TKO Bundle

How Does TKO Thrive in the Entertainment Arena?

In a world dominated by entertainment giants, how does TKO Group Holdings, born from the union of UFC and WWE, carve its path to success? This isn't just a story of two brands merging; it's a strategic masterclass in leveraging global reach and content creation. Uncover the inner workings of TKO SWOT Analysis to understand the company's strengths and weaknesses.

Delving into the TKO company structure and TKO business model reveals a complex yet fascinating operational framework. Understanding How TKO works is essential for anyone looking to grasp the dynamics of modern entertainment. This exploration will uncover the TKO services, TKO operations, and TKO strategy that fuel its global impact and financial performance, providing valuable insights for investors and industry enthusiasts alike.

What Are the Key Operations Driving TKO ’s Success?

The TKO company generates value through the production, promotion, and distribution of live sports and entertainment events, primarily through its UFC and WWE brands. Its core offerings include pay-per-view (PPV) events, weekly television programming, and a vast content library, catering to a global audience. How TKO works involves multifaceted operational processes, including talent management, event production, content creation, and global distribution.

The operational backbone of TKO operations involves intricate coordination across various departments, from securing venues and managing talent contracts to developing compelling storylines and executing live productions. Technology plays a crucial role in enhancing the fan experience, from broadcast innovations to digital platforms for content delivery. Strategic partnerships with broadcasters and streaming services are vital for expanding reach and maximizing revenue. For instance, UFC's partnership with ESPN and WWE's recent agreements with Netflix and The CW Network are examples of their distribution networks.

What makes TKO's operations unique is the synergistic integration of two distinct yet complementary entertainment powerhouses. The combined entity benefits from shared resources, cross-promotional opportunities, and a larger collective fanbase. This allows for economies of scale in areas like production, marketing, and global distribution. Its core capabilities translate into significant customer benefits, offering unparalleled access to premier combat sports and sports entertainment, while also providing market differentiation through its established brand recognition and loyal global following.

TKO offers live sports and entertainment events, including pay-per-view events and weekly television programming. These offerings cater to a diverse global audience, spanning combat sports enthusiasts and general entertainment consumers. The company leverages its content library for additional revenue streams and fan engagement.

The operational processes involve talent scouting and development, event production and logistics, content creation and broadcasting, and global distribution. These processes are coordinated across various departments, ensuring the seamless execution of events. Technology plays a crucial role in enhancing the fan experience through broadcast innovations and digital platforms.

Strategic partnerships with broadcasters, streaming services, and international promoters are vital for expanding reach and maximizing revenue. UFC's partnership with ESPN and WWE's agreements with Netflix and The CW Network are prime examples of their distribution networks. These partnerships enhance the company's ability to reach a global audience.

The integration of UFC and WWE allows for shared resources, cross-promotional opportunities, and a larger collective fanbase. This synergy enables economies of scale in production, marketing, and global distribution. The combined entity can consistently deliver high-quality, engaging content across multiple platforms.

TKO's core capabilities translate into significant customer benefits, offering unparalleled access to premier combat sports and sports entertainment. This also provides market differentiation through its established brand recognition and loyal global following. For more insights, consider reading about the Growth Strategy of TKO .

- Strong brand recognition and a loyal global following.

- Economies of scale in production, marketing, and global distribution.

- Consistent delivery of high-quality, engaging content across multiple platforms.

- Strategic partnerships for expanded reach and revenue maximization.

