TKO Bundle

Can TKO Dominate the Sports and Entertainment Arena?

Born from the fusion of UFC and WWE, TKO Group Holdings has swiftly become a major player in the global sports and entertainment industry. This strategic merger has created a powerhouse, but how does TKO stack up against its competitors? Understanding the TKO SWOT Analysis is crucial to understanding its market position.

To truly grasp TKO's potential, we must dissect its competitive landscape. This analysis will explore TKO's business strategy, examining its key competitors and market share within the dynamic sports and entertainment sector. By evaluating TKO's strengths and weaknesses, we can assess its ability to navigate challenges and capitalize on opportunities within its competitive environment, providing crucial insights for anyone interested in TKO company analysis.

Where Does TKO ’ Stand in the Current Market?

The company, TKO Group Holdings, has quickly established a strong TKO market position in the sports and entertainment sector. This is mainly due to its ownership of UFC and WWE, which are among the most valuable combat sports organizations globally as of 2024. TKO's financial results for 2024 show its strong standing, with revenues of $2.804 billion and an adjusted EBITDA of $1.251 billion.

For the first quarter of 2025, TKO reported a record revenue of $1.27 billion, marking a 4% increase year-over-year. UFC revenue increased by 15% and WWE revenue by 24%. The company has also increased its full-year 2025 revenue guidance to between $4.49 billion and $4.56 billion, and adjusted EBITDA to between $1.49 billion and $1.53 billion, reflecting strong market confidence and growth prospects. This data indicates a positive outlook for the company.

TKO's main operations include broadcasting, live events, and merchandise sales. These offerings are available to a global audience across approximately 210 countries and territories. The company hosts over 300 live events annually, attracting over two million fans. Its business strategy involves leveraging these assets to maximize revenue streams.

TKO offers high-quality sports and entertainment content through its UFC and WWE brands. It provides live events, media rights, and merchandise, creating a diversified revenue model. The company's acquisitions, such as IMG, On Location Events, and PBR, have strengthened its market position by expanding into experiential hospitality and sports promotion.

TKO shows strong financial health with a current ratio of 1.3 and impressive revenue growth. While its ROE of 0.76% and ROA of 0.24% are below industry standards, its robust revenue growth and effective cost management, as shown by a net margin of 4.83%, indicate strong profitability. The company's debt-to-equity ratio of 0.74 is below the industry average.

TKO's TKO market share is primarily driven by the UFC segment, which includes media rights, live event ticket sales, and sponsorship. The company's recent acquisitions and strategic moves aim to diversify its offerings. To understand more about the company's competitive environment, you can read this article about TKO's competitive landscape.

TKO's strengths include its ownership of UFC and WWE, strong revenue growth, and effective cost management. However, its ROE and ROA are below industry standards, indicating challenges in efficiently using equity and assets. The company faces the challenge of maintaining profitability and managing debt while expanding its market presence.

- Competitive Advantage: Ownership of UFC and WWE, generating significant revenue.

- Competitive Advantage: Strong revenue growth and effective cost management.

- Competitive Disadvantage: Lower ROE and ROA compared to industry standards.

- Competitive Disadvantage: Challenges in efficiently utilizing equity and assets.

