Sime Darby Bundle

How Does Sime Darby Thrive in a Complex Market?

Sime Darby Berhad, a Malaysian powerhouse, operates across diverse sectors, from industrial equipment to healthcare. Its strategic moves and consistent performance warrant a deep dive into its competitive arena. This analysis explores Sime Darby's position, its rivals, and the factors driving its success in a dynamic environment. Understanding the Sime Darby SWOT Analysis is crucial for grasping its market dynamics.

This comprehensive examination of the Sime Darby competitive landscape will identify key Sime Darby competitors and analyze their impact. We'll delve into Sime Darby's market share analysis, evaluating its financial performance and business strategy to understand its competitive advantages and disadvantages. Furthermore, the study will explore Sime Darby's industry positioning, offering insights into its future growth prospects and strategic direction, including its response to competitor moves and challenges in the current market.

Where Does Sime Darby’ Stand in the Current Market?

Sime Darby Berhad holds a strong market position across its diverse business segments, primarily within the Asia Pacific region. The company's core operations span several key sectors, including industrial, automotive, property, and healthcare. This diversification allows for resilience against economic fluctuations in any single sector. The company's value proposition centers on providing high-quality products and services, leveraging its extensive distribution networks, and fostering strategic partnerships to drive growth.

Sime Darby's competitive landscape is shaped by its presence in multiple industries. In the industrial sector, the company is a leading distributor of heavy equipment, especially through its Caterpillar dealerships. The automotive division represents premium brands, and the property segment focuses on sustainable township developments. The healthcare arm provides private healthcare services. Target Market of Sime Darby includes businesses and consumers across various income levels, depending on the specific business segment.

The company's financial performance reflects its market position. While specific market share figures vary by segment and region, Sime Darby consistently ranks among the top players in its operational territories. The company's strategic focus includes expanding its industrial footprint and focusing on higher-value segments in property. However, it faces intense competition in fragmented markets.

Sime Darby's industrial segment, particularly its heavy equipment distribution, benefits from strong relationships with major manufacturers like Caterpillar. This segment is a key revenue driver for the company, especially in markets like Australia and Malaysia. The company's market share in this sector is significant, positioning it as a leading player.

The Motors division holds a significant market share in the automotive distribution and retail market, with a focus on premium brands like BMW and Porsche. The division benefits from an established service network and strong brand partnerships. This helps maintain a robust position in the premium automotive segment across various countries.

Sime Darby Property is a key developer in the Malaysian property market. It has a substantial land bank and focuses on sustainable township developments. The company faces competition from other developers, but its scale and strategic focus help maintain its market position. This segment contributes significantly to the company's overall revenue.

Ramsay Sime Darby Health Care is a prominent private healthcare provider in Malaysia and Indonesia. The healthcare arm benefits from the growing demand for quality healthcare services in the region. This segment contributes to the company's diversified revenue streams and market presence.

Sime Darby's competitive advantages include its diversified business model, extensive distribution networks, and strong brand partnerships. Disadvantages include exposure to cyclical industries and intense competition in certain markets. The company's financial performance is supported by its diverse revenue streams, providing resilience against sector-specific downturns. The company's geographic presence in key growth markets in the Asia Pacific allows it to leverage regional economic development.

- Competitive Benchmarking: Sime Darby consistently ranks among the top players in its operational territories.

- Market Share Analysis 2024: The company's Motors division benefits from strong brand partnerships and an established service network, contributing to its robust positioning in the premium automotive segment.

- Strategic Partnerships and Alliances: The company has historically maintained a solid financial footing, with its diverse revenue streams providing resilience against sector-specific downturns.

- Challenges in the Current Market: In certain highly fragmented markets, such as general property development or specific heavy equipment niches, Sime Darby faces intense competition from numerous local and regional players.

