RCS Bundle

Who Really Owns RCS Company?

Understanding the ownership of a media giant like RCS MediaGroup is crucial for investors and industry watchers alike. The company's strategic direction, financial performance, and even editorial choices are all influenced by its ownership structure. Unraveling the details of who owns RCS is key to grasping its place in the competitive media landscape.

From its roots in 1927 to its current status as a leading international multimedia group, RCS's ownership has undergone significant transformations. The 2016 takeover by Cairo Communication marked a pivotal moment, reshaping the RCS SWOT Analysis and the company's future. This article will explore the RCS company ownership, providing insights into its major shareholders, RCS Group structure, and the impact of these factors on its business operations. Discover the RCS company owner and more about the RCS business.

Who Founded RCS?

The origins of the RCS Company Ownership can be traced back to 1927 when Angelo Rizzoli established 'A. Rizzoli & C.' This marked the beginning of what would become a significant publishing empire. Initially focused on the press industry, the company expanded into book publishing, setting the stage for its future growth.

In 1929, the company transitioned into a joint-stock company, adopting the name 'Rizzoli & C. Anonymous for the art of printing.' While specific details on the initial equity split or shareholding percentages of Angelo Rizzoli and early investors are not readily available in the provided information, this transformation was a key step in its development. The RCS business would later evolve significantly.

The company's early history shows a series of important changes. In 1952, it was renamed 'Rizzoli Editore SpA,' and expanded by opening bookstores. A turning point came in 1974 with the acquisition of 'Il Corriere della Sera,' leading to a name change to 'Rizzoli-Corriere della Sera.'

Angelo Rizzoli founded 'A. Rizzoli & C.' in 1927, laying the foundation for the company. The initial focus was on the press industry, with acquisitions of national magazines. This early phase set the stage for the company's later ventures.

In 1929, the company became a joint-stock company, changing its name to 'Rizzoli & C. Anonymous for the art of printing.' This change was crucial for attracting investment and expanding operations. The legal structure of RCS company was evolving.

The acquisition of 'Il Corriere della Sera' in 1974 was a pivotal moment, costing approximately 40 billion lire. This strategic move significantly altered the company's scope and market position. The RCS company structure was changing.

The company underwent several name changes, reflecting its evolving business activities and ownership structure. These changes mirrored its growth and strategic shifts. The RCS Group was adapting to the market.

The company expanded its operations by opening bookstores in key cities. However, the 1980s brought challenges, including bankruptcy protection and downsizing. These events impacted the RCS business.

Specific details about the initial equity split and early backers are not available in the provided information. However, the involvement of key families and individuals shaped the company's trajectory. Understanding RCS company ownership history is complex.

The early ownership structure saw key figures like the Crespi family, Angelo Moratti, and the Agnelli family involved after the acquisition of 'Il Corriere della Sera.' Further details about the RCS company ownership and management team can be found in a Brief History of RCS. The company's history shows a complex evolution of ownership and strategic decisions.

Understanding the early ownership and the evolution of the company provides insight into its current structure. The RCS Group's journey reflects strategic acquisitions and challenges.

- Angelo Rizzoli founded the company in 1927.

- The company transitioned to a joint-stock structure in 1929.

- The acquisition of 'Il Corriere della Sera' was a major turning point.

- Early ownership involved key families and individuals.

