Perpetual Bundle

Who is Perpetual Company's Ideal Customer?

Embark on a journey to understand the core of Perpetual Company's success: its customers. This exploration delves into the critical elements of Perpetual SWOT Analysis, customer demographics, and target market dynamics. Understanding these facets is crucial for investors, analysts, and strategists aiming to capitalize on opportunities within the financial sector. Uncover the strategies Perpetual employs to connect with and serve its diverse client base.

The evolution of Perpetual Company, from its trustee origins to a global financial services provider, necessitates a deep dive into its customer base. This analysis will examine the company's market segmentation strategies, providing insights into the ideal customer profile. We will explore detailed customer behavior analysis, including purchasing patterns and the specific needs of Perpetual Company's target market, offering actionable insights for strategic decision-making.

Who Are Perpetual’s Main Customers?

Understanding the customer demographics and target market of the Perpetual Company involves examining its diverse customer segments. The company primarily serves both consumers (B2C) and businesses (B2B) through its Asset Management, Wealth Management, and Corporate Trust divisions. This approach allows it to cater to a wide array of financial needs, from individual investors to large institutions.

Perpetual Company's market segmentation strategy is key to its operations. The company's focus on different client types allows it to offer specialized services. This includes providing tailored investment solutions and wealth management services, along with corporate trust services for businesses.

The company's strategy includes a multi-boutique model, which allows it to provide a range of specialist and differentiated investment capabilities. This model is supported by brands like Perpetual, Pendal, Barrow Hanley, J O Hambro, Regnan, Trillium, and TSW. This structure enables Perpetual Company to meet the diverse needs of its clients effectively.

The Asset Management segment targets institutional investors, wholesale clients, and retail markets. Institutional clients include large organizations and superannuation funds. Retail clients often access services through financial advisors or direct investment vehicles.

Wealth Management focuses on high-net-worth individuals, families, businesses, and not-for-profit organizations. This segment offers comprehensive wealth management, financial advice, and trustee services. Brands like Perpetual Private cater to these needs. Funds Under Advice (FUA) reached A$20.6 billion as of December 31, 2024.

The Corporate Trust division serves businesses within the banking and financial services industry. This B2B segment provides debt trustee, securitisation, and managed fund services. Clients include major banks and non-bank financial institutions. Funds Under Administration (FUA) grew to A$1.25 trillion as of December 31, 2024.

The acquisition of Pendal Group in January 2023 expanded Perpetual Company's global footprint. While there were some net outflows in late 2024 and early 2025, the overall growth in Assets Under Management (AUM) to A$230.2 billion as of December 31, 2024, indicates the benefits of its diversified model. For more insights, see the Growth Strategy of Perpetual.

Perpetual Company conducts detailed audience analysis to understand its ideal customer profile. This involves examining various factors, including customer age range, income levels, and location data. The company also considers customer interests and purchasing patterns to refine its strategies.

- The company uses market research methods to gather data.

- It focuses on understanding the needs of its target market.

- Customer segmentation strategies are employed to tailor services.

- The analysis helps in understanding customer behavior.

