Sime Darby Bundle

Who Really Owns Sime Darby?

Unraveling the intricate web of corporate ownership is key to understanding a company's true potential. Sime Darby Berhad, a Malaysian powerhouse with a rich history, provides a fascinating case study in evolving ownership structures. From its plantation roots to its diverse modern portfolio, the question of "Who owns Sime Darby?" holds the key to unlocking its strategic direction and future prospects.

This exploration into Sime Darby SWOT Analysis delves into the heart of Sime Darby's ownership, examining the influence of key stakeholders, including institutional investors, public shareholders, and government-linked entities. Understanding the Sime Darby ownership structure is crucial for anyone seeking to invest in or analyze the Sime Darby group. We'll uncover the historical shifts in control, providing a comprehensive view of who controls Sime Darby Berhad and the forces that have shaped its trajectory, right up to early 2025, including details on the Sime Darby owner and major shareholders.

Who Founded Sime Darby?

The origins of the company, now known as Sime Darby, trace back to 1910. It was founded by William Middleton Sime and Henry Darby, two British entrepreneurs. Their initial venture was a rubber plantation company in Melaka, British Malaya.

While precise details on the initial equity split are not widely available, Sime and Darby were the primary owners. They were the driving forces behind the company's early development. The company's focus centered on agricultural ventures, primarily rubber and palm oil, capitalizing on the region's natural resources.

Early backers likely included a small group of investors who saw potential in the plantation industry. These investments provided the capital needed for land acquisition and operations. There is limited documentation regarding angel investors or significant stakes beyond the founders during this initial phase. Early agreements likely focused on expanding plantations and reinvesting profits to fuel growth. Information on vesting schedules, buy-sell clauses, or founder exits during the early years is not publicly detailed. Similarly, specific initial ownership disputes or buyouts from the earliest period are not prominent in historical accounts. The founding team's vision was reflected in the distribution of control, with Sime and Darby at the helm.

William Middleton Sime, a Scottish banker, and Henry Darby, an English planter, were the founders of the company. They established the company in 1910.

The company's early focus was on agricultural ventures. Rubber and palm oil were the primary crops, utilizing the resources of British Malaya.

Early backers included a small circle of investors. These investors saw potential in the burgeoning plantation industry.

Specifics on the initial equity split are not readily available. Sime and Darby were the primary owners and driving forces.

Early agreements likely focused on operational expansion. The reinvestment of profits was key to fueling growth.

The founding team's vision was reflected in the distribution of control. Sime and Darby guided the company's expansion.

Understanding the early ownership structure is crucial to comprehending the evolution of the company. The initial setup, with Sime and Darby at the helm, set the stage for future growth. For more insights into the current operations, you can explore the Revenue Streams & Business Model of Sime Darby. The company's journey from its inception to its current status reflects strategic decisions made throughout its history. The early focus on rubber and palm oil laid the foundation for its diversification into various sectors over time. The current Sime Darby ownership structure is a result of this long-term evolution. The Sime Darby owner and who owns Sime Darby have changed significantly over the years.

The company was founded in 1910 by William Middleton Sime and Henry Darby.

- Early focus was on rubber and palm oil plantations.

- Sime and Darby were the primary owners and driving forces.

- Early investors provided capital for land acquisition and operations.

- Limited public information on initial equity splits and early agreements.

