TKO Bundle

How Did TKO Company Rise to Prominence?

Born from the strategic alliance of UFC and WWE, TKO Group Holdings has swiftly become a dominant force in global sports and entertainment. This powerful merger, finalized in September 2023, created a company poised to capitalize on the massive appeal of live events and premium content worldwide. Explore the TKO SWOT Analysis to understand its strategic positioning.

The TKO Company story is a compelling narrative of TKO origins and rapid TKO evolution. From its inception, the company has aimed to leverage the established fan bases of UFC and WWE, reaching millions globally. Understanding the TKO timeline and its strategic moves reveals a clear vision for future expansion and sustained financial success, making it a key player in the industry.

What is the TKO Founding Story?

The TKO Company, a significant player in the sports and entertainment industry, has a compelling founding story. The company's formation represents a pivotal moment in the consolidation of major sports entertainment properties. This strategic move aimed to create a powerhouse capable of maximizing value in a dynamic market.

TKO Group Holdings was officially established on September 12, 2023. This was achieved through the merger of Endeavor Group Holdings' UFC and WWE. This merger brought together two of the most recognized global leaders in their respective sports entertainment categories. Endeavor Group Holdings holds a 59% stake in TKO following recent acquisitions.

The merger was driven by the opportunity to consolidate and amplify the value of complementary sports properties. The initial business model focused on owning and operating these properties, delivering live events and premium content. The goal was to maximize shareholder value through strategic growth and operational efficiencies.

The formation of TKO Group Holdings involved the merger of UFC and WWE. This brought together two major players in sports entertainment.

- TKO Group Holdings, Inc. (NYSE: TKO) became a publicly listed company immediately after the merger.

- The merger was an all-stock deal, with Endeavor increasing its ownership.

- Ariel Emanuel serves as Executive Chair and CEO of TKO.

- Dana White is the CEO of UFC, and Nick Khan is the CEO of WWE.

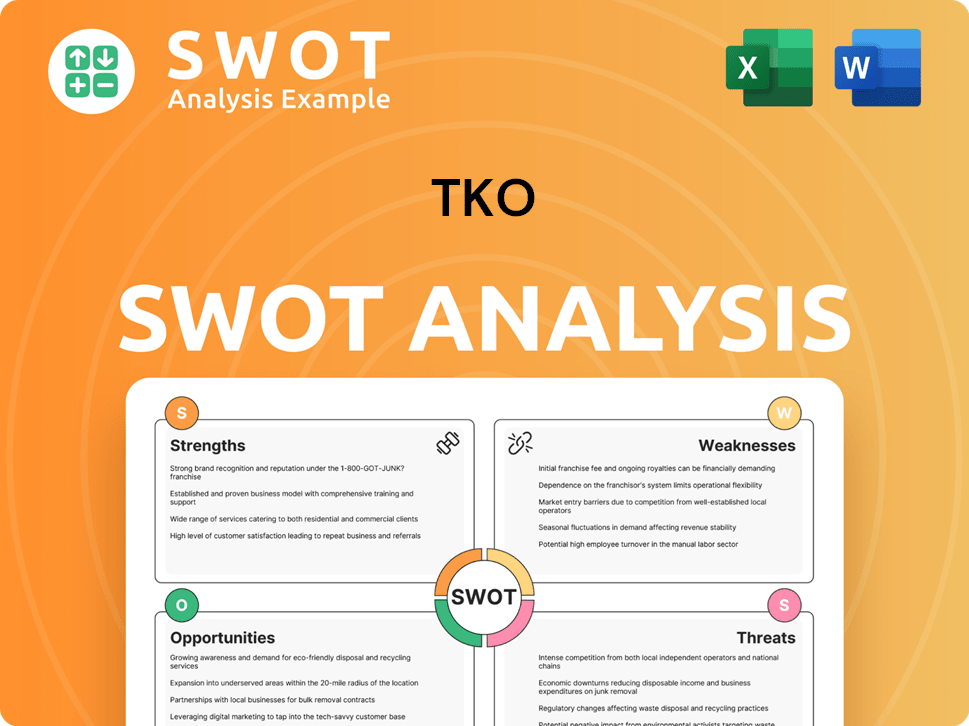

TKO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of TKO ?

The early growth and expansion of the TKO Company have been marked by significant strategic moves and impressive financial performance. Since its formation, TKO has quickly broadened its portfolio and strengthened its market position. The company's trajectory showcases a focus on both organic growth and strategic acquisitions to establish a strong presence in the sports and entertainment industry.

