SigmaRoc Bundle

Unveiling SigmaRoc: How Does This Construction Materials Giant Operate?

SigmaRoc, a rapidly expanding force in the European construction materials sector, is making waves, especially after its massive 2024 acquisition. This strategic move doubled its size and solidified its position as a key player in the building materials market. With impressive financial results and a commitment to sustainability, understanding SigmaRoc SWOT Analysis is crucial for anyone looking to understand its operations.

From its strategic acquisitions in the construction industry to its focus on sustainable building materials, SigmaRoc's success is built on a solid foundation. This detailed analysis will explore the core of How SigmaRoc works, dissecting its business model, revenue streams, and competitive advantages. Whether you're an investor, industry analyst, or simply curious about the future of building materials, this is your definitive guide to the SigmaRoc company.

What Are the Key Operations Driving SigmaRoc’s Success?

The core operations of the SigmaRoc company revolve around acquiring and enhancing businesses within the building materials sector. The company primarily focuses on lime and industrial limestone products. SigmaRoc supplies aggregates, cement, lime, and other construction-related products across various European markets, serving a wide range of sectors, including residential, commercial, infrastructure, industrial, and environmental projects.

The operational model involves investing in and owning quarries, which provides pricing power due to manageable fixed costs and high barriers to entry. SigmaRoc emphasizes empowering local managers to optimize operations, leading to effective cost control. The company seeks to sell all quarried materials and strategically adds downstream activities locally to expand margins and generate cash. This strategic approach is key to understanding how SigmaRoc works.

Furthermore, SigmaRoc actively addresses industrial challenges related to environmental footprint and product development, aiming for a competitive edge through innovation. This includes investments in research and development, with an annual budget of approximately £3 million, leading to products like the eco-friendly concrete launched in 2024. This commitment to innovation is a significant aspect of the SigmaRoc company's value proposition.

The company operates using a decentralized business model, fostering a local and personal approach with its customer base. This is particularly important for construction materials due to their high mass-to-price ratio and local consumption. This approach ensures responsiveness to local market needs.

Its supply chain, partnerships, and distribution networks are strengthened through strategic acquisitions. The acquisition of CRH Lime in Germany, Czechia, Ireland, the UK, and Poland in 2024 significantly expanded its geographical footprint. This expansion is a key element of SigmaRoc's growth strategy.

This operational model, combined with its focus on sustainability and local market understanding, translates into customer benefits. Customers receive high-quality materials and innovative, eco-friendly solutions, differentiating SigmaRoc from competitors. This focus enhances SigmaRoc's market position.

SigmaRoc is committed to sustainability and innovation, with a focus on eco-friendly products. The launch of eco-friendly concrete in 2024 demonstrates this commitment. The company's R&D budget of £3 million supports these initiatives.

The SigmaRoc company's approach involves several key elements that contribute to its success in the building materials sector. The company's strategic acquisitions and focus on sustainable practices are crucial.

- Strategic Acquisitions: The acquisition of CRH Lime operations in 2024 significantly broadened its market reach.

- Decentralized Model: Empowers local management for efficient operations and cost control.

- Innovation: Investment in R&D, including the launch of eco-friendly concrete, enhances its competitive edge.

- Sustainability: Focus on environmentally friendly products and practices.

- Customer-Focused: Delivering high-quality materials and innovative solutions to meet customer needs.

For a deeper dive into SigmaRoc's strategic approach, consider reading about the Growth Strategy of SigmaRoc.

SigmaRoc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SigmaRoc Make Money?

The primary revenue stream for the SigmaRoc company is the sale of construction materials. These materials include aggregates, asphalt, concrete products, and, increasingly, lime and limestone. This revenue is generated across diverse end-markets, including industrial, environmental, residential, and infrastructure construction.

The SigmaRoc business model focuses on strategic acquisitions and operational improvements. The company aims to improve the performance of acquired businesses, generate value through synergies, and drive organic growth. This approach is central to its monetization strategies within the construction industry.

In the financial year ending December 31, 2024, SigmaRoc reported a 72% year-on-year increase in total revenue, reaching £997.6 million (approximately $1.20 billion USD). This growth was significantly driven by contributions from its lime acquisitions. The underlying EBITDA for the same period increased by 92% to £224.6 million. For the first quarter of 2025, the company's revenue rose by 18% year-on-year to £252 million, with underlying EBITDA climbing 30% to £49 million.

