Hartford Financial Services Bundle

How Well Do You Know The Hartford?

Journey back in time with us to explore the remarkable history of Hartford Financial Services, a cornerstone of the financial world for over two centuries. From its humble beginnings in 1810 as a fire insurance provider, The Hartford has weathered economic storms and societal shifts, evolving into a global financial powerhouse. Discover the key milestones and strategic decisions that shaped this enduring institution.

The Hartford's story is a compelling narrative of adaptation and resilience within the financial services company landscape. Understanding the Hartford Financial Services SWOT Analysis offers critical insights into its current market position and future prospects. This exploration will illuminate the pivotal moments in the history of insurance companies that have defined The Hartford's trajectory, from its early focus on fire insurance to its current status as a diversified financial services provider. Delving into the history of Hartford insurance provides a valuable perspective.

What is the Hartford Financial Services Founding Story?

The story of Hartford Financial Services, often referred to as The Hartford, began in 1810. A group of local merchants in Hartford, Connecticut, came together to establish the Hartford Fire Insurance Company, marking the start of a long history in the financial services industry. This early venture laid the foundation for what would become a significant player in insurance and financial protection.

With an initial capital of $15,000, the company was founded on the principles of providing reliable financial protection. Nathaniel Terry, the first president, set the tone for a company dedicated to supporting its customers. This commitment was evident in the early years and has shaped the company's approach to business over time. The Hartford's commitment to its customers has been a constant throughout its history.

A key moment that highlighted this commitment came in 1835. Following a devastating fire in New York City's Financial District, the company's leaders, including President Eliphalet Terry, pledged their personal assets to cover all claims. This action set them apart from other insurers and cemented their reputation for integrity. This dedication to customers continues to be a core value of The Hartford.

The Hartford Fire Insurance Company was founded in 1810 in Hartford, Connecticut.

- Initial capital was $15,000.

- Nathaniel Terry was the first president.

- In 1835, the company leaders pledged personal fortunes to cover claims after a major fire in New York City.

- The iconic stag logo, first used in 1861, symbolizes the company's name and location.

The company's enduring commitment is also symbolized by its iconic stag logo. First appearing on an 1861 policy issued to Abraham Lincoln, the logo depicts a 'hart fording' a stream. This visual representation is a clever play on the company's name and location, further emphasizing its identity. The Hartford has a rich history of ownership and shareholder structure that has evolved over time.

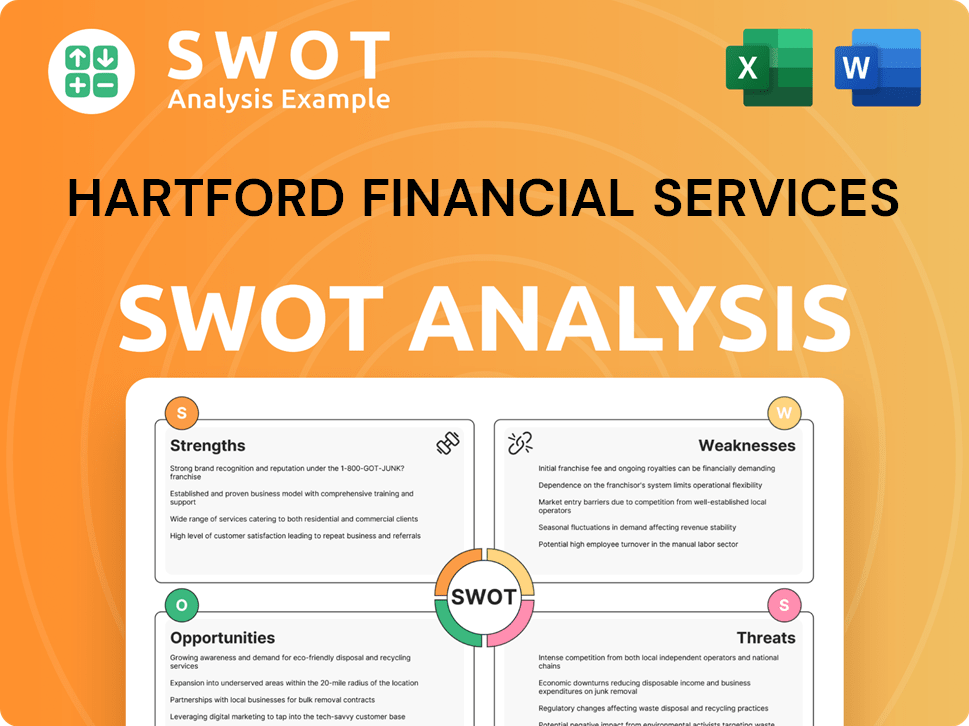

Hartford Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Hartford Financial Services?

