Republic Services Bundle

How Did Republic Services Become a Waste Management Giant?

Dive into the Republic Services SWOT Analysis and discover the fascinating story of Republic Services, a leading force in the waste management industry. From its inception in 1996 as a division within Republic Industries, the company has undergone a remarkable transformation. Explore the key milestones and strategic decisions that shaped Republic Services' journey to becoming a prominent player in environmental services.

Understanding the brief history of Republic Services provides crucial context for its current market position. Learn about the Republic Services founder and the early years, revealing the strategic vision that fueled its rapid growth through acquisitions. This exploration of Republic Services company timeline will highlight its impact on waste management and its commitment to environmental services.

What is the Republic Services Founding Story?

The story of Republic Services begins in 1996. It started as a waste management division within Republic Industries, a larger, diversified company. H. Wayne Huizenga, the driving force behind Republic Industries, spearheaded this initial venture into the waste management sector.

The early years of Republic Services were marked by rapid expansion. The company quickly identified the fragmented nature of the waste management industry as an opportunity. The initial business model focused on offering comprehensive waste collection, recycling, and disposal services to a wide range of customers.

A pivotal moment in the company's history was the spin-off from Republic Industries in 1998. This move led to an Initial Public Offering (IPO), transforming Republic Services into a standalone, publicly traded company. The company's headquarters are located in Phoenix, Arizona. This transition allowed Republic Services to focus solely on environmental services and accelerate its growth.

Here's a look at the key milestones in the Owners & Shareholders of Republic Services story.

- 1996: Republic Services is established as a waste management division under Republic Industries.

- 1998: Republic Services is spun off from Republic Industries and becomes a publicly traded company.

- Early 2000s: The company focuses on strategic acquisitions to expand its market presence.

- Present: Republic Services continues to be a leading provider of waste management and environmental services.

The early growth of Republic Services was significantly supported by the financial resources of its parent company, Republic Industries. The company's strategy centered on aggressive acquisitions. This approach allowed Republic Services to quickly consolidate its position in the waste management market.

By 2024, Republic Services had a significant presence in the waste management sector. The company's focus on environmental services and sustainability has become increasingly important. Republic Services continues to adapt and innovate within the industry.

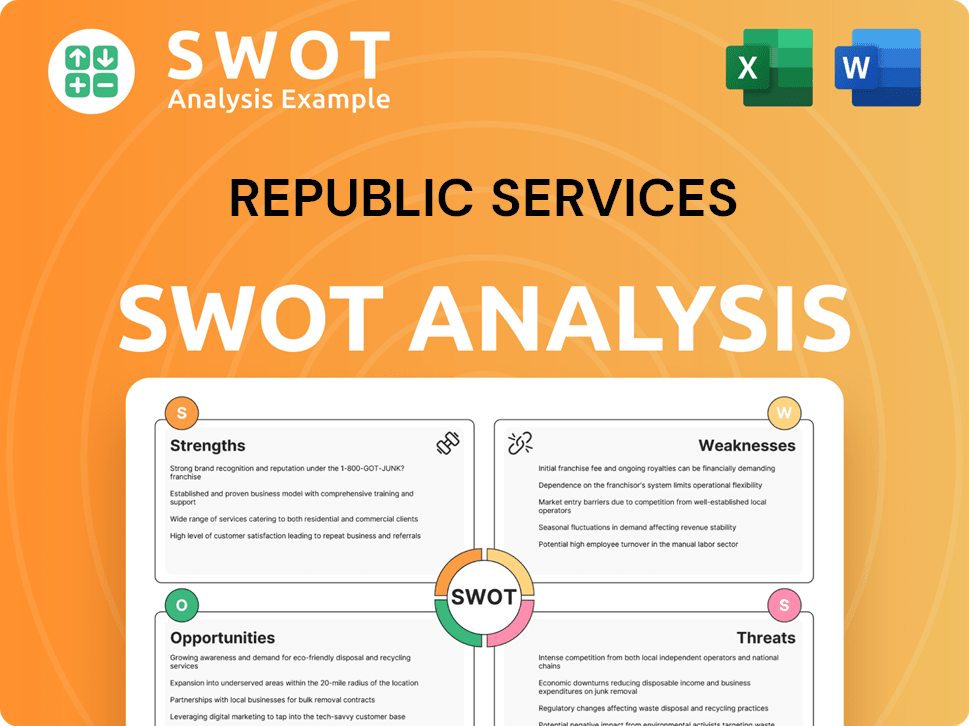

Republic Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Republic Services?