The monetization strategies employed by SigmaRoc are designed to create value through several key initiatives. These include strategic acquisitions, operational improvements within acquired businesses, and the generation of value through synergies and organic growth. The company's focus on these areas is expected to drive its financial performance and strategic focus.

- Strategic Acquisitions: SigmaRoc actively seeks and integrates new businesses to expand its portfolio and market presence.

- Operational Improvements: Enhancing the efficiency and profitability of acquired businesses through strategic initiatives.

- Synergies and Organic Growth: Leveraging synergies between acquired businesses and driving organic growth through market expansion and increased sales.

- Divestitures: The disposal of non-core assets, such as the Belgian ready-mix concrete assets in December 2024, and smaller French plants expected to complete in 2025 for a maximum total consideration of £41 million (€49 million).

- Financial Targets: The company aims to increase its annual revenue by 15% by 2025, driven by strategic growth aspirations.

For more insights into the competitive environment, you can explore the Competitors Landscape of SigmaRoc.

SigmaRoc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SigmaRoc’s Business Model?

The SigmaRoc company has shown significant growth and strategic adaptation within the building materials sector. Key to its expansion was the £1 billion acquisition of lime and limestone assets from CRH plc, a move that substantially increased its market presence. This strategic shift, along with a focus on operational efficiencies, has positioned SigmaRoc to capitalize on opportunities in the construction industry.

The company's approach involves a blend of strategic acquisitions and operational improvements. They have actively managed challenges in the construction market by focusing on efficiency programs. These efforts, combined with a commitment to sustainability and innovation, underscore SigmaRoc's strategy for long-term growth and competitiveness within the building materials sector.

The business model of SigmaRoc is centered around the acquisition and management of building material assets. This model is designed to leverage operational synergies and market opportunities. The company's structure and strategic initiatives reflect a commitment to creating value and adapting to market dynamics.

A major milestone for SigmaRoc was the acquisition of lime and limestone assets from CRH plc, finalized in 2024. This acquisition, valued at £1 billion, included assets across several European countries. The acquisition significantly expanded the company's operational scope and market reach within the construction industry.

SigmaRoc has focused on operational efficiencies and synergy programs to address market challenges. The company launched an aggressive synergy program following the lime and limestone acquisitions, targeting at least €35 million in annualised synergies, with a goal of €60 million by 2027. The company delivered £8 million in synergies in 2024.

SigmaRoc's competitive advantages include quarry ownership, which provides pricing power, and a decentralized business model. The company is committed to sustainability, demonstrated by its eco-friendly concrete launch in 2024 and a goal to reduce carbon emissions by 30% by 2030. Investment in innovation, such as the £3 million annual R&D budget, supports its competitive position.

The company's financial performance is closely tied to its strategic moves and market conditions. The acquisition of assets from CRH plc in 2024 significantly impacted its balance sheet. SigmaRoc is focused on improving financial results through operational efficiencies and synergy programs. For more detailed financial information, refer to the article on SigmaRoc company overview.

The company's strategy includes acquisitions, operational improvements, and sustainability initiatives. These initiatives are designed to enhance SigmaRoc's market position and financial performance. The focus on reducing carbon emissions and investing in innovation reflects a commitment to long-term sustainability and market leadership.

- Acquisition of lime and limestone assets to expand market presence.

- Implementation of synergy programs to drive operational efficiencies.

- Launch of eco-friendly concrete and carbon emission reduction targets.

- Investment in R&D and innovative construction technologies.

SigmaRoc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SigmaRoc Positioning Itself for Continued Success?

The SigmaRoc company has established itself as a prominent player in the European lime and minerals sector. This is particularly evident following the CRH Lime Acquisitions completed in 2024. The company benefits from its diverse regional presence and broad market exposure, serving various sectors including industrial, environmental, food, and both residential and infrastructure construction.

Key risks for the company include the broader macroeconomic and geopolitical environments. While some softening was observed in the residential construction and steel markets, the industrial mineral markets and infrastructure sectors generally performed well in 2024. Potential improvements across European markets are anticipated due to factors such as decreasing interest rates, a renewed focus on stimulating growth, and supportive megatrends.