The early growth of The Hartford, now known as Hartford Financial Services, was shaped by its response to major disasters and a continuous expansion of its offerings. Founded in 1810, the company quickly established a reputation for reliability. This commitment was crucial in the nascent insurance market, setting the stage for its future growth and diversification.

Just fifteen years after its founding, The Hartford issued its first insurance policy to an institution of higher education, Yale University, in 1825. This early focus on institutional clients demonstrated a strategic approach to securing long-term relationships and building a solid financial base. This early success laid the groundwork for future expansion and diversification.

The Hartford's commitment to paying claims, even when faced with personal financial pledges by its leadership, set it apart. Following the 1835 New York City fire, this commitment was further tested and proven during the 1871 Chicago fire and the 1906 San Francisco earthquake and fire. For the San Francisco disaster alone, The Hartford paid out over $11 million in claims, showcasing its resilience and dedication to its customers.

The 20th century brought technological advancements, especially in automobiles, which prompted The Hartford to expand its protective offerings. In 1913, the company formed its Accident and Indemnity Company to provide comprehensive coverage for automobiles and property. By the 1930s and 1950s, The Hartford insured major infrastructure projects, including the Hoover Dam (1931), the Golden Gate Bridge (1937), and the St. Lawrence Seaway (1959).

In 1959, The Hartford expanded into the life insurance business through the acquisition of The Columbian National Life Insurance Company. The 1980s saw The Hartford innovate in response to market demands. It became the first insurance provider to offer a dedicated small business service center in 1983 and, in 1984, the exclusive provider of home and auto insurance for AARP members. These moves solidified The Hartford's position as a diversified financial services provider. Read more about the Marketing Strategy of Hartford Financial Services.

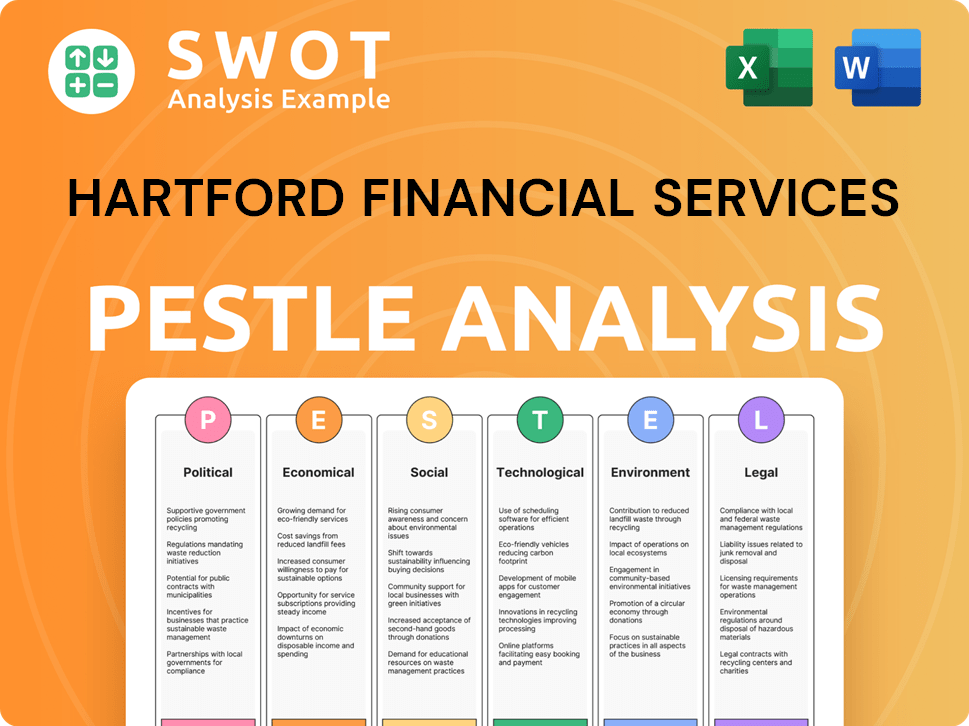

Hartford Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Hartford Financial Services history?