Following its 1998 IPO, the Republic Services company embarked on a period of significant early growth and expansion. This strategy involved both organic growth and strategic acquisitions to rapidly build its network and service offerings. A key element of its expansion was the merger with Allied Waste Industries in June 2008, a move that solidified its position in the waste management sector. The company's resilience was evident even during economic downturns, with subsequent recoveries marked by volume growth and improved margins.

Republic Services consistently broadened its service portfolio to include environmental solutions like non-hazardous solid waste collection, waste transfer, disposal, recycling, and energy services. The company focused on strategic 'tuck-in' acquisitions to enhance its existing business platform, particularly in recycling and hazardous waste disposal. For example, the 2022 acquisition of US Ecology significantly expanded its presence in the hazardous waste market, adding over $1 billion to its top line. In 2024, the company allocated $358 million towards strategic acquisitions and anticipates investing approximately $1 billion in further acquisitions in 2025.

Recent acquisitions in early 2025 include Shamrock Environmental, an industrial and wastewater company, and RecycleSource, a MRF operator and hauler in Pittsburgh, as well as Town & Country Sanitation and Peterson Sanitation in Wisconsin. These acquisitions have allowed Republic Services to expand its geographical reach and diversify its service offerings. This growth strategy is a key element in understanding the Competitors Landscape of Republic Services. The company's consistent financial performance, with revenue growing at a 12.38% CAGR and net income at 16.55% CAGR over the three years ending 2024, underscores its ability to consistently expand and generate increasing cash flow.

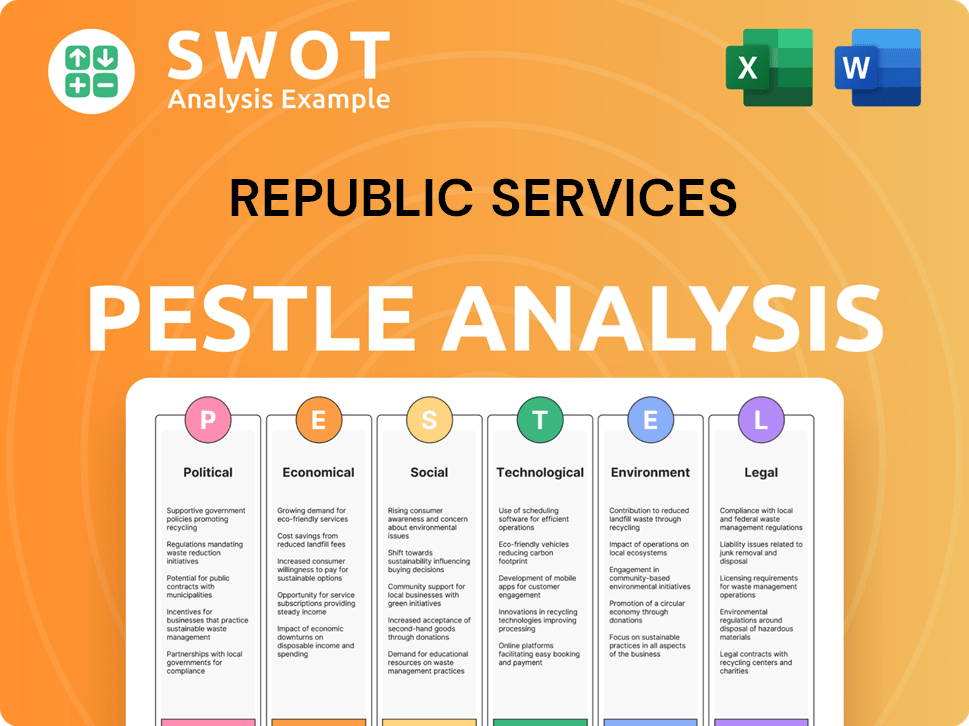

Republic Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Republic Services history?

The Republic Services company has a rich history, marked by significant milestones in the waste management and environmental services industries. From its early beginnings to its current status as a leading provider, the company has consistently adapted and evolved.

| Year | Milestone |

|---|---|

| Early Years | The company started with a focus on providing reliable garbage collection services. |

| 2008 | The merger with Allied Waste marked a significant expansion of the company's reach and capabilities. |

| 2024 | Republic Services invested $109 million in its Blue Polymers and Lightning Renewables joint ventures, demonstrating a commitment to sustainable practices. |

| 2025 | The company plans to spend $75 million on polymer centers, further advancing its recycling infrastructure. |

Republic Services has consistently embraced innovation to improve its services and reduce its environmental footprint. A key focus has been on integrating advanced recycling technologies and sustainable infrastructure.

Republic Services is electrifying its fleet, aiming to have over 150 electric collection vehicles by the end of 2025. This initiative supports the company's goal of reducing greenhouse gas emissions.

The company invests heavily in advanced recycling technologies to improve the efficiency and effectiveness of its recycling programs. These investments enhance the company's ability to process and recover valuable materials from the waste stream.

