Storskogen Group Bundle

How is Storskogen Group Revolutionizing Sales and Marketing?

Founded in 2012, Storskogen Group has quickly become a significant player in the international market by acquiring and operating successful small and medium-sized enterprises (SMEs). Their unique decentralized approach empowers subsidiaries, fostering entrepreneurial spirit while providing crucial support for growth. But how does this translate into their Storskogen Group SWOT Analysis, sales, and marketing strategies?

Storskogen Group's recent strategic shift, highlighted in late 2024 and early 2025, emphasizes organic profit growth and improved cash flows. This focus has already started to pay off, as evidenced by improved profitability and organic sales growth, even amidst slight net sales fluctuations. This analysis delves into the specifics of Storskogen Group's sales and marketing strategies, exploring how they drive performance and navigate the complexities of the market, offering valuable insights for investors and business strategists alike. We will explore their Storskogen Group business model and how they approach Storskogen Group acquisitions.

How Does Storskogen Group Reach Its Customers?

The sales channels of the Storskogen Group are diverse, reflecting the varied operations of its many acquired small and medium-sized enterprises (SMEs). The company does not have a unified direct sales force or e-commerce platform across the entire group. Instead, its sales strategies are primarily the established and specialized channels of its business units, which operate across approximately 30 countries.

These business units are organized into three main areas: Services, Trade, and Industry. Each area employs different sales approaches tailored to its specific market. This decentralized structure allows each subsidiary to manage its sales activities, with Storskogen providing strategic direction and capital to support growth. Understanding the sales channels of Storskogen Group is key to grasping its overall business model and how it achieves its goals through acquisitions and investments.

In 2024, Storskogen Group's net sales reached SEK 34,182 million, with organic sales growth at 0%. This indicates a focus on maintaining and optimizing existing sales avenues while the parent company prioritizes overall profitability and cash flow. Strategic shifts are more likely to occur at the subsidiary level, with Storskogen providing support for digital adoption or omnichannel integration where relevant to the specific business.

The Services business area includes installation, logistics, infrastructure, engineering, and digital services. Sales are typically conducted through direct business-to-business (B2B) engagements. Project-based contracts and long-term service agreements are also common.

The Trade business area consists of distributors and wholesalers. Sales channels include wholesale distribution and direct sales to retailers. Some brands may use direct-to-consumer (DTC) e-commerce platforms.

The Industry segment focuses on traditional industrial companies. These companies rely on B2B sales teams and direct sales to other businesses. Specialized distributors may also be used for their products and solutions.

Storskogen's decentralized model empowers subsidiaries to manage their sales. The parent company provides capital and strategic guidance, supporting digital adoption and omnichannel integration. This approach allows for flexibility and responsiveness in different markets.

The sales and marketing strategies are primarily managed at the subsidiary level, with Storskogen providing support and strategic direction. This approach allows each business unit to tailor its strategies to its specific market and customer base. The focus remains on optimizing existing channels and exploring new opportunities for growth.

- B2B Focus: Many sales channels are B2B-oriented, particularly in the Services and Industry segments.

- Channel Optimization: Subsidiaries are encouraged to optimize their existing sales channels.

- Digital Adoption: Storskogen supports digital adoption and omnichannel integration where relevant.

- Decentralized Management: Subsidiaries have significant autonomy in managing their sales and marketing activities.

For a deeper dive into how Storskogen Group approaches growth, consider reading about the Growth Strategy of Storskogen Group. This article provides further insights into the company's strategic initiatives and market analysis.

