Skyworth Bundle

How Does Skyworth Navigate the Cutthroat Consumer Electronics Market?

In the fast-paced world of consumer electronics, where innovation is king, Skyworth Company has carved a significant niche, especially within the Asian market. From its humble beginnings in Shenzhen, China, in 1988, Skyworth has evolved from a TV manufacturer to a diversified tech powerhouse. This strategic expansion has positioned Skyworth amidst both global giants and agile startups.

This exploration into the Skyworth SWOT Analysis will dissect the company's position within the Skyworth competitive landscape, providing a detailed Skyworth market analysis. We'll identify key Skyworth competitors and dissect its competitive advantages, while also examining the Skyworth industry trends, Skyworth challenges, and strategic opportunities that will shape its future. Understanding Skyworth's strategy is key to grasping its ability to thrive in the global consumer electronics arena, considering factors like Skyworth's market share analysis 2024 and Skyworth's global market presence.

Where Does Skyworth’ Stand in the Current Market?

Skyworth Group Limited holds a significant position in the global consumer electronics market. Its primary focus is on the Chinese market, but it is also expanding internationally. The company is known for its televisions and a growing range of smart home appliances.

The company's strategy involves broadening its offerings beyond televisions to include a wider array of smart home products. This shift is intended to strengthen its market position and competitiveness. Skyworth's financial results reflect a solid performance, with substantial revenue from its multimedia and smart home appliance businesses.

Skyworth's market presence is substantial, particularly in Asia, with a strong foothold in China and Southeast Asia. The company's strategic moves into emerging markets and its expansion plans in Europe and North America demonstrate its commitment to global growth. For a deeper understanding of its origins and evolution, consider reading the Brief History of Skyworth.

Skyworth has consistently been a top player in the Chinese TV market. While specific market share figures for 2024-2025 are dynamic, Skyworth has historically held a significant percentage. This strong position is supported by its innovation in display technology, including OLED and AI-powered displays.

Skyworth's product portfolio includes televisions, smart home appliances (refrigerators, washing machines, air conditioners), set-top boxes, and security systems. This diversification allows Skyworth to compete across various segments of the consumer electronics market. The company's strategy is to offer a comprehensive smart home ecosystem.

Skyworth's primary market is Asia, with significant operations in China and Southeast Asia. The company is expanding into Europe and North America, targeting both developed and emerging markets. This geographic diversification is key to its long-term growth strategy.

Skyworth's financial health is reflected in its annual reports, with revenue from multimedia and smart home appliances contributing significantly. The company's financial performance is an important indicator of its competitive position. The company's ability to adapt to market changes impacts its financial outcomes.

Skyworth's competitive advantages include its strong brand recognition in China, diverse product portfolio, and technological innovation. However, challenges include intense competition in the global market and supply chain issues.

- Strengths: Strong brand recognition, diverse product portfolio, innovation in display technology.

- Weaknesses: Intense competition, supply chain vulnerabilities, and dependence on the Chinese market.

- Opportunities: Expansion into new markets, growth in smart home appliances, and strategic partnerships.

- Threats: Economic downturns, changing consumer preferences, and increased competition from global brands.

Skyworth SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Skyworth?

Understanding the Skyworth competitive landscape is crucial for assessing its market position and future prospects. The company operates in a dynamic environment with significant competition across its various product lines, including televisions, smart home appliances, and set-top boxes. This analysis delves into the key players challenging Skyworth and the strategies they employ.

A thorough Skyworth market analysis reveals that the company faces both direct and indirect competitors. Direct competitors are those offering similar products, while indirect competitors may provide alternative solutions or services that fulfill the same consumer needs. The competitive intensity varies across different geographic regions and product segments, requiring Skyworth to adapt its strategies accordingly.

The Skyworth industry is characterized by rapid technological advancements, shifting consumer preferences, and intense price competition. Success depends on innovation, efficient operations, and strong brand recognition. This chapter examines the key competitors and their impact on Skyworth's performance.

In the television market, Skyworth competes with global giants and domestic rivals. Skyworth's main competitors in China include established brands that continuously introduce new technologies and features.

Samsung and LG are major competitors, known for their premium products and advanced display technologies like OLED and QLED. These companies often command higher prices and significant market share in the premium segment. Skyworth's global market presence is challenged by these well-established brands.

Hisense and TCL are key Chinese competitors, focusing on competitive pricing and technological innovation. They often compete aggressively in the affordable to mid-range segments. These companies are also expanding globally, increasing the competitive pressure on Skyworth's competitive advantages and disadvantages.