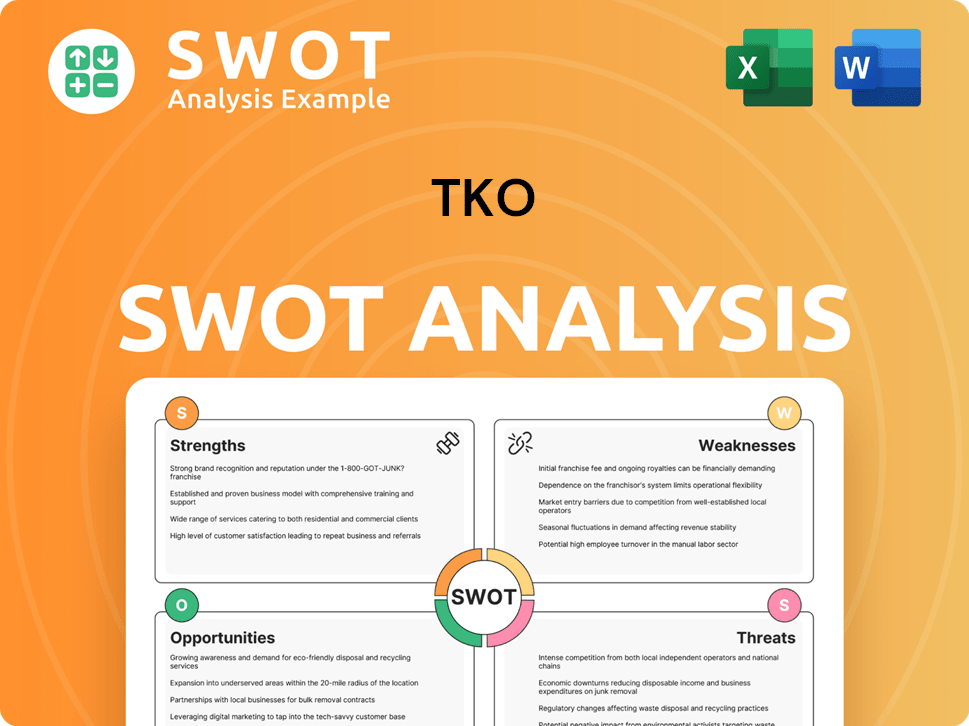

TKO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TKO Make Money?

The TKO company generates revenue through diverse streams, primarily from its UFC and WWE properties. Understanding how TKO works requires examining its key revenue sources and monetization strategies. These include media rights, live events, sponsorships, and consumer products, all contributing to its financial performance.

The TKO business model relies heavily on media rights, with significant deals driving revenue. Live events, including ticket sales for UFC fights and WWE shows, also provide substantial income. Sponsorships and consumer products further diversify the revenue streams, creating a robust financial structure. For a deeper understanding, consider exploring the Competitors Landscape of TKO .

The parent company, Endeavor, reported revenue of $5.96 billion for the full year 2023, with TKO playing a crucial role. While specific contributions from each revenue stream for the combined entity are not fully detailed, the emphasis on media rights and live events remains paramount. This financial structure highlights the importance of media rights and live events in driving overall revenue.

TKO employs innovative monetization strategies to maximize revenue. These include tiered pricing for pay-per-view events and bundled services, such as subscriptions to streaming platforms. The company also focuses on expanding its reach through international markets and new content distribution channels.

- Tiered pricing for pay-per-view events caters to different consumer segments.

- Bundled services, like subscriptions to UFC Fight Pass, provide recurring revenue streams.

- Cross-selling opportunities between UFC and WWE fanbases are explored.

- International market expansion and new content distribution channels are continuously pursued.

