TAQA Bundle

How Does TAQA Stack Up in the Global Energy Arena?

As the energy sector undergoes a seismic shift, understanding the TAQA SWOT Analysis is crucial for investors and strategists alike. TAQA, a major player in the utilities and energy landscape, faces a dynamic competitive environment. This analysis delves into TAQA's position within the industry, assessing its strengths, weaknesses, and strategic moves.

This exploration of the TAQA competitive landscape provides a detailed market analysis, examining TAQA's competition and its strategic responses. We will identify TAQA rivals, assess its performance against key competitors, and evaluate its future growth prospects. This comprehensive review will help you understand how TAQA navigates the complexities of the global energy market.

Where Does TAQA’ Stand in the Current Market?

TAQA holds a significant market position within the utilities and energy sectors, particularly in the UAE and surrounding regions. As of its latest reporting, TAQA is a dominant player in the UAE’s power and water sector, owning the majority of the country's power and water desalination capacity. Its primary product lines include conventional power generation (gas-fired plants), renewable energy (solar and hydro), water desalination, and oil and gas exploration and production, alongside midstream infrastructure like pipelines and storage.

Geographically, TAQA has a strong presence in the UAE, Canada, and the UK, with operations also extending to Saudi Arabia. The company serves a diverse customer base, including governmental entities, industrial clients, and residential consumers, providing essential utilities. Over time, TAQA has strategically shifted its positioning, emphasizing a greater focus on renewable energy and sustainable solutions, aligning with global energy transition goals. This shift is evident in its target to have over 30% of its power generation capacity from renewables by 2030.

Compared to industry averages, TAQA's financial health and scale are robust, supported by its strong asset base and strategic government backing. TAQA's significant market share in the UAE's power and water sector, combined with its international footprint in oil and gas, positions it as a formidable entity. While its position in the UAE power and water sector is particularly strong, its oil and gas operations face a more fragmented and globally competitive landscape.

TAQA's core operations encompass conventional power generation, renewable energy, water desalination, and oil and gas exploration and production. The company also manages midstream infrastructure. TAQA's diverse portfolio allows it to serve a wide range of customers and adapt to market changes.

TAQA offers a value proposition centered on providing essential utilities and energy solutions. This includes reliable power and water, alongside sustainable energy options. The company's strategic shift towards renewables underscores its commitment to long-term value creation.

TAQA's dominance in the UAE's power and water sector is a key indicator of its market share. The company's financial performance in 2024, with AED 8.3 billion in net profit, reflects its strong position. Its gross revenues for 2024 reached AED 53.6 billion, demonstrating its substantial scale.

TAQA is strategically focusing on renewable energy and sustainable solutions. Its capital expenditure for 2024 was AED 4.8 billion, a 16% increase, reflecting continued investment in growth and infrastructure. The company aims to have over 30% of its power generation capacity from renewables by 2030.

TAQA's strong government backing and dominant position in the UAE's power and water sector are significant advantages. Its focus on renewable energy aligns with global trends, positioning it well for the future. However, its oil and gas operations face a competitive landscape.

- Strengths: Strong market share, financial stability, strategic government backing, and a focus on renewables.

- Weaknesses: Exposure to the competitive oil and gas market.

- Opportunities: Expansion in renewable energy and sustainable solutions.

- Threats: Increased competition in the energy sector and regulatory changes.

TAQA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TAQA?

The TAQA competitive landscape is shaped by its diverse operations in the power, water, and oil and gas sectors. The company faces competition from both established and emerging players. Understanding the competitive dynamics is crucial for assessing TAQA's market position and future prospects.

TAQA's performance is influenced by its ability to navigate a complex market environment. This involves strategic responses to competitor actions and the adoption of new technologies. The company's success depends on its capacity to maintain a competitive edge.

In the power and water sector, particularly within the UAE, TAQA faces competition from state-owned and independent entities. The oil and gas segment sees competition from major international and national oil companies. The emergence of new technologies also influences the competitive landscape.

Key competitors in the power and water sector include state-owned utilities and independent power and water producers (IWPPs). ACWA Power is a significant rival, especially in the MENA region. These competitors often bid for similar projects.

In the oil and gas exploration and production segment, TAQA competes with major international oil companies (IOCs). These companies include global players such as BP, Shell, and TotalEnergies. They challenge TAQA on production volumes and market access.

TAQA also competes with national oil companies (NOCs), such as ADNOC within the UAE. These companies have significant financial resources and strategic influence. ADNOC is a formidable competitor in the UAE's energy sector.

