Hartford Financial Services Bundle

How is The Hartford Redefining Financial Services in 2025?

In February 2025, The Hartford unveiled a modernized brand identity, signaling a pivotal shift in its strategic direction. This rebrand, highlighted by a redesigned stag logo, represents the company's commitment to innovation and customer-centricity. This evolution reflects a dynamic approach to the financial services landscape.

The Hartford's impressive financial performance in 2024, with a 24% increase in net income, underscores the effectiveness of its Hartford Financial Services SWOT Analysis. This success stems from a robust Hartford Financial sales strategy and a sophisticated Hartford Financial marketing strategy. This analysis dives deep into how The Hartford leverages its brand, sales channels, and marketing tactics to maintain its competitive edge, offering valuable insights for anyone interested in Insurance company marketing and Financial services sales.

How Does Hartford Financial Services Reach Its Customers?

The sales and marketing strategy of the Hartford Financial Services Company involves a multi-channel approach, blending traditional and digital methods to reach a diverse customer base. This strategy aims to enhance accessibility and efficiency, catering to various customer preferences. The company's approach is designed to maintain and grow its market share in the financial services sector. This strategy includes a focus on digital capabilities, particularly for small businesses, where it has been recognized for its digital prowess.

The Hartford's sales channels include a robust network of agents and brokers, which remains a cornerstone of its distribution strategy. This traditional channel allows for personalized advice and complex policy customization, especially for commercial lines. In addition to agents and brokers, the company leverages direct sales, partnerships with banks, registered investment advisors, and affinity partners. The evolution of these channels reflects a strategic move to enhance accessibility and efficiency.

The company's digital capabilities are a key competitive advantage, particularly within the small business segment. This includes its company website, which serves as a crucial platform for information, quotes, and potentially direct sales for certain products. Investments in digital, data, analytics, cloud, and artificial intelligence have been central to this transformation, funded in part by its 'Hartford Next' operational transformation plan. The Hartford's strategy also includes partnerships, such as the long-standing relationship with AARP, serving as the auto and home insurance writer for its members for over 25 years.

The Hartford relies heavily on its network of agents and brokers for its property-casualty insurance offerings. This channel is crucial for providing personalized advice and customizing policies. This traditional approach is particularly important for commercial lines, where complex needs require expert guidance.

The company has significantly amplified its digital presence, especially for small businesses. This includes its website, which offers information, quotes, and direct sales options. The digital focus is part of a broader strategy to enhance accessibility and efficiency, supported by investments in technology.

The Hartford utilizes direct sales channels, banks, registered investment advisors, and affinity partners. A notable partnership is with AARP, providing auto and home insurance for over two decades. These channels enhance the company's reach and ability to serve diverse customer segments.

Investments in digital, data, analytics, cloud, and artificial intelligence are central to The Hartford's strategy. The integration of AI, such as Nayya's platform, streamlines customer experiences. These advancements are part of the 'Hartford Next' plan, supporting the company's transformation and growth.

The Hartford's sales strategy focuses on a multi-channel approach, combining traditional and digital methods to reach its target audience effectively. This strategy is designed to enhance customer accessibility and operational efficiency, contributing to sustained growth and market share. The company's approach is informed by a deep understanding of its target audience and a commitment to innovation.

- Agent and Broker Network: A core channel for personalized advice and complex policy customization.

- Digital Platforms: Emphasis on online channels for information, quotes, and direct sales, especially for small businesses.

- Strategic Partnerships: Leveraging partnerships, such as the one with AARP, to expand market reach.

- Technological Investments: Utilizing data, analytics, cloud, and AI to enhance customer experience and streamline operations.

For more insights, explore the Growth Strategy of Hartford Financial Services.

