SigmaRoc Bundle

How Does SigmaRoc Stack Up in the Construction Materials Arena?

The construction materials sector is a battleground of innovation, sustainability demands, and fierce competition. SigmaRoc PLC, a relatively young but rapidly expanding player, has captured attention with its acquisition-led growth model. Understanding the SigmaRoc SWOT Analysis is crucial for navigating this dynamic landscape.

This analysis delves into the SigmaRoc competitive landscape, providing a detailed SigmaRoc market analysis to identify key SigmaRoc competitors and their strategic approaches. We'll dissect SigmaRoc's business strategy and financial performance, offering insights into its competitive advantages within the SigmaRoc industry. This comprehensive overview equips decision-makers with the knowledge needed to assess SigmaRoc's position and make informed choices.

Where Does SigmaRoc’ Stand in the Current Market?

SigmaRoc PLC has carved a strategic niche within the European construction materials sector, primarily through a focused acquisition strategy. This approach has allowed the company to establish a strong regional presence, particularly in the UK and Northern European markets. The company's operations span aggregates, precast concrete, and lime products, demonstrating a diversified portfolio designed to meet various construction needs.

The company's business model centers on acquiring and integrating well-established businesses, often family-owned, to enhance operational efficiency and expand its product offerings. This strategy has been instrumental in allowing SigmaRoc to adapt to market shifts, such as the increasing demand for sustainable building materials. The company's financial performance reflects its strategic positioning, with revenues reaching £569 million in 2023, showcasing its significant scale within the industry.

SigmaRoc's core operations involve the production and distribution of construction materials, serving a diverse customer base from large infrastructure projects to residential and commercial construction. Its geographic footprint includes the UK, Belgium, and the Netherlands, with further expansion into other regions. The company's commitment to sustainable practices is evident in its integration of greener technologies within its acquired entities, aligning with current market trends. For more insights, you can explore the Target Market of SigmaRoc.

SigmaRoc holds leading positions in specific product segments within its operational areas, particularly in the UK and Northern European markets. While precise overall market share figures for the entirety of Europe are complex, the company's strong regional presence is undeniable. This is achieved through strategic acquisitions and operational excellence within its core markets.

The primary product lines include aggregates, cement, lime, and various other construction-related products. SigmaRoc serves a diverse customer base, ranging from large infrastructure projects to residential and commercial construction. This diversification allows the company to mitigate risks associated with fluctuations in specific market segments.

SigmaRoc's strategy involves acquiring well-established businesses and integrating them into its operational framework. This approach enhances efficiency and expands the product portfolio. The company focuses on acquiring businesses that align with its strategic goals, often integrating sustainable practices to meet evolving market demands.

The company's financial health remains solid, with an adjusted EBITDA of £99 million in 2023, indicating strong operational profitability. SigmaRoc's financial performance reflects its strategic positioning and operational efficiency. This strong financial foundation supports future growth and expansion initiatives.

SigmaRoc's competitive advantages include a focused acquisition strategy, strong regional presence, and a diversified product portfolio. These factors allow the company to adapt to market changes and maintain a solid financial position. The company's commitment to sustainability also enhances its competitive edge.

- Strategic Acquisitions: Enhances market presence and product offerings.

- Regional Focus: Strong positions in key European markets.

- Diversified Portfolio: Mitigates risks and caters to various customer needs.

- Financial Strength: Robust profitability and solid financial health.

SigmaRoc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging SigmaRoc?

The SigmaRoc competitive landscape is characterized by a mix of large multinational corporations and numerous regional players, creating a dynamic environment. The company operates within the construction materials sector, facing competition across various product categories and geographical regions. Understanding the competitive dynamics is crucial for assessing SigmaRoc's financial performance and future prospects.

Direct competitors include global giants like CRH plc, Heidelberg Materials (formerly HeidelbergCement), Holcim Group, and Cemex. These companies have significant scale, extensive distribution networks, and technological advancements. Indirect competition also comes from specialized material suppliers, alternative building material providers, and companies involved in recycling construction and demolition waste.

The construction materials market is subject to ongoing merger and acquisition activity, which further reshapes the competitive dynamics, as seen with Holcim's strategic adjustments. Emerging players focusing on sustainable or circular economy solutions also pose a long-term challenge, driving traditional players to innovate. A comprehensive SigmaRoc market analysis must consider all these factors.

CRH plc is a major player, offering a wide range of building materials across Europe and North America. Heidelberg Materials and Holcim Group are global leaders in cement, aggregates, and ready-mix concrete. Cemex is another significant competitor, with a global presence.

