TKO Bundle

Who Really Owns TKO Group Holdings?

Unraveling the ownership structure of TKO Group Holdings is key to understanding the powerhouse behind UFC and WWE. Formed in September 2023, this entity's creation reshaped the landscape of global sports and entertainment. Knowing who controls TKO Group Holdings directly impacts its strategic moves and market performance.

The formation of TKO Group Holdings, spearheaded by Endeavor, brought together UFC and WWE, creating a publicly traded entity. Understanding the TKO SWOT Analysis is crucial to grasping the company's strengths and weaknesses. This exploration of TKO ownership will reveal the major shareholders, initial stakes, and the evolution of its control since its inception, providing insights into its future direction and financial performance. Furthermore, it will address questions like "Who is the CEO of TKO Group Holdings?" and "Who are the major shareholders of TKO?"

Who Founded TKO ?

Understanding the early ownership of TKO Group Holdings (TKO) involves looking at its formation in September 2023 through the merger of UFC and WWE. Unlike a typical startup, TKO's ownership structure was shaped by the contributions of Endeavor and the existing shareholders of WWE. This merger created a new entity with a unique ownership distribution.

The primary drivers behind TKO's formation were Endeavor, which previously owned UFC, and the shareholders of WWE. The ownership structure at the start was a result of this merger, with Endeavor holding a controlling stake. This setup reflects the strategic consolidation of two major players in sports and entertainment.

The initial ownership of TKO Group Holdings was primarily determined by the contributions of Endeavor and the existing shareholders of WWE. Endeavor contributed its ownership of UFC, while WWE shareholders received a significant portion of shares in the new company. This arrangement set the stage for the strategic direction of the combined entity.

Endeavor, through its subsidiary, held a 51% controlling interest in TKO Group Holdings. This stake ensured Endeavor's strategic direction for the combined entity.

WWE shareholders received 49% of the shares in TKO Group Holdings. This significant shareholding made them key stakeholders in the new company.

Ari Emanuel from Endeavor played a crucial role in orchestrating the merger. Vince McMahon, a major WWE shareholder, also became a significant individual shareholder in TKO.

The formation of TKO was driven by the strategic vision of creating a dominant sports and entertainment platform. This goal influenced the early agreements and governance structure.

The distribution of control was heavily influenced by Endeavor's majority stake, ensuring their strategic direction for the combined entity. This reflected the long-term goals of the merger.

Early agreements focused on the integration of UFC and WWE. These agreements included provisions for ongoing leadership and operational control, setting the stage for the combined entity's future.

The merger that formed TKO Group Holdings involved significant financial considerations. Endeavor's contribution of UFC and the distribution of shares to WWE shareholders were based on the valuation of both entities at the time of the merger. The details of the merger, including the ownership structure and the strategic vision, are crucial for understanding the Growth Strategy of TKO . The initial ownership structure has played a key role in the company's operations and future direction, with Endeavor holding a controlling interest and WWE shareholders retaining a substantial stake.