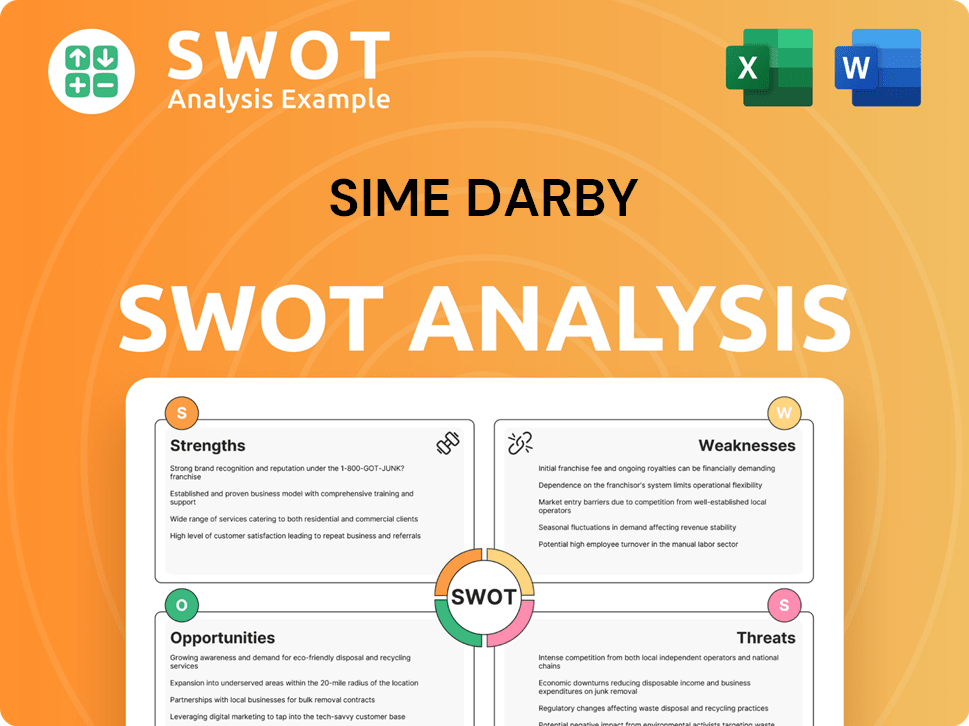

Sime Darby SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sime Darby?

Analyzing the Sime Darby competitive landscape reveals a complex environment shaped by diverse industry segments. The company faces competition across its industrial, automotive, property, and healthcare divisions. Understanding these competitive dynamics is crucial for assessing Sime Darby's business strategy and financial performance.

Sime Darby's market analysis must consider the varying competitive pressures in each sector. This includes identifying key rivals, evaluating their strengths and weaknesses, and assessing the overall market share. The competitive environment directly impacts Sime Darby's ability to maintain and grow its market position.

Sime Darby's competitive landscape is dynamic, requiring continuous monitoring and strategic adaptation. The company must navigate challenges and capitalize on opportunities to ensure long-term success. This includes understanding the strategies of its competitors and responding effectively to market changes.

In the Industrial segment, Sime Darby competes with other authorized dealers and suppliers of heavy equipment. Key rivals include authorized dealers of Komatsu, Volvo Construction Equipment, and John Deere. These competitors challenge Sime Darby in product offerings and service networks.

The Motors division faces competition from large automotive conglomerates and independent dealers. For premium brands, competitors include authorized distributors of Mercedes-Benz, Audi, and Lexus. In the mass-market segment, rivals are local distributors of Japanese and Korean brands.

Sime Darby Property competes with numerous local and international developers. Prominent Malaysian property developers like S P Setia Berhad, UEM Sunrise Berhad, and IOI Properties Group Berhad are direct competitors. They often compete for land banks and launch similar projects.

In the Healthcare sector, Ramsay Sime Darby Health Care competes with other private hospital groups. Key competitors include KPJ Healthcare Berhad and IHH Healthcare Berhad. Competition is based on specialist services, medical technology, and patient experience.

Sime Darby's market share varies across its segments. In the automotive sector, for example, the company's share is influenced by the performance of the brands it represents. In the property sector, market share depends on project launches and sales performance.

Sime Darby must continually assess its competitive position. This includes analyzing the strategies of its competitors, identifying Sime Darby's competitive advantages and disadvantages, and adapting to market changes. Strategic partnerships and alliances can also play a key role.

Several factors influence the competitive landscape for Sime Darby. These include brand reputation, pricing strategies, service quality, and the ability to adapt to changing market conditions. Understanding these factors is essential for effective Sime Darby's business strategy.

- Product and Service Quality: Offering high-quality products and services is crucial for maintaining a competitive edge.

