Samyang Bundle

How Did Samyang Company Rise to Global Prominence?

Delve into the captivating Samyang SWOT Analysis and uncover the remarkable journey of Samyang Company, a South Korean powerhouse that has captivated the Korean food industry and beyond. From its humble beginnings in 1924 as an agricultural venture, Samyang has transformed into a diversified conglomerate. Discover the pivotal moments that shaped Samyang's history and its evolution into a global brand.

The brief history of Samyang Company reveals a story of resilience and innovation. Founded by Kim Yeon-su, Samyang's early focus on contributing to Korea's economic development set the stage for its future success. Today, the Samyang Group's diverse portfolio, including its famous ramen, showcases its ability to adapt and thrive in a competitive global market. Explore how Samyang Company navigated challenges and expanded its influence, leaving a lasting impact on the instant noodle market and beyond.

What is the Samyang Founding Story?

The story of the Samyang Company begins in October 1924, when Sudang Kim Yeon-su laid the foundation with the establishment of Samsu Company. This marked the start of what would evolve into a significant player in the Korean food industry. Kim Yeon-su, a graduate of Kyoto University College of Economics, set out to cultivate national capital during a challenging period under Japanese colonial rule.

Kim's vision led to the transformation of Samsu Company into Samyang Corporation in 1931, and later, into a joint-stock company by 1934. This strategic move was pivotal in the company's growth. The company's early ventures included managing family-owned farms, such as Jangseong Farm, which played a crucial role in its initial business model.

The company's expansion included venturing into Manchuria in 1939, making it the first Korean business to enter an overseas market. Kim Yeon-su also established the Yang Young Foundation in 1939, highlighting the company's commitment to social responsibility. The Samyang philosophical motto, 'Be humble to foster blessings, be generous to raise spirits, and refrain from wasting to build wealth,' has been the company motto since 1931, guiding its corporate philosophy.

Samyang Company's roots trace back to 1924 with the establishment of Samsu Company by Sudang Kim Yeon-su. The company's initial focus was on cultivating national capital under challenging circumstances.

- Kim Yeon-su, a graduate of Kyoto University, spearheaded the company's early ventures.

- The company's business model initially involved managing family-owned farms.

- In 1931, the company was renamed Samyang Corporation, and it became a joint-stock company in 1934.

- Samyang expanded to Manchuria in 1939, becoming the first Korean business to enter an overseas market.

For more insights into the Revenue Streams & Business Model of Samyang, explore the company's financial strategies and product innovations.