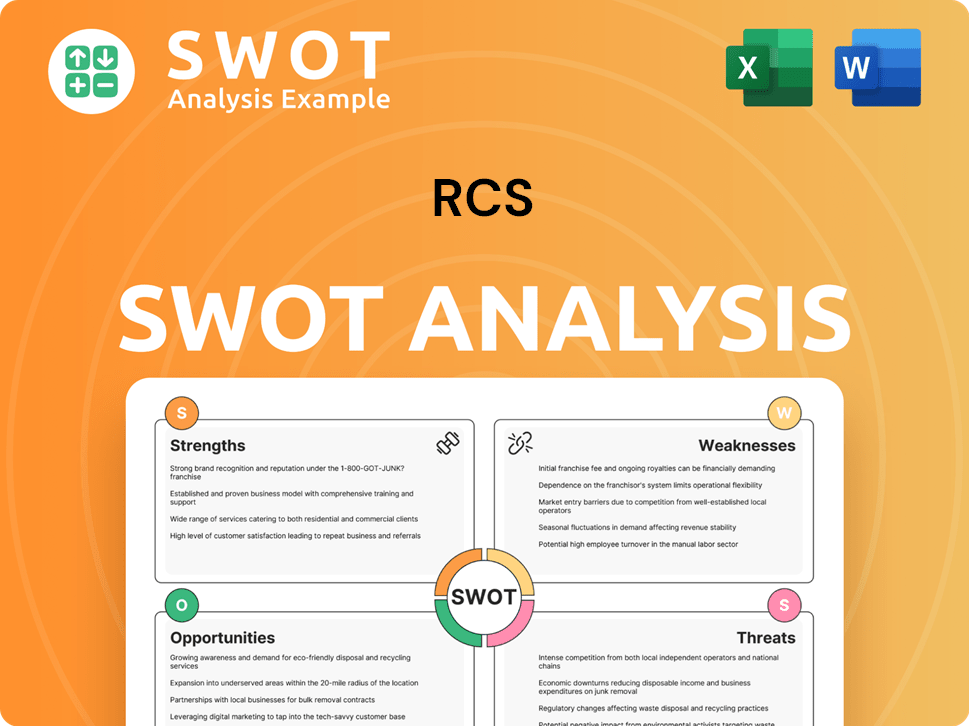

RCS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has RCS’s Ownership Changed Over Time?

The ownership of the RCS company, now known as RCS MediaGroup, has seen significant shifts since its inception. Early expansions shaped its foundation, but financial challenges in the 1980s led to major changes. In 1984, Gemina took control of Rizzoli, increasing its stake to 62.5% by 1985. The company was restructured in 1986, and the name changed to 'RCS Editori SpA'.

A pivotal moment occurred in 2016 when Cairo Communication, led by Urbano Cairo, successfully acquired RCS MediaGroup through a hostile takeover. This acquisition resulted in Cairo Communication becoming the controlling shareholder, holding 59.693% of the ordinary share capital as of May 2025. This marked a return to a single reference shareholder for RCS MediaGroup after more than 30 years. You can find more details about the company's strategic direction in this article about Growth Strategy of RCS.

| Shareholder | Stake (May 2025) | Notes |

|---|---|---|

| Cairo Communication S.p.A. | 59.693% | Controlling shareholder; Urbano Cairo is Chairman and CEO. |

| Mediobanca Banca di Credito Finanziario S.p.A. | 23.792% (combined with other minority shareholders) | Significant minority stake. |

| Diego Della Valle & C. S.r.l. | 23.792% (combined with other minority shareholders) | Part of the minority shareholders. |

| UnipolSai Assicurazioni S.p.A. and UnipolSai Finance S.p.A. | 23.792% (combined with other minority shareholders) | Part of the minority shareholders. |

| Pirelli & C. S.p.A. | 23.792% (combined with other minority shareholders) | Part of the minority shareholders. |

The acquisition by Cairo Communication centralized control, aligning RCS MediaGroup's strategic direction with Cairo's wider media interests. As of May 2025, the ownership structure clearly reflects this shift, with Cairo Communication holding a substantial majority stake. Understanding the RCS company ownership is crucial for anyone looking into the company's financial performance and strategic decisions.

The ownership of RCS MediaGroup has evolved significantly over time, with Cairo Communication now holding a controlling stake.

- Cairo Communication's stake is 59.693% as of May 2025.

- Mediobanca, Diego Della Valle, UnipolSai, and Pirelli are among the significant minority shareholders.

- The current structure reflects a centralized control under Urbano Cairo.

- Understanding the RCS company structure is essential for investors and stakeholders.