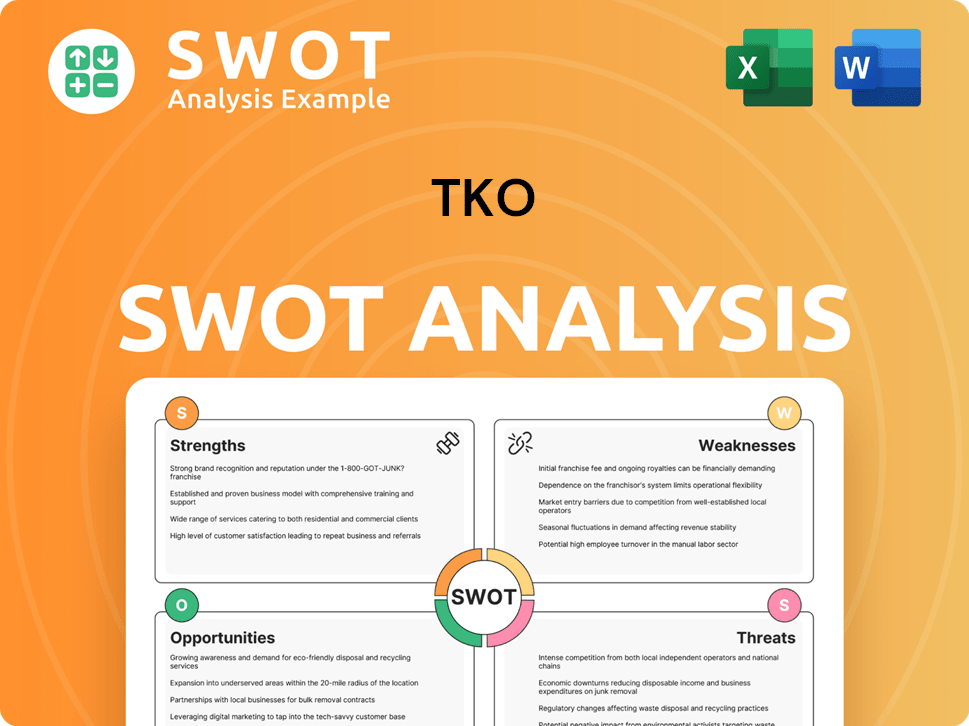

TKO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TKO ?

Understanding the TKO competitive landscape is crucial for assessing its market position. The company, formed through the merger of UFC and WWE, operates within the dynamic sports and entertainment industry. This analysis helps to identify TKO industry rivals and evaluate its TKO market share.

The TKO company analysis reveals a complex competitive environment, influenced by both direct and indirect competitors. Factors such as content creation, live event promotion, and media rights significantly shape the competitive dynamics. Analyzing TKO's strengths and weaknesses analysis is essential to understand its ability to navigate these challenges.

The TKO competitive landscape includes a variety of companies. These competitors challenge TKO for audience engagement, media rights, and revenue. Understanding these rivals is vital for evaluating TKO's market position.

Live Nation Entertainment directly competes with TKO in live events and venue bookings. Madison Square Garden Sports also competes for live event audiences. These companies challenge TKO's ability to secure live event attendance and revenue.

DraftKings competes for sports fans' entertainment spending. Warner Music Group competes for consumer attention in the content and media rights space. These companies indirectly impact TKO's revenue streams.

Streaming services and digital platforms offer alternative content consumption methods. This impacts media rights negotiations and viewership. TKO must innovate to stay competitive in this evolving landscape.

TKO's integration of acquired businesses like IMG, On Location, and PBR is crucial. These moves are essential for consolidating its market position and navigating competitive pressures. This strategy impacts TKO's business strategy.

The entertainment industry faces evolving consumer preferences and technological advancements. These factors create market challenges for TKO. Adapting to these changes is vital for long-term success.

The competitive environment for TKO is shaped by a mix of direct and indirect competitors, as well as the rise of digital platforms. TKO's market share and financial performance are impacted by these factors. For more information on the ownership structure, you can read about the Owners & Shareholders of TKO .

- DraftKings (DKNG): Operates in the daily fantasy sports and sports betting industry.

- Endeavor Group Holdings (EDR): Owns a majority stake in TKO and operates in talent representation and media production.

- Warner Music Group (WMG): Competes for consumer attention in the content and media rights space.

- Live Nation Entertainment (LYV): A global leader in live entertainment, directly competing for live event attendance.

- Madison Square Garden Sports (MSGS): Owns professional sports teams and venues, competing for live event audiences.

