State Street Bundle

How Did State Street Become a Global Financial Powerhouse?

Delve into the State Street SWOT Analysis and uncover the remarkable State Street history that shaped a financial giant. From its humble beginnings in 1792 as Union Bank in Boston, Massachusetts, to its current status, the State Street company has consistently adapted and innovated. This journey reveals key milestones and strategic decisions that propelled it to the forefront of the financial world.

Understanding the Brief history State Street is crucial for grasping its current influence in financial services and investment management. The company's evolution, including its early operations and global expansion, provides valuable insights into the dynamics of the banking history and the broader economic landscape. Examining its acquisitions, leadership, and technological advancements offers a comprehensive view of its strategic growth and impact on the financial industry.

What is the State Street Founding Story?

The story of the State Street company begins in Boston, Massachusetts. Its roots go back to July 1792, with the chartering of Union Bank by Massachusetts Governor John Hancock. This makes it one of the oldest financial institutions in the United States.

The initial purpose of Union Bank was to serve as a merchant bank. It aimed to facilitate commerce and provide essential banking services in a newly independent nation. The bank's early days were focused on supporting the growing economic activities of Boston, a significant port city.

In 1865, Union Bank received a national charter and was renamed the National Union Bank of Boston. Later, in July 1891, State Street Deposit & Trust Co. was chartered in Boston, which later became State Street Trust Company in 1897. These two entities would eventually merge, shaping the modern State Street.

The early history of State Street is marked by key developments that shaped its future in Mission, Vision & Core Values of State Street. These included strategic mergers and a focus on asset servicing.

- 1792: Founding of Union Bank in Boston.

- 1865: Union Bank receives a national charter, becoming the National Union Bank of Boston.

- 1891: State Street Deposit & Trust Co. is chartered in Boston.

- 1924: State Street Trust Company becomes custodian of Massachusetts Investors Trust, entering the mutual fund industry.

- 1925: Union Bank and State Street Trust Company merge.

A significant step for State Street Trust Company was becoming the custodian of the Massachusetts Investors Trust in 1924. This move marked its entry into the mutual fund industry and identified an opportunity in asset servicing. The merger of Union Bank and State Street Trust Company in 1925 was a strategic consolidation. It was designed to address the evolving financial landscape and capitalize on broader market opportunities. While specific financial details from the early years are not widely publicized, the merger signaled a pivotal moment in the company's trajectory.

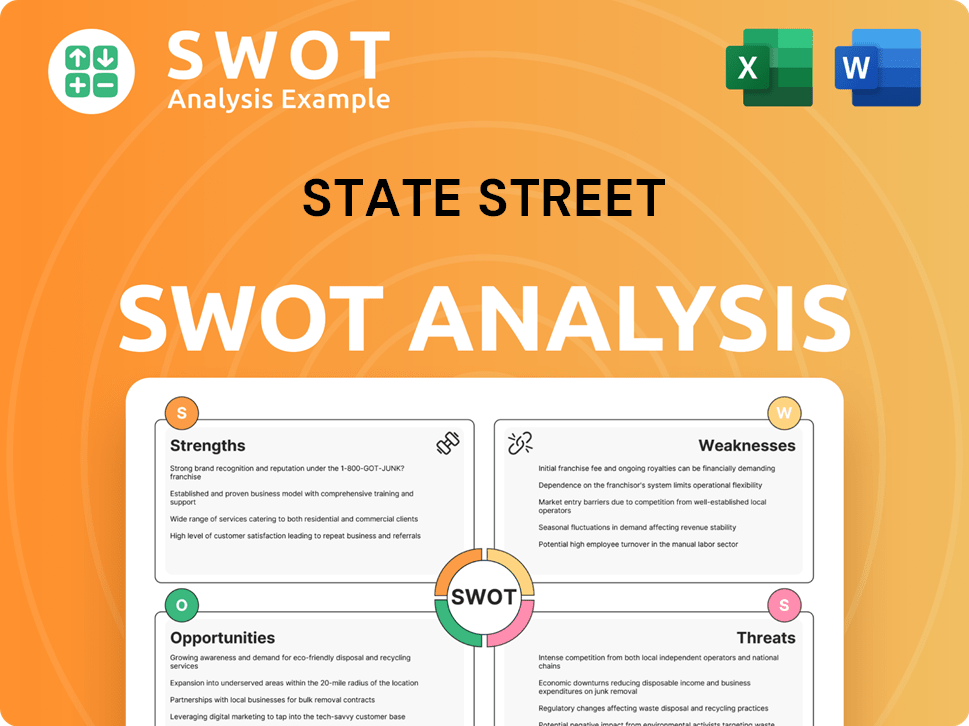

State Street SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of State Street?