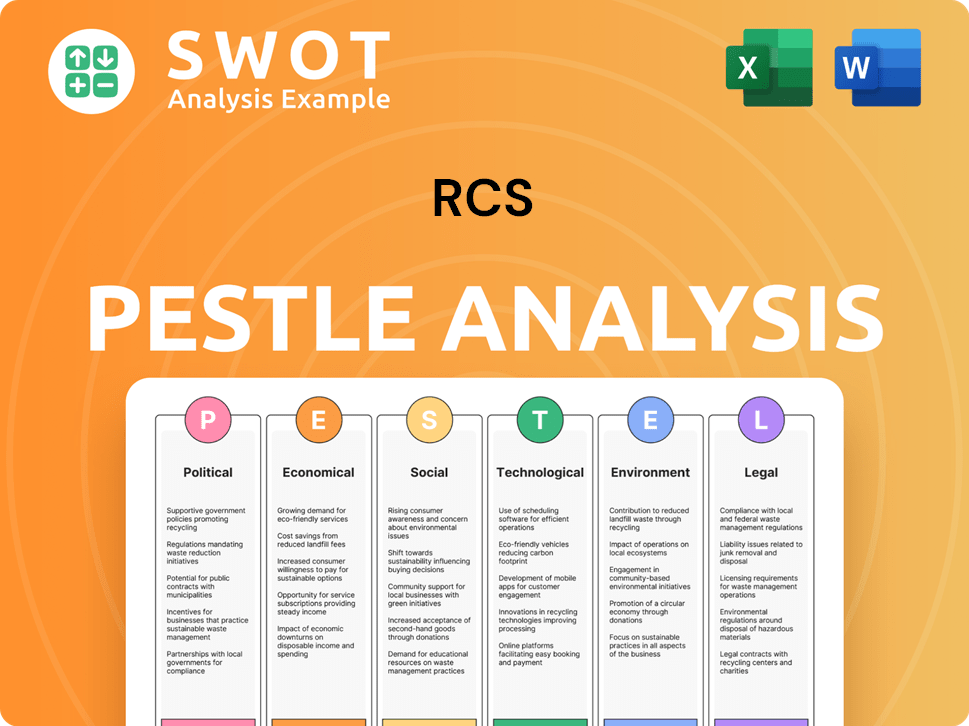

RCS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on RCS’s Board?

The current Board of Directors of the RCS MediaGroup, appointed on May 8, 2025, for the 2025-2027 term, consists of 12 members. Urbano Cairo, representing the majority shareholder Cairo Communication S.p.A., serves as Chairman and Chief Executive Officer, demonstrating a strong link between ownership and executive management. This structure is key to understanding the Growth Strategy of RCS.

The board's composition reflects the company's ownership. Cairo Communication S.p.A., holding 59.693% of ordinary shares, elected eight members, including Urbano Cairo. DDV Partecipazioni S.r.l., representing shareholders like Mediobanca and UnipolSai, with 23.792% of ordinary shares, elected four members, including Diego Della Valle. The total annual remuneration for the Board of Directors is set at €400,000.

| Board Member | Representing | Role |

|---|---|---|

| Urbano Cairo | Cairo Communication S.p.A. | Chairman and CEO |

| Uberto Fornara | Cairo Communication S.p.A. | Board Member |

| Marco Pompignoli | Cairo Communication S.p.A. | Board Member |

| Stefano Simontacchi | Cairo Communication S.p.A. | Board Member |

| Stefania Petruccioli | Cairo Communication S.p.A. | Board Member |

| Federica Calmi | Cairo Communication S.p.A. | Board Member |

| Benedetta Corazza | Cairo Communication S.p.A. | Board Member |

| Laura Gualtieri | Cairo Communication S.p.A. | Board Member |

| Diego Della Valle | DDV Partecipazioni S.r.l. | Board Member |

| Marco Tronchetti Provera | DDV Partecipazioni S.r.l. | Board Member |

| Carlo Cimbri | DDV Partecipazioni S.r.l. | Board Member |

| Veronica Gava | DDV Partecipazioni S.r.l. | Board Member |

The voting structure includes an increased voting right system, as per Article 127-quinquies of the TUF, introduced on April 29, 2021. This system enhances voting power for long-term shareholders. The presence of board members representing significant minority shareholders ensures oversight and diverse perspectives. Understanding who owns RCS is crucial for investors and stakeholders.

