State Street Bundle

How Does State Street Navigate the Trillions?

State Street Corporation, a titan in the financial world, manages and safeguards an astounding amount of assets, making it a pivotal player in global finance. With a legacy spanning centuries, this financial services giant offers a broad spectrum of services to institutional investors worldwide. Understanding State Street's inner workings is key to grasping the dynamics of the investment landscape.

This exploration into State Street SWOT Analysis will uncover the intricacies of its operations, from asset servicing to investment management, and explore its influence on the global economy. We'll examine how State Street Company has adapted to market shifts and technological advancements, providing insight into its enduring success. Delving into its history, business segments, and investment strategies will illuminate how this financial powerhouse continues to shape the future of finance, offering valuable insights for investors and strategists alike. Keywords such as: State Street, Financial services, and Investment management will be explored.

What Are the Key Operations Driving State Street’s Success?

State Street Corporation creates and delivers value primarily through its comprehensive suite of financial products and services tailored for institutional investors worldwide. Its core offerings include investment servicing, investment management, and investment research and trading. As a custodian bank, State Street Company's foundational service involves managing and safeguarding assets for its clients, which include mutual funds, collective investment funds, corporate and public retirement plans, insurance companies, and other financial institutions.

Operational processes underpinning these offerings are highly sophisticated and technology-driven. For investment servicing, State Street provides fund accounting, administration, and transfer agency services, relying on robust technological platforms to handle high volumes of transactions and data. Its investment management arm, State Street Global Advisors (SSGA), leverages extensive research capabilities and proprietary trading systems to manage a diverse range of investment strategies, including passive, active, and alternative investments. The company's State Street Alpha platform is a notable example of its technological integration, offering a front-to-back solution for institutional investors to manage their entire investment lifecycle on a single platform.

This platform integrates data, analytics, and workflow tools, enhancing efficiency and decision-making for clients. State Street's global reach, with operations in over 100 markets, further solidifies its distribution networks and ability to serve a diverse international client base. The company’s unique value proposition lies in its integrated approach, combining advanced technology, deep market expertise, and a comprehensive service offering to provide a seamless and efficient experience for institutional clients, differentiating it from competitors who may offer more siloed services.

State Street provides fund accounting, administration, and transfer agency services. These services are essential for institutional investors. The company's technology platforms handle high volumes of transactions and data efficiently.

State Street Global Advisors (SSGA) manages a diverse range of investment strategies. These strategies include passive, active, and alternative investments. SSGA utilizes extensive research capabilities and proprietary trading systems.

The State Street Alpha platform offers a front-to-back solution for institutional investors. It manages the entire investment lifecycle on a single platform. This platform integrates data, analytics, and workflow tools.

State Street operates in over 100 markets worldwide. This extensive global reach allows for serving a diverse international client base. It solidifies distribution networks and enhances service capabilities.

State Street offers a unique value proposition by integrating advanced technology and deep market expertise. They provide a comprehensive service offering for institutional clients. The company's integrated approach differentiates it from competitors.

- Custodian Banking: Managing and safeguarding assets for clients.

- Investment Servicing: Fund accounting, administration, and transfer agency services.

- Investment Management: Diverse investment strategies managed by SSGA.

- Technology: The Alpha platform enhances efficiency and decision-making.

For a deeper dive into how State Street approaches its marketing strategies, you can explore the Marketing Strategy of State Street.

