Smith & Nephew Bundle

Can Smith & Nephew's Growth Strategy Propel It to New Heights?

Smith & Nephew, a titan in the medical technology arena, is currently navigating a pivotal phase, driven by its ambitious '12-Point Plan' launched in 2022. This plan aims to reshape operations and accelerate growth, especially within its Orthopaedics division. From its humble beginnings in 1856, Smith & Nephew has evolved into a global force, with 2024 sales reaching $5.8 billion.

With the Smith & Nephew SWOT Analysis in mind, the company's strategic initiatives are designed to capitalize on the burgeoning medical device industry, particularly in the orthopedic market. This comprehensive Smith & Nephew company analysis will explore the company's future prospects, including its expansion initiatives, technological advancements, and financial outlook. The analysis also assesses potential risks and obstacles, providing a holistic view of Smith & Nephew's trajectory in the competitive surgical solutions landscape, and its impact on Smith & Nephew market share.

How Is Smith & Nephew Expanding Its Reach?

The expansion initiatives of Smith & Nephew are largely guided by its '12-Point Plan,' which focuses on solidifying its foundations, accelerating profitable growth, and transforming for long-term expansion. This strategic approach is crucial for navigating the dynamic medical device industry and achieving its future prospects. A key element involves bolstering its Orthopaedics segment to regain momentum in hip and knee implants, robotics, and trauma, aiming to capture market share with cutting-edge technology.

The company is actively engaged in new product launches and introducing existing products into new treatment areas. This focus on innovation and market penetration is vital for sustained growth and maintaining a competitive edge. Smith & Nephew's strategic initiatives are designed to enhance its global presence and deliver value to its stakeholders.

In 2024, over 60% of Smith & Nephew's underlying revenue growth stemmed from products launched within the last five years. The company introduced nearly 50 new products over the last three years, with an exciting pipeline anticipated for 2025. This continuous stream of innovation is a cornerstone of its growth strategy and a key driver of its financial performance.

The full commercial availability of the AETOS Shoulder System in the US in 2024 is a significant milestone, with expectations of 250,000 procedures in the US by 2025 in the total shoulder arthroplasty segment. This expansion underscores the company's commitment to the orthopedic market and its focus on surgical solutions.

The new CATALYSTEM Primary Hip System, designed to meet the evolving demands of primary hip surgery, received 510(k) clearance from the FDA. This launch is a testament to Smith & Nephew's dedication to research and development and its commitment to improving patient outcomes.

In Advanced Wound Management, Smith & Nephew experienced strong double-digit growth in skin substitutes following the 2024 launch of GRAFIX PLUS. This performance highlights the company's strength in the wound care market and its ability to innovate in this area.

The company is also expanding its Negative Pressure Wound Therapy business with the launch of RENASYS EDGE. This expansion supports Smith & Nephew's strategy to provide comprehensive surgical solutions and enhance its product portfolio.

Geographically, while facing headwinds in China due to regulatory changes and pricing pressures, Smith & Nephew is concentrating on strong performance in Established Markets, which saw 4.1% underlying growth in Q1 2025, and Emerging Markets (excluding China), which demonstrated 14.7% growth in Q1 2025. This balanced approach to global presence is crucial for mitigating risks and capitalizing on opportunities.

- The company is also leveraging acquisitions to drive growth.

- The most recent deal was a Later Stage VC with Miach Orthopaedics in April 2024.

- The acquisition of CartiHeal in November 2023 further strengthens its position.

- For more details on the competitive landscape, consider reading about the Competitors Landscape of Smith & Nephew.

