Perpetual Bundle

What's the Story Behind Perpetual Company's Enduring Legacy?

Journey back in time to uncover the fascinating Perpetual SWOT Analysis, a financial powerhouse with roots stretching back to 1886. From its humble beginnings as a trustee company, learn how Perpetual Company, guided by principles of client-centricity, has navigated over a century of market fluctuations. Discover the key milestones and the driving forces behind its remarkable corporate evolution, shaping it into the global asset manager it is today.

Understanding the brief history of Perpetual Company provides crucial context for investors and strategists alike. The company's story, from its founding by visionaries like Sir Edmund Barton to its current status, reveals a commitment to adaptation and growth. Exploring the early days of Perpetual Company and its subsequent business timeline illuminates the strategic decisions that have defined its success and impact on the industry. This historical background is essential for anyone seeking to understand Perpetual Company's position in the financial landscape and its future prospects.

What is the Perpetual Founding Story?

The Mission, Vision & Core Values of Perpetual company's story began in 1885, driven by a vision to provide reliable wealth management solutions. The official formation of Perpetual, then known as The Perpetual Trustee Company (Limited), occurred in 1886. This marked the start of a long and impactful journey in the financial sector, shaping the company's history.

The initial concept was developed by a committee of prominent business professionals. Key figures included Edmund Barton, who later became Australia's first Prime Minister, along with John Street and James Fairfax. Their collective efforts laid the foundation for what would become a leading financial institution.

The company's headquarters were established at 105 Pitt Street, Sydney, and its first employee was an accountant named John Pewtress. This early setup was crucial for establishing the operational framework necessary for managing trusts and estates. The early days of Perpetual Company set the stage for its future success.

Perpetual's early focus was on providing reliable management for trusts and estates. This commitment to secure wealth management was a key factor in its early success and growth.

- In 1888, a special act by the NSW Legislative Assembly granted Perpetual the power to act as a corporate executor and trustee.

- This legislative backing enhanced its reputation and attracted a growing number of clients.

- By 1935, the company managed trust estates valued at £50,000,000.

- This success solidified Perpetual's position as Australia's largest trustee company.

The late 19th-century economic and cultural environment in Australia was crucial to Perpetual's formation. The growing need for professional wealth management and intergenerational wealth transfer created a favorable environment for the company's early success. The founding of companies like Perpetual filled a significant need in the market.

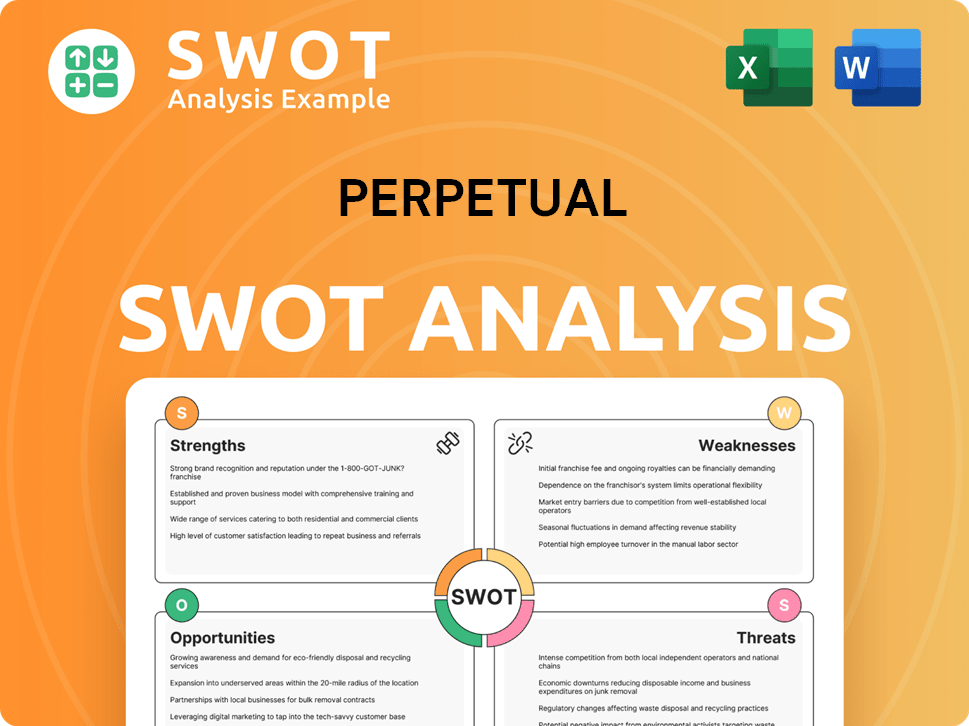

Perpetual SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Perpetual?

