TAQA Bundle

How Did TAQA Company Rise to Global Prominence?

Delve into the captivating TAQA SWOT Analysis to understand the strategic moves behind its success. Established in 2005 in Abu Dhabi as Abu Dhabi National Energy Company, TAQA's journey is a testament to visionary leadership and strategic foresight. From its inception, the company has charted an ambitious course, evolving from a regional player to a global force in the energy sector.

This brief history of TAQA Company explores its pivotal moments, tracing its expansion from oil and gas to embrace renewable energy. Discover how TAQA's early projects and strategic acquisitions fueled its growth, transforming it into a leading integrated energy company. Explore TAQA's role in the UAE energy sector and its commitment to sustainability, making it a significant player in the global energy landscape.

What is the TAQA Founding Story?

The TAQA Company, officially known as the Abu Dhabi National Energy Company, has a rich TAQA history. It was established in June 2005 in Abu Dhabi, United Arab Emirates. The company's formation was a strategic move to diversify the UAE's economy and promote sustainable energy sources.

The establishment of TAQA Company was a result of the Abu Dhabi government's initiative in 1998 to privatize the water and electricity sector. The Abu Dhabi Water and Electricity Authority (ADWEA) played a crucial role as the founding shareholder, initially holding a 51% stake. This initiative was aligned with the vision of the late Sheikh Zayed bin Sultan Al Nahyan.

The initial focus of TAQA was on power generation, water desalination, and oil and gas exploration. Peter E. Barker-Homek was appointed as the first CEO in May 2006. Under his leadership, the company expanded rapidly through strategic acquisitions in Africa and North America. The company's commitment to sustainability and innovation has been a driving force since its inception. Learn more about the Target Market of TAQA.

TAQA's journey has been marked by significant milestones and strategic expansions.

- 2005: TAQA is founded in Abu Dhabi.

- 2006: Peter E. Barker-Homek becomes the first CEO.

- Early Years: Focus on power generation, water desalination, and oil and gas exploration.

- Expansion: Rapid growth through acquisitions in Africa and North America.

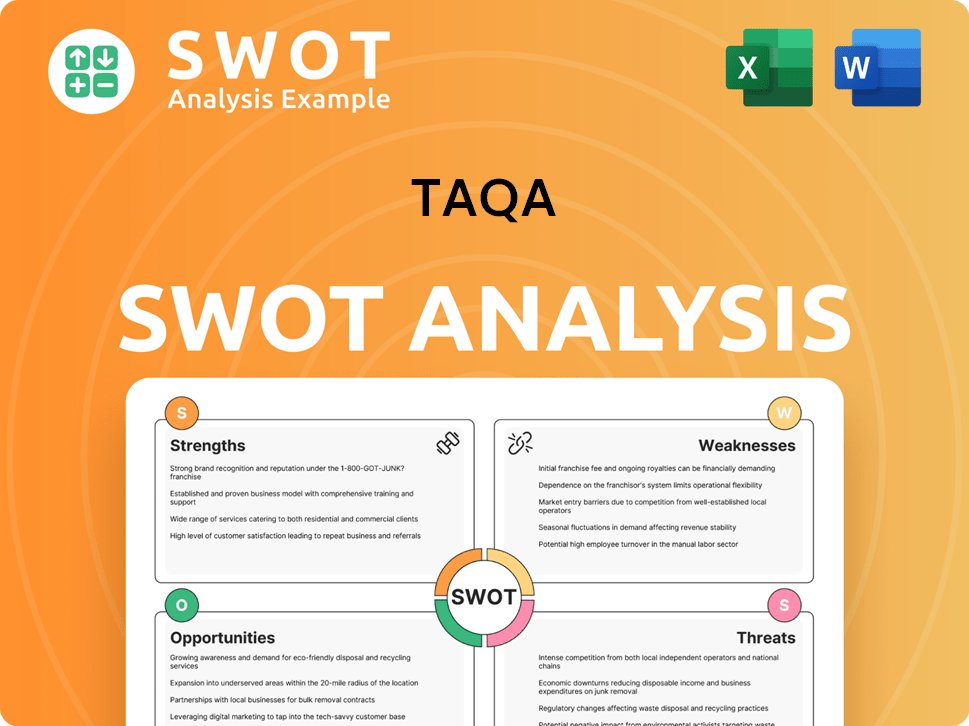

TAQA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of TAQA?