Republic Services is building sustainable infrastructure, including facilities with charging capabilities for electric vehicles. By the end of 2025, it plans to have more than 30 facilities equipped with charging capabilities.

Republic Services invested in Blue Polymers and Lightning Renewables joint ventures to foster sustainable practices. In 2024, the company allocated $109 million to these ventures.

The company is committed to reducing greenhouse gas emissions by 35% by 2030. This target underscores Republic Services' dedication to environmental stewardship.

Republic Services focuses on operational efficiency to manage costs and improve profitability. This includes optimizing routes, investing in technology, and streamlining processes.

Despite its successes, Republic Services has faced various challenges throughout its history. The economic downturn following the 2008 merger with Allied Waste presented difficulties, and more recent market conditions have also posed hurdles.

The economic recession after the 2008 merger with Allied Waste created a challenging operating environment. This period tested the company's resilience and strategic adaptability.

In Q4 2024, volumes were down 1.2% for the quarter and 1.1% for the full year, influenced by the shedding of certain residential contracts and softness in construction and manufacturing markets. In Q1 2025, volumes continued to be down 1.2%.

Severe weather conditions negatively impacted the business, with an estimated loss of $25 to $30 million in Q1 2025. These events underscore the importance of operational flexibility.

Republic Services consistently faces cost inflation, which it manages through strategic pricing and cost control measures. The company's ability to maintain profitability despite rising costs is a key strength.

Softness in construction and manufacturing markets has affected volume, requiring strategic adjustments. The company has adapted by focusing on high-return acquisitions and sustainability investments.

The net income margin expanded from 11.57% in 2023 to 12.74% in 2024, reflecting improved operational efficiency and cost control. This improvement demonstrates the company's financial resilience.

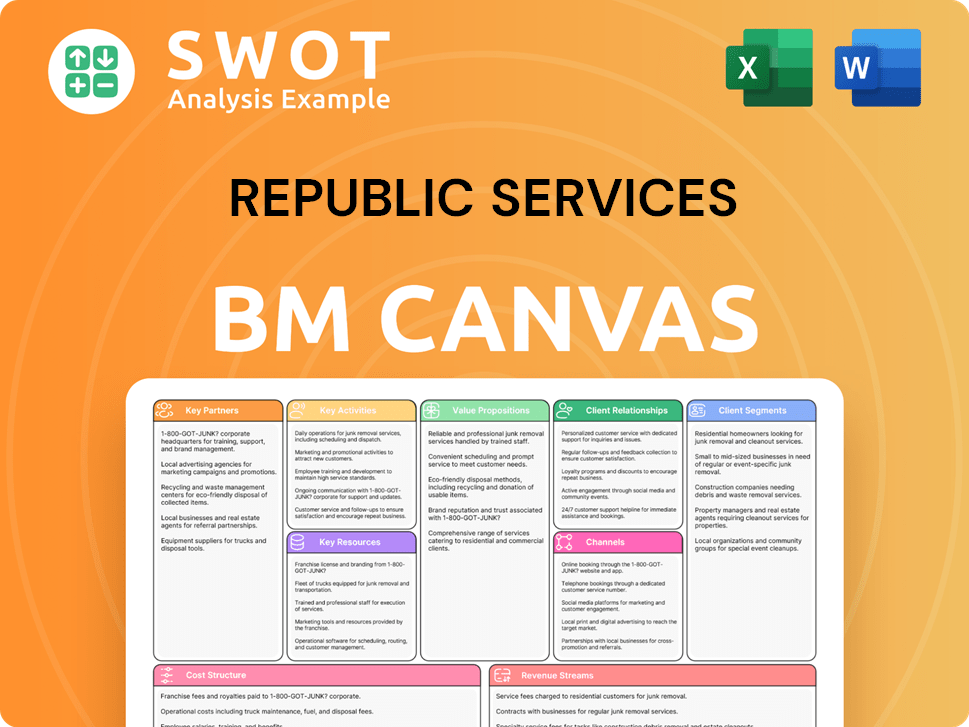

Republic Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Republic Services?

