State Street Bundle

Who Does State Street Serve?

In the complex world of finance, understanding the 'who' is just as crucial as the 'what'. For State Street Company, a global financial powerhouse, identifying its customer demographics and target market is fundamental to its strategic success. This deep dive explores the intricate landscape of State Street's clientele, revealing the strategies behind its enduring presence in the financial sector.

From its origins as a local bank to its current status as a global financial services leader, State Street SWOT Analysis reveals how the company has continuously adapted to serve a diverse range of institutional investors. This evolution highlights the importance of understanding market segmentation and the specific needs of State Street clients. This article will explore the demographics of State Street institutional investors, examining how the company defines its target market and its customer acquisition and retention strategies within the asset management industry.

Who Are State Street’s Main Customers?

The primary customer segments for State Street are institutional investors worldwide. The company operates within a Business-to-Business (B2B) model, focusing on entities with substantial assets and sophisticated investment strategies. The target market is defined by the type and scale of the institutions they serve rather than demographic factors like age or gender.

These institutional investors include asset managers, asset owners (such as pension funds, endowments, and foundations), official institutions (governments and central banks), and insurance companies. State Street's services are tailored to meet the complex needs of these large-scale entities. Their focus is on providing comprehensive and integrated financial solutions.

State Street's main business lines—investment servicing, investment management, and investment research and trading—cater specifically to the complex needs of these large-scale entities. The company's client base is characterized by its high net worth and demand for comprehensive, integrated financial solutions.

State Street's primary customer base consists of institutional investors. These include a variety of entities with significant financial holdings. Understanding these segments is crucial for analyzing the company's business model.

As of December 31, 2024, State Street reported assets under custody and administration (AUC/A) of $46.6 trillion. The company also had $4.7 trillion in assets under management (AUM). These figures highlight the scale of their institutional client base.

The investment servicing segment, which includes custody, fund administration, and record-keeping, is a significant revenue source. Servicing fees totaled $1,275 million in Q1 2025, marking a 4% year-over-year increase. This demonstrates the importance of these services to their clients.

State Street is adapting to market shifts, such as the increasing interest in private markets. Institutional investors anticipate a rise in retail allocations to private markets by 2027. This trend may influence future service offerings.

State Street is committed to technological advancements to meet the evolving needs of its clients. The State Street Alpha platform integrates front-, middle-, and back-office solutions. This platform enhances efficiency and provides comprehensive services.

- The platform streamlines operations for institutional investors.

- It offers integrated solutions for various financial processes.

- Technological investments are key to retaining and attracting clients.

- The focus is on providing sophisticated tools for complex financial needs.