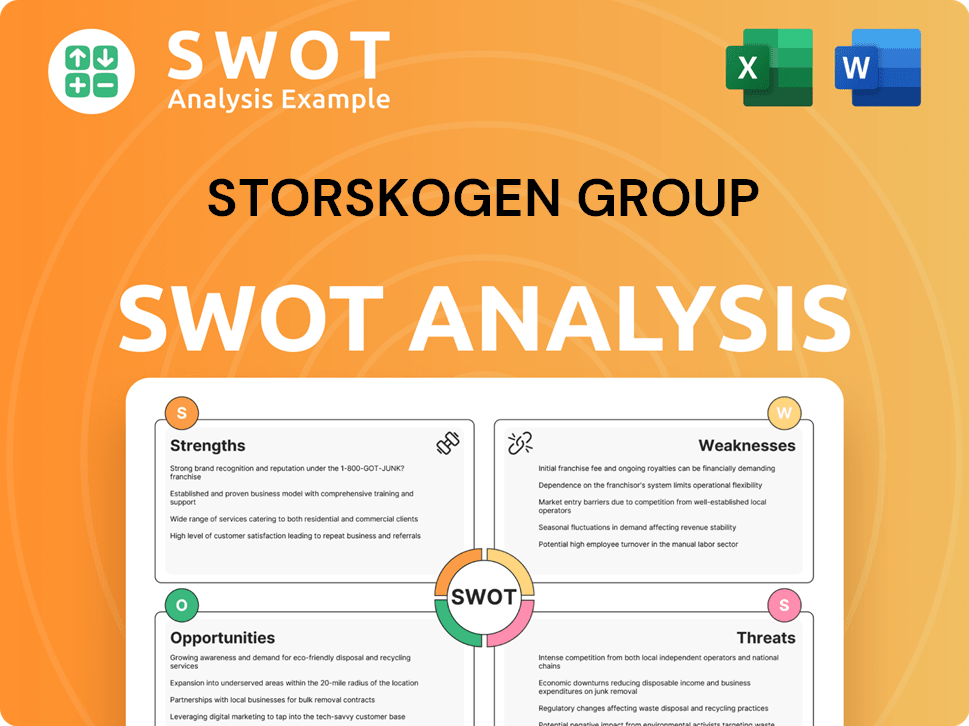

Storskogen Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Storskogen Group Use?

The marketing tactics employed by the Storskogen Group are largely decentralized, reflecting its operational model. The group's primary marketing efforts focus on investor relations and brand building. This approach aims to attract new acquisitions rather than directly marketing products or services to consumers or businesses.

Storskogen Group's strategy emphasizes being approachable, pragmatic, skilled, committed, and professional. This is designed to make the company attractive to businesses seeking acquisition. The group's marketing strategy is carefully crafted to communicate these values to potential investors and acquisition targets.

Digital strategies are crucial for Storskogen Group's marketing, specifically for investor relations and corporate communications. This includes maintaining a comprehensive website with key information. For example, the Annual and Sustainability Report for 2024 was published in April 2025. The group also utilizes news distribution services to share industry insights, articles, and case studies, demonstrating its expertise.

Storskogen Group maintains a robust digital presence through its website. This includes financial reports, press releases, and investor information. The website serves as a central hub for communicating with stakeholders.

The group uses content marketing to showcase its expertise and value. This includes articles, expert insights, and case studies. This approach helps to establish thought leadership and attract potential acquisitions.

Investor presentations and webcasts are key communication channels. These channels are used to share financial performance and strategic priorities. These tools help to keep investors informed and engaged.

Capital markets days are used to present new financial targets and strategic priorities. The most recent event was held in November 2024. These events are crucial for communicating the company's vision.

The underlying businesses within Storskogen's portfolio use various marketing tactics. These tactics range from traditional media to digital advertising. The strategies are tailored to specific markets.

Storskogen Group prioritizes transparent communication with the financial community. This includes regular updates on financial performance and strategic initiatives. The company aims to build trust through open communication.

While direct advertising campaigns for the overarching brand are not a major focus, Storskogen Group's marketing mix has evolved to prioritize transparent communication. This is demonstrated through capital markets days, where new financial targets and strategic priorities for 2025-2027 were presented in November 2024. These events highlight the company's commitment to driving organic and acquired profit growth. The underlying businesses within Storskogen's portfolio, operating in diverse sectors, employ a wide array of marketing tactics relevant to their specific markets. To learn more about the company's approach, you can refer to this article about Storskogen Group sales strategy for SMEs.

Storskogen Group's marketing strategy is designed to attract acquisitions and engage with investors. The approach includes a strong digital presence, content marketing, and investor relations activities.

- Investor Relations: Regular investor presentations and webcasts to communicate financial performance.

