Primerica Bundle

How Does Primerica Stack Up Against Its Rivals?

Primerica, a financial services powerhouse, has carved a niche by focusing on middle-income families, achieving remarkable growth in a competitive market. Its recent financial successes, including a 9% revenue increase in Q1 2025, highlight its resilience. But how does Primerica truly fare against its competitors? This analysis dives deep into the Primerica SWOT Analysis to uncover its competitive advantages.

Understanding the Primerica competitive landscape is crucial for investors and strategists alike. We'll explore Primerica competitors and conduct a thorough Primerica market analysis to assess its position in the Primerica financial services sector. This includes evaluating its unique Primerica business model and conducting a comprehensive Primerica industry analysis to provide actionable insights for informed decision-making, answering questions like: Who are Primerica's main competitors in the insurance industry; How does Primerica's business model compare to its rivals; What are the challenges faced by Primerica in the current market?

Where Does Primerica’ Stand in the Current Market?

The company focuses on serving middle-income households across North America, a market segment that is often underserved by larger financial institutions. This strategic focus allows it to tailor its products and services to meet the specific financial needs of this demographic. As of the first quarter of 2025, the company's market share, based on total revenue, was 3.38%, reflecting its presence in the broader financial services industry.

The company's core offerings include term life insurance, which it underwrites, and investment and savings products (ISP) such as mutual funds, annuities, and managed accounts, which it distributes primarily on behalf of third parties. Additionally, the company offers mortgage brokerage services, including home purchase loans, refinancing, and home equity solutions. This diverse range of products supports its mission to help families become financially secure.

The company's business model relies heavily on its extensive sales force, totaling 152,167 representatives as of March 31, 2025. This large network enables the company to reach a wide audience through a direct selling approach. This model, combined with its product offerings, helps it maintain a distinct position in the financial services market. For more insights, you can explore a detailed analysis of the company's financial performance and competitive positioning through a comprehensive primer on the company's competitive landscape.

The company's market share was 3.38% as of Q1 2025. Total revenues for the trailing 12 months ending March 31, 2025, were $3.17 billion. In Q1 2025, total revenues were $804.8 million, a 9% increase year-over-year.

ISP segment product sales reached $3.6 billion in Q1 2025, a 28% increase. Average client asset values for ISP were up 14% year-over-year, reaching $113 billion. Term Life segment revenues were $457.8 million in Q1 2025, up 4%.

The sales force totaled 152,167 representatives as of March 31, 2025, a 7% increase year-over-year. The company's return on stockholders' equity (ROE) improved to 30.0% in Q1 2025, up from 27.9%.

The company has expanded its mortgage licensing to 33 states in the U.S. This expansion supports its strategy to provide comprehensive financial solutions.

The company's competitive advantages include its focus on the middle-income market, its extensive sales force, and its diverse product offerings. This targeted approach allows the company to build strong relationships with its clients and provide tailored financial solutions.

- Targeted Market: Focus on middle-income families.

- Distribution Network: Large, life-licensed sales force.

- Product Diversification: Offers term life insurance, ISP, and mortgage services.

- Financial Performance: Strong revenue growth and improved ROE.

