RCS Bundle

How has the RCS Company Shaped the Media Landscape?

Journey back in time to explore the captivating RCS SWOT Analysis and the remarkable evolution of RCS MediaGroup S.p.A., an Italian media giant. From its humble beginnings in 1927, founded by Angelo Rizzoli, the company has transformed into a leading international multimedia publishing group. Discover how RCS company navigated the complexities of the press industry and expanded its reach through iconic brands.

Delving into the RCS history reveals a fascinating narrative of strategic acquisitions, digital adaptation, and enduring influence. With a market capitalization of $587 million as of May 30, 2025, and a robust digital subscriber base, RCS continues to demonstrate its resilience and forward-thinking approach. This exploration provides valuable insights into the RCS company's milestones, its impact on communication, and its vision for the future of RCS messaging, making it a compelling case study for investors and strategists alike. The evolution of RCS technology and the adoption over time are key elements.

What is the RCS Founding Story?

The story of the RCS company, now known as RCS MediaGroup S.p.A., began in 1927. It was founded by Angelo Rizzoli in Milan, Italy, initially under the name 'A. Rizzoli & C.'. The company's early focus was on the press industry.

Rizzoli's vision started with the acquisition of four national magazines. This marked the beginning of a diversified publishing empire. The company's primary business model was centered around print media.

The establishment of the publishing house in the 1920s was influenced by the social and economic changes following World War I in Italy. Angelo Rizzoli's experience in the printing sector provided the necessary skills and resources. He saw an opportunity in the increasing demand for printed news and entertainment. If you're interested in learning more about the company's financial aspects, you can explore Revenue Streams & Business Model of RCS.

RCS MediaGroup S.p.A. was founded in 1927 by Angelo Rizzoli in Milan, Italy.

- The initial focus was on the press industry.

- The company acquired four national magazines to start.

- The business model was centered around print media.

- The founding occurred during a period of significant social and industrial transformation in Italy.

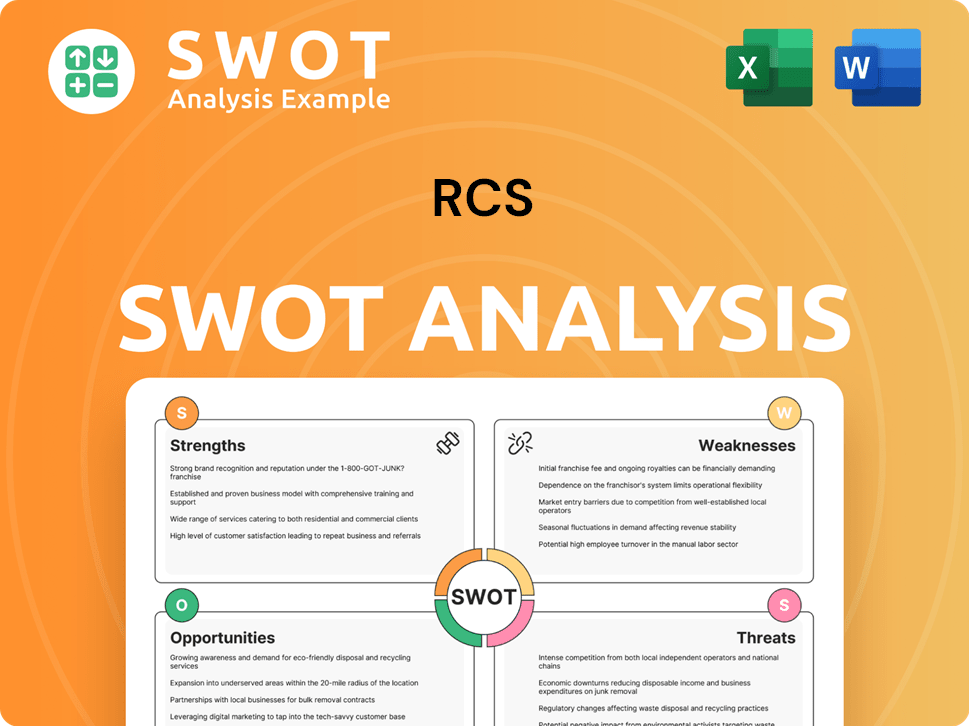

RCS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of RCS?

The early growth and expansion of the RCS company, formerly known as A. Rizzoli & C., began in 1927. The company, which later became known as 'Rizzoli Editore' in 1952, broadened its scope significantly. Key acquisitions and strategic shifts marked its evolution, particularly within the Italian and Spanish media markets. This period saw the company establish itself as a major player in the media industry.