- Pricing Strategies: Competitive pricing is essential to attract customers and maintain market share.

- After-Sales Service: Providing excellent after-sales service enhances customer loyalty and satisfaction.

- Innovation: Embracing innovation in products, services, and business models helps to stay ahead of the competition.

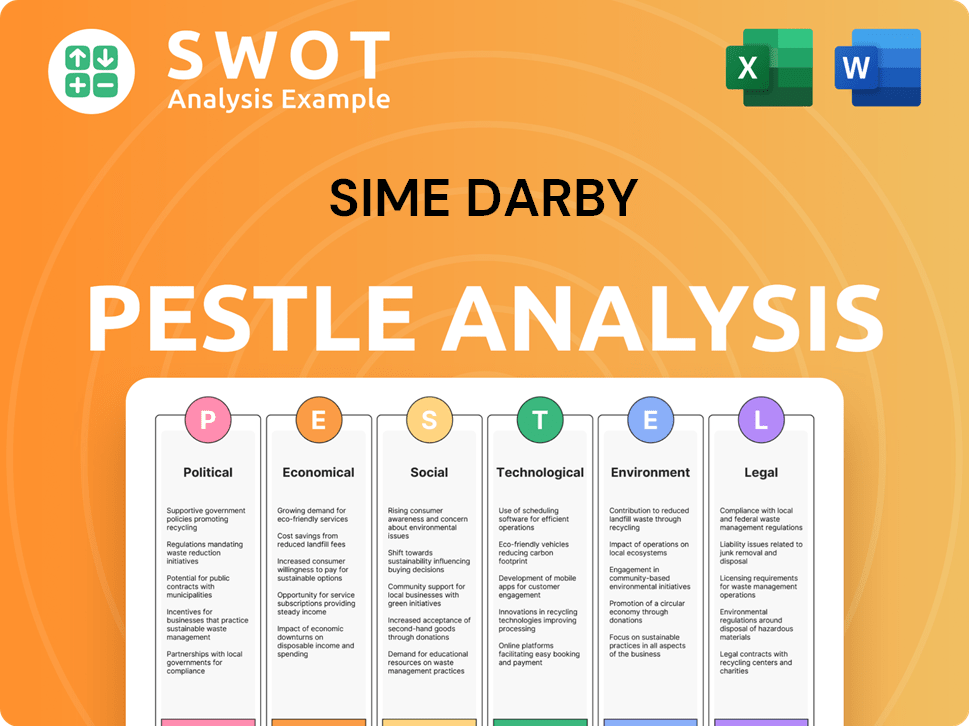

Sime Darby PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sime Darby a Competitive Edge Over Its Rivals?

The competitive landscape for Sime Darby is shaped by its diverse operations across several sectors. The company has a long-standing presence, which has helped build strong brand equity and customer loyalty. This is particularly evident in its Motors division, where it represents premium automotive brands. Understanding the Brief History of Sime Darby helps to provide context for its current market position.

Sime Darby's business strategy involves leveraging its extensive distribution network and economies of scale to achieve operational efficiencies. Its diversified portfolio helps mitigate risks associated with downturns in any single sector. The company's financial performance is also influenced by its strategic partnerships and alliances, which enhance its market position.

Sime Darby's competitive advantages include a robust after-sales service network, especially in the Industrial segment due to its partnership with Caterpillar. Its property division benefits from a substantial land bank in strategic locations. The company's experienced management team and skilled workforce contribute to its sustained performance.

Sime Darby's strong brand equity, built over more than a century, fosters customer trust and loyalty. This is a key advantage, especially in the Motors division, where it represents premium automotive brands. The company's reputation supports its competitive edge in the Sime Darby competitive landscape.

The enduring partnership with Caterpillar provides access to a superior product range and advanced technology. This collaboration enhances Sime Darby's market position in the Industrial segment. Strategic alliances are crucial for maintaining a competitive edge in the Sime Darby industry.

Sime Darby's extensive footprint across the Asia Pacific allows it to achieve operational efficiencies. Its integrated supply chain for industrial equipment and automotive parts contributes to cost effectiveness. This network is a significant advantage in the Sime Darby market analysis.