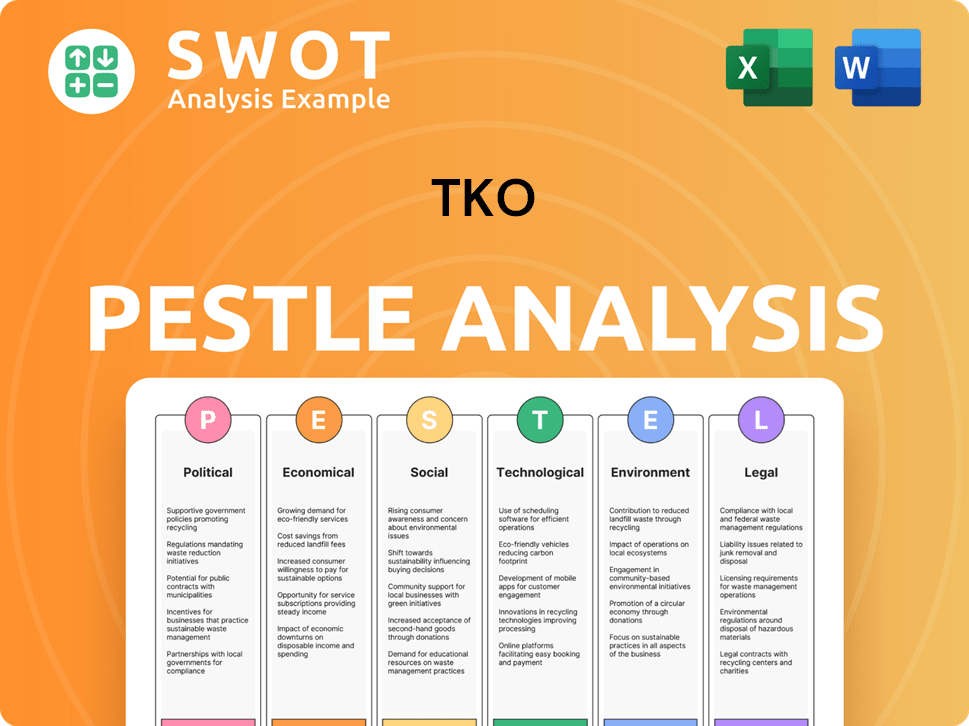

TKO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TKO ’s Business Model?

The formation of TKO Group Holdings in September 2023 marked a pivotal moment, uniting the Ultimate Fighting Championship (UFC) and World Wrestling Entertainment (WWE) under a single corporate structure. This merger, orchestrated by Endeavor, aimed to create a powerhouse in the sports and entertainment industry, capitalizing on the combined strengths of both brands. Before the merger, both UFC and WWE had achieved significant milestones, with the UFC growing into a global leader in mixed martial arts and WWE expanding its worldwide wrestling presence.

The integration of operations and the pursuit of synergies between the two brands represent a significant strategic shift for the newly formed TKO. This consolidation allows for streamlined management, shared resources, and the potential for cross-promotion, enhancing the overall value proposition. The strategic vision includes leveraging the combined reach of both entities to maximize revenue streams and expand market presence. The core of Growth Strategy of TKO involves a multi-faceted approach to generate revenue and increase its market share.

TKO faces ongoing challenges in a dynamic market, including the evolving media landscape, intense competition for entertainment dollars, and the need to constantly innovate content to maintain fan engagement. The company's response involves securing lucrative media rights deals, expanding into new international markets, and investing in new technologies to enhance the fan experience. For instance, WWE's move to Netflix demonstrates the company's adaptability to shifting media consumption habits.

The merger of UFC and WWE in September 2023. UFC's growth into a global MMA leader. WWE's expansion into a worldwide wrestling phenomenon.

Securing lucrative media rights deals. Expanding into new international markets. Investing in new technologies to enhance the fan experience. Streamlining management and sharing resources.

Brand strength of UFC and WWE. Technology leadership in live event production and content delivery. Economies of scale from the merger. The combined ecosystem effect, where fans of one brand may be introduced to the other.

TKO's operations involve live event production, content creation, and distribution. The company focuses on maximizing revenue through media rights, sponsorships, and merchandise. TKO's business model is centered on generating revenue through live events, media rights, licensing, and consumer products.

TKO's competitive advantages are multifaceted, stemming from its strong brands and operational efficiencies. The company benefits from the global recognition of both UFC and WWE, which have substantial fan bases and cultural relevance. The merger allows for economies of scale, which enhances operational efficiency and provides greater bargaining power. TKO's strategy includes exploring emerging technologies like virtual reality for fan engagement and expanding its content offerings to attract new demographics.

