Foschini Group Bundle

How Does the Foschini Group Thrive in Today's Market?

The Foschini Group (TFG), a titan of South African retail, has consistently adapted to the ever-changing consumer landscape. Its success story is a testament to strategic foresight and operational excellence. With a diverse portfolio spanning fashion, lifestyle, and homeware, TFG continues to captivate investors and customers alike. Understanding the TFG business model is key to appreciating its sustained performance.

From its expansive network of physical stores to its robust online presence, TFG's multi-channel approach is a key driver of its success. The company's ability to navigate the complexities of the South African retail market, coupled with its strategic expansion into other African countries and Australia, showcases its resilience. For a deeper dive into the strategies driving TFG's success, consider exploring a Foschini Group SWOT Analysis to understand how TFG Company manages its brands and competes effectively.

What Are the Key Operations Driving Foschini Group’s Success?

The TFG Company, also known as Foschini Group, operates as a comprehensive retail ecosystem, delivering value through a blend of diverse brands, operational efficiency, and a customer-focused approach. The TFG business model centers on offering a wide array of products, including fashion, lifestyle items, and homeware, catering to a diverse customer base. This approach allows TFG to capture a broad market share within the South African retail sector and beyond.

TFG's core offerings are designed to meet the needs of various consumer segments, from value-conscious shoppers to those seeking premium brands. Key brands under its umbrella include Markham, American Swiss, @home, and Sportscene, each targeting specific market niches. This multi-brand strategy enables TFG to mitigate risks and adapt to changing consumer preferences effectively. The company's success is rooted in its ability to manage and grow these brands strategically.

The operational processes are supported by a sophisticated supply chain, encompassing global sourcing, localized manufacturing, and efficient logistics. TFG leverages its extensive network of physical stores as key sales channels, complemented by a growing investment in e-commerce platforms like Bash, which offers a unified online shopping experience across its brands. This omnichannel strategy enhances customer convenience and drives sales growth. For more insights, explore the Marketing Strategy of Foschini Group.

TFG's strategy involves careful management of its diverse portfolio of retail brands. Each brand is positioned to target specific customer segments, ensuring a broad market reach. This approach allows TFG to adapt to changing consumer preferences and market trends effectively.

The company has an integrated approach to retail, combining physical stores with robust e-commerce platforms. This omnichannel strategy enhances customer convenience and drives sales growth. TFG's e-commerce platforms, such as Bash, offer a unified shopping experience across its brands.

TFG's operational efficiency is supported by a sophisticated supply chain. This includes global sourcing, localized manufacturing, and efficient logistics. The company's investment in TFG Manufacturing enhances control over product quality and cost efficiency.

TFG's core capabilities translate into significant customer benefits, including diverse product choices, competitive pricing, and convenient shopping experiences. The company focuses on understanding and meeting customer needs through its various brands and channels. This customer-centric approach drives market differentiation.

TFG's unique operational model combines vertical integration and strategic partnerships to enhance efficiency and customer value. The company's investments in manufacturing, such as TFG Manufacturing, allow for greater control over product quality and speed to market. Strategic alliances with international brands and local suppliers further strengthen its position.

- Diverse Brand Portfolio: A wide range of brands catering to various market segments.

- Operational Agility: Efficient supply chain and logistics for widespread product availability.

- Localized Product Offerings: Commitment to products tailored to the South African market.

- E-commerce Growth: Expansion of online shopping platforms like Bash.

Foschini Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Foschini Group Make Money?

The TFG Company, also known as Foschini Group, generates revenue primarily through its extensive retail operations. This includes sales of fashion, lifestyle, and homeware products. The company's financial success is driven by a diverse range of revenue streams.

A significant portion of TFG's income comes from direct product sales across various categories. These include clothing, footwear, jewelry, cosmetics, mobile devices, and home goods. TFG also utilizes credit offerings to customers, which contributes substantially to its financial services segment. The company continues to adapt to evolving consumer behavior and market trends.

In its financial results for the year ended March 31, 2024, TFG reported a significant increase in turnover. Total retail turnover grew by 7.1% to R58.6 billion. This growth was driven by strong performances in both its South African and Australian businesses. The company's innovative monetization strategies include tiered pricing across its various brands, catering to different income brackets and consumer preferences.

