Smith & Nephew Bundle

How Does Smith & Nephew Thrive in a Cutthroat Market?

Smith & Nephew, a titan in medical technology, has been revolutionizing patient care since 1856. From humble beginnings as a pharmacy in the UK, it has grown into a global leader, constantly pushing the boundaries of innovation. Today, it's a key player in orthopaedics, advanced wound management, and sports medicine, but how does it stay ahead?

This Smith & Nephew SWOT Analysis offers a comprehensive look at the company's strengths and weaknesses. Understanding the Smith & Nephew competitive landscape is crucial for investors and strategists alike, given the intense competition in the medical device industry. This deep dive into Smith & Nephew competitors and Smith & Nephew market analysis will reveal the strategies that allow Smith & Nephew to maintain its position in the orthopedic market and beyond, examining its surgical products and overall financial performance compared to competitors.

Where Does Smith & Nephew’ Stand in the Current Market?

In the medical technology sector, Smith & Nephew has a significant market position, especially in Orthopaedics, Advanced Wound Management, and Sports Medicine & ENT. The company is a leading player in these areas, holding a substantial competitive edge. For example, in 2023, Smith & Nephew's revenue reached approximately $5.5 billion, demonstrating its considerable scale within the industry.

The company's core offerings include a wide array of orthopaedic implants for joint reconstruction and trauma, advanced wound care dressings and devices, and surgical solutions for sports injuries and ear, nose, and throat conditions. Smith & Nephew's strategic focus emphasizes innovation and high-value solutions to meet complex medical needs. This approach has helped solidify its position in the competitive landscape.

Geographically, Smith & Nephew maintains a robust global presence, with operations and sales spanning over 100 countries. Its primary customer base comprises hospitals, clinics, and other healthcare providers. The company's financial health, as indicated by its revenue and investments in R&D, positions it strongly compared to many industry averages. Furthermore, you can learn more about the Revenue Streams & Business Model of Smith & Nephew.

Smith & Nephew holds a strong market share in key segments like Orthopaedics and Advanced Wound Management. The company is consistently ranked among the top competitors in the medical device industry. Its market position is supported by a diverse product portfolio and a global distribution network.

With operations in over 100 countries, Smith & Nephew has a widespread global presence. It maintains a particularly strong position in developed markets while expanding in emerging markets. This geographic diversification helps mitigate risks and capitalize on growth opportunities.

Smith & Nephew primarily serves hospitals, clinics, and other healthcare providers. The company's focus on these segments allows it to tailor its products and services to meet specific needs. Strong relationships with healthcare professionals are key to its market success.

Smith & Nephew emphasizes innovation and high-value solutions to address complex medical needs. This strategic shift has enhanced its competitive advantage in the market. The company's investments in R&D are crucial for maintaining its edge.

Smith & Nephew's financial performance reflects its robust position in the medical device industry. The company's revenue in 2023 was approximately $5.5 billion, showcasing its significant scale. This financial strength allows for continued investment in R&D and expansion.

- Revenue growth is a key indicator of Smith & Nephew's market success.

- Investments in research and development drive innovation.

- The company's ability to compete effectively depends on its financial stability.

- Smith & Nephew's strong performance is often compared to its competitors.