Regional competitors, such as Breedon Group plc in the UK, are significant in specific markets. These companies often engage in direct market share battles. The regional players can pose a significant threat due to their local market expertise and focus.

Indirect competition comes from specialized material suppliers and alternative building material providers. Companies involved in recycling construction and demolition waste also impact the market. These competitors challenge through price and innovation.

The construction materials market sees ongoing merger and acquisition activity, such as Holcim's strategic moves. Emerging players focusing on sustainable solutions also pose a challenge. These dynamics continuously reshape the competitive landscape.

Competitors leverage advantages such as scale, distribution networks, and technological advancements. Brand recognition and price competitiveness are also key. Understanding these advantages is crucial for SigmaRoc's business strategy.

The rise of sustainable building materials and circular economy solutions presents a long-term challenge. Economic trends and market consolidation will continue to impact the competitive environment. Adapting to these challenges is essential.

To maintain a competitive edge, SigmaRoc must focus on several strategic areas. These include operational efficiency, innovation, and strategic partnerships. Further insights can be found in a detailed SigmaRoc company overview and competitors analysis.

- Operational Efficiency: Streamlining processes to reduce costs and improve productivity.

- Innovation: Investing in research and development to offer new and improved products.

- Strategic Partnerships: Collaborating with other companies to expand market reach and share resources.

- Market Analysis: Continuously monitoring market trends and competitor activities.

- Sustainability: Embracing sustainable practices to meet evolving market demands.

SigmaRoc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives SigmaRoc a Competitive Edge Over Its Rivals?

The competitive advantages of SigmaRoc are primarily centered on its strategic approach to acquisitions, operational efficiency, and a decentralized management model. This strategy allows for rapid market share growth and diversification within the fragmented building materials sector. SigmaRoc's ability to identify and integrate undervalued assets, coupled with a focus on operational excellence, sets it apart from larger competitors. A thorough Marketing Strategy of SigmaRoc reveals how the company leverages these advantages to maintain a strong market position.

SigmaRoc's success is further bolstered by its lean corporate structure and commitment to operational excellence, which contribute to robust profit margins. The company's emphasis on sustainable practices and product innovation, particularly in lower-carbon concrete and recycled aggregates, aligns with evolving industry demands and regulatory pressures. This enhances its brand equity and positions it favorably with environmentally conscious clients. SigmaRoc's competitive edge is also sustained by its ability to identify suitable acquisition targets and effectively integrate them.

In 2023, SigmaRoc reported an adjusted EBITDA margin of 17.4%, reflecting efficient cost management and effective operational strategies. This financial performance highlights the company's ability to generate strong returns, a key aspect of its competitive positioning. The company's focus on sustainable building materials further strengthens its market position. This approach not only enhances its brand equity but also positions it favorably with environmentally conscious clients.

SigmaRoc specializes in acquiring and integrating well-run, often regional, businesses. This approach allows for rapid market share growth and diversification. The company enhances performance through synergistic integration and operational improvements.

The company benefits from a lean corporate structure and a focus on operational excellence. This contributes to strong profit margins, as demonstrated by its 2023 adjusted EBITDA margin of 17.4%. Efficient cost management and effective operational strategies are key.

SigmaRoc's decentralized model allows for leveraging local expertise and established customer relationships. This approach enables the company to adapt quickly to regional market dynamics. It supports agility and responsiveness.

SigmaRoc emphasizes sustainable practices and product innovation, like lower-carbon concrete. This aligns with industry demands and enhances brand equity. It positions the company favorably with environmentally conscious clients.

SigmaRoc's competitive advantages stem from its strategic acquisitions, operational efficiency, and sustainable practices. These factors enable the company to outperform competitors by focusing on regional market expertise and innovation. The company's ability to identify undervalued assets and unlock their potential is a significant differentiator.

- Strategic Acquisition Focus: Targeting well-run, regional businesses for integration.

- Operational Excellence: Lean structure and efficient cost management.

- Sustainable Innovation: Emphasis on lower-carbon concrete and recycled aggregates.

- Decentralized Management: Leveraging local expertise and customer relationships.

SigmaRoc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping SigmaRoc’s Competitive Landscape?

The construction materials industry is experiencing significant shifts, driven by the demand for sustainable building solutions, digitalization, and stricter environmental regulations. This dynamic environment presents both challenges and opportunities for companies like SigmaRoc. Understanding the SigmaRoc competitive landscape requires an analysis of these trends and their impact on the company's strategic positioning and financial performance.