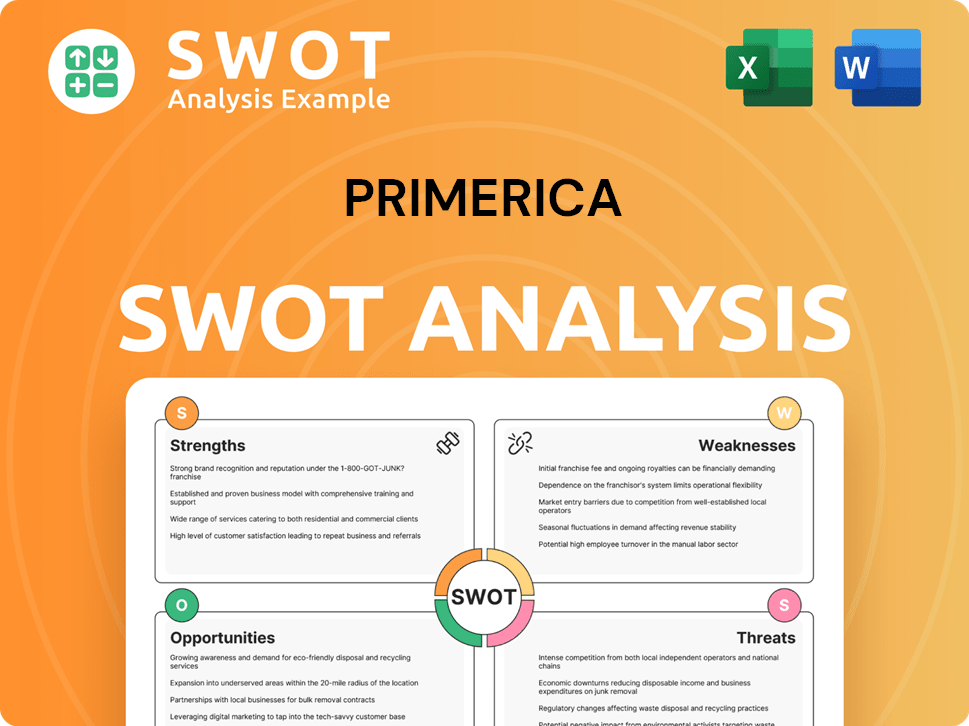

Primerica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Primerica?

The Primerica competitive landscape is shaped by its focus on life insurance and investment products, positioning it within the broader financial services industry. Understanding its competitors is crucial for a comprehensive Primerica market analysis. The company faces both direct and indirect competition, affecting its market share and strategic choices.

Primerica's business model is challenged by a variety of firms, from large, diversified financial institutions to specialized insurance providers and asset management companies. The competitive dynamics are influenced by factors such as brand recognition, product offerings, pricing strategies, and distribution channels. Analyzing these elements provides insights into Primerica's strengths and weaknesses relative to its rivals.

In the financial services sector, Primerica's primary competitors include diversified financial institutions. These entities often have established brand recognition and extensive resources. They compete by offering a wide array of products, potentially attracting a broader customer base.

Within the insurance market, Primerica competes with major players that offer similar products. These competitors often have significant market presence and resources.

Direct competitors include companies that offer similar life insurance and investment products. These firms target the same customer base as Primerica.

Indirect competitors include a broader range of financial service providers. These companies may offer alternative investment or insurance solutions, impacting Primerica's market share.

Market share data provides insights into the competitive positioning of Primerica. Comparing its market share to competitors reveals its relative strength and areas for improvement.

Primerica's competitive advantages include its distribution network and focus on middle-income families. These strengths help it differentiate itself from rivals.

Primerica faces challenges such as competition from larger, more established firms and the rise of digital financial platforms. These factors influence its strategic decisions.

A detailed analysis of Primerica's competitors reveals their strengths, weaknesses, and strategies. This analysis helps in understanding the competitive landscape and formulating effective strategies.

- Unum Group: A major competitor in the finance sector, Unum Group had more media mentions and a more favorable media sentiment score compared to Primerica in a recent week.

- Arthur J. Gallagher and Co.: Holds a significant market share in insurance brokers and asset management, with 31.19% as of Q1 2025.

- Aon Plc: Another major player in the insurance brokerage and asset management sector, with 19.91% market share as of Q1 2025.

- Primerica: Holds a market share of 3.38% in the insurance broker and asset management sector as of Q1 2025.

- MetLife and Prudential Financial: Larger insurers with greater brand recognition and broader product portfolios.

- Digital-First Financial Platforms: These platforms and robo-advisors offer low-cost investment solutions, impacting the middle-income market.

