Storskogen Group Bundle

How Does Storskogen Group Navigate Its Competitive Landscape?

In the dynamic world of acquisitions and SME management, Storskogen Group has established itself as a noteworthy player. Its unique model, focusing on long-term ownership and decentralized operations, demands a closer look at its competitive arena. This Storskogen Group SWOT Analysis can provide deeper insights into its strategic positioning.

This Company analysis delves into Storskogen Group's competitive landscape, exploring its market position and business strategy. We'll examine its key competitors, dissect its competitive advantages, and provide an industry overview to understand its growth potential. Understanding Storskogen Group's acquisition strategy and geographical presence is crucial for assessing its impact on the private equity landscape and its future outlook.

Where Does Storskogen Group’ Stand in the Current Market?

Storskogen Group has established a strong market position by acquiring and operating small and medium-sized enterprises (SMEs) across Europe. The company's business model focuses on a decentralized approach, empowering its subsidiaries to maintain their market leadership within their specific niches. This strategy allows Storskogen Group to serve a diverse range of B2B and B2C customer segments, contributing to its robust financial performance.

As of the end of 2023, Storskogen Group reported net sales of SEK 37,235 million and an adjusted EBITA of SEK 3,248 million, demonstrating its financial health. The company's portfolio is diversified across three main business areas: Industri, Trade, and Services. This diversification, combined with a strategic focus on geographic expansion, has been key to its growth. Moreover, the company's ability to generate strong cash flow, with a cash conversion rate of 94% in Q4 2023, indicates efficient operations and effective management of its acquired businesses.

Storskogen Group's success is rooted in its ability to identify and integrate niche leaders, particularly in fragmented markets. Its competitive landscape is shaped by its strategic focus on acquiring and developing SMEs. The company's investment strategy and acquisition strategy are designed to capitalize on these market opportunities. For more information about the company's target market, see Target Market of Storskogen Group.

Storskogen Group's financial performance is characterized by consistent profitability and strong cash conversion. The adjusted EBITA of SEK 3,248 million and a cash conversion rate of 94% in Q4 2023 highlight the company's operational efficiency and effective management.

The business strategy involves a decentralized model, empowering subsidiaries to maintain market leadership. This approach supports a broad spectrum of B2B and B2C customer segments. Strategic geographic expansion and portfolio diversification are key components of the growth strategy.

Storskogen Group has a significant presence in the Nordics, DACH region, and the UK. This geographic diversification supports its pan-European expansion strategy. The company's presence in these key markets enhances its market position.

Storskogen Group's competitive advantages include its ability to acquire and integrate niche leaders in fragmented markets. The company's strong cash flow generation and efficient operations further solidify its position. Its decentralized model allows subsidiaries to maintain market leadership.

Storskogen Group's strategic initiatives, including geographic expansion and portfolio diversification, have significantly strengthened its market position. The company's focus on acquiring and developing SMEs across various sectors has driven its growth. Storskogen Group's financial health, characterized by consistent profitability and strong cash conversion, positions it favorably within the industry overview.

- Strong financial performance with net sales of SEK 37,235 million in 2023.

- Diversified portfolio across Industri, Trade, and Services.

- Geographic presence in the Nordics, DACH region, and the UK.

- High cash conversion rate of 94% in Q4 2023, indicating efficient operations.

