RCS Bundle

Can RCS MediaGroup Navigate the Future of Media?

RCS MediaGroup, the Italian media giant behind Corriere della Sera and La Gazzetta dello Sport, is at a critical juncture. Founded in 1927, the company has evolved significantly, adapting to the ever-changing landscape of publishing and communication. This analysis delves into RCS's RCS SWOT Analysis to uncover its growth strategy and future prospects in a dynamic market.

With a market capitalization of $587 million and a workforce of nearly 3,000 employees as of May 2025, RCS MediaGroup faces both opportunities and challenges. This exploration will examine the company's strategic initiatives, including its approach to integrating technology and its financial planning, to understand how it aims to capitalize on the future of RCS technology and the broader media environment. We'll explore RCS market analysis and how RCS company future looks like.

How Is RCS Expanding Its Reach?

RCS MediaGroup is actively expanding, focusing on strategies to broaden its market reach and diversify its revenue streams. The company has a strong presence in Italy and Spain, where it operates leading newspapers and magazines. This expansion includes a significant emphasis on digital transformation and content diversification to adapt to evolving media consumption habits.

The company's approach involves enhancing digital offerings and organizing major events. Digital revenue accounted for nearly 27% of its total consolidated revenue in 2024, demonstrating a shift towards digital platforms. RCS MediaGroup also leverages its involvement in significant events like the Giro d'Italia and its strong position in advertising sales to diversify its income sources.

RCS MediaGroup's expansion initiatives are designed to capitalize on digital growth and diversify revenue streams. The company's strategic focus on digital offerings and event organization is key to its future growth. This approach is crucial for maintaining a competitive edge in the evolving media landscape.

RCS MediaGroup is prioritizing digital offerings to adapt to changing media consumption habits. This involves investments in digital platforms and content to attract new customers. The company's digital customer base reached over 1.2 million active subscribers by the end of March 2025.

The company is diversifying its content to attract a wider audience and generate more revenue streams. This includes organizing major events and participating in art fairs, such as the Madrid International Contemporary Art Fair in 2025. This strategy helps to expand its market reach.

RCS MediaGroup is leveraging strategic partnerships to enhance its market position. The company's involvement in major sporting events and advertising sales contributes to revenue diversification. These partnerships are crucial for expanding its reach and impact.

RCS MediaGroup is focused on expanding its presence in both Italy and Spain. This includes growing its digital subscriber base and increasing its advertising revenue. The company’s expansion efforts are designed to strengthen its position in the media industry.

RCS MediaGroup's expansion initiatives are centered around digital transformation and content diversification. These strategies are essential for adapting to the changing media landscape and driving revenue growth. The company's focus on digital platforms and event organization is key to its future success.

- Digital Subscriber Growth: Reaching over 1.2 million active subscribers by March 2025.

- Revenue Diversification: Generating revenue from digital subscriptions, advertising, and events.

- Strategic Partnerships: Leveraging partnerships to expand market reach and enhance revenue streams.

- Market Presence: Maintaining a strong presence in Italy and Spain through leading newspapers and magazines.

