Sime Darby Bundle

How Did Sime Darby Become a Regional Powerhouse?

From its roots in the early 20th century, the Sime Darby SWOT Analysis reveals a fascinating story of adaptation and growth. This Malaysian conglomerate, formerly a British trading house, has transformed from a plantation-focused entity to a diversified industry leader. Discover how this company navigated over a century of economic shifts to become a key player in the Asia Pacific region.

Delving into the brief history of Sime Darby reveals a company timeline marked by strategic business ventures and significant acquisitions. The company's origins in rubber and palm oil laid the groundwork for its expansion into industrial equipment, motors, healthcare, and property development. Understanding the Sime Darby company's journey offers valuable insights into its growth strategy and its enduring legacy in Malaysia and beyond.

What is the Sime Darby Founding Story?

The story of the [Company Name], a prominent Malaysian conglomerate, began on October 27, 1910. It was founded by William Middleton Sime and Henry Darby, two British businessmen who saw opportunity in the burgeoning agricultural sector of Malaya. Their vision laid the groundwork for what would become a major player in Southeast Asia and beyond.

The founders, William Sime, a Scottish banker, and Henry Darby, an English planter, recognized the potential of rubber and palm oil. Their initial focus was on establishing plantations and trading agricultural commodities. This early venture marked the beginning of a company that would evolve significantly over the decades.

The early Owners & Shareholders of Sime Darby had a straightforward business model: acquire land, cultivate crops, and export the raw materials. This approach required significant investment in infrastructure and labor, setting the stage for the company's future growth and diversification.

The company's initial funding came from personal capital and investments from associates, reflecting the common practices of the colonial era.

- The name 'Sime Darby' was a simple combination of the founders' surnames.

- Securing land and establishing plantation operations were primary challenges.

- The company's creation was influenced by the rise of commodity trading and the British Empire's expansion.

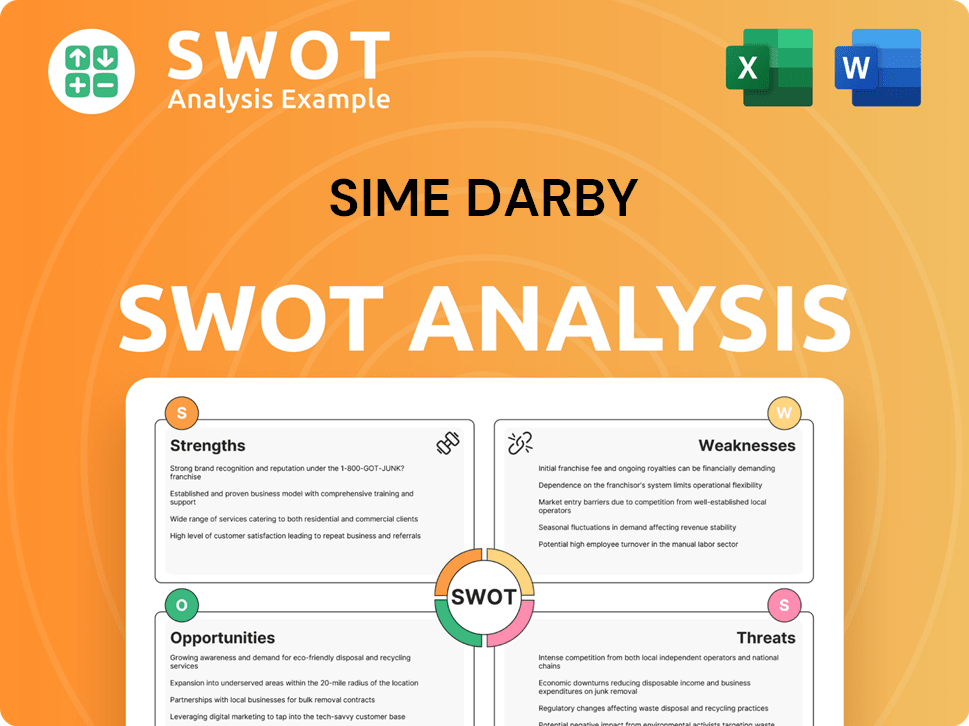

Sime Darby SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sime Darby?

The early growth of the Sime Darby company was closely tied to the flourishing rubber and palm oil industries in British Malaya. From its founding in 1910, the company focused on acquiring plantation land and investing in processing facilities. This period set the stage for its future expansion and diversification. This brief history of Sime Darby highlights its early strategic moves.

