Republic Services Bundle

Who Really Controls Republic Services?

Ever wondered who pulls the strings at a leading Republic Services SWOT Analysis? Understanding Republic Services ownership is key to unlocking its future. This waste management company is more than just trash trucks; it's a complex entity shaped by its owners. Knowing who owns Republic Services is crucial for any investor or stakeholder.

This exploration into Republic Services ownership will help you understand its strategic direction and financial performance. We'll uncover the major shareholders, explore the company's history, and examine how the ownership structure influences its decisions. Whether you're tracking the Republic Services stock or evaluating the company's long-term potential, this analysis provides essential insights. This deep dive will help you to understand the Republic Services company profile.

Who Founded Republic Services?

The formation of Republic Services, a prominent waste management company, in 1998, stemmed from a spin-off from Republic Industries Inc. H. Wayne Huizenga, the founder of Republic Industries, played a pivotal role in its expansion into various sectors, including environmental services. However, the specifics of the initial equity split among founders or key executives at the inception of Republic Services are not publicly available.

The spin-off essentially distributed shares of the new Republic Services to the existing shareholders of Republic Industries. This meant that early Republic Services ownership was primarily held by those who already owned stock in Republic Industries. This group included a mix of institutional and individual investors.

The structure of Republic Services' early ownership was more of a corporate realignment than a traditional startup with a small group of initial investors. The arrangements were governed by the spin-off terms, ensuring a smooth transition of ownership and operational control from the parent company to the newly independent entity. The company's history is detailed in various financial reports and company profiles.

Early ownership of Republic Services was primarily determined by the distribution of shares to Republic Industries shareholders during the 1998 spin-off. This process involved a wide array of investors, including institutional and individual shareholders. The company's structure was a corporate realignment rather than a traditional startup.

- The spin-off distributed shares to existing Republic Industries shareholders.

- Early ownership included institutional and individual investors.

- The focus was on a smooth transition of ownership and control.

- The company's operations have grown significantly since its inception.

Republic Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Republic Services’s Ownership Changed Over Time?

The ownership structure of Republic Services has changed considerably since its initial public offering (IPO) in 1998. Initially, the company's shares were distributed to the public, but over time, institutional investors have accumulated a significant portion of the outstanding stock. This shift reflects the company's growth and its inclusion in various investment indices, making it an attractive holding for large investment firms. Republic Services, a prominent waste management company, is now largely owned by institutional investors, which impacts its strategic direction and governance.

As of early 2025, Republic Services is a publicly traded company, with major stakeholders primarily comprising institutional investors. These include mutual funds, index funds, and asset management firms that manage substantial portfolios. These entities hold significant percentages of Republic Services' shares, demonstrating their confidence in the company's long-term prospects. The ownership structure influences the company's strategic decisions and its responsiveness to market dynamics.

| Key Events | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Shares distributed to the public, establishing a public ownership structure. | 1998 |

| Accumulation by Institutional Investors | Gradual increase in holdings by mutual funds, index funds, and asset management firms. | Ongoing |

| Index Inclusion | Inclusion in major market indices attracts passive investment, further concentrating ownership among institutional investors. | Ongoing |

The substantial ownership by institutional investors means that a significant portion of Republic Services' stock is held on behalf of individual investors through their retirement accounts and other investment vehicles. As of March 31, 2025, top institutional holders included The Vanguard Group, holding approximately 9.39% of the shares, and BlackRock Inc., with around 8.44%. These holdings represent considerable voting power in shareholder matters, influencing company strategy and governance. The concentration of ownership among these large institutional investors highlights the importance of their investment decisions on the company's performance and market perception. Changes in their holdings can influence stock performance and provide insights into market sentiment towards the company. For instance, as of Q1 2025, State Street Corp. also held a significant stake, reflecting the widespread institutional interest in Republic Services stock.

Republic Services' ownership is primarily held by institutional investors, making it a widely held public company.

- The Vanguard Group and BlackRock Inc. are among the top institutional holders.

- Institutional investors influence company strategy and governance.

- Changes in institutional holdings can impact stock performance.

- Understanding the ownership structure is key for investors.

Republic Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Republic Services’s Board?

