Samyang Bundle

Can Samyang Company Maintain Its Century-Long Growth Trajectory?

Founded in 1924, Samyang Company has evolved from a textile and sugar producer into a diversified conglomerate with a significant global presence. This transformation showcases the power of strategic adaptation and a commitment to industrial development. Today, Samyang operates across food, chemicals, packaging, and IT, a testament to its enduring vision.

To understand Samyang's future, we must examine its core Samyang SWOT Analysis. This article dives deep into Samyang's growth strategy, exploring market expansion, innovation, and operational planning. We'll analyze Samyang's business model and future prospects, considering its market share and financial performance to provide a comprehensive Samyang company analysis. Expect insights into Samyang's revenue growth drivers and how it navigates challenges like inflation and supply chain disruptions, all while aiming to answer: what are Samyang's future plans?

How Is Samyang Expanding Its Reach?

The company is actively pursuing multi-pronged expansion initiatives to strengthen its market presence and diversify its revenue streams. These strategies are designed to access new customer segments, mitigate market risks through diversification, and maintain a competitive edge in rapidly evolving industries. The company's approach includes geographic expansion, product development, strategic mergers and acquisitions, and sustainable practices.

In the food business, the company is focusing on expanding its global reach for processed foods, particularly its popular ramen products. This includes targeting new international markets in Southeast Asia and Europe. The chemical sector is also a focus, with the aim to increase market share in high-performance engineering plastics, driven by growing demand in the automotive and electronics industries. These initiatives are not merely about increasing sales but are designed to access new customer segments and mitigate market risks.

Recent reports indicate that the company is considering investments in biotech startups to expand its functional food ingredients business, aiming to capture a share of the burgeoning health and wellness market. The company also plans to strengthen its packaging business through strategic partnerships that allow for the adoption of more sustainable and eco-friendly packaging solutions. These efforts reflect a broader strategy to enhance Marketing Strategy of Samyang and drive long-term growth.

The company is targeting Southeast Asia and Europe for its ramen products. This expansion is supported by localized product development to cater to regional tastes and preferences. The goal is to increase market share and revenue streams in these key regions. This strategy is crucial for the company's Samyang growth strategy.

The company aims to increase its market share in high-performance engineering plastics. This growth is driven by demand from the automotive and electronics industries. Investments in new production facilities and research are planned to enhance capacity and product offerings. This is a key element of the company's Samyang future prospects.

The company is exploring strategic mergers and acquisitions to enter new product categories and acquire advanced technologies. Investments in biotech startups are considered to expand the functional food ingredients business. This helps capture a share of the health and wellness market. This is a part of Samyang company analysis.

The company plans to strengthen its packaging business through strategic partnerships. These partnerships aim to adopt more sustainable and eco-friendly packaging solutions. This initiative is part of the company's broader sustainability efforts. This contributes to Samyang's Samyang business model.

The company's expansion initiatives are focused on geographic diversification, product innovation, and strategic partnerships. These strategies aim to drive revenue growth and maintain a competitive edge. The company is investing in research and development to support these initiatives.

- Targeting new international markets for ramen products.

- Increasing market share in high-performance engineering plastics.

- Exploring strategic mergers and acquisitions for new technologies.

- Strengthening packaging with sustainable solutions.

