Primerica Bundle

How Does Primerica Thrive in the Financial Services Arena?

Founded in 1977, Primerica has carved a unique niche in the financial services industry. Their success stems from a distinctive direct sales model, empowering individuals to offer financial products to middle-income families. But what exactly fuels their Primerica SWOT Analysis and keeps them ahead?

This article explores the intricacies of Primerica's Primerica sales strategy and Primerica marketing strategy. We'll examine their Primerica business model, focusing on how they distribute their Primerica products and services, and how they strategically position their brand. Discover how Primerica's approach, including their Primerica financial services and Primerica compensation plan, has driven their impressive growth, making them a notable player in the competitive financial landscape. Learn about Primerica's sales training program and Primerica lead generation techniques.

How Does Primerica Reach Its Customers?

The core of the Primerica sales strategy revolves around its extensive network of independent representatives. This direct sales approach is the primary channel for distributing their financial products and services across the United States and Canada. The company's business model heavily relies on these representatives to reach and serve middle-income families.

As of March 31, 2025, the company had a life-licensed sales force of 152,167 representatives. This represents a 7% increase compared to March 31, 2024, highlighting the continued growth and appeal of their entrepreneurial opportunity. The direct sales model allows Primerica to build personal connections and provide tailored financial solutions.

Primerica's marketing strategy has evolved to incorporate digital platforms. These platforms support representatives and enhance the client experience. The company's digital platform generated approximately $47.3 million in annual digital sales revenue. Primerica also engages in strategic partnerships to expand its product offerings and market reach.

Primerica's sales strategy is heavily reliant on its network of independent representatives. These representatives operate on a direct sales model, focusing on personal connections to serve clients. This approach is central to their distribution strategy, especially in the United States and Canada.

Primerica is increasingly leveraging digital platforms to support its representatives. These platforms enhance agent productivity and improve the client experience. The company's digital platform generates significant annual digital sales revenue.

Primerica engages in key partnerships to expand its product offerings and market reach. A notable partnership in 2024 was with Canada Life, providing advisors access to segregated funds. Primerica Mortgage, LLC partners with Rocket Mortgage for mortgage brokerage services.

In 2024, Primerica recruited over 446,000 new representatives, with over 56,000 becoming newly life-licensed. The company's sales force continues to grow, reflecting the attractiveness of their entrepreneurial model and the effectiveness of their sales training program. The growth in sales representatives highlights the success of Primerica's Primerica's business model.

Primerica's sales strategy focuses on direct sales through a large network of independent representatives. This approach allows for personal interactions and tailored financial advice. The company also uses digital platforms and strategic partnerships to enhance its reach and improve agent productivity.

- Direct Sales Force: The primary sales channel, with over 152,167 life-licensed representatives as of March 31, 2025.

- Digital Platforms: Used to support representatives and enhance client experience, generating significant revenue.

- Strategic Partnerships: Collaborations to expand product offerings and market reach, such as the agreement with Canada Life.

- Mortgage Services: Partnering with Rocket Mortgage, closing nearly $400 million in US mortgage volume in 2024.

