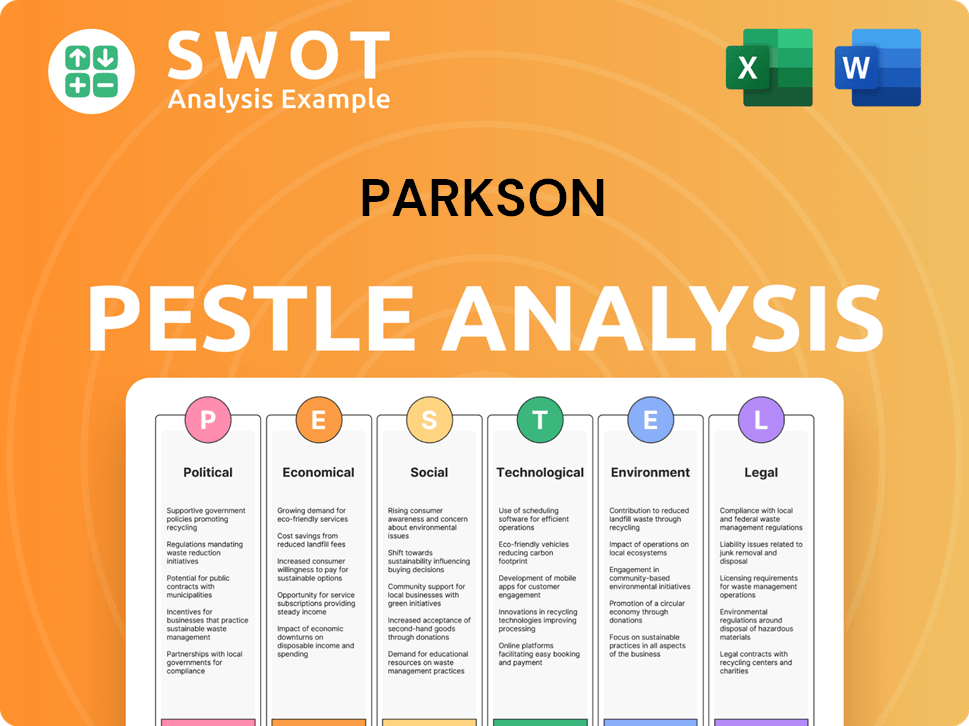

Parkson PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Parkson’s Business Model?

The journey of Parkson Retail Asia has been marked by significant milestones and strategic decisions within the evolving Southeast Asian retail market. While specific recent developments for 2024-2025 are not widely publicized, the company's past moves likely included expanding its store network and introducing new brands to attract customers. The company's ability to adapt to changing consumer preferences and intense competition remains crucial for its success.

Parkson's operations have likely been shaped by challenges common to the retail sector. These include supply chain disruptions, evolving consumer preferences, and competition from online retailers and specialized stores. The company's responses to these challenges likely involve optimizing inventory management, enhancing the in-store experience, and potentially exploring omnichannel retail strategies to meet customer demands.

The company's competitive advantages, such as established brand strength and economies of scale, are essential in a dynamic market. Its physical presence in prime retail locations also supports its competitive position. The company continues to adapt to new trends by potentially refreshing store layouts and exploring digital initiatives to complement its brick-and-mortar operations. However, the shift towards e-commerce and changing consumer shopping habits are significant competitive threats that must be continually addressed.

Key milestones for Parkson likely involve market entries into new Southeast Asian countries and expansion of its store network. The company has likely formed partnerships with international brands to enhance its product offerings. These moves are crucial for maintaining its market presence and attracting a diverse customer base.

Strategic moves for Parkson include optimizing inventory management and enhancing the in-store experience. Exploring omnichannel retail strategies is another key focus. These strategies are essential for adapting to evolving consumer preferences and intense competition from online retailers.