The competitive landscape is also influenced by emerging players and technological disruptors. Companies specializing in renewable energy technologies and smart grid solutions pose a challenge. Distributed generation and prosumers could also impact TAQA's model.

Mergers and alliances within the energy sector reshape competitive dynamics. Strategic partnerships between technology firms and energy companies introduce new pressures. These developments create larger, more integrated rivals.

TAQA's competitive advantages include its diversified portfolio and strategic location in the UAE. Disadvantages may include competition from larger, more established players. Understanding these factors is key to analyzing TAQA's position.

A detailed analysis of TAQA's competitive position involves examining its strengths and weaknesses against its rivals. This includes assessing its market share, financial performance, and strategic partnerships. Recent acquisitions and their implications also play a role.

- Market Share: TAQA's market share varies across its business segments. In the UAE, it holds a significant share in the power and water sector, competing with other major utilities.

- Financial Performance: TAQA's financial performance is compared to its competitors, such as ACWA Power and ADNOC. Key metrics include revenue, profitability, and return on assets.

- Strategic Partnerships: Strategic partnerships impact TAQA's competitive position. These alliances can enhance its capabilities and market reach.

- Recent Acquisitions: Recent acquisitions have implications for TAQA's competitive position. These acquisitions can expand its portfolio and increase its market presence.

- Future Growth Prospects: TAQA's future growth prospects depend on its ability to adapt to changing market dynamics. This includes responding to competitor strategies and embracing new technologies.

TAQA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TAQA a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of TAQA requires a deep dive into its competitive advantages. The company's success is built on a foundation of strategic positioning, a robust asset base, and strong financial backing. This has allowed it to navigate the complexities of the energy sector and maintain a strong market position.

TAQA's competitive edge is further bolstered by its commitment to technological innovation, particularly in renewable energy. This proactive approach not only enhances its environmental credentials but also opens new market opportunities. The company's established infrastructure and experienced talent pool further solidify its competitive standing, enabling efficient project execution and reliable service delivery.

The company's diversified portfolio across power, water, and oil and gas provides a distinct advantage, allowing for risk mitigation across different commodity cycles and revenue streams. The strategic relationship with the Abu Dhabi government provides stability and access to large-scale projects. These factors collectively contribute to TAQA's sustained competitive advantage in the industry.

TAQA benefits from a strong relationship with the Abu Dhabi government, ensuring strategic stability and preferential access to projects. This advantage is crucial in securing essential utility contracts and infrastructure development projects within the UAE. This relationship provides a competitive edge in a market where government support is significant.

TAQA's diversified portfolio across power, water, and oil and gas allows for risk mitigation across different commodity cycles. The stable revenue from regulated power and water assets provides a consistent financial base. This diversification strategy enhances its resilience to market fluctuations.

TAQA's substantial scale in power and water operations allows for significant economies of scale. This scale enables significant investment in large-scale infrastructure projects, such as the Al Dhafra Solar PV project. These efficiencies translate into cost advantages that smaller players cannot replicate.

The company's commitment to technological adoption and innovation in renewable energy is a key differentiator. Investments in solar and other clean energy technologies align with global trends. This focus enhances environmental credentials and attracts environmentally conscious investors.

TAQA's competitive advantages are multifaceted, including strategic partnerships, operational scale, and technological innovation. These advantages are crucial in the TAQA competitive landscape. The company's ability to leverage these strengths positions it favorably against its competitors.

- Strong government backing provides project access and regulatory advantages.

- Diversified portfolio mitigates risks and ensures stable revenue streams.

- Economies of scale in power and water operations lead to cost efficiencies.

- Commitment to renewable energy positions the company for future growth.

TAQA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TAQA’s Competitive Landscape?

The utilities and energy industry is currently undergoing significant changes, driven by global trends toward decarbonization and technological advancements. These shifts create both challenges and opportunities for companies like TAQA. Understanding the TAQA competitive landscape is crucial for investors and stakeholders to assess its future prospects. This involves analyzing TAQA competition, market dynamics, and strategic positioning within the evolving energy sector.

The energy sector is experiencing a transition towards renewable energy sources and digital transformation. The shift away from fossil fuels, coupled with the integration of smart technologies, is reshaping the industry's operational models. This transition creates both risks, such as the potential for stranded assets, and opportunities, including the expansion of renewable energy portfolios and the development of innovative customer-centric services. A thorough TAQA market analysis is essential to navigate these complex dynamics.