In its first full year of operation, 2024, TKO generated $2.804 billion in revenue. UFC contributed $1.406 billion and WWE $1.398 billion. The company's Adjusted EBITDA for 2024 increased by 55% year-over-year, reaching $1.251 billion.

A key development was the acquisition of businesses under the IMG brand, On Location, and Professional Bull Riders (PBR) from Endeavor Group Holdings, Inc. on February 28, 2025, for $3.25 billion. This expanded TKO's operations into sports rights, production, and event management. These acquired businesses generated $1.269 billion in revenue in Q1 2025, contributing to TKO's overall revenue of $1.268.8 million in the first quarter of 2025.

TKO has demonstrated a strategic focus on global expansion. In April 2025, TKO, through WWE, announced the acquisition of a 51% controlling stake in Lucha Libre AAA Worldwide. On March 5, 2025, TKO partnered with Saudi entertainment conglomerate Sela to launch a new boxing promotion in 2026. For a deeper dive into the competitive landscape, consider reading the Competitors Landscape of TKO article.

The company is actively working to secure long-term U.S. domestic media rights agreements for UFC, whose current contract with ESPN expires at the end of 2025, with a target of over $1 billion annually for the next agreement. These initiatives highlight TKO's aggressive strategy to diversify its revenue streams and expand its global footprint.

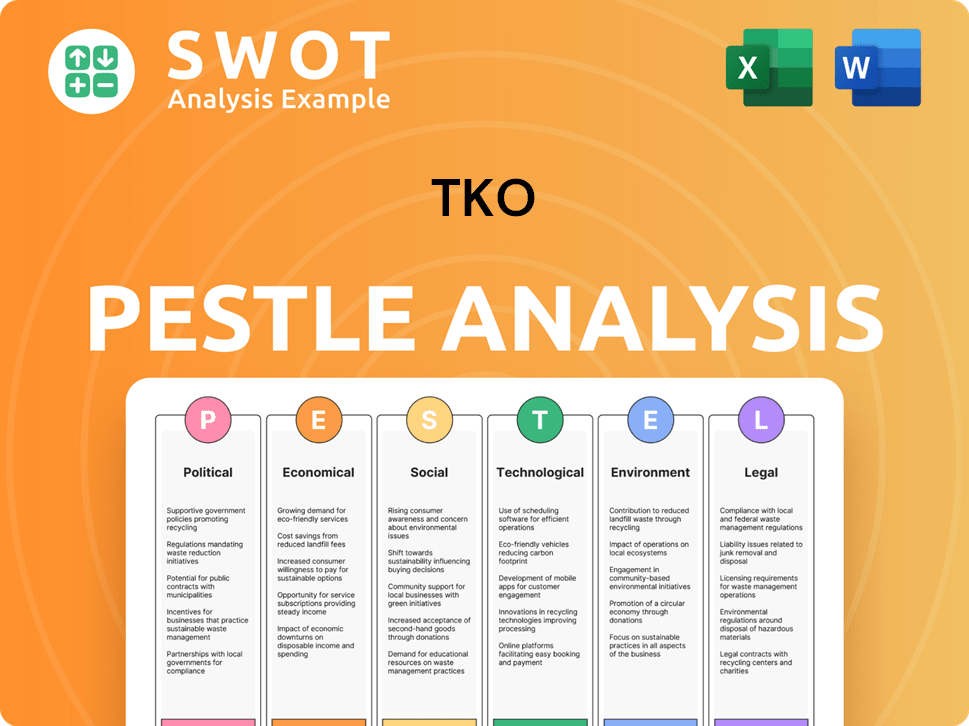

TKO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in TKO history?

The TKO Company has achieved several significant milestones since its inception, marking its TKO evolution in the sports and entertainment industry. These achievements reflect the company's strategic vision and ability to adapt and grow within a dynamic market. The TKO history is one of strategic acquisitions and successful integrations.

| Year | Milestone |

|---|---|

| 2024 | Reported record financial performance with revenue reaching $2.804 billion and adjusted EBITDA at $1.251 billion. |

| 2024 | Organized over 500 live events, attracting more than three million fans globally. |

| February 28, 2025 | Acquired IMG, On Location, and Professional Bull Riders (PBR) from Endeavor for $3.25 billion in an all-stock deal. |

| March 2025 | Announced a partnership to launch a new boxing promotion in 2026 with Saudi Arabia. |

The company has embraced innovation through strategic acquisitions and partnerships. The acquisition of IMG, On Location, and PBR significantly broadened its capabilities in sports marketing and live event properties. These moves have solidified its position within the sports and entertainment sector.