SigmaRoc aims to increase its market share by an additional 10% within its operational regions by 2026. This growth will be driven by targeted marketing efforts and enhanced customer relationship management. The company's strategic focus is on the building materials sector, particularly in the construction industry.

The company faces risks from the wider macroeconomic and geopolitical environment, which can affect the construction industry. The residential construction and steel markets have shown some softness, impacting the demand for building materials. Fluctuations in interest rates and economic growth can also create headwinds.

SigmaRoc is focused on its synergy program, expecting a minimum of £33 million (€40 million) incremental EBITDA. The company is rationalizing its portfolio through the disposal of non-core assets. The demand for lime and limestone is expected to grow, positioning SigmaRoc to capitalize on this trend.

The company's ongoing strategic initiatives include a continued focus on its synergy program. It is also rationalizing its portfolio through the disposal of non-core assets. SigmaRoc has seen a positive start to 2025 and remains confident in its ability to deliver value and maintain its growth trajectory.

SigmaRoc's strategic actions include a focus on cost discipline and synergy realization, which are crucial for enhancing financial performance. The company's guidance for 2025 remains unchanged, indicating confidence in its operational strategies.

- Continued focus on synergy program, with a minimum £33 million (€40 million) incremental EBITDA expected.

- Rationalization of the portfolio through the disposal of non-core assets.

- Positive start to 2025, maintaining confidence in delivering value and growth.

- Unchanged guidance for 2025, emphasizing cost discipline and synergy realization.

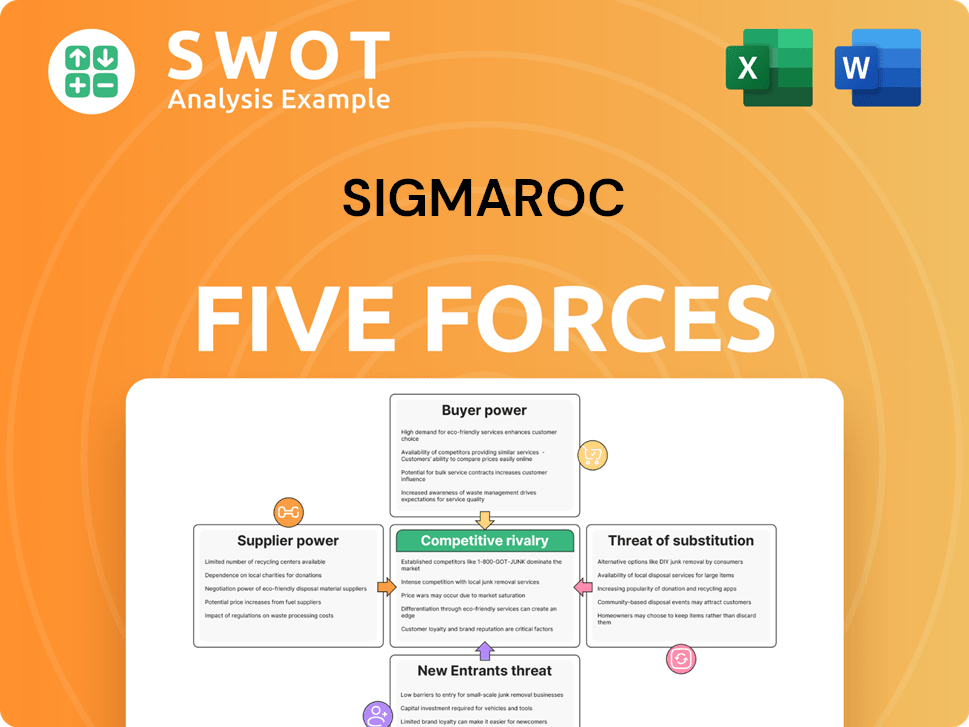

SigmaRoc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SigmaRoc Company?

- What is Competitive Landscape of SigmaRoc Company?

- What is Growth Strategy and Future Prospects of SigmaRoc Company?

- What is Sales and Marketing Strategy of SigmaRoc Company?

- What is Brief History of SigmaRoc Company?

- Who Owns SigmaRoc Company?

- What is Customer Demographics and Target Market of SigmaRoc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.