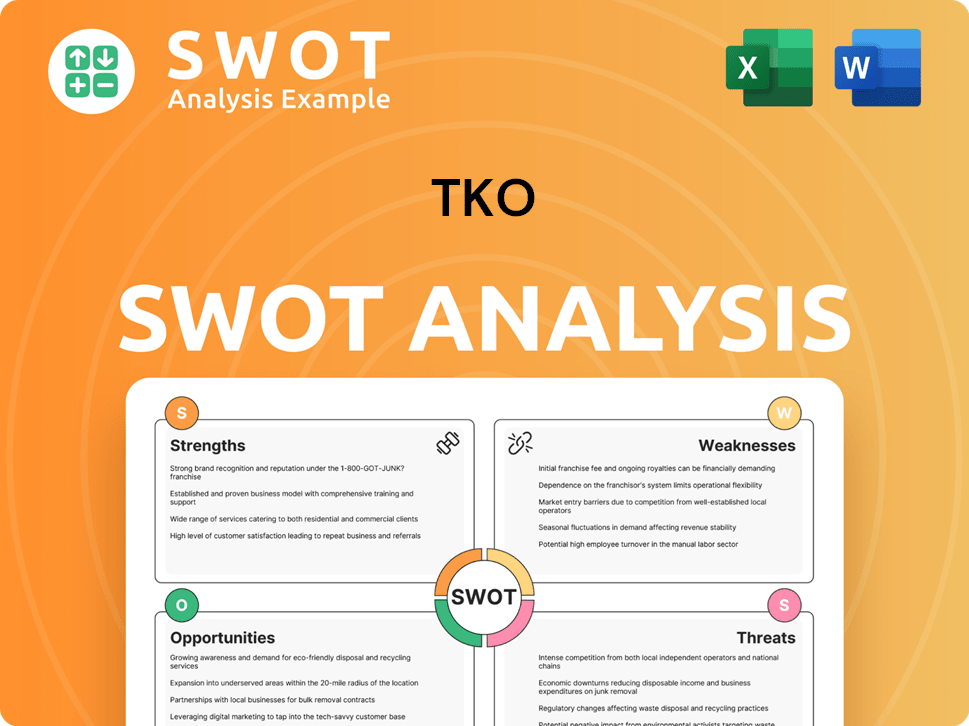

TKO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TKO ’s Ownership Changed Over Time?

The formation of TKO Group Holdings in September 2023 marked a pivotal moment in its ownership history, stemming from the merger of the Ultimate Fighting Championship (UFC) and World Wrestling Entertainment (WWE). This merger, followed by an initial public offering (IPO), set the stage for TKO's debut on the New York Stock Exchange. The initial market capitalization reflected the combined valuation of both UFC and WWE, immediately positioning TKO as a significant entity in the live sports and entertainment industry. This strategic move consolidated two major players under one umbrella, reshaping the landscape of sports entertainment and influencing subsequent ownership dynamics.

The ownership structure of TKO Group Holdings has evolved since its inception, with key stakeholders influencing its strategic direction and market performance. The initial public offering and subsequent trading of shares have introduced a diverse group of investors, including institutional investors and individual insiders. These shifts in ownership have had a direct impact on the company's governance and strategic focus, driving decisions related to global expansion, content monetization, and shareholder value.

| Event | Date | Impact on Ownership |

|---|---|---|

| Merger of UFC and WWE | September 2023 | Formation of TKO Group Holdings; Initial public offering (IPO) on the New York Stock Exchange. |

| Endeavor's Controlling Stake | Ongoing | Endeavor Group Holdings maintains a 51% controlling interest, influencing strategic direction. |

| Shareholder Activity | 2024-2025 | Trading of shares by institutional investors and individual insiders, impacting the ownership profile. |

Currently, Brief History of TKO reveals that Endeavor Group Holdings holds a controlling stake in TKO Group Holdings, influencing the company's strategic vision. Institutional investors and individual insiders also hold significant portions of TKO stock. As of Q1 2025, prominent institutional investors have continued to build their positions in TKO, reflecting confidence in the company's growth strategy. The ongoing trading of shares by major individual holders, such as the former Executive Chairman Vince McMahon, has altered the individual insider ownership profile. These ownership dynamics are crucial to understanding the strategic direction and governance of TKO Group Holdings.

Understanding the ownership structure of TKO Group Holdings is vital for investors and stakeholders alike.

- Endeavor holds a controlling interest, shaping TKO's strategic direction.

- Institutional investors and individual insiders also play a significant role in the ownership landscape.

- The merger of UFC and WWE formed TKO, leading to its IPO and debut on the New York Stock Exchange.

- Changes in ownership impact TKO's strategy and governance, influencing its focus on global expansion and content monetization.

