RCS Bundle

How Does RCS Company Thrive in the Digital Age?

RCS MediaGroup S.p.A., a titan in European media, has a rich history dating back to 1927, and it continues to evolve. With a portfolio boasting renowned publications like Corriere della Sera and El Mundo, the company's journey through print, digital media, and broadcasting paints a compelling picture of adaptation and resilience. Its financial performance, particularly its digital revenue growth, offers a glimpse into its strategic prowess.

As RCS MediaGroup navigates the complexities of the media landscape, understanding its operational framework is key. The shift from traditional print to digital platforms, coupled with its diversification into advertising and new media, showcases a robust business model. To gain a deeper understanding of RCS's strategic direction and market resilience, consider exploring the RCS SWOT Analysis, which delves into its strengths, weaknesses, opportunities, and threats. This analysis will help you understand how RCS company leverages the power of Rich Communication Services (RCS) and its features.

What Are the Key Operations Driving RCS’s Success?

The core operations of the media company involve creating and distributing content through various channels in Italy and Spain. This encompasses publishing newspapers, magazines, broadcasting radio and television, and organizing events. The company's diverse portfolio caters to a wide audience, from general readers to sports enthusiasts, and it's constantly adapting to evolving consumption habits.

The value proposition centers on providing authoritative, innovative, and culturally enriching information and entertainment. This is achieved through a blend of traditional and digital media, including digital subscriptions and interactive content. The company's ability to adapt and innovate is crucial in a rapidly changing media landscape.

The company's operations are built on creating and distributing content across multiple platforms. This includes editorial teams, technology development, and extensive distribution networks. The focus is on delivering information and entertainment to a broad audience.

A key operational shift has been the acceleration of digital transformation. This includes migrating IT infrastructure to cloud platforms like Google Cloud Platform and Microsoft Azure. This enhances flexibility and capacity for handling digital audiences, with daily traffic peaks averaging 350 GB.

The supply chain involves sourcing news, printing, distribution, and managing digital platforms. Partnerships, such as the collaboration with Colt Technology Services, are crucial for supporting the digital-first strategy. These partnerships ensure continuous data access and cost optimization.

The company's value proposition translates into readily accessible information and diverse content offerings. This includes digital subscriptions and interactive content, allowing customers to engage in various ways. This approach ensures that the company remains competitive.

The company's operational success hinges on its ability to adapt to changing consumption models. This includes offering digital subscriptions and engaging interactive content. The company's strategic partnerships and digital transformation initiatives are crucial for its ongoing success.

- Content Creation: Editorial teams produce content across various topics.

- Digital Infrastructure: Migration to cloud platforms enhances flexibility.

- Distribution Networks: Extensive networks support both print and digital content.

- Strategic Partnerships: Collaborations optimize digital strategies.

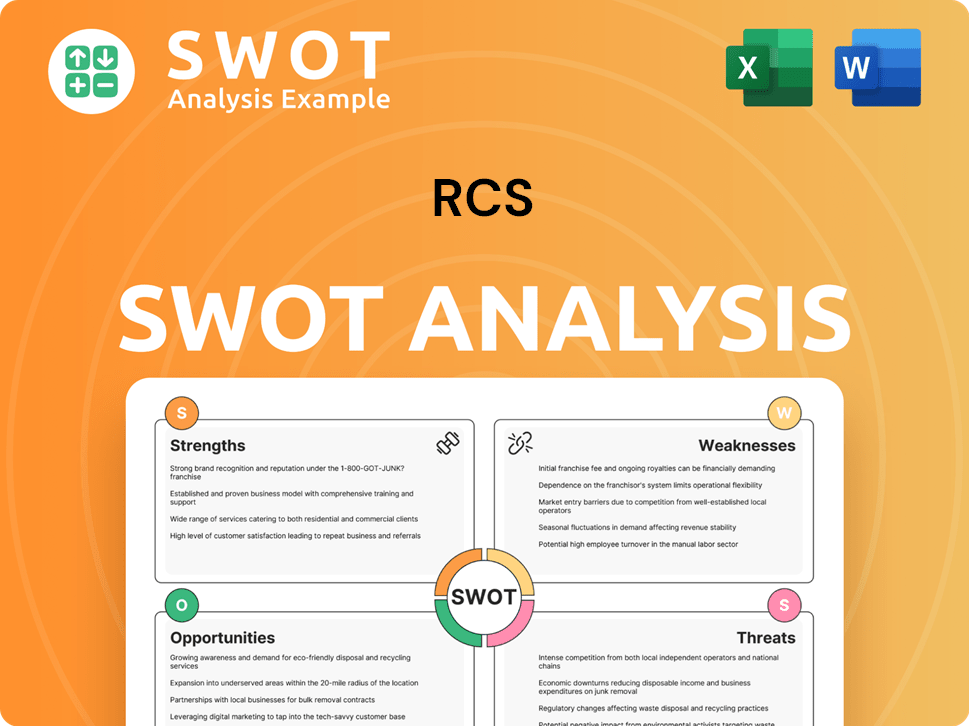

RCS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RCS Make Money?