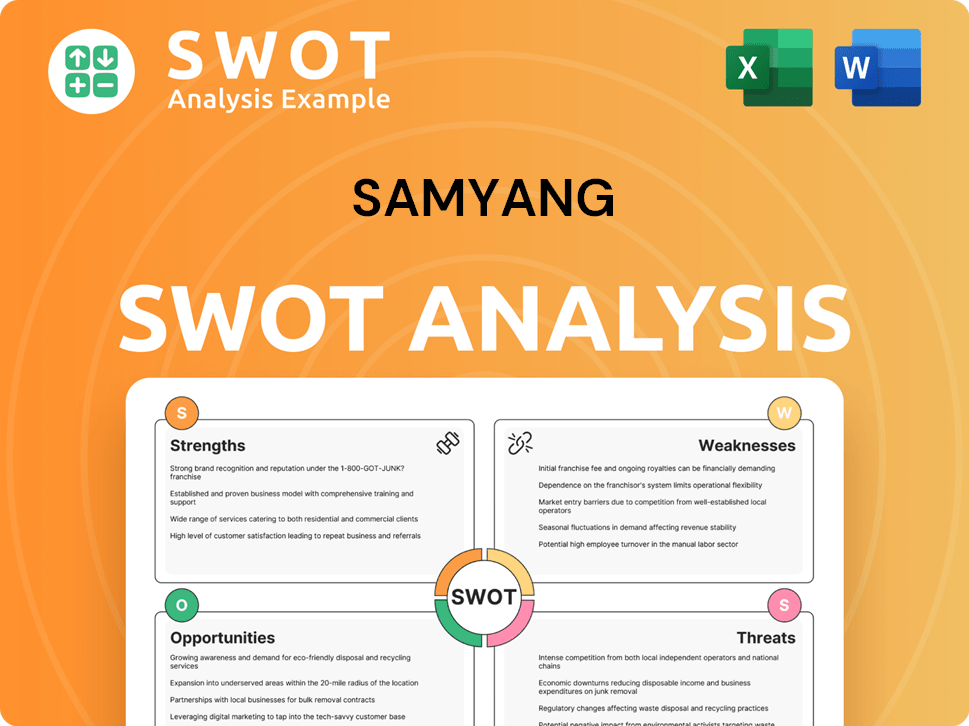

Samyang SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Samyang?

The early years of the Samyang Company saw significant diversification and expansion beyond its initial agricultural focus. This period was marked by strategic investments and acquisitions that solidified its presence in key sectors. The company's commitment to growth and innovation laid the groundwork for its future success in the Korean food industry and beyond.

Following the Korean War, the company expanded beyond agriculture. In 1953, it established Samyang Trading and Seonam Fisheries. This diversification was a crucial step in its early growth. The establishment of a sugar mill in 1955 marked the beginning of sugar production.

A pivotal moment was the integration of Samyang Corporation and Samyang Trading in 1956. This consolidation strengthened the company's foundation. This integration was key to establishing the modern Samyang Corporation. The company continued to build on this solid base.

Samyang entered the textile business with the establishment of Samyang Mobang in 1963. The completion of the Yeonji-dong building in 1975 signaled a shift to a second-generation management system. Further diversification occurred in 1977 with the acquisition of Icheon Heavy Industries, expanding into the machinery business.

In 1984, Samyang entered the starch sweetener business by acquiring Seonil Glucose. The establishment of Samnam Petrochemical in 1988, through a joint venture, further expanded its portfolio. The acquisition of Shinhan Flour Mills in the same year, later renamed Samyang Milmax, solidified its position in food ingredients.