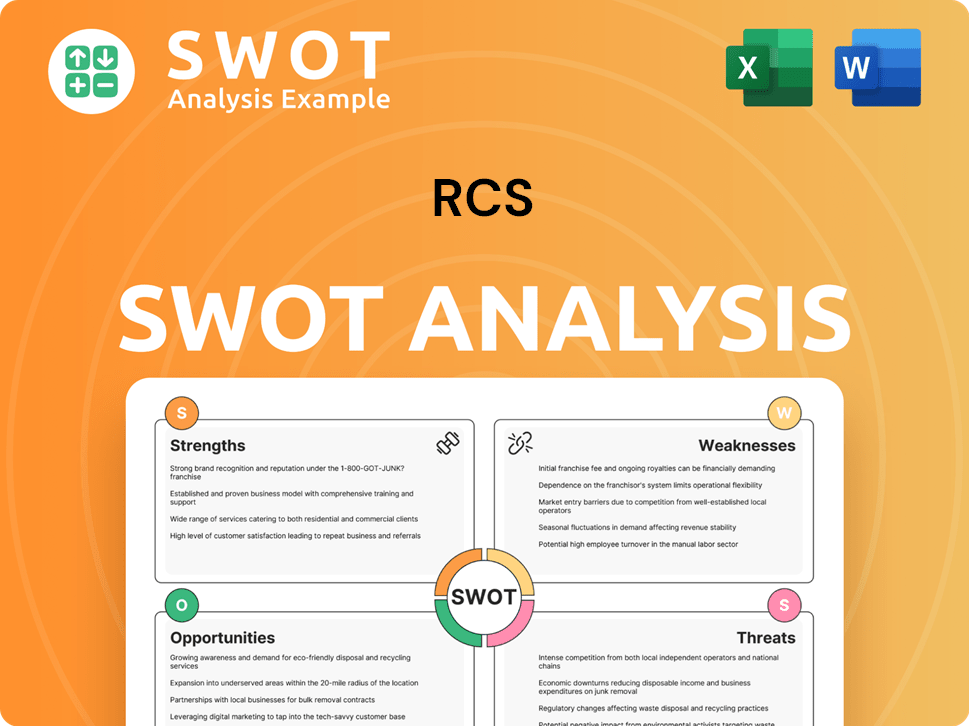

RCS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RCS Invest in Innovation?

The foundation of the RCS MediaGroup's sustained growth lies in its dedication to innovation and technology. This commitment is particularly evident in its ongoing digital transformation initiatives. The company consistently leverages technological advancements to adapt to evolving media consumption habits and broaden its audience reach. This strategic focus is crucial for maintaining a competitive edge in the dynamic media landscape.

RCS MediaGroup's digital transformation strategy is multifaceted, encompassing various technological upgrades and partnerships. These efforts are designed to enhance user experience, improve content delivery, and drive revenue growth. By embracing new technologies like AI and cloud computing, the company aims to optimize its operations and create new opportunities for engagement and monetization.

The company's digital revenue accounted for approximately 27.8% of its total consolidated revenue, which was €169.6 million, in the first quarter of 2025. This demonstrates the significance of digital initiatives in the overall financial performance of RCS MediaGroup. The company's strategic investments in technology are clearly reflected in its revenue streams.

RCS MediaGroup is migrating its Content Management System (CMS) to a multi-cloud environment. This move aims to manage traffic and data growth efficiently. The company is also supporting a digital-first strategy to prioritize online content delivery.

The company is focused on enabling AI adoption and harnessing the full potential of cloud technologies. These technologies are considered key drivers for 2025, enhancing operational efficiency and content delivery.

RCS MediaGroup collaborates with external innovators to expand its digital reach. Partnerships, such as the agreement with Google News Showcase, boost the visibility of its publications online. The company also works with Taboola to increase content recirculation and user engagement.

Continuous efforts to improve digital traffic figures are a priority. In 2024, Corriere della Sera and La Gazzetta dello Sport averaged 28.5 million and 15.4 million unique monthly users, respectively. These figures highlight the success of the company's digital strategies.

The company is actively seeking ways to enhance user engagement. This includes improving content delivery, optimizing website performance, and leveraging data analytics to understand user preferences better. This is a key component of the overall Mission, Vision & Core Values of RCS.

RCS MediaGroup is positioned to leverage technology and innovation for future growth. The company's focus on digital transformation, AI adoption, and strategic partnerships is expected to drive revenue growth and enhance its competitive position in the media market.

RCS MediaGroup's approach to innovation and technology is multifaceted, aiming to drive growth and adapt to the evolving media landscape. The company focuses on several key areas to achieve its strategic objectives.

- Digital Transformation: Migrating to a multi-cloud CMS and adopting a digital-first strategy to enhance content delivery and user experience.

- AI and Cloud Technologies: Enabling AI adoption and leveraging cloud technologies to improve operational efficiency and content optimization.

- Strategic Partnerships: Collaborating with external innovators to expand digital reach and user engagement, such as partnerships with Google News Showcase and Taboola.

- Data-Driven Decisions: Utilizing data analytics to understand user preferences and optimize content delivery, leading to improved user engagement and revenue generation.

- Continuous Improvement: Constantly improving digital traffic figures and website performance to maintain a competitive edge in the market.

