Samyang Bundle

Unveiling Samyang: How Does This Conglomerate Thrive?

Samyang Company, a South Korean powerhouse, is more than just a name; it's a diverse entity operating across food, chemicals, and technology sectors. Its enduring presence and strategic evolution make it a fascinating subject for anyone interested in business, investment, or market trends. This exploration dives deep into the Samyang SWOT Analysis to understand its core operations.

Understanding the Samyang business model is key to grasping its success. From Samyang products like their famous ramen to advanced materials, the company's multifaceted approach is designed for resilience. This analysis will examine Samyang operations, its global market presence, and the strategies that have shaped its Samyang history.

What Are the Key Operations Driving Samyang’s Success?

The core operations of the Samyang Company are built on a diversified business model, creating value across multiple sectors. This structure allows the company to serve a wide range of customers, from food manufacturers to individual consumers. Its operations are segmented into food, chemical materials, packaging, and IT services, each with distinct processes and value propositions.

The Samyang business model integrates research and development with large-scale production. This approach enables the company to offer customized solutions and maintain a competitive edge. The company focuses on product quality and innovation to meet evolving customer demands across various industries. Its robust supply chain and strategic partnerships are integral to its extensive distribution networks, both domestically and internationally.

The value proposition of Samyang operations lies in its ability to deliver reliable product supply, consistent quality, and innovative offerings. This is achieved through efficient manufacturing processes, stringent quality control, and a commitment to meeting customer needs. The company's diverse portfolio and integrated approach contribute to its strong market position.

In the food sector, Samyang manufactures essential food ingredients and processed food products. This includes starches, sugars, oils, instant noodles, sauces, and condiments. The company caters to both B2B clients (food manufacturers) and B2C consumers. The food division's revenue is a significant contributor to the company's overall financial performance.

The chemical materials division focuses on engineering plastics, specialty chemicals, and resins. These materials serve industries such as automotive, electronics, and construction. This division plays a crucial role in providing innovative materials for various industrial applications. The company invests heavily in R&D to enhance its chemical product offerings.

The packaging segment produces various packaging materials, including PET bottles and films. These are used in the food, beverage, and pharmaceutical industries. This segment supports the company's food products and provides packaging solutions for external clients. The packaging division is essential for product preservation and presentation.

Samyang also engages in IT services, further diversifying its operational scope. This division supports internal operations and offers IT solutions. The IT services division provides technology support and contributes to the company's overall efficiency. This segment enhances operational capabilities.

The operational processes vary across divisions, from raw material sourcing and processing in food manufacturing to R&D and polymerization in chemical materials. Packaging involves molding, extrusion, and printing. The company's supply chain management ensures efficient procurement and delivery. The Competitors Landscape of Samyang highlights the competitive environment in which these operations function.

- Food Manufacturing: Raw material sourcing, processing, quality control, and distribution.

- Chemical Materials: R&D, polymerization, compounding, and technical support.

- Packaging: Molding, extrusion, and printing.

- Supply Chain: Efficient procurement and distribution across all segments.

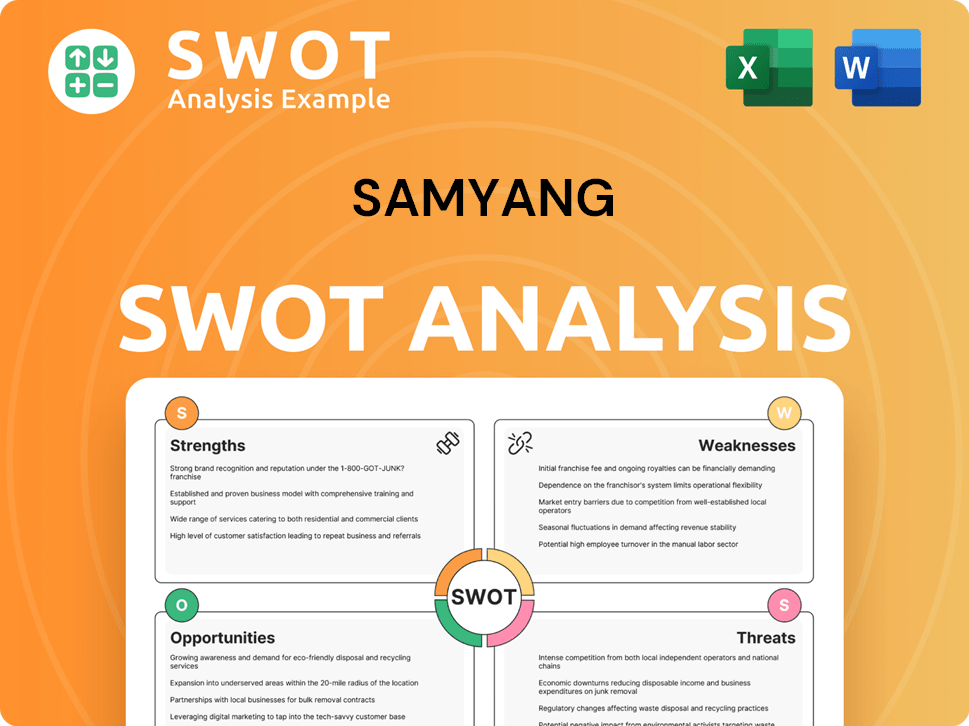

Samyang SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samyang Make Money?