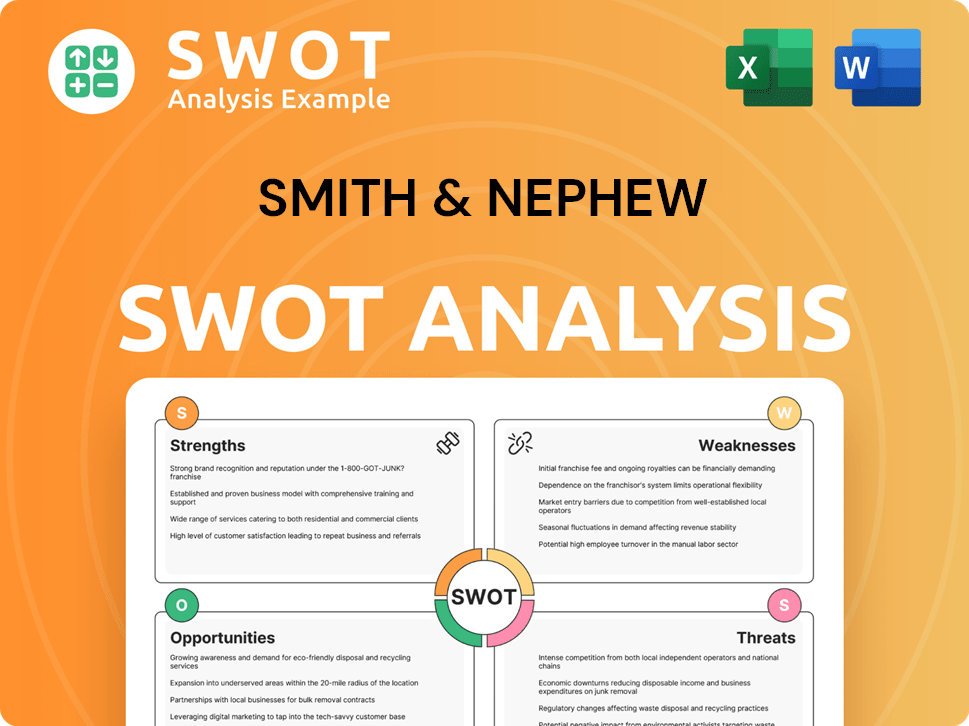

Smith & Nephew SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Smith & Nephew Invest in Innovation?

The driving force behind the sustained success of Smith & Nephew is its unwavering commitment to innovation, which is a core tenet of its growth strategy. This focus is evident in the company's substantial investments in research and development, aimed at creating cutting-edge medical solutions. As the medical device industry evolves, Smith & Nephew's ability to anticipate and meet customer needs through technological advancements remains paramount.

The company's strategic emphasis on innovation is further underscored by its robust product pipeline, which is designed to address evolving market demands. This proactive approach allows Smith & Nephew to stay ahead of competitors and capitalize on emerging opportunities within the orthopedic market and surgical solutions sectors. The company's dedication to technological advancements is a key element of its long-term vision.

In 2024, Smith & Nephew allocated $329 million to research and development, representing approximately 5.3% of its sales. This significant investment underscores the company's commitment to innovation. This commitment is evident in their robust product pipeline, which includes advancements in robotics, digital surgery, and regenerative medicine, which is a core part of its Smith & Nephew future prospects.

Smith & Nephew is strategically concentrating on several key technological areas to drive growth and maintain its competitive edge. These focus areas include robotics, digital surgery, and regenerative medicine, all of which are critical to the company's strategic initiatives. The company's approach to innovation is designed to improve patient outcomes and enhance surgical precision.

- CORI Surgical System: The CORI Surgical System is a leader in robotics-assisted surgery, with the Orthopaedics division experiencing over 40% growth in Q1 2025. This image-free robotic technology is increasingly adopted by hospitals for knee replacements, showcasing the company's leadership in the orthopedic market.

- Spatial Surgery: Smith & Nephew is pioneering 'Spatial Surgery,' a new frontier in arthroscopic surgical innovation. The company has submitted a 510(k) application to the FDA for the TESSA Spatial Surgery System. If cleared, TESSA will combine a real-time, tracking-enabled device powered by an NVIDIA GPU, using video processing and augmented reality to assist surgeons in ACL reconstruction. This initiative aims to mitigate technical failures, which are the second most common reason for ACLR failure.

- Negative Pressure Wound Therapy: The company is also focusing on evolving its negative pressure wound therapy products, which are seeing multi-year growth opportunities. This demonstrates the company's commitment to innovation in wound care products.

- New Product Launches: More than 60% of Smith & Nephew's 2024 revenue growth came from products launched in the last five years, demonstrating the significant contribution of new technologies to its growth objectives.

- Stemless Anatomic Total Shoulder: The company received 510(k) clearance from the FDA for a stemless anatomic total shoulder for the AETOS Shoulder System, addressing the growing demand for anatomic total shoulder replacement.

The company's emphasis on innovation and technology is further illustrated in an article about Mission, Vision & Core Values of Smith & Nephew, which highlights the company's dedication to improving patient outcomes and advancing medical technology. These strategic initiatives position Smith & Nephew for continued success in the medical device industry.