Cairo Communication S.p.A. is the majority shareholder, holding a significant portion of the ordinary share capital.

- The board is structured to reflect the ownership, with members elected by both majority and minority shareholders.

- An increased voting right system is in place, favoring long-term shareholders.

- The board's composition ensures a balance of perspectives and oversight.

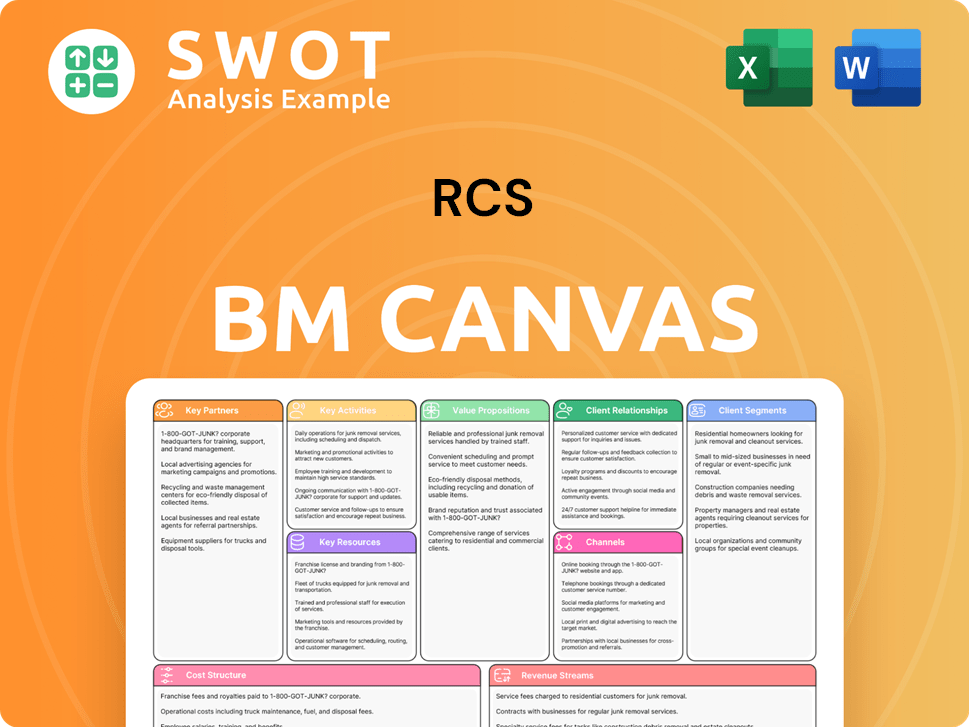

RCS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped RCS’s Ownership Landscape?

Over the past few years, the RCS Company Ownership has been marked by consolidation. Under the leadership of Urbano Cairo and Cairo Communication, the company has seen significant shifts. As of June 13, 2025, Cairo Communication holds a substantial 59.693% of RCS MediaGroup's ordinary share capital, solidifying its control over the strategic direction of the company. This ownership structure reflects a broader trend of consolidation within the Italian media sector.