- Brand Strength: UFC and WWE are globally recognized brands.

- Technology Leadership: Advanced live event production and content delivery.

- Economies of Scale: Resulting from the merger, enabling more efficient operations.

- Combined Ecosystem Effect: Cross-promotion opportunities.

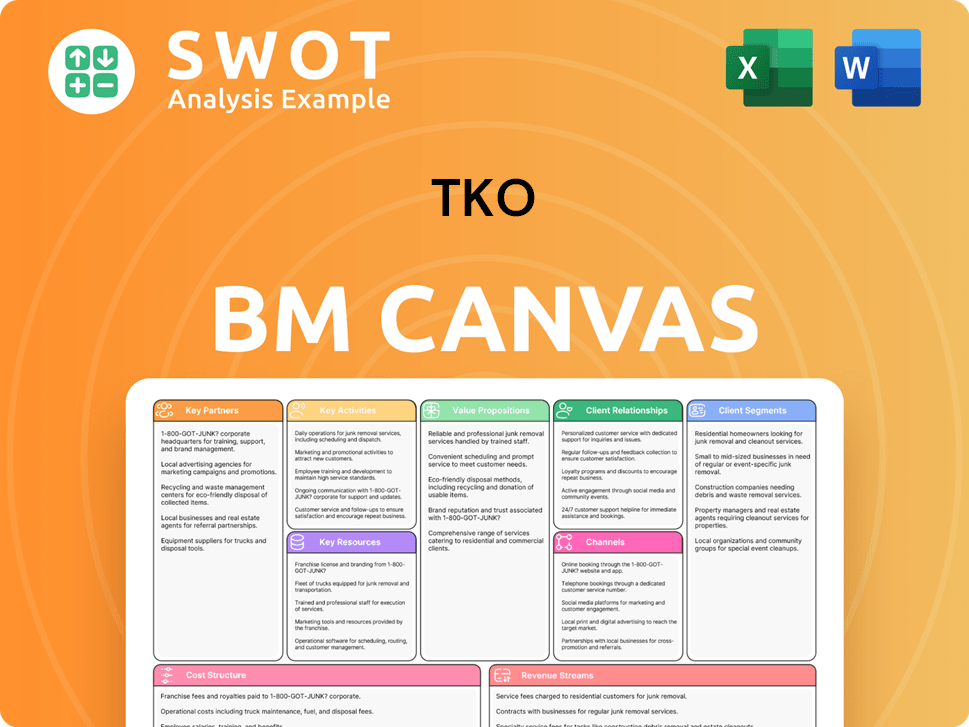

TKO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TKO Positioning Itself for Continued Success?

The TKO Group Holdings, Inc. (TKO) holds a prominent position in the combat sports and sports entertainment sectors, primarily due to the strength of its major brands, UFC and WWE. These brands have substantial global fan bases and strong brand loyalty, which allows TKO to dominate significant portions of the live events and media rights markets. The company's financial scale, considering its market capitalization and revenue, places it among the top entertainment companies worldwide.

Despite its strong market position, TKO faces several key risks. These include potential impacts from regulatory changes, competition from new entertainment options, and technological disruptions. Changes in consumer preferences and the reliance on major media rights deals also pose challenges. Understanding the intricacies of how TKO works is crucial for anyone considering investing in or analyzing the company.

TKO benefits from the substantial brand recognition and global reach of UFC and WWE. These brands have a solid grip on the live events and media rights markets. The company's financial standing, based on its market cap and revenue, places it among the top entertainment firms globally. The TKO business model leverages the popularity of its events and content to generate significant revenue streams.

TKO is exposed to risks such as regulatory changes, especially those related to athlete welfare and antitrust issues. Competition from new entertainment options and technological disruptions, like shifts in content consumption, are also significant threats. Changing consumer preferences, and the dependence on key media rights deals, add to the risks faced by the company. Understanding these risks is key to evaluating TKO operations.