The brief history of Republic Services showcases its evolution from a waste management division to a leading environmental services company. The company's journey includes pivotal moments like its IPO in 1998, the merger with Allied Waste Industries in 2008, and the US Ecology acquisition in 2022, which significantly expanded its hazardous waste services. Recent financial performance highlights a strong revenue of $16.03 billion and a net income of $2.04 billion in 2024, with continued growth demonstrated in early 2025. Key milestones include strategic acquisitions such as Shamrock Environmental and RecycleSource in February 2025, and the expansion through the acquisition of Town & Country Sanitation and Peterson Sanitation in May 2025.

| Year | Key Event |

|---|---|

| 1996 | Republic Services begins as a waste management division within Republic Industries. |

| 1998 | Republic Services spins off from Republic Industries via an IPO, becoming a standalone public company. |

| 2008 | Republic Services merges with Allied Waste Industries, becoming the second-largest waste management company in the U.S. |

| 2022 | Acquisition of US Ecology significantly expands hazardous waste services. |

| 2024 | Reports full-year revenue of $16.03 billion and net income of $2.04 billion. Invests $109 million in Blue Polymers and Lightning Renewables joint ventures. |

| February 2025 | Acquires Shamrock Environmental and RecycleSource. Reports Q4 2024 revenue of $4.05 billion and net income of $512 million. |

| April 2025 | Reports Q1 2025 revenue of $4.01 billion and net income of $495 million. Named to Barron's 2025 100 Most Sustainable Companies List. |

| May 2025 | Acquires Town & Country Sanitation and Peterson Sanitation in Wisconsin. Announces plans to construct a new 105,000-square-foot recycling center in St. Louis. Joint venture with OPAL Fuels for an RNG facility in North Carolina announced, with construction underway. |

Republic Services is positioned for continued growth, with an estimated 9% growth in EPS projected for 2025. The company anticipates 2025 revenue to be in the range of $16.85 billion to $16.95 billion.

Adjusted EBITDA is projected between $5.275 billion and $5.325 billion for 2025. The company expects to invest approximately $1 billion in acquisitions in 2025, demonstrating its commitment to strategic expansion.

Strategic initiatives include investments in recycling technologies, with the Indianapolis polymer recycling facility starting commercial production by mid-2025, and the Blue Polymer facility in Buckeye, Arizona, projected for late 2025. Seven new renewable natural gas projects are expected to come online in 2025.

The company plans to have over 150 electric collection vehicles in its fleet by the end of 2025. Analyst consensus reflects a positive outlook, with average EPS estimates projecting growth to $6.89 for 2025, $7.64 in 2026, and reaching $10.00 by 2029.

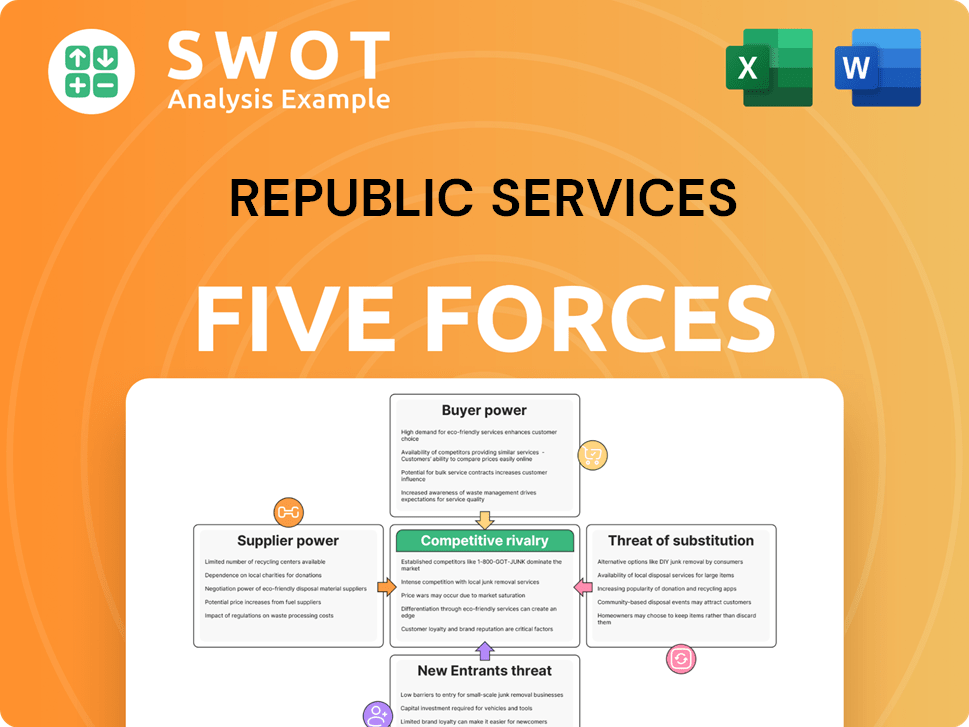

Republic Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Republic Services Company?

- What is Growth Strategy and Future Prospects of Republic Services Company?

- How Does Republic Services Company Work?

- What is Sales and Marketing Strategy of Republic Services Company?

- What is Brief History of Republic Services Company?

- Who Owns Republic Services Company?

- What is Customer Demographics and Target Market of Republic Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.