Parkson's competitive advantages stem from its established brand strength and recognition across Southeast Asia. The company benefits from economies of scale in procurement and logistics due to its extensive store network. Its physical presence in prime retail locations also serves as a strong competitive advantage.

The company faces challenges such as supply chain disruptions and competition from online retailers. Adapting to changing consumer shopping habits is also a significant concern. Parkson must continually address these challenges to maintain its market position and ensure long-term sustainability.

Parkson continues to adapt to new trends by potentially refreshing store layouts and introducing new brands. Digital initiatives complement its brick-and-mortar operations. The company's ability to embrace these changes is vital for staying relevant in the competitive retail landscape.

- Focus on enhancing the in-store experience to attract customers.

- Explore digital initiatives to complement physical store operations.

- Adapt to changing consumer shopping habits and preferences.

- Optimize inventory management to meet customer demands efficiently.

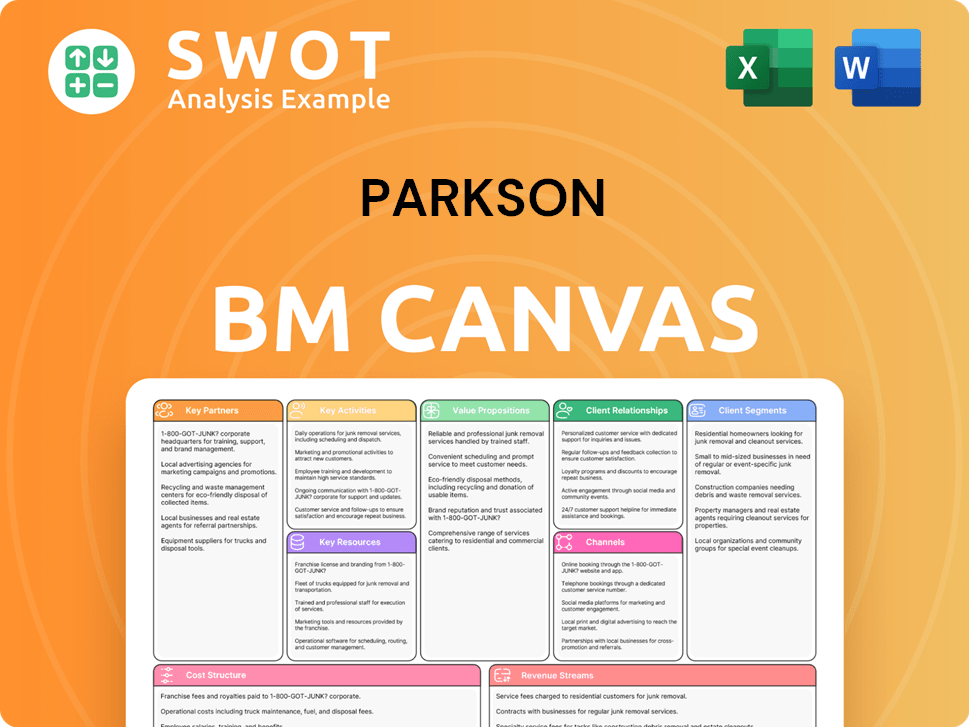

Parkson Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Parkson Positioning Itself for Continued Success?

The industry position of the Parkson Company within Southeast Asia's department store sector involves competing with both local and international retail chains. Its market share fluctuates across different countries, influenced by competitive pressures and the presence of other major retail groups. Customer loyalty is built on its brand reputation, product variety, and the overall shopping experience. The company's global reach is mainly concentrated in Southeast Asia, making it a regional player.

Key risks include competition from e-commerce platforms and specialized retail formats. Regulatory changes and economic downturns could impact sales and profitability. The company also faces risks related to supply chain disruptions and adapting to changing consumer preferences. For more information, you can read about Parkson's Target Market.

Parkson faces strong competition from both local and international retailers in Southeast Asia. The company's market share varies across different countries, reflecting the intensity of competition and the presence of other major retail groups. Its brand reputation, product variety, and shopping experience are key factors in building customer loyalty.