Initially, the Sime Darby origins were rooted in agriculture, specifically rubber and palm oil plantations. By the mid-20th century, the company had established a strong presence in these sectors. This focus allowed the company to build a solid foundation in the agricultural industry.

A significant shift occurred in the 1950s when Sime Darby business ventures expanded into the automotive sector. The company began distributing Ford vehicles, marking its move beyond its agricultural roots. This diversification was a key step in its growth strategy.

The 1960s and 1970s saw Sime Darby expansion across Southeast Asia. Markets like Singapore, Hong Kong, and the Philippines were entered during this period. This geographical expansion was crucial for its long-term growth.

Strategic acquisitions, such as the purchase of R.G. Shaw & Co. in 1970, bolstered Sime Darby's international trading capabilities. Leadership transitions during the post-colonial era also played a role. These moves helped the company broaden its reach and capabilities. For more details, you can read about the Sime Darby history.

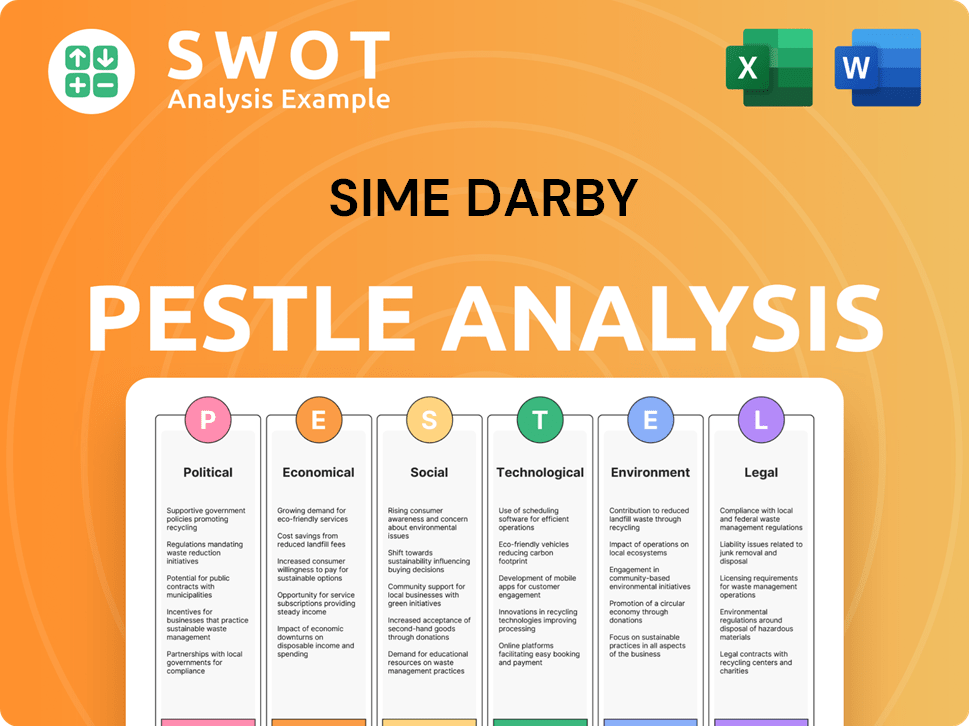

Sime Darby PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sime Darby history?

The Sime Darby history is marked by significant milestones, reflecting its evolution from its

| Year | Milestone |

|---|---|

| Early 1900s | Founding of |

| Mid-20th Century | Expansion into various sectors, including motors and heavy equipment. |

| 1990s | Strategic acquisitions and partnerships to strengthen its market position. |

| 2017 | Demerger, focusing the company on industrial and motors businesses. |

| 2023 | Motors division reported RM 2.7 billion in profit before tax. |

The

Early diversification into motors and heavy equipment, moving beyond its plantation roots. This foresight allowed the company to adapt to changing global economic conditions and market demands.

Forging partnerships with leading automotive brands like BMW, Hyundai, and Porsche. These collaborations have significantly boosted the motors division's market share and revenue.

Implementing efficient operational strategies across its various divisions. This includes supply chain management, cost control, and leveraging technology to enhance productivity and profitability.

Adapting to market changes and economic downturns through strategic restructuring and asset management. The company has shown resilience in the face of challenges like the Asian Financial Crisis and the COVID-19 pandemic.