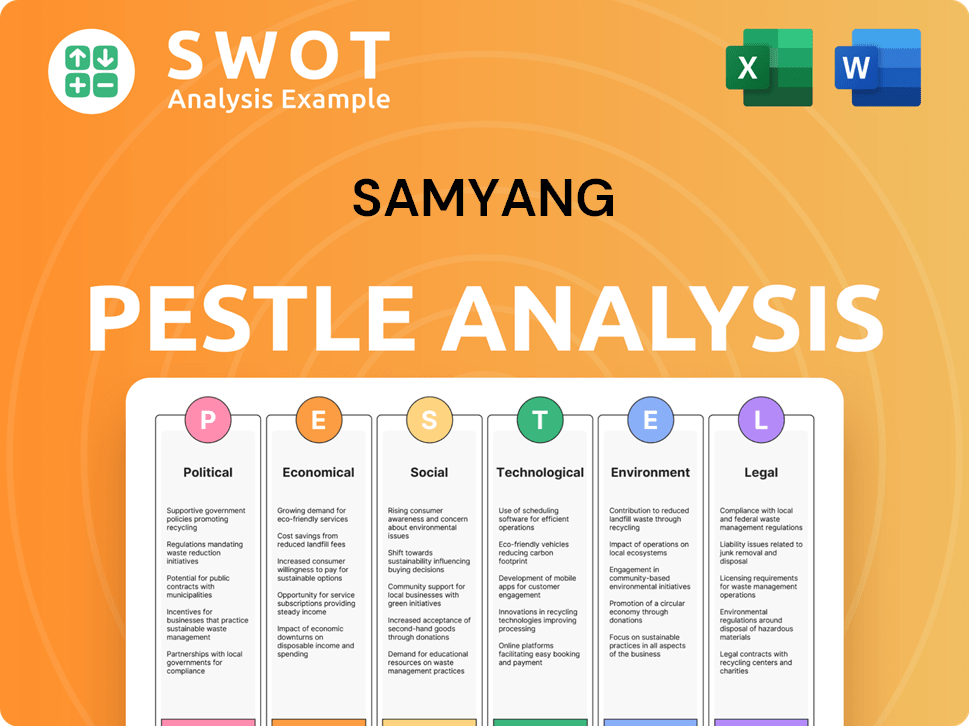

Samyang PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Samyang history?

The Samyang Company has a rich history marked by several key milestones, including significant expansions and strategic pivots. The company's journey showcases its adaptability and commitment to innovation within the Korean food industry and beyond. The Samyang Group has consistently aimed to broaden its market presence and product offerings.

| Year | Milestone |

|---|---|

| 2016 | Development of proprietary enzyme-based production technology for liquid allulose, a nearly zero-calorie sweetener, was a key innovation. |

| 2017 | Allulose was approved by the FDA as Generally Recognized as Safe (GRAS), marking a significant regulatory achievement. |

| 2020 | Commercial production of allulose commenced, showcasing the company's move into large-scale production. |

| 2023 | Samyang Holdings acquired Verdant Specialty Solutions, expanding its international footprint in the specialty chemicals sector. |

| 2024 | Completed construction of South Korea's largest specialty food ingredient production facility in Ulsan, enhancing production capabilities. |

| 2024 | Achieved the first novel food approval for allulose in Australia and New Zealand, broadening its market reach. |

Innovation has been central to the Samyang Company's strategy, particularly in food and chemical sectors. The development of allulose and advancements in engineering plastics highlight its commitment to R&D.

The company's development of enzyme-based production for liquid allulose in 2016, a nearly zero-calorie sweetener, was a major innovation. This technology has positioned Samyang as a leader in healthier food ingredients.

Samyang has consistently invested in R&D for engineering plastics, ion exchange resins, and industrial fibers. These advancements have led to significant progress in materials used in displays and semiconductors.

The completion of South Korea's largest specialty food ingredient production facility in Ulsan in 2024 demonstrates its dedication to scaling up production capabilities. This facility supports the growing demand for innovative food ingredients.

The approval of allulose as a novel food in Australia and New Zealand in 2024 is a testament to Samyang's ability to navigate regulatory landscapes. This approval opens up new markets for its products.

Samyang has faced various challenges throughout its history, including the 'industrial oil scandal' in 1989, which impacted public perception. Despite these setbacks, the company has demonstrated resilience and adapted to market changes.

The 'industrial oil scandal' of November 1989 affected public trust, posing a significant challenge to the company's reputation. Samyang responded by focusing on rebuilding trust and repositioning its brand.

The company has consistently adapted to market demands, as seen in its strategic shift towards businesses 'indispensable to our lives.' This adaptability has been crucial for its long-term survival.

The Korean food industry is highly competitive, requiring Samyang to continuously innovate and improve its products. This competition drives the company to seek new opportunities and markets.

Maintaining a positive brand image is essential, especially after past challenges. Samyang focuses on transparency and quality to build and maintain consumer trust.

Navigating regulatory landscapes, such as obtaining approvals for new food ingredients, is a constant challenge. Samyang must stay compliant with evolving regulations to expand its product offerings.

Economic downturns and fluctuations in raw material costs can impact Samyang's profitability. Strategic planning and diversification are essential to mitigate these risks.

For more information on the company's strategic approaches, consider reading about the Marketing Strategy of Samyang.