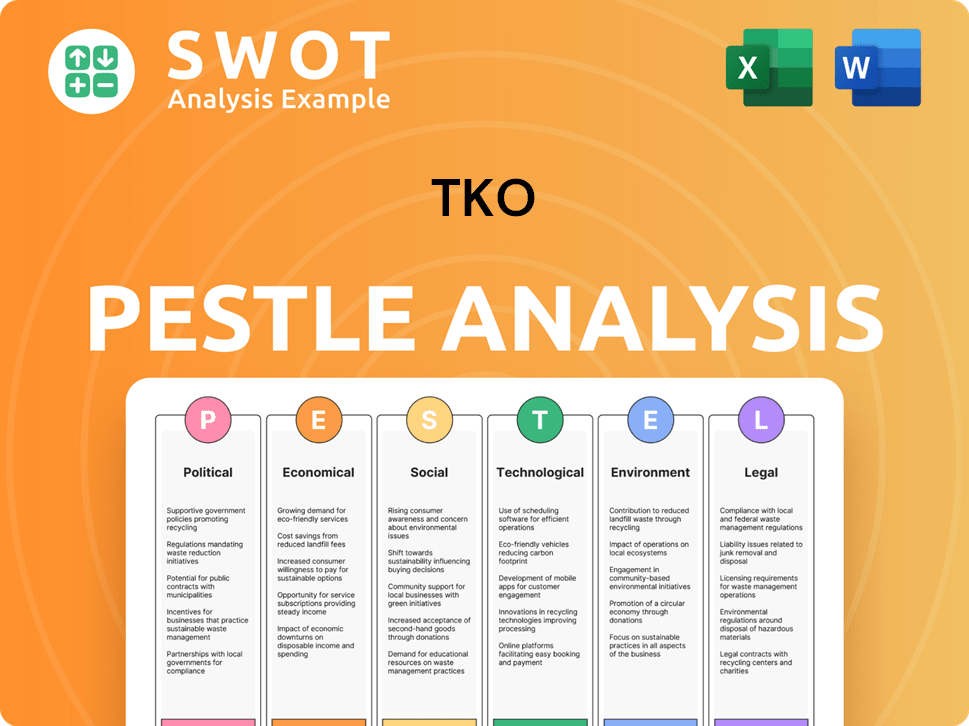

TKO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TKO a Competitive Edge Over Its Rivals?

The Brief History of TKO reveals a company built on strong brands and strategic moves. TKO Group Holdings has established a solid foundation in the sports and entertainment sector. Understanding the TKO competitive landscape is crucial for grasping its market position and future potential.

TKO's success stems from its ability to leverage its assets and adapt to market changes. The company's business strategy focuses on maximizing revenue streams and expanding its global reach. This approach has allowed TKO to maintain a competitive edge in a dynamic industry. Analyzing TKO's competitive advantages and disadvantages is key to understanding its overall performance.

TKO's financial performance, including its revenue and EBITDA, highlights its market share and ability to generate substantial returns. The company's strategic moves, such as acquisitions and operational efficiencies, contribute to its sustained growth. Exploring TKO's key competitive differentiators provides insight into its ability to outperform industry rivals.

TKO's brand portfolio, including UFC and WWE, is a significant competitive advantage. UFC boasts over 700 million fans and 228 million social media followers. WWE reaches over 1 billion households across approximately 210 countries and territories. This strong brand recognition attracts top talent and secures lucrative partnerships.

TKO's global reach and event organization expertise are key differentiators. The company organizes more than 300 live events annually, attracting over 2 million fans worldwide. This global footprint allows TKO to tap into diverse markets and expand its fan base. This operational scale gives it a significant advantage in attracting international talent and hosting events in key markets.

TKO employs innovative marketing strategies to engage fans across multiple platforms. This includes leveraging cutting-edge marketing techniques and social media campaigns. WWE's YouTube channel has over 80 million subscribers, generating billions of video views. These strategies drive ticket sales and enhance brand visibility.