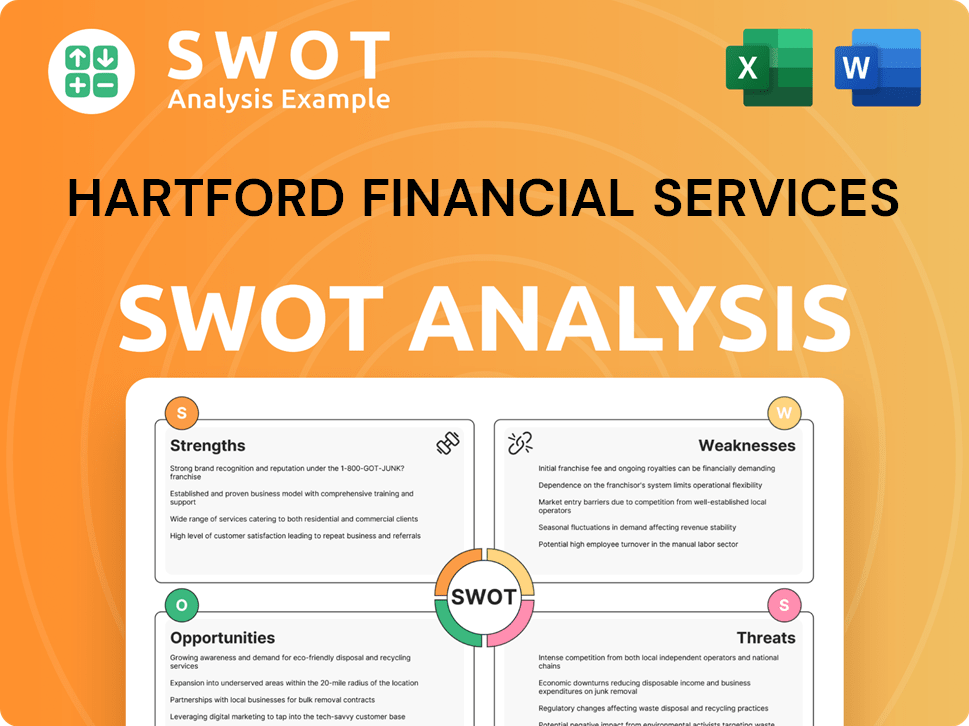

Hartford Financial Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Hartford Financial Services Use?

The Hartford Financial Services Company employs a multifaceted marketing strategy, blending digital and traditional methods to boost brand recognition, generate leads, and drive sales. Their approach showcases a strong emphasis on digital transformation, leveraging data analytics, cloud technology, and artificial intelligence to refine products, services, and customer experiences. This strategy is particularly evident in the small business market, where they highlight exceptional functionality and ease of use for agents and customers.

The company's marketing efforts extend beyond the digital sphere, incorporating traditional media to reinforce its brand presence. While specific details on recent campaigns are not available in the provided information, the ongoing investment in a modernized brand identity, including a redesigned logo and streamlined business segment names, suggests a commitment to maintaining a strong presence in the market. The Hartford's marketing strategy is data-driven, using customer segmentation to create customized insurance plans and identify coverage gaps.

The integration of human resources technologies, such as the partnership with Nayya, further illustrates a focus on personalization and simplifying benefits experiences for customers. The evolution of The Hartford's marketing mix is marked by a clear emphasis on digital transformation and the strategic application of AI and data analytics to improve operational efficiency and customer satisfaction. This approach is crucial for effective Hartford Financial marketing strategy in the competitive financial services landscape.

The Hartford Financial sales strategy includes significant digital marketing initiatives. They use data and analytics, cloud computing, and AI to enhance products and services. These technologies automate processes and personalize customer interactions.

Machine learning and AI algorithms automate license verification and insurance application processing. Text processing algorithms direct customer requests efficiently. These tools improve operational efficiency and customer satisfaction.

The company uses customer segmentation to create customized insurance plans. This approach helps identify coverage gaps for clients. This data-driven strategy enhances customer experience and satisfaction.

The claims department uses data analytics to offer innovative services. They identify treatment patterns for health insurance claims. Fleet telematics is used for automobile insurance to identify risky driving behaviors.

The Hartford continues to invest in traditional media and brand identity. This includes a redesigned stag logo and streamlined business segment names. These efforts support brand awareness and market presence.

The partnership with Nayya demonstrates a focus on personalization. This integration simplifies benefits experiences for customers. This approach enhances customer satisfaction and engagement.

The Hartford Financial services employs a range of tactics to reach its target audience. These include digital marketing, data analytics, and traditional media. The company focuses on personalization and operational efficiency.

- Digital Transformation: Emphasis on data analytics, cloud, and AI.

- Customer Segmentation: Tailoring insurance plans to individual needs.

- AI Automation: Using AI for process automation and customer service.