The early growth of the State Street company involved strategic mergers and expansions that shaped its role in the financial sector. This period saw the consolidation of several financial institutions, significantly increasing its assets and market presence. These moves, coupled with a shift in focus towards investment services, laid the foundation for its evolution into a global financial services provider. For a deeper look at the company's marketing approach, consider reading about the Marketing Strategy of State Street.

In 1925, the merger of State Street Trust and National Union Bank marked an early consolidation. Further expansions included mergers with Second National Bank in 1955 and Rockland-Atlas National Bank in 1961. These strategic acquisitions were crucial in boosting the company's financial capacity and market reach.

The mergers significantly increased deposits, growing from approximately $2 million in 1900 to over $40 million by 1925. This substantial growth reflected the company’s expanding influence and its ability to attract and manage considerable financial resources. This growth trajectory set the stage for future developments.

In 1960, the company incorporated as State Street Boston Financial Corp., later becoming State Street Boston Corporation in 1977. The completion of the State Street Bank Building in 1966, Boston's first high-rise office tower, marked a significant physical expansion. The initial international office opened in Munich, Germany, in 1972.

A pivotal shift occurred in 1975, with a focus on investments, trusts, and securities processing. The 1973 joint venture with DST Systems formed Boston Financial Data Services, which provided shareholder record-keeping. The establishment of State Street Global Advisors in 1978 marked a major step into asset management, particularly in equity indexing.

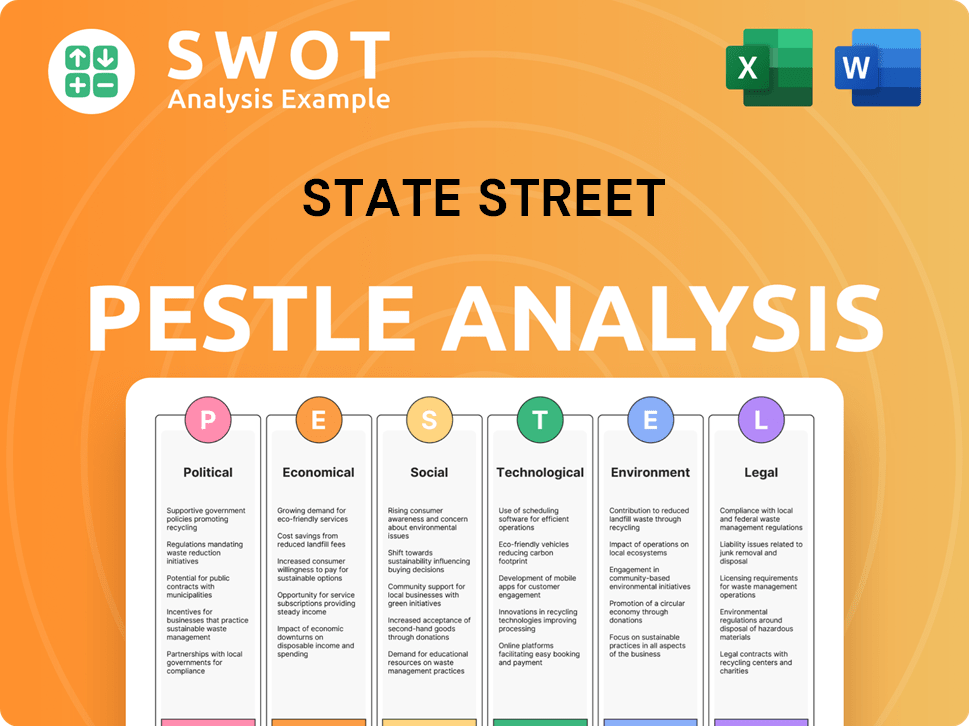

State Street PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in State Street history?

