Skyworth Bundle

How Did Skyworth Rise to Become a Global Tech Powerhouse?

Ever wondered how a Chinese electronics company could become a global leader? Skyworth's journey, starting in Shenzhen in 1988, is a compelling story of ambition and innovation. From its early days as a TV manufacturer, Skyworth has consistently pushed boundaries, evolving into a diversified technology giant. This Skyworth SWOT Analysis reveals the strategic moves that fueled its remarkable growth.

Skyworth's story is more than just a corporate timeline; it's a reflection of China's economic transformation. The Skyworth company background reveals a relentless drive to compete with established brands like Sony and Panasonic. Understanding the Skyworth history provides valuable insights into the strategies that propelled this Chinese electronics company to international prominence, including its impressive Skyworth market share and its impact on the TV manufacturer landscape.

What is the Skyworth Founding Story?

The Skyworth Group Co., Ltd. has a rich Skyworth history, beginning in Shenzhen, China. The Skyworth company was founded in April 1988 by Huang Hongsheng, marking the start of an ambitious journey in the electronics industry.

Huang's vision was to build a leading electronics firm, drawing inspiration from global giants. This ambition was fueled by China's economic reforms and the development of the Shenzhen Special Economic Zone, creating an ideal environment for new businesses.

Huang Hongsheng, with a background in engineering and import-export, saw an opportunity in the emerging TV market, which lacked advanced technology. His initial venture, Skyworth Industrial, faced early challenges. However, this experience provided valuable insights for his later success.

- Huang Hongsheng established Skyworth Digital in Shenzhen.

- The company initially focused on developing a remote control for televisions.

- This product became a success, earning Huang the nickname 'Remote Control King.'

- The early business model emphasized technological leadership and quality in electronic product manufacturing.

The initial funding likely came from Huang's personal savings and support from associates. This marked a significant leap of faith into the electronics industry.

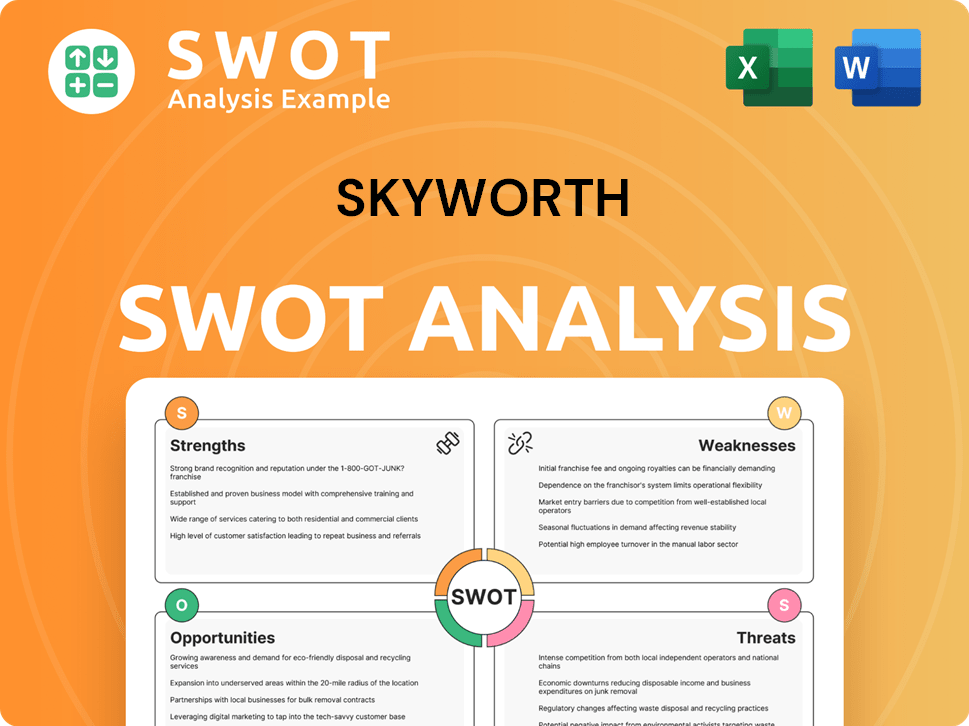

Skyworth SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Skyworth?

The early growth of the Skyworth company was marked by strategic moves in product diversification and market penetration. Initially known for TV remote controls, the Skyworth brand expanded into set-top boxes and video players. This period saw the company establish a strong foothold in the television manufacturing sector, setting the stage for future expansion. The Skyworth company quickly evolved, becoming a significant player in the Chinese electronics market.