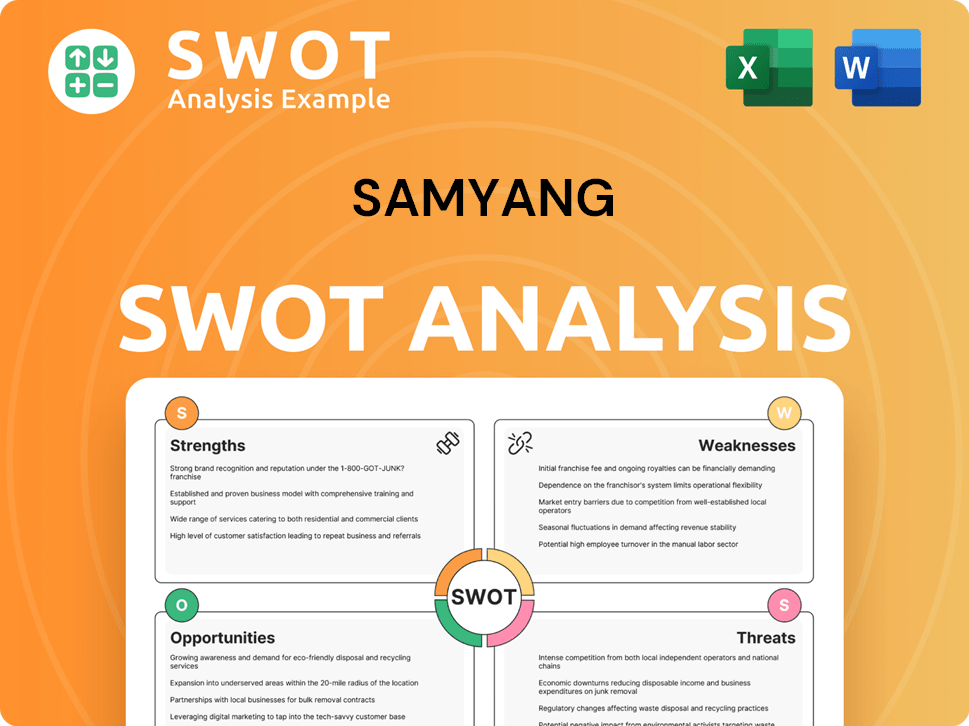

Samyang SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samyang Invest in Innovation?

The Mission, Vision & Core Values of Samyang underscores its commitment to innovation and technological advancement. This strategy is crucial for the company's sustained growth and competitive edge. Investing in cutting-edge technologies and processes is key to achieving its goals, as evidenced by its recent initiatives.

Samyang's approach to innovation is multifaceted, focusing on both product development and operational efficiency. This includes enhancing existing product lines and exploring new markets through technological advancements. The company's strategic investments in R&D are a testament to its long-term vision.

The company's innovation and technology strategy is a key driver of its future prospects. By focusing on new materials, improved production methods, and innovative products, Samyang aims to stay ahead in a competitive market. Its commitment to digital transformation and sustainability further strengthens its position.

Samyang significantly invests in research and development to drive growth. The company's R&D expenditure is projected to increase by 10% in 2024 compared to the previous year, highlighting its commitment to innovation.

In its chemical materials division, Samyang develops advanced engineering plastics. These materials are designed for applications in electric vehicles and 5G technology. This focus reflects a commitment to future-oriented industries.

Samyang integrates automation and smart factory solutions across its manufacturing facilities. This integration aims to boost efficiency and product quality. The company is also exploring AI in supply chain management and consumer trend analysis.

Sustainability is central to Samyang's innovation strategy. The company focuses on developing biodegradable packaging materials and reducing carbon footprints. A recent breakthrough includes a new bio-plastic compound developed in early 2025.

The company is exploring the application of artificial intelligence (AI) in optimizing supply chain management and consumer trend analysis. This allows for more responsive product development within its food business.

A new bio-plastic compound developed in early 2025 has received industry recognition. This innovation highlights Samyang's commitment to environmental sustainability. This development contributes directly to Samyang's growth objectives.

Samyang's technological advancements and strategic collaborations directly support its growth objectives. These initiatives foster new revenue streams and enhance operational competitiveness. The company's focus on innovation ensures its adaptability to changing market demands.

- R&D Focus: Development of new materials, particularly advanced engineering plastics for EVs and 5G.

- Digital Integration: Implementation of automation and smart factory solutions.

- AI Application: Use of AI in supply chain management and consumer trend analysis.

- Sustainability: Development of biodegradable packaging and reduction of carbon footprint.

- Recent Innovation: Introduction of a new bio-plastic compound in early 2025.