- Brand Reinforcement: Continued investment in brand identity and traditional media.

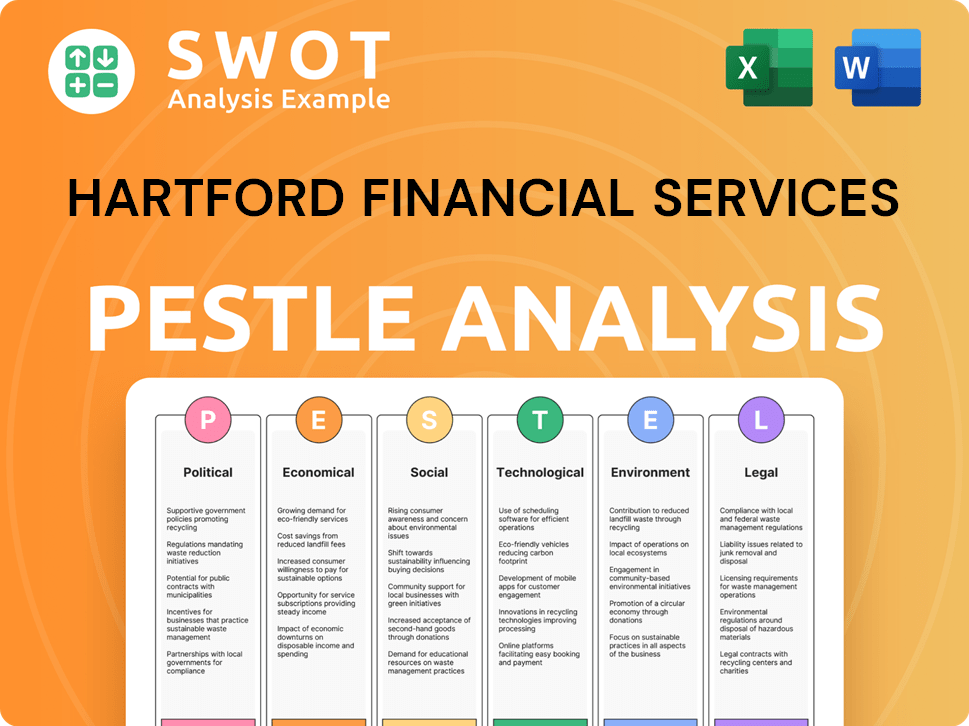

Hartford Financial Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Hartford Financial Services Positioned in the Market?

The Hartford's brand positioning centers on its extensive history and a forward-looking approach. It differentiates itself through its long-standing expertise, dedication to service, sustainable practices, and commitment to trust and integrity. The core message focuses on helping customers secure their assets and achieve financial stability.

A key element of its brand is the iconic stag logo, which has been a symbol since 1867. In February 2025, the company updated the stag logo, representing strength and resilience, with the stag facing the future. This rebrand also included changing the holding company name to The Hartford Insurance Group, Inc., and streamlining business segments. The visual identity moved away from the traditional blue, emphasizing maroon as its primary color and introducing fuchsia for a modern feel. The new wordmark uses a lowercase style to create a more conversational tone.

The company aims to appeal to its target audience by building trust and reliability, which is supported by its long presence in the industry. The company's commitment to sustainable business practices and operating with integrity is evident in its recognition as the No. 1 insurer on the 2024 JUST 100 list by JUST Capital and CNBC, ranking No. 15 overall. The brand maintains consistency across all touchpoints through its unified brand identity. The Hartford's response to shifts in consumer sentiment includes continuous investment in digital capabilities and AI to improve customer experience and operational efficiency, showing a proactive approach to market changes. This approach is critical for the company's Revenue Streams & Business Model of Hartford Financial Services.

The company leverages its history of over two centuries to build trust and credibility. This long-standing presence in the financial services market is a key differentiator. Its brand messaging often highlights its experience and reliability.

The stag logo, updated in February 2025, symbolizes strength and forward-thinking. The logo is a recognizable symbol of the company's identity. It is a key element in Hartford Financial's brand recognition.

The company uses maroon as its primary color and fuchsia to convey energy and modernity. The shift from traditional blue in the financial sector aims to stand out. The lowercase wordmark aims for a conversational tone.