- Digital Marketing: Utilizing the company website and news distribution services to share information.

- Capital Markets Days: Presenting new financial targets and strategic priorities.

- Decentralized Approach: Allowing subsidiaries to implement their own marketing strategies.

- Brand Building: Focusing on building a strong brand to attract potential acquisitions.

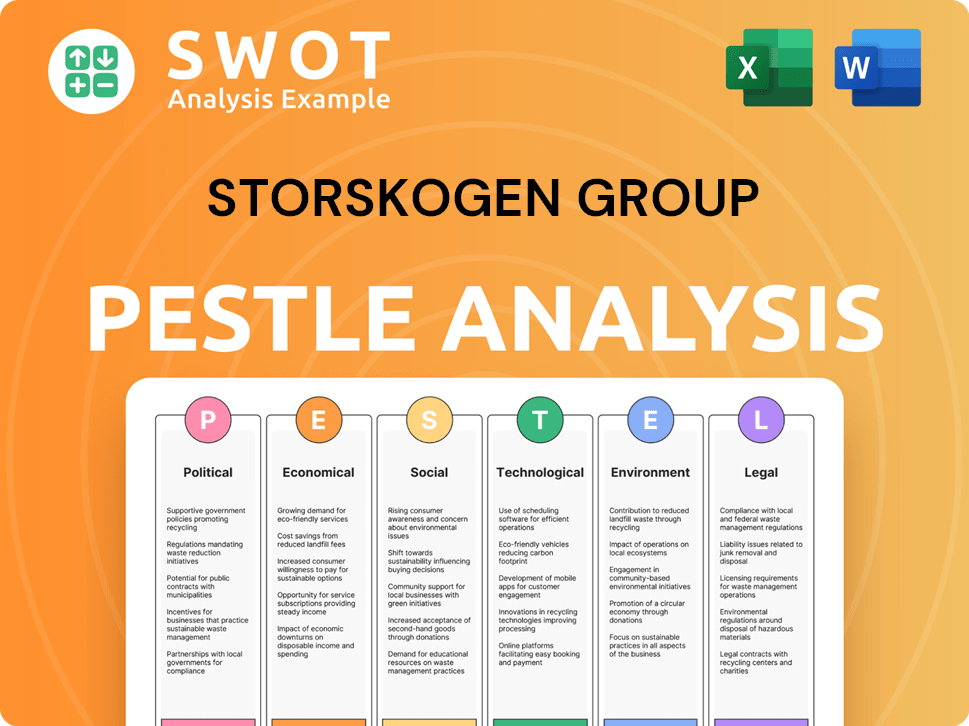

Storskogen Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Storskogen Group Positioned in the Market?

The brand positioning of the company emphasizes its role as a long-term, active owner, focusing on acquiring and developing market leaders with sustainable business models. This approach is central to the company's sales and marketing strategy. The core message revolves around empowering businesses for long-term growth. This strategy is designed to attract sellers and units seeking stability and continued growth.

The company's visual identity and tone of voice are professional and pragmatic, conveying skill and commitment. The aim is to be perceived as an approachable and reliable partner within the business community. This positioning is crucial for differentiating itself from competitors, especially private equity firms with shorter investment horizons. The focus is on long-term ownership, ensuring the acquired companies' future competitiveness. This approach supports its Growth Strategy of Storskogen Group.

The company appeals to its target audience of profitable small and medium-sized enterprises by offering stability, resources, and continued entrepreneurial freedom. The commitment to sustainable value creation is also a key aspect, with climate analyses incorporated into acquisition assessments. The company's resilience, built on a diversified group of companies, further strengthens its brand by mitigating risks and demonstrating endurance.

The company's sales strategy focuses on attracting and acquiring profitable small and medium-sized enterprises (SMEs). This involves highlighting the benefits of long-term ownership, access to capital, and strategic support. The decentralized operational model allows subsidiaries to maintain their entrepreneurial spirit.

Marketing efforts likely include targeted communications to potential acquisition targets, emphasizing the company's unique value proposition. This involves showcasing the benefits of long-term ownership and the resources available for growth. The company uses investor relations and corporate news to reinforce its brand identity.