A diversified portfolio mitigates risks associated with downturns in any single sector, providing stable revenue streams. This diversification is a key component of Sime Darby's business strategy. It helps the company navigate challenges in the current market.

Sime Darby's competitive advantages include strong brand recognition, strategic partnerships, and an extensive distribution network. These factors contribute to its financial performance and market share. The company faces challenges from new entrants and technological advancements, requiring continuous adaptation. In 2024, the Motors division saw a rise in sales due to strong demand for premium vehicles, while the Industrial segment benefited from infrastructure projects.

- Strong brand equity and customer loyalty.

- Strategic partnerships with leading global brands.

- Extensive distribution network across Asia Pacific.

- Diversified portfolio mitigating sector-specific risks.

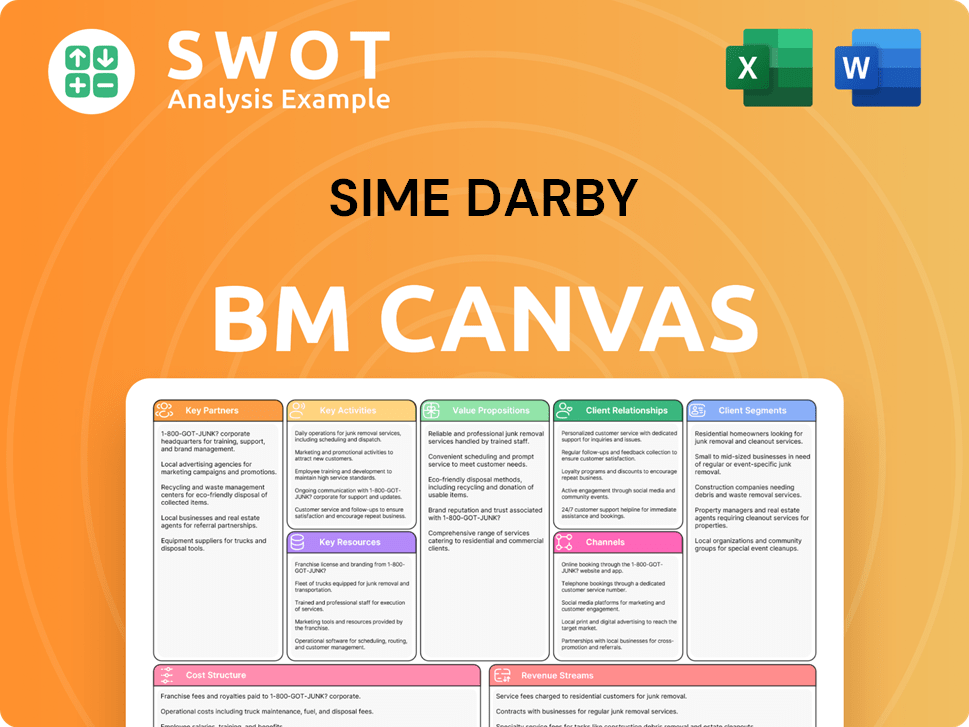

Sime Darby Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sime Darby’s Competitive Landscape?

The competitive landscape for Sime Darby is significantly influenced by industry trends, presenting both opportunities and challenges across its diverse business segments. A thorough Sime Darby market analysis reveals the need for strategic adaptation to navigate these dynamics effectively. Understanding the Sime Darby competitive landscape is crucial for assessing its future growth prospects.

Sime Darby's business strategy must consider evolving market demands, technological advancements, and economic uncertainties. The company's ability to capitalize on emerging trends and mitigate potential risks will determine its financial performance and market position. The Sime Darby industry is dynamic, requiring continuous evaluation and strategic adjustments.

The Industrial segment faces a growing emphasis on decarbonization and sustainable practices, increasing demand for electric and hybrid equipment. The adoption of advanced telematics and automation solutions is also on the rise. These trends present opportunities for expansion into green technologies and smart equipment.

Geopolitical uncertainties and fluctuating commodity prices can impact demand for heavy equipment and industrial services. Adapting existing infrastructure and expertise to accommodate new technologies is a significant challenge. Competition in this sector is also intense.

The Motors division is undergoing a rapid transformation due to the rise of electric vehicles (EVs) and autonomous driving technology. Consumer preferences are shifting towards shared mobility and digital sales channels. The market is experiencing significant disruption.