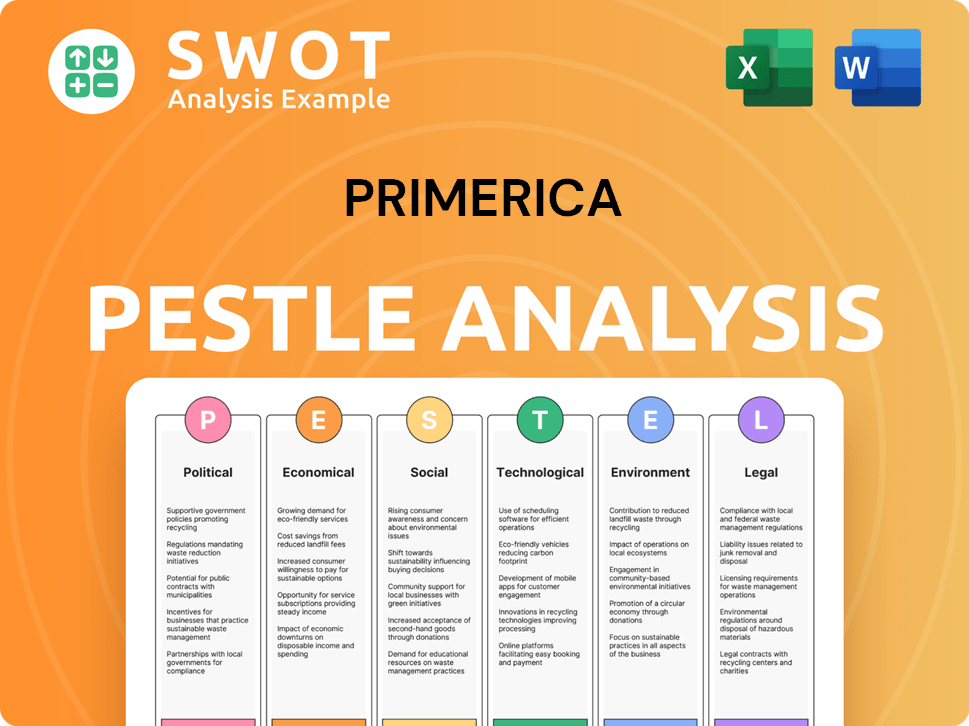

Primerica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Primerica a Competitive Edge Over Its Rivals?

Analyzing the Growth Strategy of Primerica reveals a competitive landscape shaped by its unique strengths. The company's approach to the financial services market is distinguished by its direct selling model and focus on financial education. This strategy has fostered a dedicated sales force and a loyal customer base, setting it apart from traditional financial institutions.

A key element of Primerica's competitive edge lies in its extensive network of independent licensed representatives. This network allows for personalized interactions, particularly benefiting middle-income families who may find traditional financial services less accessible. By offering a range of products and services, including term life insurance and investment products, Primerica addresses a significant market need.

The company’s focus on financial education and needs-based selling further strengthens its market position. Representatives conduct Financial Needs Analyses (FNAs) to help clients understand their financial situations, offering tailored solutions. This educational approach, combined with low-cost financial products, resonates strongly with its target market, contributing to customer loyalty and a competitive advantage.

Primerica's direct selling approach, leveraging a vast network of independent representatives, is a core competitive advantage. As of March 31, 2025, the company had 152,167 life-licensed representatives, marking a 7% year-over-year increase. This extensive network enables personalized engagement with clients, fostering customer loyalty.

Primerica differentiates itself through its emphasis on financial education and needs-based selling. Representatives conduct Financial Needs Analyses (FNAs) to help clients understand their financial situations and offer tailored solutions. This educational approach, combined with low-cost financial products, resonates strongly with its target market.

The stability of its large block of in-force term life insurance policies provides a consistent revenue stream, contributing to its financial resilience. As of late 2024, Primerica insured over 5.5 million lives. This provides a strong foundation for financial stability and growth.

The strong performance of its Investment and Savings Products (ISP) segment is another key advantage. Sales reached $3.6 billion in Q1 2025, with client asset values of $109.9 billion, demonstrating its ability to diversify revenue and capitalize on market opportunities. This growth highlights Primerica’s expanding presence in the financial services sector.

Primerica's competitive advantages are multifaceted, stemming from its unique business model and strategic focus. These advantages include a vast network of licensed representatives, a commitment to financial education, and a diversified product portfolio. The company's ability to adapt to market changes and maintain a strong financial position further enhances its competitive standing within the financial services industry.