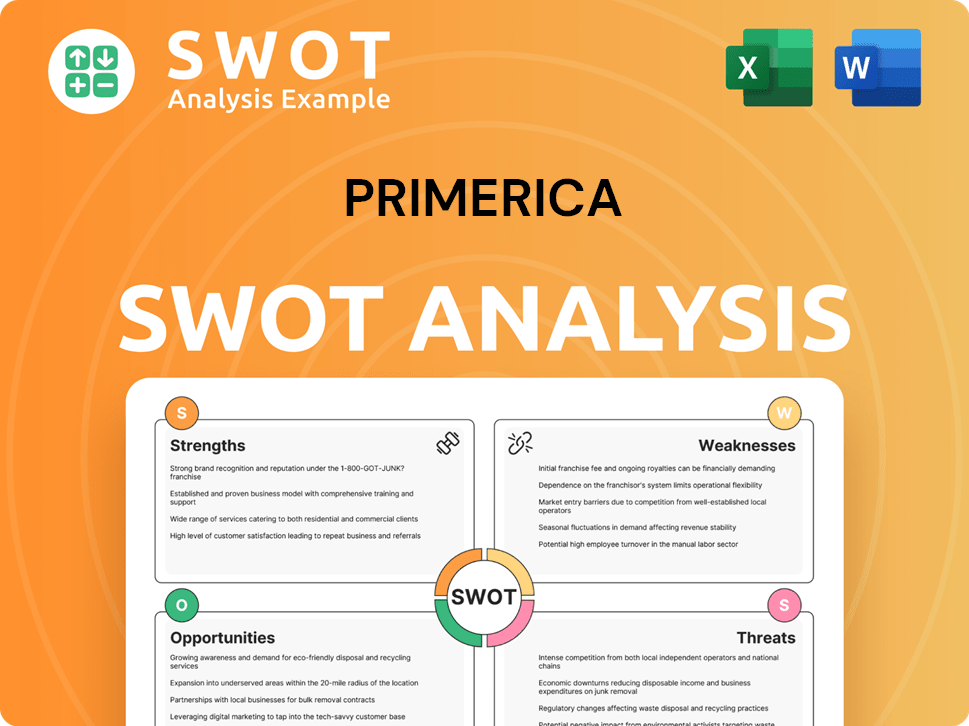

Primerica SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Primerica Use?

The marketing tactics of Primerica are primarily centered on its extensive network of independent representatives, who serve as the main channel for direct engagement with potential clients. This direct sales model is complemented by digital and traditional media strategies designed to enhance brand awareness and generate leads. The company focuses on empowering its sales force with the necessary tools and resources to effectively reach and serve its target demographic.

Primerica's approach emphasizes a needs-based financial planning model, tailored to middle-income families. This strategy is supported by ongoing investments in technology to improve agent productivity and the overall client experience. While specific details on digital marketing campaigns are not extensively publicized, the company's digital platform plays a crucial role in supporting its sales and recruitment efforts.

Traditional marketing, such as large-scale events, also plays a role in Primerica's strategy. These events provide a platform for rallying the sales force and casting a vision for the future. The company's marketing mix has evolved to incorporate digital tools, aiming for a more efficient and effective reach to its target demographic.

Primerica's core marketing tactic revolves around its direct sales model, utilizing a vast network of independent representatives. As of March 31, 2025, the company had over 152,167 life-licensed representatives. This extensive sales force is key to educating and acquiring clients, particularly middle-income families across North America. This approach is a critical element of the Growth Strategy of Primerica.

Primerica has been increasing its investments in technology to enhance agent productivity and client experience. The company's digital platform supports annual digital sales revenue, and the focus is on equipping representatives with digital tools to facilitate sales and recruitment. The specific details on content marketing, SEO, paid advertising, and email marketing campaigns are not extensively publicized.

Large-scale events, such as the biennial convention, play a significant role in Primerica's marketing strategy. The convention held in July 2024, saw nearly 40,000 attendees, serving as a platform for casting a vision for the future and rallying its sales force. These events help build momentum and reinforce the company's message.

Primerica implicitly ties its marketing to its direct sales model, where representatives assess the needs of middle-income households. The target demographic typically has annual incomes between $50,000 and $100,000. This needs-based financial planning approach allows for personalization in product recommendations, primarily term life insurance and investment products.

The company focuses on a specific customer segment: middle-income families. This customer segmentation allows Primerica to tailor its products and services, such as term life insurance and investment products, to meet the financial needs of this demographic. This targeted approach is a key part of the Primerica marketing strategy.

Primerica is increasing its spending on technology to enhance automation and overall agent productivity. This suggests a move towards more data-informed strategies, although specific technology platforms or analytics tools are not widely disclosed. These investments aim to improve the efficiency and effectiveness of its sales force.