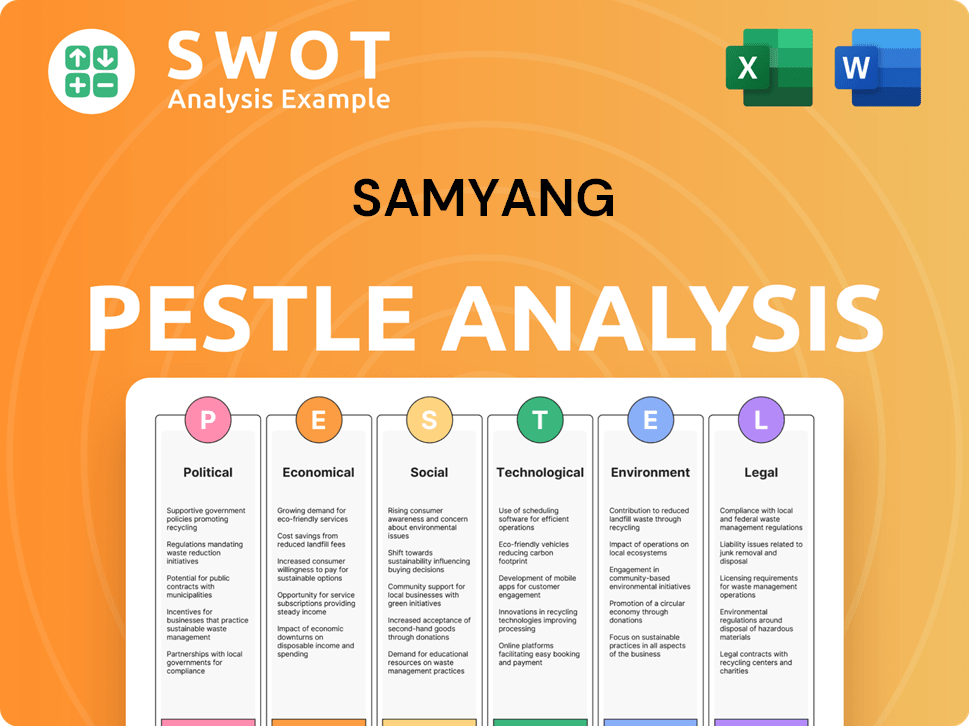

Samyang PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Samyang’s Growth Forecast?

The financial outlook for the company, reflects a strategic focus on sustained growth, supported by its diverse business segments. For the fiscal year 2024, the company aimed for a consolidated revenue of approximately KRW 3.5 trillion. This indicates a steady growth trajectory, driven by increased demand in its chemical and food divisions, especially from international markets. This growth is a key part of its overall Revenue Streams & Business Model of Samyang.

Profit margins are expected to remain healthy, with ongoing efforts to optimize operational efficiency and cost management. Recent analyst forecasts for 2025 suggest a potential 5-7% increase in revenue. This growth is supported by new product launches and market expansion initiatives. The company’s strategic financial planning is designed to support its long-term growth objectives.

Investment levels are robust, with significant capital expenditure allocated towards R&D for new materials and production capacity expansion, particularly in high-growth areas like specialized chemicals and functional food ingredients. The company's long-term financial goals include achieving a stronger global market position in its core businesses and enhancing shareholder value through consistent profitability and strategic investments. The company’s financial strategy also emphasizes prudent financial management and maintaining a strong balance sheet to support future growth initiatives without excessive leverage.

The company's revenue growth is primarily driven by increased demand in its chemical and food divisions. International market expansion and new product launches are also significant contributors. The company is focused on increasing its Samyang market share through strategic initiatives.

Over the past five years, the company has demonstrated steady financial performance, with consistent revenue growth. This growth is supported by strategic investments in R&D and expansion of production capacities. The company's Samyang financial performance reflects its robust business model.

The company actively manages the impact of inflation through cost optimization and operational efficiency. Strategic pricing adjustments and supply chain management are key strategies. These measures help maintain profitability despite inflationary pressures.

The company plans to launch new products to capitalize on emerging market trends. Investment in R&D is a key focus, with a strong emphasis on innovation in food and chemical sectors. These initiatives are crucial for the company's Samyang future prospects.

Strategic partnerships and collaborations are key to the company's expansion plans. These partnerships facilitate market access and innovation in key sectors. Collaborations are designed to enhance Samyang's competitive advantage analysis.