The early growth of the Perpetual Company, a cornerstone of the financial sector, was marked by its establishment as a trusted trustee company. The company quickly expanded its role, demonstrating early success and significant market penetration. This period was crucial for setting the stage for its future endeavors and establishing its reputation. The company adapted to various societal and economic changes, continually evolving its products and services.

By 1935, the company managed trust estates valued at £50,000,000, showcasing its early dominance. A significant milestone was its listing on the Australian Stock Exchange in 1964. This event marked a new phase in the company's corporate evolution, providing access to capital and enhancing its profile.

In 2020, Perpetual acquired Trillium Asset Management and a 75% interest in Barrow Hanley Mewhinney & Strauss, LLC, aiming to build a global multi-boutique asset management capability. The acquisition of Pendal Group in 2023, including brands like J O Hambro, Regnan, and TSW, was a defining moment, significantly growing its asset management business.

Perpetual Private has expanded through strategic acquisitions, including Jacaranda Financial Planning and Priority Life, enhancing services for high-net-worth individuals. This expansion reflects a focus on providing comprehensive financial solutions. The company's growth strategy has been further detailed in Target Market of Perpetual.

As of December 31, 2024, Perpetual's total Assets Under Management (AUM) reached A$230.2 billion, up from A$222.3 billion at September 30, 2024. This growth was driven by positive currency movements of A$15.8 billion, despite net outflows of A$3.8 billion and negative market movements of A$4.1 billion. Corporate Trust business had Funds Under Administration (FUA) totaling A$1.25 trillion as of December 31, 2024, a 2.5% increase from the prior quarter.

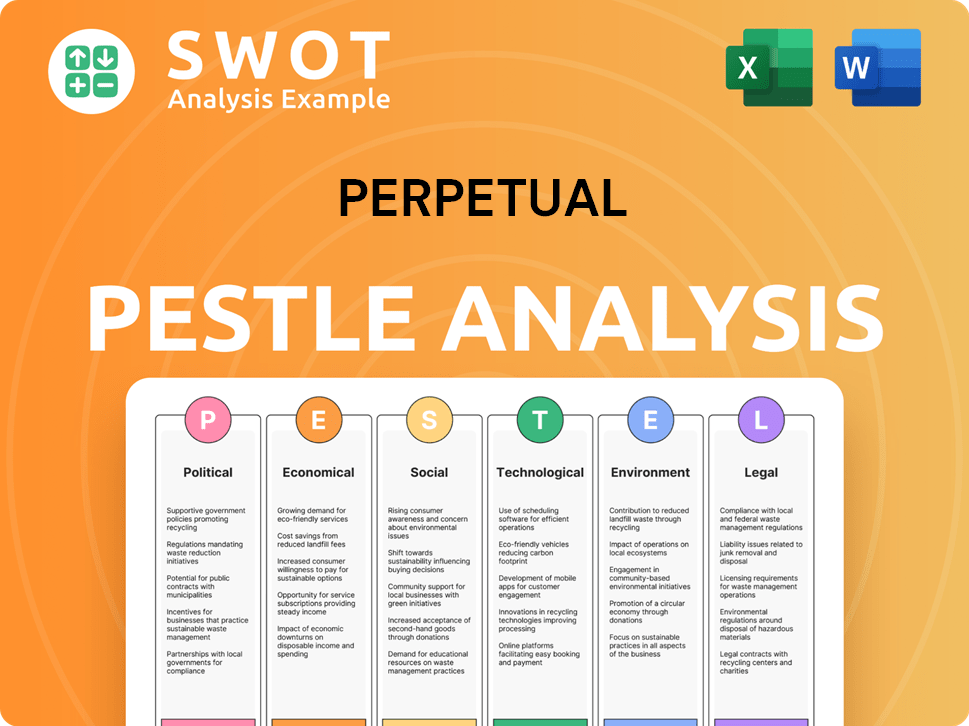

Perpetual PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Perpetual history?