The core of the business model revolves around multiple revenue streams, reflecting its multifaceted media operations. Primary sources of income include the sale of publications, advertising services, and other miscellaneous revenues. In the first quarter of 2025, consolidated net revenue reached €169.6 million.

The financial strategy emphasizes digital transformation and diversification to adapt to evolving market trends. This includes a focus on subscription-based models for digital content and leveraging its brand portfolio for cross-selling opportunities. The strategic merger of its advertising business unit with Cairo Communication's parent company, CAIRORCS, aims to maximize synergies.

The Competitors Landscape of RCS reveals how the company generates income through a variety of channels, adapting to the digital shift while maintaining its traditional revenue streams.

The company's revenue streams are diversified, with digital initiatives playing a significant role. Here's a detailed breakdown of the revenue contributions in the first three months of 2025:

- Publishing and Circulation Revenue: This segment generated €76.6 million, a slight decrease from €79.8 million in Q1 2024. Digital subscriptions, particularly for Corriere della Sera, helped offset declines in print circulation.

- Advertising Revenue: This increased to €59.4 million in Q1 2025 from €57.3 million in Q1 2024, marking a 3.7% year-over-year growth. Digital advertising sales accounted for approximately 47.5% of total advertising revenue, reaching €28.2 million.

- Digital Revenue: This category, which includes digital subscriptions and online advertising, contributed approximately 27.8% of total revenue, totaling €47.1 million in Q1 2025. The active digital customer base for its flagship titles is substantial, with Corriere della Sera having 689,000 digital subscribers, La Gazzetta dello Sport with 265,000, El Mundo with 165,000, and Expansión with 116,000 as of March 2025.

- Sundry Revenue: This segment closed at €33.6 million in the first three months of 2025, an increase of €1.8 million compared to the same period in 2024. It includes income from non-sporting events, training programs, and other digital revenues.

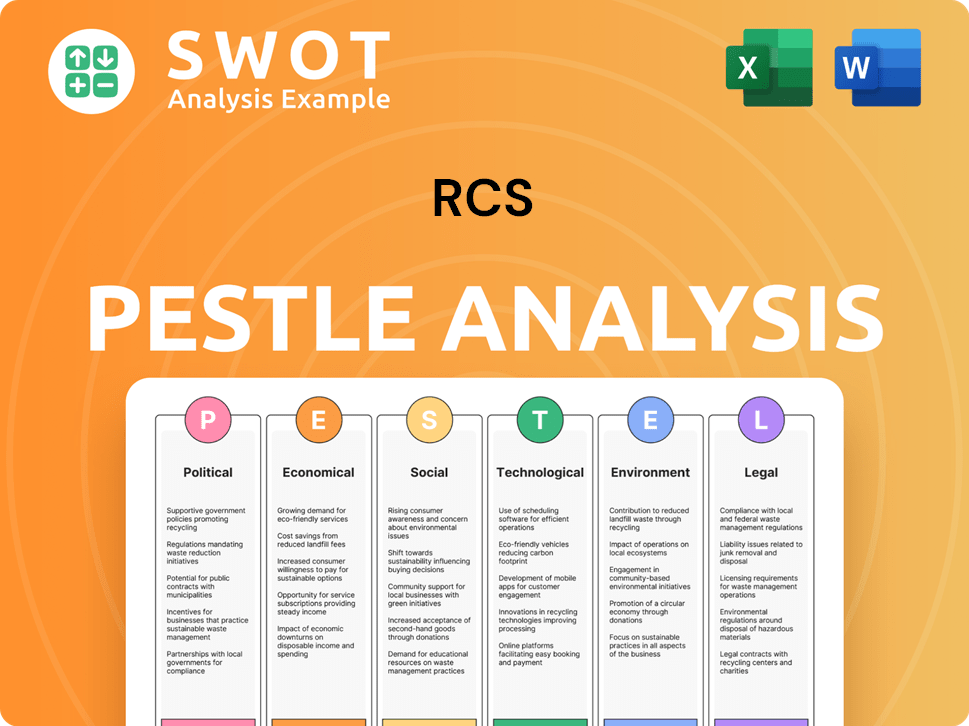

RCS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped RCS’s Business Model?