The Brief history State Street is marked by significant milestones, innovations, and strategic shifts within the financial services industry. From its early banking history to its current status as a global financial institution, State Street has consistently adapted to market changes and technological advancements.

| Year | Milestone |

|---|---|

| 1993 | Launched the first US-listed Exchange Traded Fund (ETF). |

| 1998 | Introduced the industry's first sector-specific ETFs. |

| 1999 | Pioneered multi-asset class, liability-driven investing strategies. |

| 1999 | Established Asia ex-Japan's first ETF in collaboration with the Hong Kong government. |

| 2000 | Launched the Official Institutions Group. |

| 2004 | Introduced the first gold-backed ETF in the US. |

| 2003 | Acquired the securities services division of Deutsche Bank. |

| 2007 | Acquired Investors Bank & Trust. |

State Street's commitment to innovation is evident in its pioneering role in the ETF market and its development of sophisticated investment strategies. The introduction of the first US-listed ETF and sector-specific ETFs showcases its forward-thinking approach to investment management.

State Street's early entry into the ETF market with the launch of the first US-listed ETF in 1993, has solidified its position as a leader in the industry. This innovation provided investors with efficient access to capital markets and set a precedent for future ETF developments.

In 1998, State Street introduced the industry's first sector-specific ETFs, expanding the range of investment options available to investors. This innovation allowed for more targeted investment strategies and increased diversification possibilities.

The introduction of pioneering multi-asset class, liability-driven investing strategies in 1999, demonstrated State Street's commitment to providing comprehensive investment solutions. These strategies helped clients manage risk and achieve their financial goals.

State Street expanded its global footprint by establishing Asia ex-Japan's first ETF in collaboration with the Hong Kong government in 1999. This move marked a significant step in its international growth strategy.

The launch of the Official Institutions Group in 2000, dedicated to serving sovereign wealth funds and central banks, highlighted State Street's focus on institutional clients. This initiative allowed the company to provide specialized services to a key segment of the financial market.

In 2004, State Street introduced the first gold-backed ETF in the US, providing investors with a new avenue for accessing the gold market. This innovation offered a convenient and cost-effective way to invest in gold.

Despite its achievements, State Street has faced challenges, including market volatility and the need for strategic realignments. In Q4 2024, the company experienced an increase in adjusted expenses, but demonstrated resilience with fee revenue growth in Q1 2025.

Navigating market volatility has been a consistent challenge for State Street, requiring proactive risk management strategies. The company's ability to adapt to changing market conditions is crucial for maintaining its financial performance.

Managing expenses remains a key focus, as seen in the Q4 2024 earnings report where adjusted expenses increased by 8.2%. Efficient cost management is essential for maintaining profitability and competitiveness in the financial services industry.

Strategic realignments, such as the sale of its retail and commercial banking businesses, have been necessary for State Street to sharpen its focus. These decisions have allowed the company to concentrate on its core strengths and adapt to evolving market dynamics.

Despite challenges, State Street has demonstrated resilience, with fee revenue growth of 6% year-over-year in Q1 2025. This growth reflects the company's ability to attract and retain clients, and its strong performance in the investment management sector.

State Street's net income increased by 39% to $644 million in Q1 2025, indicating strong financial health and effective management. This significant increase highlights the company's ability to generate profits and create value for its shareholders.

In recent years, State Street has focused on technology and data solutions for institutional investors, as demonstrated by the launch of its State Street Alpha platform. This commitment to technological advancement is crucial for staying competitive in the financial services industry.