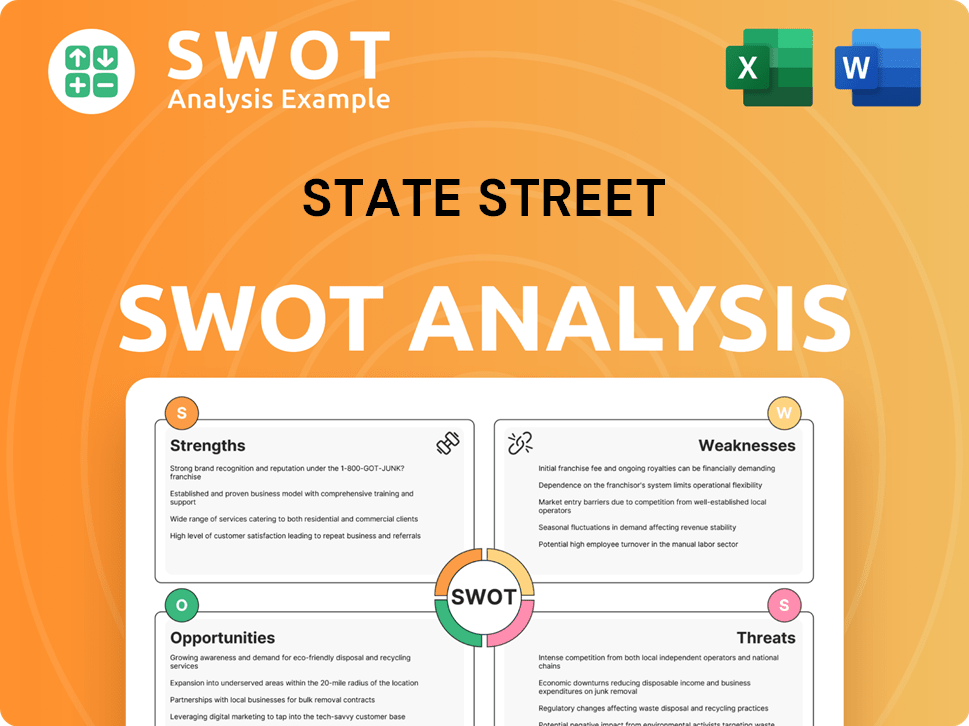

State Street SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does State Street Make Money?

State Street Corporation generates revenue through various streams, primarily catering to institutional investors. These streams include servicing fees, management fees, and trading services revenue, reflecting its diverse offerings in the financial services sector.

The company's financial performance is significantly influenced by its assets under custody and administration (AUC/A) and assets under management (AUM). These metrics directly impact the fees generated from its core services and investment management arm.

State Street Company's revenue streams are diversified to capture opportunities across the financial spectrum, enhancing its financial stability and market presence. The company's strategic approach to revenue generation supports its position in the financial industry.

Servicing fees are a major revenue source for State Street, derived from its custody, fund accounting, and administration services. These fees are typically based on the value of assets under custody and administration (AUC/A).

Management fees come from State Street Global Advisors (SSGA), the investment management arm. These fees are based on assets under management (AUM).

Revenue from trading services includes foreign exchange, securities lending, and other trading activities. This segment contributes to the company's overall revenue profile.

In the first quarter of 2024, total revenue was $3.1 billion. Servicing fees contributed $1.2 billion, management fees $1.0 billion, and net interest income $669 million. Trading services revenue was $245 million.

Additional revenue sources include software and processing fees and other income. These streams diversify State Street's revenue base.

State Street employs tiered pricing models for its services, often scaled to the volume and complexity of assets managed. The Alpha platform is a key monetization tool.

As of March 31, 2024, State Street's AUC/A stood at $43.9 trillion, and AUM totaled $4.3 trillion. The company focuses on expanding its technology offerings and investment management capabilities. This strategy aims to increase its share of clients' financial operations and enhance its competitive position within the financial services sector. For more insights into the company's market positioning, consider exploring the Target Market of State Street.

- Tiered pricing models are used to align fees with service complexity.

- The Alpha platform offers an integrated solution for end-to-end investment lifecycle support.

- Expansion of technology and investment management capabilities is a key growth strategy.

- Focus on capturing a larger share of clients' overall financial operations.