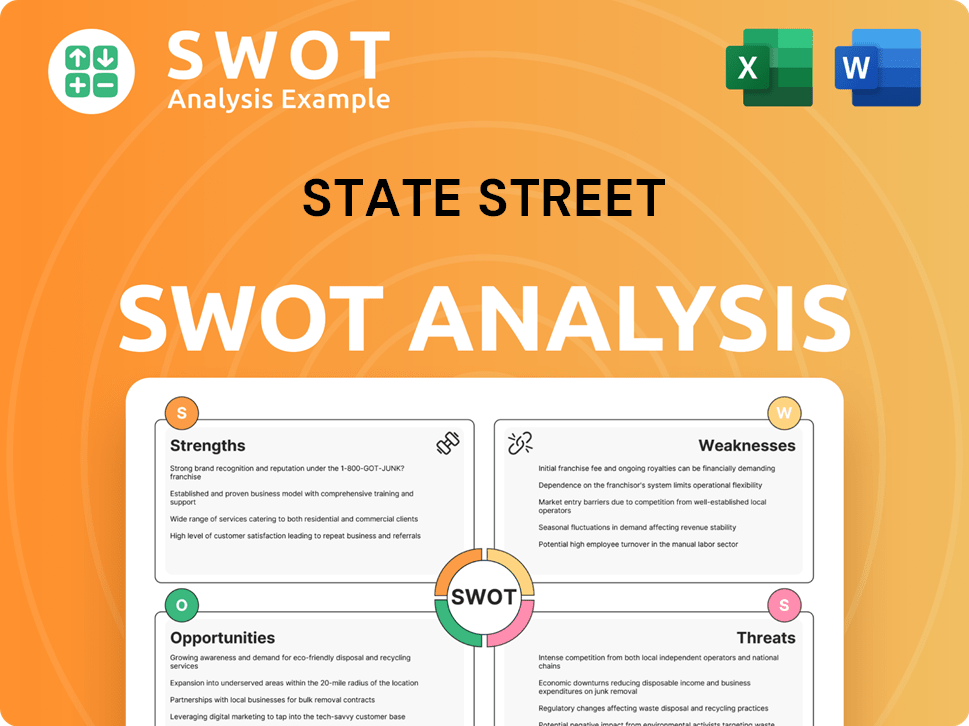

State Street SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do State Street’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial institution, and for the State Street Company, this involves a deep dive into the requirements of its institutional clients. These clients, ranging from asset managers to insurance companies, have complex needs that go beyond basic financial transactions. They are focused on operational efficiency, risk management, and achieving superior investment outcomes.

The primary driver for choosing State Street's services is the demand for integrated, end-to-end solutions. Clients are looking for critical infrastructure and technology to improve their operational effectiveness, reduce costs, and gain access to advanced solutions and specialized expertise. This is particularly evident in the demand for platforms like State Street Alpha, which offers a front-to-back investment servicing solution.

Purchasing behaviors and decision-making criteria are heavily influenced by the need for robust risk management, transparency, and high-quality service. Clients rely on State Street to protect their assets and provide reliable data management and analytics. The company's commitment to integrity and excellence has been key to attracting and retaining a loyal customer base.

State Street's clients seek integrated solutions, robust risk management, and high-quality service. They trust State Street to provide reliable data and analytics, helping them make informed investment decisions. The company addresses pain points such as portfolio complexity and the need for advanced data management.

- Integrated Solutions: Clients want comprehensive services that streamline operations and reduce costs.

- Risk Management: The need for robust risk management tools and strategies is a top priority.

- Data and Analytics: Clients require reliable data and analytics to drive informed investment decisions.

- Operational Efficiency: Improving operational effectiveness and reducing costs are key drivers.

- Transparency: Clients value transparency in all aspects of service delivery.

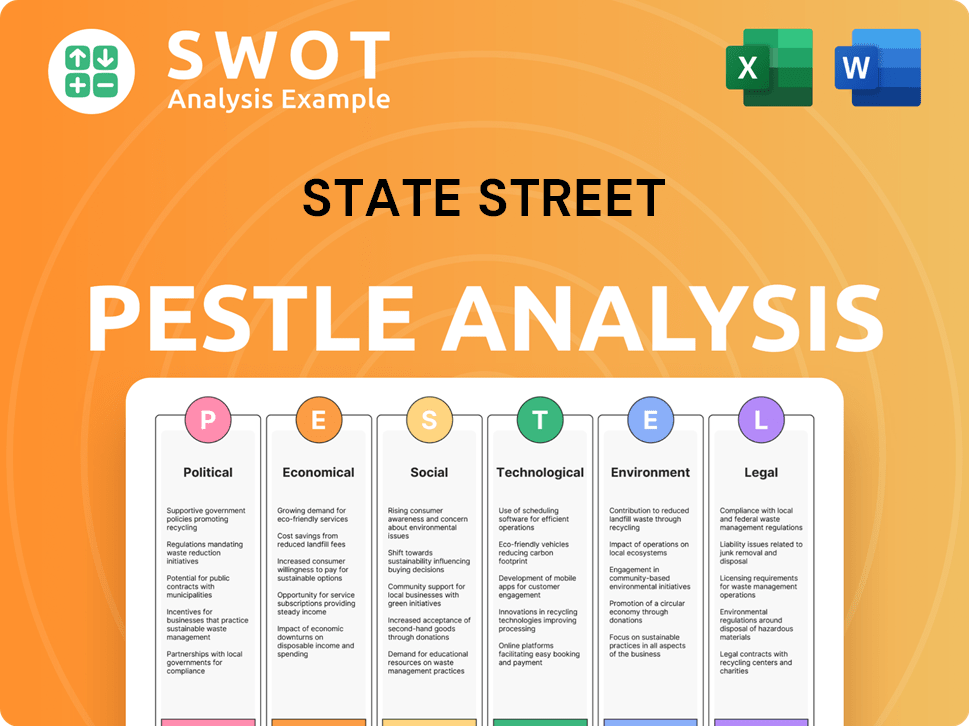

State Street PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does State Street operate?

State Street Corporation maintains a significant global presence, operating in over 100 geographic markets. As of March 31, 2025, the company employed approximately 53,000 individuals worldwide. Its headquarters are located in Boston, Massachusetts, U.S.