The TAQA Company experienced significant growth and expansion in its early years, quickly becoming a major player in the energy sector. Established in 2005, the company focused on power generation, water desalination, and oil and gas exploration. Strategic acquisitions and diversification efforts fueled this rapid expansion, shaping its global presence and impact on the economy.

Under the leadership of Peter E. Barker-Homek, appointed in May 2006, TAQA expanded quickly through key acquisitions. Notable early moves included acquisitions in Africa and North America. In 2007, TAQA entered Europe by acquiring gas exploration and production assets from BP Netherlands.

Further investments in the UK and Scotland occurred between 2008 and 2011. A significant acquisition in August 2009 involved a 15% interest in North Sea assets, leading to TAQA taking over the operatorship of the L11b-A production platform. The company also acquired BP Nederland Energie B.V. in 2006.

In July 2020, a major transaction with ADPower saw TAQA acquire the majority of ADPower's power and water generation, transmission, and distribution assets. This deal significantly expanded TAQA's regulated asset value and strengthened its presence in the UAE's utility sector, making it one of the largest utility companies in the region.

As of December 2024, TAQA's total assets were estimated at around AED 200 billion ($54 billion). In 2024, TAQA's group revenues increased by 6.7% year-on-year to AED 55.2 billion, primarily driven by growth in Transmission & Distribution (T&D) and the consolidation of TAQA Water Solutions. Capital expenditure surged by 63.8% to AED 9.2 billion in 2024.

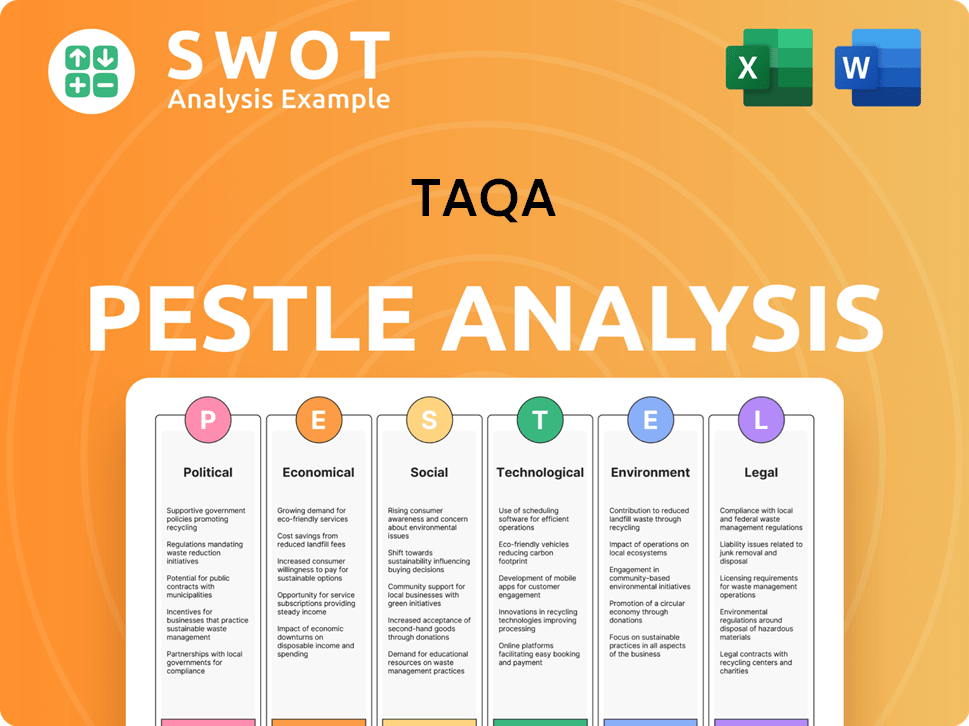

TAQA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in TAQA history?