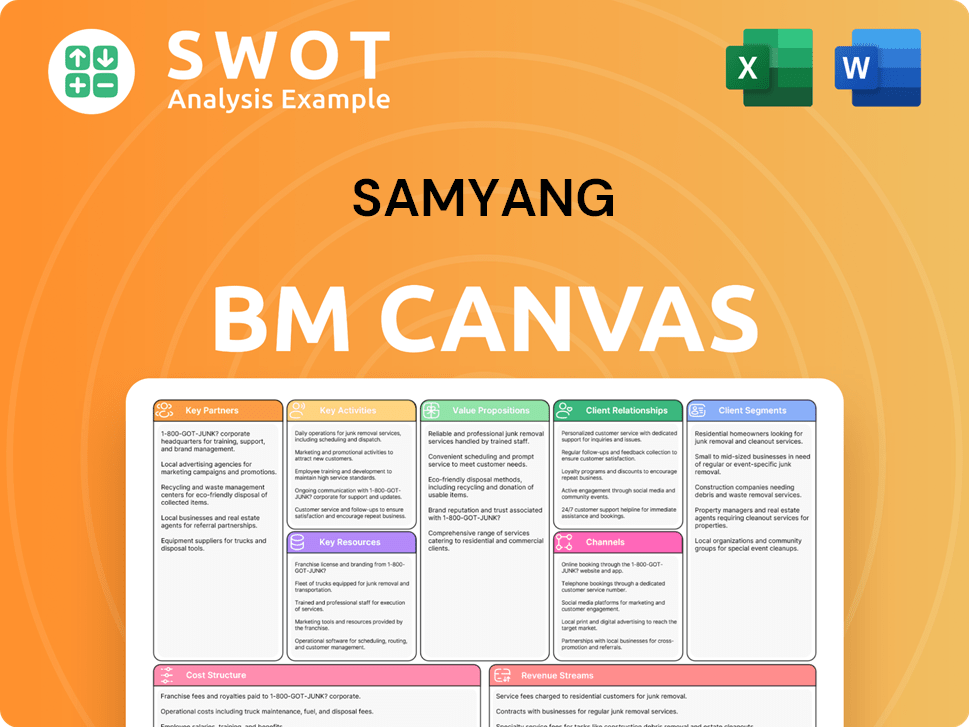

Samyang Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Samyang?

The Samyang Company's journey began in 1924 with the establishment of Samsu Company and Jangseong Farm, evolving significantly over the years. It later became Samyang Corporation and expanded into various sectors, including food, chemicals, and pharmaceuticals. The company's history is marked by innovation, such as the introduction of 'Samyang Sugar' in 1956 and the establishment of the Samyang Research Center in 1979, which propelled its growth in the Korean food industry and beyond. Samyang has consistently adapted and expanded, making it a significant player in the global market.

| Year | Key Event |

|---|---|

| 1924 | Sudang Kim Yeon-su establishes Samsu Company and Jangseong Farm. |

| 1931 | The company is renamed Samyang Corporation. |

| 1939 | Establishes Korea's first private scholarship foundation, Yang Young Foundation. |

| 1955 | Begins food business with the completion of the Ulsan sugar refining plant. |

| 1956 | 'Samyang Sugar' is launched. |

| 1963 | Establishes Samyang Woolen Spinning Co. |

| 1979 | Samyang Research Center is inaugurated. |

| 1984 | Enters starch sweetener business by acquiring Sunil Glucose. |

| 1988 | Establishes Samnam Petrochemical and acquires Shinhan Flour Mills. |

| 1993 | Opens Samyang Group R&D Center in Daedeok. |

| 2002 | Launches food family brand Q.one. |

| 2011 | Samyang Holdings is formed as a holding company. |

| 2014 | Samyang Corporation, Samyang Milmax, and Samyang Wellfood merge. |

| 2016 | Launches Allulose; Samyang Discovery Center completed. |

| 2023 | Acquires Verdant Specialty Solutions, an American specialty chemicals provider. |

| 2024 | Completes construction of South Korea's largest allulose production facility. |

| 2025 (Q1) | Samyang Holdings Corporation reports sales of KRW 865,935.91 million and a net income of KRW 24,860.35 million. |

Samyang Group is focused on its 'Vision 2025', aiming to become a global leader in health and wellness materials solutions and advanced industrial fields. This strategy emphasizes expansion through mergers and acquisitions (M&A), corporate venture capital (CVC) investments, and strategic partnerships. The company intends to leverage its technological capabilities and R&D to develop innovative products and services, driving future growth.