The company's operations are spread across the Americas, Europe, the Middle East, and Asia-Pacific. Notable growth has been observed in the Americas and Europe. State Street's extensive reach allows it to serve a diverse range of clients and adapt to varying market conditions.

Key markets where State Street holds a strong position include the United States, Europe, and Asia. For example, in mutual funds and UCITS, State Street services 38% of the U.S. market, 23% of the global market, and 16% of the EMEA market as of December 31, 2024. The company's success is also reflected in its ETF servicing, where it is the world's largest, servicing over 40% of the global ETF market.

State Street tailors its services to meet the specific needs of different regions. This approach is essential for effective market segmentation and customer satisfaction. This strategy helps the company to better address the varied needs of its Owners & Shareholders of State Street.

The company forms strategic partnerships to strengthen its market presence. These collaborations can enhance service offerings and expand reach within specific regions. An example is the acquisition of Mizuho Financial Group's global custody business outside of Japan.

State Street has a long-standing presence in Japan, with over 35 years of operations. They provide a comprehensive suite of services tailored to Japanese institutional investors. The company has over 500 employees in Tokyo and Fukuoka.

State Street has been present in Luxembourg for 35 years, offering fund administration, custody, and transfer agency services. This long-term commitment highlights the company's dedication to serving the European market.

State Street's success is also attributed to its focus on risk management and a strong brand reputation. These factors are crucial for maintaining trust and attracting clients in diverse markets. These elements contribute to the company's ability to thrive in various regions.

State Street is the world's largest ETF servicer, servicing over 40% of the global ETF market. This dominant position underscores the company's expertise and influence in the ETF industry. It is also the third-largest sponsor/manager of ETFs.

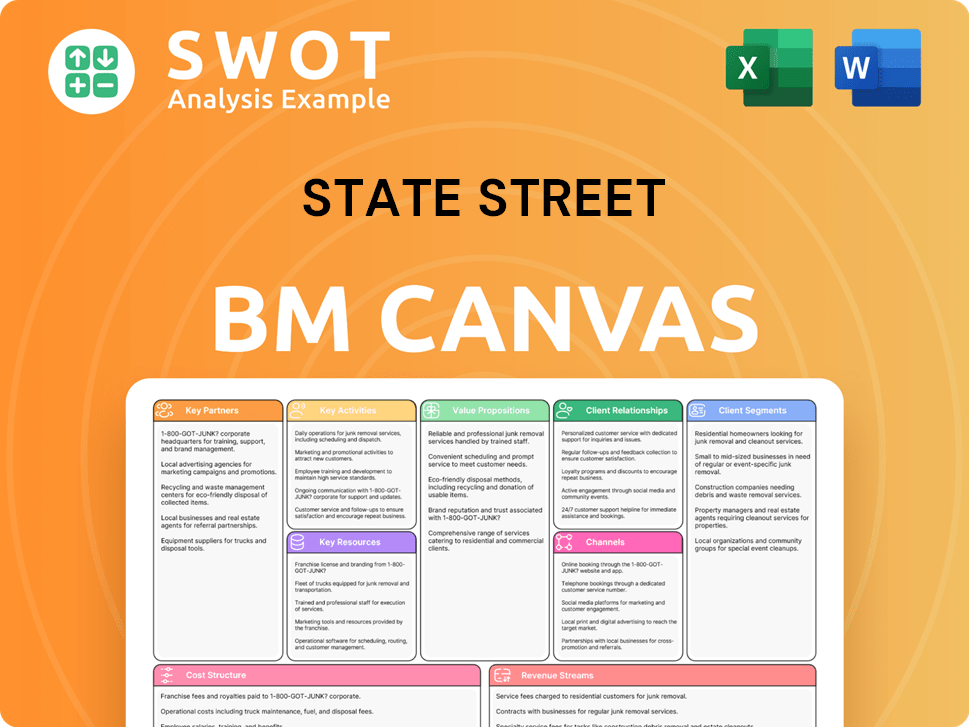

State Street Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does State Street Win & Keep Customers?

State Street's approach to acquiring and retaining customers centers on delivering exceptional service and building trust. They leverage their expertise as a leading asset servicer and manager to attract new clients. This strategy is supported by strong financial performance, such as a 6% year-over-year increase in fee revenue in Q1 2025, driven by favorable market conditions and client activity.

A key component of their acquisition strategy involves showcasing their comprehensive solutions and global presence. New asset servicing wins in Q1 2025, totaling $182 billion in assets under custody and administration (AUC/A), demonstrate their ability to attract new business. Moreover, an emphasis on continuous innovation and adaptation to meet evolving client needs is central to maintaining strong client relationships.