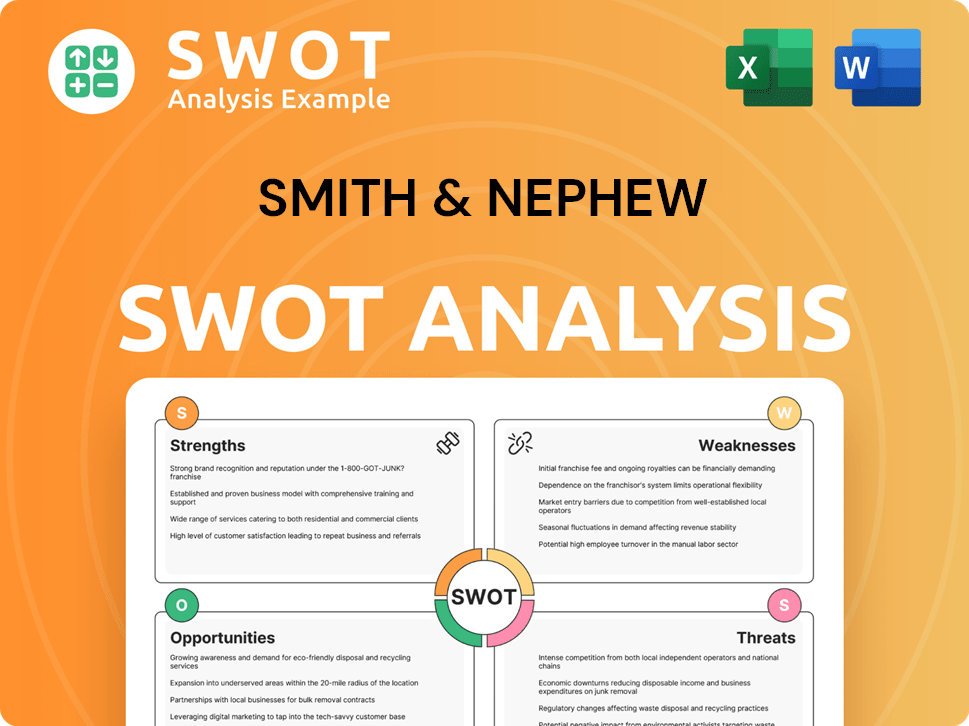

Smith & Nephew SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Smith & Nephew?

The Owners & Shareholders of Smith & Nephew face a dynamic and challenging competitive landscape. The medical device industry is characterized by intense competition, technological advancements, and evolving market demands. Understanding the key players and their strategies is crucial for assessing Smith & Nephew's position and future prospects.

Smith & Nephew's success hinges on its ability to differentiate itself through innovation, product quality, and effective market strategies. Analyzing its competitors helps to identify opportunities for growth and areas where the company can strengthen its competitive advantages. The competitive landscape is constantly shifting due to mergers, acquisitions, and the emergence of new technologies.

The competitive environment for Smith & Nephew is multifaceted, encompassing both direct and indirect competitors across its core business segments. The company's market analysis reveals a diverse range of rivals, each with unique strengths and strategies. The intensity of competition varies by segment, with different players dominating in orthopaedics, advanced wound management, and sports medicine.

In the orthopaedics segment, Smith & Nephew faces direct competition from major players. These competitors include Johnson & Johnson (DePuy Synthes), Stryker Corporation, and Zimmer Biomet. These companies offer a broad range of products and services.

DePuy Synthes, a division of Johnson & Johnson, is a significant competitor. It provides a wide array of products across joint reconstruction, trauma, and spine. They leverage a vast global distribution network and strong brand recognition. Their market share in orthopaedics is substantial.

Stryker is another key competitor, known for its innovative orthopaedic implants and surgical equipment. They often compete on technological advancements and integrated solutions. Stryker's focus on innovation has helped them gain market share.

Zimmer Biomet specializes in musculoskeletal healthcare, with a strong emphasis on joint reconstruction. They compete through extensive product offerings and an established customer base. Their product portfolio includes a wide range of implants.

In advanced wound management, Smith & Nephew competes with companies like Convatec Group Plc, Mölnlycke Health Care, and 3M Health Care. These companies offer a variety of wound care solutions. The market is driven by product efficacy and clinical evidence.

Convatec provides a broad range of wound care, ostomy care, and continence care solutions. They compete on product efficacy and clinical evidence. Convatec has a strong presence in the wound care market.

The medical device industry is subject to constant change, influenced by mergers, acquisitions, and the emergence of new technologies. Smith & Nephew's ability to navigate this dynamic environment is crucial for its long-term success. The company must continuously evaluate its strategic position and adapt to evolving market conditions.

- Mergers and Acquisitions: These activities reshape the competitive landscape, creating larger, more diversified competitors.

- Innovation: Emerging players specializing in technologies like robotics or personalized medicine pose disruptive threats.

- Market Share: Understanding the market share of competitors is essential for strategic planning.