The company's commitment to sustainability is a key aspect of its brand positioning. Recognition on the 2024 JUST 100 list highlights its focus on serving employees, customers, communities, the environment, and shareholders. This approach enhances its appeal to socially conscious customers.

The company's brand is built on several key attributes that resonate with its target audience. These attributes are consistently communicated across all channels to reinforce the brand's identity and values.

- Trust and Reliability: Emphasizing its long history and consistent performance.

- Expertise: Highlighting its deep understanding of the insurance and financial services industry.

- Customer-Centric: Focusing on protecting assets and ensuring financial security for customers.

- Innovation: Investing in digital capabilities and AI to enhance customer experience and operational efficiency.

- Integrity: Operating with transparency and ethical practices.

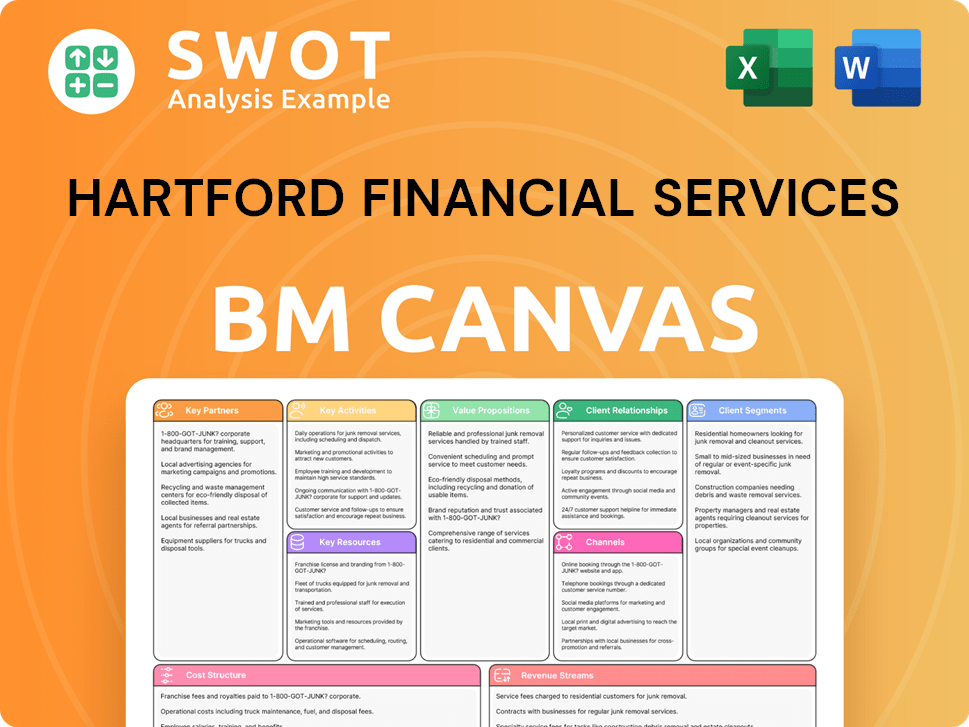

Hartford Financial Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Hartford Financial Services’s Most Notable Campaigns?

The Hartford Financial Services' sales and marketing strategy in 2024-2025 focuses on several key campaigns designed to drive growth and enhance its market position. These initiatives are not isolated events but rather integrated strategies that support the company's overall objectives. The company's approach includes a strong emphasis on digital capabilities, brand modernization, and leveraging its robust financial performance.

These campaigns are interconnected, with each supporting the others to create a cohesive and effective sales and marketing strategy. For example, digital investments support the modernized brand by providing new channels for customer engagement and lead generation. The Hartford's commitment to these key areas demonstrates a proactive approach to meeting the evolving needs of its customers and the market.

Understanding these key campaigns provides insight into how The Hartford, a leading insurance company, is positioning itself for continued success in the financial services sector.

The Hartford is heavily investing in digital capabilities and the integration of artificial intelligence (AI). This is a core element of its sales and marketing strategy. The goal is to improve customer experience, streamline operations, and drive growth across all business segments.

A significant campaign involves modernizing The Hartford's brand identity, which was unveiled in February 2025. This initiative aims to blend its historical roots with a forward-looking strategy. The redesigned brand includes a new stag logo and streamlined business segment names.

