Storskogen Group Bundle

How Did Storskogen Group Rise to International Prominence?

Founded in 2012 in Stockholm, Sweden, Storskogen Group has rapidly become a significant player in the global market. This Storskogen Group SWOT Analysis offers insights into its strategic positioning. From its humble beginnings, this Swedish company has charted an impressive course, marked by strategic

This brief history of Storskogen Group delves into the company's journey, exploring its founders' vision and the evolution of its

What is the Storskogen Group Founding Story?

The Storskogen Group, a Swedish company, has a fascinating history. Its story began in 2012, with its headquarters in Stockholm, Sweden. This marked the start of a journey that would see it grow and evolve significantly.

The founders of Storskogen Group AB (publ) were Daniel Samuel Kaplan, who serves as the CEO, and Alexander Murad Bjargard. Bjargard, initially the Head of M&A and Corporate Development, continues to serve as a director. The company's early days were rooted in developing and managing residential properties, setting the stage for its future expansion.

Storskogen's initial business model centered on long-term ownership and sustainable value creation. This approach provided capital and strategic direction while maintaining a decentralized operational model for its subsidiaries, fostering an entrepreneurial spirit within the acquired companies. This strategy helped the company to grow and develop.

Here are some key aspects of the Storskogen Group's founding and early development:

- Foundation Year: 2012

- Headquarters: Stockholm, Sweden

- Initial Focus: Residential property development and management.

- Business Model: Long-term ownership and sustainable value creation.

- Operational Approach: Decentralized model for subsidiaries.

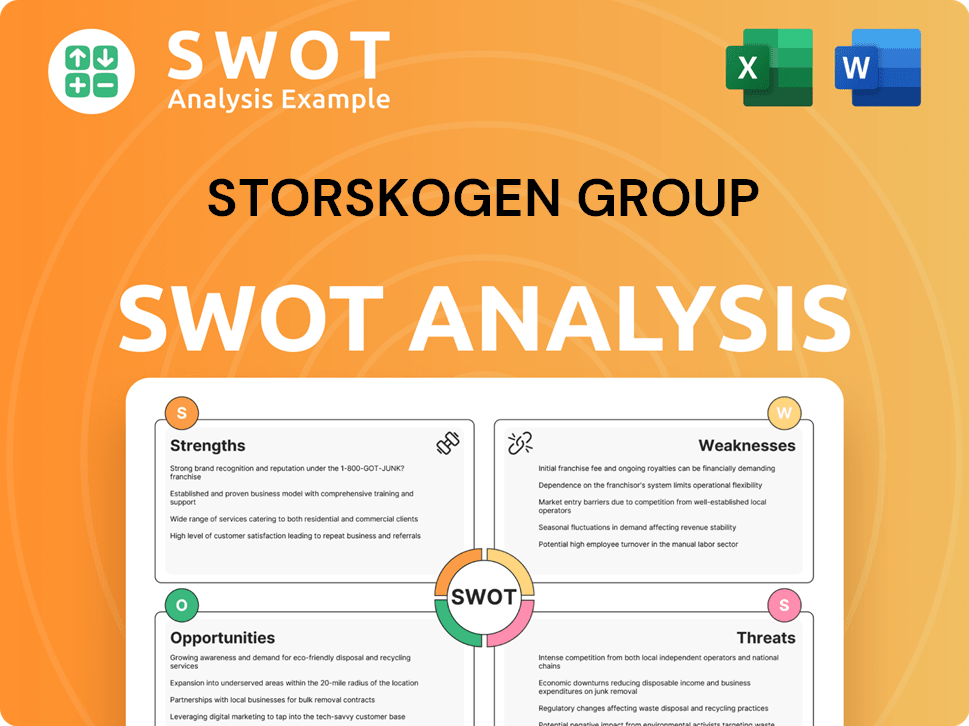

Storskogen Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Storskogen Group?

The early growth of the Storskogen Group, a Swedish company, focused on acquiring established businesses. This strategy built a diverse portfolio across various sectors including industry, trade, and services. By mid-2021, the company had expanded to include 94 business units and approximately 7,000 employees, with a trailing annual turnover nearing SEK 19 billion.

In 2024, Storskogen completed five add-on acquisitions, with combined annual sales of SEK 23 million. The company also made strategic adjustments by divesting eleven companies, which had combined annual sales of SEK 2,024 million.

The first quarter of 2025 saw net sales of SEK 7,940 million, a 5% decrease from SEK 8,358 million in Q1 2024, primarily due to divestments. However, organic sales growth was 1% in Q1 2025. The adjusted EBITA margin improved to 8.8% in Q1 2025, up from 8.4% in Q1 2024.

Storskogen's growth strategy included expanding into new geographical markets, such as the Nordic countries, the DACH region, and the United Kingdom. The company also enhanced its financial flexibility by successfully refinancing and extending its term loan facility from EUR 289 million to EUR 345 million, maturing in September 2027.