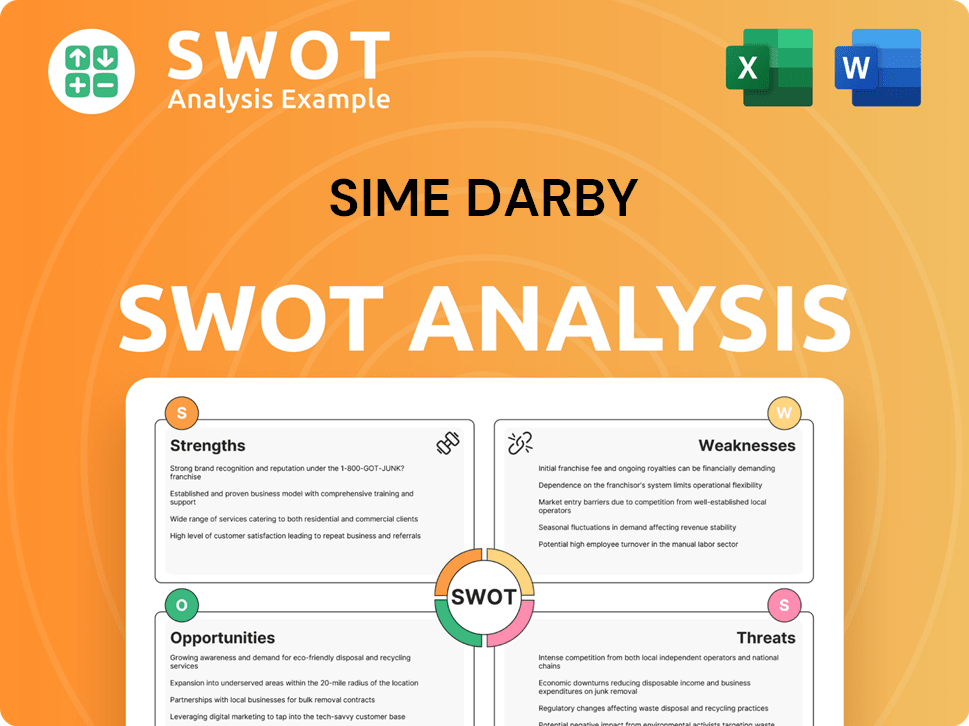

Sime Darby SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Sime Darby’s Ownership Changed Over Time?

The evolution of Sime Darby's ownership reflects its journey from a private plantation business to a major public conglomerate. Key events, such as the initial public offering (IPO), were crucial in broadening its shareholder base. The company's history shows a continuous shift in its major shareholding, particularly with the increasing influence of institutional investors. Understanding the Target Market of Sime Darby is also important for understanding the company's strategic direction.

A significant aspect of Sime Darby's ownership is the role of Permodalan Nasional Berhad (PNB). PNB, a government-linked investment company, holds a substantial stake in Sime Darby Berhad. This ownership structure indicates the Malaysian government's strategic interest in the company, influencing its long-term direction and governance. Other major stakeholders include various institutional investors and individual retail shareholders, whose collective holdings contribute to the company's public float. The latest annual reports and filings provide the most current details on these shareholdings.

| Ownership Aspect | Details | Impact |

|---|---|---|

| Initial Public Offering (IPO) | Marked a shift from private to public ownership. | Broadened the shareholder base and increased access to capital. |

| PNB's Stake | PNB is the largest shareholder. | Aligns the company's strategy with national economic goals. |

| Institutional Investors | Hold significant portions of shares. | Influences corporate governance and strategic decisions. |

The ownership structure of Sime Darby, particularly the significant stake held by PNB, has a considerable impact on the company's strategy. This often aligns the company with national economic development goals and long-term sustainability initiatives. The influence of institutional investors also plays a role in shaping corporate governance and strategic decisions. The current ownership structure reflects a blend of government influence and market-driven dynamics, making it a key aspect of the company's identity.

Sime Darby's ownership has evolved significantly over time, transitioning from private to public ownership.

- Permodalan Nasional Berhad (PNB) is the dominant shareholder.

- Institutional investors and retail shareholders also hold significant portions of the company's shares.

- The Malaysian government indirectly influences Sime Darby's strategic direction.

- The ownership structure impacts the company's alignment with national economic goals.

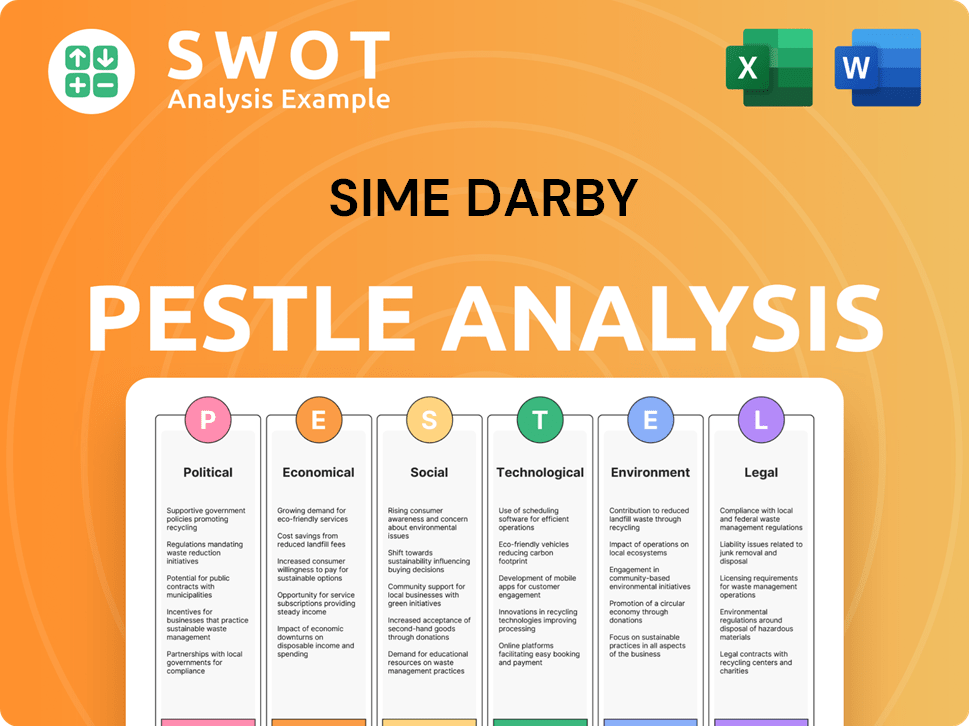

Sime Darby PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Sime Darby’s Board?