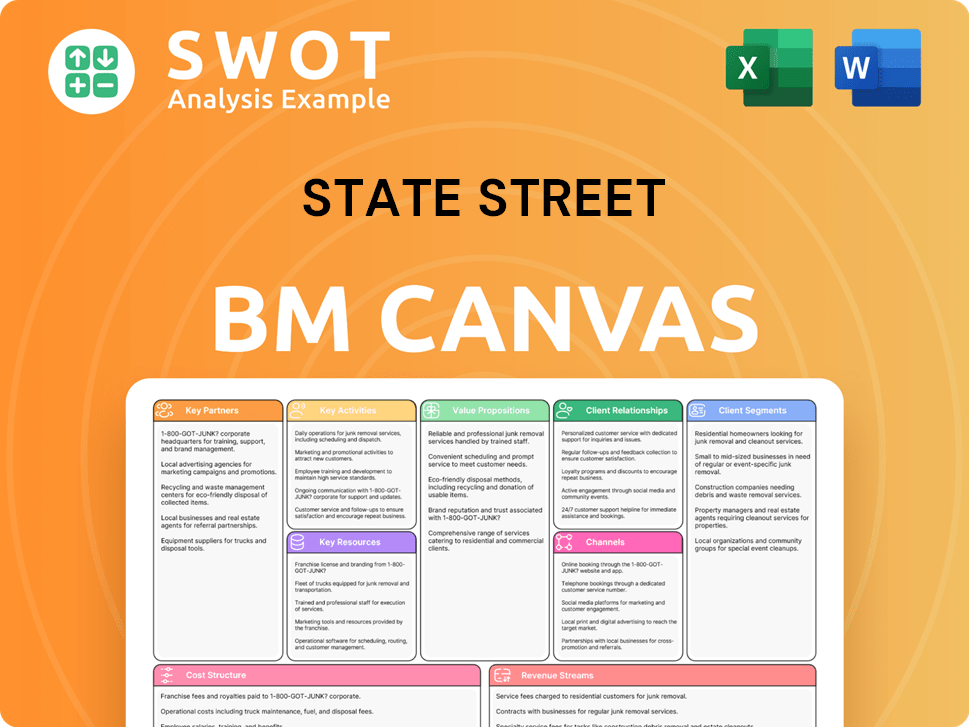

State Street Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for State Street?

The brief history of State Street is a story of continuous adaptation and expansion within the financial services sector, evolving from its origins to become a global financial leader. The company's journey reflects significant shifts in the financial landscape, from commercial banking to investment management and global asset servicing. This evolution is marked by key milestones, strategic acquisitions, and technological advancements, shaping its role in the global economy.

| Year | Key Event |

|---|---|

| 1792 | Union Bank, the precursor to State Street, is chartered in Boston. |

| 1891 | State Street Deposit & Trust Co. is chartered. |

| 1924 | State Street Trust becomes custodian of the first U.S. mutual fund, Massachusetts Investors Trust. |

| 1925 | State Street and National Union Bank merge. |

| 1955 | Merges with Second National Bank. |

| 1960 | Incorporates as State Street Boston Financial Corp., a one-bank holding company. |

| 1966 | Completes construction of the State Street Bank Building, its new headquarters and Boston's first high-rise office tower. |

| 1972 | Opens its first international office in Munich. |

| 1973 | Forms Boston Financial Data Services, a joint venture with DST Systems. |

| 1975 | Begins shifting focus from commercial banking to investments, trusts, and securities processing. |

| 1978 | State Street Global Advisors is established. |

| 1993 | Launches the first US-listed ETF. |

| 1994 | State Street Global Advisors, a global asset management business, is formally formed. |

| 1999 | Sells its retail and commercial banking businesses to Citizens Financial Group. |

| 2003 | Acquires the securities services division of Deutsche Bank. |

| 2007 | Acquires Investors Bank & Trust. |

| 2010 | Launches its Global Exchange division, focusing on data and analytics. |

| 2016 | Acquires GE Asset Management, adding over $100 billion in AUM. |

| 2025 (Q1) | Reports $46.7 trillion in AUC/A and $4.7 trillion in AUM. |

State Street's future strategy centers on technological advancements and global expansion within institutional financial services. The 'State Street Alpha' platform is a key initiative, aiming to provide comprehensive solutions for clients. The company is also focused on leveraging data and analytics to enhance its service offerings, supporting its growth in the financial services sector.

Analyst forecasts predict a positive trend in earnings per share (EPS), with projections of $9.50 for fiscal year 2025 and $10.50 for fiscal year 2026. Q1 2025 results showed a significant increase in net income and revenue, driven by strong fee revenue growth. New asset servicing AUC/A wins of $182 billion in Q1 2025 further demonstrate the company's momentum.

State Street continues to pursue strategic acquisitions, such as the agreement to acquire Mizuho Financial Group's global custody business outside of Japan in February 2025, which will add approximately $580 billion in assets under custody. The company maintains a global presence, operating in over 100 geographic markets with approximately 53,000 employees worldwide. This expansion supports its evolution from a local merchant bank to a global financial powerhouse.

State Street Global Advisors' 2025 Global Market Outlook anticipates continued macroeconomic resilience and further rate cuts by central banks, which could influence market conditions. These factors are critical for investment strategies. The company's ability to navigate these conditions will be key to its future performance.

State Street Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of State Street Company?

- What is Growth Strategy and Future Prospects of State Street Company?

- How Does State Street Company Work?

- What is Sales and Marketing Strategy of State Street Company?

- What is Brief History of State Street Company?

- Who Owns State Street Company?

- What is Customer Demographics and Target Market of State Street Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.