Republic Services Bundle

How Does Republic Services Thrive in the Waste Management Industry?

Republic Services stands as a giant in the U.S. environmental services sector, consistently demonstrating its financial strength and strategic prowess. With a remarkable $16.03 billion in revenue in 2024 and projections soaring to nearly $17 billion in 2025, the company's influence is undeniable. But what exactly fuels this impressive performance, and how does it maintain its leading position in the competitive world of Republic Services SWOT Analysis?

From trash collection to recycling services, Republic Services offers comprehensive solutions across over 40 states, serving a diverse customer base. Understanding the intricacies of its operations, from garbage disposal methods to its commitment to sustainability, is crucial for anyone looking to understand the future of environmental services. This deep dive will explore how Republic Services generates value, its strategic initiatives, and its competitive advantages in the ever-evolving landscape of waste management.

What Are the Key Operations Driving Republic Services’s Success?

Republic Services provides integrated environmental services, focusing on waste management solutions for a diverse customer base. Their core operations encompass the entire waste stream, from collection and garbage disposal to recycling and final disposal. This comprehensive approach allows them to offer reliable and efficient services to commercial, industrial, municipal, and residential clients.

The company's value proposition centers on providing dependable trash collection, recycling services, and disposal solutions. This includes a vast network of collection routes, transfer stations, and landfills. By owning key disposal assets, they gain a significant cost advantage over competitors, ensuring efficient operations and competitive pricing for services such as dumpster rental and bulk trash pickup.

Republic Services is committed to sustainability and innovation, with initiatives like renewable natural gas (RNG) projects and investments in electric vehicles. These efforts not only address environmental concerns but also create new revenue streams and enhance customer value through eco-friendly services.

Republic Services operates a vast network of collection routes, transfer stations, and landfills. This infrastructure is critical for managing the flow of waste. Their well-placed disposal assets provide a cost advantage, supporting efficient operations and competitive pricing for services.

The company invests in advanced recycling services infrastructure, including polymer centers. They are also focused on sustainability initiatives, such as electric vehicles and renewable natural gas projects. These efforts enhance their environmental profile and create new revenue streams.

Republic Services leverages technology to improve operational efficiency. Digital tools like MPower are used to enhance productivity and reduce costs. The RISE digital platform also contributes to revenue growth, improving overall service delivery.

They offer a range of services catering to both residential and commercial clients, including Republic Services residential services and Republic Services commercial waste disposal options. Customer convenience is enhanced through online tools such as Republic Services online bill pay and resources like Republic Services recycling guidelines.

Republic Services' operations are marked by strategic investments and partnerships aimed at enhancing efficiency and sustainability. They focus on integrating technology and expanding their renewable energy projects to drive both environmental and economic benefits. For more insights, see Growth Strategy of Republic Services.

- The Indianapolis polymer center is expected to start commercial production by mid-2025.

- They plan to have over 150 electric vehicles by the end of 2025.

- MPower is targeted to achieve $20 million in annual cost savings by the end of 2025.

- They are developing renewable natural gas (RNG) facilities in partnership with OPAL Fuels.