The business model centers on acquiring and developing market-leading businesses across various sectors. The decentralized operational model allows subsidiaries to maintain autonomy while benefiting from the parent company's strategic guidance and financial support. This model supports sustainable value creation.

The company's acquisitions are a core component of its growth strategy. The acquisition process includes identifying and evaluating potential targets that align with its investment criteria. Climate analyses are integrated into acquisition assessments to ensure sustainability.

The company differentiates itself through its long-term ownership approach, contrasting with the shorter investment horizons of private equity firms. This focus ensures the future competitiveness of acquired companies. This approach supports its strategic goals.

- Long-term ownership perspective.

- Decentralized operational model.

- Commitment to sustainable value creation.

- Focus on acquiring market leaders.

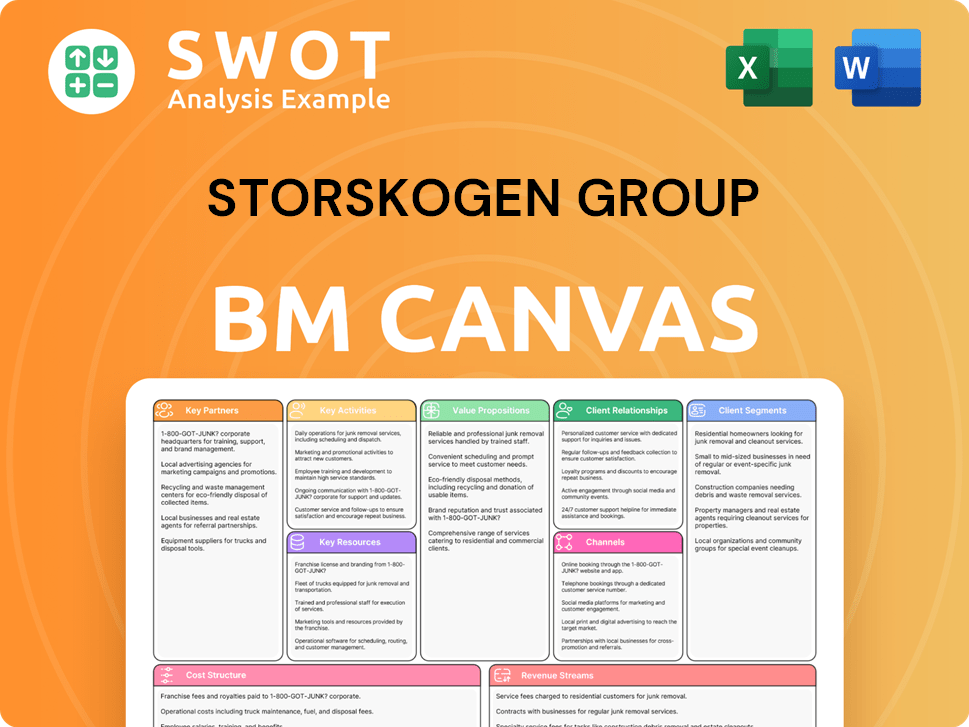

Storskogen Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Storskogen Group’s Most Notable Campaigns?

The core of the 's sales and marketing strategy revolves around strategic communications and initiatives targeting investors and potential acquisition targets rather than traditional consumer-facing campaigns. These efforts are designed to boost investor confidence, attract new acquisitions, and highlight a clear path to sustainable growth. This approach is a key aspect of their overarching business model, focusing on long-term value creation.

A prominent example of this strategy is the strategic review initiated after the appointment of Christer Hansson as CEO in February 2024. This review culminated in a Capital Markets Day in November 2024. The primary goal was to refine capital allocation, investment priorities, and present new financial targets for the period from 2025 to 2027. These initiatives are central to understanding the company's approach to Storskogen Group sales and marketing.

The strategic 'campaign' used webcasts, teleconferences, and detailed reports on the investor relations website. The year-end report for 2024, published in February 2025, and the Q1 2025 interim report, released in May 2025, were crucial communication tools. These reports provided updates on progress and financial performance, reflecting the company's commitment to transparency and strategic clarity in its sales and marketing efforts.