TKO's financial backing and diverse revenue streams are significant advantages. In 2024, TKO reported revenue of $2.804 billion. The company generates substantial revenue from media rights, merchandise, and sponsorships. Strategic acquisitions further strengthen its presence and expand its revenue streams.

TKO benefits from operational synergies and cost reduction initiatives following the merger of UFC and WWE. These initiatives have improved financial performance, with Adjusted EBITDA increasing by 55% to $1.251 billion in 2024. The integration of operations enhances overall efficiency and profitability. These measures help the company maintain a strong competitive position.

- Integration of UFC and WWE operations.

- Cost-saving initiatives across various departments.

- Improved financial performance metrics.

- Strategic investments in content and events.

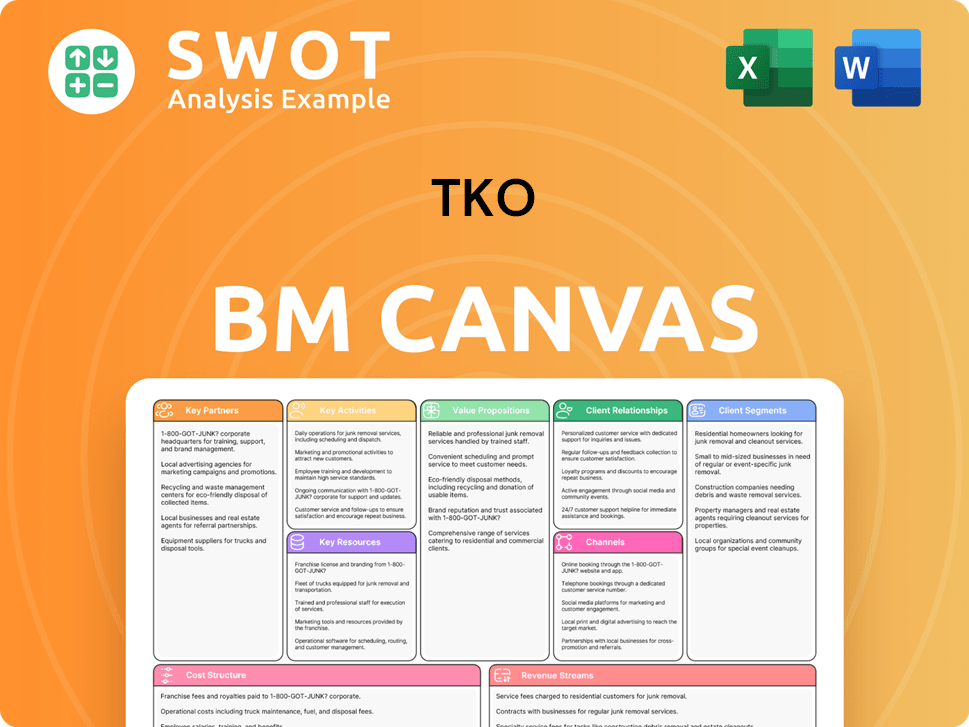

TKO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TKO ’s Competitive Landscape?

The competitive landscape for TKO Group Holdings is dynamic, influenced by digital streaming, global economic shifts, and evolving consumer preferences. Understanding the TKO competitive landscape is crucial for investors and stakeholders. The company faces both opportunities and challenges in a rapidly changing market. This TKO company analysis will explore these factors in detail.

TKO's market position is shaped by its ability to adapt to industry trends and manage potential risks. The future outlook for TKO hinges on strategic initiatives, including securing media rights and expanding into emerging markets. Examining TKO's business strategy and its response to market changes is key to assessing its long-term viability.

The increasing popularity of digital streaming platforms significantly impacts TKO. The company can leverage platforms like ESPN+ for wider distribution. This trend is driving the need for continuous innovation and engaging experiences. The global mixed martial arts (MMA) market was valued at approximately $10.6 billion in 2020.