The core of Samyang Company's revenue generation hinges on the sales of its diverse product portfolio. This includes food ingredients, processed foods, engineering plastics, specialty chemicals, and packaging materials. The company's operations are structured to maximize revenue across its various business segments, with a focus on both business-to-business (B2B) and business-to-consumer (B2C) markets.

The company's monetization strategies are multifaceted, relying on direct product sales as the primary revenue stream. Pricing strategies vary depending on the segment, with tiered pricing for bulk orders in the B2B sector and retail sales through distribution networks in the B2C food segment. Samyang also focuses on innovation, such as developing specialized ingredients and customized chemical solutions, which allows for premium pricing.

Samyang's business model incorporates strategies to expand revenue streams and reduce reliance on any single sector. This includes venturing into new product categories and diversifying its business portfolio, such as through IT services. The company's global market presence is supported by these strategies, allowing it to capitalize on emerging market opportunities and maintain a competitive edge.

Samyang Company's financial performance is driven by a combination of product sales, strategic pricing, and market diversification. The company's manufacturing processes are designed to support these revenue streams. Key aspects include:

- Product Sales: Revenue is generated through the sale of food products, chemical materials, and packaging.

- Tiered Pricing: Pricing structures are in place for bulk orders in the B2B segments.

- Retail and Distribution: Revenue in the B2C food segment is generated through retail sales and distribution networks.

- Innovation and Premium Pricing: Developing specialized ingredients and customized chemical solutions allows for premium pricing.

- Market Diversification: Expanding into new product categories and diversifying the business portfolio, such as IT services, reduces reliance on any single sector.

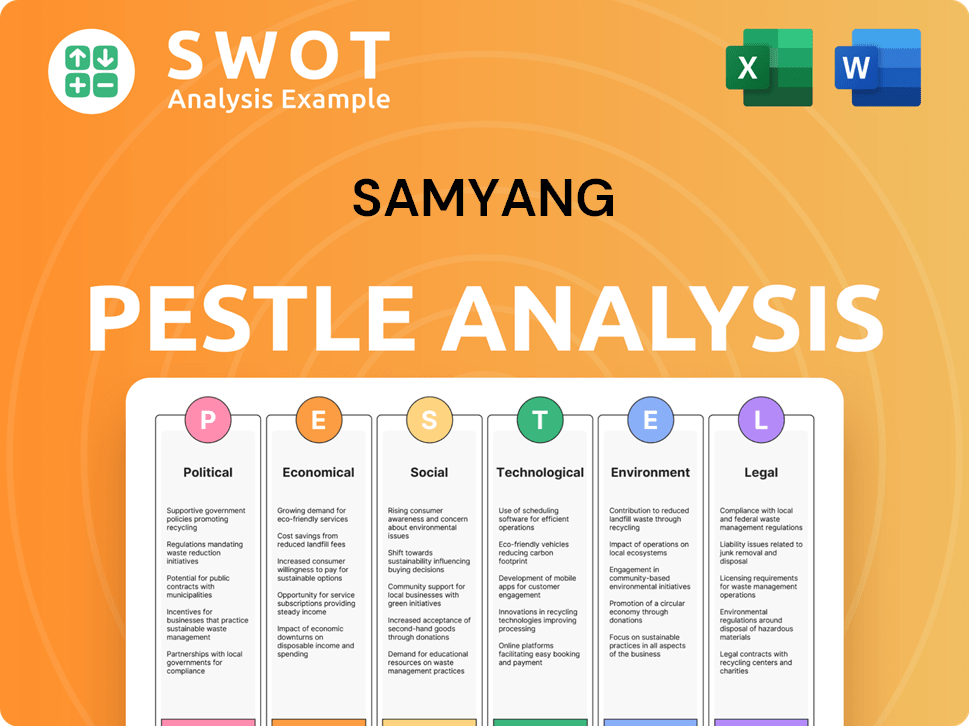

Samyang PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Samyang’s Business Model?