The acquisition of IMG, On Location, and PBR expanded TKO's reach in sports marketing and live events.

Venturing into new markets, such as the partnership with Saudi Arabia for boxing promotion.

Exploring new content formats, such as esports, to stay competitive.

Successfully integrating UFC and WWE to create a combined entity.

Announced partnership to launch a new boxing promotion in 2026 with Saudi Arabia.

Organizing over 500 live events annually, attracting millions of fans worldwide.

Despite its successes, TKO has faced several challenges in its journey. Legal and regulatory scrutiny, including ongoing antitrust litigation, has been a concern. The company also experienced a decrease in net income in 2024, impacted by higher operating expenses and settlement charges.

Ongoing antitrust litigation poses a significant challenge for the company.

The net income decreased to $6.4 million in 2024 from $175.7 million in 2023.

WWE revenue declined by 10% to $298.3 million in Q4 2024.

Strategic cost reduction programs are being implemented to address financial challenges.

Focusing on securing new media rights deals to boost revenue.

Efforts are underway to integrate recently acquired assets effectively.

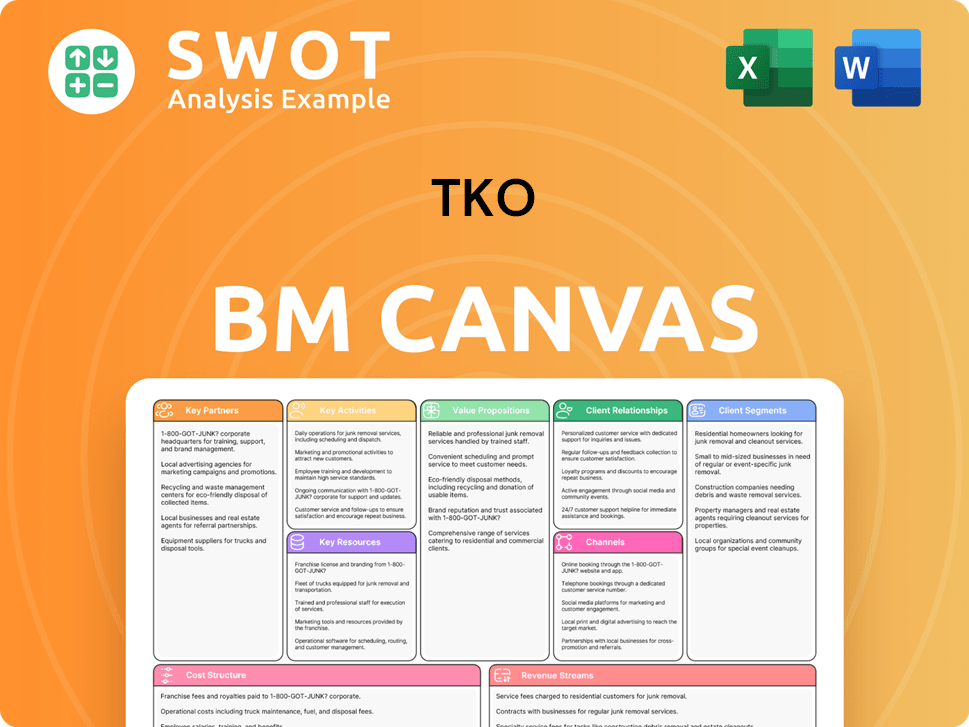

TKO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for TKO ?