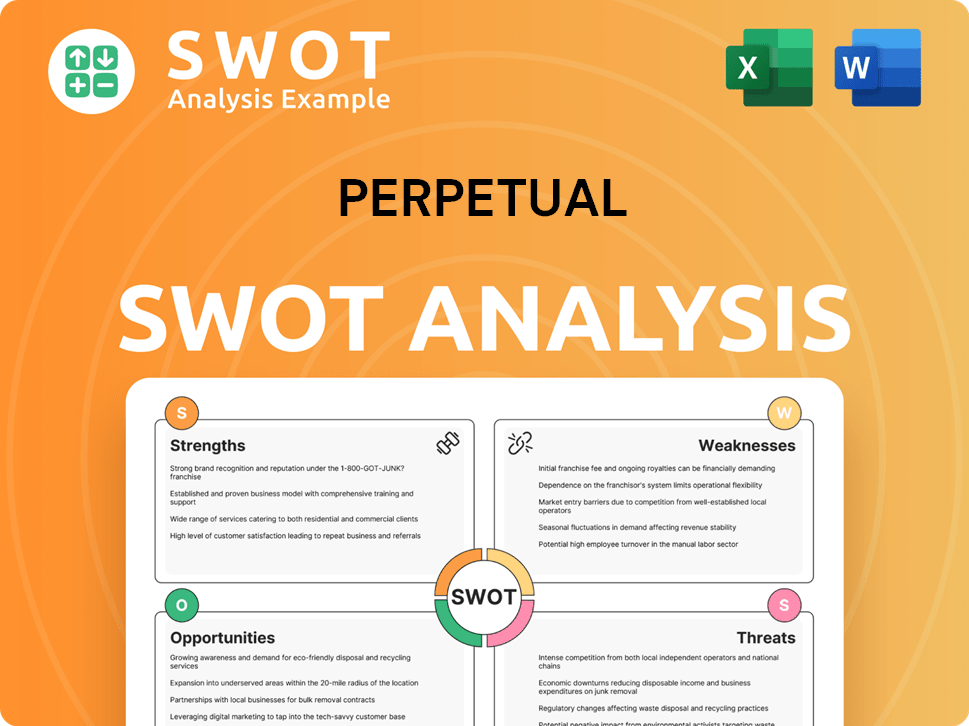

Perpetual SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Perpetual’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial services company. For the [Company Name], this involves catering to a diverse customer base, including institutional investors, high-net-worth individuals, and retail clients. Each segment has unique requirements and expectations that influence their investment decisions and overall satisfaction.

The company's approach to meeting these diverse needs includes providing tailored solutions, robust risk management, and a focus on long-term strategic alignment. By understanding the nuances of each customer segment, the company aims to deliver value and build lasting relationships. This customer-centric focus is essential for driving growth and maintaining a competitive edge in the financial services market.

The company's ability to meet the diverse needs of its customer base is reflected in its financial performance and strategic initiatives. The company's commitment to innovation and client satisfaction is evident in its investments in technology and its focus on sustainable investment strategies. This multifaceted approach ensures that the company remains relevant and competitive in a dynamic market.

These clients prioritize investment performance, risk management, and tailored solutions. They often seek diversification and long-term strategic alignment. Decision-making involves detailed due diligence and a focus on the financial partner's reputation.

Retail clients often prioritize accessibility, ease of understanding, and personalized financial advice. They seek wealth protection, growth, superannuation, and retirement planning. Trust and security are key psychological drivers for these clients.

Across all segments, common needs include strong returns, risk mitigation, and alignment with financial goals. Clients are motivated by the aspiration for long-term financial well-being and the desire to navigate complex market conditions. The company addresses pain points such as intergenerational wealth transfer and regulatory compliance.

The company's strategies have demonstrated strong performance, with 65% of strategies outperforming over three years and 74% over five years to 31 December 2024, on a gross of fees basis. The company adapts its offerings based on client feedback and market trends, including a focus on ESG-aligned investments.

The company uses solutions like Charles River Investment Management Solution to manage portfolios, order execution, compliance, and front office data. This indicates a focus on operational efficiency and robust infrastructure to meet client demands. This ensures streamlined operations.

The company's Wealth Management's Funds Under Advice (FUA) reached A$20.6 billion as at 31 December 2024, highlighting the ongoing demand for these services. This growth underscores the company's ability to attract and retain retail clients seeking wealth management solutions.

The company's success is rooted in its customer-centric approach, which involves understanding and addressing the unique needs of each client segment. This approach is supported by market research methods and detailed audience analysis, helping the company define its target market and create ideal customer profiles. For more insights into the company's broader strategic goals, consider reading about the Growth Strategy of Perpetual.

- Market Segmentation: The company segments its customer base to tailor its offerings effectively.

- Audience Analysis: Detailed analysis helps in understanding customer behavior and purchasing patterns.

- Ideal Customer Profile: Creating ideal customer profiles aids in targeting the right audience.

- Customer Behavior Analysis: Understanding customer behavior helps in refining product development and service delivery.