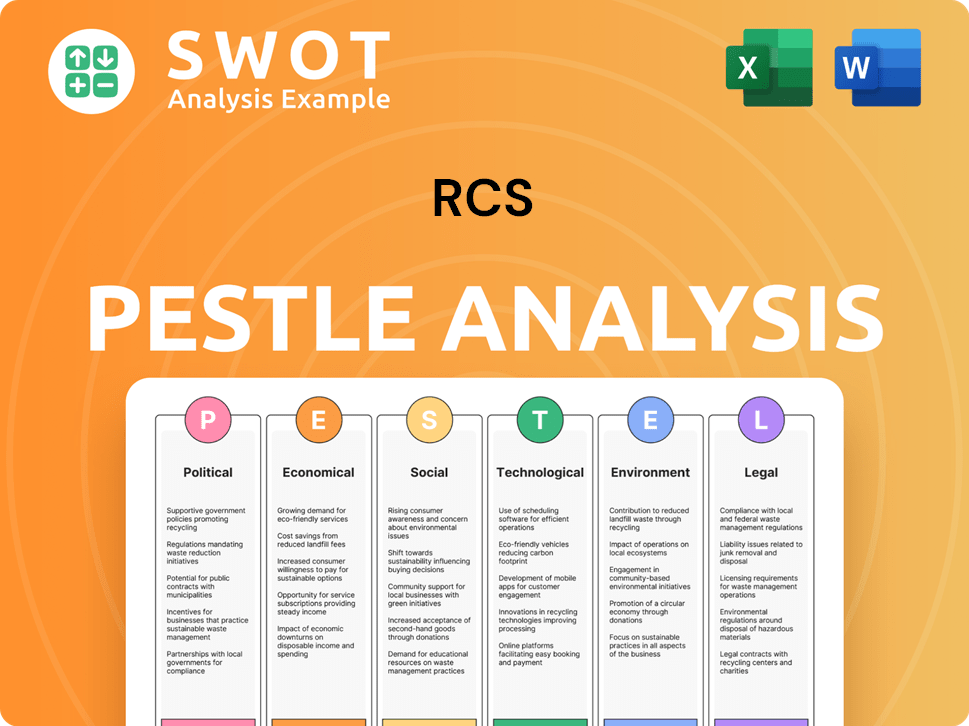

RCS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is RCS’s Growth Forecast?

The financial outlook for RCS MediaGroup presents a picture of resilience and strategic growth. The company's performance in 2024 and early 2025 showcases its ability to navigate market fluctuations and capitalize on digital opportunities. This financial stability is crucial for sustaining the company's long-term RCS growth strategy and exploring new ventures in the RCS market analysis.

In 2024, RCS MediaGroup demonstrated solid financial health, with a net profit of €62 million. Despite a slight decrease in consolidated net revenues, the company managed to increase its EBITDA, indicating effective cost management and operational efficiency. The digital segment's significant contribution to total revenues highlights the importance of RCS technology and its integration into the RCS business model.

The first quarter of 2025 continued this positive trend, with revenue growth and improved profitability. The increase in advertising revenue and the positive net financial position underscore the company's ability to adapt and thrive in a competitive market. These financial indicators support the company's strategic growth plans and its potential for future expansion, making it a compelling subject for RCS company investment prospects.

In 2024, RCS MediaGroup achieved a net profit of €62 million, up from €57 million in 2023. Consolidated net revenues were €819.2 million, a slight decrease of 1.1% from €828 million in 2023. EBITDA increased by 8.7% to €148 million, demonstrating strong operational performance.

For Q1 2025, consolidated revenue reached €169.6 million, an increase from €168.9 million in Q1 2024. Advertising revenue grew by 3.7%. EBITDA for Q1 2025 was €14.6 million, up from €12.6 million in Q1 2024, and EBIT improved to €1.6 million.

The Shareholders' Meeting on May 8, 2025, approved a dividend of €0.07 per share. The net financial position as of March 31, 2025, was positive at €20.1 million, an improvement of €12.3 million from the end of 2024.

The company's gross profit margin for fiscal years ending December 2020 to 2024 averaged 14.6%, with a 15.5% margin in 2024. This consistent profitability supports the company's strategic initiatives and future growth.