The Company history of Perpetual Company is marked by significant milestones that have shaped its identity and strategic direction. Starting as a trustee company, it evolved into a publicly listed entity and expanded its asset management capabilities through strategic acquisitions, establishing itself as a key player in the financial industry.

| Year | Milestone |

|---|---|

| 1886 | Established as a trustee company, laying the foundation for its wealth protection services. |

| 1888 | Granted special powers to act as a corporate executor and trustee, solidifying its role. |

| 1964 | Listed on the Australian Stock Exchange, marking its transition into a public entity. |

| 2020 | Acquired Trillium Asset Management and a 75% stake in Barrow Hanley Mewhinney & Strauss, LLC, expanding its global presence. |

| 2023 | Acquired Pendal Group, including brands like J O Hambro, Regnan, and TSW, boosting its asset management capabilities. |

| 2024 | Underlying profit before tax reached A$200.4 million in FY24, and total revenue reached A$1,333,900,000. |

| 2025 | Perpetual Corporate Trust secured a Market License to digitally enable the Wholesale Term Deposit market, showcasing innovation. |

Perpetual Company has demonstrated innovation by expanding its asset management capabilities and embracing digital solutions. The acquisition of Pendal Group and the securing of a Market License to digitally enable the Wholesale Term Deposit market are examples of this commitment.

Perpetual Corporate Trust's Market License to digitally enable the Wholesale Term Deposit market showcases its commitment to digital solutions. This innovation streamlines processes and enhances market access.

Acquisitions like Trillium Asset Management and Pendal Group have expanded Perpetual's asset management capabilities. These moves have broadened its service offerings and market reach.

Despite its successes, Perpetual Company has faced challenges, including market-driven outflows and strategic setbacks. The termination of the proposed sale of its Wealth Management and Corporate Trust businesses and the subsequent restructuring efforts highlight these difficulties.

In the third quarter of FY25, the Asset Management business experienced outflows, particularly in global and US equities and cash. These outflows led to a 4% decrease in total AUM to A$221.2 billion.

The proposed sale of Wealth Management and Corporate Trust businesses to KKR & Co. for US$1.43 billion was terminated. This led to a restructuring, including a new operating model for Asset Management.

Perpetual is implementing a simplification program to deliver annualised cost reductions. The goal is to achieve A$30 million in annualised cost savings by June 30, 2025.

Perpetual is now pursuing the sale of its Wealth Management unit as part of its restructuring efforts. This strategic shift aims to streamline operations.