The industry is seeing a strong push towards decarbonization and renewable energy sources. Technological advancements, like smart grids and energy storage, are reshaping operational efficiencies. Regulatory changes, including carbon pricing, are also influencing the sector. These trends are creating new demands and altering the competitive dynamics.

Managing the transition away from fossil fuels while ensuring energy security is a key challenge. Geopolitical uncertainties and increased competition from renewable energy-focused new entrants are also significant. Water scarcity in the MENA region presents a continuous operational challenge.

Emerging markets offer significant growth prospects, particularly in regions with growing energy demand. Innovations in green hydrogen, carbon capture, and energy storage create new revenue streams. Strategic partnerships can accelerate growth and market penetration.

TAQA's strategic direction, as outlined in its 2030 strategy, emphasizes becoming a leading low-carbon power and water champion. This positioning is designed to capitalize on the opportunities presented by the global energy transition. The company aims to increase its renewable generation capacity to 30% by 2030.

The TAQA industry is dynamic, and the company must adapt to these changes to maintain its competitive edge. Understanding TAQA's performance relative to its TAQA rivals is essential for strategic planning and investment decisions. For a deeper understanding of TAQA's background, you can refer to Brief History of TAQA.

TAQA's future success depends on its ability to navigate the energy transition, manage risks, and capitalize on emerging opportunities. This involves strategic investments, technological innovation, and effective partnerships. The company's focus on renewable energy and sustainable practices positions it well for long-term growth.

- Focus on Renewable Energy: Expanding renewable energy capacity is critical for long-term sustainability.

- Technological Integration: Leveraging smart grids and digital solutions to improve efficiency.

- Strategic Partnerships: Collaborating with technology providers and financial institutions to accelerate growth.

- Geopolitical Awareness: Navigating geopolitical uncertainties affecting energy markets.

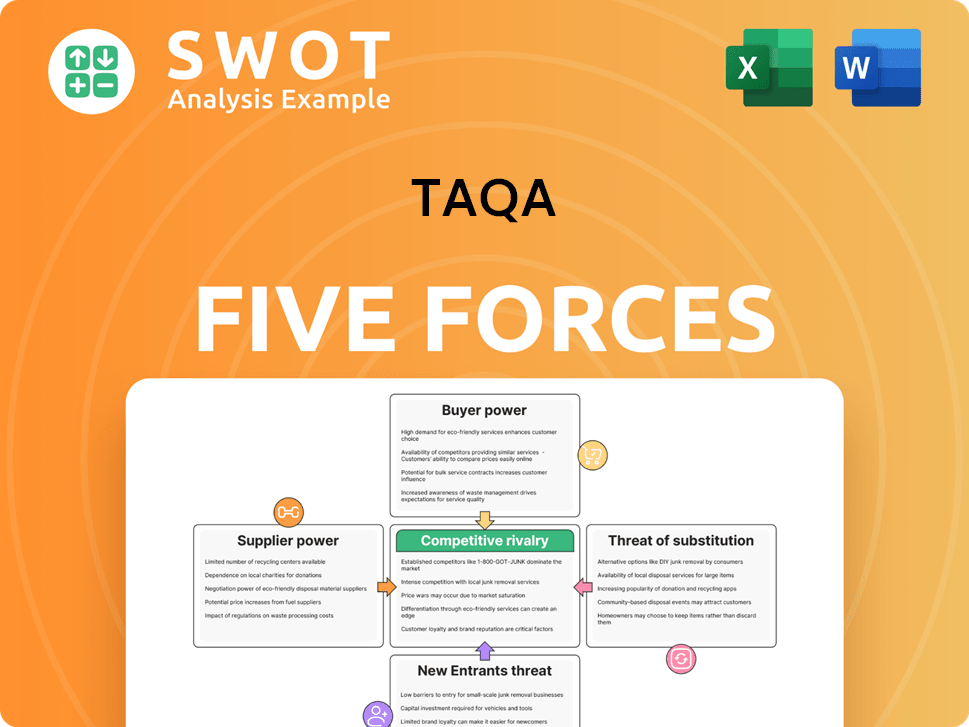

TAQA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TAQA Company?

- What is Growth Strategy and Future Prospects of TAQA Company?

- How Does TAQA Company Work?

- What is Sales and Marketing Strategy of TAQA Company?

- What is Brief History of TAQA Company?

- Who Owns TAQA Company?

- What is Customer Demographics and Target Market of TAQA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.