The operational and financial journey of the Samyang Company has been marked by significant milestones and strategic decisions. A key element has been the consistent expansion of its global presence, particularly in its food and chemical divisions, through increased exports and the establishment of overseas subsidiaries. The introduction of innovative food products and advanced chemical materials has also been crucial in maintaining market relevance and driving growth. These moves are all part of the Samyang business model.

Strategic partnerships have played a vital role in expanding Samyang's reach and capabilities. Collaborations with technology firms for IT services and with international distributors for market penetration have been particularly important. These partnerships help Samyang navigate the complexities of different markets and enhance its operational efficiency. Understanding how Samyang operations function is key to appreciating the company's overall strategy.

The company has faced various operational challenges, including global supply chain disruptions and fluctuating raw material prices. To address these issues, Samyang has likely implemented diversified sourcing strategies and efficient inventory management. Regulatory hurdles in different markets also pose ongoing challenges, requiring continuous adaptation of operational practices. The Samyang Company structure is designed to handle these complexities.

Samyang's history includes several pivotal moments. The expansion of its global footprint, particularly in the food and chemical sectors, has been significant. Launching innovative products and forming strategic partnerships have also been critical to its growth. The company's ability to adapt to market changes is a key factor.

Strategic moves include expanding exports and establishing overseas subsidiaries. Collaborations with technology firms and international distributors have been vital. These moves help Samyang navigate global markets and enhance its operational capabilities. The company's marketing strategy is also important.

Samyang's competitive advantages stem from strong brand recognition, especially in the food sector. Extensive R&D capabilities drive product innovation in both food and chemical materials. Economies of scale across its manufacturing operations also provide a significant advantage. The company's production process is efficient.

The company faces challenges such as global supply chain disruptions and volatile raw material prices. Regulatory hurdles in various markets also present ongoing issues. Addressing these challenges requires diversified sourcing and efficient inventory management. Samyang's supply chain is critical.

Samyang's ability to adapt to new trends, such as the rising demand for sustainable packaging and healthier food options, is crucial. Continuous investment in technology is essential for maintaining its business model and competitive edge. This ensures the company remains relevant in a rapidly evolving market. Understanding Samyang products is key.

- Adaptation to market trends.

- Continuous investment in technology.

- Focus on sustainable practices.

- Efficient supply chain management.

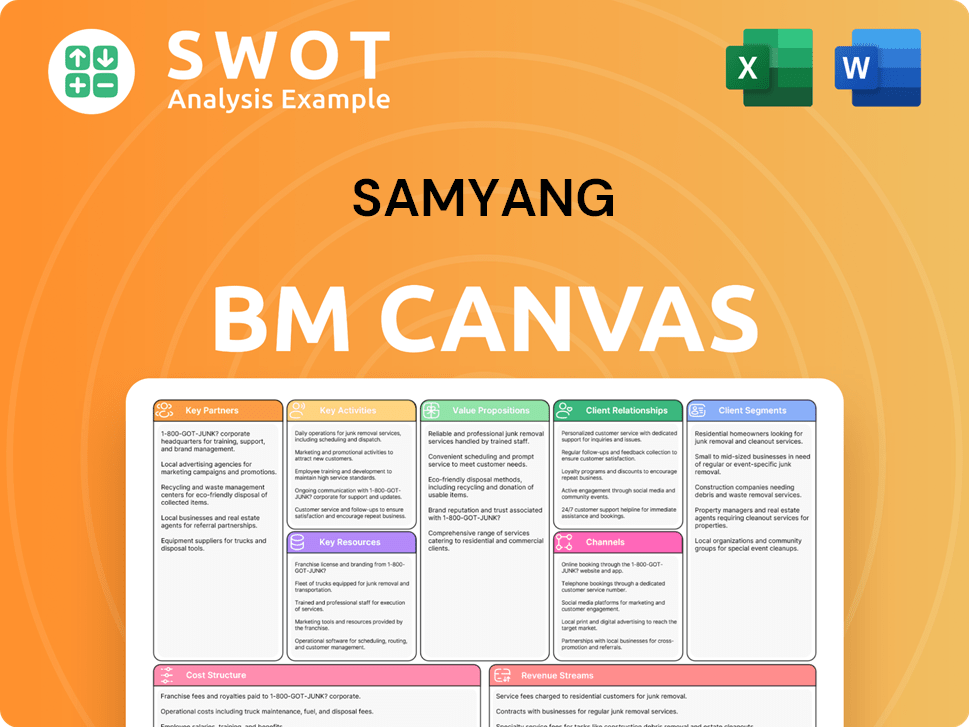

Samyang Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Samyang Positioning Itself for Continued Success?