Following its initial success, Skyworth diversified its product range. This included set-top boxes and video players, which complemented its core business. This diversification strategy was key to capturing a larger market share and increasing revenue streams. This early product evolution helped solidify its position as a TV manufacturer.

The period from 1996 to 2000 is recognized as a 'fast growth period' for Skyworth. During this time, the company rapidly expanded its production volume. By the end of this period, Skyworth had become the number four television manufacturing company in China. This rapid growth was a key Skyworth company milestone.

A significant step in Skyworth's history was its IPO on the Hong Kong Stock Exchange in April 2000. This IPO raised RMB 1.18 billion, providing capital for both domestic and international growth. The IPO was a crucial Skyworth company milestone, enabling further expansion. The IPO also enhanced the Skyworth brand's visibility.

Skyworth began expanding its international presence by establishing subsidiaries in various regions. Skyworth formed Skyworth Marco Commercial Offshore Co Ltd in November 2000 to manage research, development, production, and distribution for overseas markets. By 2022, its products were sold in over 100 countries, with overseas revenue reaching RMB 12.1 billion (approximately USD 1.77 billion), contributing about 17% of its total revenue. For more details on the company's growth, see the Growth Strategy of Skyworth.

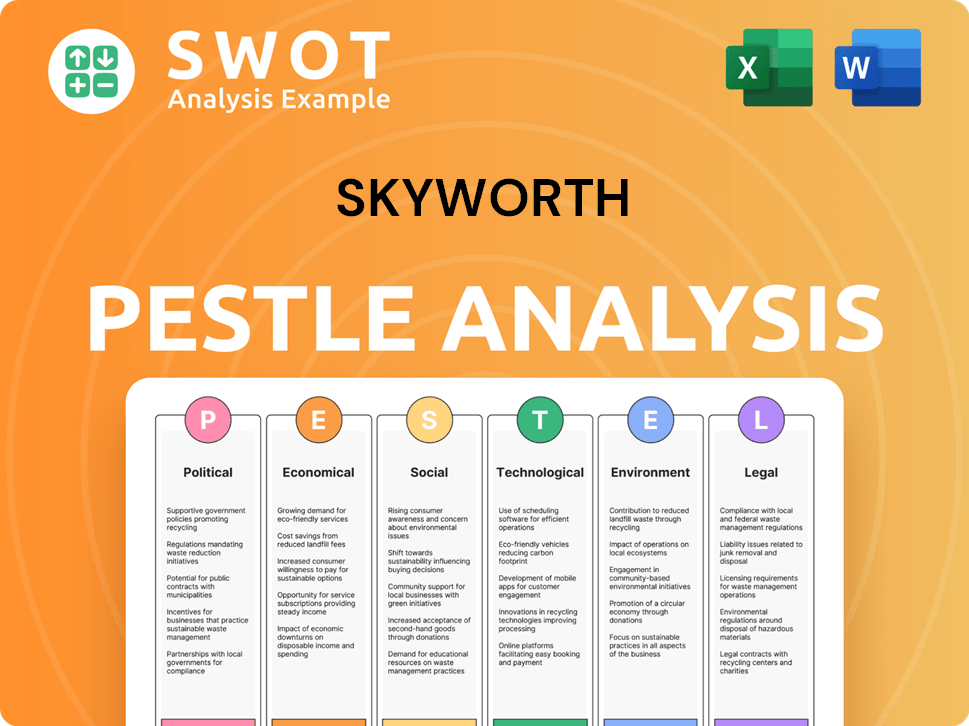

Skyworth PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Skyworth history?

The Skyworth company's journey, a significant player in the Chinese electronics market, has been marked by notable milestones and strategic adaptations. Its evolution reflects the dynamic shifts in the consumer electronics industry and the company's responses to both opportunities and challenges. Understanding the Skyworth history provides insights into the trajectory of a major TV manufacturer.

| Year | Milestone |

|---|---|

| Early Years | Established itself as a key player in the Chinese electronics market. |

| 2013 | Launched the world's first full color gamut TV and China's first OLED TV. |

| 2024 | Introduced the world's first AI Karaoke Google TV series and 'Find My Remote' feature. |

| 2025 | Launched the groundbreaking OmniView Matte Screen technology. |

Skyworth has consistently pushed the boundaries of display technology, showcasing a commitment to innovation. The company was an early adopter of advanced TV technologies, including flicker-free and 4K TVs, and has invested heavily in research and development.