The company faces risks from e-commerce and specialized retail formats, regulatory changes, and economic downturns. Supply chain disruptions and adapting to changing consumer preferences also pose challenges. These factors could impact its revenue and profitability, requiring strategic adjustments.

Parkson's future depends on its ability to adapt to market shifts and maintain relevance with new consumers. The company is likely to focus on optimizing its store portfolio and integrating more digital elements. Enhancing the customer experience and maintaining its brand reputation will be crucial.

The company will likely concentrate on optimizing its store portfolio and improving customer experience. The integration of digital elements into its business model is expected to be a key focus. Adapting to changing consumer preferences and maintaining its brand reputation will be crucial for its future success.

Analyzing the financial performance of Parkson Malaysia and other Parkson stores provides insights into its operational efficiency. Key indicators include revenue growth, profit margins, and same-store sales. The company's ability to manage costs and adapt to market changes affects its financial health.

- Revenue fluctuations can be influenced by economic conditions and consumer spending.

- Profit margins are affected by factors such as cost of goods sold and operating expenses.

- Same-store sales growth indicates the performance of existing stores.

- Digital integration and online presence are important for revenue generation.

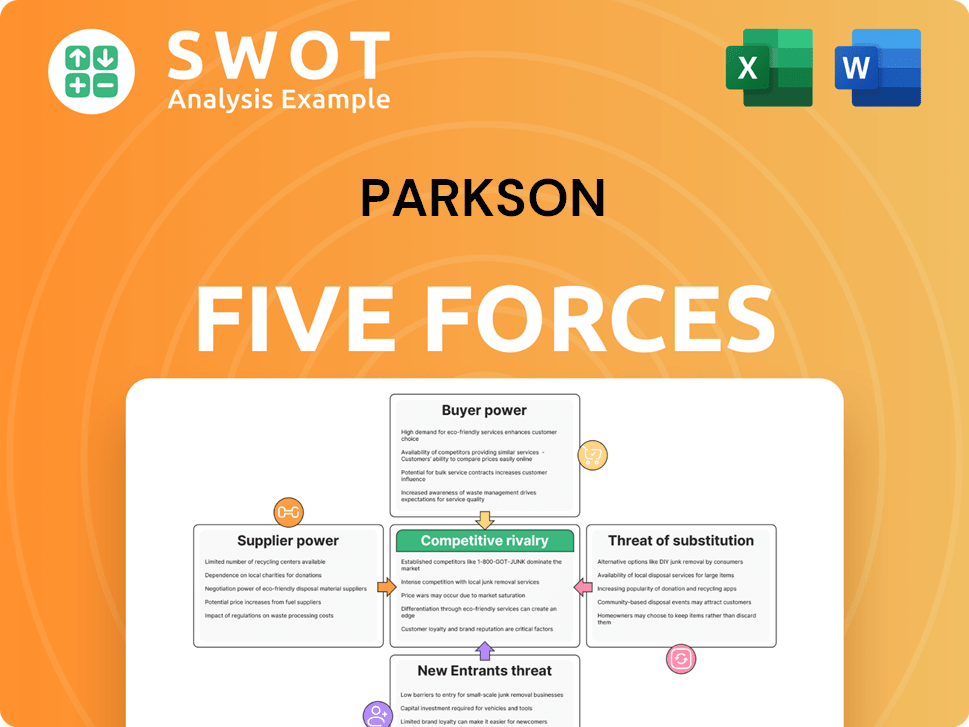

Parkson Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Parkson Company?

- What is Competitive Landscape of Parkson Company?

- What is Growth Strategy and Future Prospects of Parkson Company?

- What is Sales and Marketing Strategy of Parkson Company?

- What is Brief History of Parkson Company?

- Who Owns Parkson Company?

- What is Customer Demographics and Target Market of Parkson Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.