The Storskogen Group's early focus on acquisitions and strategic divestments shaped its financial trajectory. The Q1 2025 results reflect the impact of these moves, with a focus on maintaining profitability and expanding market presence. The refinancing of the term loan facility demonstrates proactive financial management.

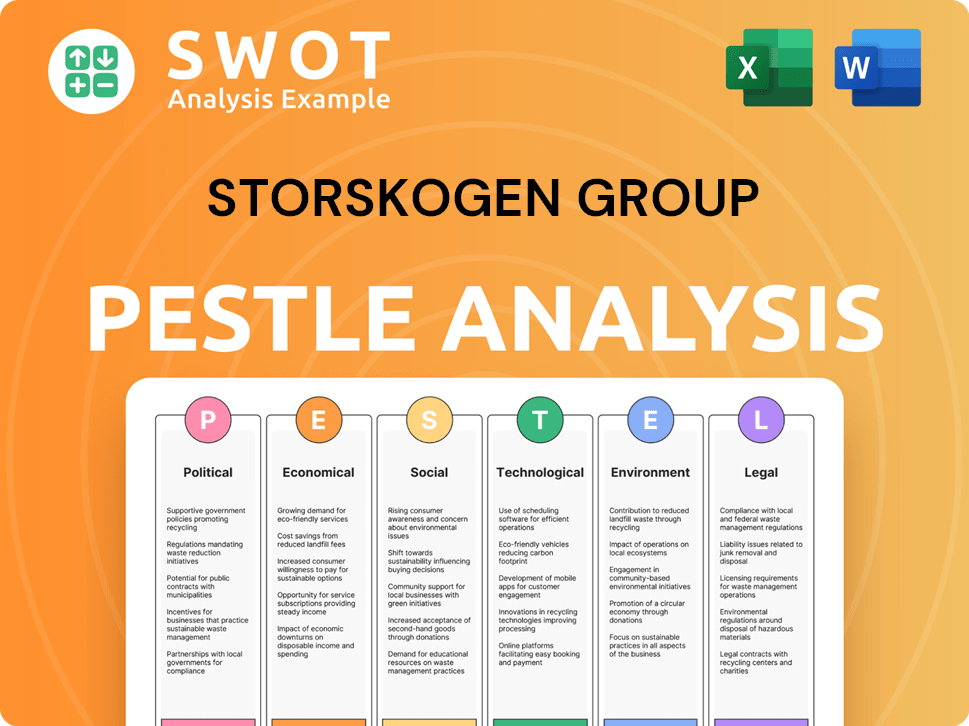

Storskogen Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Storskogen Group history?

The Storskogen Group, a prominent Swedish company, has achieved several significant milestones since its inception. These achievements highlight its growth and impact in the business world. The Storskogen history is marked by strategic moves and a focus on sustainable growth.

| Year | Milestone |

|---|---|

| 2019 | Received the Green Building Awards for Smart Solutions for Sustainable Cities, recognizing its commitment to environmental responsibility. |

| 2020 | Awarded the International Real Estate Developers Award for Best New Development, showcasing its success in real estate. |

| 2021 | Listed on Nasdaq Stockholm on October 6, marking a significant step in its corporate journey. |

| Ongoing | Continues to expand its portfolio through Storskogen acquisitions and Storskogen investments, driving its growth strategy. |

Storskogen Group supports its subsidiaries by fostering innovation across various sectors. This includes initiatives in automation, digitalization, sustainability, and urbanization within its Industry business area, developing solutions that boost productivity and optimize resources.

Implementing automation technologies to streamline operations and enhance efficiency across its subsidiaries.

Driving digital transformation initiatives to improve data management, customer experience, and operational agility.

Focusing on sustainable practices and solutions to reduce environmental impact and promote responsible business operations.

Developing solutions that support sustainable urbanization and contribute to the development of smart cities.

Despite its successes, Storskogen Group has faced challenges, particularly in a weak macroeconomic environment. In 2024, the company's net sales decreased, impacting its financial performance.

Net sales decreased by 5% to SEK 34,182 million in 2024, reflecting the impact of the economic environment.

Organic sales growth was at 0%, indicating challenges in achieving revenue growth organically.

Adjusted EBITA was SEK 3,229 million in 2024, slightly down from SEK 3,238 million in 2023, with organic EBITA growth at -3%.

Profit for the period decreased significantly to SEK 116 million in 2024 from SEK 944 million in 2023, affected by items affecting comparability.

Storskogen Group has responded by focusing on improving organic growth, strengthening cash flow, and reducing debt, including strategic divestments.

Christer Hansson became CEO in February 2024, and a strategic review was conducted to sharpen capital allocation and investment priorities.

For more insights into the company's financial structure and business model, you can read Revenue Streams & Business Model of Storskogen Group.

