SigmaRoc Bundle

What's the Story Behind SigmaRoc?

Ever wondered how a company rapidly reshapes the construction materials landscape? SigmaRoc, a dynamic player in the European market, has carved its niche through strategic acquisitions and operational excellence. This SigmaRoc SWOT Analysis will help you to understand the company's strengths and weaknesses. Explore the journey of SigmaRoc, from its strategic beginnings to its current market position.

Uncover the brief history of SigmaRoc, a company that has strategically navigated the building materials and construction industry. From its initial vision to consolidate fragmented market segments, SigmaRoc's focus on acquiring and optimizing assets has fueled its impressive growth. This article will explore SigmaRoc's acquisitions and mergers and its evolution into a prominent construction materials group, examining key milestones and strategic decisions.

What is the SigmaRoc Founding Story?

The story of the SigmaRoc company began in 2016. It was founded with the ambition to consolidate the fragmented construction materials market. Max Vermorken and David Barrett co-founded the company, bringing together financial acumen and industry expertise.

Their initial goal was to acquire and improve smaller building materials businesses. They aimed to create a unified group that could benefit from economies of scale and shared resources. This strategy focused on identifying, acquiring, and integrating these businesses to boost profitability.

Early funding came from equity and debt, which supported the initial acquisitions. The name 'SigmaRoc' reflects the consolidation strategy, symbolizing the combination of diverse construction material businesses. The company's formation took place during a period of consolidation in the construction materials sector, driven by the need for greater efficiency and market share.

Here are the key aspects of the founding story of SigmaRoc:

- Founding Year: 2016.

- Founders: Max Vermorken (CEO) and David Barrett (Chairman).

- Strategic Intent: To consolidate the fragmented construction materials market.

- Initial Strategy: Acquire and optimize smaller, regional building materials businesses.

- Funding: Combination of equity placings and debt facilities.

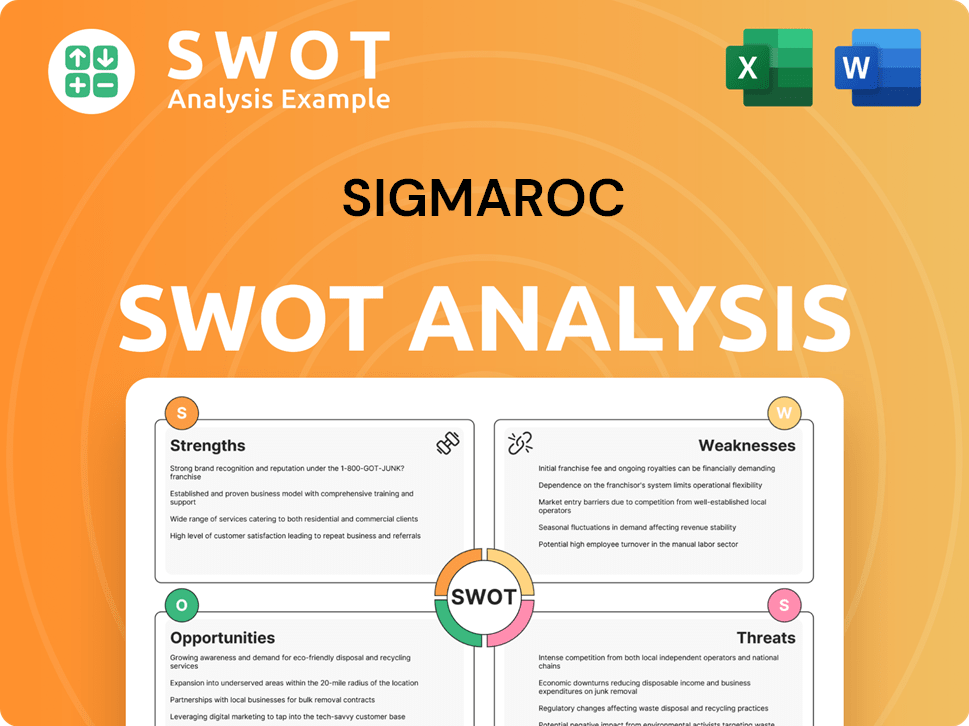

SigmaRoc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of SigmaRoc?