The Board of Directors of Republic Services, a leading waste management company, comprises individuals with varied expertise. As of early 2025, the board includes a blend of independent directors and executive leadership. These board members are primarily focused on their fiduciary duty to all shareholders. Understanding the structure of Republic Services ownership is key to grasping its governance.

The voting structure for Republic Services common stock is typically one-share-one-vote. This means each share of common stock gives its holder one vote on shareholder matters. There are no indications of special voting rights that would give any individual or entity outsized control. The board's decisions align with the interests of its broad shareholder base, emphasizing sustainable growth and operational efficiency within the environmental services sector. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Republic Services.

| Board Member | Title | Year Joined |

|---|---|---|

| Jon Vander Ark | President and CEO | 2021 |

| Manuel Kadre | Lead Independent Director | 2016 |

| Mary K. Bush | Independent Director | 2014 |

The current board members are elected by a majority of votes cast by shareholders. Institutional investors hold considerable voting power due to their large shareholdings. There have been no significant proxy battles or activist investor campaigns that have substantially challenged the company's governance in recent years. As of December 31, 2024, the company's market capitalization was approximately $66.8 billion, reflecting its strong position in the environmental services market. The Republic Services stock symbol is RSG.

The Board of Directors oversees Republic Services, ensuring alignment with shareholder interests.

- The voting structure is one-share-one-vote.

- Institutional investors hold substantial voting power.

- The board focuses on sustainable growth and operational efficiency.

- The company's market capitalization reflects its strong market position.

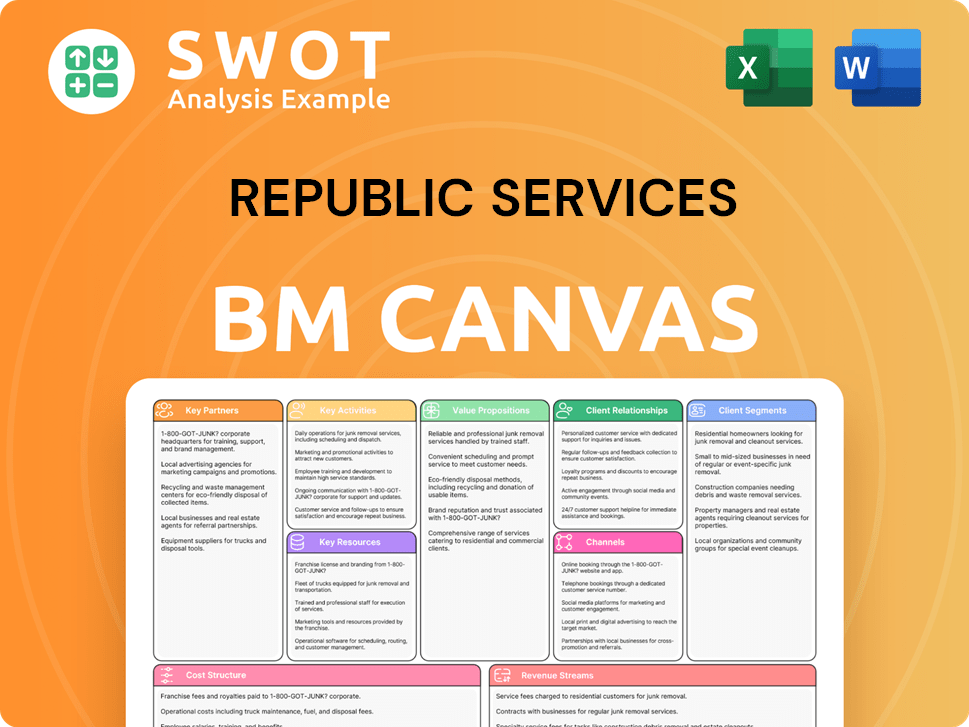

Republic Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Republic Services’s Ownership Landscape?

Over the past 3-5 years (2022-2025), the ownership structure of Republic Services has remained relatively stable, with a strong presence of institutional investors. Major shifts in ownership, such as significant share buybacks or secondary offerings, have not been prominent. The company has focused on strategic acquisitions to expand its operational capabilities and service offerings. For example, Republic Services acquired US Ecology, Inc. in 2022 for about $2.2 billion, enhancing its environmental solutions, particularly in hazardous waste services. These acquisitions are typically financed through a combination of cash, debt, and sometimes equity, which can slightly impact ownership through new share issuance, although significant dilution has not been a reported trend.