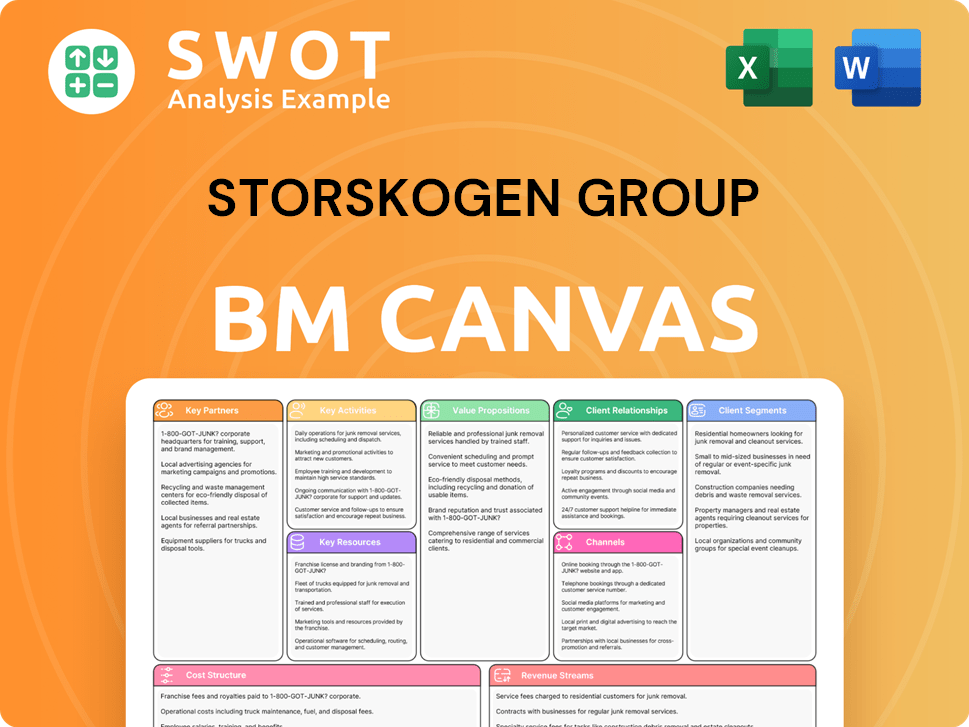

Storskogen Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Storskogen Group?

The Storskogen Group has a relatively short but eventful history. Founded in Stockholm, Sweden, the company has expanded through strategic acquisitions and a public listing, showcasing a commitment to growth and diversification within the Swedish company landscape. Key milestones highlight the company's evolution and strategic direction.

| Year | Key Event |

|---|---|

| 2012 | Storskogen Group was founded in Stockholm, Sweden. |

| 2019 | Recognized with Green Building Awards and a European Citizen Award for its social and environmental impact. |

| 2020 | Awarded the International Real Estate Developers Award. |

| October 6, 2021 | Storskogen Group AB (publ) was listed on Nasdaq Stockholm. |

| August 2021 | Signed agreements to acquire Adero, Buildercom, SoVent, Viametrics, and Persson Innovation, completed in October 2021. |

| Q2 2024 | Organic growth turned mildly positive after four quarters in negative territory. |

| November 27, 2024 | Storskogen presented new financial targets for 2025-2027 at its Capital Markets Day. |

| February 13, 2025 | Christer Hansson, CEO, and Lena Glader, CFO, presented the year-end report for 2024; Alexander Bjärgård stepped down from the management team to lead the Investment Committee, succeeded by Johan Ekström as Group Head of M&A. |

| May 7, 2025 | Annual General Meeting approved a dividend of SEK 0.10 per share for the financial year 2024. |

| May 26, 2025 | Chris Pullen appointed as new Managing Director for Storskogen UK. |

Looking ahead, Storskogen Group aims to generate acquired growth, focusing on its prioritized areas. This strategy involves a continued emphasis on strategic

The company has set ambitious financial targets for the period 2025-2027. These include an adjusted EBITA growth with a compounded annual growth rate (CAGR) of 15%, and an adjusted EBITA margin above 10% (LTM). Furthermore, Storskogen targets an adjusted cash conversion above 70% (LTM).

Storskogen Group aims for a leverage ratio of interest-bearing net debt to adjusted RTM EBITDA of 2.0-3.0x. The company's dividend policy is set at 0-20% of Group net profit for the year, indicating a commitment to shareholder returns while maintaining financial flexibility.

Analysts project significant growth for Storskogen Group. Earnings are forecast to grow by 42.4% per annum, and revenue is expected to increase by 2.3% per annum. EPS is anticipated to grow by 42.3% per annum, reflecting positive expectations for the company's future performance and its ability to execute its strategy.

Storskogen Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Storskogen Group Company?

- What is Growth Strategy and Future Prospects of Storskogen Group Company?

- How Does Storskogen Group Company Work?

- What is Sales and Marketing Strategy of Storskogen Group Company?

- What is Brief History of Storskogen Group Company?

- Who Owns Storskogen Group Company?

- What is Customer Demographics and Target Market of Storskogen Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.