The early growth and expansion of SigmaRoc, a key player in the building materials sector, was marked by a series of strategic acquisitions. This rapid expansion demonstrated the company's ambition to become a significant force in the construction industry. This period laid the foundation for its future growth and diversification.

Following its founding in 2016, SigmaRoc quickly implemented an aggressive acquisition strategy. A crucial early acquisition was Ronez, based in the Channel Islands, in 2017 for approximately £45 million. This move marked SigmaRoc's entry into the aggregates and concrete market. The company's focus was on expanding its geographical footprint and product offerings.

In 2018, SigmaRoc acquired Poundfield Products, a precast concrete business, further expanding its UK product portfolio. The Johnston Quarry Group acquisition in 2019 significantly strengthened its presence in the UK aggregates market. These acquisitions were supported by capital raises, including equity placings, to fund its ambitious growth plans.

SigmaRoc's consolidation strategy was well-received, as it aimed to create value in a mature construction industry. The company targeted businesses with opportunities for synergy and operational efficiencies. While competing with established industry giants, SigmaRoc differentiated itself with its agile acquisition model.

Key leadership, particularly CEO Max Vermorken, played a crucial role in these strategic moves and integrations. The company's early growth efforts laid the groundwork for its subsequent expansion into mainland Europe. For more detailed insights into the company's journey, you can read a brief history of SigmaRoc.

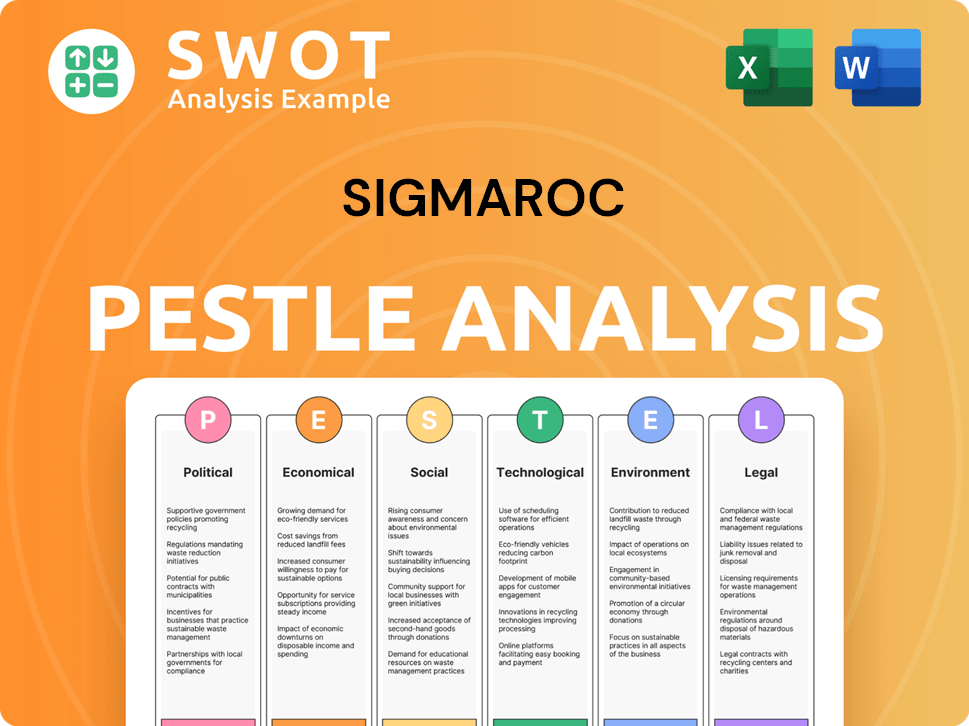

SigmaRoc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in SigmaRoc history?

The SigmaRoc company has experienced significant growth and transformation, marked by strategic acquisitions and operational improvements. Key milestones highlight the company's expansion and adaptation within the building materials and construction industry.

| Year | Milestone |

|---|---|

| 2021 | Acquisition of Nordkalk Corporation for approximately €490 million, establishing SigmaRoc as a leading lime and limestone producer in Northern Europe. |

| 2024 | Secured a new £200 million revolving credit facility, demonstrating financial agility and securing funding for future endeavors. |

Innovation at SigmaRoc focuses on enhancing operational efficiency and promoting sustainable practices. The company has invested in modernizing plant equipment and adopting sustainable sourcing within its aggregates and lime businesses.