Potential legal liabilities, such as the ongoing UFC antitrust lawsuit, pose a challenge. Integration of recent acquisitions and stock volatility can also strain resources. Media rights negotiations, particularly for UFC, present ongoing uncertainties. The company is also facing economic uncertainty, which can impact consumer spending and event attendance.

Securing long-term US domestic media rights agreements for UFC and WWE is a key opportunity. Integrating IMG, On Location, and PBR can strengthen its market position. TKO is deploying a robust capital return program, including a share repurchase authorization. Strategic investments in AI and cybersecurity are also key.

The company's outlook for 2025 anticipates sustained growth. Projected revenue is between $4.49 billion and $4.56 billion. The company's financial performance compared to competitors is a key factor. TKO's recent strategic moves, including the capital return program, indicate its commitment to shareholder value.

TKO is focused on securing long-term media rights deals and expanding its global presence. The integration of acquired companies is expected to create more compelling live events. The company is investing in technology and returning capital to shareholders to drive future growth. For more details on the target audience, read this article about the Target Market of TKO .

- Securing long-term media rights agreements.

- Expanding into emerging markets.

- Investing in AI and cybersecurity.

- Implementing a capital return program.

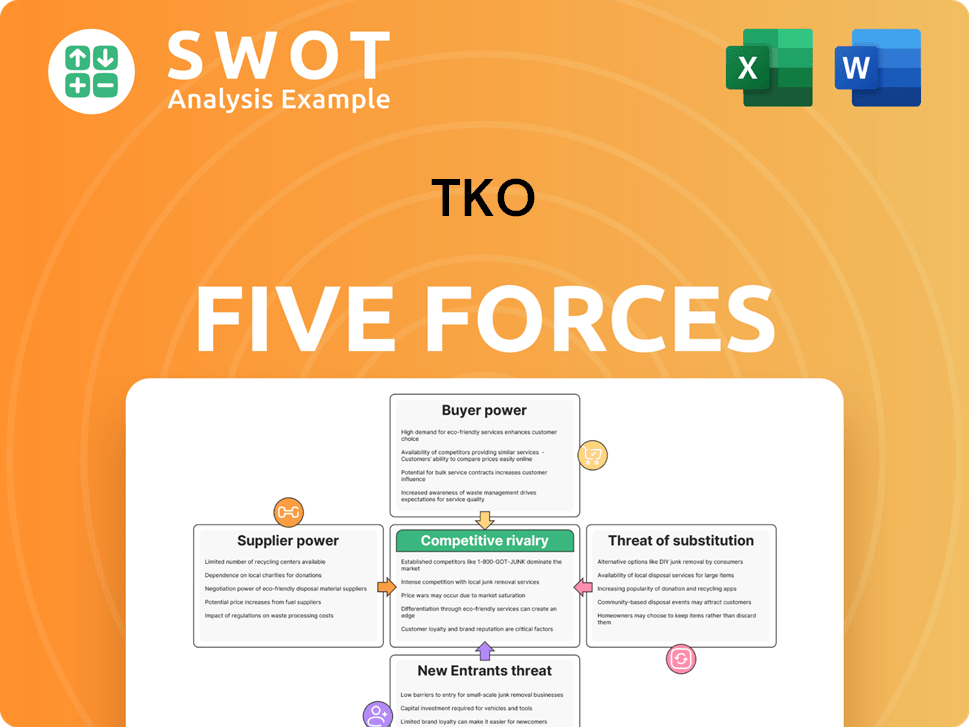

TKO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TKO Company?

- What is Growth Strategy and Future Prospects of TKO Company?

- How Does TKO Company Work?

- What is Sales and Marketing Strategy of TKO Company?

- What is Brief History of TKO Company?

- Who Owns TKO Company?

- What is Customer Demographics and Target Market of TKO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.