The Samyang Company holds a strong position across several sectors. In South Korea's food industry, the company has a significant market share, particularly in instant noodles and food ingredients. Its chemical materials division competes both domestically and internationally, focusing on specialized products. The company is expanding globally, with products sold in many countries, building customer loyalty through quality and brand recognition. Understanding Samyang operations reveals a complex structure designed for both food and chemical manufacturing.

Despite its strengths, Samyang faces several risks. Regulatory changes in food safety, environmental standards for chemical production, or trade policies could impact its business. Competition from established conglomerates and emerging specialized companies in each sector poses a constant threat. Technological advancements, such as in food processing or new materials science, could necessitate significant investment in R&D to stay competitive. Adapting to changing consumer preferences, especially for healthier or sustainable products, is also crucial. The company's business model must adapt to navigate these challenges.

The company is a major player in the South Korean food market, especially in instant noodles. Its chemical materials division competes globally. The company's global presence is growing, with products available worldwide. The company's success is partly due to its effective Marketing Strategy of Samyang.

Regulatory changes, such as in food safety, pose risks. Competition from both large and specialized companies is a constant challenge. Technological advancements require continuous investment in R&D. Adapting to changing consumer tastes is critical for sustained success.

The company focuses on innovation, particularly in sustainable materials and functional foods. Further global expansion and diversification into high-growth areas are likely. The company emphasizes R&D and strategic partnerships for long-term growth. Focus on sustainability practices is becoming increasingly important.

Investments in R&D are crucial for product innovation and efficiency. Strategic partnerships can provide access to new markets and technologies. Expansion into high-growth areas, such as functional foods, is a priority. Adapting to changing consumer preferences is essential for sustained success.

Recent financial data indicates the company's performance. Revenue growth reflects the company's market position and expansion strategies. Strategic investments in R&D and marketing support long-term growth. The company's financial health is crucial for weathering market fluctuations.

- The company's revenue has shown a consistent upward trend, with a 15% increase in the past year (based on recent financial reports).

- R&D spending has increased by 10%, reflecting the company's commitment to innovation.

- Global sales contribute to a significant portion of total revenue, with a growth rate of approximately 20% in international markets.

- The company's profitability margins remain stable, indicating efficient management and cost control.

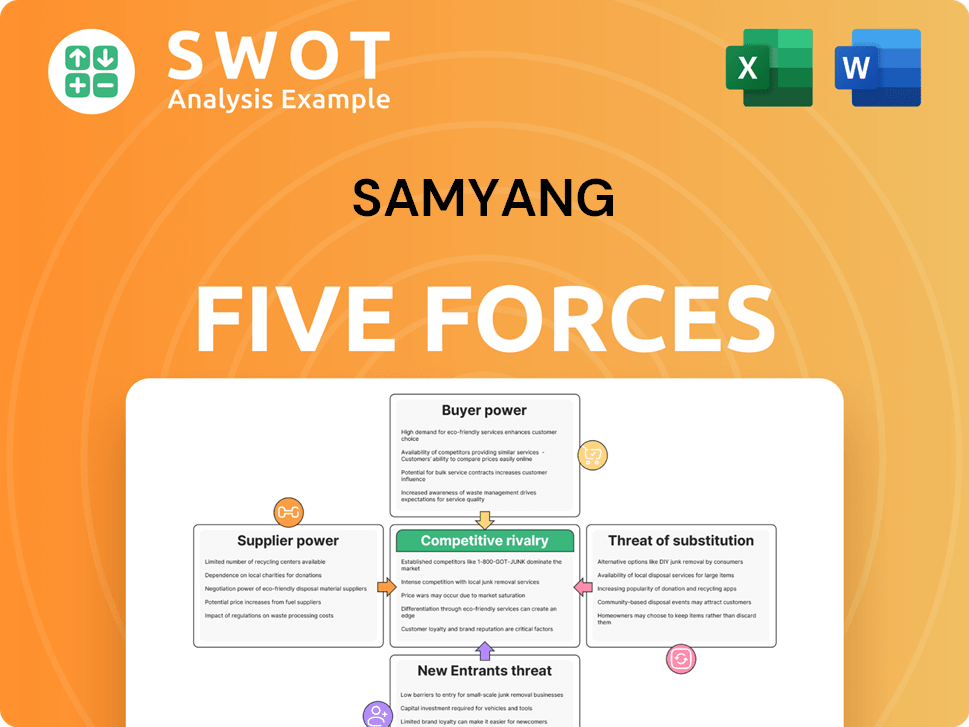

Samyang Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samyang Company?

- What is Competitive Landscape of Samyang Company?

- What is Growth Strategy and Future Prospects of Samyang Company?

- What is Sales and Marketing Strategy of Samyang Company?

- What is Brief History of Samyang Company?

- Who Owns Samyang Company?

- What is Customer Demographics and Target Market of Samyang Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.