- Geographic Presence: Smith & Nephew's geographic market presence is a key factor in its competitive strategy.

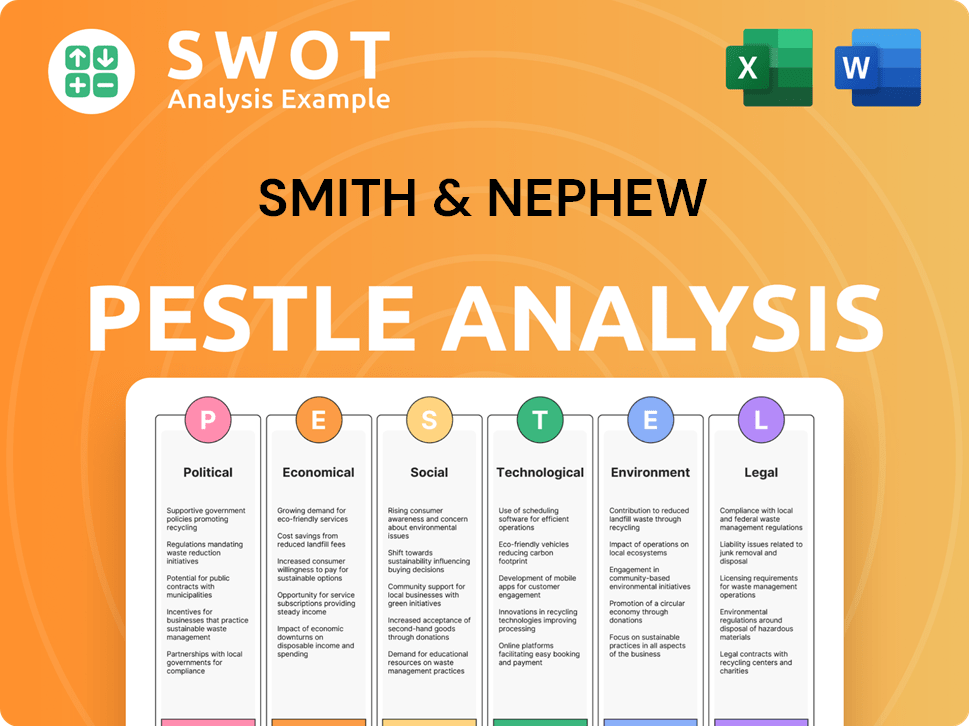

Smith & Nephew PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Smith & Nephew a Competitive Edge Over Its Rivals?

Understanding the Smith & Nephew competitive landscape involves analyzing its key advantages in the medical device industry. The company's success is rooted in a robust portfolio of proprietary technologies and intellectual property, particularly in advanced materials and surgical techniques. This focus allows it to maintain a strong position in the orthopedic market and wound management sectors.

The company's brand equity, built over more than 160 years, fosters significant customer loyalty among healthcare professionals. Economies of scale, derived from its global manufacturing and distribution networks, enable it to achieve cost efficiencies. These advantages are leveraged in its marketing strategies, product development cycles, and strategic partnerships, allowing the company to maintain a competitive edge. For a look at the company's origins, check out this Brief History of Smith & Nephew.

Smith & Nephew's global presence and extensive distribution channels ensure its products are widely accessible to hospitals and clinics worldwide. The company's ability to continually innovate and bring new products to market is supported by a strong talent pool, particularly in research and development. These factors contribute significantly to its competitive standing within the surgical products segment.

Smith & Nephew holds a significant number of patents in advanced wound care and orthopedic devices. These patents protect its unique material science and surgical techniques. This intellectual property allows the company to maintain a competitive edge in the market.

The company's long-standing reputation, built over more than 160 years, fosters strong customer loyalty. Healthcare professionals trust the quality and innovation associated with the brand. This loyalty translates into consistent demand for its products.

Smith & Nephew's global manufacturing and distribution networks enable significant cost efficiencies. This scale allows the company to compete effectively on price and profitability. These efficiencies are difficult for smaller competitors to match.