The Capital Markets Day in November 2024 announced key targets for 2025-2027. These included an adjusted EBITA growth (CAGR) of 15%, an adjusted EBITA margin of over 10% (LTM), and an adjusted cash conversion of over 70% (LTM). These targets are central to the company's growth strategy.

The strategic updates were primarily communicated through webcasts, telephone conferences, and detailed reports on the investor relations website. The year-end report for 2024 and the Q1 2025 interim report were key communication tools.

In Q1 2025, the company reported an adjusted EBITA margin of 8.8%, up from 8.4% in Q1 2024, and positive organic sales growth of 1%. This shows an improved focus on profitability. The company's sales performance is a key indicator of its marketing and sales efforts.

In 2024, the company completed five add-on acquisitions with combined annual sales of SEK 23 million, and eleven divestments with combined annual sales of SEK 2,024 million. This demonstrates active portfolio management. This is a vital part of how Storskogen Group acquires companies.

These strategic campaigns aim to increase investor confidence and attract new, profitable acquisition targets. By demonstrating a clear path to sustainable growth and value creation, the company enhances its market position. Understanding the Target Market of Storskogen Group helps to illustrate how these strategies are designed to resonate with key stakeholders.

- Focus on Transparency: Clear communication of financial targets and progress.

- Strategic Clarity: Highlighting the company's investment priorities.

- Renewed Focus: Emphasizing organic profit growth, profitability, and cash flow.

- Active Portfolio Management: Acquisitions and divestments aligned with strategic goals.

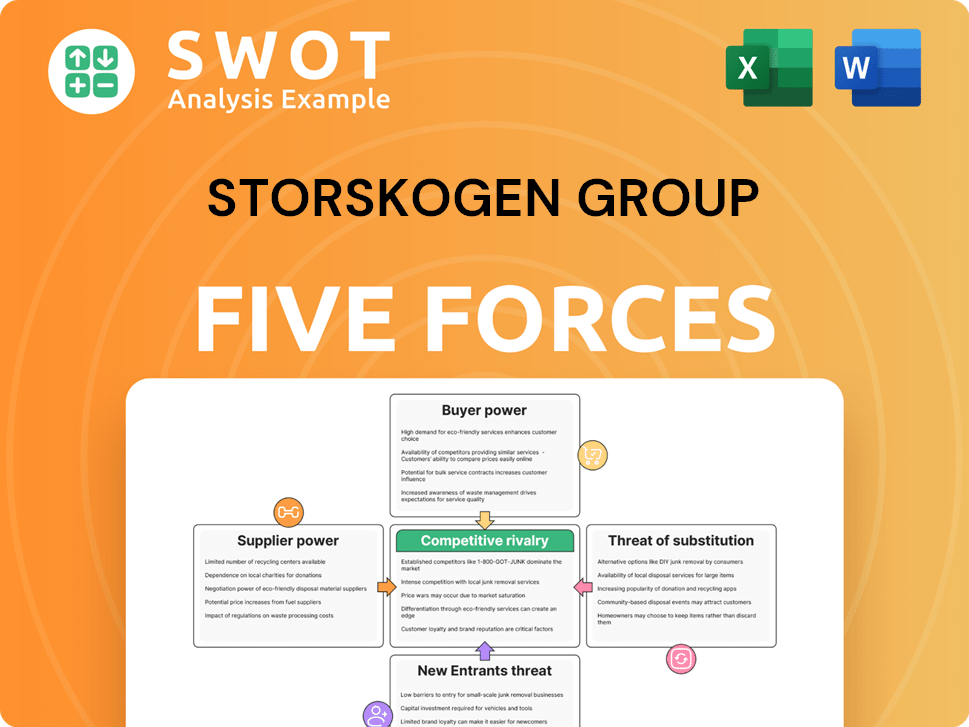

Storskogen Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Storskogen Group Company?

- What is Competitive Landscape of Storskogen Group Company?

- What is Growth Strategy and Future Prospects of Storskogen Group Company?

- How Does Storskogen Group Company Work?

- What is Brief History of Storskogen Group Company?

- Who Owns Storskogen Group Company?

- What is Customer Demographics and Target Market of Storskogen Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.