Samyang Corporation is actively participating in international exhibitions, such as IFIA Japan and IFT 2025 in the USA, to boost its global sales. Samyang Foods is also expanding into the wellness and healthcare sector, extending its product range beyond ramen to include sauces, snacks, ready-to-eat meals, beverages, and new healthcare products. This strategic diversification supports its global ambitions.

In Q1 2025, Samyang Holdings Corporation reported robust financial results, with sales reaching KRW 865,935.91 million and a net income of KRW 24,860.35 million. These figures demonstrate the company's strong performance and its ability to maintain profitability. These results reflect the ongoing success of Samyang Group's strategic initiatives and market position.

The completion of South Korea's largest allulose production facility in 2024 underscores Samyang's commitment to innovation. The company's focus on developing new products and services, alongside its expansion in the wellness and healthcare sectors, highlights its adaptability. This commitment to innovation is key to its future success.

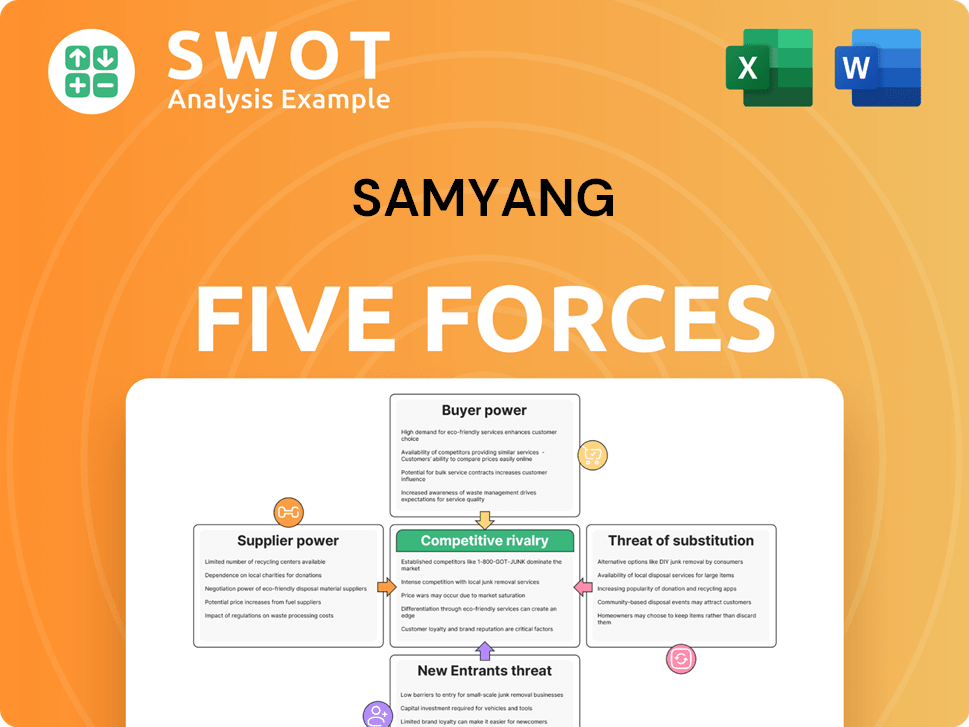

Samyang Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Samyang Company?

- What is Growth Strategy and Future Prospects of Samyang Company?

- How Does Samyang Company Work?

- What is Sales and Marketing Strategy of Samyang Company?

- What is Brief History of Samyang Company?

- Who Owns Samyang Company?

- What is Customer Demographics and Target Market of Samyang Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.