The financial performance of the RCS Group also reflects the company's evolution. For the first quarter of 2025, RCS MediaGroup reported consolidated revenue of €169.6 million, slightly up from €168.9 million in the first quarter of 2024. Digital revenue contributed approximately 27.8% of the total revenue. Advertising revenue saw a 3.7% increase in the first quarter of 2025. The net financial position improved, reaching a positive €20.1 million as of March 31, 2025, which is an improvement of €12.3 million from the end of 2024. The total active digital customer base surpassed 1.2 million subscribers as of March 2025, with Corriere della Sera leading with 689,000 subscribers and Gazzetta dello Sport with 265,000.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Consolidated Revenue (€ million) | 168.9 | 169.6 |

| Digital Revenue (% of Total) | ~27% | ~27.8% |

| Advertising Revenue Growth | N/A | 3.7% |

| Net Financial Position (€ million) | -7.8 (end of 2024) | 20.1 (as of March 31, 2025) |

The Italian media sector has seen increased institutional ownership and consolidation, as evidenced by Cairo Communication's acquisition of RCS MediaGroup in 2016. This trend is driven by the challenges within the publishing industry, leading to strategic realignments and new ownership structures. In November 2024, RCS MediaGroup announced a partial demerger project to spin off RCS Sports & Events S.r.l., which indicates a strategic restructuring of its assets. The company's outlook for 2025 aims for strongly positive EBITDA margins, at least in line with 2024, and continued positive cash flow generation from operations. For more insights into the RCS business, you can explore the Revenue Streams & Business Model of RCS.

Cairo Communication holds a majority stake, with 59.693% of the ordinary share capital as of June 13, 2025.

Cairo Communication's control significantly influences the strategic direction and decision-making within RCS MediaGroup.

The company's revenue in Q1 2025 was €169.6 million, and digital revenue accounted for approximately 27.8%.

The 2025 outlook anticipates positive EBITDA margins and continued positive cash flow from operations.

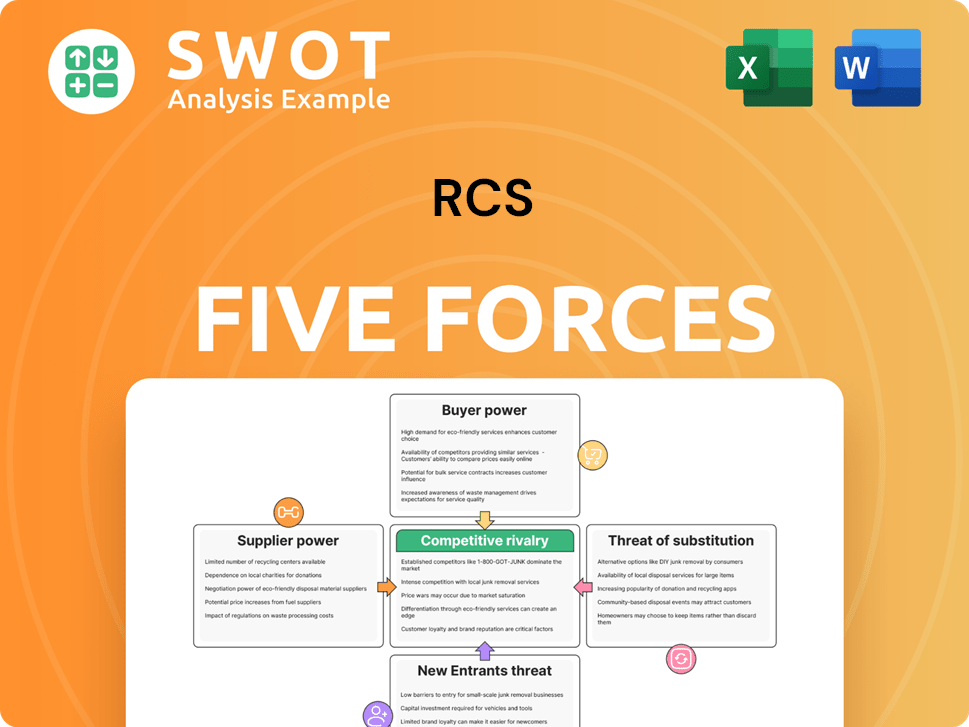

RCS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RCS Company?

- What is Competitive Landscape of RCS Company?

- What is Growth Strategy and Future Prospects of RCS Company?

- How Does RCS Company Work?

- What is Sales and Marketing Strategy of RCS Company?

- What is Brief History of RCS Company?

- What is Customer Demographics and Target Market of RCS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.