Parkson Bundle

Can Parkson Thrive in Southeast Asia's Evolving Retail Scene?

Parkson Retail Asia is at a critical juncture, facing the challenges and opportunities of a rapidly changing retail landscape. This Parkson SWOT Analysis provides a comprehensive look at the company's strategic positioning. Understanding the Parkson growth strategy is essential to assess its ability to navigate the shift towards e-commerce and changing consumer preferences.

This exploration of the Parkson company analysis delves into its past, present, and future, examining how it plans to capitalize on retail industry trends and adapt within the department store market. We'll examine the Parkson future prospects, considering its expansion plans, technological innovations, and financial strategies. Ultimately, this analysis aims to offer actionable insights into Parkson's potential for long-term success in Southeast Asia.

How Is Parkson Expanding Its Reach?

The expansion strategy of the company, focuses on optimizing its existing stores and exploring new retail formats. The goal is to enhance market presence in Southeast Asia. While there might not be immediate expansion into new countries, the company is likely to prioritize strategic renovations and remerchandising of existing stores.

This approach aims to offer a more modern and engaging shopping experience. This includes enhancing product assortments, introducing new brands, and creating specialized zones to cater to specific consumer segments. The company's focus on adapting to Mission, Vision & Core Values of Parkson, which includes a commitment to customer satisfaction, is crucial in this expansion strategy.

The company might also explore partnerships with popular international and local brands. This could involve concession models or exclusive distribution agreements for specific product categories. Furthermore, it could diversify its revenue streams beyond traditional department store operations.

The company is likely to prioritize optimizing its existing store network. This involves strategic renovations, remerchandising, and enhancing the shopping experience. This includes introducing new brands and curating specialized zones to cater to specific consumer segments, which is a key aspect of the overall

The company may explore partnerships with international and local brands. This could involve concession models or exclusive distribution agreements. These collaborations are aimed at strengthening offerings and attracting a wider customer base, which is vital for

The company might diversify its revenue streams beyond traditional department store operations. This could involve specialized retail concepts, such as standalone boutiques, or hybrid models that combine retail with F&B or entertainment. This diversification is a key component of the

Specific timelines and milestones for these initiatives are often outlined in the company's annual reports. These reports detail capital expenditure allocations for store upgrades and new concept rollouts. This financial planning is crucial for assessing

The company's expansion initiatives are primarily focused on enhancing its market presence within Southeast Asia. This includes optimizing the existing store network through renovations and remerchandising. The company is also exploring partnerships and diversifying revenue streams.

- Strategic Renovations: Upgrading existing stores to offer a modern shopping experience.

- Brand Partnerships: Collaborating with popular brands to strengthen offerings.

- Revenue Diversification: Exploring specialized retail concepts and hybrid models.

- Financial Planning: Detailed in annual reports, outlining capital expenditure for upgrades.

Parkson SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Parkson Invest in Innovation?

For the company, a robust innovation and technology strategy is essential for navigating the evolving retail landscape. This strategy is critical for sustaining growth, particularly in a market that is rapidly digitizing. Investing in digital transformation is a key focus area to enhance customer engagement and operational efficiency.

The company's approach likely includes developing advanced e-commerce platforms and mobile applications to complement its physical store presence. This will facilitate seamless omni-channel shopping experiences. Integrating online and offline channels, such as click-and-collect services and in-store digital kiosks, is expected to be a priority. This strategy aims to meet the changing needs of modern consumers.

The company is expected to leverage data analytics and artificial intelligence (AI) to gain deeper insights into consumer behavior and personalize marketing campaigns. AI's role could extend to predictive analytics for demand forecasting. This can lead to supply chain optimization and waste reduction. Automation in warehousing and logistics is another area where technology can drive improvements in operational costs and delivery times.

The company's investment in e-commerce platforms and mobile applications is crucial for competing in the current market. These digital tools are essential for offering customers seamless shopping experiences. The goal is to provide convenient and accessible shopping options, catering to the preferences of today's consumers.

Integrating online and offline channels is a key aspect of the company's strategy. This includes services like click-and-collect and in-store digital kiosks. This approach aims to provide customers with a unified shopping experience, allowing them to interact with the brand across multiple touchpoints.

The company is expected to use data analytics and AI to gain deeper insights into consumer behavior. This data-driven approach enables personalized marketing campaigns. This will help the company to better understand customer preferences and improve its marketing efforts.

AI is expected to play a role in predictive analytics for demand forecasting. This helps optimize the supply chain and reduce waste. The use of AI can lead to more efficient inventory management and better alignment of supply with demand.