TFG's revenue streams are diversified, ensuring financial stability and growth. The TFG business model incorporates several strategies to maximize revenue and customer engagement.

- Product Sales: The core of TFG's revenue comes from selling a wide array of products. This includes apparel, footwear, accessories, and home goods, across its various retail brands.

- Credit Offerings: TFG provides credit facilities to its customers, generating revenue through interest and fees. This financial services segment is a significant contributor to the company's overall profitability.

- Tiered Pricing: TFG employs tiered pricing strategies across its brands, catering to different consumer segments. This allows the company to capture a broader market and maximize sales.

- Cross-Selling: The company encourages customers to purchase from multiple TFG brands. This strategy leverages the diverse brand portfolio to increase revenue per customer.

- E-commerce: TFG's online platforms, such as Bash, have expanded its revenue generation through online sales and digital engagement. This strategic shift towards omnichannel retail is crucial.

The expansion of TFG's e-commerce platforms, particularly Bash, has opened new avenues for revenue generation through online sales and digital engagement, indicating a strategic shift towards omnichannel retail. For more insights into their target market, consider reading about the Target Market of Foschini Group.

Foschini Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Foschini Group’s Business Model?

The TFG Company, formerly known as Foschini Group, has navigated the South African retail landscape through strategic milestones and competitive maneuvers. Its journey reflects a commitment to adapting to market dynamics and enhancing operational efficiencies. Key decisions and strategic pivots have been instrumental in shaping its current position.

TFG's strategic moves have significantly impacted its market reach and operational capabilities. The company has expanded its brand portfolio through acquisitions, such as Tapestry Home Brands and Jet. Investments in TFG Manufacturing have boosted local sourcing and supply chain resilience, which is crucial for navigating global disruptions. These initiatives have been pivotal in maintaining a competitive edge.

The company's response to market challenges and changing consumer preferences has been marked by its digital transformation initiatives. The launch of the Bash e-commerce platform is a prime example, providing a unified online shopping experience. This focus on e-commerce has been critical in capturing the growing online retail market in South Africa.

TFG's strategic acquisitions, including Tapestry Home Brands and Jet, broadened its market presence. Investing in TFG Manufacturing enhanced local sourcing and supply chain capabilities. The launch and continuous development of the Bash e-commerce platform exemplify its digital transformation efforts.

Aggressive expansion of its brand portfolio through acquisitions has been a key strategy. The company has focused on enhancing local sourcing capabilities and supply chain resilience. Accelerating digital transformation, particularly through the Bash platform, has been a priority.

TFG benefits from a strong brand portfolio, fostering customer loyalty and brand recognition. Its extensive store network and purchasing power enable competitive pricing and operational efficiencies. The company's commitment to local manufacturing and its omnichannel strategy provide a significant advantage.

The TFG business model focuses on a diversified portfolio of retail brands. It emphasizes both physical and online retail channels to reach a broad customer base. The company's strategy includes strategic acquisitions and investments in supply chain efficiency.

TFG's competitive advantages include its strong brand portfolio, which drives customer loyalty, and its extensive store network, which supports economies of scale. The company's omnichannel strategy, combining physical stores with online platforms like Bash, enhances its market reach. The Growth Strategy of Foschini Group highlights TFG's focus on adapting to market trends and consumer preferences.

- Strong Brand Portfolio: Brands like @home, Markham, and Sportscene contribute to customer loyalty.

- Omnichannel Strategy: Integration of physical stores and e-commerce platforms, including Bash, to enhance customer experience.

- Financial Performance: In recent reports, TFG has shown resilience, with strategic initiatives aimed at improving profitability.

- Market Adaptation: TFG continuously adapts to changing consumer behaviors and technological advancements.

Foschini Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Foschini Group Positioning Itself for Continued Success?

The Foschini Group (TFG Company) holds a prominent position in the South African retail sector. It has a substantial market share and strong brand loyalty across its diverse portfolio of retail brands. TFG's operations extend globally, with a significant presence in Africa and Australia, which further strengthens its industry standing.