In the smart home appliance sector, Skyworth faces competition from both domestic and international brands. These competitors challenge Skyworth through their extensive product portfolios and established brand loyalty.

Haier, Midea, and Gree are major domestic competitors. These companies have strong manufacturing capabilities and extensive distribution networks within China. They are continually innovating to maintain their market positions.

Bosch, Siemens, and Whirlpool are significant international competitors. These brands often focus on premium products and advanced features, targeting different consumer segments. They leverage their global brand recognition and technological expertise.

Skyworth's strategies for entering new markets and maintaining its position involve several key approaches. These include product innovation, competitive pricing, and strategic partnerships. Understanding these strategies is crucial for evaluating Skyworth's financial performance compared to rivals.

- Product Innovation: Continuously introducing new features and technologies to stay ahead of the competition. Skyworth's innovation strategy in the TV market includes advancements in display technology and smart TV platforms.

- Competitive Pricing: Offering competitive prices to attract consumers, especially in the affordable to mid-range segments. Skyworth's competitive pricing strategies are essential for gaining market share.

- Strategic Partnerships: Collaborating with technology providers and content creators to enhance its product offerings. Skyworth's partnerships and collaborations are vital for expanding its market reach.

- Marketing and Branding: Investing in marketing and branding to increase brand awareness and customer loyalty. The Marketing Strategy of Skyworth provides further insights into these efforts.

- Supply Chain Management: Optimizing its supply chain to reduce costs and improve efficiency. Skyworth's supply chain analysis and its impact on competition are critical for maintaining profitability.

Skyworth PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Skyworth a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of a company like Skyworth involves assessing its strengths, weaknesses, and strategic positioning within the consumer electronics market. Skyworth's competitive advantages are multifaceted, stemming from its strategic focus on technology, vertical integration, and a strong brand presence in key markets. Analyzing its performance against rivals provides insights into its market share, innovation capabilities, and overall financial health. This analysis is crucial for investors, strategists, and anyone interested in the consumer electronics industry.

The competitive dynamics within the TV market are constantly evolving, influenced by technological advancements, consumer preferences, and economic factors. Skyworth, as a major player, must navigate these challenges while leveraging its strengths to maintain and grow its market share. A deep dive into Skyworth's competitive advantages, including its product portfolio, innovation strategy, and response to market competition, is essential for a comprehensive understanding of its position.

Skyworth's success is also tied to its ability to adapt to changing market conditions and consumer demands. Its competitive advantages include a strong brand reputation, which helps it maintain customer loyalty and expand into new product categories. Further, the company's ability to form strategic partnerships and continuously develop new products is critical in a rapidly evolving industry. For more information about the company, you can read about Owners & Shareholders of Skyworth.

Skyworth's investment in proprietary display technologies, particularly OLED, is a key competitive advantage. This focus on advanced display technology is backed by significant research and development efforts, leading to patents and unique product features. Skyworth has been a pioneer in promoting OLED televisions in China, offering superior picture quality and design, which differentiates it from competitors.

Skyworth benefits from a degree of vertical integration, especially in its television manufacturing process. This integration provides cost efficiencies and greater control over the supply chain. This allows the company to manage production costs more effectively and respond quickly to market changes. This advantage helps Skyworth maintain competitive pricing and ensure product quality.

Skyworth's extensive distribution network, particularly within China, allows for broad market penetration and efficient delivery of products. This strong distribution capability enables the company to reach a wide customer base and quickly introduce new products. The robust distribution network is a critical factor in maintaining and growing its market share.

The company has cultivated strong brand equity within its primary markets, built on years of delivering reliable and increasingly innovative consumer electronics. This brand recognition fosters customer loyalty and provides a foundation for expanding into new product categories. Skyworth leverages these advantages through strategic partnerships and aggressive marketing campaigns.

Skyworth's competitive advantages include technological innovation, vertical integration, a strong distribution network, and brand equity. These strengths enable the company to maintain a strong position in the market. Skyworth's focus on OLED technology and its extensive distribution network are key differentiators.

- Innovation in Display Technology: Skyworth's focus on OLED technology provides a superior viewing experience, setting it apart from competitors.

- Vertical Integration: Manufacturing control allows for cost efficiencies and supply chain management.

- Extensive Distribution Network: Broad market penetration and efficient product delivery.

- Strong Brand Reputation: Customer loyalty and opportunities for product diversification.

Skyworth Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Skyworth’s Competitive Landscape?