Embracing technology to improve various aspects of its operations, from customer service to supply chain management. This has enhanced efficiency and provided a competitive advantage.

The 2017 demerger allowed the company to focus on industrial and motors. This strategic move enabled greater specialization and agility in its core business areas.

The

Fluctuations in commodity prices, particularly affecting its plantation interests. These fluctuations can impact revenue and profitability, requiring careful risk management strategies.

Economic crises, such as the Asian Financial Crisis of 1997-1998, which necessitated strategic restructuring and asset divestments. These events tested the company's financial resilience and adaptability.

Disruptions to supply chains, especially during the COVID-19 pandemic, impacting operations and consumer demand. The company had to navigate logistical challenges and adapt to changing market conditions.

Intense competition in the automotive and industrial equipment sectors. The company faces pressure to innovate, offer competitive pricing, and maintain strong customer relationships.

Changes in regulations and policies, which can impact its operations and require adjustments to ensure compliance. The company must stay informed and adapt to evolving legal frameworks.

Geopolitical risks and international trade tensions, which can affect its global operations. The company must monitor and mitigate risks associated with political instability and trade disruptions.

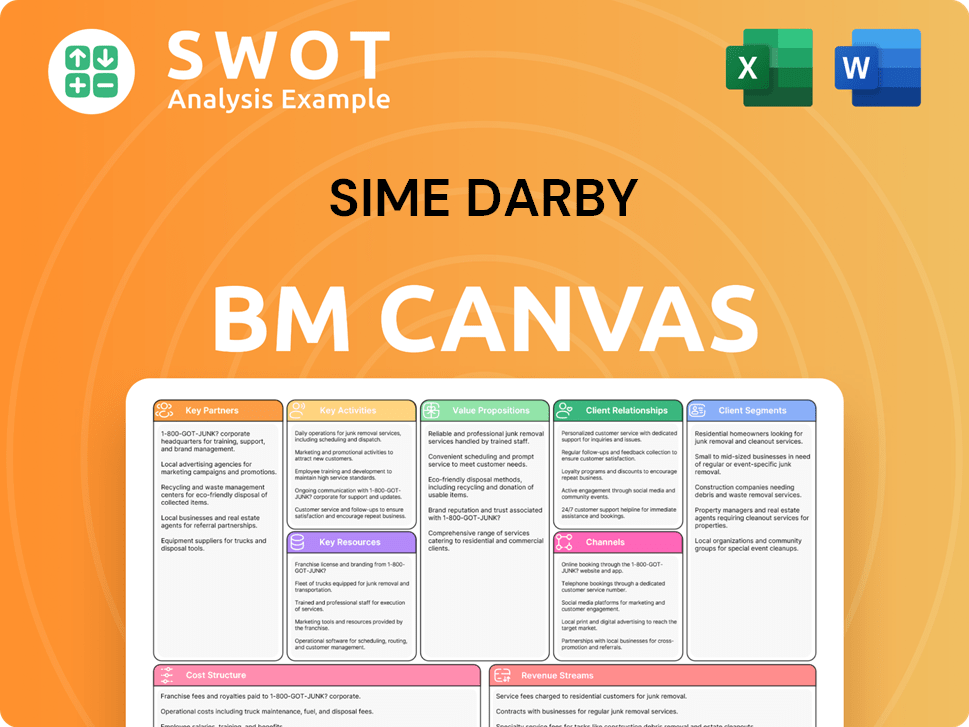

Sime Darby Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sime Darby?

The Sime Darby history is a chronicle of strategic evolution and adaptation. Founded in 1910 by William Middleton Sime and Henry Darby in British Malaya, the Malaysian conglomerate

has grown significantly over the years. From its early focus on plantations, the company diversified into various sectors, including automotive, industrial, and property. Key Sime Darby key milestones

include significant acquisitions, mergers, and strategic shifts to navigate changing market dynamics and capitalize on emerging opportunities. This Sime Darby company

timeline reflects the company's resilience and its ability to adapt to global and regional economic challenges, ensuring its continued relevance and growth.