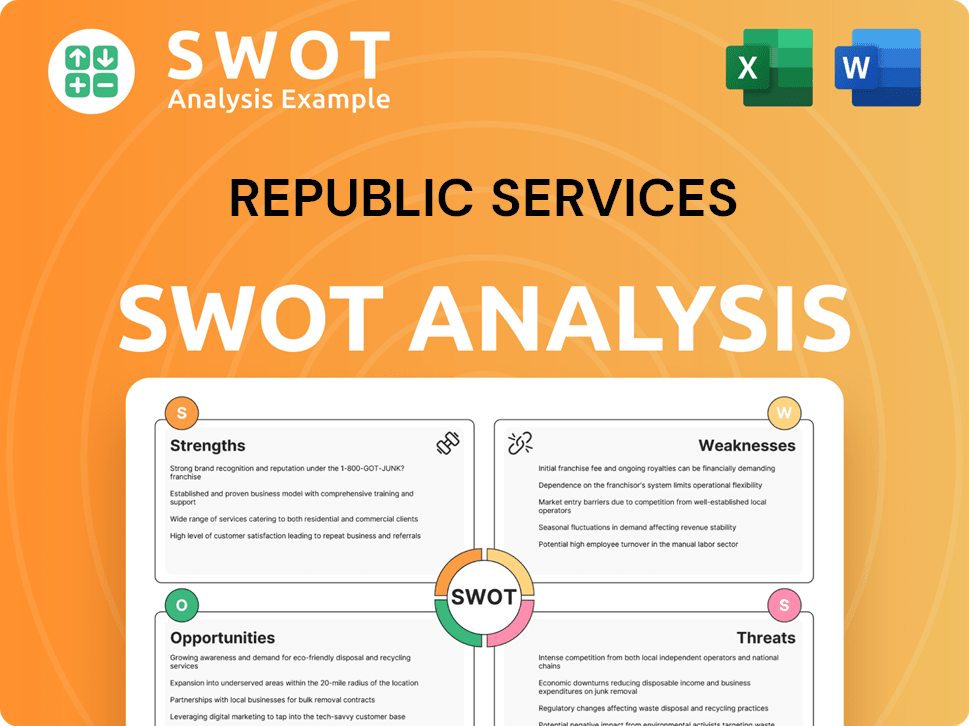

Republic Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Republic Services Make Money?

The core of [Company Name]'s business revolves around providing comprehensive environmental services. Its revenue streams are diverse, encompassing various aspects of waste management and resource recovery. The company strategically leverages its assets and expertise to generate income from multiple sources, ensuring a resilient financial model.

Key revenue streams include residential, commercial, and industrial waste collection, along with landfill fees and recycling services. This diversified approach allows [Company Name] to cater to a broad customer base and adapt to changing market demands. The company also focuses on innovative strategies to enhance profitability and sustainability.

For the full year 2024, [Company Name] reported a total revenue of $16.03 billion, marking a 7.1% increase compared to 2023. In the first quarter of 2025, total revenue reached $4.009 billion, reflecting a 3.8% increase from the same period in 2024. Organic growth contributed 2.9% to this Q1 2025 revenue increase, with acquisitions adding 0.9%. Core price on total revenue increased revenue by 6.1% in Q1 2025, and average yield on total revenue was 4.5%.

Beyond traditional waste management, [Company Name] employs several innovative strategies to boost revenue. These include strategic investments in renewable energy and digital platforms. The company's forward-thinking approach not only drives financial growth but also supports environmental sustainability. To learn more about the consumers, read about the Target Market of Republic Services.

- Leveraging extensive landfill ownership to charge tipping fees, even to competitors, is a key strategy.

- Sustainability recycling adjustment fees contribute to revenue.

- Strategic investments in renewable energy projects, such as landfill gas-to-energy and renewable natural gas (RNG) facilities, generate new revenue streams.

- Advanced polymer recycling centers are expected to significantly contribute to future earnings and free cash flow growth.

- Digital platforms, like RISE, contribute to incremental revenue.

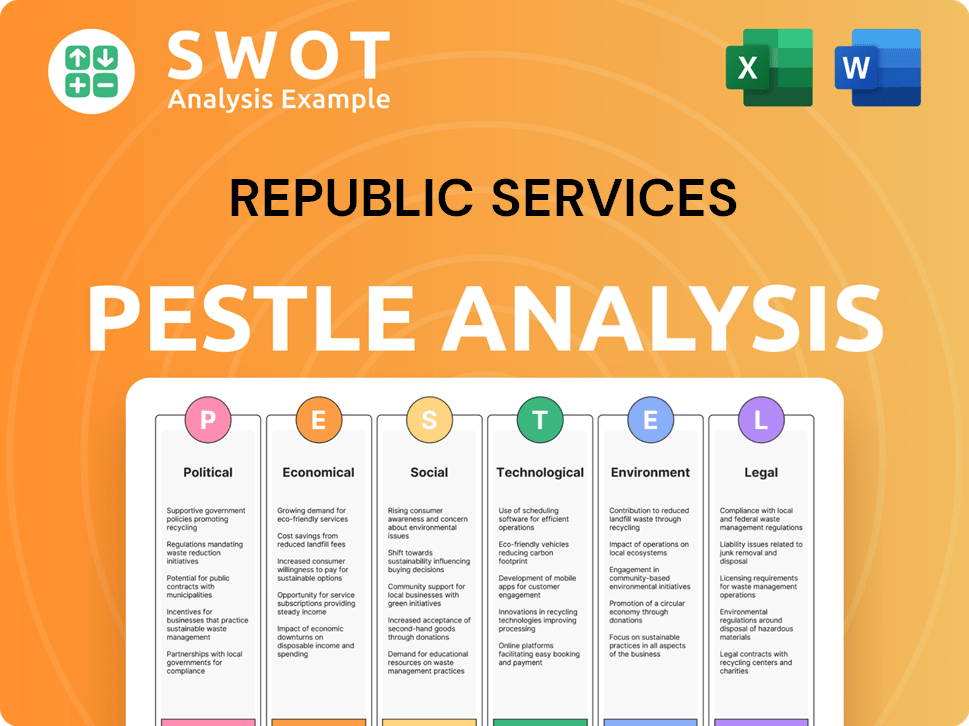

Republic Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Republic Services’s Business Model?