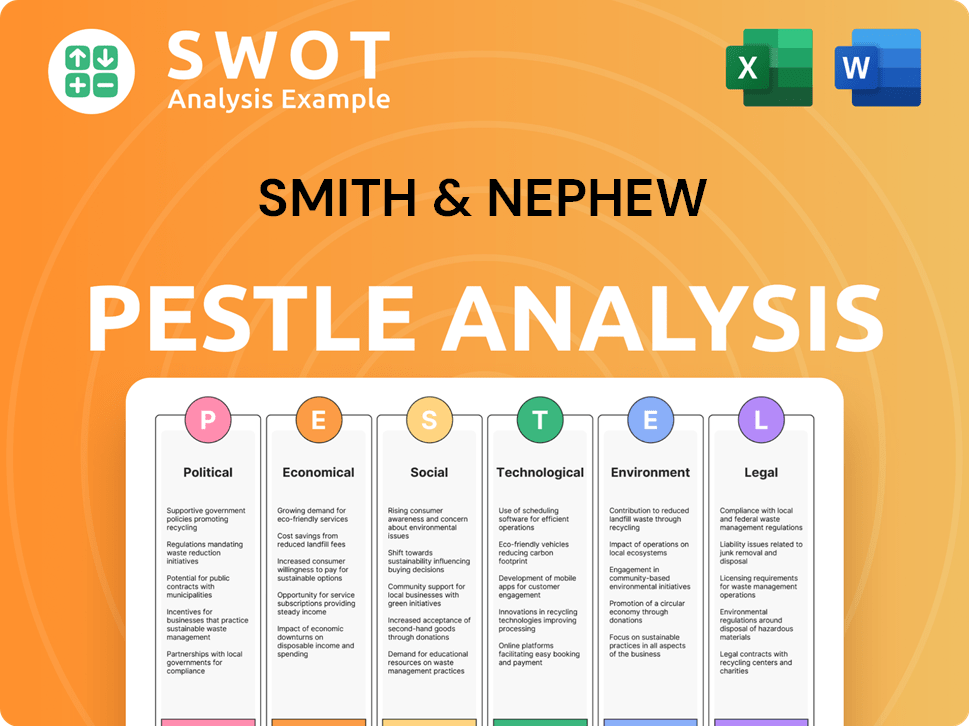

Smith & Nephew PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Smith & Nephew’s Growth Forecast?

In 2024, the financial performance of Smith & Nephew demonstrated robust results, underscoring the effectiveness of its strategic initiatives within the medical device industry. The company's revenue reached $5.81 billion, reflecting an underlying revenue growth of 5.3% compared to $5.55 billion in 2023. This growth trajectory highlights the company's ability to navigate the competitive landscape and capitalize on opportunities within the orthopedic market and surgical solutions sectors.

The increase in trading profit to $1.049 billion, an 8.2% rise, and the improvement in the trading profit margin from 17.5% in 2023 to 18.1% in 2024, demonstrate the success of cost-saving measures and operational efficiencies. Furthermore, the significant increase in free cash flow to $551 million from $129 million in the previous year, alongside a marginal decrease in net debt to $2.7 billion, strengthens the company's financial position. These figures are crucial for understanding the Smith & Nephew company analysis and its ability to generate value.

Looking at the future prospects, Smith & Nephew maintains its full-year 2025 guidance, projecting an underlying revenue growth of approximately 5%. The anticipated step-up in trading profit margin, expected to be in the range of 19.0% to 20.0% for 2025, is a key indicator of the company's continued focus on operational excellence. The company's strategic initiatives, including manufacturing network optimization, are expected to drive further cost savings and margin expansion. For more detailed insights, you can refer to the comprehensive [Smith & Nephew company analysis 2024](https://www.example.com/smith-nephew-analysis) for a deeper dive into the company's performance and outlook.

In Q1 2025, Smith & Nephew experienced an underlying revenue growth of 3.1%, reaching $1.407 billion. This growth, although slightly lower than the full-year guidance, indicates a solid start to the year. The company anticipates ongoing improvement in average daily sales growth throughout 2025.

