Foschini Group Bundle

How Did The Foschini Group Become a Retail Giant?

The Foschini Group (TFG), a cornerstone of South African retail, boasts a fascinating history of growth and adaptation. From its humble beginnings in 1924, this retail company has transformed into a diversified powerhouse. Discover the pivotal moments that shaped TFG's journey to market leadership, including its listing on the Johannesburg Stock Exchange (JSE) in 1941.

Founded by the Foschini siblings, the company's initial focus on targeted merchandise has been a constant in their success. Today, with over 4,923 stores across 23 countries and a robust online presence, Foschini Group SWOT Analysis reveals the strategic thinking behind its evolution. Explore the TFG history, from its early years as a garment store to its current status as a leading retail conglomerate, and understand its impact on the South African retail landscape.

What is the Foschini Group Founding Story?

The Foschini Group, initially known as Foschini Limited, has a rich history rooted in South African retail. Established in 1924 by the Foschini siblings, the company began its journey with a single store in Cape Town. Their initial vision was to cater to specific market segments with clothing, setting the stage for future growth.

The early success of The Foschini Group can be attributed to its ability to understand and meet consumer needs. While specific details about the company's early funding are not readily available, the founders' focus on tailoring merchandise to their target audience was key. This approach, combined with the burgeoning urban population and developing consumer market of 1920s South Africa, provided a fertile ground for expansion.

Over the years, The Foschini Group has evolved significantly. To learn more about its current operations, consider exploring the Revenue Streams & Business Model of Foschini Group.

The Foschini Group's history is marked by strategic expansions and acquisitions. The company has grown from a single store to a significant player in the South African retail landscape.

- 1924: Foschini Limited is founded in Cape Town.

- Early Years: The company focuses on providing clothing to specific target markets, establishing a strong foundation for future growth.

- Expansion: Through strategic acquisitions and organic growth, the company expanded its brand portfolio.

- Evolution: The Foschini Group has adapted to changing consumer trends and economic conditions, maintaining its relevance in the retail sector.

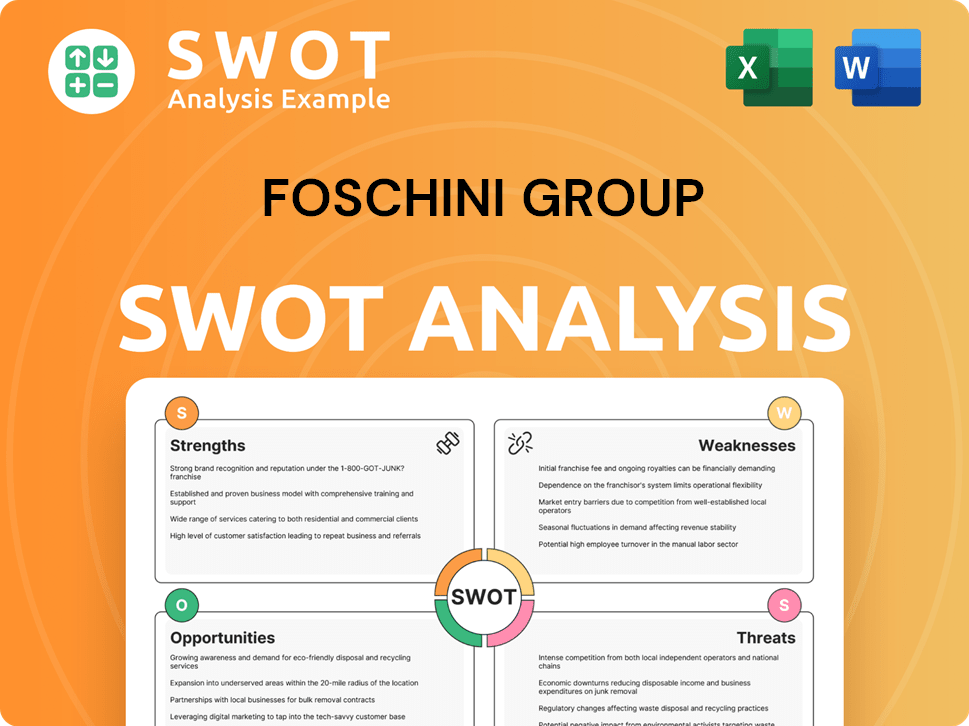

Foschini Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Foschini Group?