In 1974, the acquisition of 'Editoriale Corriere della Sera S.a.s.' and its newspaper Il Corriere della Sera was a pivotal move. This was followed by the management takeover of La Gazzetta dello Sport in 1976, strengthening its position in the Italian newspaper market. In 1990, the company expanded internationally by acquiring a holding in the Spanish company Unidad Editorial S.A.

Gemina acquired a controlling stake in Rizzoli in 1984, influencing the company's strategic direction. The separation of 'Rizzoli-Corriere della Sera' from Gemina's other industrial activities occurred in 1997. The company officially adopted its current name, 'RCS MediaGroup', in 2003, reflecting its evolving identity and scope.

By the first nine months of 2024, RCS MediaGroup's consolidated revenue reached €602.3 million. Digital revenue contributed approximately 25% of the total, amounting to €150.4 million, showing a successful shift towards digital growth. As of March 31, 2025, the company's net financial position was positive at €20.1 million, an improvement of €12.3 million compared to December 31, 2024.

The acquisitions and strategic moves solidified the company's dominance in both Italian and Spanish media markets. The focus on digital revenue indicates a forward-looking strategy to adapt to changing media consumption habits. The positive net financial position as of early 2025 suggests a stable financial foundation for future growth.

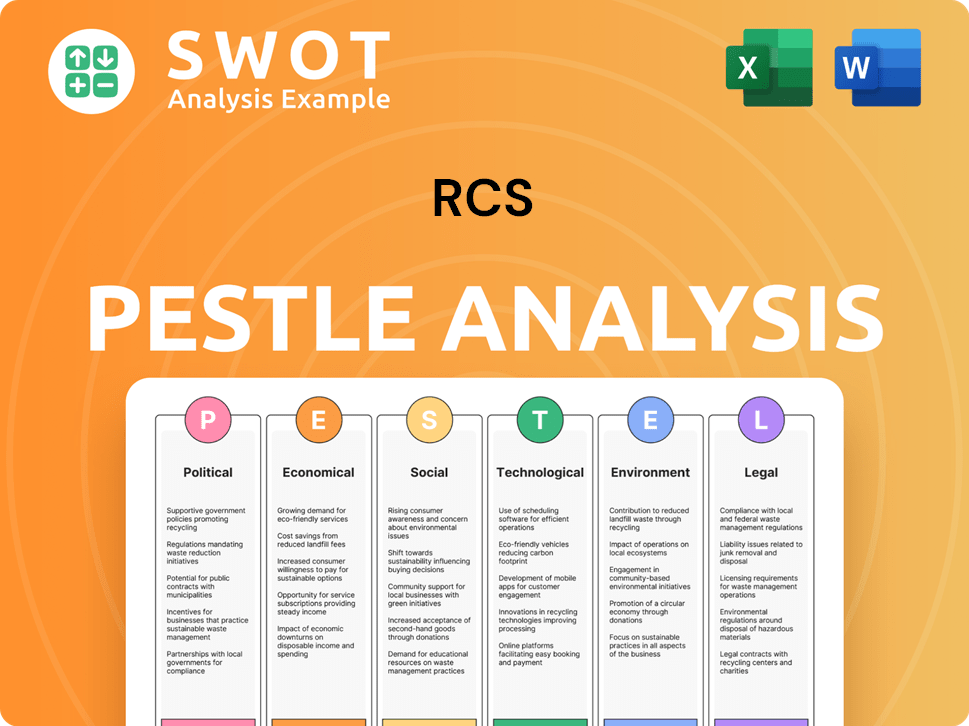

RCS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in RCS history?

RCS MediaGroup's journey is marked by significant milestones, from strategic acquisitions to digital transformations. The company's evolution reflects its ability to adapt and innovate within the dynamic media landscape, shaping its position in the industry. The Target Market of RCS has been crucial for its growth.

| Year | Milestone |

|---|---|

| 1974 | Acquisition of Il Corriere della Sera, solidifying its presence in Italian daily newspapers. |

| 1976 | Acquisition of La Gazzetta dello Sport, further strengthening its position in the Italian media market. |

| 1990 | Expansion into Spain with Unidad Editorial S.A., marking a significant international milestone. |

| 2016 | Cairo Communication, led by Urbano Cairo, completes a hostile takeover, becoming the main shareholder. |

| 2024 | Achieved an active digital customer base exceeding 1.1 million subscriptions by September. |

| 2025 | Digital revenue accounts for approximately 27.8% of total revenue in the first three months, reaching €47.1 million. |

RCS MediaGroup has shown innovation by becoming the leading online publisher in Italy. The company has successfully transformed its business model to embrace digital platforms.

RCS MediaGroup has significantly invested in digital platforms to expand its reach and revenue streams. This includes developing digital subscriptions and online advertising models.