However, TFG faces several risks. These include economic volatility and fluctuations in consumer spending, particularly in its primary South African market. Regulatory changes, increasing competition from both traditional and online retailers, and technological disruptions also pose potential challenges to its operations and revenue.

TFG competes with major retailers in South Africa and Australia. It maintains a competitive edge through its extensive brand offerings and an omnichannel approach. TFG's global reach, especially in Africa and Australia, supports its industry standing.

Economic volatility and consumer spending fluctuations are key risks. Regulatory changes and competition from traditional and online retailers also pose challenges. Technological disruptions further add to the potential headwinds for TFG.

TFG is focused on growing its e-commerce platforms, such as Bash, to enhance the online customer experience. The company is investing in technology and data analytics to personalize customer experiences. TFG is also investing in local manufacturing.

TFG aims to expand its omnichannel capabilities and adapt to consumer trends. The company is leveraging its robust brand portfolio to maintain market leadership. TFG is committed to ensuring sustained profitability.

In recent financial reports, TFG has emphasized its commitment to digital growth and operational efficiency. The company continues to focus on its omnichannel strategy to meet evolving consumer demands within the South African retail market. TFG's strategic investments are aimed at enhancing its market position and driving sustainable growth.

- TFG continues to invest in its e-commerce platforms to boost online sales.

- The company is focusing on data analytics to personalize customer experiences.

- TFG is also investing in its local manufacturing capabilities.

- The company is committed to expanding its omnichannel capabilities.

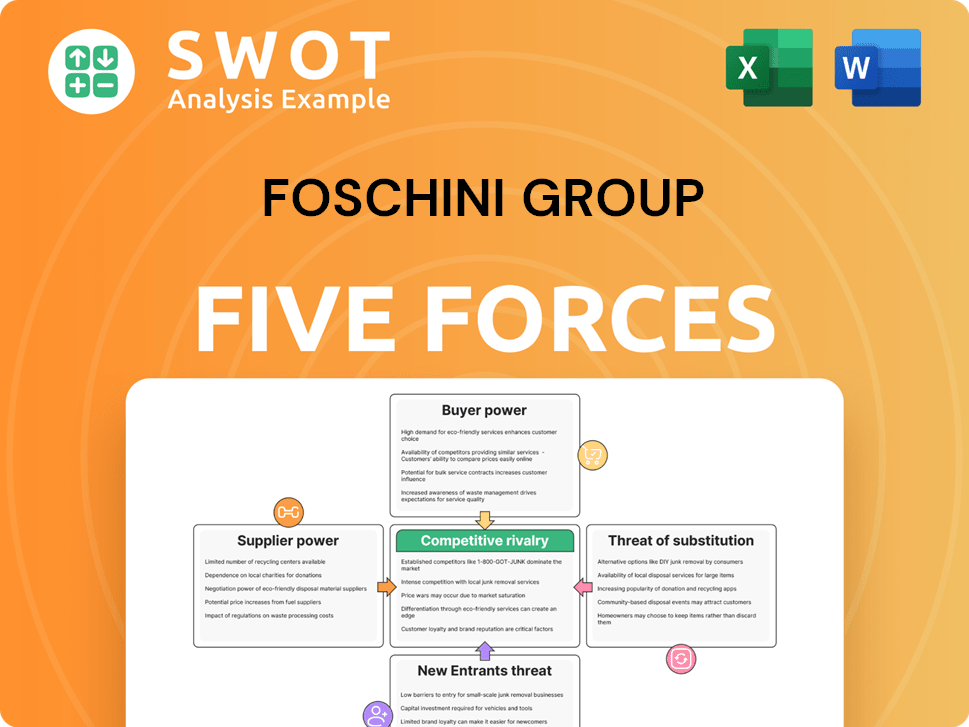

Foschini Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foschini Group Company?

- What is Competitive Landscape of Foschini Group Company?

- What is Growth Strategy and Future Prospects of Foschini Group Company?

- What is Sales and Marketing Strategy of Foschini Group Company?

- What is Brief History of Foschini Group Company?

- Who Owns Foschini Group Company?

- What is Customer Demographics and Target Market of Foschini Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.