Smith & Nephew Bundle

How Did Smith & Nephew Become a Global Healthcare Powerhouse?

Journey back in time to 1856, when a small chemist shop in the UK laid the foundation for a medical technology giant. This is the Smith & Nephew SWOT Analysis. From humble beginnings supplying cod liver oil, the Smith & Nephew company has evolved into a global leader in healthcare. Discover the remarkable Smith and Nephew history and the pivotal moments that shaped this enduring enterprise.

This article explores the brief history of Smith & Nephew, a prominent medical device company, examining its evolution from a local supplier to a global force. We'll uncover the key milestones, including its expansion into Orthopedic implants and Wound care, and how strategic decisions propelled Smith & Nephew's growth. Learn about Smith & Nephew's innovation, market share, and financial performance, offering insights into its enduring success and future prospects.

What is the Smith & Nephew Founding Story?

The Smith & Nephew story began in 1856 in Kingston upon Hull, UK. Thomas James Smith, the founder, initially operated as a dispensing chemist. This early venture laid the groundwork for what would become a global medical device company.

A strategic shift occurred by 1858 when Smith transitioned from retail to wholesale. This move allowed the company to supply medical products directly to hospitals and dispensaries. This early focus on wholesale was a key factor in the company's initial growth and future success.

The company's name changed before Thomas James Smith's death in 1896. His nephew, Horatio Nelson Smith, joined the business, leading to the renaming of the company to T. J. Smith and Nephew. Horatio Nelson Smith played a key role in the company's evolution.

The company's focus shifted from cod liver oil to surgical dressings and bandages.

- 1904: The company began specializing in bandages and surgical dressings.

- This product line proved crucial in the years to come.

- The company's early success was influenced by the increasing demand for medical supplies.

- The company's early financial strategies involved wholesale distribution.

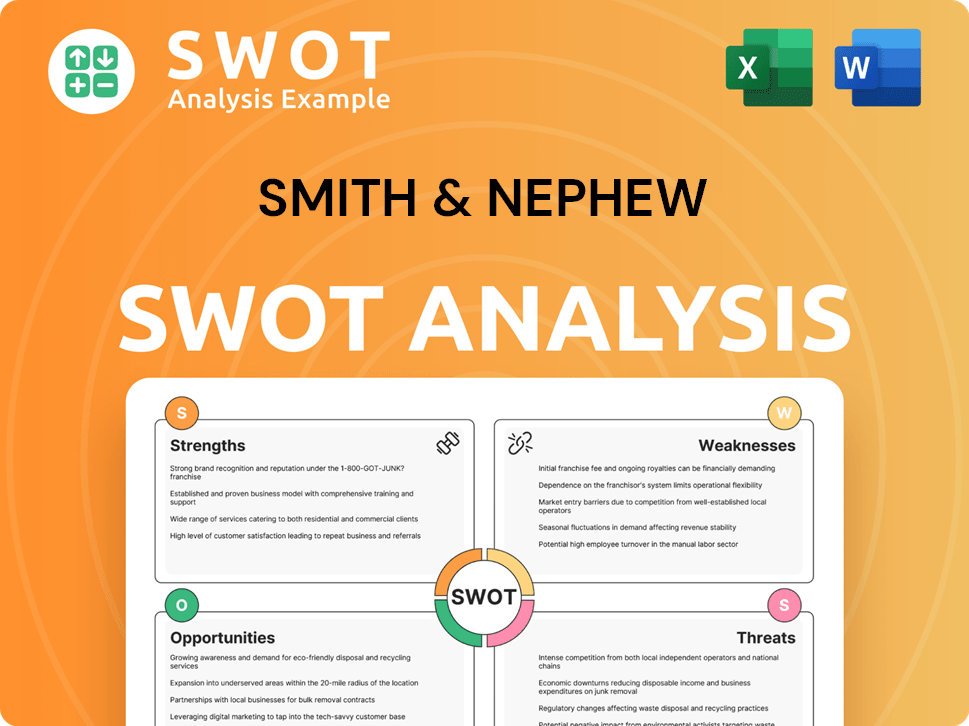

Smith & Nephew SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Smith & Nephew?

The early 20th century witnessed significant expansion for Smith & Nephew. This period was marked by strategic shifts and a growing global presence. The company adapted to changing market demands, particularly through its focus on wound care and surgical dressings. This proactive approach set the stage for its future success as a leading medical device company.

Recognizing the declining demand for cod liver oil, Smith & Nephew shifted its focus. In 1906, the company acquired a bandage cutting and rolling machine, pivoting toward wound dressings and bandages. This was a crucial move that positioned the company for growth, especially with the onset of World War I. This early innovation in wound care products proved to be a pivotal moment in the Smith & Nephew company timeline.