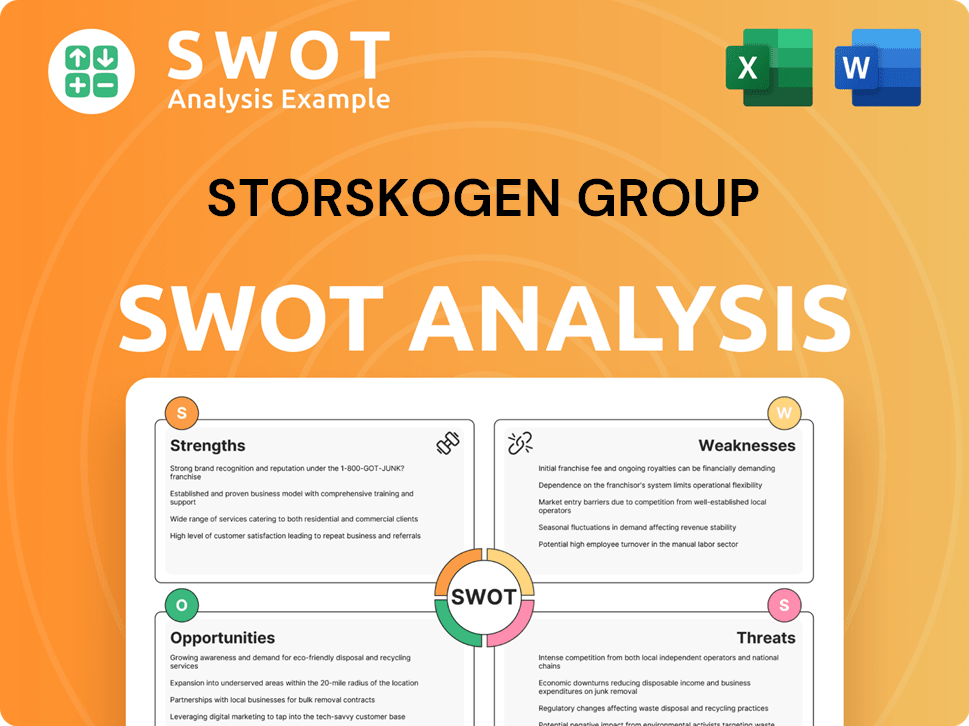

Storskogen Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Storskogen Group?

The competitive landscape for Storskogen Group is complex, involving various players vying for acquisitions in the small and medium-sized enterprise (SME) market. This landscape is shaped by investment firms, industrial conglomerates, and other holding companies, all seeking to acquire and manage businesses. Understanding the dynamics of this environment is crucial for assessing Storskogen Group's market position and future prospects.

Storskogen Group's business strategy centers on acquiring and developing profitable SMEs, which places it in direct competition with entities employing similar acquisition models. Indirect competition arises from larger entities that may seek to acquire smaller companies for strategic purposes, adding another layer of complexity to the competitive environment. The ability to identify attractive acquisition targets and offer competitive valuations is key to success in this arena.

The competitive environment for Storskogen Group is dynamic and multifaceted, requiring a keen understanding of its rivals and the broader market forces at play. The company's approach to acquisitions and its long-term ownership model are critical differentiators in this competitive setting. For more insights into the company's strategic approach, consider reading about the Marketing Strategy of Storskogen Group.

Direct competitors include investment companies with similar acquisition strategies, such as Lifco. These entities compete by identifying attractive acquisition targets and offering competitive valuations.

Indirect competition comes from larger industrial groups and private equity funds. These competitors may have different investment horizons or strategic goals, influencing their approach to acquisitions.

Competition often intensifies during the bidding processes for high-quality SMEs. The ability to offer compelling growth strategies and valuations is crucial.

New and emerging players, particularly those backed by significant capital, can disrupt the traditional competitive landscape. These entities may focus on specific high-growth sectors.

Mergers and alliances among competitors can create larger entities with greater financial muscle and market reach. This can significantly impact the competitive environment.

Storskogen Group focuses on maintaining its disciplined acquisition strategy and appealing to entrepreneurial sellers. Long-term ownership and a decentralized model are key.

Several factors influence the competitive landscape, including valuation, speed of transaction, and the ability to offer synergies. Understanding these factors is crucial for company analysis.

- Valuation: Competitive offers are essential to secure acquisitions.

- Speed of Transaction: Quick and efficient processes can be a competitive advantage.

- Synergies: Strategic buyers may offer synergies that Storskogen, with its decentralized model, does not emphasize.