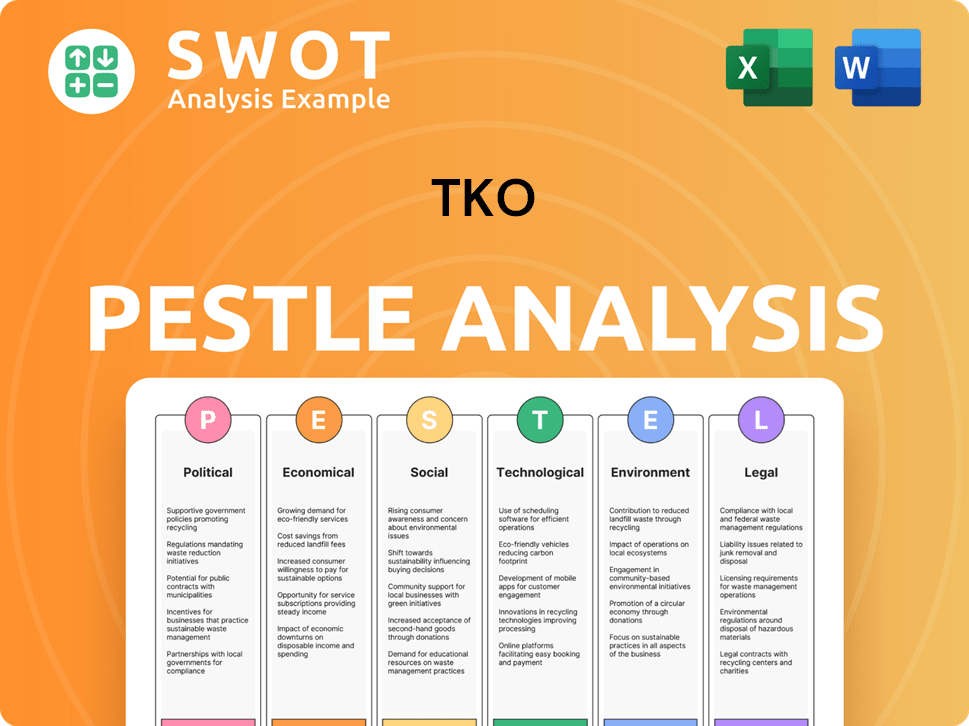

TKO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TKO ’s Board?

The current Board of Directors of TKO Group Holdings reflects a blend of representatives from its major shareholders and independent voices. As of early 2025, the board includes members who represent Endeavor, given their controlling interest, as well as independent directors with diverse industry experience. Ari Emanuel, the CEO of Endeavor, serves as the CEO of TKO Group Holdings, highlighting Endeavor's direct influence on the company's leadership and strategic direction. Vince McMahon, while a significant shareholder, resigned from his position as Executive Chairman in January 2024.

| Board Member | Title | Affiliation |

|---|---|---|

| Ari Emanuel | CEO | Endeavor |

| Mark Shapiro | President & COO | Endeavor |

| Andrew Schleimer | Director | Endeavor |

The voting structure of TKO Group Holdings primarily operates on a one-share-one-vote basis for its publicly traded shares. However, the initial merger agreement and Endeavor's majority ownership grant them significant voting power and control over major corporate decisions. While there are no explicit dual-class shares or golden shares outside of the initial ownership structure, Endeavor's 51% stake effectively gives them outsized control.

Endeavor's significant ownership stake in TKO Group Holdings, which includes both WWE and UFC, provides substantial control over the company's strategic direction. The departure of Vince McMahon from his executive role in January 2024, was a significant governance event. For more insights into the company's marketing approaches, read about the Marketing Strategy of TKO .

- Endeavor's control is paramount.

- One-share-one-vote structure.

- Vince McMahon's departure impacted board composition.

- No proxy battles have been widely reported.