A strong talent pool, especially in R&D, supports continuous innovation and new product launches. This focus on innovation helps maintain a competitive advantage. Strategic partnerships further enhance its ability to bring new products to market.

Smith & Nephew's competitive advantages are multifaceted, including proprietary technologies, brand recognition, and global scale. These elements are crucial in the Smith & Nephew market analysis. The company's focus on innovation and strategic partnerships further strengthens its market position.

- Proprietary technologies and intellectual property in advanced materials and surgical techniques.

- Strong brand equity and customer loyalty, built over more than 160 years.

- Economies of scale derived from global manufacturing and distribution networks.

- A strong talent pool, especially in research and development, driving continuous innovation.

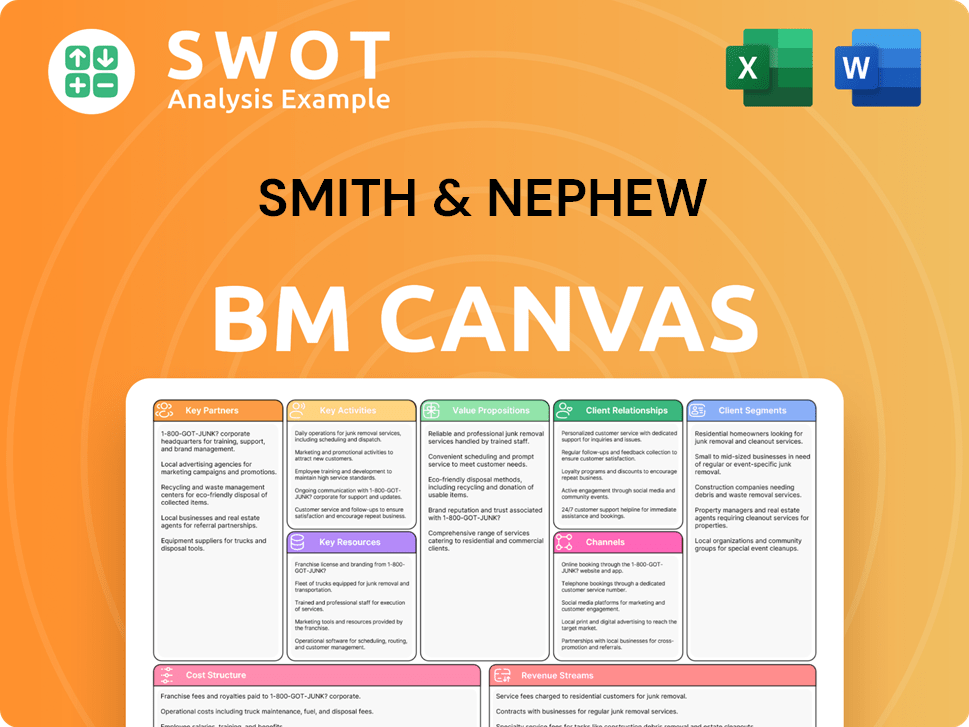

Smith & Nephew Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Smith & Nephew’s Competitive Landscape?

The medical technology industry, where Smith & Nephew operates, is undergoing significant shifts driven by technological advancements, evolving consumer preferences, and regulatory changes. This dynamic environment presents both challenges and opportunities for companies in the Smith & Nephew competitive landscape. Understanding these trends is crucial for assessing the company's future prospects and strategic positioning within the medical device industry.

Smith & Nephew market analysis reveals that the company faces potential threats from aggressive competitors and pricing pressures. However, it also has significant growth opportunities in emerging markets and through product innovation. The company's ability to adapt to these changes will be critical for maintaining its competitive edge and ensuring long-term success in the orthopedic market and beyond. To learn more about their strategic approach, consider the Growth Strategy of Smith & Nephew.

Technological advancements, including robotics, AI, and personalized medicine, are transforming surgical procedures and patient care. Regulatory changes, such as stricter approvals and evolving reimbursement models, are also impacting the industry. Consumer preferences are shifting towards less invasive procedures and faster recovery times, driving demand for innovative solutions.