The expected trading profit margin expansion to 19.0% to 20.0% in 2025 is a critical aspect of Smith & Nephew's financial outlook. This improvement is driven by operating leverage and cost savings, reflecting the success of the 12-Point Plan and other strategic initiatives.

Restructuring costs are projected to decrease to around $45 million in 2025, a significant reduction from $123 million in 2024. This decrease further supports the company's focus on operational efficiency and improved profitability. This will help the company in its Smith & Nephew growth strategy.

The substantial increase in free cash flow to $551 million in 2024 is a testament to Smith & Nephew's strong financial management. This improvement allows for further investment in research and development and potential acquisitions, enhancing the company's long-term growth prospects.

The marginal decrease in net debt to $2.7 billion in 2024 indicates prudent financial management and a focus on deleveraging. This strengthens the company's balance sheet and provides flexibility for future investments and strategic initiatives. This is a key factor in the Smith & Nephew future prospects.

The successful implementation of the 12-Point Plan has significantly contributed to the company's improved financial performance. The focus on innovation, operational efficiency, and market expansion is expected to drive continued growth. This is a key driver for the Smith & Nephew company analysis.

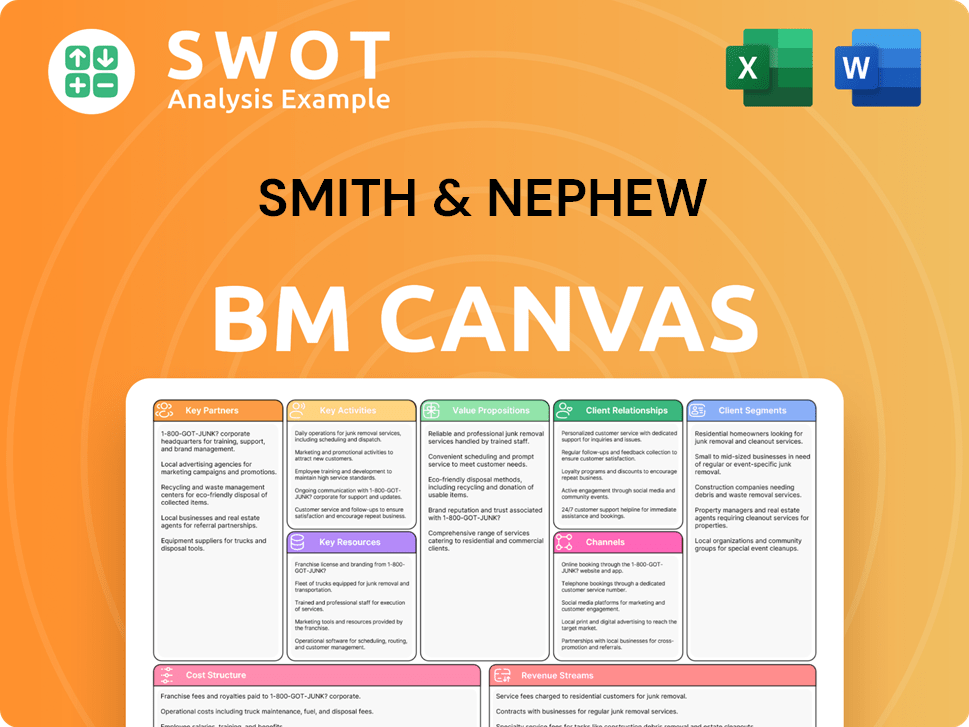

Smith & Nephew Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Smith & Nephew’s Growth?

The path of Smith & Nephew's growth strategy and future prospects is fraught with potential risks and obstacles. These challenges span competitive pressures, regulatory hurdles, and supply chain vulnerabilities. Understanding these elements is crucial for investors and stakeholders assessing the company's long-term viability within the medical device industry.

The company's strategic initiatives are frequently tested by external factors. Economic conditions and unexpected events can significantly impact the company's performance. Smith & Nephew proactively manages these risks through a comprehensive approach, but the dynamic nature of the market means constant vigilance is required.

Market competition remains a significant challenge. The orthopedic market, in particular, is highly competitive, with larger players often outperforming Smith & Nephew. This competitive pressure necessitates ongoing innovation and strategic adjustments to maintain or improve market share. For detailed insights into their financial structure, consider reviewing the Revenue Streams & Business Model of Smith & Nephew.