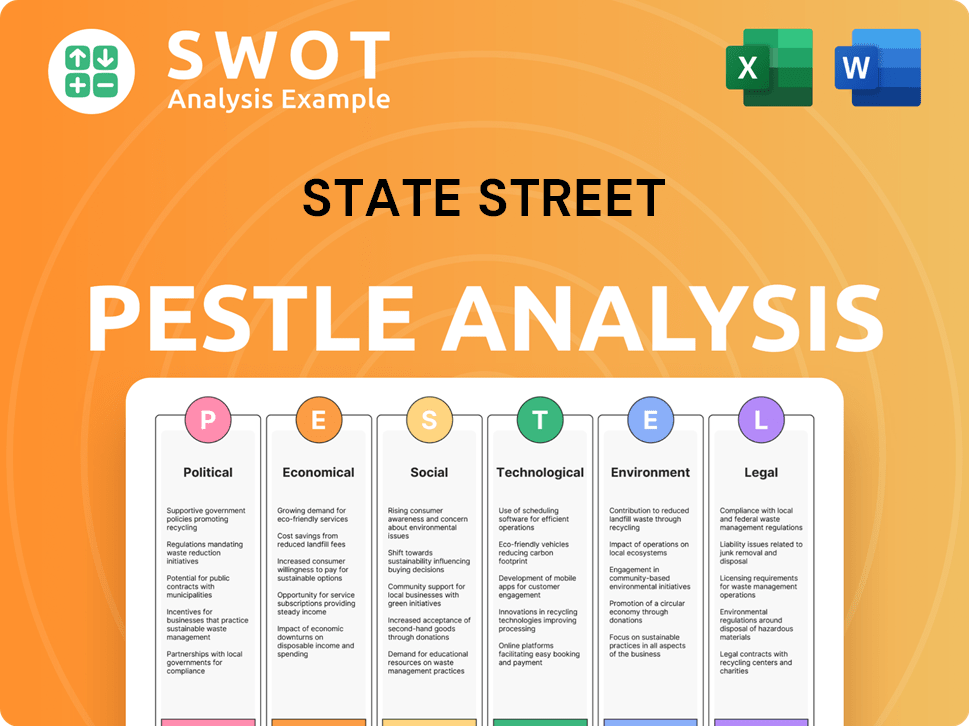

State Street PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped State Street’s Business Model?

State Street Corporation's journey has been marked by significant milestones and strategic shifts that have shaped its operational and financial performance. The company's evolution includes continuous investments in technology, exemplified by the development and ongoing enhancement of its State Street Alpha platform. This front-to-back platform integrates various services, aiming to provide a seamless experience for institutional investors, which is a key differentiator in the competitive landscape. Strategic partnerships have also played a crucial role, particularly in expanding digital asset capabilities, including digital custody and blockchain-based solutions, reflecting the growing importance of digital assets in the financial industry.

The company has navigated various operational challenges, including complex regulatory environments and market volatility. Fluctuations in interest rates, for example, directly impact its net interest income, necessitating strategic adjustments to maintain profitability. State Street's ability to adapt to these challenges and capitalize on emerging opportunities has been crucial to its sustained success and its position as a leading financial services provider. Understanding Competitors Landscape of State Street is also important for assessing its market position.

State Street's competitive advantages are multifaceted, contributing to its strong market position. Its long-standing reputation as a trusted custodian bank provides a significant barrier to entry for new competitors. The sheer scale of its assets under custody and administration, reaching $43.9 trillion as of March 31, 2024, and assets under management, totaling $4.3 trillion as of March 31, 2024, allows for economies of scale, enabling efficient processing and competitive pricing. Technology leadership, especially with platforms like Alpha, offers a distinct edge by providing integrated solutions that streamline client operations and enhance data analytics. State Street continually adapts to new trends, such as the increasing demand for ESG (Environmental, Social, and Governance) investing, by expanding its sustainable investment offerings within SSGA. It also addresses competitive threats by focusing on innovation in areas like artificial intelligence and data analytics to improve service delivery and efficiency.