Skyworth was among the first to introduce flicker-free TVs and 4K TVs in China, setting a new standard for visual experience. This early adoption positioned the Skyworth brand as a technology leader.

Skyworth was a pioneer in OLED technology, launching China's first OLED TV in 2013 and achieving mass production of 8K OLED TVs. This demonstrates the company's commitment to cutting-edge display technology.

Skyworth has integrated AI and IoT into its products, enhancing user experience and functionality. This focus on smart technology reflects the evolving demands of the market.

The OmniView Matte Screen technology, designed to enhance MiniLED displays, is a recent innovation. This technology aims to provide performance comparable to OLED displays with features like a low reflect layer and anti-glare material.

Skyworth introduced the world's first AI Karaoke Google TV series in 2024, integrating entertainment with advanced technology. This innovation enhances the user experience by combining entertainment with smart features.

The 'Find My Remote' feature, introduced in 2024, enhances user convenience by addressing a common issue. This feature reflects Skyworth's focus on user-friendly design and functionality.

Despite its successes, Skyworth has faced challenges, including fluctuations in the market and internal issues. These challenges have led to strategic adjustments and a renewed focus on core strengths and future growth areas. For more insights into the company's ownership and financial structure, you can explore Owners & Shareholders of Skyworth.

The arrest and imprisonment of founder Huang Hongsheng in 2006 for embezzlement created significant disruption. Despite this, the company emphasized its good corporate governance and continued operations.

In 2024, Skyworth projected a significant profit decline of 35% due to impairment provisions on properties and inventories. This was primarily influenced by the prolonged slump in China's real estate market and competitive pressures.

The company's 2024 annual report showed a 5.8% decline in revenue, reaching RMB 65,013 million, and a 34.3% drop in profit to RMB 1,160 million. These figures highlight the impact of market challenges.

Skyworth has responded to challenges by focusing on new energy and smart systems technology. The company is also working on strengthening corporate governance and investor relations.

Intense competition in the smart systems technology sector has put pressure on profitability. This has led to strategic shifts to maintain competitiveness.

The prolonged slump in China's real estate market has negatively impacted the company's financial performance. This has resulted in impairment provisions on properties and inventories.

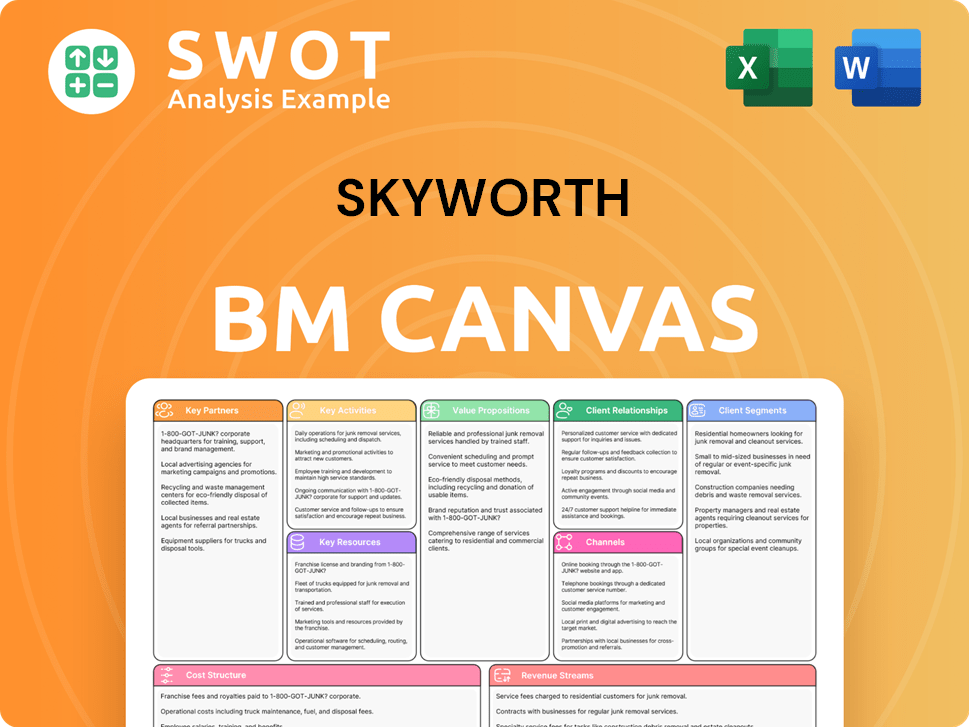

Skyworth Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Skyworth?