Regulatory changes in China, particularly the China VBP process, pose a headwind. The expected implementation of the Volume-Based Procurement process for mechanical resection blades and coblation wands in the second half of 2025 could result in a sales headwind of approximately $25 million. These regulatory shifts can impact Smith & Nephew's revenue and market access in the region.

Supply chain disruptions and vulnerabilities are an ongoing concern. The company is actively mitigating tariff pressures, including the U.S. tariffs on Chinese imports, which surged to 125% ad valorem in April 2025. Smith & Nephew estimates these tariffs will reduce 2025 profits by $15-$20 million. They are countering this through a global manufacturing overhaul and optimizing their product mix.

Economic and financial conditions can affect healthcare providers and customers. Price levels for medical devices, regulatory approvals, and potential product defects or recalls also pose risks. These factors can influence demand, pricing, and the overall financial performance of Smith & Nephew. The company's financial performance is under continuous scrutiny.

Smith & Nephew faces litigation risks, competition for qualified personnel, and disruptions from natural disasters or climate change-related events. The company's ability to manage these operational challenges is critical for maintaining its operations and reputation. These risks can affect the company's strategic initiatives.

Management addresses these risks through its 12-Point Plan, which includes initiatives to strengthen the supply chain and improve productivity. They have also implemented an Enterprise Risk Management process. Improvements in pricing strategy and execution were observed in 2024, indicating proactive risk management. Smith & Nephew continuously adapts to the evolving market dynamics.

China's headwinds are expected to constrain underlying revenue growth to 1-2% in Q1 2025. The company believes it is past the peak impact. The company's ability to navigate these challenges is crucial for its future prospects. The impact of tariffs and regulatory changes directly affects Smith & Nephew's financial performance.

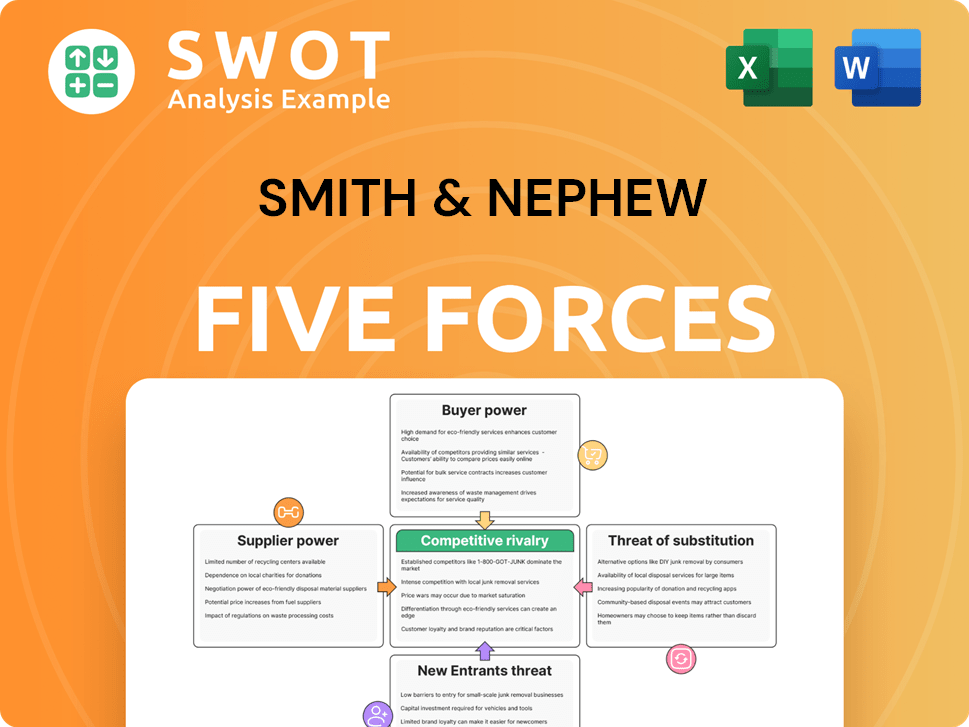

Smith & Nephew Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Smith & Nephew Company?

- What is Competitive Landscape of Smith & Nephew Company?

- How Does Smith & Nephew Company Work?

- What is Sales and Marketing Strategy of Smith & Nephew Company?

- What is Brief History of Smith & Nephew Company?

- Who Owns Smith & Nephew Company?

- What is Customer Demographics and Target Market of Smith & Nephew Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.