The financial data reveals a strong foundation for future growth, with positive trends in revenue, profitability, and financial position. This performance is vital for the company's strategic objectives and expansion plans, particularly in the evolving landscape of RCS messaging platform growth.

- EBITDA margins are expected to remain strongly positive in 2025.

- The company continues to generate operating cash.

- The digital component contributes significantly to total revenues.

- The company's ability to adapt and thrive in a competitive market.

For those interested in understanding the broader strategic approach, a related article on the Marketing Strategy of RCS provides additional insights into how the company is positioning itself for continued success. The financial stability and strategic vision of RCS MediaGroup position it well for future growth, particularly in the context of RCS and the future of mobile messaging.

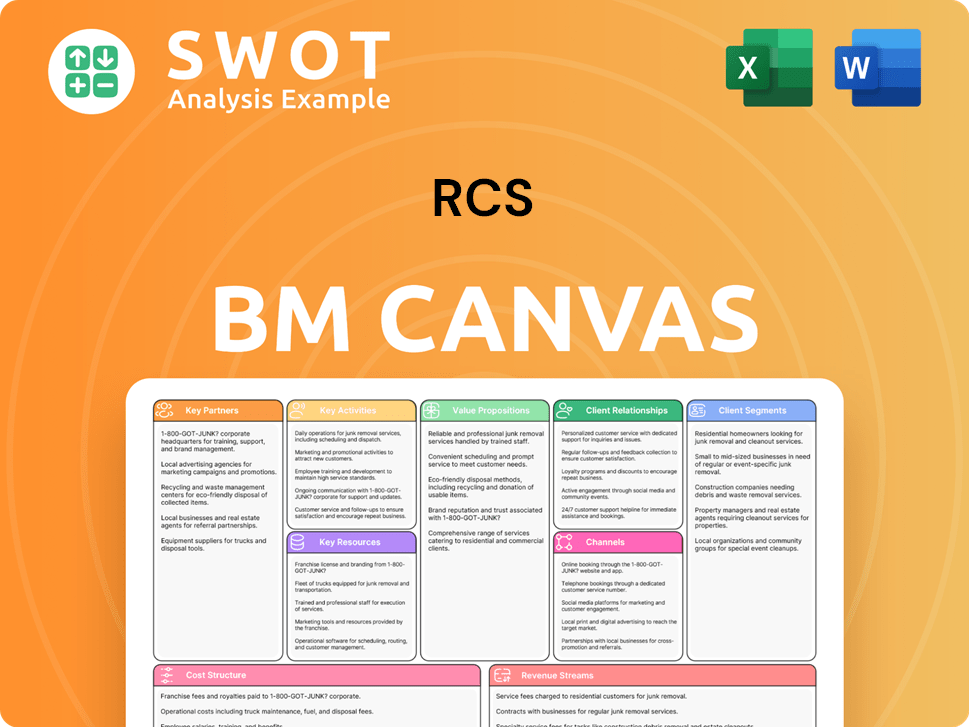

RCS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow RCS’s Growth?

The growth strategy of RCS MediaGroup faces several potential risks and obstacles. These challenges range from market competition and regulatory changes to global economic uncertainties and technological disruptions. Understanding these risks is crucial for investors and stakeholders assessing the company's future prospects.

Market dynamics in the media sector demand continuous adaptation to maintain readership and advertising revenue. Changes in regulations in Italy and Spain could also impact operations. Furthermore, global events and technological advancements pose significant challenges that the company must navigate to ensure sustained growth.

RCS MediaGroup's ability to successfully drive digital transformation and AI adoption is a key factor. Cybersecurity and staying ahead of technological shifts are also critical. The company's management actively monitors these risks, aiming to maintain positive EBITDA margins and cash generation amidst external pressures.

The media market is highly competitive, with many players vying for audience attention and advertising revenue. This requires constant innovation and adaptation to stay relevant. The company must differentiate itself through unique content and effective digital strategies to maintain its market position.

Changes in publishing and broadcasting regulations in Italy and Spain could affect RCS MediaGroup's operations. Compliance with new laws and regulations may require significant investments and adjustments. The company needs to stay informed and adapt to these changes to avoid financial and operational impacts.