The outbreak of World War I in 1914 dramatically increased the demand for surgical dressings. Smith & Nephew secured a substantial contract worth £350,000 to supply surgical and field dressings to the French President's envoy. To meet these wartime demands, the company significantly increased its workforce, growing from 50 to 1,200 employees. This rapid expansion highlights the company's ability to respond to large-scale needs.

In 1907, Smith & Nephew became a limited company, solidifying its corporate structure. The company's international expansion began in 1921 with the establishment of its first overseas branch in Canada. This branch secured contracts to supply Canadian hospitals with bandages. This early international presence laid the groundwork for the company’s future global reach and its position as a key player in the medical device company sector.

Throughout this early growth phase, Smith & Nephew demonstrated agility in adapting its product portfolio. The company's focus on wound care and bandages, along with its expansion into international markets, showcases its ability to identify and capitalize on market opportunities. This strategic approach was crucial in establishing the company's foundation. For more details, you can read about Smith & Nephew history.

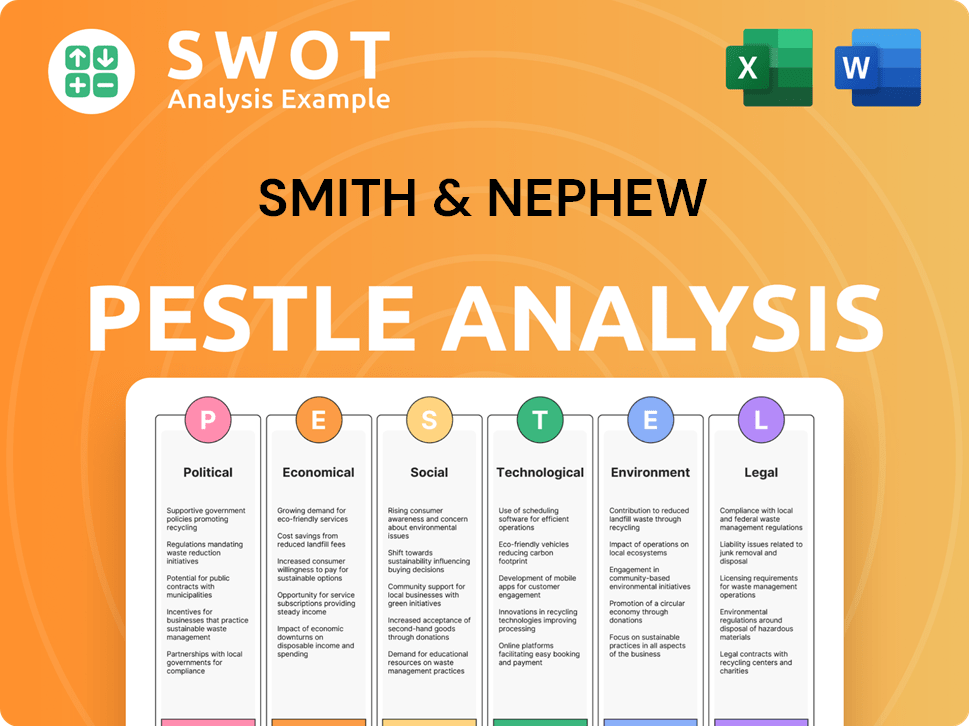

Smith & Nephew PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Smith & Nephew history?

The Smith & Nephew company has a rich history, marked by significant milestones in the medical device industry. From its early days to its current global presence, the company has consistently adapted and innovated.

| Year | Milestone |

|---|---|

| 1856 | Founded in Hull, England, by Thomas James Smith as a pharmacy. |

| 1896 | Began manufacturing surgical dressings. |

| 1937 | Became a public company. |

| 1953 | Supplied a low-temperature plaster for the Everest expedition. |

| 2024 | Over 60% of revenue growth attributed to products launched within the last five years. |

| 2025 | Launched the TESSA Spatial Surgery System. |

The company has consistently pushed the boundaries of medical technology. Recent innovations include the CORI Surgical System and advancements in arthroscopic surgical innovation with the TESSA Spatial Surgery System.

The CORI Surgical System is an advanced robotics-assisted surgical platform, which is being showcased across Europe in 2025 for total knee and hip joint replacement procedures. This platform represents a significant advancement in orthopedic surgery.

EVOS is one of the key platforms driving growth for the company. It is a testament to the company's commitment to innovation in medical devices.

REGENETEN is another key platform that has delivered strong double-digit growth in the first quarter of 2025. This product highlights Smith & Nephew's focus on regenerative medicine.

Smith & Nephew's Negative Pressure Wound Therapy portfolio has also shown strong double-digit growth in the first quarter of 2025. This demonstrates the company's expertise in wound care.