Primerica's marketing strategy is designed to reach its target demographic through a combination of direct sales, digital tools, and traditional methods. The company's focus on empowering its sales force and leveraging technology is crucial for its growth. Here are some key elements:

- Direct Sales Force: The primary channel for customer acquisition and education.

- Digital Tools: Used to support representatives and enhance the client experience.

- Traditional Media: Large-scale events to build momentum and rally the sales force.

- Targeted Approach: Focus on middle-income families and their financial needs.

- Technology Investments: Aimed at improving agent productivity and data-driven strategies.

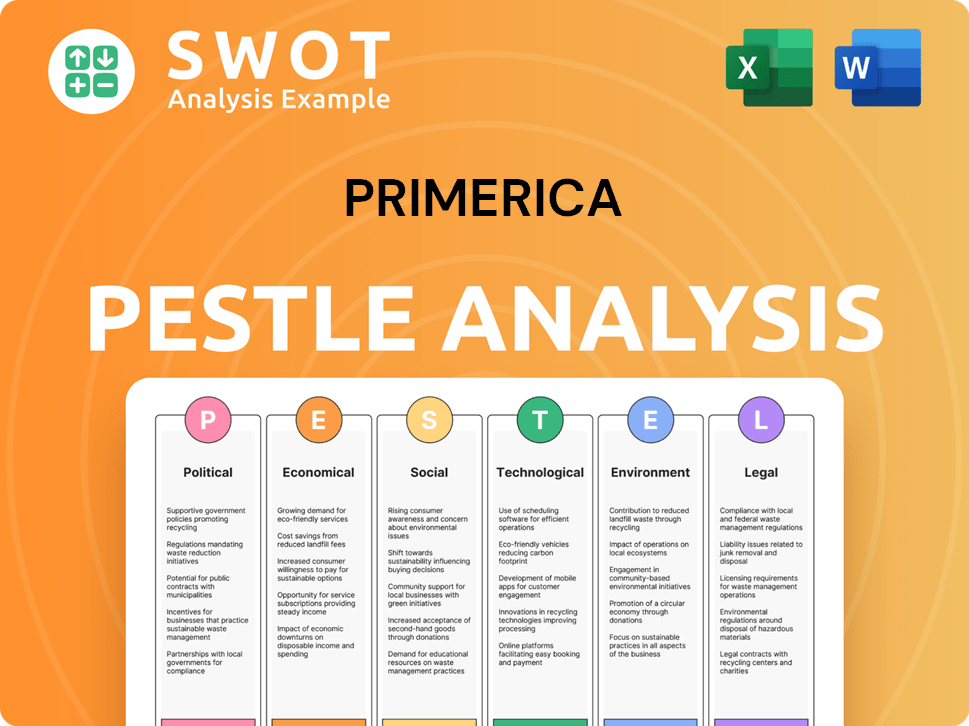

Primerica PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Primerica Positioned in the Market?

The company strategically positions itself as a financial services provider, primarily catering to middle-income families in North America. This positioning centers on empowering individuals to achieve financial security through education and personalized financial planning. The core message emphasizes the importance of financial literacy and providing accessible solutions for its target demographic.

A key differentiator in the company's brand positioning is its 'Buy Term and Invest the Difference' philosophy. This approach advocates for affordable term life insurance to free up funds for investments. This strategy aims to provide the highest amount of coverage at the lowest cost, aligning with the financial needs of its target audience. This approach is a cornerstone of their Primerica sales strategy.

The company's brand identity is built on trust and accessibility, appealing to its target audience by offering financial education in straightforward language. The company emphasizes helping families reduce debt, invest for the future, and plan for the unexpected. Its visual identity and tone of voice are designed to convey reliability and support, reinforcing its commitment to guiding clients towards a more secure financial future. This is a key component of their Primerica marketing strategy.

The company's focus is on middle-income families, providing financial solutions tailored to their needs. This targeted approach allows for more effective Primerica customer acquisition strategies. They aim to provide accessible financial products.

This core principle differentiates the company by promoting affordable term life insurance. This allows clients to free up funds for investments, which is a key element of their Primerica products strategy. This approach is designed to maximize financial coverage while minimizing costs.