Republic Services has a history marked by significant milestones and strategic maneuvers that have reshaped its operations and financial performance. The 2008 merger with Allied Waste was a pivotal moment, establishing the company as the second-largest waste management firm in the U.S. This strategic consolidation set the stage for future growth and expansion within the waste management and environmental services sector.

More recently, the acquisition of US Ecology in 2022 significantly broadened Republic's reach in the hazardous waste market, adding over $1 billion to its top line. This move underscores the company's commitment to expanding its service offerings and market presence. The company is actively pursuing tuck-in acquisitions, with plans to invest approximately $1 billion in mergers and acquisitions (M&A) in 2025. This includes deals like Shamrock Environmental and RecycleSource, which enhance its capabilities in industrial and wastewater services, as well as material recovery facility (MRF) operations.

Operational challenges include volume declines in sectors like construction and manufacturing, and disruptions caused by weather. To counter these, Republic Services has focused on disciplined pricing strategies, which have exceeded cost inflation, and enhanced operational efficiencies through digital tools. Its customer retention rate remains strong at over 94%, indicating effective service delivery and customer loyalty. For those seeking information, the competitive landscape of Republic Services provides further insights.

The merger with Allied Waste in 2008 was a major milestone, making it a leading player in the waste management industry. The acquisition of US Ecology in 2022 expanded its footprint in the hazardous waste market. Ongoing investments in tuck-in acquisitions, with a planned $1 billion for M&A in 2025, are a key part of their strategy.

Focus on disciplined pricing strategies to offset cost inflation. Implementing digital tools to improve operational efficiencies. Strong customer retention rate of over 94% demonstrates effective service and customer loyalty. Investing in sustainability initiatives, including electric vehicles and renewable natural gas projects.

Intangible assets like regulatory permits for landfills provide a significant advantage. Cost advantages from route density and ownership of strategic disposal assets. Ability to raise core prices on acquired volumes supports margin expansion. Proactive investments in sustainability align with environmental mandates and customer expectations.

Continued focus on strategic acquisitions to expand service offerings. Further enhancements to operational efficiencies through technology. Increased investment in sustainability initiatives to meet evolving environmental standards. Maintaining strong customer relationships and high retention rates.

Republic Services' competitive advantages stem from its intangible assets, such as permits for landfills, and significant cost advantages derived from route density and ownership of disposal assets. The ability to raise core prices on acquired volumes further supports margin expansion. The company's investments in sustainability, including electric vehicle fleets and renewable natural gas projects, also provide a competitive edge.

- Regulatory Permits: Possession of permits for landfills.

- Cost Advantages: Route density and ownership of disposal assets.

- Pricing Power: Ability to raise core prices on acquired volumes.

- Sustainability: Investments in electric vehicles and renewable natural gas.

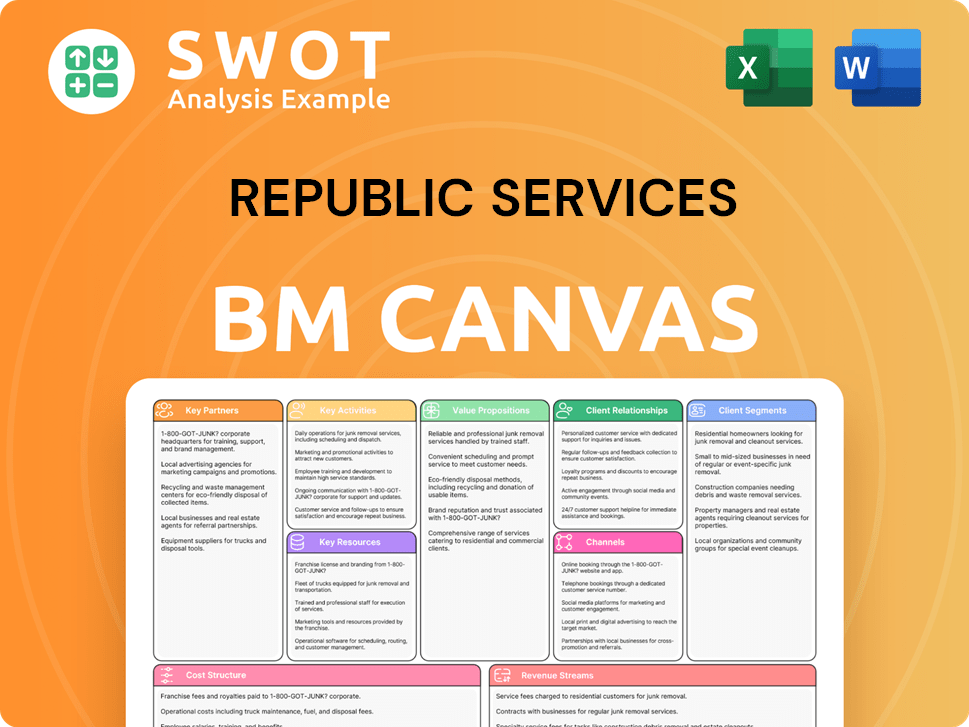

Republic Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Republic Services Positioning Itself for Continued Success?