Retention is heavily focused on service quality and building long-term partnerships. The company aims for a servicing fee revenue retention of 97 percent, as highlighted in the 2024 annual report. Continuous improvements to offerings and technological advancements, like the State Street Alpha platform, are crucial for retaining clients by providing a comprehensive ecosystem.

State Street focuses on demonstrating its expertise in asset servicing, asset management, and data insights. They use their strong financial performance, such as the 6% fee revenue growth in Q1 2025, to attract new clients. Winning new asset servicing business, such as the $182 billion in AUC/A in Q1 2025, is a key indicator of successful acquisition.

Retention efforts are centered on service quality and building long-term partnerships. State Street targets a servicing fee revenue retention rate of 97 percent. The company emphasizes continuous improvements and technological advancements, like the State Street Alpha platform, to meet evolving client needs and foster client loyalty.

Marketing and sales strategies involve direct engagement, thought leadership, and showcasing their global capabilities. Providing valuable insights through reports, such as the Global Market Outlook, helps in attracting and informing potential and existing clients. The company is also expanding its customer base through improved marketing and customer relationship management, driven by increased market demand and product innovation. For more insights, you can explore the Growth Strategy of State Street.

Direct engagement with institutional clients is a primary channel. Thought leadership through reports and publications provides valuable insights. Showcasing global presence and comprehensive solutions is also key.

Customer data and CRM systems are essential for targeted campaigns. Insights from client data are used to tailor solutions to specific client segments. This approach helps in personalizing the client experience.

Launching new products, such as the State Street Target Retirement IndexPlus in April 2025, is a key strategy. This provides defined contribution investors access to public and private market exposures. Innovation helps meet evolving investor needs.

The company's commitment to returning approximately 80% of earnings to shareholders in 2025 reflects financial strength. This strong financial position underpins client confidence. It demonstrates stability and commitment to stakeholders.

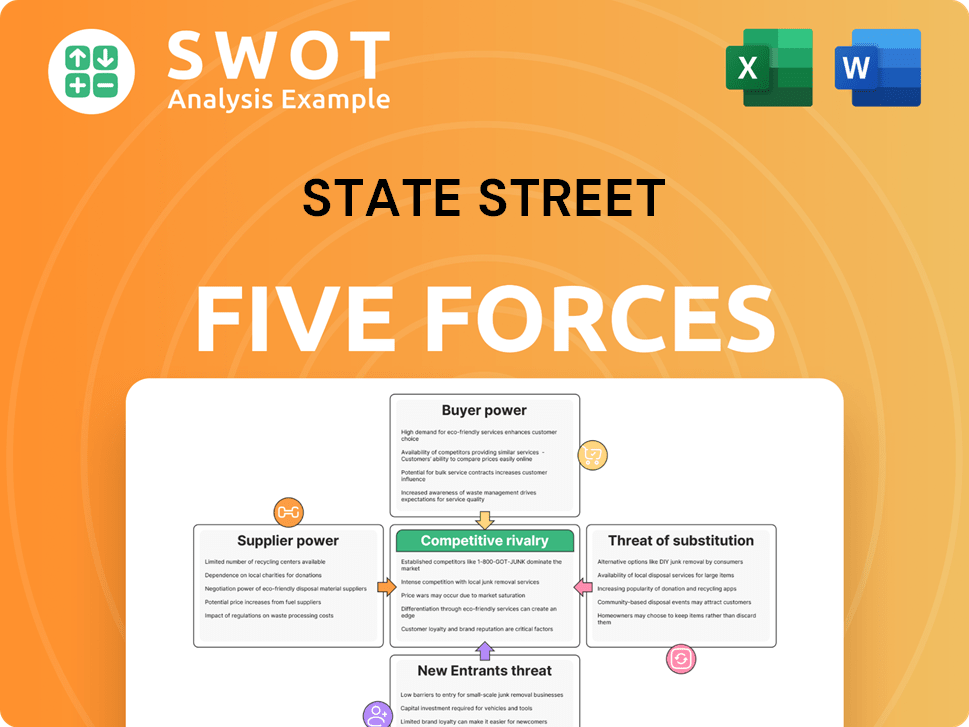

State Street Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of State Street Company?

- What is Competitive Landscape of State Street Company?

- What is Growth Strategy and Future Prospects of State Street Company?

- How Does State Street Company Work?

- What is Sales and Marketing Strategy of State Street Company?

- What is Brief History of State Street Company?

- Who Owns State Street Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.