The TAQA Company, also known as Abu Dhabi National Energy Company, has achieved several significant milestones throughout its history, evolving from an oil and gas entity to a key player in the renewable energy sector. This transformation aligns with the UAE's strategic vision for a sustainable future.

| Year | Milestone |

|---|---|

| 2020 | TAQA announced a strategic shift towards becoming a low-carbon power and water champion, supporting Abu Dhabi's 2030 vision and the UAE's Net Zero 2050 targets. |

| 2024 | TAQA's Masdar unit acquired a 50% stake in the US renewable energy company Terra-Gen, expanding its global footprint. |

| April 2025 | TAQA acquired 100% of Transmission Investment (TI), a leading UK-based energy and utility investment platform, strengthening its position in the UK and enabling expansion into European and international markets. |

| January 2025 | TAQA Transmission, a subsidiary, became effective, operating as the largest transmission asset owner in the UAE. |

| Q1 2025 | Masdar, in which TAQA holds a leading stake, made significant strides in expanding its global renewables portfolio. |

| April 2025 | TAQA and Emirates Water and Electricity Company (EWEC) announced new energy infrastructure projects to advance the UAE National Strategy for Artificial Intelligence 2031. |

TAQA has been at the forefront of technological advancements and large-scale projects, particularly in the renewable energy sector. These innovations are crucial for the company's transition to a low-carbon future.

Masdar's Saeta Yield platform acquired the 243 MW Valle Solar project in Spain in Q1 2025. Masdar also reached an agreement to acquire a 49.99% stake in four of Endesa S.A.'s solar assets in Spain, totaling 446 MW.

Masdar is developing the world's first giga-scale 'round-the-clock' renewables project in Abu Dhabi, integrating 5.2 GW of solar capacity with 19 GWh of battery storage to deliver 1 GW of continuous clean power.

TAQA and EWEC announced new energy infrastructure projects to advance the UAE National Strategy for Artificial Intelligence 2031. This includes TAQA's 1-gigawatt (GW) Al Dhafra Open-Cycle Gas Turbine (OCGT) project.

TAQA Transmission is investing AED 36 billion in grid infrastructure to support these initiatives. This investment is crucial for integrating renewable energy sources and ensuring a reliable power supply.

Despite its achievements, TAQA has faced challenges, including commodity price volatility and the decline in oil and gas production. However, the company's focus on its core utilities business has provided stability.

Commodity price volatility impacted net income and EBITDA in Q1 2025. This highlights the challenges faced by the Energy company in a fluctuating market.

A decline in oil and gas production also affected the financial results in Q1 2025. This underscores the strategic shift towards renewable energy sources.

The company's commitment to sustainability was recognized with an upgrade in its MSCI ESG rating to 'A' from 'BBB' in 2024. This reflects TAQA's growing focus on environmental, social, and governance factors.