Technology can drive significant improvements in operational costs and delivery times through automation. Automation in warehousing and logistics is another area where technology can drive significant improvements in operational costs and delivery times. This will help the company to streamline its operations and improve efficiency.

Sustainability initiatives, such as energy-efficient store designs and responsible sourcing, could be integrated into the company's innovation strategy. This will appeal to environmentally conscious consumers. This approach reflects a commitment to environmental responsibility and consumer preferences.

The company's commitment to digital transformation and the adoption of cutting-edge technologies are vital for staying competitive. While specific details on patents or industry awards are not widely publicized, the focus on innovation is clear. The company is adapting to meet the evolving expectations of modern consumers. For a deeper understanding of the company's history, you can refer to the Brief History of Parkson.

The company's technology strategy focuses on enhancing customer experience and operational efficiency. This includes investments in e-commerce, data analytics, and automation.

- E-commerce Platforms: Developing online stores and mobile apps for seamless shopping.

- Data Analytics: Using AI to analyze consumer behavior and personalize marketing.

- Supply Chain Optimization: Implementing predictive analytics for demand forecasting.

- Automation: Automating warehousing and logistics for cost reduction.

- Sustainability: Integrating eco-friendly practices into store designs and sourcing.

Parkson PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Parkson’s Growth Forecast?

The financial outlook for Parkson Retail Asia is closely tied to its ability to adapt to market changes, execute its growth strategies, and manage operational costs effectively. The Parkson growth strategy will likely focus on optimizing profitability amidst competitive pressures within the department store market.

Investment levels will reflect its commitment to store renovations, digital infrastructure, and inventory management. Recent financial reports are crucial for understanding the company's performance, including revenue, gross profit, net profit, and cash flow from operations. Analyst forecasts offer external perspectives on the company's future performance, often comparing it to industry benchmarks.

A key indicator of financial health will be the ability to maintain healthy profit margins while investing in expansion and innovation. Investors and stakeholders will be keen to see how Parkson balances revenue growth with cost control and efficient capital allocation. Understanding Parkson's financial performance requires a deep dive into its financial reports and market analysis.

The company's revenue and profit margins are critical indicators. Parkson's financial performance is directly influenced by its ability to attract customers and manage operational costs. Monitoring these metrics helps assess the company's financial health and its capacity to achieve long-term goals.

Capital expenditure, including investments in store renovations and digital infrastructure, is a significant factor. The level of investment indicates the company's commitment to growth and modernization. Prudent capital expenditure management is essential for sustainable growth.

Cash flow from operations and debt management strategies are crucial. The ability to generate cash internally and manage debt efficiently impacts financial stability. Strategic debt financing, if necessary, should be managed carefully.

Analyzing market trends and competitive dynamics is vital for understanding Parkson's future prospects. Factors such as retail industry trends and the performance of competitors influence the company's financial outlook. This analysis provides context for evaluating Parkson's strategies.

Several key financial metrics will be critical in assessing Parkson’s performance. These include revenue growth, gross profit margin, net profit margin, and cash flow from operations. These metrics provide insights into the company's ability to generate revenue, manage costs, and maintain profitability.

- Revenue Growth: The rate at which Parkson increases its sales, indicating market demand and the effectiveness of its strategies.

- Gross Profit Margin: The percentage of revenue remaining after deducting the cost of goods sold, reflecting the company's pricing strategies and cost management.

- Net Profit Margin: The percentage of revenue remaining after all expenses, including taxes and interest, showcasing overall profitability.

- Cash Flow from Operations: The cash generated from the company’s core business activities, indicating its ability to fund operations and investments.

Parkson Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Parkson’s Growth?

The future of Parkson Retail Asia hinges on its ability to navigate a complex landscape filled with potential risks and obstacles. The company's Parkson growth strategy must account for intense competition and rapid shifts in consumer behavior. Understanding these challenges is crucial for investors and stakeholders analyzing Parkson company analysis.

One of the primary threats to Parkson future prospects is the highly competitive retail environment. This includes both traditional department stores and the ever-growing e-commerce sector. Furthermore, regulatory changes and supply chain disruptions could significantly impact the company's operations and financial performance.

Additionally, internal resource constraints and the need to adapt to technological advancements pose further hurdles. The ability to effectively address these risks will determine Parkson's success in the evolving department store market and broader retail industry trends.