The early growth of The Foschini Group (TFG) was marked by strategic expansion and diversification within the South African retail sector. This expansion included significant acquisitions and strategic moves that shaped its diverse portfolio. The company's evolution reflects its commitment to growth and adaptation in the dynamic retail landscape. This journey began with its listing on the Johannesburg Stock Exchange (JSE) and continued through various acquisitions and rebranding efforts.

In 1941, Foschini Limited was listed on the JSE, marking an early milestone in its growth. By the 1960s, it had become South Africa's first retail chain, establishing a strong foundation. This early success set the stage for future expansion and acquisitions, driving its evolution into a major player in the retail industry. The company's commitment to strategic growth is evident in these initial steps.

A pivotal moment occurred in 1958 when Stanley Lewis acquired a major shareholding, further fueling expansion. The company began a series of strategic acquisitions, including American Swiss Watch Company in 1967 and Markham in 1968. These acquisitions broadened its portfolio and solidified its market position. This acquisition strategy was a key element of the TFG history.

The 1990s saw continued growth with the acquisition of Sterns in 1993 and the launch of Donna Claire (later rebranded as Donna) in 1994. These acquisitions expanded the company's reach and product offerings. Further strengthening its position, TFG acquired Sportscene in 1996 and rebranded its Pages stores to Exact in 1999.

In 2010, Foschini Limited officially changed its name to The Foschini Group (TFG) Limited, reflecting its evolution into a diversified retail entity. By March 2024, TFG served over 37 million rewards customers and employed more than 47,520 individuals globally. The company's revenue peaked in March 2024 at R56.221 billion (approximately $2.98 billion USD), demonstrating substantial growth. For more insights, explore the Target Market of Foschini Group.

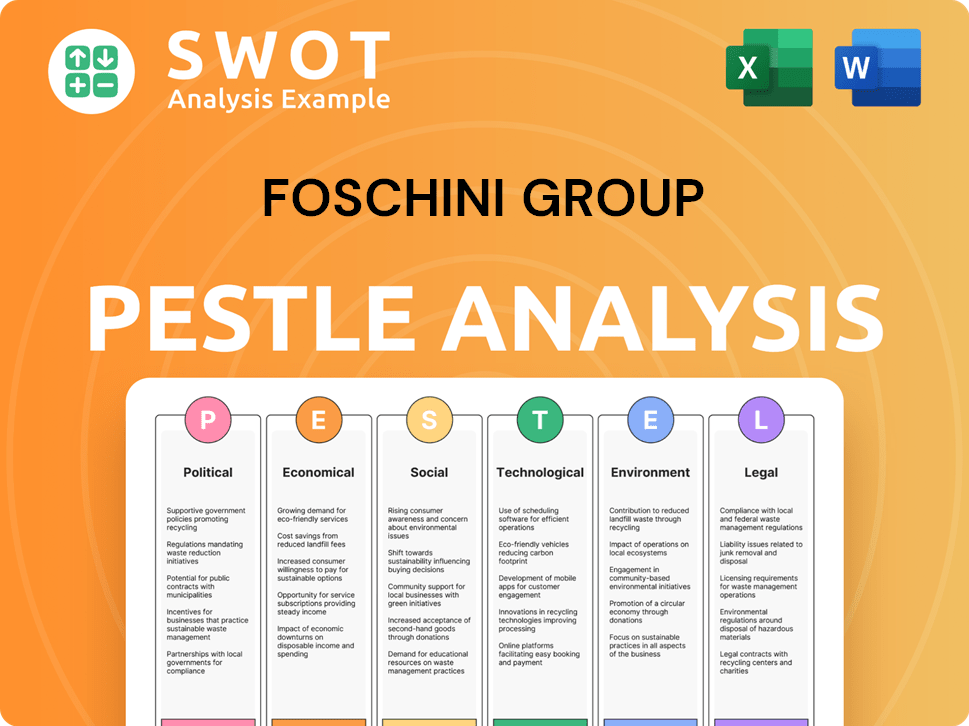

Foschini Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Foschini Group history?