- Direct Selling Model: Leverages a large network of independent representatives for personalized client engagement.

- Financial Education: Emphasizes financial literacy and needs-based selling to build trust and loyalty.

- Product Diversification: Offers a range of products, including term life insurance and investment options.

- Consistent Revenue: Benefits from a stable revenue stream from in-force term life insurance policies.

- Strong Financial Performance: Demonstrated by growth in ISP sales and client assets.

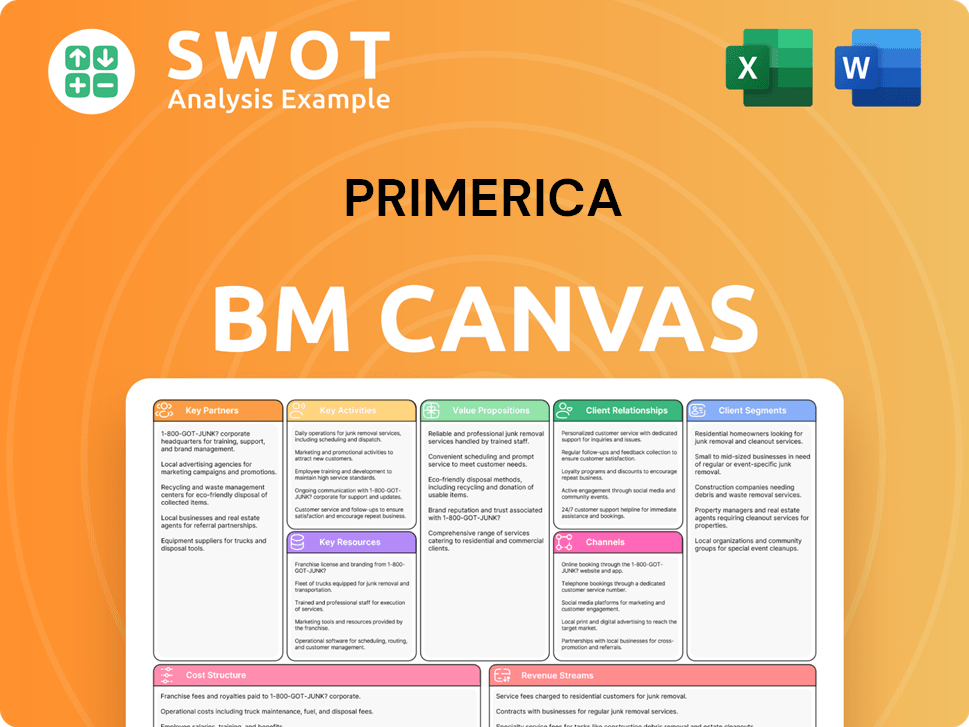

Primerica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Primerica’s Competitive Landscape?

The financial services industry is currently experiencing significant shifts driven by technological advancements, evolving regulations, and changing consumer preferences. For a company like Primerica, these trends present both challenges and opportunities. The increasing demand for digital solutions and automated advisory services impacts its traditional, in-person sales model. However, Primerica's diversified business model and focus on financial education position it to capitalize on the enduring needs of middle-income households.

Economic uncertainties, such as cost of living pressures and market volatility, directly affect Primerica's target demographic and could influence recruiting and sales. Regulatory changes, especially regarding higher standards of conduct and licensing for independent sales representatives, also pose potential challenges. Despite these hurdles, Primerica's focus on expanding its wealth management offerings and its robust capital position provide a foundation for growth and stability within the dynamic financial services landscape.

Technological advancements and the demand for digital solutions are reshaping the financial services sector. Regulatory changes, including heightened standards for financial professionals, are also impacting the industry. Economic uncertainties, such as cost of living pressures, influence consumer behavior and market dynamics.

Maintaining a competitive edge against digital platforms is a key challenge. Regulatory changes and licensing requirements could impact Primerica's business model. Economic uncertainties and market volatility may affect recruiting efforts and sales, as seen in the slight dip in life insurance productivity in Q1 2025.

