Primerica Bundle

How did Primerica rise to become a financial services giant?

Primerica, a name synonymous with financial empowerment, has a compelling history that began with a revolutionary idea. Founded in 1977, the company set out to disrupt the insurance industry, focusing on the financial needs of middle-income families. This article delves into the Primerica SWOT Analysis, exploring its journey from a bold vision to its current status as a publicly traded financial powerhouse.

From its origins as A.L. Williams & Associates, Primerica's founder championed a 'Buy Term and Invest the Difference' philosophy, challenging established financial norms. The Primerica company's evolution reflects its commitment to providing accessible financial solutions. This exploration will uncover key milestones, innovations, and challenges that have shaped the Primerica financial services trajectory, offering insights into its enduring impact on the industry.

What is the Primerica Founding Story?

The story of Primerica, a prominent player in the financial services industry, begins on February 10, 1977. The company was founded by Arthur L. Williams Jr. in Duluth, Georgia. Williams, a former football coach, brought a unique perspective to the financial world, challenging established norms and aiming to empower individuals with better financial solutions.

Williams saw a significant problem in the life insurance industry. He believed that whole life insurance policies, common at the time, were often not the best fit for middle-income families due to their high costs. This insight led him to develop a new approach to financial services. His background in coaching proved valuable in building a sales force and spreading his financial philosophy.

The original business model of A.L. Williams & Associates focused on selling term life insurance and promoting the 'Buy Term and Invest the Difference' strategy. This approach encouraged clients to purchase affordable term life insurance and invest the savings they would have spent on more expensive whole life policies. This strategy directly challenged the industry's status quo. Initial funding for the company came from Williams' personal resources and the commitment of his early recruits. Williams's passion for empowering everyday people to achieve financial security fueled the company's rapid expansion. The late 1970s provided a favorable environment for his vision to succeed, as the middle class sought better financial solutions.

Primerica's foundation was built on a vision to provide accessible financial solutions. The company challenged industry norms by focusing on term life insurance.

- Founded: February 10, 1977, in Duluth, Georgia.

- Founder: Arthur L. Williams Jr., a former football coach.

- Initial Focus: Selling term life insurance and promoting the 'Buy Term and Invest the Difference' strategy.

- Funding: Primarily bootstrapped, relying on Williams' personal resources and early recruits.

- Impact: Challenged the status quo of the life insurance industry.

The company's early success was driven by its innovative approach to life insurance and its focus on empowering middle-income families. The 'Buy Term and Invest the Difference' strategy offered a cost-effective way for individuals to protect their families while also building wealth. This strategy was a key differentiator, setting the company apart from competitors. For a deeper dive into the company's business model, consider exploring the Revenue Streams & Business Model of Primerica.

Over time, Primerica expanded its product offerings to include investments, such as mutual funds, and other financial products. The company's growth was fueled by its expanding sales force and its ability to reach a broad customer base. The company's history is marked by its commitment to financial education and its focus on helping families achieve their financial goals. In the 2024, the company's net revenues reached approximately $768.5 million, demonstrating continued growth and market presence.

Primerica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Primerica?

The early growth of the Primerica company, then known as A.L. Williams & Associates, was marked by rapid expansion. This growth was fueled by its innovative business model and a highly motivated sales force. The company quickly gained traction by focusing on term life insurance, which was more affordable than traditional whole life policies. This approach helped the company establish a strong presence in the United States.

One of the primary drivers of Primerica's initial success was its rapid expansion across the United States. The company focused on recruiting and training a large sales force of independent representatives. By the early 1980s, Primerica had significantly increased the number of licensed representatives and the volume of life insurance policies sold, establishing a strong presence across the country. This expansion was crucial to its early success.

In 1982, Primerica made a pivotal move by acquiring the mutual fund sales force of Waddell & Reed. This strategic acquisition marked its entry into the investment services sector. This allowed Primerica to offer both insurance and investment products. This acquisition was a key step in shaping the company's future, allowing it to offer a broader range of financial services.