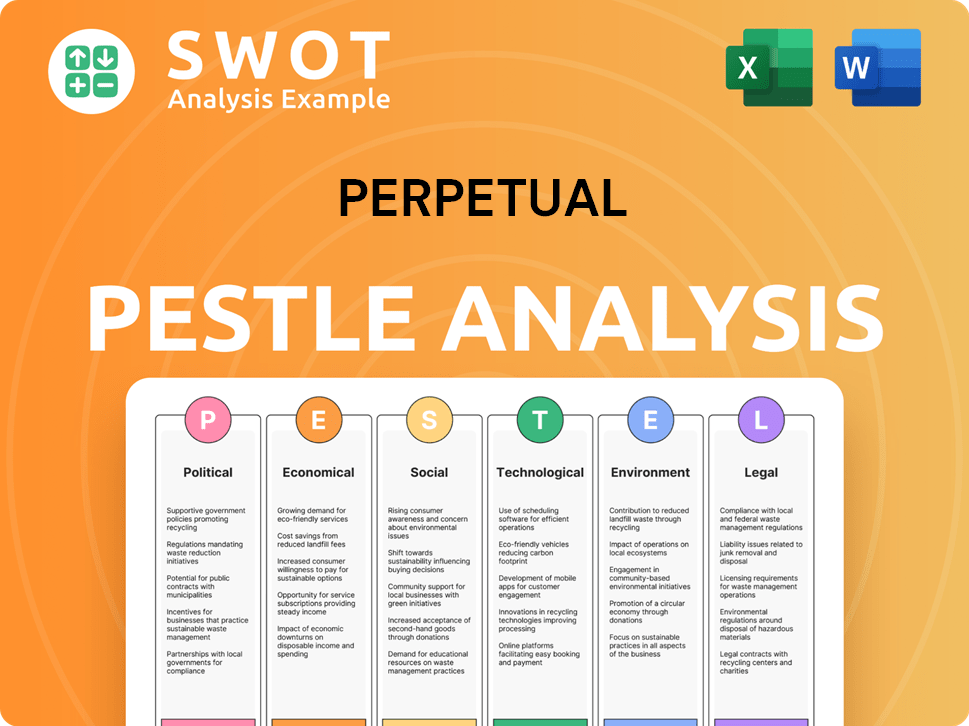

Perpetual PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Perpetual operate?

The geographical market presence of Perpetual is extensive, spanning from its headquarters in Sydney, Australia, to key financial centers globally. This widespread reach is crucial for serving its diverse client base, which includes individuals, families, businesses, and institutions. The company's operations are strategically located across Australia, Asia, Europe, the United Kingdom, and the United States, reflecting its commitment to a global footprint.

Australia serves as a core market for Perpetual, where it maintains strong brand recognition and market share, particularly in funds management, wealth management, and corporate trust services. The company's Wealth Management and Corporate Trust businesses primarily operate within Australia and Singapore, respectively. This focus underscores the importance of the domestic market while also recognizing the potential for international expansion.

Through its multi-boutique Asset Management business, Perpetual has a global presence, with brands like Pendal, Barrow Hanley, J O Hambro, Regnan, Trillium, and TSW operating in key markets worldwide. This diversification is vital, as seen in the positive impact of currency movements on Assets Under Management (AUM), which increased by A$15.8 billion in the quarter ending December 31, 2024. This exposure to different equity markets and currencies highlights Perpetual's international reach and its ability to navigate global financial landscapes.

Differences in customer demographics, preferences, and buying power across regions necessitate localized approaches for Perpetual. This involves adapting product offerings, marketing messages, and client servicing to local regulatory environments and cultural nuances. For instance, the company's investment capabilities include global, emerging markets, UK, US, European, Asian, and Australian equity strategies, indicating a tailored approach to different markets.

Recent strategic discussions, such as the potential separation of the Wealth Management and Corporate Trust businesses, were aimed at creating a more simplified, standalone global Asset Management business. Although the proposed sale of these units to KKR was terminated in February 2025, Perpetual remains committed to a business separation program to establish standalone and more autonomous businesses. This strategic review and potential restructuring underscore the dynamic nature of Perpetual's geographic market presence and its ongoing efforts to optimize its global operations.

Perpetual's customer base is diverse, including high-net-worth individuals, families, businesses, not-for-profit organizations, and Indigenous communities. Competitors Landscape of Perpetual reveals that the company's market research methods involve understanding the specific needs and preferences of each segment.

- The Wealth Management business focuses on high-net-worth individuals and families, providing tailored financial solutions.

- The Corporate Trust business serves the banking and financial services industry, offering fiduciary and digital solutions.

- The Asset Management business, through its global brands, caters to a broad range of institutional and retail investors.

- The company's geographic reach and diverse product offerings reflect its commitment to serving a wide array of customer needs.