SigmaRoc continually optimizes production processes across its operations to improve efficiency and reduce costs.

The company focuses on improving logistics and supply chain management to ensure timely delivery of materials.

SigmaRoc implements digital solutions across its operations to streamline processes and improve decision-making.

Challenges for SigmaRoc include navigating market downturns and competitive pressures within the construction industry. Supply chain disruptions and securing funding for growth also present ongoing hurdles.

Economic uncertainties and shifts in construction demand can impact SigmaRoc's performance.

Competition from larger players in the building materials sector requires SigmaRoc to remain strategic in its operations.

Disruptions to material availability and logistics pose challenges to the company's operations.

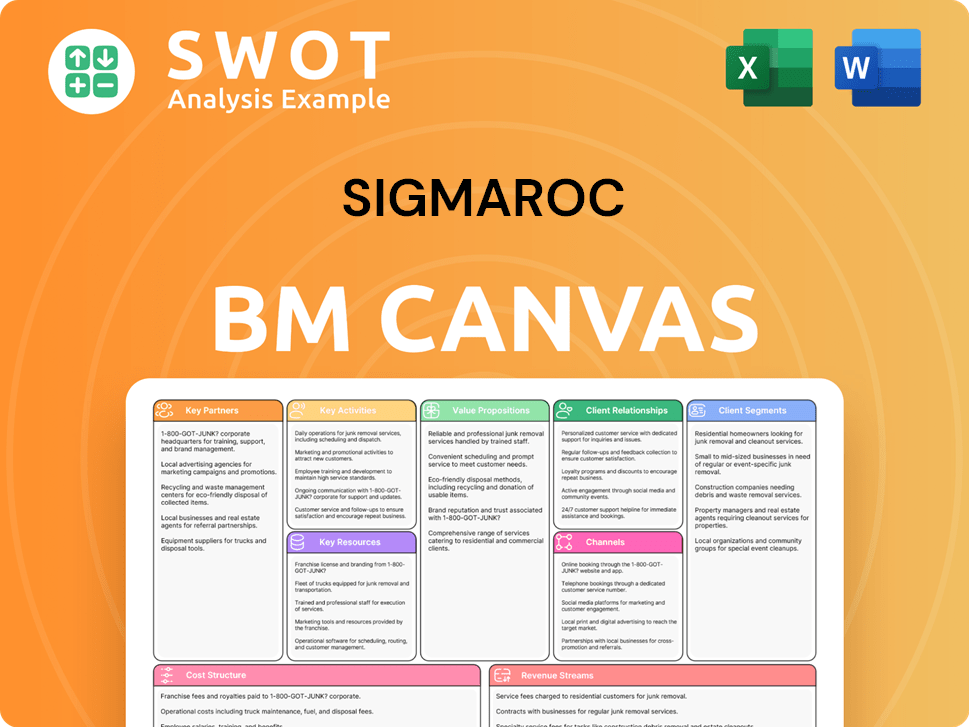

SigmaRoc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for SigmaRoc?

The SigmaRoc history is marked by rapid expansion through strategic acquisitions, transforming it into a significant player in the building materials sector. Founded in 2016, the company quickly grew through key acquisitions, including Ronez in 2017, Poundfield Products in 2018, and Johnston Quarry Group in 2019, to broaden its portfolio. A major milestone was the 2021 acquisition of Nordkalk Corporation, significantly enhancing its presence in European lime and limestone production. Recent years have focused on integrating these acquisitions and optimizing operations, with a strategic review in 2023 and securing a new £200 million revolving credit facility in 2024 to support future growth.

| Year | Key Event |

|---|---|

| 2016 | SigmaRoc PLC was founded with a strategy to consolidate the construction materials sector. |

| 2017 | Acquisition of Ronez, marking its entry into aggregates and concrete in the Channel Islands. |

| 2018 | Acquisition of Poundfield Products, expanding its precast concrete offerings in the UK. |

| 2019 | Acquisition of Johnston Quarry Group, significantly boosting its UK aggregates presence. |

| 2021 | Transformative acquisition of Nordkalk Corporation for approximately €490 million, establishing a strong presence in European lime and limestone production. |

| 2022 | Continued integration of Nordkalk and focus on operational synergies across the group. |

| 2023 | Strategic review and ongoing optimization of its diverse portfolio of businesses. |

| 2024 | Secured a new £200 million revolving credit facility, enhancing financial flexibility for future growth and working capital needs. |

SigmaRoc is expected to continue its acquisition strategy in the building materials sector. The focus will be on improving performance, generating value through synergies, and organic growth. The company aims to expand geographically, especially within Europe, and optimize existing assets for efficiency and profitability. The company's commitment to sustainability and technological advancements will enhance operational capabilities.