In March 2025, Smith & Nephew announced pioneering efforts in Spatial Surgery, a new category in arthroscopic surgical innovation. The TESSA Spatial Surgery System submitted to the FDA.

Over the last three years, Smith & Nephew has launched nearly 50 new products. This continuous stream of new products underscores the company's commitment to innovation.

Despite its successes, the

Challenges in China, including lower pricing from the Volume-Based Procurement (VBP) program in Sports Medicine Joint Repair and early effects in arthroscopic enabled technologies, are expected to persist through the first half of 2025. These issues have affected the company's performance in the region.

The company has also contended with ongoing tariff impacts, estimated at $15-20 million for 2025. These tariffs have added to the financial pressures faced by Smith & Nephew.

Smith & Nephew has undertaken strategic initiatives, including closing four manufacturing plants to streamline operations and shifting 67% of its U.S. production to domestic facilities to mitigate tariff exposure. These efforts include a 9% reduction in headcount.

These restructuring efforts are forecast to contribute major cost savings and enhance operating efficiency. The company's '12-Point Plan' has been instrumental in driving operational and commercial improvements.

The company's '12-Point Plan' has led to consistent revenue growth above historical levels and supports margin expansion. This plan has been key to navigating challenges.

The company's ability to adapt to market dynamics, such as the VBP program in China, is crucial for its continued success. Smith & Nephew's strategic responses are vital.

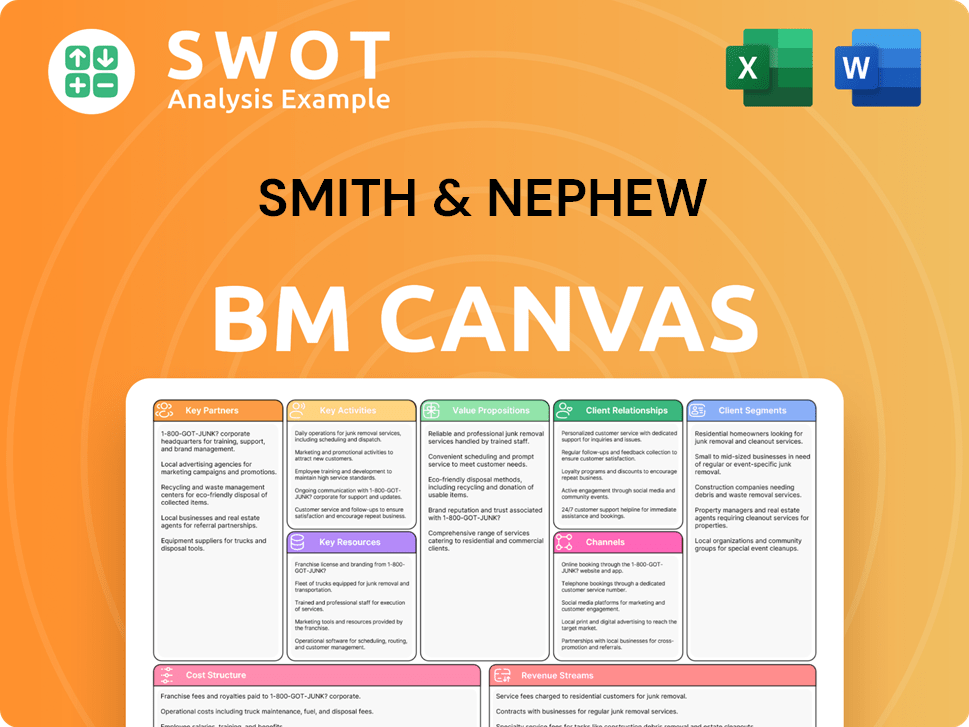

Smith & Nephew Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Smith & Nephew?

The Smith & Nephew company's journey is a compelling story of adaptation and innovation in the medical device sector. From its humble beginnings as a chemist shop, it has grown into a global leader, consistently evolving to meet the changing needs of the healthcare industry. The Smith and Nephew history is marked by strategic expansions, technological advancements, and a commitment to improving patient outcomes. The company's ability to navigate market challenges and embrace new technologies has been key to its sustained success. This journey is further detailed in Mission, Vision & Core Values of Smith & Nephew.