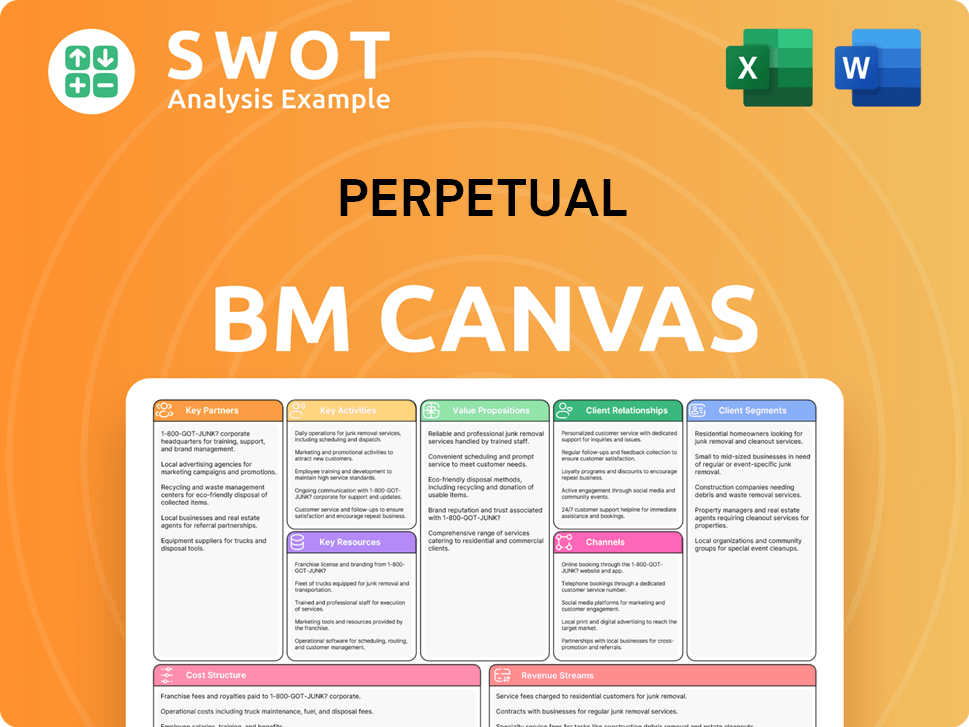

Perpetual Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Perpetual?

The brief history of the Perpetual Company traces back to 1886, marked by significant milestones in its corporate evolution. From its origins as a trustee company to its expansion through acquisitions and strategic shifts, Perpetual has adapted to market changes while maintaining a focus on client wealth management.

| Year | Key Event |

|---|---|

| 1886 | The Perpetual Trustee Company (Limited) was officially formed in Sydney, marking the founding of companies. |

| 1888 | Granted a special act by the NSW Legislative Assembly, empowering it to act as a corporate executor and trustee. |

| 1935 | Controlled trust estates valued at £50,000,000, becoming Australia's largest trustee company. |

| 1964 | Listed on the Australian Stock Exchange (ASX: PPT). |

| 2020 | Completed the acquisition of Trillium Asset Management and acquired a 75% interest in Barrow Hanley Mewhinney & Strauss, LLC. |

| 2023 | Acquired Pendal Group and its boutique brands, a defining moment in its history. |

| May 2024 | Announced plans to sell its Wealth Management and Corporate Trust units to KKR & Co. for US$1.43 billion. |

| August 29, 2024 | Reported FY24 financial results, with underlying profit after tax (UPAT) of A$206.1 million. |

| December 31, 2024 | Total Assets Under Management (AUM) reached A$230.2 billion, and Funds Under Administration (FUA) for Corporate Trust reached A$1.25 trillion. |

| February 24, 2025 | Announced the termination of the Scheme of Arrangement with KKR. |

| February 27, 2025 | Reported 1H25 results, with an underlying profit after tax of A$100.5 million for the half-year ended December 31, 2024. |

| April 15, 2025 | Released Q3 FY25 business update, reporting AUM of A$221.2 billion, a 4% decrease from December 31, 2024. |

| June 2, 2025 | Announced refinancing of its syndicated debt facilities, with no debt maturities until 2027. |

Perpetual is simplifying its business model, focusing on its core strengths, and pursuing growth opportunities. The company is progressing with the separation of its three underlying businesses into standalone entities. Key strategies include the proposed sale of its Wealth Management business.

A new operating model for Asset Management and a cost reduction program are being implemented. The company is targeting annualised cost reductions of between A$25 million and A$35 million over two years, with A$30 million expected by June 30, 2025. This will improve shareholder returns.

Leadership emphasizes a client-centric approach, aiming for a future-fit, scalable business platform. Perpetual is exploring new horizons by adding capabilities and building a global footprint. The long-term vision remains centered on protecting and growing clients' wealth.

In the FY24 results, the underlying profit after tax (UPAT) was A$206.1 million, up 26% on FY23. Total operating revenue reached A$1,335 million, an increase of 32% on FY23. As of December 31, 2024, AUM was A$230.2 billion, and Corporate Trust FUA was A$1.25 trillion.

Perpetual Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Perpetual Company?

- What is Growth Strategy and Future Prospects of Perpetual Company?

- How Does Perpetual Company Work?

- What is Sales and Marketing Strategy of Perpetual Company?

- What is Brief History of Perpetual Company?

- Who Owns Perpetual Company?

- What is Customer Demographics and Target Market of Perpetual Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.