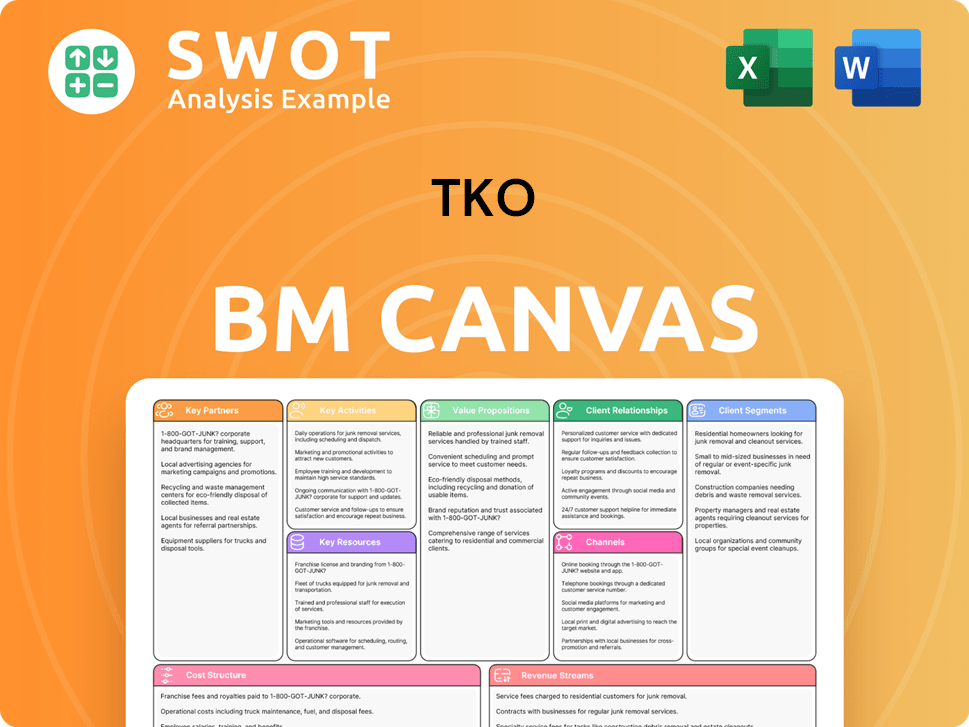

TKO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TKO ’s Ownership Landscape?

Over the past 12-18 months since its formation in September 2023, TKO Group Holdings has experienced shifts in its ownership structure. A significant development has been the sale of shares by Vince McMahon. In April 2024, it was reported that McMahon sold approximately 2.4 million shares of TKO stock, following previous sales. This trend is notable, as it increases the stock's float and diversifies ownership among institutional and retail investors.

Industry trends influencing TKO's ownership include the broader increase in institutional ownership across publicly traded companies. Large funds and asset managers continue to invest in established market players. While founder dilution is common, in TKO's case, the 'founders' are the original entities of UFC and WWE, and the dilution reflects a shift from concentrated individual ownership to more dispersed public ownership, with Endeavor retaining control.

| Key Development | Details | Impact |

|---|---|---|

| Share Sales by Vince McMahon | Sold approximately 2.4 million shares in April 2024. | Increased stock float; diversified ownership. |

| Institutional Ownership | Growing investment by large funds and asset managers. | Reflects confidence in the market and company. |

| Endeavor's Control | Endeavor maintains a controlling stake. | Ensures strategic direction and management. |

There have been no public statements about a planned privatization or significant change in Endeavor's controlling stake. The company is focused on leveraging its combined assets for growth and maximizing shareholder value. Analysts project revenue growth in 2025. The company’s focus remains on leveraging its combined assets for growth and maximizing shareholder value through operational efficiencies and strategic initiatives, such as securing new media rights deals and expanding into new markets.

Vince McMahon's share sales have been a key trend. Institutional investors are increasing their stakes. Endeavor continues to hold a controlling interest in TKO Group Holdings.

The sales increase the stock's float. This may lead to more diverse ownership. The shift could affect the stock's trading dynamics.

The company projects strong financial performance. Endeavor's control remains a key factor. The focus is on leveraging combined assets.

Endeavor is the controlling shareholder. Institutional investors are growing in importance. Vince McMahon's actions are still relevant.

TKO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TKO Company?

- What is Competitive Landscape of TKO Company?

- What is Growth Strategy and Future Prospects of TKO Company?

- How Does TKO Company Work?

- What is Sales and Marketing Strategy of TKO Company?

- What is Brief History of TKO Company?

- What is Customer Demographics and Target Market of TKO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.