Aggressive new competitors leveraging disruptive technologies pose a threat. Increased pricing pressure from healthcare systems and global economic shifts impacting healthcare spending are also significant challenges. The rise of specialized start-ups could fragment the market, intensifying competition within the Smith & Nephew competitive landscape.

Emerging markets offer significant growth potential due to expanding healthcare infrastructure and rising demand for advanced medical technologies. Product innovations, particularly in regenerative medicine and digital health solutions, provide avenues for diversification. Strategic partnerships can unlock new market segments and accelerate innovation within the surgical products sector.

Continued investment in R&D is crucial for sustaining innovation and competitive advantage. Strategic acquisitions can expand technological capabilities and market reach. A focus on addressing unmet clinical needs will help maintain resilience and capitalize on future growth opportunities. Understanding Smith & Nephew's competitors is key.

The global orthopedic devices market is projected to reach approximately $78.4 billion by 2024, with an expected CAGR of 4.2% from 2024 to 2032, according to a 2024 report. Robotic-assisted surgery is experiencing rapid growth, with the market expected to reach $12.9 billion by 2030. The demand for Smith & Nephew orthopedic implant competitors is also on the rise.

- The increasing adoption of minimally invasive procedures is driving demand for innovative surgical solutions.

- Emerging markets, such as China and India, are experiencing significant growth in healthcare spending.

- Digital health solutions and AI are becoming increasingly integrated into medical devices.

- Regulatory scrutiny and evolving reimbursement models continue to impact the industry.

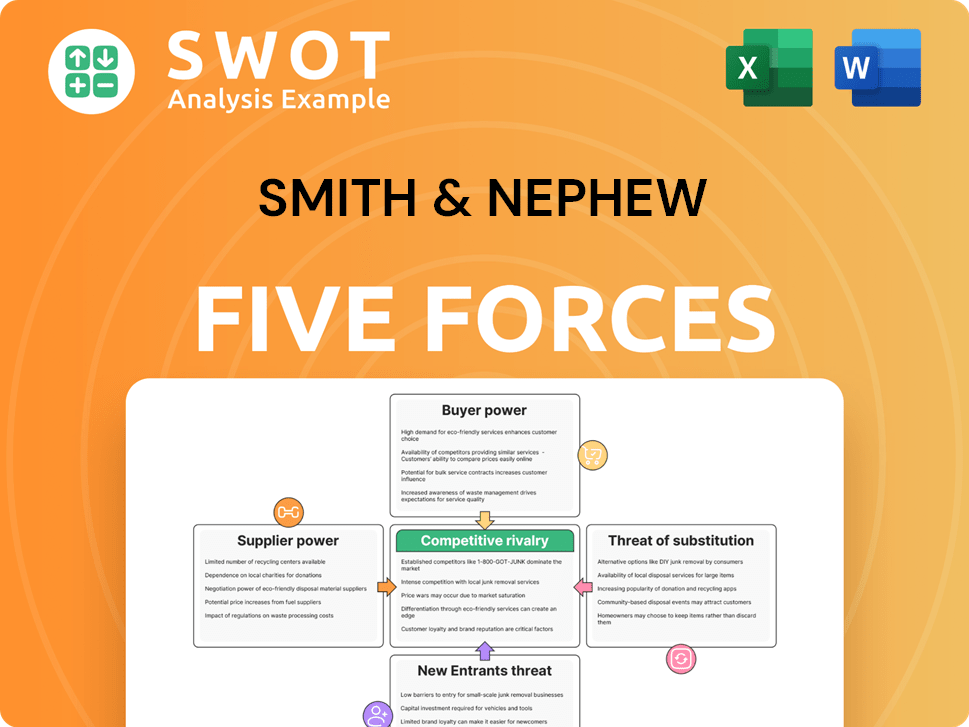

Smith & Nephew Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Smith & Nephew Company?

- What is Growth Strategy and Future Prospects of Smith & Nephew Company?

- How Does Smith & Nephew Company Work?

- What is Sales and Marketing Strategy of Smith & Nephew Company?

- What is Brief History of Smith & Nephew Company?

- Who Owns Smith & Nephew Company?

- What is Customer Demographics and Target Market of Smith & Nephew Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.