The continued need for financial education and personalized advice among middle-income families remains strong. Primerica's diversified business model, balancing Term Life and Investment and Savings Products (ISP), provides resilience. Strong demand for ISP products, particularly mutual funds, annuities, and managed accounts, presents a significant growth opportunity.

Primerica anticipates mid to high single-digit growth in ISP sales and around 5% growth in adjusted direct premiums for its Term Life segment in 2025. The company plans to continue its $450 million stock repurchase program throughout 2025. Primerica aims to leverage its entrepreneurial sales force and diversify its product offerings to ensure continued resilience.

The competitive landscape for Primerica involves navigating industry trends, addressing future challenges, and capitalizing on opportunities. The company's ability to adapt to technological advancements, comply with regulatory changes, and meet the evolving needs of its target market will be crucial for its long-term success. For a deeper dive, explore the Growth Strategy of Primerica.

Primerica's competitive position relies on its ability to adapt to industry changes and maintain a strong financial footing. The company's focus on financial education and personalized advice, combined with its diversified product offerings, are key strengths. The company's financial performance, including its anticipated growth in ISP sales and its commitment to stock repurchases, indicates confidence in its future.

- Technological advancements and digital solutions.

- Regulatory changes and licensing requirements.

- Economic uncertainties and market volatility.

- Demand for financial education and personalized advice.

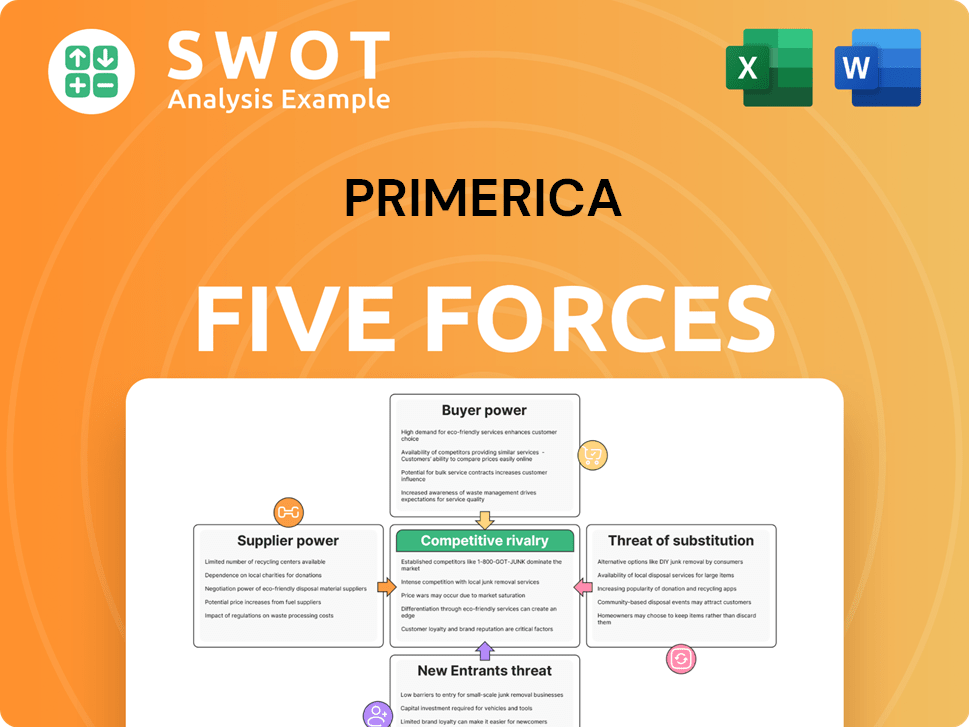

Primerica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Primerica Company?

- What is Growth Strategy and Future Prospects of Primerica Company?

- How Does Primerica Company Work?

- What is Sales and Marketing Strategy of Primerica Company?

- What is Brief History of Primerica Company?

- Who Owns Primerica Company?

- What is Customer Demographics and Target Market of Primerica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.