The company has adapted its content strategy to cater to digital audiences, offering a mix of news, sports, and lifestyle content. This includes the use of RCS messaging to engage with its audience.

RCS MediaGroup has leveraged technological advancements to enhance user experience and content delivery. This includes the use of RCS technology to improve user engagement.

The company has formed strategic partnerships to expand its digital footprint and enhance its offerings. These partnerships help to increase the adoption of RCS features.

RCS MediaGroup uses data analytics to understand audience behavior and tailor its content. This data-driven approach helps to optimize content and increase engagement.

The company has successfully implemented subscription models to generate recurring revenue from its digital content. This shift has been crucial for its financial stability.

RCS MediaGroup has faced challenges, including market shifts and financial difficulties. The decline in print media circulation and advertising revenue has required strategic adjustments.

The print media segment has experienced a decline in circulation figures. This includes a decrease of 5.3% for print overall and 5.9% for newspapers in early 2025.

The evolving advertising market poses challenges for traditional media companies. This requires RCS to adapt its advertising strategies.

The company has undergone financial restructuring to address economic pressures. This includes cost-cutting measures and strategic investments.

RCS MediaGroup faces intense competition from digital media platforms. This requires continuous innovation and adaptation to stay relevant.

The company has navigated regulatory and legal challenges. This includes addressing issues related to media ownership and content regulation.

The media market is subject to volatility, which impacts the company's financial performance. This requires agile strategies to mitigate risks.

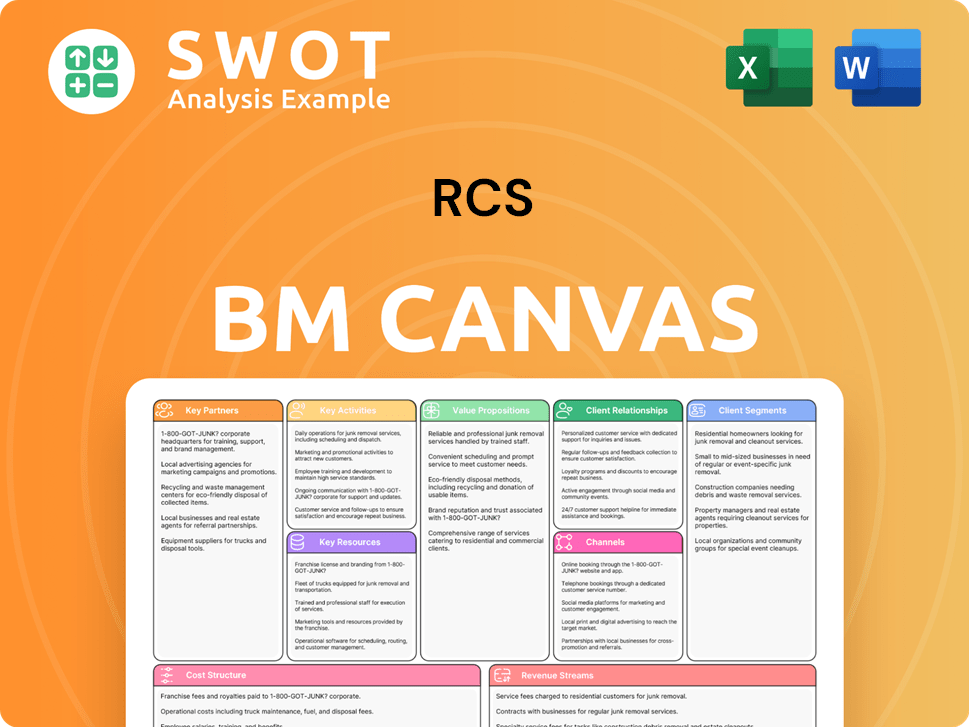

RCS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for RCS?

The RCS company, now known as RCS MediaGroup, has a rich history rooted in Italian publishing. The company's evolution from its founding in 1927 to its current status reflects significant shifts in the media landscape, including acquisitions, ownership changes, and a strong pivot towards digital platforms. The company's journey highlights its adaptability and strategic focus on maintaining a leading position in the media industry, particularly in the realm of RCS messaging and digital content delivery.