State Street's strategic moves have been pivotal in shaping its current market position and future prospects. These moves include significant investments in technology, strategic partnerships, and expansion into new markets. The company's focus on innovation and client-centric solutions has been instrumental in its success, allowing it to meet the evolving needs of institutional investors and adapt to changing market dynamics.

- Technology Investments: Continuous development and enhancement of the State Street Alpha platform to integrate services and improve client experience.

- Strategic Partnerships: Collaborations to expand digital asset capabilities, including digital custody and blockchain-based solutions.

- ESG Initiatives: Expansion of sustainable investment offerings to meet growing demand for ESG investing.

- Focus on Innovation: Investment in artificial intelligence and data analytics to improve service delivery and efficiency.

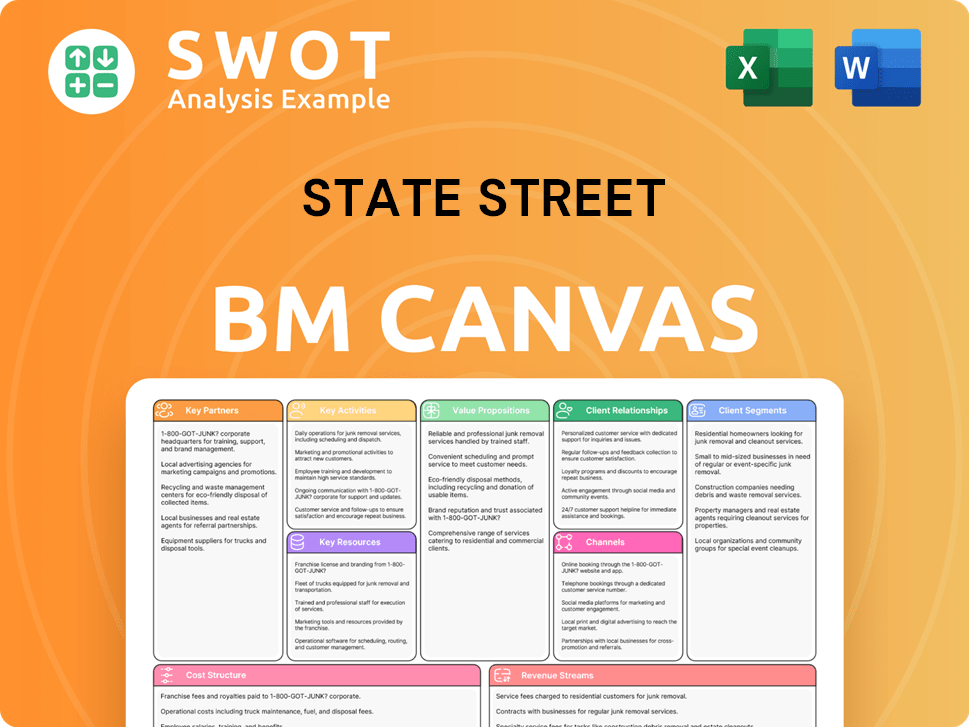

State Street Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is State Street Positioning Itself for Continued Success?

Within the global financial services sector, State Street Corporation holds a significant position, particularly in asset servicing and investment management. As one of the world's largest custodian banks, it oversees trillions of dollars in assets under custody and administration. Its market share is substantial, although it operates in a competitive environment alongside major players like BNY Mellon and JPMorgan Chase. State Street Company benefits from long-standing client relationships and a global presence, extending to over 100 geographic markets, which fosters strong customer loyalty.

However, State Street faces several risks. Regulatory changes, especially those impacting capital requirements or data privacy, can significantly affect its operations and profitability. Intense competition from both traditional financial institutions and emerging fintech companies presents an ongoing challenge. Technological disruption, while an area of investment for State Street, poses a risk if the company fails to adapt to advancements in areas like blockchain, artificial intelligence, and cloud computing. Economic downturns or market volatility can impact asset values, reducing fee-based revenues tied to AUC/A and AUM. Changes in interest rates also directly influence its net interest income.