The TKO history showcases a rapid rise within the sports and entertainment sectors, marked by strategic mergers, acquisitions, and a focus on global expansion. The TKO origins trace back to the merger of UFC and WWE, setting the stage for an ambitious growth trajectory. Key milestones highlight the company's evolution, including significant financial achievements and strategic partnerships.

| Year | Key Event |

|---|---|

| September 12, 2023 | TKO Group Holdings, Inc. is officially formed through the merger of UFC and WWE. |

| November 6, 2024 | TKO reports strong Q3 2024 results, with revenue of $681 million. |

| December 9, 2024 | TKO participates in the UBS Global Media & Communications Conference. |

| February 26, 2025 | TKO announces Q4 and full-year 2024 results, reporting $2.804 billion in revenue for 2024. |

| February 28, 2025 | TKO completes the acquisition of IMG, On Location, and Professional Bull Riders (PBR) from Endeavor. |

| March 5, 2025 | TKO announces a partnership to launch a new boxing promotion in 2026 with Saudi Arabia. |

| April 19, 2025 | TKO, via WWE, announces the acquisition of a controlling stake in Mexican lucha libre promotion Lucha Libre AAA Worldwide. |

| April 24, 26, 28, 2025 | TKO stages 'TKO Takeover' in Kansas City, featuring consecutive PBR, UFC, and WWE events. |

| May 8, 2025 | TKO reports Q1 2025 results, with revenue of $1.268.8 billion and net income of $165.5 million, raising full-year 2025 guidance. |

For 2025, TKO is targeting revenue between $4.490 billion and $4.560 billion. The projected Adjusted EBITDA is between $1.490 billion and $1.530 billion. Excluding recent acquisitions, the company aims for revenue of $3.005 billion to $3.075 billion.

Securing long-term U.S. domestic media rights for UFC and WWE is a key strategy. UFC is reportedly targeting over $1 billion annually for its next deal. The company is also focusing on integrating newly acquired businesses and creating compelling live events.

Expanding the global footprint is a key growth driver for TKO. The company is targeting emerging markets in Europe, Asia Pacific, and the Middle East. This expansion strategy supports the vision of creating a global sports and entertainment enterprise.

Analyst predictions are generally positive, citing raised revenue targets and steady growth. Continued dividends are anticipated, although monitoring legal developments is advised. This outlook supports TKO's strategy of leveraging iconic brands for growth.

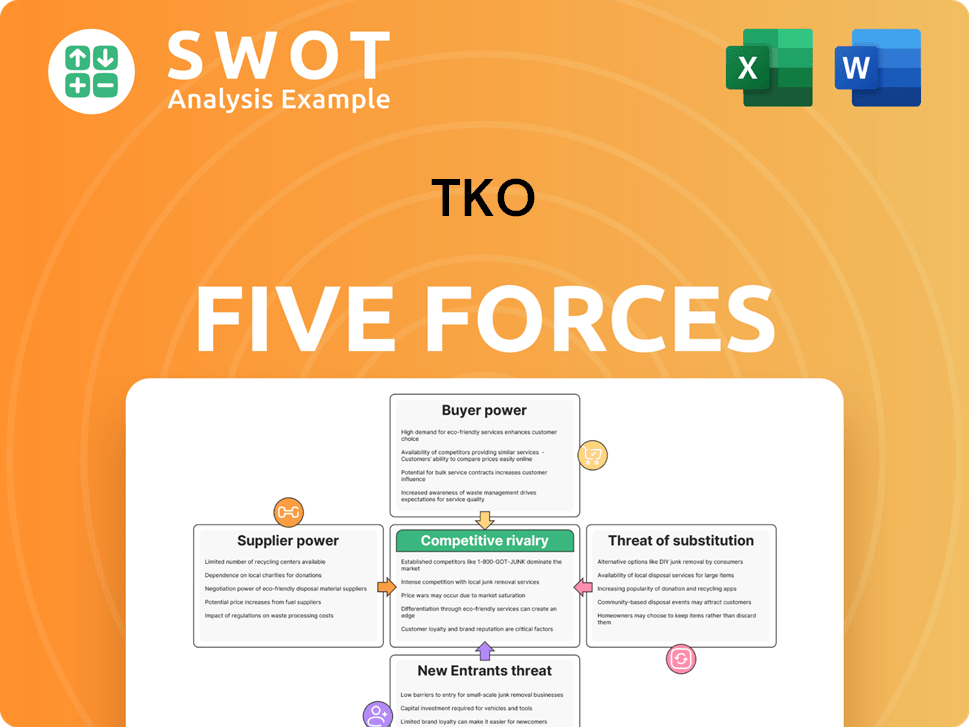

TKO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of TKO Company?

- What is Growth Strategy and Future Prospects of TKO Company?

- How Does TKO Company Work?

- What is Sales and Marketing Strategy of TKO Company?

- What is Brief History of TKO Company?

- Who Owns TKO Company?

- What is Customer Demographics and Target Market of TKO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.