The company's first major capital raise came through an initial public offering (IPO) in 1983. This IPO provided the necessary funds for continued expansion and growth. The IPO was a significant milestone, providing Primerica with the capital needed to fuel its expansion plans. This move helped solidify its position in the financial services market.

The core philosophy of Primerica, centered on the 'Buy Term and Invest the Difference' approach, resonated with consumers seeking more transparent and cost-effective financial solutions. This model, combined with a focus on education and empowerment, helped Primerica attract a large customer base. This approach set Primerica apart from competitors and contributed significantly to its growth. For a deeper dive into their strategies, check out the Growth Strategy of Primerica.

Primerica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Primerica history?

The Primerica company has achieved several significant milestones throughout its history, marking its growth and evolution in the financial services industry. From its founding to its current status as a publicly traded company, Primerica has consistently adapted to market changes while staying true to its core mission of helping middle-income families.

| Year | Milestone |

|---|---|

| 1977 | Arthur L. Williams Jr. founded A.L. Williams & Associates, which later became Primerica. |

| 1980s | The company expanded its offerings to include mutual funds and other investment products. |

| 1989 | The company was acquired by the financial services giant, Citicorp. |

| 1990s | Primerica continued to grow, expanding its reach across North America. |

| 2010 | Primerica was spun off from Citigroup and became an independent, publicly traded company. |

| 2023 | Primerica reported a total revenue of approximately $2.9 billion. |

A key innovation for Primerica financial services was its 'Buy Term and Invest the Difference' concept, which revolutionized how many families approached life insurance and savings. This client-centric approach, combined with a strong emphasis on financial education, set the company apart from traditional financial institutions.

Focusing on the needs of middle-income families, Primerica provided accessible financial solutions. This approach helped build trust and long-term relationships with clients, fostering financial literacy.

Primerica emphasized financial education, empowering clients to make informed decisions about their financial futures. This focus on education distinguished Primerica's approach from competitors.

The company broadened its product portfolio to include mutual funds and investment products. This expansion allowed Primerica to offer a more comprehensive range of financial services.

Partnerships with leading investment companies enabled Primerica to provide diverse investment options to its clients. These collaborations enhanced the company's service offerings.

Primerica consistently invested in compliance and ethical conduct training for its sales force. This adaptation helped the company navigate evolving regulatory landscapes effectively.

The spin-off from Citigroup in 2010 allowed Primerica to operate as an independent public company. This strategic move enabled a focused approach on its core mission.

The Primerica business has faced challenges, including intense competition from established financial institutions and the complexities of evolving regulatory environments. Market downturns, such as the 2008 financial crisis, tested the resilience of both the company and its clients' investments.

Traditional financial institutions posed significant competition. Primerica needed to continuously innovate and adapt to maintain its market position.

Evolving regulatory landscapes required Primerica to invest in compliance and ethical conduct training. Staying compliant was crucial for its operations.

Market downturns, such as the 2008 financial crisis, tested the company's resilience and its clients' investment portfolios. These events highlighted the importance of diversification and risk management.

Product failures or underperforming investments in certain periods presented obstacles. Addressing these issues required strategic pivots and adjustments to product offerings.

The company refined its product offerings and enhanced training programs for representatives. This adaptation helped meet changing market demands and client needs.

The spin-off from Citigroup in 2010 was a significant strategic repositioning. This allowed Primerica to operate as an independent public company, focusing on its core mission.

For further insights into how Primerica targets its customer base, you can explore the Target Market of Primerica.

Primerica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Primerica?

The history of Primerica is marked by several key milestones, starting with its founding in 1977 as A.L. Williams & Associates. Over the years, the Primerica company has evolved through acquisitions, public offerings, and corporate restructuring, including a spin-off from Citigroup in 2010. The Primerica financial services company has also expanded its services and reached significant achievements, such as insuring over 5 million lives by 2015. The company continues to adapt to market changes, focusing on digital capabilities and expanding its product offerings, as highlighted in the article Owners & Shareholders of Primerica.