The TFG history reflects a journey of strategic growth and adaptation within the South African retail landscape, marked by significant milestones that have shaped its trajectory. These achievements highlight the company's resilience and its ability to capitalize on market opportunities while navigating challenges.

| Year | Milestone |

|---|---|

| 2020 | Acquired Jet stores from Edcon, expanding its retail footprint. |

| 2021 | Partnered with TymeBank to introduce banking kiosks across its retail outlets. |

| 2022 | Launched the online platform, BASH.com, which became profitable ahead of schedule. |

| 2024 | Ralph Buddle appointed as the new CFO and executive director. |

| 2025 | BASH.com accounts for 12.0% of total group sales as of March 31, 2025. |

Innovations have been central to The Foschini Group's evolution, particularly its commitment to local production and digital transformation. These initiatives have allowed the company to enhance its operational efficiency and customer experience.

By November 2021, 75% of TFG's apparel was manufactured in South Africa, supporting local industries. This strategy reduced reliance on imports and improved supply chain agility.

In 2021, TFG partnered with TymeBank to introduce 600 banking kiosks across its retail outlets by 2022. This initiative expanded financial services access for customers.

Launched in 2022, BASH.com has become a significant digital asset, contributing to group sales. The platform's success highlights TFG's digital prowess.

TFG Africa's online sales alone grew by 43.5% in the last financial year. This demonstrates the company's ability to adapt to changing consumer behaviors.

Throughout its history, TFG has faced various challenges, including market downturns and competitive pressures. The company has responded with strategic initiatives to maintain its market position.

Economic fluctuations have tested TFG's resilience, prompting cost-saving measures and strategic adjustments. The company has adapted to maintain profitability during challenging periods.

Intense competition from international online retailers like Shein and Temu has driven TFG to leverage its local advantage. This includes offering same-day or next-day delivery through its BASH platform.

To mitigate operational interruptions, TFG has invested heavily in solar power and water reserves. These investments ensure business continuity and reduce environmental impact.

The appointment of Ralph Buddle as CFO in April 2024 reflects TFG's commitment to strong financial leadership. Such changes ensure strategic alignment and effective governance.

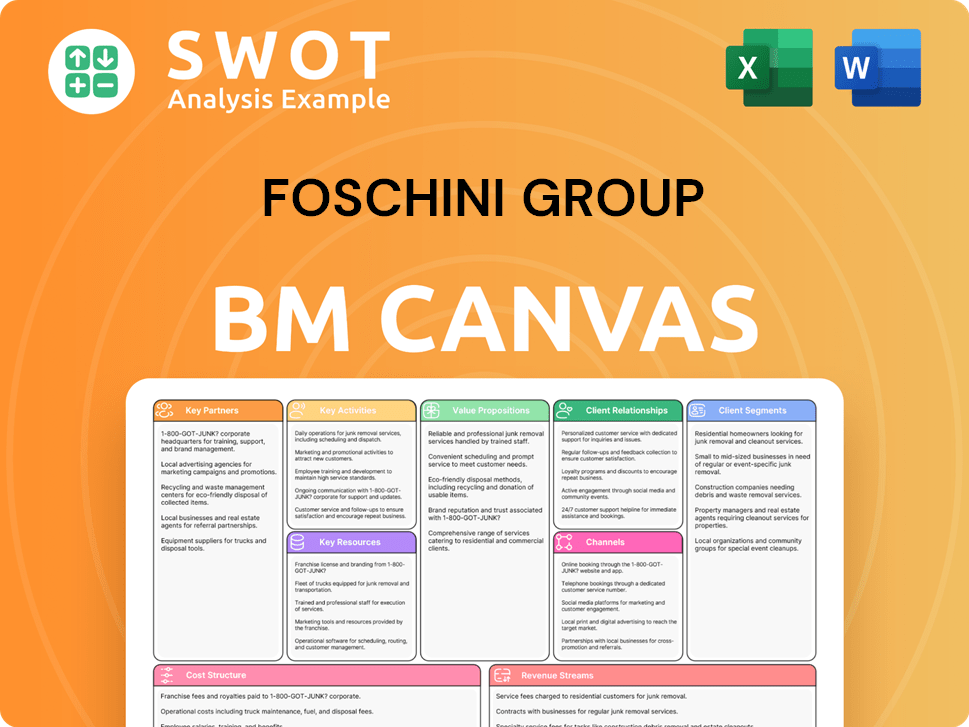

Foschini Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Foschini Group?