State Street is a leading provider of financial services, especially in asset servicing and investment management. It manages substantial assets under custody and administration, placing it among the top global custodian banks. Its extensive global reach and established client relationships contribute to its strong market position.

State Street offers a range of services, including asset servicing, investment management, and data & analytics. These services cater to institutional investors globally. The company's offerings are designed to meet the complex needs of its diverse client base.

State Street faces risks from regulatory changes, intense competition, and technological advancements. Economic downturns and market volatility can also negatively affect its financial performance. These factors can impact the company's profitability and operational efficiency.

Looking ahead, State Street is focused on leveraging its Alpha platform and driving efficiency through automation. The company continues to invest in data analytics and AI. Its strategic goals include expanding in high-growth markets and developing digital asset capabilities. For more details, see Growth Strategy of State Street.

State Street is implementing several strategic initiatives to maintain its competitive edge and drive future growth. These initiatives include expanding its Alpha platform and enhancing its digital asset capabilities. The company is also focused on improving operational efficiency through technological innovations.

- Expanding the State Street Alpha platform to deepen client relationships and expand integrated service offerings.

- Driving efficiency through further automation and digitization of processes.

- Investing in data analytics and artificial intelligence to enhance insights and service capabilities.

- Expanding its presence in higher-growth markets and further developing its digital asset capabilities.

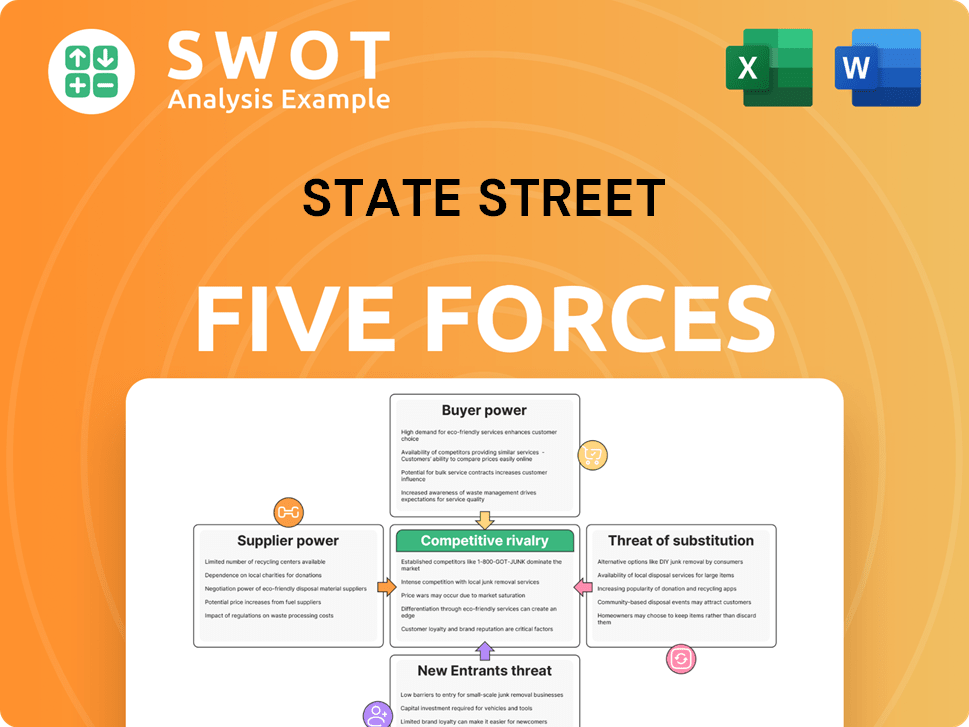

State Street Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of State Street Company?

- What is Competitive Landscape of State Street Company?

- What is Growth Strategy and Future Prospects of State Street Company?

- What is Sales and Marketing Strategy of State Street Company?

- What is Brief History of State Street Company?

- Who Owns State Street Company?

- What is Customer Demographics and Target Market of State Street Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.