- Long-Term Ownership: Storskogen's appeal to entrepreneurial sellers is based on its long-term approach.

- Market Focus: Identifying and targeting specific industries is crucial for success.

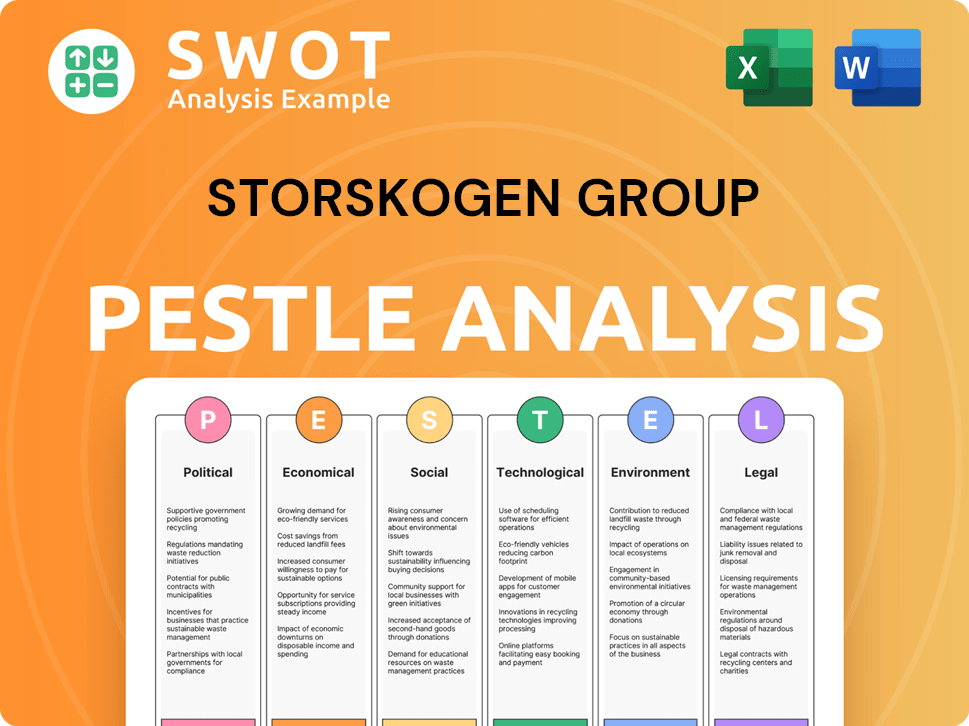

Storskogen Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Storskogen Group a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of the Storskogen Group requires a deep dive into its core strengths. The company's unique approach to acquisitions and long-term ownership sets it apart from many competitors. This strategy, coupled with a focus on sustainable value creation, forms the bedrock of its competitive advantages within the industry.

Storskogen's business model centers on acquiring and supporting well-managed, profitable small and medium-sized enterprises (SMEs). This focus allows the group to build a diverse portfolio across various sectors. The company's commitment to decentralized ownership ensures that acquired companies retain their operational autonomy, fostering a culture of entrepreneurship and innovation.

The Owners & Shareholders of Storskogen Group have cultivated a business model that prioritizes long-term value creation over short-term gains. This approach is a key differentiator in the competitive landscape. By focusing on indefinite ownership, Storskogen can make strategic investments in its subsidiaries, strengthening their market positions and fostering sustainable growth.

Storskogen's decentralized model allows acquired companies to maintain their entrepreneurial spirit. This autonomy is attractive to business owners seeking long-term stability. The model provides financial stability and strategic support while preserving the acquired company's identity.

Unlike many private equity firms, Storskogen aims for indefinite ownership. This fosters sustainable value creation. The long-term view allows for strategic investments in subsidiaries. This approach strengthens market positions over time.

Storskogen's financial strength is a key competitive advantage. The company's robust cash flow generation supports consistent acquisitions. Prudent capital management enables growth initiatives. In Q4 2023, Storskogen reported a strong cash conversion of 94%.