The TFG history is a story of growth and adaptation in the South African retail landscape. Founded in 1924, the company has evolved from a single store to a diverse group with a global presence. Key milestones include its listing on the Johannesburg Stock Exchange in 1941, acquisitions of major brands, and strategic expansions into international markets. The company's ability to adapt to changing consumer preferences and market dynamics has been crucial to its longevity and success, marking its journey as a significant player in the retail industry.

| Year | Key Event |

|---|---|

| 1924 | Foschini Limited was founded in Cape Town by the Foschini siblings, marking the beginning of the retail company's journey. |

| 1941 | The company was listed on the Johannesburg Stock Exchange (JSE), a pivotal move in its financial growth. |

| 1958 | Stanley Lewis acquired a major shareholding, influencing the company's strategic direction. |

| 1960s | The company established itself as South Africa's first retail chain, expanding its reach. |

| 1967 | American Swiss Watch Company was acquired, broadening its portfolio. |

| 1968 | Markham was acquired, further diversifying its offerings. |

| 1993 | Sterns was acquired, expanding its presence in the market. |

| 1994 | Donna Claire (later Donna) was launched, catering to a specific market segment. |

| 1996 | Sportscene was acquired, adding to its range of brands. |

| 1999 | Pages stores were rebranded to Exact, streamlining its brand strategy. |

| 2010 | Foschini Limited changed its name to The Foschini Group (TFG) Limited, reflecting its broader scope. |

| 2015 | The British apparel chain Phase Eight was acquired, marking its international expansion. |

| 2016 | Whistles, a British chain, was acquired, further expanding its global footprint. |

| 2017 | The Australian Retail Apparel Group was acquired, strengthening its presence in the region. |

| 2020 | Jet stores were acquired from Edcon, increasing its market share. |

| 2021 | A partnership with TymeBank was established for banking kiosks, innovating its services. |

| 2022 | The online platform BASH.com was launched, alongside the acquisition of Tapestry Home Brands, enhancing its digital presence. |

| 2023 | Street Fever was acquired, expanding its brand offerings. |

| 2024 | A franchise agreement with JD Sports was entered, the Riverfields Distribution Centre was inaugurated, and Ralph Buddle was appointed CFO. |

| 2024 (October) | The UK-based fashion brand White Stuff was acquired, continuing its global expansion. |

| 2025 (March 31) | A record operating profit of R6.2 billion was reported for the year, showcasing its financial performance. |

The company plans to open over 100 new stores during the 2026 financial year, indicating significant growth plans. This expansion strategy is part of a broader effort to increase its market presence and reach.

TFG is focusing on digital transformation to enhance customer experiences and improve operational efficiency. This includes optimizing its online platforms and integrating digital technologies across its operations.

TFG Africa's sales for the eight weeks ended May 24, 2025, increased by 9.9%, demonstrating strong performance. The company is also focusing on improving operating margins and capital returns in 2026 and beyond.

Ongoing strategic initiatives include further improvements in operating margins and capital returns in 2026 and beyond through efficiency strategies. Analyst predictions and leadership statements emphasize a focus on recovery across all geographies to drive long-term shareholder value creation.

Foschini Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Foschini Group Company?

- What is Growth Strategy and Future Prospects of Foschini Group Company?

- How Does Foschini Group Company Work?

- What is Sales and Marketing Strategy of Foschini Group Company?

- What is Brief History of Foschini Group Company?

- Who Owns Foschini Group Company?

- What is Customer Demographics and Target Market of Foschini Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.