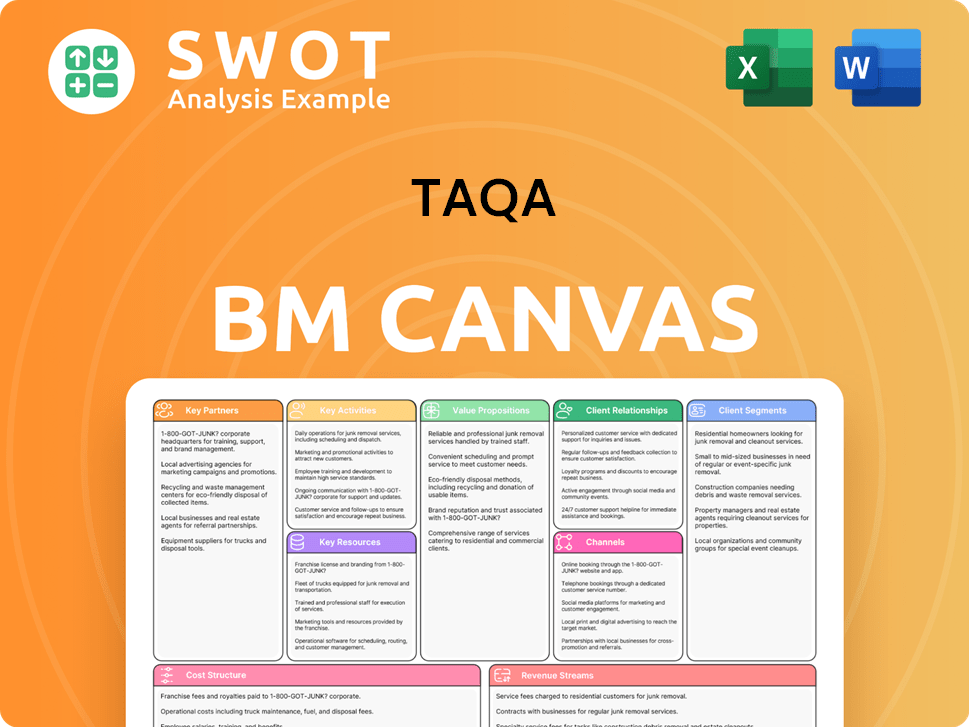

TAQA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for TAQA?

The TAQA Company has a rich TAQA history. It began in 1998, rooted in Abu Dhabi's initiative to privatize the water and electricity sector. The Abu Dhabi National Energy Company, or TAQA, was officially established in June 2005. Over the years, TAQA has expanded its operations, made significant acquisitions, and adapted its strategy to focus on renewable energy, making it a key player in the energy sector.

| Year | Key Event |

|---|---|

| 1998 | Beginnings of TAQA rooted in Abu Dhabi's government initiative to privatize the water and electricity sector. |

| June 2005 | TAQA (Abu Dhabi National Energy Company PJSC) officially founded in Abu Dhabi, UAE, as a public joint-stock company. |

| May 2006 | Peter E. Barker-Homek appointed as the first CEO. |

| 2007 | TAQA starts operations in Europe with the acquisition of gas exploration and production assets from BP Netherlands. |

| August 2009 | TAQA acquires a 15% interest in North Sea assets and takes over operatorship of the L11b-A production platform. |

| July 2020 | TAQA completes a deal with ADPower, creating one of the largest utility companies in the region. |

| August 2020 | TAQA announces a new strategic direction, focusing on becoming a low-carbon power and water champion. |

| September 2024 | TAQA announces a new brand identity for its group of companies. |

| October 2024 | TAQA issues USD 1.75 billion in dual-tranche bonds to finance growth. |

| December 2024 | TAQA reports full-year revenue of AED 55.2 billion and net income of AED 7.1 billion, with capital expenditure reaching AED 9.2 billion. |

| January 2025 | TRANSCO officially becomes TAQA Transmission. |

| February 2025 | TAQA Distribution receives the 'Abu Dhabi Effortless Customer Experience' award. |

| April 2025 | TAQA acquires 100% of Transmission Investment (TI), a UK-based energy and utility investment platform. |

| April 2025 | TAQA and EWEC announce new energy infrastructure projects, including the 1GW Al Dhafra OCGT project, to advance the UAE National Strategy for Artificial Intelligence 2031. |

| May 2025 | TAQA reports Q1 2025 revenue of AED 14.2 billion. Khalid Nouh steps down as CEO, and Adel Al-Ghadhban is appointed Interim CEO, effective June 1, 2025. TAQA announces an investment of AED 52 billion in Morocco for large-scale power and water projects. |

TAQA aims to increase its gross generation capacity to 150 GW by 2030, a 169% increase from the current 56 GW. The company plans to shift its energy mix to 65% renewables by 2030, up from 39% currently.

TAQA plans to invest over AED 75 billion ($20.5 billion) in energy transition projects through 2030. TAQA Transmission is set to invest AED 36 billion in grid infrastructure. The company is actively seeking acquisition opportunities in the United States and other regions.

TAQA's focus includes energy security and sustainability. The company is aligning with the UAE's broader economic vision and net-zero targets by 2050, driving the shift to renewable energy sources.

TAQA's future is tied to its global infrastructure leadership. The company is committed to supporting the energy reliability needed for data-driven technologies and high-performance computing.

TAQA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of TAQA Company?

- What is Growth Strategy and Future Prospects of TAQA Company?

- How Does TAQA Company Work?

- What is Sales and Marketing Strategy of TAQA Company?

- What is Brief History of TAQA Company?

- Who Owns TAQA Company?

- What is Customer Demographics and Target Market of TAQA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.