Managing the transition from internal combustion engine (ICE) vehicles requires significant investment in new technologies and workforce retraining. The increasing prevalence of online vehicle sales and subscription models necessitates digital transformation. Competition is fierce, particularly from EV-focused manufacturers.

Urbanization, changing demographics, and a growing emphasis on sustainable and smart living are key drivers in the Property sector. There's an increased demand for integrated, eco-friendly townships and smart homes. Technology integration is becoming crucial.

Intense competition, rising construction costs, and regulatory complexities pose challenges. Economic downturns and interest rate hikes can dampen property demand. Maintaining profitability in a competitive market is a key concern.

The Healthcare sector is experiencing increasing demand for specialized medical services and digital health solutions. There is a growing focus on preventative care and the integration of telemedicine. Technological advancements are rapidly changing the landscape.

A shortage of skilled healthcare professionals and rising operational costs are significant challenges. The need to constantly upgrade facilities to meet evolving patient expectations and medical advancements is also a factor. Competition from both public and private healthcare providers is increasing.

To maintain a competitive edge, Sime Darby must embrace technological innovation, adapt to sustainability mandates, and strategically invest in high-growth areas. Navigating economic volatilities and intense competition across its diverse portfolio is crucial. For further insights into the company's structure, consider reading about Owners & Shareholders of Sime Darby.

- Focus on digital transformation across all business segments.

- Expand EV offerings and charging infrastructure in the Motors division.

- Develop sustainable and smart living solutions in the Property sector.

- Invest in cutting-edge medical technology and expand healthcare networks.

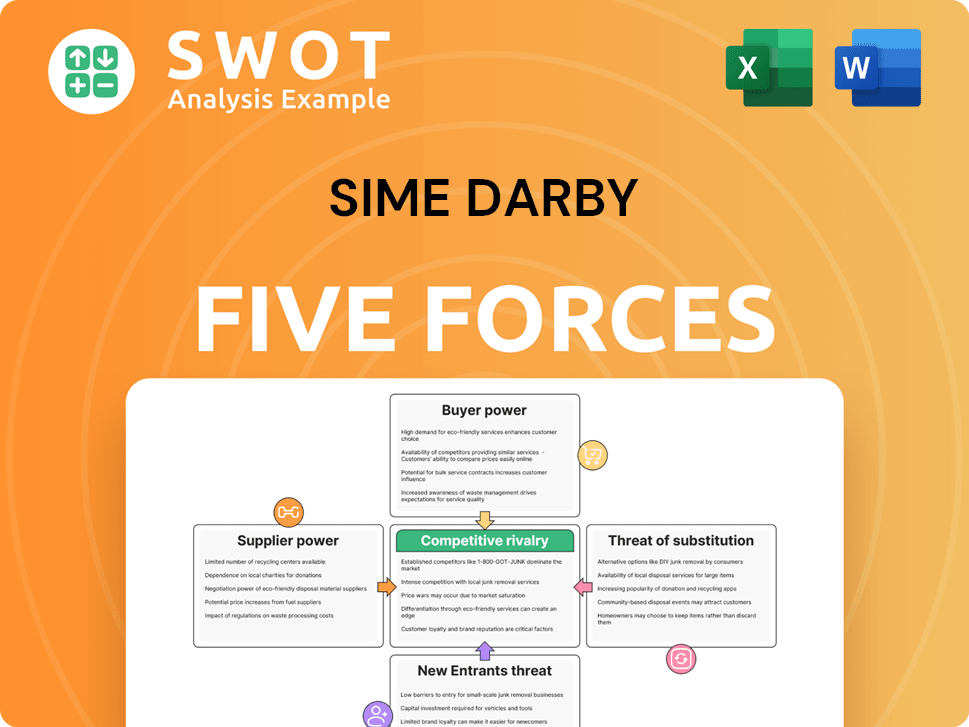

Sime Darby Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sime Darby Company?

- What is Growth Strategy and Future Prospects of Sime Darby Company?

- How Does Sime Darby Company Work?

- What is Sales and Marketing Strategy of Sime Darby Company?

- What is Brief History of Sime Darby Company?

- Who Owns Sime Darby Company?

- What is Customer Demographics and Target Market of Sime Darby Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.