The Skyworth company, a prominent player in the Chinese electronics sector, has a rich history marked by significant milestones. From its humble beginnings in Shenzhen, China, to its global presence today, the company's journey reflects its adaptability and commitment to innovation. The following timeline highlights key events in the evolution of the Skyworth brand and its contributions to the TV manufacturer landscape.

| Year | Key Event |

|---|---|

| 1988 | Skyworth Group Co., Ltd. was founded in Shenzhen, China, marking the company's inception. |

| 1992 | The company established its headquarters in Hong Kong, expanding its operational base. |

| 1993 | Shenzhen Skyworth-RGB Electronic Co Ltd was co-established, strengthening its manufacturing capabilities. |

| 1996-2000 | Skyworth experienced a 'fast growth period,' becoming the fourth-largest TV manufacturer in China. |

| 1999 | Skyworth established its lab in Silicon Valley, USA, and Skyworth Hong Kong, expanding its global presence. |

| April 2000 | The company was listed on the Hong Kong Stock Exchange (HK0751), opening up opportunities for investment. |

| November 2000 | Skyworth Marco Commercial Offshore Co Ltd was established to focus on overseas markets. |

| 2003 | The head office moved to the newly built Skyworth Building in Shenzhen. |

| 2006 | Founder Huang Hongsheng was sentenced to imprisonment. |

| 2007 | Skyworth became a co-partner and sponsor of the Chinese Space Craft. |

| 2008 | Skyworth ranked No. 1 in the Chinese market for volume and revenue in the TV segment. |

| 2013 | The company launched the world's first full color gamut TV and China's first OLED TV, demonstrating its commitment to innovation. |

| 2015 | Skyworth acquired Metz and Strong Media to enter the EU market. |

| 2016 | The company merged the Toshiba Indonesia factory to facilitate the supply chain in Southeast Asia. |

| 2017 | Skyworth contributed to China's DTMB standard development and received the National Science and Technology Progress Award (First Class). |

| 2018 | A new brand, METZ blue, was set up and launched in Europe, India, and Hong Kong, China. |

| 2019 | Skyworth announced its new global brand strategy, 'Open, Share, Win-win.' |

| 2020 | Shenzhen Skyworth Commercial Technology, a B2B subsidiary, was established. |

| 2021 | The company launched the world's second 8K OLED TV (W92) and Skyworth's first deformable OLED TV (W82). |

| 2024 | Skyworth reported total revenues of RMB 65.013 billion, with a net profit of 1.16 billion yuan. |

| 2025 | Skyworth unveiled the OmniView Matte Screen technology at the Canton Fair. |

Skyworth is focused on advancing major projects, including the Shenzhen Headquarters Base and smart manufacturing bases in the Pearl River Delta and Yangtze River Delta. These initiatives aim to solidify its position as a leader in smart household appliances and information technology. The company's strategic focus includes advanced product technologies, sound corporate governance, and global competitiveness.

The company is developing four key business segments: smart household appliances, smart systems technology, new energy, and modern services. This diversification strategy aims to capture growth opportunities in various sectors. The 5G+8K technology is also a key growth engine for the next decade, and the company plans to interconnect products across different categories.

Skyworth is heavily investing in innovation, particularly in high-end display technologies like Mini-LED. Global Mini-LED TV sales are projected to reach 35.5 million units in 2025. The company's focus on technology advancements and market trends positions it well for continued growth. Skyworth's commitment to providing consumers with wonderful, healthy, and technological life is unwavering.

Skyworth aims to become a global leader in the electronics industry. The company's strategic initiatives and investments are aligned with its vision of providing consumers with innovative and high-quality products. This includes a focus on international expansion and strengthening its position in key markets. The future outlook for Skyworth is promising.

Skyworth Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Skyworth Company?

- What is Growth Strategy and Future Prospects of Skyworth Company?

- How Does Skyworth Company Work?

- What is Sales and Marketing Strategy of Skyworth Company?

- What is Brief History of Skyworth Company?

- Who Owns Skyworth Company?

- What is Customer Demographics and Target Market of Skyworth Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.