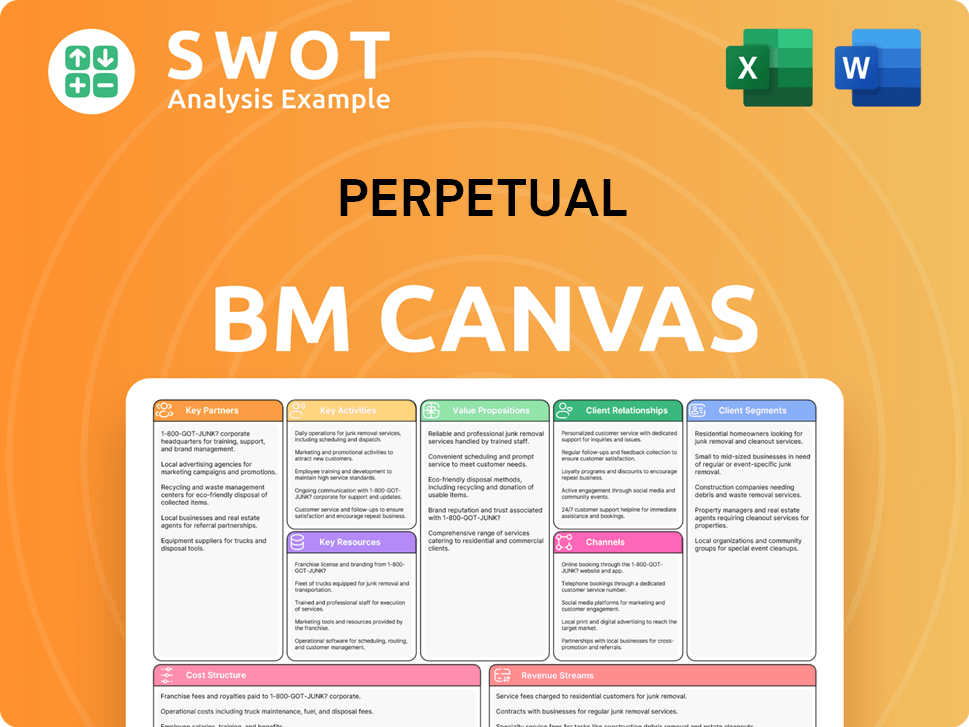

Perpetual Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Perpetual Win & Keep Customers?

The company, employs a multifaceted approach to acquire and retain customers across its various business segments. These strategies are tailored to the specific needs of each division, including Asset Management, Wealth Management, and Corporate Trust. A key focus is on delivering strong investment performance, personalized financial advice, and robust service offerings to build and maintain client relationships.

For the Asset Management division, acquisition strategies highlight investment performance, with outperformance of 65% of strategies over three years and 74% over five years to December 31, 2024. In Wealth Management, which caters to high-net-worth individuals, the focus is on trust, personalized advice, and comprehensive services. The Corporate Trust segment attracts new clients through its market position and digital business initiatives.

Retention efforts involve ongoing client relationship management and adapting services to meet evolving client needs. The Simplification Program aims to reduce costs, potentially improving service delivery. The company's approach to customer data and CRM systems is implied by its focus on tailored experiences and segmentation. For more details, you can explore Owners & Shareholders of Perpetual.

Focuses on showcasing strong investment performance, particularly over longer time horizons. The outperformance of investment strategies is a key driver for attracting institutional and wholesale clients. This strategy is crucial for the company's customer acquisition efforts in a competitive market.

Relies on building trust, offering personalized financial advice, and providing comprehensive services. This includes fiduciary and philanthropic services tailored for high-net-worth individuals and families. Growth in Funds Under Advice (FUA) indicates the effectiveness of these strategies.

Driven by its strong market position and expanding digital business. The division focuses on attracting new clients in debt trustee, securitization, and managed fund services. Successful B2B acquisition is evident from new client additions.

Involves ongoing client relationship management, consistent communication, and adapting services. The Simplification Program, aiming for A$70 million to A$80 million in annualised cost reductions by FY27, supports retention through improved efficiency and service delivery.

The company segments its customer base to tailor services and marketing efforts effectively. This involves understanding the unique needs and preferences of different client groups, such as institutional investors, high-net-worth individuals, and corporate clients. This approach enhances customer satisfaction and loyalty.

Creating an ideal customer profile helps the company focus its acquisition and retention efforts. This involves identifying the characteristics, needs, and behaviors of the most valuable customers. Understanding the ideal customer allows for targeted marketing and service improvements.

Analyzing customer behavior helps the company understand purchasing patterns and preferences. This includes tracking customer interactions, transactions, and feedback. This data informs decisions about product development, service enhancements, and marketing strategies.

Understanding customer purchasing patterns is crucial for optimizing sales and marketing efforts. The company analyzes which products and services customers buy, how frequently, and through which channels. This analysis helps in tailoring offers and improving customer experience.

The company uses various segmentation strategies to group customers based on shared characteristics. This includes demographic, geographic, psychographic, and behavioral segmentation. Effective segmentation enables the company to deliver personalized experiences and targeted communications.

A detailed analysis of the customer base provides insights into customer demographics, needs, and preferences. This analysis supports strategic decision-making, including product development, marketing campaigns, and customer service improvements. It ensures that the company's offerings align with customer expectations.

Perpetual Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Perpetual Company?

- What is Competitive Landscape of Perpetual Company?

- What is Growth Strategy and Future Prospects of Perpetual Company?

- How Does Perpetual Company Work?

- What is Sales and Marketing Strategy of Perpetual Company?

- What is Brief History of Perpetual Company?

- Who Owns Perpetual Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.