Storskogen excels at identifying and integrating profitable SMEs. The focus is on companies with leading market positions. This ensures a baseline of quality and resilience. Leveraging its network and sharing best practices contributes to overall group strength.

Storskogen Group's competitive advantages are rooted in its distinctive business strategy and operational approach. These advantages are crucial for its market position and sustained growth. The company’s ability to maintain a strong financial performance is a key factor.

- Decentralized ownership model fostering entrepreneurial spirit.

- Long-term ownership perspective promoting sustainable value creation.

- Strong financial health supporting acquisitions and growth.

- Expertise in acquiring and integrating profitable SMEs.

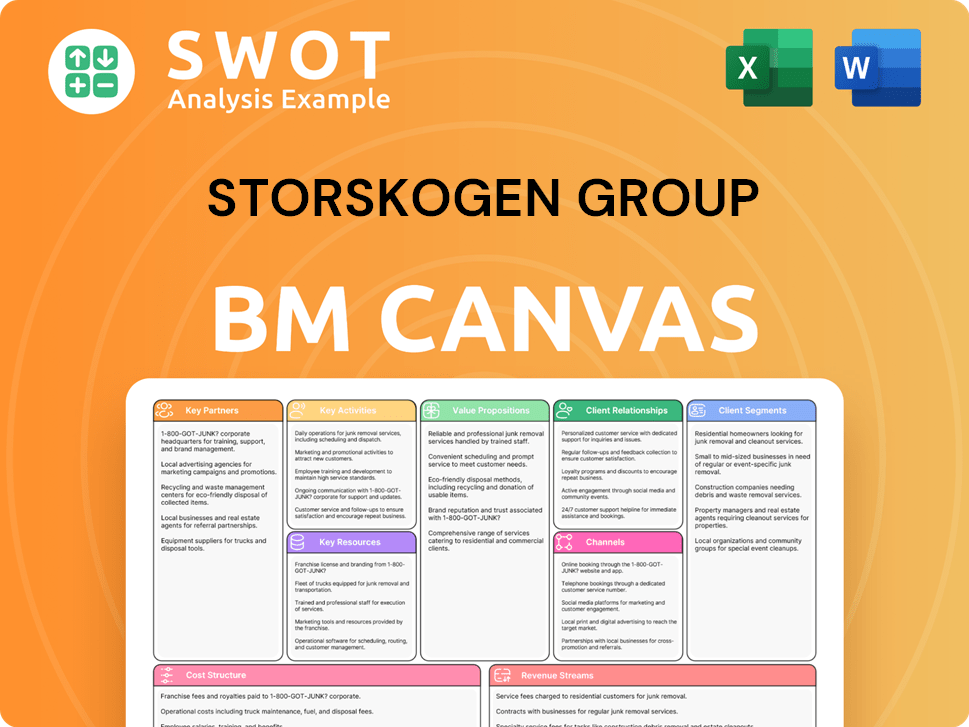

Storskogen Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Storskogen Group’s Competitive Landscape?

Understanding the competitive landscape of Storskogen Group requires an examination of the broader industry trends, potential challenges, and future opportunities. The company's market position is influenced by factors such as technological advancements, regulatory changes, and global economic shifts. A comprehensive company analysis must consider these elements to assess Storskogen Group's ability to navigate the evolving business environment.

Storskogen Group's business strategy involves a decentralized model, with a focus on acquiring and developing small and medium-sized enterprises (SMEs) across various sectors. This approach is designed to foster innovation and resilience. The company's investment strategy and acquisition strategy are crucial for long-term value creation, particularly in a competitive market. To better understand the company, you can read more about the Revenue Streams & Business Model of Storskogen Group.

Digitalization and automation are reshaping business operations, creating opportunities for efficiency gains and new product development. Regulatory changes, especially in ESG factors, are increasingly important in investment decisions. Global economic shifts, including inflation and interest rate fluctuations, impact financing and operational costs.