The waste management sector continues to attract interest from institutional investors due to its stable nature. While founder dilution is a natural occurrence for established public companies, the focus remains on consistent financial performance and dividend payouts, which appeal to large institutional holders. There have been no public statements indicating a potential privatization or a significant change in its public listing status. The company's strategy centers on organic growth, strategic acquisitions, and improving shareholder value through operational excellence and sustainability initiatives. The trend of increasing institutional ownership in large-cap companies aligns with Republic Services' ownership profile, reflecting confidence in its long-term stability and market position.

| Metric | Value | Year |

|---|---|---|

| Market Capitalization | Approximately $60 billion | 2024 |

| Revenue (Annual) | Over $14 billion | 2023 |

| Institutional Ownership | Over 80% | 2024 |

The consistent performance of the Waste management company, along with its strategic acquisitions, like the US Ecology deal, continues to solidify its position in the market. The focus on sustainability and operational excellence is a key driver for attracting and retaining investors. To learn more about the company's strategic approach, consider reading about the Marketing Strategy of Republic Services.

Republic Services ownership is largely institutional. This indicates strong investor confidence.

The US Ecology acquisition in 2022 expanded the company's environmental services portfolio.

The company consistently generates strong revenue and maintains a high market capitalization.

Republic Services is expected to continue its focus on strategic growth and shareholder value.

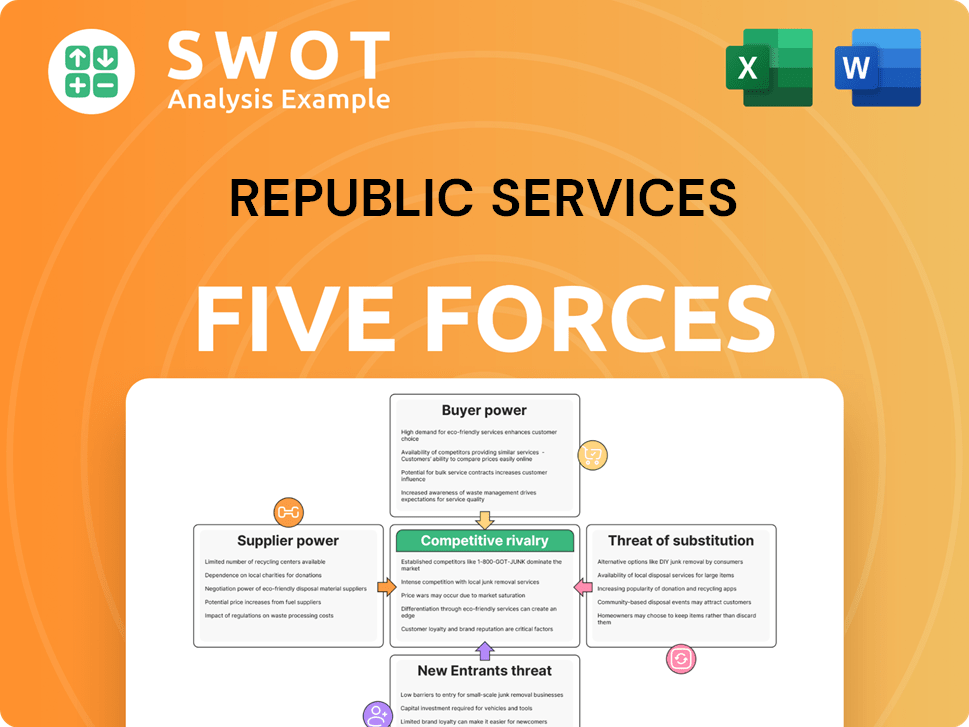

Republic Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Republic Services Company?

- What is Competitive Landscape of Republic Services Company?

- What is Growth Strategy and Future Prospects of Republic Services Company?

- How Does Republic Services Company Work?

- What is Sales and Marketing Strategy of Republic Services Company?

- What is Brief History of Republic Services Company?

- What is Customer Demographics and Target Market of Republic Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.