The company places a strong emphasis on financial education, providing clients with straightforward and accessible information. This helps clients understand financial concepts and make informed decisions. This educational approach supports their Primerica financial services.

The company offers personalized service through its network of independent licensed representatives. These representatives meet with clients face-to-face and use technology to provide real-time assistance. This personalized approach is a key part of their Primerica business model.

The company's brand perception is reflected in its market position, being the #3 issuer of Term Life insurance coverage in the United States and Canada in 2024. The company's stock is included in the S&P MidCap 400 and the Russell 1000 stock indices, solidifying its standing in the financial industry. The company's resilience is attributed to its balanced business model and the personalized support provided by its independent sales force, especially during economic uncertainties. To learn more about the company's financial structure, read the Revenue Streams & Business Model of Primerica article.

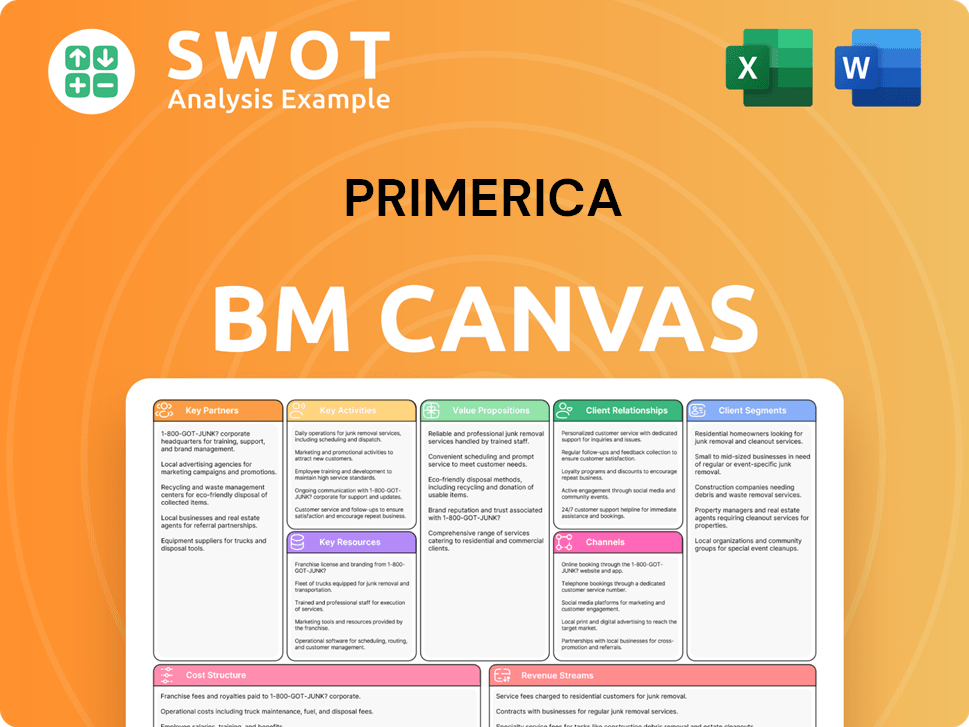

Primerica Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Primerica’s Most Notable Campaigns?

The sales and marketing strategy of Primerica revolves around its direct sales model, heavily reliant on its independent sales force. The company's 'campaigns' are ongoing initiatives focused on recruiting, licensing, and driving product sales through its representatives. A core focus is the continuous expansion of its sales force and enhancing their productivity, directly impacting the company's market reach and financial product distribution.

A key aspect of Primerica's marketing strategy involves consistent efforts to boost product sales and client asset growth. This is achieved by providing financial solutions to middle-income families, utilizing the existing network of independent representatives. The company also invests in internal marketing and motivational events, such as its biennial conventions, to reinforce its mission and boost sales and recruitment efforts.