Global geopolitical events create uncertainty that can indirectly affect RCS MediaGroup. Although the company states it has no direct exposure to markets in conflict, broader economic repercussions and trade restrictions could still impact its performance. Concerns over tariffs and international trade further intensify this uncertainty.

The media landscape is rapidly evolving with new digital platforms and content consumption trends. RCS MediaGroup's digital transformation efforts and AI adoption are crucial responses to this. Successfully implementing these strategies and keeping pace with technological shifts are vital for long-term success. The Brief History of RCS explains how the company has adapted to these changes.

Cybersecurity is a major concern for businesses globally, including RCS MediaGroup. Protecting data and operations requires robust security measures. The company must invest in and maintain strong cybersecurity protocols to mitigate risks and maintain stakeholder trust.

Economic downturns and shifts in consumer spending can affect advertising revenue and subscription models. RCS MediaGroup must remain flexible and adapt its business model to navigate economic fluctuations. Diversifying revenue streams and controlling costs are important strategies for mitigating these risks.

RCS MediaGroup's ability to maintain and grow its market share is critical. This involves understanding consumer preferences, adapting to digital trends, and competing effectively against other media outlets. The company's success depends on its ability to innovate and provide compelling content that attracts and retains readers and viewers.

The integration of new technologies, including AI and data analytics, is essential for RCS MediaGroup to improve efficiency and enhance content delivery. Investment in technology is crucial for staying competitive and meeting the evolving needs of its audience. This includes upgrades to infrastructure and platforms.

Diversifying revenue streams beyond traditional advertising is important for long-term financial health. This includes subscriptions, digital content, and other services. RCS MediaGroup must continually evaluate and adapt its business model to ensure sustainability and profitability in a dynamic market.

The future of RCS MediaGroup depends on its ability to manage these risks and capitalize on opportunities. Strategic planning, continuous monitoring, and proactive adaptation are essential for long-term success. The company's ability to maintain positive EBITDA margins and cash generation will be key indicators of its performance.

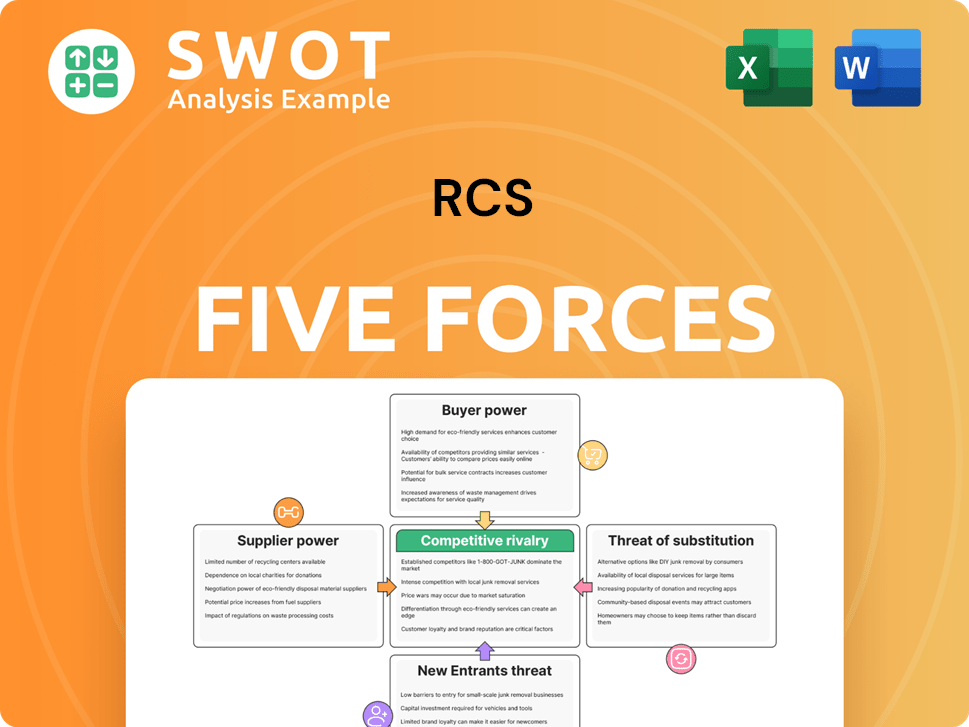

RCS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.