| Year | Key Event |

|---|---|

| 1927 | Angelo Rizzoli founded 'A. Rizzoli & C.', marking the beginning of the company's publishing ventures. |

| 1952 | The company was renamed 'Rizzoli Editore', signaling a new phase in its development. |

| 1974 | Acquisition of 'Editoriale Corriere della Sera S.a.s.', publisher of Il Corriere della Sera, expanded its portfolio. |

| 1976 | Took over management of La Gazzetta dello Sport, further diversifying its media interests. |

| 1984 | Gemina acquired a controlling holding of Rizzoli, influencing the company's strategic direction. |

| 1990 | Acquired a holding in the Spanish company Unidad Editorial S.A., extending its reach internationally. |

| 1997 | 'Rizzoli-Corriere della Sera' separated from Gemina's other industrial activities, restructuring the company. |

| 2003 | The company was renamed 'RCS MediaGroup', reflecting its broader media focus. |

| 2016 | Cairo Communication acquired a controlling stake of RCS MediaGroup, leading to new ownership. |

| September 2024 | Consolidated revenue reached €602.3 million, with digital revenue contributing 25%. |

| December 31, 2024 | Net profit stood at €62 million, with consolidated net revenues at €819.2 million. |

| May 8, 2025 | Shareholders' Meeting approved the 2024 financial statements and a dividend of €0.07 per share. |

| May 13, 2025 | Consolidated revenue for the first three months of 2025 reached €169.6 million, with net financial position positive at €20.1 million. |

In 2024, RCS MediaGroup demonstrated strong financial results. Consolidated net revenues reached €819.2 million, and the company achieved a net profit of €62 million. This performance underscores its ability to generate substantial revenue and maintain profitability, which is crucial for its continued growth and investment in RCS features.

RCS MediaGroup is experiencing significant growth in its digital subscriber base. As of March 2025, the Group's titles reached a total active digital customer base of over 1.2 million subscribers. Corriere della Sera has 689,000 subscribers, and Gazzetta has 265,000. This growth is a key indicator of the company's successful digital transformation and its ability to compete in the evolving media landscape.

Looking ahead to 2025, RCS MediaGroup aims to maintain strong EBITDA margins, at least in line with those achieved in 2024. The company is also focused on generating positive operating cash flows, barring unforeseen impacts. These strategic goals highlight the company's commitment to financial stability and sustainable growth.

RCS MediaGroup is prioritizing digital growth through its leading online publishing position in Italy and its expansion in Spain. The company's continuous growth in digital subscriptions for its flagship newspapers, such as Corriere della Sera and La Gazzetta dello Sport, as well as Spanish titles El Mundo and Expansión, reflects its commitment to the future of RCS technology and digital content delivery.

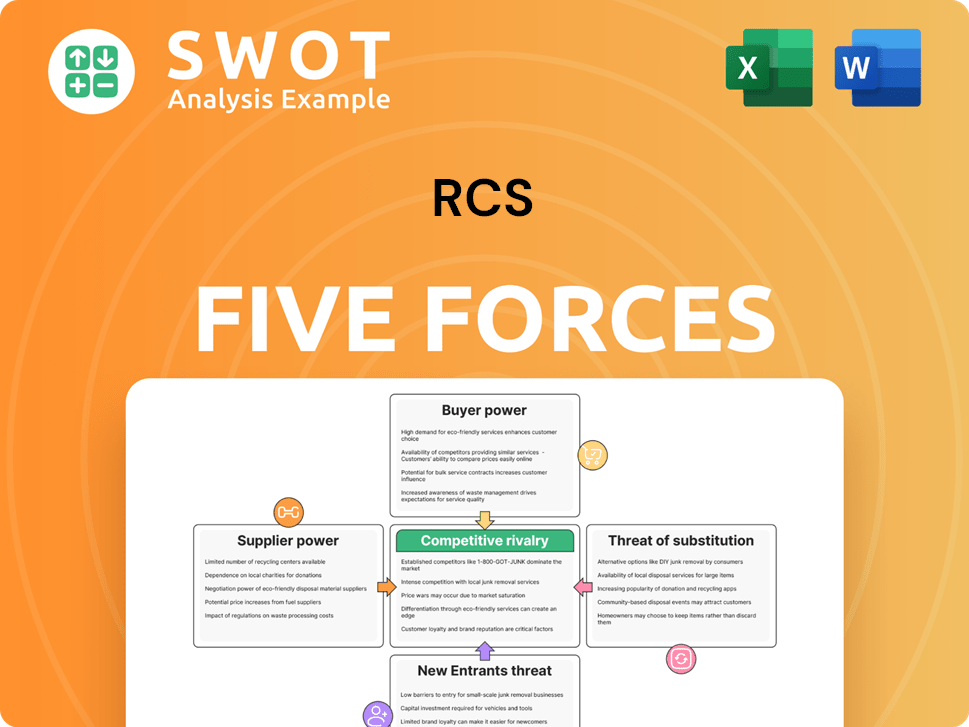

RCS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of RCS Company?

- What is Growth Strategy and Future Prospects of RCS Company?

- How Does RCS Company Work?

- What is Sales and Marketing Strategy of RCS Company?

- What is Brief History of RCS Company?

- Who Owns RCS Company?

- What is Customer Demographics and Target Market of RCS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.