The company's direct sales approach, which is a crucial part of the Owners & Shareholders of Primerica, is characterized by its emphasis on the independent sales force to drive sales and market penetration. This strategy is supported by ongoing recruitment and training programs, aimed at equipping representatives with the necessary skills and knowledge to succeed. Primerica consistently monitors and adapts its sales and marketing strategies to meet the evolving needs of its target market and maintain its competitive edge.

In 2024, the company grew its licensed sales force by 7%, reaching over 151,600 life-licensed representatives. This expansion is a direct result of recruitment-focused campaigns.

The recruitment efforts in 2024 attracted over 446,000 new recruits. This resulted in over 56,000 newly life-licensed representatives joining the sales force.

In Q1 2025, record ISP sales reached $3.6 billion, a 28% increase year-over-year. This growth was driven by strong investor demand for mutual funds, annuities, and managed accounts.

Term Life net premiums grew 4%, and adjusted direct premiums increased 5% in the first quarter of 2025. The company issued 86,415 new life insurance policies in Q1 2025, providing $28 billion in new term life protection.

These events serve as internal marketing and motivational campaigns, attended by nearly 40,000 people. The conventions aim to cast a vision for the future, celebrate achievements, and reinforce the company's mission.

- They indirectly boost sales and recruitment.

- The conventions are a key part of the company's internal marketing strategy.

- These events help in the Primerica marketing strategy and are a crucial part of the Primerica business model.

- They help drive the company's Primerica sales strategy.

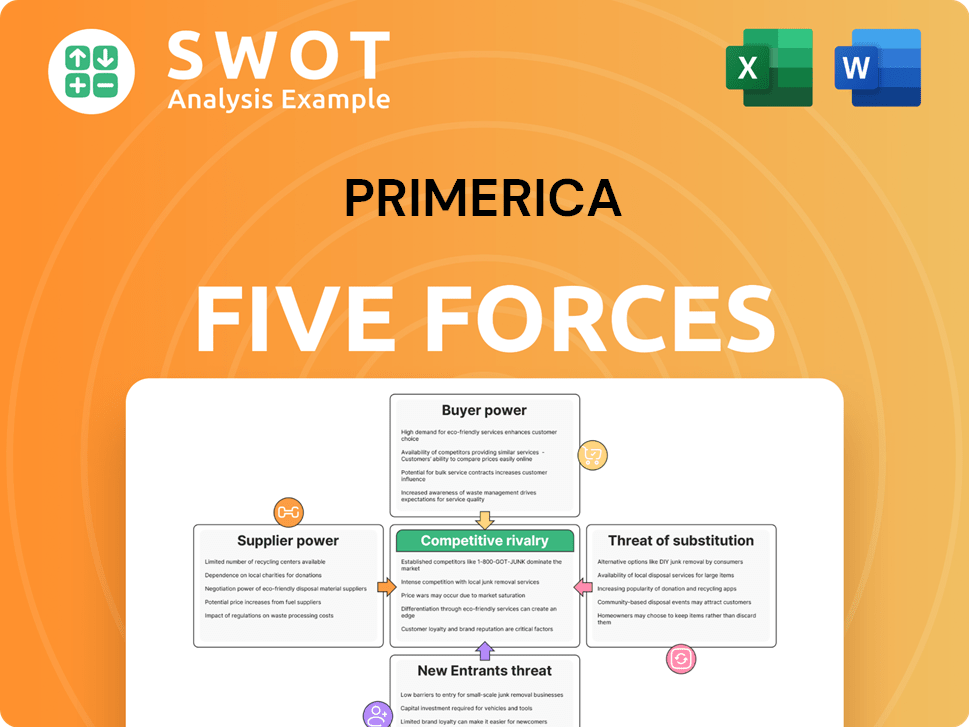

Primerica Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Primerica Company?

- What is Competitive Landscape of Primerica Company?

- What is Growth Strategy and Future Prospects of Primerica Company?

- How Does Primerica Company Work?

- What is Brief History of Primerica Company?

- Who Owns Primerica Company?

- What is Customer Demographics and Target Market of Primerica Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.