The construction industry is expected to see continued consolidation, creating opportunities for SigmaRoc to expand its market share. Analyst predictions suggest ongoing strategic acquisitions as a key growth driver. The company's financial flexibility, enhanced by the recent £200 million credit facility, supports its ability to pursue these opportunities. The focus on organic growth within existing operations is also a key priority.

SigmaRoc’s long-term strategy includes further geographic expansion, particularly within Europe. The company is focused on optimizing its existing assets to drive efficiency and profitability. The company aims to be a consolidator of choice in the building materials sector. The company's leadership has indicated a commitment to sustainable practices and leveraging technological advancements.

The company's financial performance will be driven by the integration of recent acquisitions and operational improvements. The new £200 million revolving credit facility provides financial flexibility for future acquisitions and working capital needs. The focus on organic growth within existing operations and potential for further strategic acquisitions is a key part of the strategy. The company is focused on creating significant value for its shareholders.

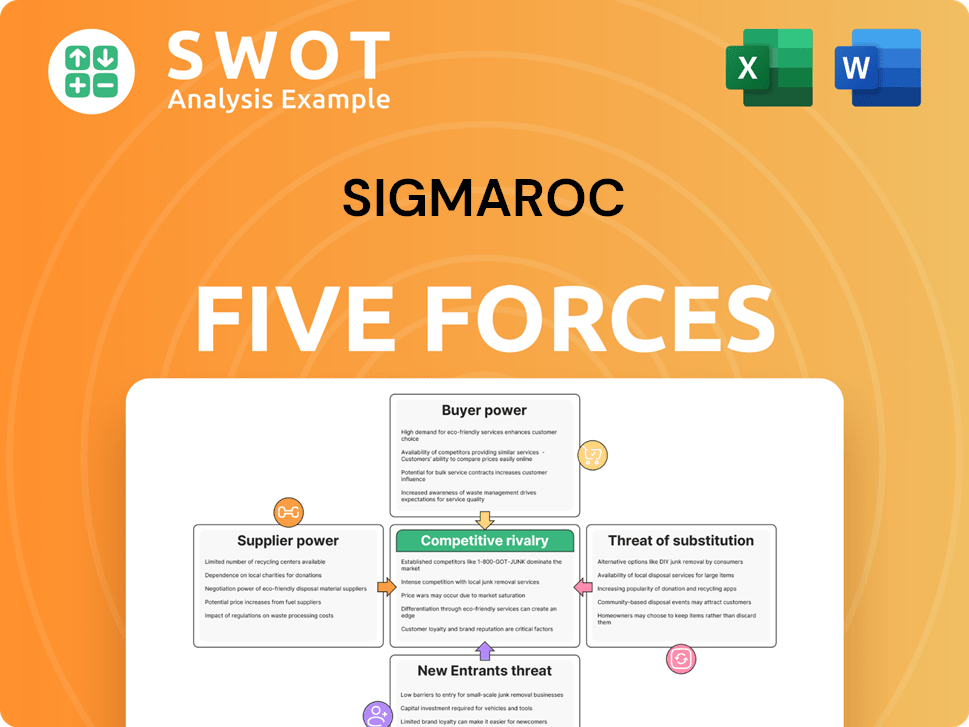

SigmaRoc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of SigmaRoc Company?

- What is Growth Strategy and Future Prospects of SigmaRoc Company?

- How Does SigmaRoc Company Work?

- What is Sales and Marketing Strategy of SigmaRoc Company?

- What is Brief History of SigmaRoc Company?

- Who Owns SigmaRoc Company?

- What is Customer Demographics and Target Market of SigmaRoc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.