The Board of Directors of Sime Darby Berhad is pivotal in the company's governance, reflecting its ownership structure. As of early 2025, the board likely includes representatives from major shareholders, independent directors, and executive directors. Given the significant majority stake held by Permodalan Nasional Berhad (PNB), it's probable that individuals representing PNB are present. These representatives ensure that PNB's strategic interests and long-term vision for Sime Darby are considered in the company's decision-making processes. Independent directors provide oversight and ensure good corporate governance, while executive directors are typically senior management within the company.

The composition of the board is crucial for understanding who owns Sime Darby. The presence of PNB representatives underscores the influence of the major shareholder. The board's decisions are primarily shaped by the collective interests of its shareholders, with PNB's influence being a significant factor due to the sheer size of its stake. This structure helps to align the company's strategic direction with the long-term goals of its primary owner. For more insights into the competitive landscape, you can explore the Competitors Landscape of Sime Darby.

| Board Role | Description | Influence |

|---|---|---|

| Major Shareholder Representatives | Individuals representing Permodalan Nasional Berhad (PNB). | Ensures PNB's strategic interests are considered. |

| Independent Directors | Appointed to provide oversight and ensure good corporate governance. | Provides unbiased perspective on company decisions. |

| Executive Directors | Senior management within the company. | Brings operational expertise to the board. |

Sime Darby Berhad operates under a one-share-one-vote structure for its ordinary shares, meaning each share carries equal voting rights. While PNB, as the largest shareholder, exerts considerable influence through its substantial ownership, its voting power is directly proportional to its shareholding. There have been no prominent public reports of recent proxy battles or activist investor campaigns that have significantly challenged the existing governance structure or decision-making within Sime Darby Berhad in the recent past. This structure ensures that the voting power aligns with the proportion of shares held, maintaining a clear and transparent governance framework.

Understanding Sime Darby's ownership structure is crucial for investors and stakeholders. The board reflects the influence of major shareholders like PNB.

- PNB's representatives on the board ensure alignment with its strategic goals.

- Independent directors provide oversight and maintain good governance.

- The one-share-one-vote structure ensures proportional voting power.

- No significant challenges to the governance structure have been reported recently.

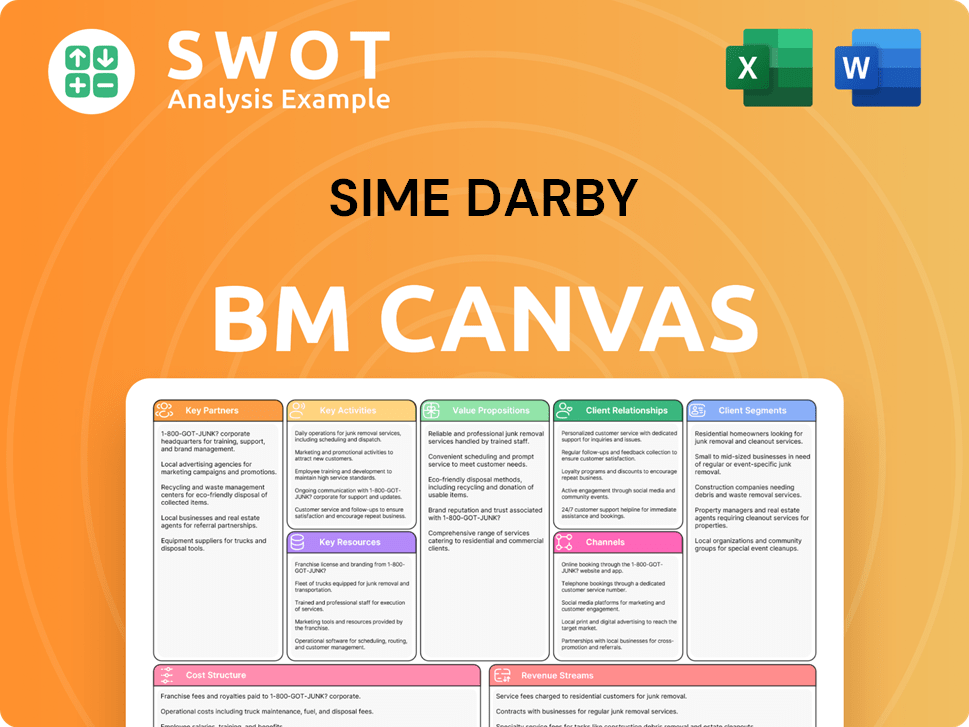

Sime Darby Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Sime Darby’s Ownership Landscape?