The consumer electronics industry is currently undergoing significant transformations, impacting the Skyworth competitive landscape. The rise of Artificial Intelligence (AI) and the Internet of Things (IoT) is reshaping product development and consumer expectations. This creates both opportunities and challenges for companies like Skyworth, demanding strategic adaptations to stay competitive.

This analysis explores the trends, challenges, and opportunities facing Skyworth. It examines how the company can navigate the evolving market dynamics. We will also look at the Skyworth market analysis to understand the competitive pressures and strategic options available.

Key trends include the growing demand for smart home integration and higher-resolution displays, such as 8K TVs. There's also a push for energy-efficient appliances. The market is shifting towards personalized content delivery and connected experiences, which Skyworth must address in its product development.

Skyworth faces intense competition from global tech giants. Geopolitical tensions and supply chain disruptions pose risks. Rapid technological advancements require continuous investment in research and development to avoid obsolescence and maintain a competitive edge.

Opportunities exist in expanding into emerging markets and further developing its smart home platform. Strategic partnerships with content providers and other smart home device manufacturers can unlock growth. Focusing on innovation and adapting to market changes is crucial.

Skyworth must focus on innovation, managing supply chain complexities, and adapting to market trends. The company should concentrate on creating an integrated and user-friendly ecosystem. Exploring new markets and forming strategic alliances are also vital.

The Skyworth industry faces significant competitive pressure, with major players vying for market share. This involves understanding Skyworth's main competitors in China and globally. The company needs to leverage its strengths to overcome challenges. For a deeper dive into Skyworth's growth strategies, consider reading the Growth Strategy of Skyworth.

- Skyworth's competitive advantages and disadvantages include its established brand recognition and extensive product portfolio.

- Skyworth's product portfolio and its competitors: The company's product range spans TVs, appliances, and smart home devices, competing with a broad spectrum of rivals.

- Skyworth's innovation strategy in the TV market: Focusing on high-resolution displays and smart features is essential.

- Skyworth's response to market competition: Adapting pricing strategies and expanding into new markets are key responses.

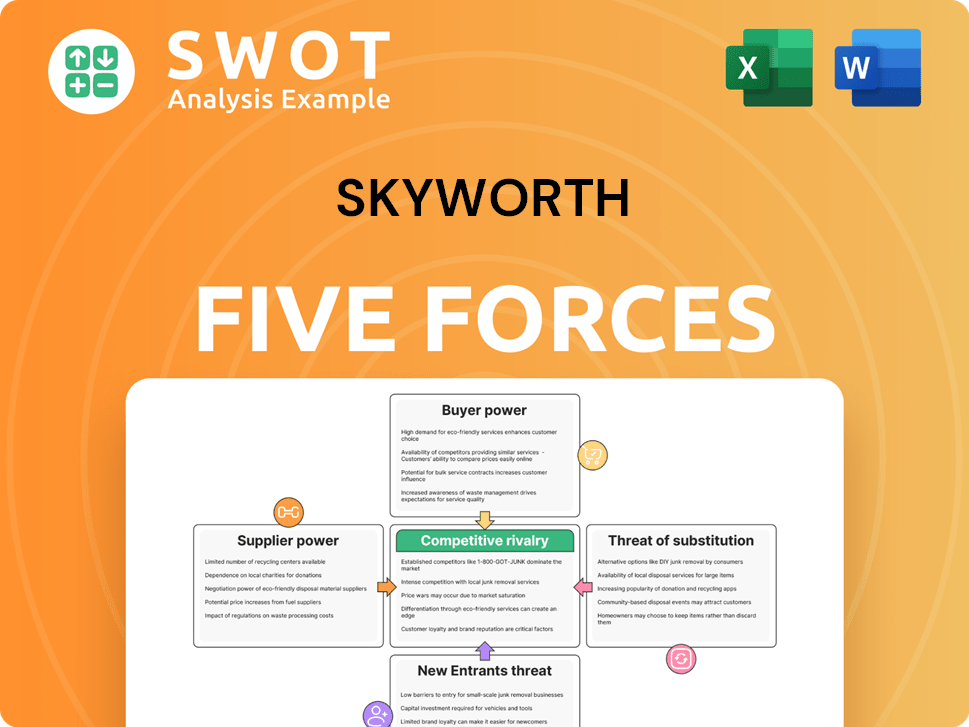

Skyworth Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Skyworth Company?

- What is Growth Strategy and Future Prospects of Skyworth Company?

- How Does Skyworth Company Work?

- What is Sales and Marketing Strategy of Skyworth Company?

- What is Brief History of Skyworth Company?

- Who Owns Skyworth Company?

- What is Customer Demographics and Target Market of Skyworth Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.