| Year | Key Event |

|---|---|

| 1910 | Founded by William Middleton Sime and Henry Darby in British Malaya, marking the Sime Darby founding. |

| 1950s | Diversified into the automotive industry, expanding its Sime Darby business ventures. |

| 1970 | Acquired R.G. Shaw & Co., facilitating international trading expansion and further Sime Darby expansion. |

| 1970s | Significant localization of ownership and management, reflecting a shift in corporate strategy. |

| 1980s-1990s | Continued expansion into property development and healthcare. |

| 1997-1998 | Navigated the challenges of the Asian Financial Crisis, demonstrating resilience. |

| 2007 | Merger of Sime Darby, Golden Hope Plantations, and Kumpulan Guthrie, creating a larger entity. |

| 2017 | Demerger of Sime Darby Plantation Berhad and Sime Darby Property Berhad, allowing Sime Darby Berhadto focus on industrial and motors. |

| 2023 | Reported robust financial performance, with the Industrial division securing significant orders and the Motors division achieving strong sales. |

| 2024 | Continues to focus on core businesses, exploring growth opportunities in electrification and automation within its industrial and motors segments. |

Sime Darby is currently concentrating on strengthening its industrial and motors divisions. This strategic direction aims to leverage the company's existing strengths and market position. The focus includes operational excellence and sustainable growth, aligning with its long-term vision.

The company is actively pursuing growth opportunities in the electrification of vehicles and equipment. The Motors division is expanding its electric vehicle (EV) offerings, responding to the increasing demand for sustainable transportation. The Industrial division is exploring automation and digitalization to enhance efficiency and service delivery.

Analysts predict continued stability and growth for Sime Darby, driven by its strong brand partnerships and regional presence. The company's leadership emphasizes a commitment to operational excellence and sustainable growth. This approach is designed to build on its legacy while adapting to evolving market dynamics.

Sime Darby is adapting to evolving market dynamics by investing in future-oriented technologies. This includes focusing on electrification and automation within its core business segments. The company's strategic investments are aimed at ensuring its long-term competitiveness and relevance in the market.

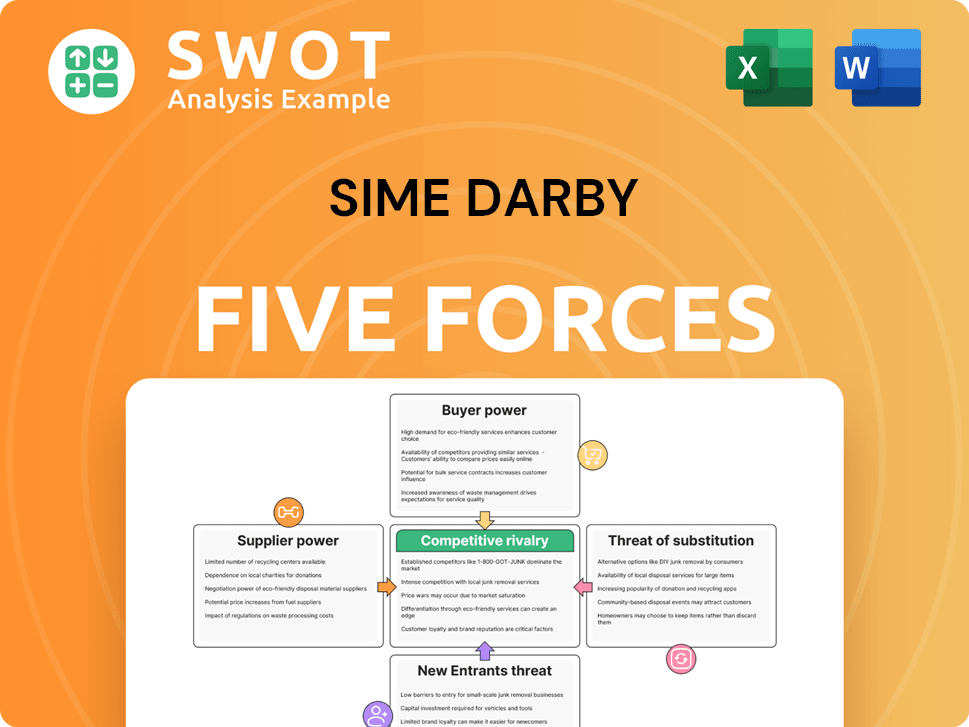

Sime Darby Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sime Darby Company?

- What is Growth Strategy and Future Prospects of Sime Darby Company?

- How Does Sime Darby Company Work?

- What is Sales and Marketing Strategy of Sime Darby Company?

- What is Brief History of Sime Darby Company?

- Who Owns Sime Darby Company?

- What is Customer Demographics and Target Market of Sime Darby Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.