Over the past few years, Sime Darby's ownership has been characterized by strategic shifts. The company has focused on its core industrial and motors businesses. There have been no recent large-scale share buybacks or secondary offerings. The company has been streamlining operations to enhance efficiency across its segments.

Institutional ownership has increased, with significant stakes held by large funds and investment institutions. Government-linked investment companies, such as PNB, continue to have a defining influence on the company's ownership structure. There have been no recent announcements about immediate ownership changes, suggesting a period of relative stability.

| Ownership Category | Approximate Stake | Details |

|---|---|---|

| PNB (Permodalan Nasional Berhad) | Significant | The largest shareholder, reflecting the influence of government-linked investment companies. |

| Institutional Investors | Significant | Includes large funds and investment institutions. |

| Public Float | Variable | Represents shares available for public trading. |

The focus remains on operational performance and strategic growth within the existing framework. The company's strategic direction has not seen major shifts in ownership or control recently, indicating a stable outlook for shareholders. The company's headquarters are in Malaysia. The company operates in multiple countries through various subsidiaries, with ownership details varying.

The ownership structure is mainly composed of institutional investors and a significant stake held by PNB. The company is publicly listed, and the remaining shares are available for public trading. This structure provides a balance between institutional influence and public market participation.

The key stakeholders include PNB, other institutional investors, and the public shareholders. The company's management team is responsible for operational decisions. The company's performance and strategic direction are closely watched by these stakeholders.

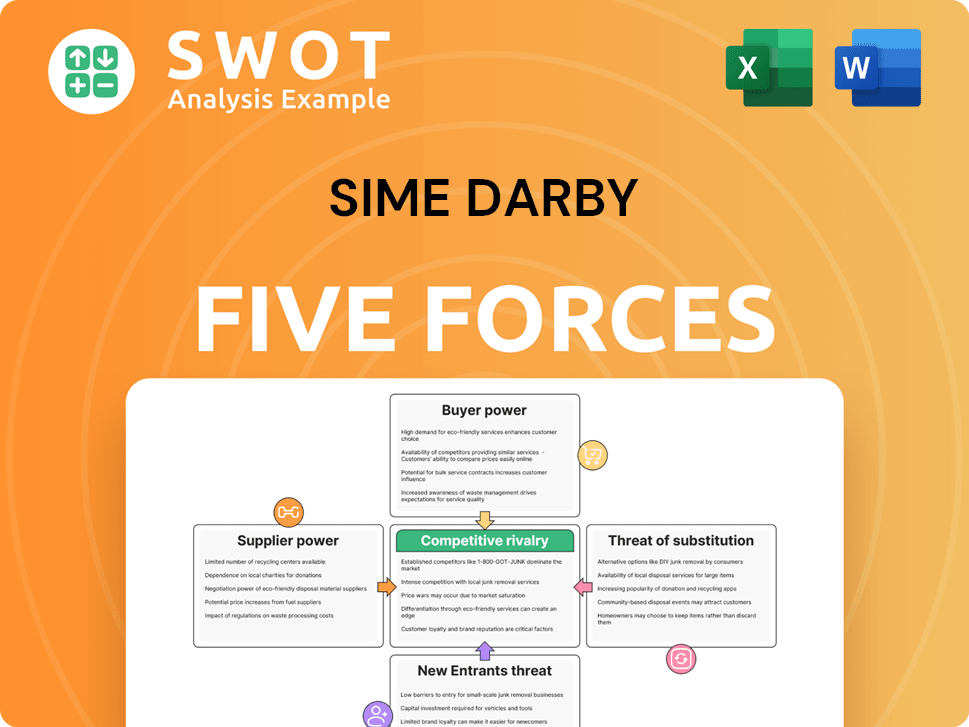

Sime Darby Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sime Darby Company?

- What is Competitive Landscape of Sime Darby Company?

- What is Growth Strategy and Future Prospects of Sime Darby Company?

- How Does Sime Darby Company Work?

- What is Sales and Marketing Strategy of Sime Darby Company?

- What is Brief History of Sime Darby Company?

- What is Customer Demographics and Target Market of Sime Darby Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.