In the U.S. environmental services sector, Republic Services holds a strong market position. It consistently ranks behind Waste Management Inc. The company's control over the waste stream is significant, thanks to its extensive landfill ownership and integrated waste hauling network. Furthermore, customer loyalty is high, with a retention rate exceeding 94%.

Key risks include potential softness in sectors like construction and manufacturing, inflationary pressures, and volatility in recycled commodity prices. Weather disruptions and regulatory changes also pose challenges. However, Republic Services actively invests in innovation to mitigate these risks, focusing on profitable growth, sustainability, and digital transformation.

For the full year 2025, revenue is projected to be between $16.85 billion and $16.95 billion. Adjusted EBITDA is expected in the range of $5.275 billion to $5.325 billion. The company plans to invest approximately $1 billion in acquisitions, targeting high-margin areas like hazardous waste and recycling.

The company is focused on profitable growth, sustainability, and digital transformation. Innovation includes expanding its electric vehicle fleet to over 150 by the end of 2025. Seven new renewable natural gas projects are planned to come online in 2025, with commercial production at the Indianapolis polymer recycling facility expected by mid-2025.

Republic Services aims to sustain and expand its profits through pricing ahead of cost inflation. It also aims to capitalize on value-creating acquisition opportunities. The company's financial resilience and focus on sustainability are expected to drive long-term profitability.

- Continued strategic initiatives focused on profitable growth.

- Expansion of electric vehicle fleet.

- Development of renewable natural gas projects.

- Commercial production at the Indianapolis polymer recycling facility.

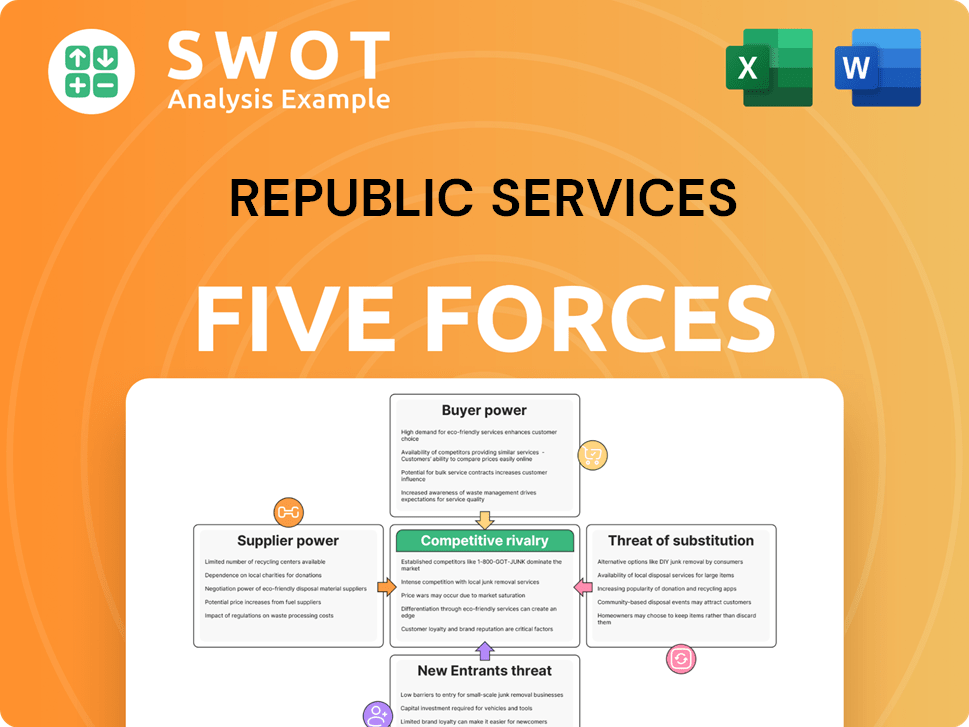

Republic Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Republic Services Company?

- What is Competitive Landscape of Republic Services Company?

- What is Growth Strategy and Future Prospects of Republic Services Company?

- What is Sales and Marketing Strategy of Republic Services Company?

- What is Brief History of Republic Services Company?

- Who Owns Republic Services Company?

- What is Customer Demographics and Target Market of Republic Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.