The RCS MediaGroup has significantly evolved, with a primary focus on digital media, especially since early 2020. This strategic shift was a direct response to the changes brought about by the pandemic, aiming to provide continuous information and adapt its operations. A key part of this transformation included investing in technology and digital platforms to meet the changing needs of its audience.

A major milestone in this digital transition was the notable increase in digital subscriptions for Corriere della Sera, reaching 308,000 by the end of 2020, an 81% rise from 2019. The company also launched new apps for La Gazzetta dello Sport and Giro d'Italia. Furthermore, RCS MediaGroup has strategically moved its IT infrastructure to Google Cloud Platform and Microsoft Azure, showing its commitment to technological advancement and scalability.

Operational challenges, such as declining print circulation and lower ad revenues, have been addressed by expanding its business model to include digital subscriptions and exploring new revenue streams. While print circulation revenue decreased, it was offset by the growth in digital subscription revenue. The company's focus on cost containment and digital development has also improved its margins, showcasing its adaptability in a dynamic media landscape.

RCS MediaGroup's digital transformation included a significant increase in digital subscriptions and the launch of new apps. The company also invested in cloud infrastructure to support its digital initiatives. These moves were crucial in adapting to the changing media consumption habits and market demands.

The company adjusted its business model to include digital subscriptions, offsetting declines in print revenue. Cost containment and digital development actions were also implemented to improve margins. These strategies ensured the company's financial stability and growth in a competitive market.

RCS MediaGroup holds strong brand recognition with publications like Corriere della Sera and La Gazzetta dello Sport. Its diverse portfolio across Italy and Spain provides a broad reach and content offerings. The company's commitment to digital transformation, including advanced access control paywall solutions, enhances its competitive edge.

The ability to adapt to new trends, such as the increasing demand for interactive mobile messages, is crucial for sustaining its business model. Building trust through verified sender identity is also key. This approach helps RCS MediaGroup maintain its position in the evolving media landscape.

RCS MediaGroup's competitive strengths are rooted in its strong brand and extensive portfolio, including newspapers, magazines, and digital platforms. Publications like Corriere della Sera and El Mundo hold leading positions in their respective markets. The company’s focus on digital transformation, including advanced access control paywall solutions, further enhances its competitive edge. For a deeper understanding of the company's target market, you might find insights in Target Market of RCS.

- Strong brand recognition in Italy and Spain.

- Diverse portfolio of over 70 brands across various media.

- Commitment to digital transformation and innovation.

- Adaptability to new trends in media consumption.

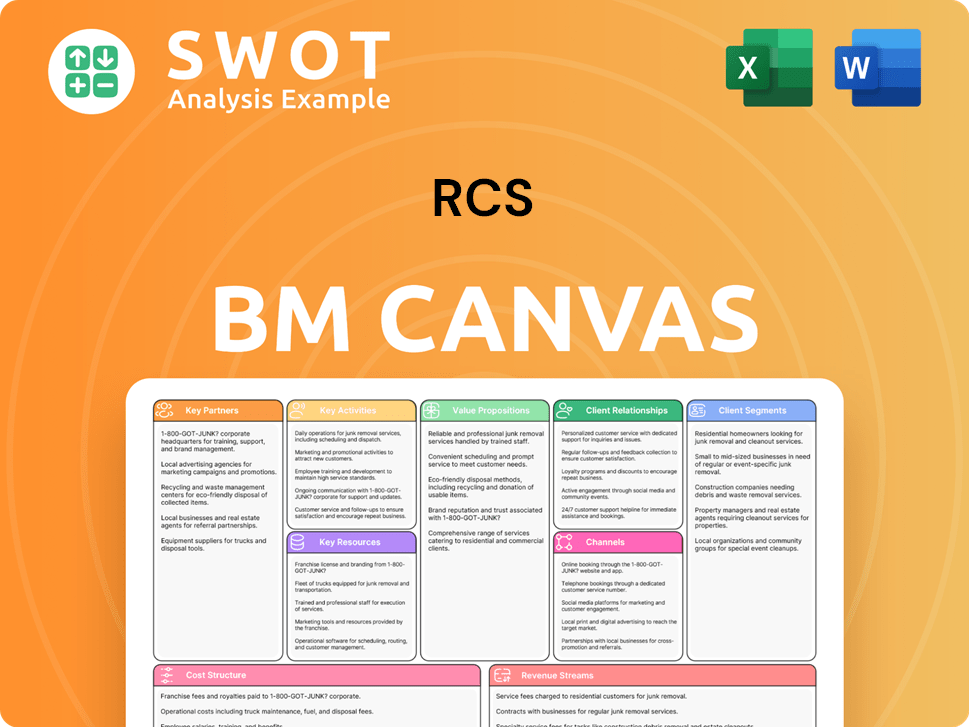

RCS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is RCS Positioning Itself for Continued Success?