Parkson faces stiff competition from both established brick-and-mortar retailers and the expanding e-commerce market. Online retailers and direct-to-consumer brands are increasingly capturing market share. This competitive pressure necessitates strategic adaptation and innovation to maintain relevance and attract customers.

Changes in import duties, labor laws, and consumer protection regulations across Southeast Asia could affect Parkson's operational costs. Supply chain vulnerabilities, stemming from geopolitical events or natural disasters, pose further risks. These factors require proactive risk management and strategic planning.

The rapid pace of technological advancements in retail presents both opportunities and risks. Parkson must invest in digital transformation and e-commerce to stay competitive. Failure to adapt to new technologies could lead to a decline in market share and customer engagement.

Internal resource constraints, particularly in talent acquisition and retention, can hinder growth. Skilled professionals in e-commerce, data analytics, and digital marketing are crucial for success. Addressing these constraints requires strategic workforce planning and competitive compensation packages.

Changing consumer preferences and shopping habits require constant adaptation. Understanding and responding to evolving trends, such as the demand for online shopping and personalized experiences, is essential. Parkson must focus on customer retention and adapt its strategies to meet these new demands.

Economic downturns and fluctuations in consumer spending can significantly impact Parkson's financial performance. Economic instability in Southeast Asia or globally could reduce consumer spending. Diversification of product offerings and cost management are essential strategies to mitigate these risks.

Parkson's strategic responses to these challenges are crucial. This includes diversification of product offerings to cater to varied consumer preferences and demographics. Robust risk management frameworks are essential for anticipating and mitigating potential impacts from market volatility. The ability to quickly adapt to changing consumer behavior and effectively navigate the competitive landscape is paramount.

Enhancing its online retail strategy is vital for Parkson. This involves investing in user-friendly e-commerce platforms, improving logistics, and offering competitive online promotions. Integrating online and offline experiences, such as click-and-collect services, can also enhance customer engagement and drive sales. For more insights, consider reading Marketing Strategy of Parkson.

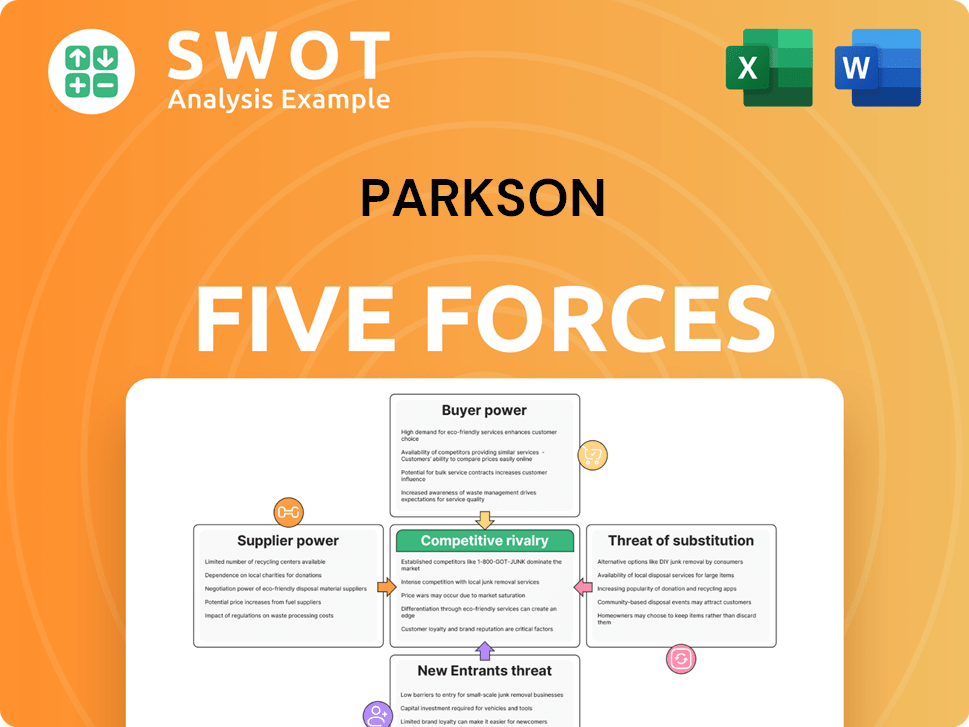

Parkson Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Parkson Company?

- What is Competitive Landscape of Parkson Company?

- How Does Parkson Company Work?

- What is Sales and Marketing Strategy of Parkson Company?

- What is Brief History of Parkson Company?

- Who Owns Parkson Company?

- What is Customer Demographics and Target Market of Parkson Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.