| Year | Key Event |

|---|---|

| 1977 | Founded as A.L. Williams & Associates. |

| 1982 | Acquired Waddell & Reed's mutual fund sales force, entering the investment services market. |

| 1983 | Initial Public Offering (IPO). |

| 1989 | Acquired by Commercial Credit, which later became Travelers Group. |

| 1993 | A.L. Williams & Associates renamed Primerica Financial Services. |

| 1998 | Travelers Group merged with Citicorp to form Citigroup, making Primerica part of one of the world's largest financial services companies. |

| 2010 | Primerica spun off from Citigroup, becoming an independent public company (NYSE: PRI). |

| 2015 | Reached a significant milestone of serving over 5 million lives insured through its term life insurance policies. |

| 2020 | Continued to expand its digital capabilities to support its sales force and client engagement. |

| 2023-2024 | Reported strong financial results, with continued growth in client accounts and representative force, demonstrating resilience in varying economic conditions. |

Primerica is focused on expanding its core markets and enhancing its agent productivity. They plan to leverage technology to improve both agent and client experiences. The company is also working on expanding its product offerings to meet evolving client needs, ensuring long-term relevance and success.

Primerica aims to increase its presence in the middle-income market, emphasizing financial education. They will offer personalized financial strategies to better serve this segment. This approach supports their founding vision of helping families achieve financial security.

The increasing demand for financial planning services and the shift towards digital engagement are impacting Primerica’s direction. Analysts predict steady growth for the company, due to its established distribution model. The company is well-positioned to benefit from these industry trends.

In 2023 and 2024, Primerica reported strong financial results. This included continued growth in client accounts and its representative force. This demonstrates the company's resilience and ability to perform well in different economic conditions.

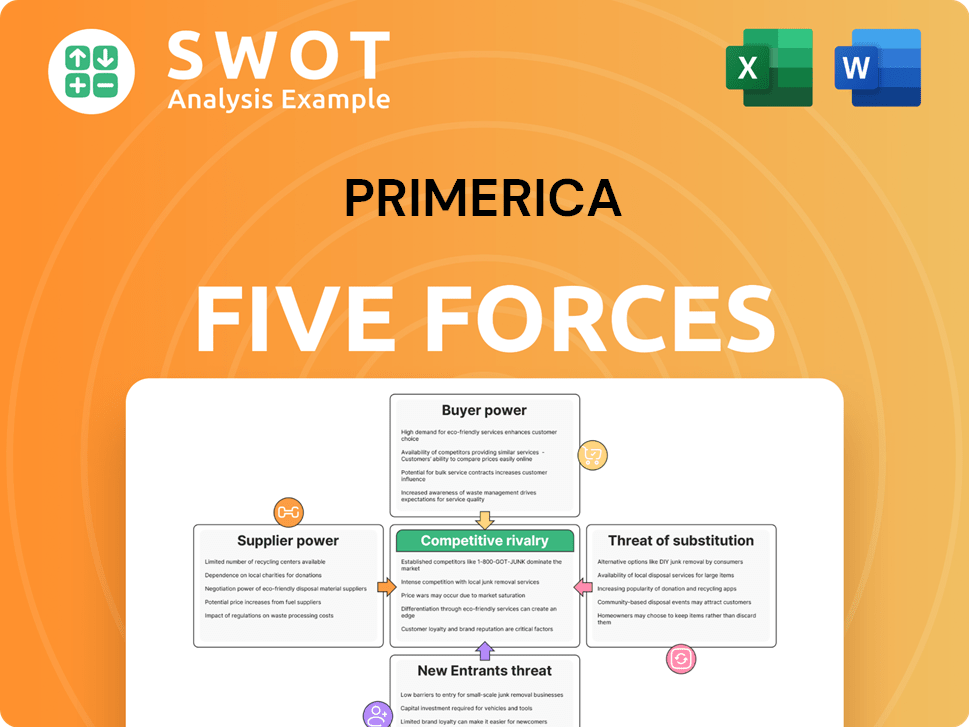

Primerica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Primerica Company?

- What is Growth Strategy and Future Prospects of Primerica Company?

- How Does Primerica Company Work?

- What is Sales and Marketing Strategy of Primerica Company?

- What is Brief History of Primerica Company?

- Who Owns Primerica Company?

- What is Customer Demographics and Target Market of Primerica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.