- Joint ventures to enter new markets.

- Collaborations for R&D and new product development.

- Partnerships to strengthen supply chain resilience.

- Strategic alliances to enhance market share.

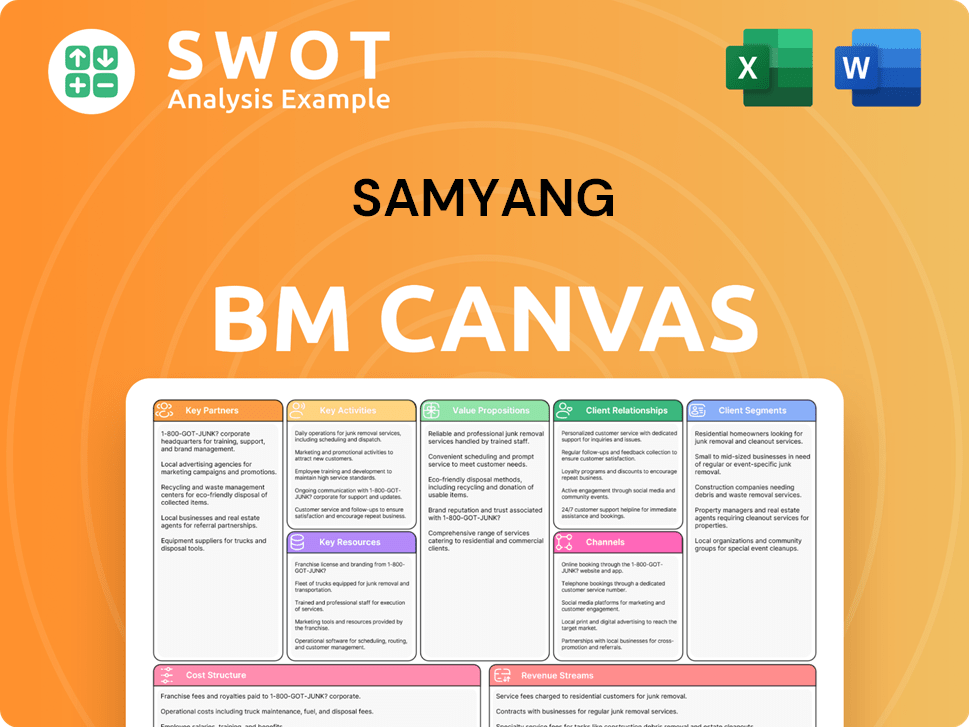

Samyang Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Samyang’s Growth?

The Samyang growth strategy faces several potential risks and obstacles that could impact its Samyang future prospects. Market competition, regulatory changes, and supply chain vulnerabilities represent significant challenges. The company must navigate these risks to maintain its Samyang business model and achieve sustainable growth.

Competition in the food and chemical sectors is fierce, with numerous domestic and international players vying for Samyang market share. Regulatory changes, especially those related to environmental protection and food safety, could increase operational costs and compliance burdens. Supply chain disruptions, exacerbated by global events, pose a continuous threat to production and distribution.

Technological advancements and internal resource management also present challenges. Failure to keep pace with rapid advancements in manufacturing or material science could hinder innovation. Managing a diversified portfolio across various industries can strain resources and require agile organizational structures. To understand more about Samyang company analysis, you can read the article on Target Market of Samyang.

The food and chemical sectors are highly competitive, with many domestic and international companies competing for market share. This competition can affect pricing, innovation, and market penetration. Companies must continually innovate and adapt to maintain their competitive edge.

Changes in regulations, particularly those related to environmental protection and food safety standards, can increase operational costs. Stricter rules on plastic usage, for example, could affect packaging and chemical divisions. Compliance with these regulations is essential but can be costly.

Supply chain disruptions, often caused by global events and natural disasters, can threaten production and distribution. Diversifying suppliers and strategic inventory management are key mitigation strategies. These disruptions can lead to increased costs and delays.