Increased competition for attractive SME targets could lead to higher valuations. New market entrants, such as specialized investment funds, may intensify the bidding landscape. Changes in business models, driven by e-commerce and consumer preferences, necessitate adaptability. Economic downturns and aggressive competitors pose potential threats.

Emerging markets offer significant growth potential for geographic expansion. Product innovations within existing portfolio companies can drive growth. Strategic partnerships with technology providers or other industry players could unlock new efficiencies. A disciplined acquisition strategy is key.

Storskogen Group aims to remain resilient by focusing on companies with stable cash flows and strong market positions. The company adapts to market changes while maintaining its core investment philosophy. The focus is on selective acquisitions, portfolio optimization, and leveraging its decentralized model.

Storskogen Group's success hinges on its ability to adapt to changing market conditions. This includes maintaining a disciplined approach to acquisitions and focusing on long-term value creation. The company's decentralized model supports innovation and resilience across its diverse portfolio.

- Disciplined acquisition strategy focused on companies with stable cash flows.

- Optimizing the existing portfolio for profitability and sustainability.

- Leveraging a decentralized model to foster innovation and resilience.

- Adapting to market changes while maintaining the core investment philosophy.

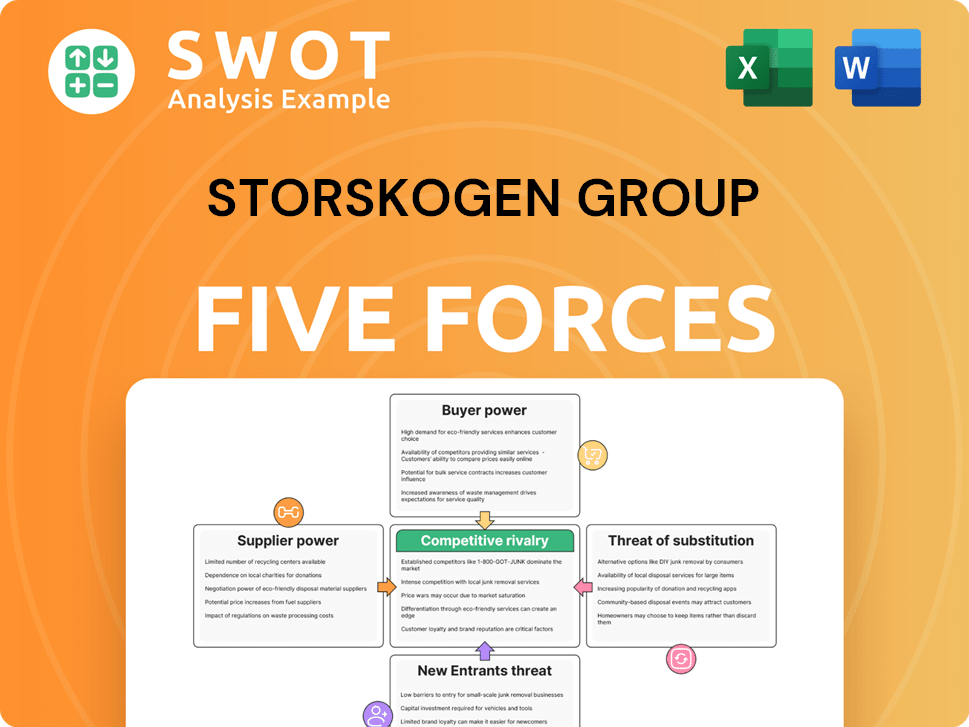

Storskogen Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Storskogen Group Company?

- What is Growth Strategy and Future Prospects of Storskogen Group Company?

- How Does Storskogen Group Company Work?

- What is Sales and Marketing Strategy of Storskogen Group Company?

- What is Brief History of Storskogen Group Company?

- Who Owns Storskogen Group Company?

- What is Customer Demographics and Target Market of Storskogen Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.