The Hartford Financial Services has a rich history marked by significant milestones, strategic shifts, and a commitment to innovation. From its early days to its evolution into a leading financial services company, The Hartford has adapted to changing market dynamics while maintaining a focus on customer needs and financial strength. The company has navigated through various periods of growth, acquisitions, and strategic realignments, shaping its current position in the insurance and financial services industry.

| Year | Milestone |

|---|---|

| 1947 | Established the Junior Fire Marshal program, a long-standing initiative focused on fire prevention and safety education for children. |

| 1970 | Acquired by ITT Corporation for $1.4 billion, the largest corporate takeover in American history at the time, and renamed ITT-Hartford Group, Inc. |

| 1997 | Changed its name to The Hartford Financial Services Group, Inc., and launched an IPO for its Hartford Life business. |

| 2012 | Announced a strategic focus on property and casualty insurance, group benefits, and mutual funds, divesting its wealth management businesses to streamline operations. |

| 2017 | Launched the InsurTech Hub, an accelerator program supporting insurtech startups. |

| 2019 | Launched an IoT Innovation Lab to accelerate IoT advancements within the group, focusing on real-time data from sensors to prevent accidents. |

The Hartford has consistently embraced innovation to stay ahead in the financial services sector. The company has invested heavily in digital transformation, utilizing AI, data analytics, and cloud platforms to enhance customer experiences and streamline operations. The launch of the InsurTech Hub and IoT Innovation Lab demonstrates The Hartford's commitment to leveraging technology for improved underwriting and risk management.

Significant investments in AI, data analytics, and cloud platforms to enhance customer experiences, streamline operations, and improve underwriting processes.

Launched an accelerator program supporting insurtech startups in 2017, fostering innovation and collaboration within the industry.

Launched an IoT Innovation Lab in 2019 to accelerate IoT advancements, focusing on real-time data from sensors to prevent accidents and improve risk assessment.

Despite its advancements, Hartford Insurance has faced challenges in a competitive market. The company has had to navigate market downturns and competitive pressures, particularly in the small commercial and personal auto sectors. However, The Hartford's consistent financial performance, including earnings that often surpass analyst expectations, and a strong financial health score, demonstrate its resilience and ability to adapt.

The company has faced market downturns and economic challenges that have impacted financial performance.

The competitive landscape in the small commercial and personal auto sectors poses ongoing challenges for The Hartford.

In the fourth quarter of 2024, the company reported earnings per share (EPS) of $2.94, exceeding consensus estimates. In the first quarter of 2025, net income available to common stockholders decreased by 16% to $625 million, and core earnings declined by 10% to $639 million, reflecting elevated catastrophe losses.

Despite challenges, the company's underlying combined ratio in Business Insurance remained flat at 88.4, and Employee Benefits delivered strong growth in net income and core earnings, demonstrating underlying operational strength.

The Hartford's strategic focus on property and casualty insurance, group benefits, and mutual funds has helped it navigate challenges and maintain a strong market position.

The company's commitment to disciplined underwriting, pricing execution, and customer-centric solutions has been crucial in overcoming challenges.

To understand more about the company's target market, you can read about the Target Market of Hartford Financial Services.