Rapid advancements in manufacturing processes and material science require continuous investment in R&D. Failing to keep pace with these advancements can hinder innovation and competitiveness. Collaborations with external innovators are crucial.

Managing a diversified portfolio across various industries can strain resources and require agile organizational structures. Effective resource allocation and organizational agility are crucial for success. This includes financial and human capital management.

Inflation and fluctuating raw material prices can significantly impact profitability. Hedging strategies and optimized procurement processes are essential to mitigate these risks. Economic conditions require flexible financial planning.

Samyang employs a robust risk management framework, scenario planning, and continuous market analysis to proactively adapt its strategies. They diversify suppliers to reduce supply chain risks. Investing in R&D and fostering collaborations with external innovators helps in keeping up with technological changes. Hedging strategies and optimized procurement processes are used to manage fluctuating raw material prices.

To assess Samyang's financial performance and Samyang market share, it's essential to analyze recent financial data. For example, the company's revenue growth, profit margins, and market share in key regions like Asia. Look for specific data from 2024 or 2025 to understand the current performance and trends. Understanding these metrics helps assess the company's resilience against risks.

Samyang's future plans include new product development and exploring overseas expansion opportunities. Innovation in the food sector, such as new flavor profiles and packaging, is critical. Investment in R&D is crucial for staying competitive. Strategic partnerships can also facilitate growth.

Adapting to changing consumer preferences is vital. This includes offering healthier food options and sustainable packaging. Sustainability initiatives are becoming increasingly important. Understanding and responding to consumer trends is key for long-term success.

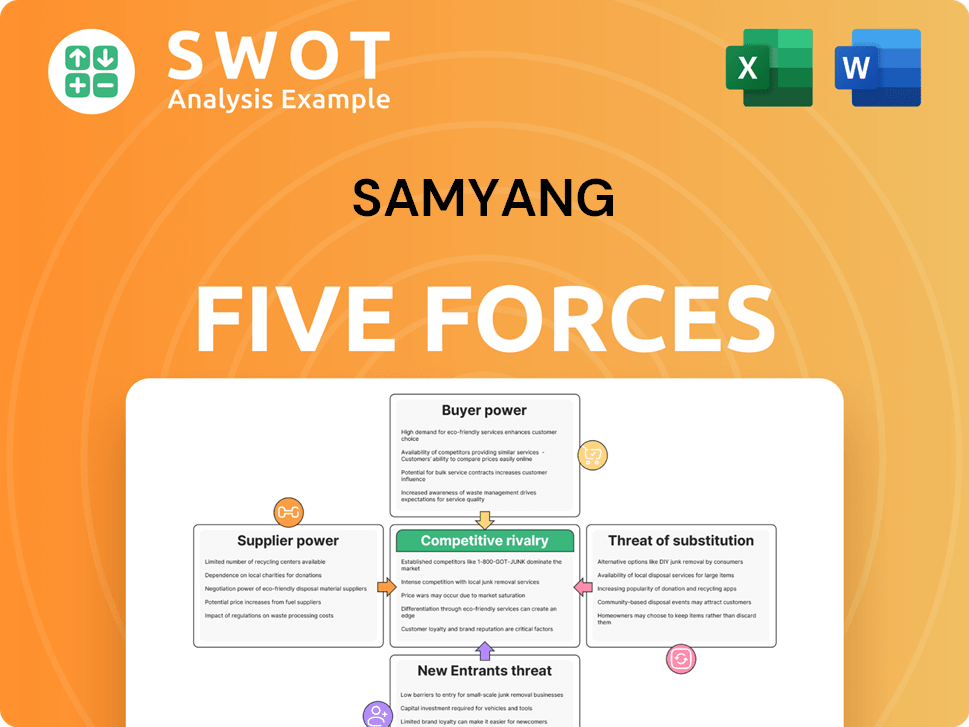

Samyang Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samyang Company?

- What is Competitive Landscape of Samyang Company?

- How Does Samyang Company Work?

- What is Sales and Marketing Strategy of Samyang Company?

- What is Brief History of Samyang Company?

- Who Owns Samyang Company?

- What is Customer Demographics and Target Market of Samyang Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.