| Year | Key Event |

|---|---|

| 1856 | Thomas James Smith establishes a chemist shop in Kingston upon Hull, UK. |

| 1858 | The company shifts from retail to wholesale of medical supplies. |

| 1896 | Horatio Nelson Smith joins, and the company becomes T. J. Smith and Nephew. |

| 1904 | Begins producing bandages and surgical dressings. |

| 1907 | Becomes a limited company. |

| 1914 | Awarded a significant contract to supply surgical dressings during World War I; staff grows from 50 to 1,200. |

| 1921 | Opens its first independent overseas branch in Canada. |

| 1953 | Develops a special low-temperature plaster used by Everest climbers. |

| 2022 | Deepak Nath appointed CEO, initiating the '12-Point Plan' for turnaround. |

| 2024 | Reports group revenue of $5.81 billion, with underlying revenue growth of 5.3%. |

| 2025 (February 25) | Announces full year 2024 results, targeting around 5% underlying revenue growth and 19.0% to 20.0% trading profit margin for 2025. |

| 2025 (March 4) | Announces pioneering efforts in Spatial Surgery with the TESSA Spatial Surgery System. |

| 2025 (March 12) | Showcases advanced Orthopaedic Reconstruction technologies at AAOS 2025, including CORI Surgical System and AETOS Shoulder System. |

| 2025 (April 30) | Reports Q1 2025 underlying revenue growth of 3.1%, reaffirming full-year guidance. |

Smith & Nephew reported $5.81 billion in group revenue for 2024, with underlying revenue growth of 5.3%. The company is targeting approximately 5% underlying revenue growth for 2025. A trading profit margin between 19.0% and 20.0% is expected for 2025, with stronger margin expansion anticipated in the second half of the year.

Smith & Nephew is focused on continued product launches and clinical evidence to drive growth. The company is investing in surgical robotics and regenerative technologies. Further margin expansion beyond 2025 is a key strategic goal. Ongoing innovation and efficiency gains are also major components of the company's strategy.

The company is at the forefront of innovation, particularly in Orthopaedic Reconstruction. Recent showcases include the CORI Surgical System and AETOS Shoulder System. Smith & Nephew is also making pioneering efforts in Spatial Surgery with the TESSA Spatial Surgery System. Over 60% of revenue growth comes from products launched in the last five years.

Smith & Nephew aims to improve patient lives through innovative medical technology. The company is adapting to global market conditions and an aging population, which is expected to reach 2.1 billion by 2050. The long-term strategy emphasizes sustained growth and efficiency gains. This vision aligns with the company's founding principles.

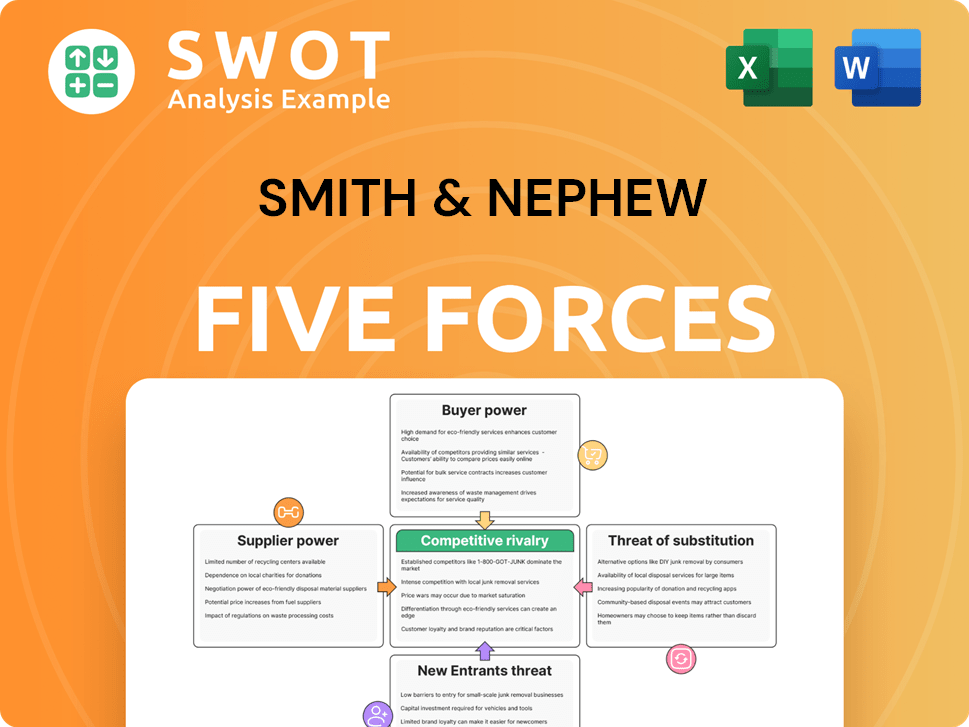

Smith & Nephew Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Smith & Nephew Company?

- What is Growth Strategy and Future Prospects of Smith & Nephew Company?

- How Does Smith & Nephew Company Work?

- What is Sales and Marketing Strategy of Smith & Nephew Company?

- What is Brief History of Smith & Nephew Company?

- Who Owns Smith & Nephew Company?

- What is Customer Demographics and Target Market of Smith & Nephew Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.