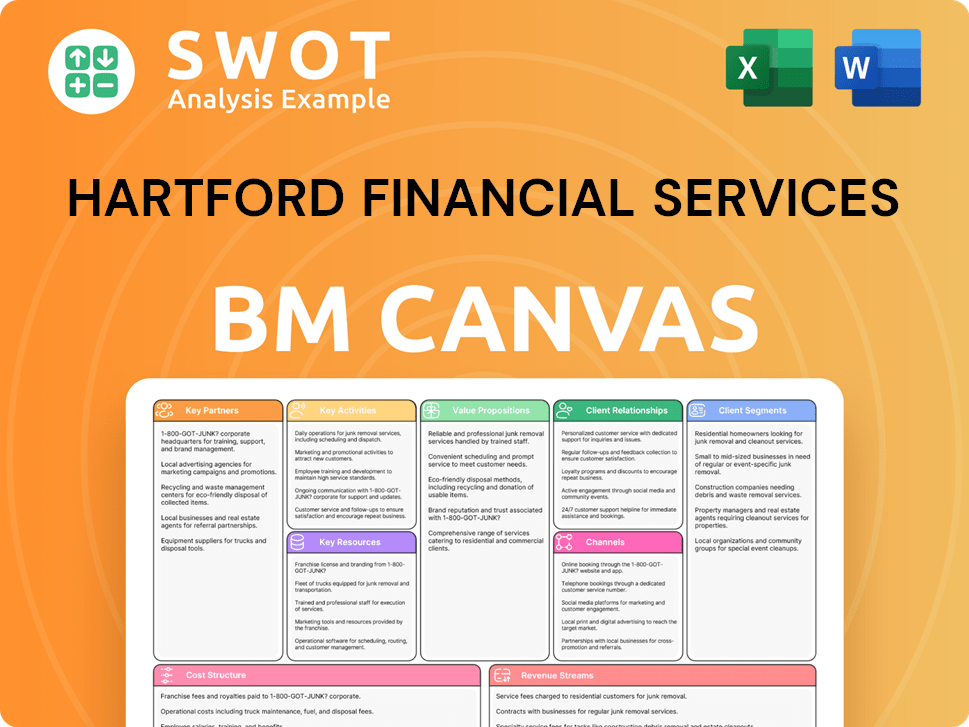

Hartford Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Hartford Financial Services?

The Hartford Financial Services has a rich history, evolving from its origins as the Hartford Fire Insurance Company in 1810. The company has consistently adapted to meet changing market demands and technological advancements. Its journey includes significant expansions, strategic acquisitions, and a consistent focus on customer-centric solutions. This evolution showcases its resilience and adaptability in the financial services sector. The Hartford has demonstrated a commitment to innovation and customer service, remaining a significant player in the insurance and financial services industries. Learn more about the [Hartford Financial Services] (0) by clicking here.

| Year | Key Event |

|---|---|

| 1810 | Founded as the Hartford Fire Insurance Company in Hartford, Connecticut. |

| 1825 | Wrote its first insurance policy for an institution of higher education, Yale University. |

| 1835 | Company leadership pledged personal fortunes to pay claims after the New York City Financial District fire. |

| 1861 | Abraham Lincoln's home in Illinois was protected by a policy from The Hartford, featuring the earliest recorded use of the iconic stag logo. |

| 1871 | Stood by Chicago after a significant fire, paying claims. |

| 1906 | Paid over $11 million in damage claims following the San Francisco earthquake and fire. |

| 1913 | Formed the Hartford Accident and Indemnity Company to expand into automobile and property protection. |

| 1947 | Established the Junior Fire Marshal program. |

| 1959 | Expanded into the life insurance business by acquiring The Columbian National Life Insurance Company. |

| 1970 | Acquired by ITT Corporation for $1.4 billion, becoming ITT-Hartford Group, Inc. |

| 1983 | Became the first insurance provider to offer a dedicated small business service center. |

| 1984 | Became the exclusive provider of Home and Auto insurance for AARP members. |

| 1997 | Changed name to The Hartford Financial Services Group, Inc., and issued an IPO for Hartford Life. |

| 2012 | Announced a strategic focus on property and casualty insurance, group benefits, and mutual funds, selling wealth management businesses. |

| 2017 | Launched the Hartford InsurTech Hub, an accelerator program. |

| 2019 | Acquired Navigators, adding specialty products and international offices. |

| 2024 | Entered partnerships to mitigate business risks and provide adaptive equipment. |

| 2025 | Opened a new service company in Singapore in January. Announced first quarter 2025 financial results in April, reporting $625 million net income available to common stockholders. |

The Hartford is focused on accelerating profitable organic growth. They are leveraging their competitive advantages across Property & Casualty and Group Benefits platforms. This strategic approach aims to drive sustained expansion and market leadership.

The company is investing in digital capabilities, data, analytics, cloud, and artificial intelligence. These investments are supported by efficiencies gained through the 'Hartford Next' operational transformation. This will enhance customer experiences and operational efficiency.

The Hartford and Nayya announced integrated human resources technologies to personalize and simplify benefits experiences in May 2025. This highlights a continued focus on customer-centric solutions, improving user engagement and satisfaction.

Analysts predict a meaningful acceleration in revenue growth, with forecasts of US$28.4 billion in revenue for 2025. Earnings per share are expected to grow by 14% to US$11.83 in 2025. This positive outlook reflects the company's strategic initiatives and market position.

Hartford Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Hartford Financial Services Company?

- What is Growth Strategy and Future Prospects of Hartford Financial Services Company?

- How Does Hartford Financial Services Company Work?

- What is Sales and Marketing Strategy of Hartford Financial Services Company?

- What is Brief History of Hartford Financial Services Company?

- Who Owns Hartford Financial Services Company?

- What is Customer Demographics and Target Market of Hartford Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.