RCS MediaGroup holds a prominent position in the European media sector, particularly in Italy and Spain. As a leading multimedia publishing group, it owns prominent daily newspapers such as Corriere della Sera and La Gazzetta dello Sport in Italy, and El Mundo and Marca in Spain. The company's strong market share is evident in the national daily press, with 19% in Italy and 18% in Spain.

Despite its strong market position, RCS MediaGroup faces several challenges. The media industry is experiencing declining print circulation and fluctuating advertising revenues. The digital advertising market can be volatile, and regulatory changes, technological advancements, and evolving consumer preferences also pose ongoing risks. Furthermore, the company operates within a context of geopolitical conflicts, which can introduce economic uncertainties.

RCS MediaGroup is a major player in the European media landscape, especially in Italy and Spain. It boasts leading newspapers like Corriere della Sera and El Mundo. The company maintains a strong market share in the national daily press in both Italy and Spain.

The media industry faces declining print circulation and fluctuating advertising revenues. Digital advertising can be volatile. Regulatory changes, technological disruption, and evolving consumer habits are also ongoing challenges. Geopolitical conflicts introduce economic uncertainties.

RCS MediaGroup is focused on its digital transformation and growing digital subscriptions. They are investing in digital media and optimizing their IT infrastructure. The company is committed to producing high-quality content across all platforms and leveraging RCS for enhanced customer engagement.

RCS MediaGroup reported a positive net financial position of €20.1 million as of March 31, 2025, improving by €12.3 million from the end of 2024. This financial strength supports their investments in future growth. The company's digital subscriber base exceeded 1.2 million active digital subscribers as of March 2025.

RCS MediaGroup is strategically focused on digital transformation, particularly through RCS messaging. This commitment is evident in their investments in digital media and their focus on growing digital subscriptions. The company aims to leverage RCS features to enhance customer engagement and conversion rates, aligning with the broader trends in Marketing Strategy of RCS.

- Continued investment in digital media.

- Focus on growing digital subscriptions.

- Optimization of IT infrastructure.

- Leveraging RCS for enhanced customer engagement.

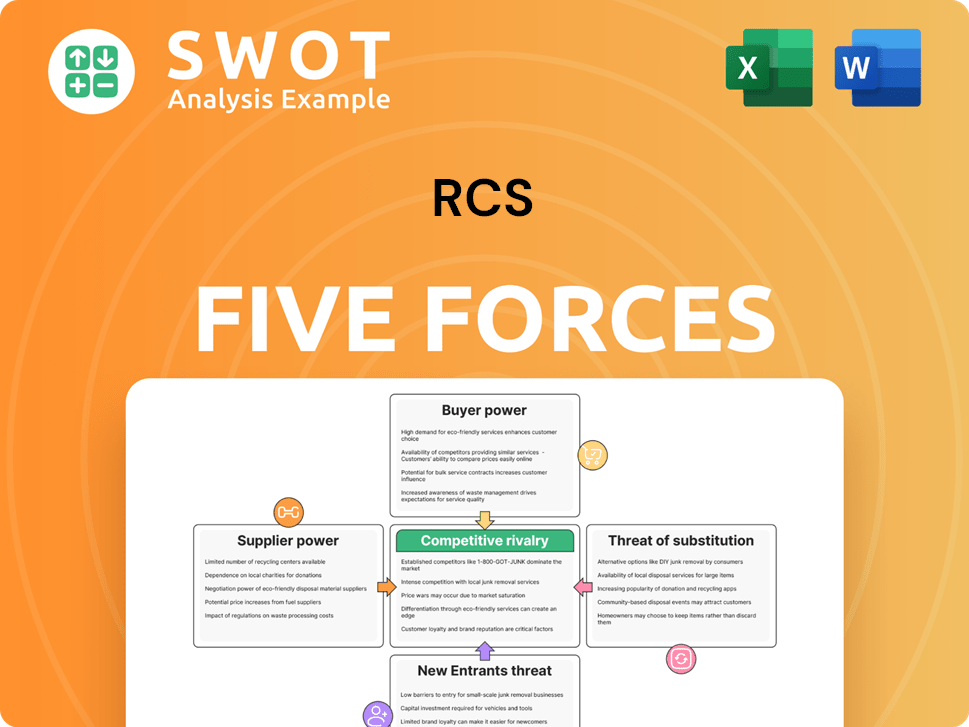

RCS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RCS Company?

- What is Competitive Landscape of RCS Company?

- What is Growth Strategy and Future Prospects of RCS Company?

- What is Sales and Marketing Strategy of RCS Company?

- What is Brief History of RCS Company?

- Who Owns RCS Company?

- What is Customer Demographics and Target Market of RCS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.