The Hartford's strong financial performance in 2024 is a testament to the success of its underlying sales and marketing strategies. The company reported a net income available to common stockholders of $3.1 billion for the full year 2024. This growth indicates effective sales and marketing efforts across its product lines.

As part of the brand modernization, The Hartford announced a major philanthropic expansion. This included increasing annual giving by over 30%, extending its Small Business Accelerator, and deepening its partnership with Active Minds for mental health awareness. This initiative aims to reinforce brand relevance and appeal in the current market.

The Hartford's sales strategy emphasizes digital transformation to enhance customer experience. It includes the use of data, analytics, and AI to improve underwriting results. The company focuses on providing innovative customer-centric technology.

The marketing strategy involves modernizing the brand to deepen engagement with customers. A key element is the philanthropic expansion, which reinforces brand relevance. Digital marketing is also a major component, with a focus on social media marketing and email marketing.

The Hartford provides a range of insurance and financial services. This includes property and casualty insurance, with written premiums increasing by 10% in 2024. The company's focus is on delivering value to its customers through disciplined underwriting and pricing.

Effective insurance company marketing involves brand building and digital engagement. The Hartford's approach includes brand modernization and the use of digital channels. The company focuses on customer-centric technology and data-driven insights.

Financial services sales at The Hartford are driven by a focus on customer needs and digital innovation. The company leverages data and analytics to improve its sales processes. The sales team structure is designed to support customer acquisition and retention.

The Hartford's strategy is focused on digital transformation, brand modernization, and strong financial performance. In Q1 2025, digital capabilities provided a 'significant competitive advantage' in the small business market. The company aims to lead the insurance industry in AI.

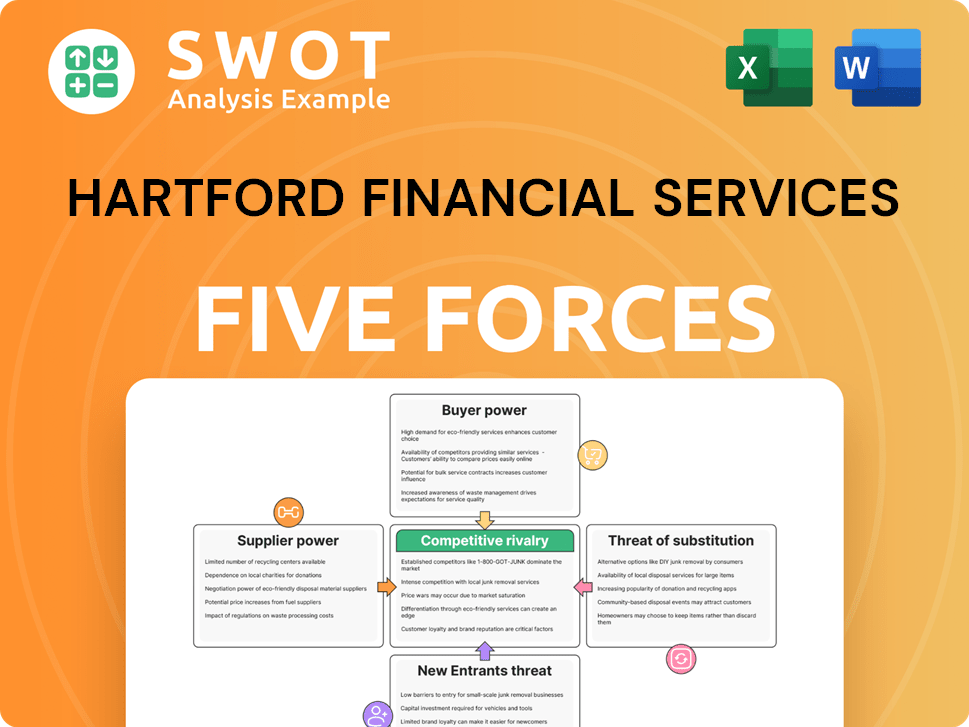

Hartford Financial Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hartford Financial Services Company?

- What is Competitive Landscape of Hartford Financial Services Company?

- What is Growth Strategy and Future Prospects of Hartford Financial Services Company?

- How Does Hartford Financial Services Company Work?

- What is Brief History of Hartford Financial Services Company?

- Who Owns Hartford Financial Services Company?

- What is Customer Demographics and Target Market of Hartford Financial Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.