Key risks include the high capital investments needed for decarbonization and digital infrastructure, along with potential increases in operating costs tied to greener production methods. Volatility in raw material and energy prices also poses a challenge. However, the growing market for sustainable products and infrastructure development creates opportunities for growth and expansion. Strategic acquisitions and partnerships can further strengthen its market position. For a deeper dive into the company's structure, you can read about the Owners & Shareholders of SigmaRoc.

The construction materials sector is seeing a surge in demand for sustainable building materials, driven by environmental concerns and regulatory pressures. Digitalization, including BIM and automation, is improving operational efficiency. Increased focus on reducing carbon emissions is pushing companies to adopt lower-carbon production methods.

Significant capital investments are needed for decarbonization technologies and digital infrastructure. Higher operating costs associated with greener production and increased regulation on emissions can impact profitability. Volatility in raw material and energy prices presents a risk to production costs and financial planning.

The growing demand for sustainable products creates a premium market segment for companies investing in greener technologies. Expansion into new geographic markets, especially those with strong infrastructure projects, offers growth avenues. Strategic partnerships with technology providers can accelerate innovation and market penetration, improving SigmaRoc market analysis.

SigmaRoc’s business strategy needs to focus on integrating sustainable practices and digital solutions across its acquired businesses. Adapting to these industry shifts requires a commitment to innovation and efficient resource management. Strategic acquisitions will continue to play a crucial role in adapting to and capitalizing on these industry shifts.

Several elements will significantly impact the SigmaRoc competitive landscape and its ability to compete. These include the ability to meet sustainability targets, successfully integrating digital technologies, and managing operational costs effectively. Strategic decisions will be crucial for long-term success.

- Sustainability Initiatives: The ability to reduce carbon emissions and offer sustainable products will be critical.

- Digital Transformation: Implementing digital solutions across operations will improve efficiency.

- Market Expansion: Entering new geographic markets will be essential for growth.

- Financial Performance: Maintaining strong SigmaRoc financial performance through effective cost management and strategic investments.

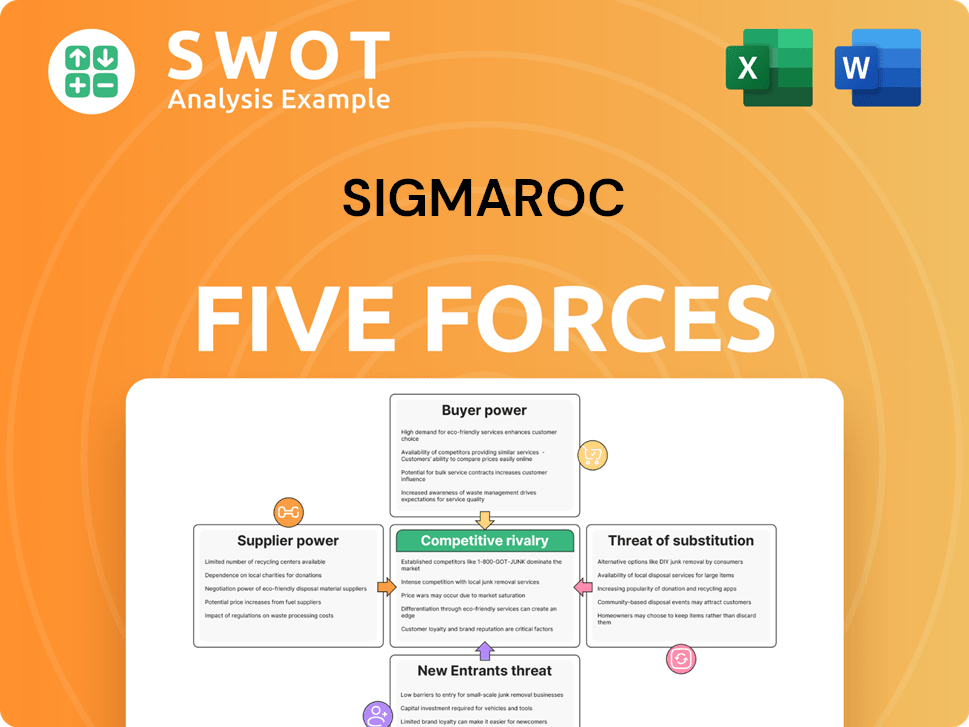

SigmaRoc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SigmaRoc Company?

- What is Growth Strategy and Future Prospects of SigmaRoc Company?

- How Does SigmaRoc Company Work?

- What is Sales and Marketing Strategy of SigmaRoc Company?

- What is Brief History of SigmaRoc Company?

- Who Owns SigmaRoc Company?

- What is Customer Demographics and Target Market of SigmaRoc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.