The future for TKO involves strategic growth initiatives, innovation, and maximizing shareholder value. Plans include exploring new international markets, expanding its digital presence, and developing new content formats. The company aims to leverage the combined strength of UFC and WWE to create new revenue streams and enhance fan experiences. TKO strategy focuses on sustaining and expanding revenue by capitalizing on global demand for live sports and entertainment.

In 2024, WWE's revenue reached approximately $1.3 billion, with significant growth in media rights deals. UFC also demonstrated strong financial performance, with pay-per-view revenue remaining a key component. The recent media rights deals, such as the WWE agreement with Netflix, highlight the company's focus on securing long-term, high-value partnerships. These deals are crucial for driving future revenue growth. For more details, see the Marketing Strategy of TKO article.

TKO is focused on expanding its digital footprint and exploring new international markets to drive growth. The company plans to develop new content formats to enhance fan engagement and create additional revenue streams. Innovation in broadcast technology and data analytics will be critical to understanding and serving its audience better.

- International Expansion: Targeting new regions for live events and content distribution.

- Digital Initiatives: Enhancing digital platforms and content offerings.

- Content Innovation: Developing new formats to attract and retain audiences.

- Strategic Partnerships: Securing long-term agreements to maximize revenue.

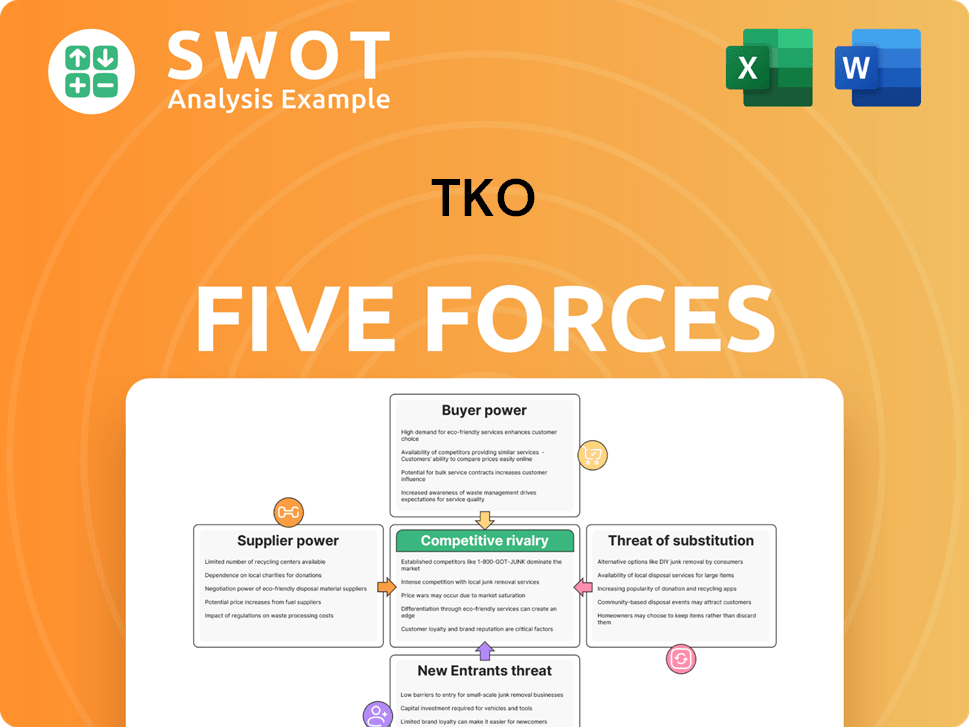

TKO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TKO Company?

- What is Competitive Landscape of TKO Company?

- What is Growth Strategy and Future Prospects of TKO Company?

- What is Sales and Marketing Strategy of TKO Company?

- What is Brief History of TKO Company?

- Who Owns TKO Company?

- What is Customer Demographics and Target Market of TKO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.